0001711012

false

CN

0001711012

2023-07-12

2023-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 12, 2023

| SENMIAO TECHNOLOGY LIMITED |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-38426 |

|

35-2600898 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

16F, Shihao Square, Middle Jiannan

Blvd.

High-Tech Zone, Chengdu

Sichuan, People’s Republic of China |

|

610000 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: +86 28 61554399

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

AIHS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On

July 12, 2023, Senmiao Technology Limited, a Nevada corporation, issued a press release announcing certain financial results for

the fiscal year ended March 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

This information under this

Item 2.02 and the press release attached to this Form 8-K as Exhibit 99.1 shall be deemed to be “furnished” and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities under that section and shall not be deemed incorporated by reference in any filing under the Exchange

Act or the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: July 12, 2023 |

SENMIAO TECHNOLOGY LIMITED |

| |

|

| |

By: |

/s/ Xi Wen |

| |

Name: |

Xi Wen |

| |

Title: |

Chief Executive Officer

(Principal Executive Officer) |

Exhibit 99.1

Senmiao Technology Reports Fiscal 2023 Year-end

Financial Results

CHENGDU, China, July 12, 2023 -- Senmiao

Technology Limited (“Senmiao”) (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry

in China, as well as an operator of its own online ride-hailing platform, today announced financial results for the fiscal year ended

March 31, 2023.

Fiscal 2023 Year-end

Financial and Operating Highlights

| · | Total revenues of $8.1 million from continuing

operations, an increase of 64.5% from $4.9 million in the prior fiscal year, primarily as a result of increased operating lease revenues

from automobile rentals and increased revenues from online ride-hailing platform services. |

| · | From October 23, 2020, the date Senmiao launched its online ride-hailing

platform, to March 31, 2023, approximately 29.6 million rides were completed (including orders completed on the platform operated by Senmiao

and orders completed on partner platforms, such as Xiehua and Anma) with fares paid by riders totaling $95.6 million. As of July 12, 2023,

Senmiao operated in 26 cities in China, including Chengdu, Changsha and Guangzhou. |

| · | Net loss from continuing operations improved

to $3.8 million, compared to net loss of $5.6 million in the prior fiscal year, primarily due to the Company’s cost-cutting initiatives

that directly resulted in significantly lower selling, general and administrative expenses. |

Management Commentary

Xi Wen, Chairman, Chief Executive Officer and

President of Senmiao, stated, “We were pleased with our financial performance in fiscal 2023, reporting a 64.5% increase in total

revenues to $8.1 million and gross profit of $1.5 million, compared to a gross loss of $2.1 million in the prior fiscal year. As a result

of our top line growth and effective cost-cutting initiatives, we narrowed bottom-line losses by 32.4% from fiscal 2022, enabling us to

achieve positive cash flow from operating activities. Our strong top-line results were driven by operating lease revenues from automobile

rentals more than doubling year over year and revenues from online ride-hailing platform services growing 39.2%. We have been focusing

on growing these two businesses in recent years and are confident that we will continue to see positive momentum as China has moved away

from its zero-COVID policy in a post-pandemic environment. Since the launch of our online ride-hailing business in October 2020, we have

helped facilitate over 31.1 million rides in 26 cities as of May 2023. We expect to continue expanding our business partnerships as we

look to enter potential new markets, exploring opportunities for new partner models and strengthening our presence in our strongest markets

of Chengdu, Changsha and Guangzhou.”

Financial Review

Revenues

Total revenues were $8.1 million for the year

ended March 31, 2023, an increase of 64.5% from $4.9 million in the prior fiscal year. The increase was mainly due to a $1.7 million

increase in operating lease revenues from automobile rentals and a $1.0 million increase in revenue contributions from online ride-hailing

platform services.

During the year ended March 31, 2023, the automobile

rental business generated operating lease revenues of $3.5 million, an increase of 100.5% from $1.7 million in the prior fiscal year,

due to a significant increase in the number of automobiles leased. The online ride-hailing platform services business generated revenues

of $3.7 million, an increase of 39.2% from $2.7 million in the prior fiscal year. The increase was primarily due to the significantly

lower amount of incentives the Company paid to ride-hailing drivers who completed rides and earned income through its platform in the

year ended March 31, 2023.

Cost of Revenues

Cost of revenues decreased to $6.6 million for

the year ended March 31, 2023, compared to $7.0 million in the prior fiscal year, primarily due to a decrease in direct

expense and technical service fees for the online ride-hailing platform services business as a result of a decrease in the number of completed

orders, partially offset by the increase in costs of automobiles under operating leases as a result of business expansion.

Gross Profit

Gross profit was $1.5 million for the year

ended March 31, 2023, compared to gross loss of $2.1 million in the prior fiscal year. The change of $3.6 million was mainly due

to the increase in profit in our online ride-hailing platform services and operating lease, partially offset by the gross loss of approximately

$0.1 million from sales of automobiles.

Selling, General and Administrative Expenses

Selling, general and administrative expenses decreased

32.0% to $6.1 million for the year ended March 31, 2023, from $9.0 million in the prior fiscal year. The decrease was mainly attributable

to the Company’s implementation of initiatives to streamline expenses during the period, which resulted in a $0.9 million decrease

in financial, legal and marketing consulting fees, a $0.7 million decrease in salary and employee benefit expenses, a $0.8 million decrease

in advertising and promotion expenses for online ride-hailing platform services, and other expense reductions.

Net Loss from Continuing Operations

As a result of the foregoing, net loss from Senmiao’s

continuing operations for the year ended March 31, 2023, improved to $3.8 million, compared to net loss of $5.6 million in the prior fiscal

year.

Loss per Share

Loss per diluted share for continuing operations

for the year ended March 31, 2023, was approximately $0.43 based on a weighted average number of basic and diluted common stock

of 7.2 million, compared to loss per diluted share of approximately $1.66 based on a weighted average number of basic and diluted common

stock of 5.7 million in the prior fiscal year.

Financial Position

As of March 31, 2023, Senmiao had cash and

cash equivalents of $1.6 million, compared to $1.2 million as of March 31, 2022. Total stockholders’ equity

was $4.4 million as of March 31, 2023, compared to $8.1 million as of March 31, 2022.

Additional information regarding Senmiao's results

of operations for this annual period can be found in Senmiao’s Annual Report on Form 10-K for the fiscal year ended March 31,

2023, to be filed with the Securities and Exchange Commission on the date of this earnings release.

About Senmiao Technology Limited

Headquartered in Chengdu, Sichuan Province, Senmiao

provides automobile transaction and related services including sales of automobiles, facilitation and services for automobile purchases

and financing, management, operating leases, guarantees and other automobile transaction services, as well as operates its own ride-hailing

platform aimed principally at the growing online ride-hailing market in Senmiao’s areas of operation in China. For more information

about Senmiao, please visit: http://www.senmiaotech.com. Senmiao routinely provides important updates on its website.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements (including those relating

to the operation of Senmiao’s ride-hailing platform) are subject to significant risks, uncertainties and assumptions, including

those detailed from time to time in the Senmiao’s filings with the SEC, and represent Senmiao’s views only as of the date

they are made and should not be relied upon as representing Senmiao’s views as of any subsequent date. Senmiao undertakes no obligation

to publicly revise any forward-looking statements to reflect changes in events or circumstances.

For more information, please contact:

At the Company:

Yiye Zhou

Email: edom333@ihongsen.com

Phone: +86 28 6155 4399

Investor Relations:

| The Equity Group Inc. |

In China |

| Carolyne Sohn, Vice President |

Lucy Ma, Associate |

| +1 408-538-4577 |

+86 10 5661 7012 |

| csohn@equityny.com |

lma@equityny.com |

Alice Zhang, Associate

+1 212-836-9610

azhang@equityny.com

© 2023 Senmiao Technology Ltd. All rights

reserved.

SENMIAO TECHNOLOGY LIMITED

CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. dollars, except for the number

of shares)

| | |

March 31, | | |

March 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,610,090 | | |

$ | 1,185,221 | |

| Accounts receivable, net, current portion | |

| 158,435 | | |

| 418,022 | |

| Accounts receivable, a related party | |

| 6,312 | | |

| — | |

| Inventories | |

| 6,678 | | |

| 286,488 | |

| Finance lease receivables, net, current portion | |

| 146,114 | | |

| 314,264 | |

| Prepayments, other receivables and other assets, net | |

| 1,438,243 | | |

| 2,713,208 | |

| Due from related parties, current portion, net | |

| 1,488,914 | | |

| 682,335 | |

| Total current assets | |

| 4,854,786 | | |

| 5,599,538 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 3,343,457 | | |

| 5,658,773 | |

| | |

| | | |

| | |

| Other assets | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| 121,672 | | |

| 109,621 | |

| Operating lease right-of-use assets, net, related parties | |

| 92,916 | | |

| 515,906 | |

| Financing lease right-of-use assets, net | |

| 623,714 | | |

| 305,933 | |

| Intangible assets, net | |

| 774,324 | | |

| 959,551 | |

| Accounts receivable, net, noncurrent | |

| — | | |

| 69 | |

| Finance lease receivables, net, noncurrent | |

| 71,133 | | |

| 92,980 | |

| Due from a related party, noncurrent | |

| 3,640,206 | | |

| 6,635,746 | |

| Other non-current assets | |

| 716,407 | | |

| — | |

| Total other assets | |

| 6,040,372 | | |

| 8,619,806 | |

| | |

| | | |

| | |

| Total assets | |

$ | 14,238,615 | | |

$ | 19,878,117 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANNIE EQUITY AND EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Borrowings from a financial institution | |

$ | 8,813 | | |

$ | 145,542 | |

| Accounts payable | |

| 183,645 | | |

| 14,446 | |

| Advances from customers | |

| 148,188 | | |

| 120,629 | |

| Accrued expenses and other liabilities | |

| 3,377,507 | | |

| 2,444,367 | |

| Due to related parties and affiliates | |

| 8,667 | | |

| 11,682 | |

| Operating lease liabilities | |

| 60,878 | | |

| 50,177 | |

| Operating lease liabilities - related parties | |

| 143,462 | | |

| 330,781 | |

| Financing lease liabilities | |

| 264,052 | | |

| 304,557 | |

| Derivative liabilities | |

| 501,782 | | |

| 2,215,204 | |

| Current liabilities - discontinued operations | |

| 487,829 | | |

| 528,426 | |

| Total current liabilities | |

| 5,184,823 | | |

| 6,165,811 | |

| | |

| | | |

| | |

| Other liabilities | |

| | | |

| | |

| Operating lease liabilities, non-current | |

| 83,485 | | |

| 47,910 | |

| Operating lease liabilities, non-current - related parties | |

| 42,247 | | |

| 226,896 | |

| Financing lease liabilities, non-current | |

| 388,064 | | |

| 1,376 | |

| Deferred tax liability | |

| 42,930 | | |

| 46,386 | |

| Total other liabilities | |

| 556,726 | | |

| 322,568 | |

| | |

| | | |

| | |

| Total liabilities | |

| 5,741,549 | | |

| 6,488,379 | |

SENMIAO TECHNOLOGY LIMITED

CONSOLIDATED BALANCE SHEETS (CONTINUED)

(Expressed in U.S. dollars, except for the number

of shares)

| | |

March 31, | | |

March 31, | |

| | |

2023 | | |

2022 | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine Equity | |

| | | |

| | |

| Series A convertible preferred stock (par value $1,000 per share, 5,000 shares authorized; 1,641 and 5,000 shares issued and outstanding at March 31, 2023 and March 31, 2022, respectively) | |

| 269,386 | | |

| 820,799 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock (par value $0.0001 per share, 500,000,000 shares authorized; 7,743,040 and 6,186,783 shares issued and outstanding at March 31, 2023 and March 31, 2022, respectively) * | |

| 773 | | |

| 618 | |

| Additional paid-in capital | |

| 43,355,834 | | |

| 42,803,045 | |

| Accumulated deficit | |

| (37,715,294 | ) | |

| (34,601,545 | ) |

| Accumulated other comprehensive loss | |

| (1,247,099 | ) | |

| (109,454 | ) |

| Total Senmiao Technology Limited stockholders’ equity | |

| 4,394,214 | | |

| 8,092,664 | |

| | |

| | | |

| | |

| Non-controlling interests | |

| 3,833,466 | | |

| 4,476,275 | |

| | |

| | | |

| | |

| Total equity | |

| 8,227,680 | | |

| 12,568,939 | |

| | |

| | | |

| | |

| Total liabilities, mezzanine equity and equity | |

$ | 14,238,615 | | |

$ | 19,878,117 | |

*Giving retroactive effect to the 1-for-10 reverse stock split effected

on April 6, 2022

SENMIAO TECHNOLOGY LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (LOSS)

(Expressed in U.S. dollars, except for the number

of shares)

| | |

For the Year Ended

March 31, | |

| | |

2023 | | |

2022 | |

| Revenues | |

| | |

| |

| Revenues | |

$ | 7,738,394 | | |

$ | 4,913,102 | |

| Revenues, a related party | |

| 344,120 | | |

| — | |

| Total revenues | |

| 8,082,514 | | |

| 4,913,102 | |

| | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | |

| Cost of revenues | |

| (6,080,097 | ) | |

| (7,001,297 | ) |

| Cost of revenues, a related party | |

| (509,904 | ) | |

| — | |

| Total cost of revenues | |

| (6,590,001 | ) | |

| (7,001,297 | ) |

| | |

| | | |

| | |

| Gross profit (loss) | |

| 1,492,513 | | |

| (2,088,195 | ) |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (6,142,447 | ) | |

| (9,035,142 | ) |

| Provision for doubtful accounts, net of recovery | |

| (1,487,889 | ) | |

| (235,279 | ) |

| Impairments of inventories | |

| (3,085 | ) | |

| (60,398 | ) |

| Impairments of long-lived assets and goodwill | |

| — | | |

| (142,974 | ) |

| Total operating expenses | |

| (7,633,421 | ) | |

| (9,473,793 | ) |

| | |

| | | |

| | |

| Loss from operations | |

| (6,140,908 | ) | |

| (11,561,988 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Other income (expense), net | |

| 664,001 | | |

| (107,444 | ) |

| Interest expense | |

| — | | |

| (5,893 | ) |

| Interest expense on finance leases | |

| (25,675 | ) | |

| (55,844 | ) |

| Change in fair value of derivative liabilities | |

| 1,711,889 | | |

| 6,951,482 | |

| Issuance cost incurred for issuing series A convertible preferred stock | |

| — | | |

| (821,892 | ) |

| Total other income, net | |

| 2,350,215 | | |

| 5,960,409 | |

| | |

| | | |

| | |

| Loss before income taxes | |

| (3,790,693 | ) | |

| (5,601,579 | ) |

| | |

| | | |

| | |

| Income tax expense | |

| — | | |

| (4,566 | ) |

| | |

| | | |

| | |

| Net loss from continuing operations | |

| (3,790,693 | ) | |

| (5,606,145 | ) |

| | |

| | | |

| | |

| Discontinued operations: | |

| | | |

| | |

| Loss from discontinued operations, net of applicable income taxes | |

| — | | |

| (2,747,209 | ) |

| Net gain from deconsolidation of VIEs - discontinued operations | |

| — | | |

| 10,975,101 | |

| Gain from discontinued operations | |

| — | | |

| 8,227,892 | |

| | |

| | | |

| | |

| Net (loss) income | |

| (3,790,693 | ) | |

| 2,621,747 | |

| | |

| | | |

| | |

| Net loss (income) attributable to non-controlling interests from continuing operations | |

| 676,944 | | |

| (3,872,645 | ) |

| Net loss attributable to non-controlling interests from discontinued operations | |

| — | | |

| 714,274 | |

| | |

| | | |

| | |

| Net loss attributable to the Company’s stockholders | |

$ | (3,113,749 | ) | |

$ | (536,624 | ) |

| | |

| | | |

| | |

| Net (loss) income | |

$ | (3,790,693 | ) | |

$ | 2,621,747 | |

SENMIAO TECHNOLOGY LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (LOSS) (CONTINUED)

(Expressed in U.S. dollars, except for the number

of shares)

| | |

For the Year Ended March 31, | |

| | |

2023 | | |

2022 | |

| Other comprehensive (loss) income | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (1,103,510 | ) | |

| 64,470 | |

| | |

| | | |

| | |

| Comprehensive income (loss) | |

| (4,894,203 | ) | |

| 2,686,217 | |

| Less: Total comprehensive income (loss) attributable to noncontrolling interests | |

| (642,809 | ) | |

| 3,142,520 | |

| | |

| | | |

| | |

| Total comprehensive loss attributable to stockholders | |

| (4,251,394 | ) | |

| (456,303 | ) |

| | |

| | | |

| | |

| Weighted average number of common stock | |

| | | |

| | |

| Basic and diluted* | |

| 7,195,781 | | |

| 5,726,997 | |

| | |

| | | |

| | |

| Earnings (loss) per share - basic and diluted* | |

| | | |

| | |

| Continuing operations | |

$ | (0.43 | ) | |

$ | (1.66 | ) |

| Discontinued operations | |

| — | | |

| 1.56 | |

| Net loss per share - basic and diluted* | |

$ | (0.43 | ) | |

$ | (0.10 | ) |

*Giving retroactive effect to the 1-for-10 reverse stock split effected

on April 6, 2022

SENMIAO TECHNOLOGY LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. dollars, except for the number

of shares)

| | |

For the Years Ended March 31, | |

| | |

2023 | | |

2022 | |

| Cash Flows from Operating Activities: | |

| | | |

| | |

| Net income (loss) | |

$ | (3,790,693 | ) | |

$ | 2,621,747 | |

| Net income from discontinued operations | |

| — | | |

| 8,227,892 | |

| Net loss from continuing operations | |

| (3,790,693 | ) | |

| (5,606,145 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation of property and equipment | |

| 1,095,518 | | |

| 956,400 | |

| Stock compensation expense | |

| — | | |

| 653,000 | |

| Issuance cost incurred for issuing series A convertible preferred stock | |

| — | | |

| 821,892 | |

| Amortization of right-of-use assets | |

| 711,630 | | |

| 955,443 | |

| Amortization of intangible assets | |

| 184,215 | | |

| 160,831 | |

| Provision for doubtful accounts, net of recovery | |

| 1,487,889 | | |

| 235,279 | |

| Impairments of inventories | |

| 3,085 | | |

| 60,398 | |

| Impairments of long-lived assets and goodwill | |

| — | | |

| 142,974 | |

| Gain on disposal of equipment | |

| (452,522 | ) | |

| — | |

| Change in fair value of derivative liabilities | |

| (1,711,889 | ) | |

| (6,951,482 | ) |

| Change in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| 224,673 | | |

| 4,456 | |

| Accounts receivable, a related party | |

| (6,327 | ) | |

| — | |

| Inventories | |

| 316,139 | | |

| (260,464 | ) |

| Finance lease receivables | |

| 258,932 | | |

| 634,103 | |

| Prepayments, other receivables and other assets | |

| 1,046,465 | | |

| 28,254 | |

| Accounts payable | |

| 170,703 | | |

| (31,434 | ) |

| Advances from customers | |

| 36,911 | | |

| 6,678 | |

| Accrued expenses and other liabilities | |

| 1,170,510 | | |

| (377,965 | ) |

| Operating lease liabilities | |

| (53,620 | ) | |

| (240,051 | ) |

| Operating lease liabilities - related parties | |

| (133,782 | ) | |

| (228,281 | ) |

| Net cash provided by (used in) operating activities from continuing operations | |

| 557,837 | | |

| (9,036,114 | ) |

| Net cash used in operating activities from discontinued operations | |

| — | | |

| (123,167 | ) |

| Net Cash Provided by (Used in) Operating Activities | |

| 557,837 | | |

| (9,159,281 | ) |

| | |

| | | |

| | |

| Cash Flows from Investing Activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (1,151,076 | ) | |

| (3,223,992 | ) |

| Cash proceed from disposal of long-lived assets | |

| 1,498,024 | | |

| — | |

| Purchases of intangible assets | |

| (26,420 | ) | |

| (141,730 | ) |

| Cash released upon termination of a VIE | |

| — | | |

| (193 | ) |

| Net cash provided by (used in) investing activities from continuing operations | |

| 320,528 | | |

| (3,365,915 | ) |

| Net cash used in investing activities from discontinued operations | |

| — | | |

| (111,210 | ) |

| Net Cash Provided by (Used in) Investing Activities | |

| 320,528 | | |

| (3,477,125 | ) |

SENMIAO TECHNOLOGY LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

(Expressed in U.S. dollars, except for the number

of shares)

| | |

For the Years Ended March 31, | |

| | |

2023 | | |

2022 | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Net proceeds from issuance of common stock in registered direct offering | |

| — | | |

| 5,771,053 | |

| Net proceeds from issuance of common stock upon warrants exercised | |

| — | | |

| 22,015 | |

| Net proceeds from issuance of series A convertible preferred stock and warrants in a private placement offering | |

| — | | |

| 4,369,937 | |

| Borrowings from a financial institution | |

| — | | |

| 183,390 | |

| Repayments to related parties and affiliates | |

| — | | |

| (117,761 | ) |

| Repayments from related parties and affiliates | |

| 144,151 | | |

| — | |

| Repayments of current borrowings from financial institutions | |

| (125,840 | ) | |

| (39,613 | ) |

| Principal payments of finance lease liabilities | |

| (392,145 | ) | |

| (433,611 | ) |

| Net cash provided by (used in) financing activities from continuing operations | |

| (373,834 | ) | |

| 9,755,410 | |

| Net Cash Provided by (Used in) Financing Activities | |

| (373,834 | ) | |

| 9,755,410 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (79,662 | ) | |

| (381,858 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| 424,869 | | |

| (3,262,854 | ) |

| Cash and cash equivalents, beginning of the year | |

| 1,185,221 | | |

| 4,448,075 | |

| Cash and cash equivalents, end of the year | |

$ | 1,610,090 | | |

$ | 1,185,221 | |

| | |

| | | |

| | |

| Supplemental Cash Flow Information | |

| | | |

| | |

| Cash paid for interest expense | |

$ | — | | |

$ | 5,893 | |

| Cash paid for income tax | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Non-cash Transaction in Investing and Financing Activities | |

| | | |

| | |

| Recognition of other receivables from Jinkailong upon deconsolidation | |

$ | — | | |

$ | 7,298,208 | |

| Recognition of right-of-use assets and lease liabilities | |

$ | 917,687 | | |

$ | 273,555 | |

| Recognition of right-of-use assets and lease liabilities, related parties | |

$ | 121,742 | | |

$ | 181,620 | |

| Termination of right-of use assets and lease liabilities | |

$ | 47,438 | | |

$ | — | |

| Termination of right-of use assets and lease liabilities, related parties | |

$ | 302,010 | | |

$ | — | |

| Cashless exercise of November 2021 Investor warrants into common stock | |

$ | 1,533 | | |

$ | — | |

| Allocation of fair value of derivative liabilities for issuance of common stock | |

$ | — | | |

$ | 7,932,341 | |

| Allocation of fair value of derivative liabilities to additional paid in capital upon warrants exercised | |

$ | — | | |

$ | 45,674 | |

| Acquisition of XXTX'S minority interest with issuance of common stock at fair value | |

$ | — | | |

$ | 1,972,717 | |

v3.23.2

Cover

|

Jul. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 12, 2023

|

| Entity File Number |

001-38426

|

| Entity Registrant Name |

SENMIAO TECHNOLOGY LIMITED

|

| Entity Central Index Key |

0001711012

|

| Entity Tax Identification Number |

35-2600898

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

16F, Shihao Square, Middle Jiannan

Blvd.

|

| Entity Address, Address Line Two |

High-Tech Zone

|

| Entity Address, City or Town |

Chengdu

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

610000

|

| City Area Code |

+86 28

|

| Local Phone Number |

61554399

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

AIHS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

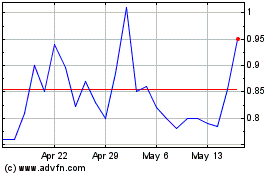

Senmiao Technology (NASDAQ:AIHS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Senmiao Technology (NASDAQ:AIHS)

Historical Stock Chart

From Jan 2024 to Jan 2025