China Exports & Imports Hurt By Zero Covid Policy, Weaker Demand

07 December 2022 - 12:32PM

RTTF2

China's exports and imports fell more than expected in November

as strict Covid restrictions continued to disrupt supply chains as

well as consumption, further darkening the growth outlook for the

biggest Asian economy amid signs of an imminent global

recession.

Chinese shipments registered an annual decrease of 8.7 percent

in November, data from the General Administration of Customs

revealed Wednesday.

Economists had expected a moderate 3.6 percent drop in exports

after a 0.3 percent easing in October. This was the second

consecutive fall and also the largest since early 2020.

Likewise, imports to China decreased the most since the middle

of 2020. Imports fell 10.6 percent annually, bigger than the

expected 5.0 percent fall and October's 0.7 percent decrease.

As a result, China's trade balance showed a surplus $69.84

billion, which was below the expected level of $79.05 billion.

Exports set to retreat further over the coming quarters even as

China moves away from zero-COVID, Capital Economics' economist

Julian Evans-Pritchard said. Of much greater consequence will be

the downturn in global demand for Chinese goods due to the reversal

in pandemic-era demand and the coming global recession, the

economist added.

"The upshot is that virus disruptions and property weakness will

continue to weigh on imports in the near term," the economist

said.

The S&P Global Purchasing Managers' survey released this

week showed that the private sector continued to shrink in November

as new business declined strongly.

Last month, the Organisation for Economic Co-operation and

Development projected China's economic growth to slow to 3.3

percent this year before rebounding to 4.6 percent in 2023 and 4.1

percent in 2024.

The projection for this year was much weaker than Beijing's

target of around 5.5 percent GDP growth.

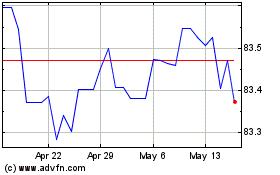

US Dollar vs INR (FX:USDINR)

Forex Chart

From Feb 2025 to Mar 2025

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Mar 2025