U.S. Dollar Jumps After Jobs Data

08 February 2025 - 12:49AM

RTTF2

The U.S. dollar firmed against its most major counterparts in

the New York session on Friday, as the latest jobs data showed a

drop in the unemployment rate and strong wage growth.

Data from the Labor Department showed that non-farm payroll

employment rose by 143,000 jobs in January compared to economist

estimates for an increase of about 170,000 jobs.

Meanwhile, employment in December and November surged by

upwardly revised 307,000 jobs and 261,000 jobs, respectively,

reflecting a net upward revision of 100,000 jobs.

The unemployment rate dipped to 4.0 percent in January from 4.1

percent in December. The unemployment rate was expected to remain

unchanged.

The Labor Department also said average hourly employee earnings

climbed $0.17 or 0.5 percent to $35.87 in January.

Average hourly employee earnings were up by 4.1 percent

year-over-year in January, unchanged from an upwardly revised

reading for December.

The data raised hopes that the Fed will keep interest rates

unchanged at its next meeting on March 19.

The greenback climbed to 3-day highs of 0.9102 against the franc

and 1.0325 against the euro, from an early low of 0.9045 and a

2-day low of 1.0410, respectively. The next possible resistance for

the currency is seen around 0.93 against the franc and 1.02 against

the euro.

The greenback recovered to 1.4340 against the loonie and 0.6258

against the aussie, from an early 2-day low of 1.4279 and an 11-day

low of 0.6301, respectively. The currency is seen finding

resistance around 1.47 against the loonie and 0.61 against the

aussie.

The greenback edged up to 1.2391 against the pound. The

greenback is poised to challenge resistance around the 1.22

level.

The greenback touched a 3-day high of 0.5640 against the kiwi,

from an early 2-day low of 0.5695. If the currency rises further,

it is likely to find resistance around the 0.55 region.

In contrast, the greenback fell to near a 2-month low of 150.92

against the yen. If the currency falls further, it is likely to

test support around the 145.00 region.

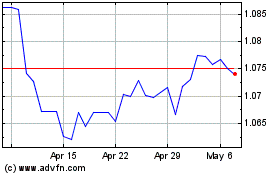

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Jan 2025 to Feb 2025

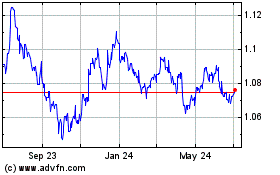

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Feb 2024 to Feb 2025