Please replace the release issued January 24, 2025 at 9:25am ET

with the following corrected version due to multiple revisions.

The updated release reads:

TOP RANKING FIRST TRUST RBA AMERICAN

INDUSTRIAL RENAISSANCE® ETF REACHES NEW MILESTONES IN GROWTH AND

PERFORMANCE OVER ITS 10+ YEAR HISTORY

First Trust Advisors L.P. (“First Trust”), a leading ETF

provider and asset manager, announced that the First Trust RBA

American Industrial Renaissance® ETF (NASDAQ: AIRR) has reached

over $3 billion in net assets as of 1/6/2025 and continues to be a

top performing fund. AIRR seeks investment results that correspond

generally to the price and yield (before the fund’s fees and

expenses) of an equity index called the Richard Bernstein Advisors

American Industrial Renaissance® Index (the “index”). The index is

designed to measure the performance of small and mid-cap U.S.

companies in the industrial and community banking sectors. These

companies are directly involved in manufacturing, related

infrastructure, and banking, including regional banks from U.S.

states traditionally known as manufacturing hubs.

Richard Bernstein Advisors (“RBA”) believes the U.S. industrial

sector may continue gaining global market share over the next

decade as a result of deglobalization, potentially making the

American Industrial Renaissance® an investment theme for many years

to come.

“The American Industrial Renaissance has proven to be an

exceptionally successful investment theme, as evidenced AIRR

surpassing $3 billion in net assets,” said Richard Bernstein, CEO,

CIO at Richard Bernstein Advisors. “Despite this achievement, the

critical need for the U.S. to invest in manufacturing—both to

safeguard economic independence and bolster national

security—remains widely underappreciated. This underscores the

American Industrial Renaissance's potential as a compelling

long-term investment opportunity.”

“In our view, one of the most intriguing aspects of this theme

is how little attention it has received from investors,” said Ryan

Issakainen, CFA, Senior Vice President and ETF Strategist at First

Trust. “Not only in light of its strong performance over the past

decade, but more importantly, how well we believe it’s positioned

for the next several years.”

AIRR Performance Highlights as of 12/31/2024:

- 1-year average annual total return of 33.43%, based on net

asset value (NAV), versus 17.47% for the S&P 500® Industrials

Index.

- Since its inception in March 2014, AIRR has achieved an average

annual total return of 13.56%, based on NAV, outperforming the

S&P 500® Industrials Index which had a total return of 10.80%

over the same period.

- Largest and fastest-growing ETF in Morningstar’s Industrials

category, based on total net assets.1

- 5-Star Overall Morningstar RatingTM, among 44 funds in the

Industrials category. This fund was rated 5 stars/44 funds (3

years), 5 stars/42 funds (5 years), 5 stars/32 funds (10 years)

based on risk adjusted returns.

- #1 performing fund in Morningstar’s Industrials category,

ranking #1/41 funds (1 year), #1/32 funds (5 years), #1/25 funds

(10 years) and #1/25 funds (since fund inception).

- AIRR has outperformed the S&P 500® Index in the 1-year,

5-year, and 10-year time periods based on NAV despite not holding

information technology or large cap growth companies.

Performance (%)

1 Year

5 Year

10 Year

Since Fund Inception

Net Asset Value*

33.43

21.70

15.70

13.56

Market Price*

33.24

21.70

15.69

13.56

Richard Bernstein Advisors

American Industrial Renaissance® Index**

34.45

22.61

16.57

14.42

S&P 500® Industrials

Index**

17.47

12.03

10.75

10.80

Russell 2500® Index**

12.00

8.77

8.85

8.50

S&P 500® Index**

25.02

14.53

13.10

13.19

Performance data quoted represents past performance. Past

performance is not a guarantee of future results and current

performance may be higher or lower than performance quoted.

Investment returns and principal value will fluctuate and shares

when sold or redeemed, may be worth more or less than their

original cost. You can obtain performance information which is

current through the most recent month-end by visiting

www.ftportfolios.com.

Inception Date: 3/10/2014. Total Expense Ratio: 0.70%.

*NAV returns are based on the fund’s net asset value

which represents the fund’s net assets (assets less liabilities)

divided by the fund’s outstanding shares. Market Price

returns are determined by using the midpoint of the national best

bid offer price ("NBBO") as of the time that the fund's NAV is

calculated. Returns are average annualized total returns.

**Performance information for each listed index is for

illustrative purposes only and does not represent actual fund

performance. Indexes do not charge management fees or brokerage

expenses, and no such fees or expenses were deducted from the

performance shown. Indexes are unmanaged and an investor cannot

invest directly in an index.

1Source: Morningstar, based on net assets under management from

AIRR inception date of 3/10/2014 through 12/31/2024.

For more information about First Trust, please contact Ryan

Issakainen at (630) 765-8689 or RIssakainen@FTAdvisors.com.

About First Trust

First Trust is a federally registered investment advisor and

serves as the fund’s investment advisor. First Trust and its

affiliate First Trust Portfolios L.P. (“FTP”), a FINRA registered

broker-dealer, are privately held companies that provide a variety

of investment services. First Trust has collective assets under

management or supervision of approximately $256 billion as of

December 31, 2024, through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts. First Trust is the supervisor of the First Trust unit

investment trusts, while FTP is the sponsor. FTP is also a

distributor of mutual fund shares and exchange-traded fund creation

units. First Trust and FTP are based in Wheaton, Illinois. For more

information, visit https://www.ftportfolios.com.

About Richard Bernstein

Advisors

Richard Bernstein Advisors LLC is a global macro multi-asset

investment manager with a broad range of products across global

equity and fixed income markets. Founded in 2009, RBA manages

approximately $16 billion in client assets today, including several

prominent pension plans, corporations and foundations, as well as

financial advisors and high net worth individuals. RBA acts as

sub-advisor for the Eaton Vance Richard Bernstein Equity Strategy

Fund and the Eaton Vance Richard Bernstein All-Asset Strategy Fund

and offers income and theme-oriented unit trusts and ETFs through

First Trust. RBA's investment insights as well as further

information about the firm and products can be found at

www.rbadvisors.com.

You should consider a fund’s investment objectives, risks,

and charges and expenses carefully before investing. Contact First

Trust Portfolios L.P. at 1-800-621-1675 or visit

www.ftportfolios.com to obtain a prospectus or summary

prospectus which contains this and other information about a fund.

The prospectus or summary prospectus should be read carefully

before investing.

Risk Considerations

Unlike mutual funds, shares of the fund may only be redeemed

directly from a fund by authorized participants in very large

creation/redemption units. If a fund's authorized participants are

unable to proceed with creation/redemption orders and no other

authorized participant is able to step forward to create or redeem,

fund shares may trade at a premium or discount to a fund's net

asset value and possibly face delisting and the bid/ask spread may

widen.

Community banks were significantly impacted by the decline in

the subprime mortgage lending market in the U.S. which brought

about legislative and regulatory changes, changes in short-term and

long-term interest rates, inflation and changes in government

monetary and fiscal policies. Unlike larger national or other

regional banks that are more geographically diversified, a

community bank's financial performance may be highly dependent upon

the business environment in certain geographic regions of the U.S.

and may be adversely impacted by any downturn or unfavorable

economic or employment developments in its local market and the

U.S. as a whole.

Current market conditions risk is the risk that a particular

investment, or shares of the fund in general, may fall in value due

to current market conditions. For example, changes in governmental

fiscal and regulatory policies, disruptions to banking and real

estate markets, actual and threatened international armed conflicts

and hostilities, and public health crises, among other significant

events, could have a material impact on the value of the fund's

investments.

A fund is susceptible to operational risks through breaches in

cyber security. Such events could cause a fund to incur regulatory

penalties, reputational damage, additional compliance costs

associated with corrective measures and/or financial loss.

Depositary receipts may be less liquid than the underlying

shares in their primary trading market and distributions may be

subject to a fee. Holders may have limited voting rights, and

investment restrictions in certain countries may adversely impact

their value.

Equity securities may decline significantly in price over short

or extended periods of time, and such declines may occur in the

equity market as a whole, or they may occur in only a particular

country, company, industry or sector of the market.

An index fund will be concentrated in an industry or a group of

industries to the extent that the index is so concentrated. A fund

with significant exposure to a single asset class, or the

securities of issuers within the same country, state, region,

industry, or sector may have its value more affected by an adverse

economic, business or political development than a broadly

diversified fund.

A fund may be a constituent of one or more indices or models

which could greatly affect a fund's trading activity, size and

volatility.

There is no assurance that the index provider or its agents will

compile or maintain the index accurately. Losses or costs

associated with any index provider errors generally will be borne

by a fund and its shareholders.

Industrials and producer durables companies are subject to

certain risks, including the general state of the economy, intense

competition, consolidation, domestic and international politics,

excess capacity and consumer demand and spending trends. They may

also be significantly affected by overall capital spending levels,

economic cycles, technical obsolescence, delays in modernization,

labor relations, and government regulations.

Market risk is the risk that a particular security, or shares of

a fund in general may fall in value. Securities are subject to

market fluctuations caused by such factors as general economic

conditions, political events, regulatory or market developments,

changes in interest rates and perceived trends in securities

prices. Shares of a fund could decline in value or underperform

other investments as a result. In addition, local, regional or

global events such as war, acts of terrorism, spread of infectious

disease or other public health issues, recessions, natural

disasters or other events could have significant negative impact on

a fund.

A fund faces numerous market trading risks, including the

potential lack of an active market for fund shares due to a limited

number of market makers. Decisions by market makers or authorized

participants to reduce their role or step away in times of market

stress could inhibit the effectiveness of the arbitrage process in

maintaining the relationship between the underlying values of a

fund's portfolio securities and a fund's market price.

An index fund's return may not match the return of the index for

a number of reasons including operating expenses, costs of buying

and selling securities to reflect changes in the index, and the

fact that a fund's portfolio holdings may not exactly replicate the

index.

A fund and a fund's advisor may seek to reduce various

operational risks through controls and procedures, but it is not

possible to completely protect against such risks. The fund also

relies on third parties for a range of services, including custody,

and any delay or failure related to those services may affect the

fund's ability to meet its objective.

A fund that invests in securities included in or representative

of an index will hold those securities regardless of investment

merit and the fund generally will not take defensive positions in

declining markets.

High portfolio turnover may result in higher levels of

transaction costs and may generate greater tax liabilities for

shareholders.

The market price of a fund's shares will generally fluctuate in

accordance with changes in the fund's net asset value ("NAV") as

well as the relative supply of and demand for shares on the

exchange, and a fund's investment advisor cannot predict whether

shares will trade below, at or above their NAV.

Securities of small- and mid-capitalization companies may

experience greater price volatility and be less liquid than larger,

more established companies.

Trading on an exchange may be halted due to market conditions or

other reasons. There can be no assurance that a fund's requirements

to maintain the exchange listing will continue to be met or be

unchanged.

First Trust Advisors L.P. (FTA) is the adviser to the First

Trust fund(s). FTA is an affiliate of First Trust Portfolios L.P.,

the distributor of the fund(s).

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

Richard Bernstein Advisors and Richard Bernstein Advisors

American Industrial Renaissance® Index ("Index") are trademarks and

trade names of Richard Bernstein Advisors ("RBA"). The Fund is not

sponsored, endorsed, sold or promoted by RBA and RBA makes no

representation or warranty, express or implied, to the owners of

the Fund or any member of the public regarding the advisability of

trading in the Fund. RBA's only relationship to First Trust is the

licensing of certain trademarks and trade names of RBA and of the

Index, which is determined and composed by RBA without regard to

First Trust or the Fund. RBA has no obligation to take the needs of

First Trust or the owners of the Fund into consideration in

determining or composing the Index. RBA is not responsible for and

has not participated in the determination of the timing of, prices

at, or quantities of the Fund to be listed or in the determination

or calculation of the equation by which the Fund is to be converted

into cash. RBA has no obligation or liability in connection with

the administration, marketing or trading of the Fund.

^The Morningstar Rating™ for funds, or “star rating”, is

calculated for managed products (including mutual funds, variable

annuity and variable life subaccounts, exchange-traded funds,

closed-end funds, and separate accounts) with at least a three-year

history. Exchange-traded funds and open-ended mutual funds are

considered a single population for comparative purposes. It is

calculated based on a Morningstar Risk Adjusted Return measure that

accounts for variation in a managed product’s monthly excess

performance, placing more emphasis on downward variations and

rewarding consistent performance. The Morningstar Rating does not

include any adjustment for sales loads. The top 10% of products in

each product category receive 5 stars, the next 22.5% receive 4

stars, the next 35% receive 3 stars, the next 22.5% receive 2

stars, and the bottom 10% receive 1 star. The Overall Morningstar

Rating for a managed product is derived from a weighted average of

the performance figures associated with its three-, five-, and

10-year (if applicable) Morningstar Rating metrics. The weights

are: 100% three-year rating for 36-59 months of total returns, 60%

five-year rating/40% three-year rating for 60-119 months of total

returns, and 50% 10-year rating/30% five-year rating/20% three-year

rating for 120 or more months of total returns. While the 10-year

overall star rating formula seems to give the most weight to the

10-year period, the most recent three-year period actually has the

greatest impact because it is included in all three rating periods.

©2025 Morningstar, Inc. All Rights Reserved. The Morningstar

Rating™ information contained herein: (1) is proprietary to

Morningstar; (2) may not be copied or distributed; and (3) is not

warranted to be accurate, complete or timely. Neither Morningstar

nor its content providers are responsible for any damages or losses

arising from any use of this information. Past performance is no

guarantee of future results.

S&P 500® Industrials Index - The Index is an unmanaged index

which includes the stocks in the industrials sector of the S&P

500 Index.

Russell 2500® Index - The Index is an unmanaged market-cap

weighted index that includes the smallest 2,500 companies from the

Russell 3000 Index.

S&P 500® Index - The Index is an unmanaged index of 500

companies used to measure large-cap U.S. stock market

performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124768701/en/

Ryan Issakainen First Trust (630) 765-8689

RIssakainen@FTAdvisors.com

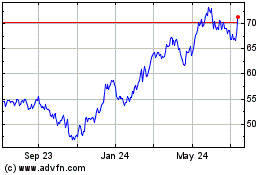

First Trust RBA American... (NASDAQ:AIRR)

Historical Stock Chart

From Jan 2025 to Feb 2025

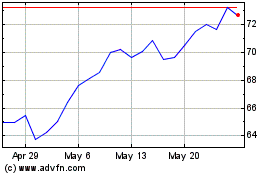

First Trust RBA American... (NASDAQ:AIRR)

Historical Stock Chart

From Feb 2024 to Feb 2025