0001014763false00010147632023-09-252023-09-25iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2023

AINOS, INC |

(Exact name of registrant as specified in its charter) |

Texas | | 0-20791 | | 75-1974352 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

8880 Rio San Diego Drive, Ste. 800, San Diego, CA 92108

(858) 869-2986

(Address and telephone number, including area code, of registrant’s principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Lind Financing

On September 25, 2023, AINOS, INC. (the “Company”) entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Lind Global Fund II LP (“Lind”).

The Securities Purchase Agreement provides for loans in an aggregate principal amount of up to $10 million under various tranches (the “Financing”). As of September 28, 2023, the initial closing date, Lind funded $2.0 million (less commitment fees) to the Company out of the $3.0 million “First Funding Amount” (as defined in the Securities Purchase Agreement) and Lind will fund the remaining $1.0 million (less commitment fees) after the Company provides written confirmation to Lind that (i) stockholder approval of the transactions has been obtained; (ii) that a resale Registration Statement on Form S-1 (the “Resale Registration Statement”) has been declared effective by the Securities and Exchange Commission (the “Commission”) for the registration of the shares of the Company’s common stock (the “common stock”) issuable upon conversion of the Note (as defined below) and the Warrant (as defined below); (iii) there is no Event of Default (as defined in the Securities Purchase Agreement) that has occurred or will occur as a result of such additional funding; and (iv) subordination agreements have been duly executed and delivered by the Company, Lind and the applicable Junior Credit party thereto (as defined in the Securitas Purchase Agreement) and in full force and effect.

In consideration for the First Funding Amount, on September 28, 2023, the Company issued and sold to Lind, in a private placement, (A) a senior secured convertible promissory note in the aggregate principal amount of $3,540,000 (the “Note”) and (B) warrants to purchase 3,456,221 shares of common stock at an initial exercise price of $0.90 per share of common stock, subject to certain adjustments (the “First Funding Warrant”).

Following stockholder approval and the effectiveness of the Resale Registration Statement and, subject to the satisfaction of certain conditions, the Company may request additional tranches of funding from Lind in the aggregate amount not to exceed $7.0 million (the "Increased Funding Amount"). Lind will receive additional warrants to purchase a number of shares of common stock equal to the Increased Funding Amount, multiplied by 0.75, divided by the average of the five daily volume weighted average price ("VWAP") during the five trading days prior to each subsequent closing date, with an exercise price equal to the average of the ten daily VWAPs during the ten trading days prior to the subsequent closing date, multiplied by 1.25 (each, a “Subsequent Warrant” and together with the First Funding Warrant, the "Warrants"). The Warrants will expire after five years from the date of issuance and may be exercised on a cashless basis.

Following the earlier to occur of (i) 90 days from the date of the Securities Purchase Agreement or (ii) the date the Resale Registration Statement is declared effective by the Commission, the Note is convertible into shares of the Company’s common stock at the lower of the price of $1.50 per share, subject to adjustment, or 90.0% of the average of the three lowest daily VWAP of the common stock during the 20 trading days prior to conversion, subject to certain adjustments (the "Conversion Price").

The Note does not bear any interest and matures on March 28, 2025. Following the date that is sixty days after the earlier to occur of (i) the date the Registration Statement is declared effective or (ii) the date that any shares issued pursuant to the Note may be immediately resold under Rule 144 of the Securities Act of 1933, as amended (the “Securities Act”), the Company may repay all, but not less than all, of the then outstanding principal amount of the Note, subject to a 5% premium. If the Company elects to prepay the Note, Lind has the right to convert up to 33 1/3% of the principal amount of the Note at the Conversion Price into shares of the Company’s common stock.

Upon the occurrence of any Event of Default (as defined in the Note), the Company must pay Lind an amount equal to 120% of the then outstanding principal amount of the Note, in addition to any other remedies under the Note or the other Transaction Documents (as defined in the Securities Purchase Agreement).

As collateral for the obligations under the Securities Purchase Agreement, the Company has granted to Lind a senior security interest in all of Company’s right, title, and interest in, to and under all of Company’s property (inclusive of intellectual property), subject to certain exceptions, as set forth in the Security Agreement (as defined in the Securities Purchase Agreement).

Each of the Note and the Warrants provide that Lind will not have the right to convert any portion of the Note or exercise any portion of the Warrants, as applicable, if, together with its affiliates, and any other party whose holdings would be aggregated with those of the holder for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended, would beneficially own in excess of 4.99% of the number of shares of the Company’s common stock outstanding immediately after giving effect to such conversion or exercise, as applicable (the “Beneficial Ownership Limitation”); provided, however, that the Beneficial Ownership Limitation will automatically increase to 9.99% if Lind, together with its affiliates, owns in excess of 4.99% of the Company’s outstanding common stock.

Pursuant to the Securities Purchase Agreement, if at any time prior to September 28, 2025, Company proposes to offer or sell New Securities (as defined in the Securities Purchase Agreement) Lind will have a right of first offer to purchase up to 20% of such New Securities.

The Securities Purchase Agreement provides for customary shelf and piggyback registration rights with respect to the shares of Common Stock underlying the Lind Note and the Warrants whereby the Company has agreed to file the Resale Registration Statement.

The Securities Purchase Agreement also contains customary representation and warranties of the Company and Lind, indemnification obligations of the Company, termination provisions, and other obligations and rights of the parties.

The Company intends to use the proceeds from the issuance of the Note and Warrants to fund clinical trials, commercial product launch and working capital.

Placement Agent and Placement Agent Warrant

Maxim Partners LLC (“Maxim”) together with its executing broker dealer, Brookline Capital Markets, a division of Arcadia Securities, LLC, (together with its affiliates, “Brookline”), pursuant to a placement agent agreement, served as the exclusive placement agent (the “Placement Agent”) of the placement. As a result of the placement, the Company will pay the Placement Agent (i) a cash fee of 7% of the gross proceeds from the sale of the Note and Warrants, and (ii) common stock purchase warrants to purchase 4% of the number of shares of common stock issuable under the Note and any Additional Funding Amount. The Company also agreed to pay certain expenses of the placement agent in connection with the placement.

On September 28, 2023, upon the initial closing, in consideration for its services in respect of the Lind Financing described above, the Company issued to the Placement Agent warrants to purchase 53,333 shares of the Company’s common stock at an exercise price per share of $1.65, subject to adjustment (the “Placement Agent Warrants”). The Placement Agent Warrants have five-year terms. In addition, the Company paid the Placement Agent a cash fee of 7% of the gross proceeds from the sale of the Note and First Funding Warrant. The Placement Agent Warrants also provides for customary demand and piggyback registration rights with respect to the shares of common stock underlying the Placement Agent Warrants.

The foregoing descriptions of the Securities Purchase Agreement, the Note, the Warrants, the Placement Agent Agreement and the Placement Agent Warrants are not complete and are subject to and qualified in their entirety by reference to the full text of the forms of such documents, which are filed as Exhibits hereto and incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information contained above under Item 1.01, to the extent applicable, is hereby incorporated by reference herein. Based in part upon the representations of Lind in the Securities Purchase Agreement, the placement and sale of the Note and Warrants was made in reliance on the exemption afforded by Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D under the Securities Act and corresponding provisions of state securities or “blue sky” laws. The Placement Agent Warrants were sold in reliance on the exemption afforded by Section 4(a)(2) of the Securities Act.

None of the securities have been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration with the SEC or an applicable exemption from the registration requirements. Neither this Current Report on Form 8-K nor any exhibit attached hereto is an offer to sell or the solicitation of an offer to buy shares of common stock or other securities of the Company.

Item 8.01 Other Events.

The Company issued a press release on September 25, 2023 announcing the placement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Number | | Exhibit |

4.1 | | Form of Placement Agent Warrant |

4.2 | | Convertible Promissory Note |

4.3 | | Common Stock Purchase Warrant |

10.1 | | Security Agreement, dated as of September 28, 2023, by and between Lind Global Fund II LP and Ainos, Inc. |

10.2 | | Securities Purchase Agreement, dated as of September 25, 2023, by and between Lind Global Fund II LP and Ainos, Inc. |

10.3 | | Placement Agent Agreement, dated as of September 25, 2023 by and between Maxim Partners LLC and Ainos, Inc. |

99.1 | | Press Release of Ainos, Inc., dated September 25, 2023 |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Ainos, Inc. | |

| | | |

Date: September 29, 2023 | By: | /s/ Chun-Hsien Tsai | |

| | Name: Chun-Hsien Tsai | |

| | Title: Chief Executive Officer | |

nullnullnullnullnullnullnull

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

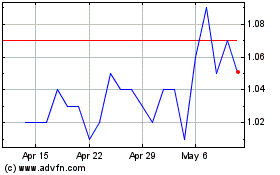

Ainos (NASDAQ:AIMD)

Historical Stock Chart

From Apr 2024 to May 2024

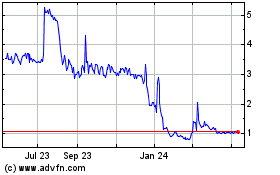

Ainos (NASDAQ:AIMD)

Historical Stock Chart

From May 2023 to May 2024