As

filed with the Securities and Exchange Commission on February 6, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

AmpliTech Group, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

27-4566352 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

155

Plant Avenue

Hauppauge,

NY |

|

11788 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Amended

and Restated 2020 Equity Incentive Plan

|

(Full

title of the plan)

|

Fawad

Maqbool

155

Plant Avenue

Hauppauge,

NY 11788

(631)-521-7831

(Name,

address and telephone number, including area code,

of

agent for service) |

|

Copy

to:

Gregory

Sichenzia, Esq.

Avital

Perlman, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

(212)

930-970 |

Indicate

by check mark whether the Company is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See definitions of “large, accelerated filer,” “accelerated filer”, “small

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large,

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

EXPLANATORY

NOTE

This

registration statement on Form S-8 (the “Registration Statement”) relates to an additional 1,000,000 shares of common stock,

par value $0.001 per share of AmpliTech Group, Inc. (the “Registrant,” the “Company,” “we,” “us”

or “our”), which are issuable pursuant to awards that may be granted under our Amended and Restated 2020 Equity Incentive

Plan (the “Plan”). Under the Plan, a total of 2,250,000 shares of common stock have been reserved for issuance upon the grant

of awards and exercise of options to directors, officers, employees and consultants of the Company and of the Company’s affiliates,

of which 1,250,000 shares (adjusted to reflect our 1 for 20 reverse stock split effective February 17, 2021) have been registered pursuant

to the Registrant’s previously filed Registration Statement on Form S-8 (File No. 333-251332) filed on December 14, 2020.

Pursuant to General Instruction E to Form S-8, Part I and Items 4-7 and 9 of Part II of the Registrant’s Registration Statement

on Form S-8 (File No. 333-251332) are incorporated herein by reference except to the extent supplemented, amended or superseded by the

information set forth herein. Only those items of Form S-8 containing new information not contained in the earlier registration statement

are presented herein.

This

Registration Statement also includes a reoffer prospectus prepared in accordance with General Instruction C of Form S-8 and in accordance

with the requirements of Part I of Form S-3, to be used in connection with resales of securities registered hereunder by selling stockholders

(the “Selling Stockholders”), some of whom may be considered affiliates of the Company, as defined in Rule 405 under the

Securities Act of 1933, as amended. The Selling Stockholders may be selling up to an aggregate of 870,000 shares of common stock that

constitute “restricted securities” and “control securities” which have been issued by the Registrant pursuant

to the Plan, prior to the filing of this Registration Statement.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information specified in Part I, and the Note to Part I of Form S-8 will be delivered to each of the participants

in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), but these documents and

the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement,

taken together, constitute a Prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item

2. Registrant Information and Employee Annual Information.

Upon

written or oral request, any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents

are incorporated by reference in this Section 10(a) Prospectus) and other documents required to be delivered to eligible employers, non-employee

directors and consultants pursuant to Rule 428(b) are available without charge by contacting: Secretary, AmpliTech Group, Inc., 155 Plant

Avenue, Hauppauge, New York, 11788 at (631) 521-7831.

REOFFER

PROSPECTUS

870,000

Shares

AmpliTech

Group, Inc.

Common

Stock

This

reoffer prospectus relates to the public resale, from time to time, of an aggregate of 870,000 shares (the “Shares”) of our

common stock, $0.001 par value per share, by certain security holders identified herein in the section entitled “Selling Stockholders”.

Such Shares have been or may be acquired in connection with awards granted under the Amended and Restated 2020 Equity Incentive Plan

(the “Plan”) of AmpliTech Group, Inc. (the “Company”). You should read this prospectus carefully before you invest

in the common stock.

Such

resales shall take place on the Nasdaq Capital Market, or such other stock market or exchange on which our common stock may be listed

or quoted, in negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated

(see “Plan of Distribution” starting on page 6 of this prospectus). We will receive no part of the proceeds from sales

made under this reoffer prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses

incurred by us in connection with the registration and offering and not borne by the Selling Stockholders will be borne by us.

This

reoffer prospectus has been prepared for the purposes of registering the Shares under the Securities Act to allow for future sales by

the Selling Stockholders on a continuous or delayed basis to the public without restriction. We have not entered into any underwriting

arrangements in connection with the sale of the Shares covered by this reoffer prospectus. The Selling Stockholders identified in this

reoffer prospectus, or their pledgees, donees, transferees or other successors-in-interest, may offer the Shares covered by this reoffer

prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market

prices or at privately negotiated prices.

Investing

in our common stock involves risks. See “Risk Factors” beginning on page 4 of this reoffer prospectus. These are speculative

securities.

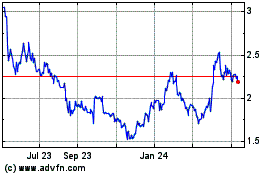

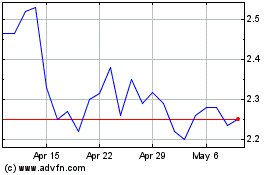

Our

common stock and tradable warrants are listed on the Nasdaq Capital Market under the symbols “AMPG” and “AMPGW,”

respectively, and the last reported sale prices of our common stock and warrants on February 2, 2024 was $2.20 and $0.17,

respectively.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this Prospectus is February 6, 2024

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934 (the “Exchange Act”) that involve risks and uncertainties. All statements other than statements of historical

fact contained in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, including

statements regarding future events, our future financial performance, business strategy, and plans and objectives of management for future

operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements

unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions

and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or

elsewhere in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein, which may cause

our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time

to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any

forward-looking statements.

We

have based these forward-looking statements largely on our current expectations and projections about future events and financial trends

that we believe may affect our financial condition, results of operations, business strategy, short term and long-term business operations,

and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results

to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences

include, but are not limited to, those discussed in this this prospectus, any accompanying prospectus supplement and the documents incorporated

by reference herein, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed

in other documents we file with the Securities and Exchange Commission, or the SEC. We undertake no obligation to revise or publicly

release the results of any revision to these forward-looking statements, except as required by law. In light of these risks, uncertainties

and assumptions, the forward-looking events and circumstances discussed in this prospectus, any accompanying prospectus supplement and

the documents incorporated by reference herein may not occur and actual results could differ materially and adversely from those anticipated

or implied in the forward-looking statement.

You

should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus. Except

as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this

prospectus to conform our statements to actual results or changed expectations.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that

you should consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated

by reference herein. In particular, attention should be directed to our “Risk Factors,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained

herein or otherwise incorporated by reference hereto, before making an investment decision.

Our

Corporate History and Structure

AmpliTech

Group Inc. (“AMPG,” “AmpliTech” or the “Company”), was incorporated under the laws of the State of

Nevada on December 30, 2010. On August 13, 2012, the Company acquired AmpliTech Inc., by issuing 833,750 shares of the Company’s

common stock to the shareholders of AmpliTech Inc. in exchange for 100% of the outstanding shares of AmpliTech Inc. (the “Share

Exchange”). After the Share Exchange, the selling shareholders owned 60,000 shares of the outstanding 893,750 shares of Company

common stock, resulting in a change in control. Accordingly, the transaction was accounted for as a reverse acquisition in which AmpliTech,

Inc. was deemed to be the accounting acquirer, and the operations of the Company were consolidated for accounting purposes. The capital

balances have been retroactively adjusted to reflect the reverse acquisition.

On

September 12, 2019, AmpliTech Group Inc. acquired substantially all the assets of Specialty Microwave Corporation, a privately held company

based in Ronkonkoma, NY. The purchase included all inventory, orders, customers, property and equipment, and goodwill. Following the

closing of the asset purchase, we hired all eight team members of SMW. In connection with the acquisition, the Company began using the

trade name “Specialty Microwave”. The total consideration paid was $1,143,633, consisting of $668,633 in cash and a $475,000

promissory note with an interest rate of 6%.

On

February 17, 2021, AmpliTech Group Inc.’s common stock and warrants commenced trading on NASDAQ under the symbols “AMPG”

and “AMPGW,” respectively. A reverse split of the outstanding common stock at a 1-for-20 ratio became effective February

17, 2021, as of 12:01 a.m., Eastern Time. All share amounts have been retroactively re-stated to reflect the reverse split.

On

November 19, 2021, AmpliTech Group, Inc. entered into an Asset Purchase Agreement with SSM, pursuant to which AmpliTech would acquire

substantially all of the assets of SSM. The aggregate purchase price for the acquisition was $10,123,276, subject to certain working

capital and other adjustments. $665,200 of the aggregate purchase price was paid by the issuance of 188,442 unregistered shares of AmpliTech

common stock at the closing of the acquisition. The Acquisition was completed on December 15, 2021.

In

2021, the Company opened a MMIC chip design center in Texas and has started to implement several of its proprietary amplifier designs

into MMIC components. MMICs are semiconductor chips used in high-frequency communications applications. MMICs are widely desired for

power amplification solutions to service emerging technologies, such as phased array antennas and quantum computing. MMICs carry a smaller

footprint enabling them to be incorporated into a broader array of systems while reducing costs.

In

August 2022, TGSS division was formed to enable “true G speeds” to the industry. TGSS’ main function will be to plan

and configure 5G radio systems and make them O-RAN compliant. TGSS will implement AmpliTech’s low noise amplifier devices in these

systems to promote greater coverage, longer range and faster speeds.

Our

principal executive offices are located at 155 Plant Avenue, Hauppauge, NY 11788. Our telephone number is (631) 521-7831. Our corporate

website is www.amplitechinc.com. The information on our website is not a part of, or incorporated in, this prospectus.

Business

Overview

The

Company is the parent company of AmpliTech, Inc., and also operates through its divisions Specialty Microwave, Spectrum Semiconductor

Materials, AmpliTech Group MMIC Design Center (“AGMDC”) and AmpliTech Group True G Speed Services (“TGSS”).

AmpliTech,

Inc. designs, engineers and assembles micro-wave component-based amplifiers that meet individual customer specifications. Our products

consist of Radio Frequency (“RF”) amplifiers and related subsystems, operating at multiple frequencies from 50kHz to 44GHz,

including low noise amplifiers (“LNA”), medium power amplifiers, cryogenic amplifiers, and custom assembly designs for the

global satellite communications, telecom (5G & IoT), space, defense, and quantum computing markets. We also offer non-recurring engineering

services on a project-by-project basis, for a predetermined fixed contractual amount, or on a time plus material basis. We have both

domestic and international customers in such industries as aerospace, governmental, defense and commercial satellite.

Specialty

Microwave designs and manufactures state-of- the-art precision SATCOM microwave components, RF subsystems and specialized electronic

assemblies for the military and commercial markets, flexible and rugged waveguides, wave guide adapters and more.

On

November 19, 2021, AMPG entered into an Asset Purchase Agreement with Spectrum Semiconductor Materials Inc. (“SSM”), a globally

authorized distributor of integrated circuit (IC) packaging and lids for semiconductor device assembly, prototyping, testing, and production

requirements founded in 1990 and headquartered in San Jose, CA, pursuant to which AMPG acquired substantially all the assets of the Company

(the Acquisition). The Acquisition was completed on December 15, 2021.

In

2021, the Company opened AGMDC, a monolithic microwave integrated circuits (“MMIC”) chip design center, in Texas and has

started to implement several of its proprietary amplifier designs into MMIC components. MMICs are semiconductor chips used in high-frequency

communications applications. MMICs are widely desired for power amplification solutions to service emerging technologies, such as phased

array antennas and quantum computing. MMICs carry a smaller footprint enabling them to be incorporated into a broader array of systems

while reducing costs. AGMDC designs, develops and manufactures state-of-the-art signal processing components for satellite and 5G communications

networks, defense, space and other commercial applications, allowing the Company to market its products to wider base of customers requiring

high technology in smaller packages.

In

August 2022, AmpliTech Group True G Speed Services (“TGSS”) division was formed to enable “true G speeds” to

the industry. TGSS’ main function will be to plan and configure 5G radio systems and make them O-RAN compliant. TGSS will implement

AmpliTech’s low noise amplifier devices in these systems to promote greater coverage, longer range and faster speeds.

Our

mission is to patent our proprietary IP and trade secrets that were used in small volume niche markets and expand our capabilities through

strategic partnerships, joint ventures, mergers/acquisitions with key industry leaders in the 5G/6G, quantum computing, and cybersecurity

markets. We believe this will enable us to scale up our products and revenue by developing full systems and subsystems with our unique

technology as a core component, which we expect will position us as a global leader in these rapidly emerging technology sectors and

addresses large volume markets as well, such as cellphone handsets, laptops, server networks, and many other applications that improve

everyday quality of life.

The

Company’s research and development initiative to expand its product line of low noise amplifiers to include its new 5G and wireless

infrastructure products and MMIC designs is progressing significantly. Our combined engineering and manufacturing resources are expected

to complement the development of new subsystems for satellite, wireless, and 5G infrastructures, as well as advanced military and commercial

markets.

RISK

FACTORS

An

investment in our common stock involves risks. Prior to deciding about investing in our common stock, you should consider carefully all

of the information contained or incorporated by reference in this prospectus, including any risks in the section entitled “Risk

Factors” contained in any supplements to this prospectus and in our Annual Report on Form 10-K for the fiscal year ended December

31, 2022, as amended to date, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Additional risks not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial

condition and the value of an investment in our securities.

USE

OF PROCEEDS

The

shares which may be sold under this reoffer prospectus will be sold for the respective accounts of each of the Selling Stockholders listed

herein (which includes our officers and directors). Accordingly, we will not realize any proceeds from the sale of the Shares. We will

receive proceeds from the exercise of the options; however, no assurance can be given as to when or if any or all of the options will

be exercised. If any options are exercised, the proceeds derived therefrom will be used for working capital and general corporate purposes.

All expenses of the registration of the Shares will be paid by us. See “Selling Stockholders” and “Plan of Distribution.”

SELLING

STOCKHOLDERS

We

are registering for resale the Shares covered by this reoffer prospectus to permit the Selling Stockholders identified below and their

pledgees, donees, transferees and other successors-in-interest that receive their securities from a Selling Stockholder as a gift, partnership

distribution or other non-sale related transfer after the date of this prospectus to resell the Shares when and as they deem appropriate.

The Selling Stockholders may acquire these Shares from us pursuant to the Plan. The Shares may not be sold or otherwise transferred by

the Selling Stockholders unless and until the applicable awards vest and are exercised, as applicable, in accordance with the terms and

conditions of the Plan.

The

following table sets forth:

| |

● |

the

name of each Selling Stockholder; |

| |

|

|

| |

● |

the

number and percentage of shares of our common stock that each Selling Stockholder beneficially owned as of February 2, 2024 prior

to the offering for resale of the Shares under this prospectus; |

| |

|

|

| |

● |

the

number of Shares that may be offered for resale for the account of each Selling Stockholder under this prospectus; and |

| |

|

|

| |

● |

the

number and percentage of shares of our common stock to be beneficially owned by each Selling Stockholder after the offering of the

resale Shares (assuming all of the offered resale Shares are sold by such Selling Stockholder). |

Information

with respect to beneficial ownership is based upon information obtained from the Selling Stockholders. Because the Selling Stockholders

may offer all or part of the Shares, which they own pursuant to the offering contemplated by this reoffer prospectus, and because its

offering is not being underwritten on a firm commitment basis, no estimate can be given as to the amount of Shares that will be held

upon termination of this offering. Except where indicated, all options and warrants held by the selling stockholders are exercisable

within 60 days of February 2, 2024.

The

number of shares in the column “Number of Shares Being Offered Hereby” represents all of the Shares of our common stock that

each Selling Stockholder may offer under this prospectus. We do not know how long the Selling Stockholders will hold the Shares before

selling them or how many Shares they will sell. The Shares of our common stock offered by this prospectus may be offered from time to

time by the Selling Stockholders listed below. We cannot assure you that any of the Selling Stockholders will offer for sale or sell

any or all of the Shares of common stock offered by them by this prospectus.

| | |

Number of | |

| |

Number of | |

Percentage of |

| | |

Shares | |

| |

Shares | |

Shares to be |

| | |

Beneficially | |

Number of | |

Beneficially | |

Beneficially |

| | |

Owned | |

Shares | |

Owned Upon | |

Owned Upon |

| Name of Selling | |

Prior to | |

Being Offered | |

Completion of | |

Completion of |

| Stockholder | |

the Offering(1) | |

Hereby (2) | |

the

Offering (3) | |

the Offering (4) |

| Fawad Maqbool | |

| 2,819,504 | (5) | |

| 400,000 | | |

| 2,649,504 | | |

| 27.34 | % |

| Louisa Sanfratello | |

| 95,000 | (6) | |

| 200,000 | | |

| 10,000 | | |

| * | |

| Jorge Flores | |

| 79,418 | (7) | |

| 180,000 | | |

| 14,000 | | |

| * | |

| Daniel Mazziota | |

| 237,618 | (8) | |

| 55,000 | | |

| 203,243 | | |

| 2.45 | % |

| Andrew Lee | |

| 43,750 | (9) | |

| 17,500 | | |

| 30,000 | | |

| * | |

| Matthew Kappers | |

| 43,750 | (9) | |

| 17,500 | | |

| 30,000 | | |

| * | |

| |

(1) |

Includes

shares noted under “Number of Shares Being Offered Hereby” and represents the total number of shares that a Selling Stockholder

currently owns or has the right to acquire within sixty (60) days of February 2, 2024. |

| |

(2) |

Represents

shares of stock issuable upon exercise of outstanding stock options. |

| |

(3) |

Represents

the total number of shares that a Selling Stockholder currently owns or has the right to acquire within sixty (60) days of February

2, 2024, assuming all of the offered resale Shares are sold. |

| |

(4) |

Based

on shares 9,689,613issued and outstanding as of February 2, 2024. |

| |

(5) |

Includes

170,000 options to purchase shares of common stock. |

| |

(6) |

Includes

85,000 options to purchase shares of common stock. |

| |

(7) |

Includes

65,418 options to purchase shares of common stock. |

| |

(8) |

Includes

34,375 options to purchase shares of common stock. |

| |

(9) |

Includes

13,750 options to purchase shares of common stock. |

PLAN

OF DISTRIBUTION

Our

common stock is quoted on the Nasdaq Capital Market under the symbol “AMPG.”

The

selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each and any sale.

The

Selling Stockholders may, from time to time, sell all or a portion of the Shares on any market where our common stock may be listed or

quoted (currently the Nasdaq Capital Market), in privately negotiated transactions or otherwise. Such sales may be at fixed prices prevailing

at the time of sale, at prices related to the market prices or at negotiated prices. The Shares being offered for resale by this Prospectus

may be sold by the Selling Stockholders by one or more of the following methods:

| |

● |

block

trades in which the broker or dealer so engaged will attempt to sell the Shares as agent but may position and resell a portion of

the block as principal to facilitate the transaction; |

| |

● |

purchases

by broker or dealer as principal and resale by the broker or dealer for its account pursuant to this prospectus; |

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

ordinary

brokerage transactions and transactions in which the broker solicits purchasers; |

| |

● |

privately

negotiated transactions; |

| |

● |

market

sales (both long and short to the extent permitted under the federal securities laws); |

| |

● |

at

the market to or through market makers or into an existing market for the Shares; |

| |

● |

through

transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and |

| |

● |

a

combination of any of the aforementioned methods of sale. |

The

selling stockholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by

them and, if they default in the performance of their secured obligations, the pledge or secured parties may offer and sell the shares

of common stock from time to time under this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or any

other applicable provision of the Securities Act amending the list of stockholders to include the pledge, transferee or other successors

in interest as selling stockholders under this prospectus.

In

effecting sales, brokers and dealers engaged by the Selling Stockholders may arrange for other brokers or dealers to participate. Brokers

or dealers may receive commissions or discounts from a Selling Stockholder or, if any of the broker-dealers act as an agent for the purchaser

of such Shares, from a purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions

involved. Broker-dealers may agree with a Selling Stockholder to sell a specified number of the Shares at a stipulated price per Share.

Such an agreement may also require the broker-dealer to purchase as principal any unsold Shares at the price required to fulfill the

broker-dealer commitment to the Selling Stockholder if such broker-dealer is unable to sell the Shares on behalf of the Selling Stockholder.

Broker-dealers who acquire Shares as principal may thereafter resell the Shares from time to time in transactions which may involve block

transactions and sales to and through other broker-dealers, including transactions of the nature described above. Such sales by a broker-dealer

could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated

transactions. In connection with such resales, the broker-dealer may pay to or receive from the purchasers of the Shares commissions

as described above.

The

Selling Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the sale of the Shares may be

deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. In that event, any commissions

received by the broker-dealers or agents and any profit on the resale of the Shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act.

From

time to time, any of the Selling Stockholders may pledge its Shares pursuant to the margin provisions of customer agreements with brokers.

Upon a default by a Selling Stockholder, their broker may offer and sell the pledged Shares from time to time. Upon a sale of the Shares,

the Selling Stockholders intend to comply with the Prospectus delivery requirements under the Securities Act by delivering a Prospectus

to each purchaser in the transaction. We intend to file any amendments or other necessary documents in compliance with the Securities

Act which may be required in the event any of the Selling Stockholders defaults under any customer agreement with brokers.

To

the extent required under the Securities Act, a post-effective amendment to this Registration Statement will be filed disclosing the

name of any broker-dealers, the number of Shares, the price at which the Shares are to be sold, the commissions paid or discounts or

concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the

information set out or incorporated by reference in this Prospectus and other facts material to the transaction. We and the Selling Stockholders

will be subject to applicable provisions of the Exchange Act and the rules and regulations under it, including, without limitation, Rule

10b-5 and, insofar as a Selling Stockholder is a distribution participant and we, under certain circumstances, may be a distribution

participant, under Regulation M.

All

of the foregoing may affect the marketability of the common stock.

Any

commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the Shares will be borne by the Selling

Stockholders, the purchasers participating in such transaction, or both.

Any

Shares covered by this Prospectus which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under

Rule 144 rather than pursuant to this Prospectus.

LEGAL

MATTERS

The

validity of the issuance of the Shares described in this Prospectus will be passed upon for us by Sichenzia Ross Ference Carmel LLP,

New York, NY 10036.

EXPERTS

Our

financial statements as of December 31, 2022 and December 31, 2021 have been incorporated by reference in reliance on the report of Sadler,

Gibb & Associates, LLC, an independent registered public accounting firm, as stated in its report incorporated by reference herein,

and have been so incorporated by reference in reliance upon such report and upon the authority of such firm as experts in accounting

and auditing.

INCORPORATION

OF DOCUMENTS BY REFERENCE

We

are “incorporating by reference” in this Prospectus certain documents we file with the SEC, which means that we can disclose

important information to you by referring you to those documents. The information in the documents incorporated by reference is considered

to be part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in

this Prospectus will automatically update and supersede information contained in this Prospectus, including information in previously

filed documents or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from

or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with

the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form

8-K):

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 31, 2023 and our amended Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on August 9, 2023; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 15, 2023; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended June 30, filed with the SEC on August 14, 2023; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on November 14, 2023; |

| |

● |

Our

Definitive Proxy Statement filed with the SEC on October 23, 2023; |

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on April 17, 2023 and December 12, 2023; |

| |

● |

The

description of certain capital stock contained in our Registration Statement 8-A filed on February 16, 2021, as it may further be

amended from time to time. |

Any

information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information

in this Prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated

herein by reference modifies or replaces such information.

We

also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act,

until we sell all of the securities offered by this Prospectus supplement. Information in such future filings updates and supplements

the information provided in this Prospectus supplement. Any statements in any such future filings will automatically be deemed to modify

and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein

by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You

may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: AmpliTech Group, Inc., 155 Plant Avenue,

Hauppauge, NY 11788, (631) 521-7831. Our corporate website is www.amplitechinc.com. The information on our website is not a part of,

or incorporated in, this prospectus.

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION

FOR

SECURITIES ACT LIABILITIES

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the

registrant, the registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed

in the Securities Act and is therefore unenforceable.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC under the Securities Act a Registration Statement on Form S-8, of which this Prospectus forms a part, with respect

to the Shares being offered in this offering. This Prospectus does not contain all of the information set forth in the Registration Statement,

certain items of which are omitted in accordance with the rules and regulations of the SEC. The omitted information may be inspected

and copied at the Public Reference Room maintained by the SEC at 100 F. Street, N.E., Washington, D.C. 20549. You can obtain information

about operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we

file with the SEC (including exhibits to such documents) at the SEC’s Public Reference Room at 100 F. Street, N.E., Room 1580,

Washington, D.C. 20549. You may obtain additional information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. In

addition, the SEC maintains a site on the Internet at http://www.sec.gov/ that contains reports, proxy statements and other information

that we file electronically with the SEC.

Statements

contained in this Prospectus as to the contents of any contract or other document filed as an exhibit to the Registration Statement are

not necessarily complete and in each instance reference is made to the copy of the document filed as an exhibit to the Registration Statement,

each statement made in this Prospectus relating to such documents being qualified in all respect by such reference. For further information

with respect to us and the securities being offered hereby, reference is hereby made to the Registration Statement, including the exhibits

thereto.

REOFFER

PROSPECTUS

AmpliTech

Group, Inc.

870,000

shares of

Common

Stock

February

6, 2024

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

We

are “incorporating by reference” in this Prospectus certain documents we file with the SEC, which means that we can disclose

important information to you by referring you to those documents. The information in the documents incorporated by reference is considered

to be part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in

this Prospectus will automatically update and supersede information contained in this Prospectus, including information in previously

filed documents or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from

or is inconsistent with the old information. We incorporate by reference the following information or documents that we have filed with

the SEC (excluding those portions of any Form 8-K that are not deemed “filed” pursuant to the General Instructions of Form

8-K):

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 31, 2023 and our amended Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on August 9, 2023; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 15, 2023; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended June 30, filed with the SEC on August 14, 2023; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on November 14, 2023; |

| |

● |

Our

Definitive Proxy Statement filed with the SEC on October 23, 2023; |

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on April 17, 2023 and December 12, 2023; |

| |

● |

The

description of certain capital stock contained in our Registration Statement 8-A filed on February 16, 2021, as it may further be

amended from time to time. |

Any

information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information

in this Prospectus supplement or the accompanying prospectus or in a later filed document that is incorporated or deemed to be incorporated

herein by reference modifies or replaces such information.

We

also incorporate by reference any future filings (excluding information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act,

until we sell all of the securities offered by this Prospectus supplement. Information in such future filings updates and supplements

the information provided in this Prospectus supplement. Any statements in any such future filings will automatically be deemed to modify

and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein

by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You

may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: AmpliTech Group, Inc., 155 Plant Avenue,

Hauppauge, NY 11788, (631) 521-7831. Our corporate website is www.amplitechinc.com. The information on our website is not a part of,

or incorporated in, this prospectus.

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

The

NRS empower us to indemnify our directors and officers against expenses relating to certain actions, suits or proceedings as provided

for therein. In order for such indemnification to be available, the applicable director or officer must not have acted in a manner that

constituted a breach of his or her fiduciary duties and involved intentional misconduct, fraud or a knowing violation of law, or must

have acted in good faith and reasonably believed that his or her conduct was in, or not opposed to, our best interests. In the event

of a criminal action, the applicable director or officer must not have had reasonable cause to believe his or her conduct was unlawful.

Pursuant

to our articles, we may indemnify each of our present and future directors, officers, employees or agents who becomes a party or is threatened

to be made a party to any suit or proceeding, whether pending, completed or merely threatened, and whether said suit or proceeding is

civil, criminal, administrative, investigative, or otherwise, except an action by or in the right of the Company, by reason of the fact

that he is or was a director, officer, employee, or agent of the Company, or is or was serving at the request of the corporation as a

director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses,

including, but not limited to, attorneys’ fees, judgments, fines, and amounts paid in settlement actually and reasonably incurred

by him in connection with the action, suit, proceeding or settlement, provided such person acted in good faith and in a manner which

he reasonably believed to be in or not opposed to the best interest of the Company, and, with respect to any criminal action or proceeding,

had no reasonable cause to believe his conduct was unlawful.

The

expenses of directors, officers, employees or agents of the Company incurred in defending a civil or criminal action, suit, or proceeding

may be paid by the Company as they are incurred and in advance of the final disposition of the action, suit, or proceeding, if and only

if the director, officer, employee or agent undertakes to repay said expenses to the Company if it is ultimately determined by a court

of competent jurisdiction, after exhaustion of all appeals therefrom, that he is not entitled to be indemnified by the corporation.

No

indemnification shall be applied, and any advancement of expenses to or on behalf of any director, officer, employee or agent must be

returned to the Company, if a final adjudication establishes that the person’s acts or omissions involved a breach of any fiduciary

duties, where applicable, intentional misconduct, fraud or a knowing violation of the law which was material to the cause of action.

The

NRS further provides that a corporation may purchase and maintain insurance or make other financial arrangements on behalf of any person

who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a

director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise for any liability

asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising

out of his status as such, whether or not the corporation has the authority to indemnify him against such liability and expenses. We

have secured a directors’ and officers’ liability insurance policy. We expect that we will continue to maintain such a policy.

Item

7. Exemption From Registration Claimed.

The

grant of our securities were issued as compensation awards or as enticement or incentive awards. These grants were exempt from registration

pursuant to Section 4(2) of the Securities Act.

Item

8. Exhibits.

Item

9. Undertakings.

(a)

The undersigned Company hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement;

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Company pursuant to section

13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned Company hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

Company’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC such indemnification

is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of

the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled

by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized in Hauppauge, New York, on February 6, 2024.

| AMPLITECH

GROUP, INC. |

|

| |

|

|

| By: |

/s/

Fawad Maqbool |

|

| |

Fawad

Maqbool |

|

| |

Chief

Executive Officer (Principal Executive Officer) |

|

POWER

OF ATTORNEY

KNOW

ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Fawad Maqbool their true and lawful

attorneys-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and

all capacities, to sign any and all amendments, to this Registration Statement on Form S-8, and to file the same, with exhibits thereto

and other documents in connection therewith, with the SEC granting unto said attorney-in-fact and agent full power and authority to do

and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could

do in person, hereby ratifying and confirming all that each of said attorney-in-fact and agent, or his substitute or substitutes may

lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act, this Registration Statement has been signed below by the following persons in the capacities

and on the dates indicated.

| Name |

|

Position |

|

Date |

| |

|

|

|

|

| /s/

Fawad Maqbool |

|

President,

Chairman and Chief Executive Officer (Principal Executive Officer) |

|

February

6, 2024 |

| Fawad

Maqbool |

|

|

|

|

| |

|

|

|

|

| /s/

Louisa Sanfratello |

|

Chief

Financial Officer (Principal Financial Officer and Principal Accounting Officer) and Director |

|

February

6, 2024 |

| Louisa

Sanfratello |

|

|

|

|

| |

|

|

|

|

| /s/

Andrew Lee |

|

Director |

|

February

6, 2024 |

| Andrew

Lee |

|

|

|

|

| |

|

|

|

|

| /s/

Daniel Mazziota |

|

Director |

|

February

6, 2024 |

| Daniel

Mazziota |

|

|

|

|

| |

|

|

|

|

| /s/

Matthew Kappers |

|

Director |

|

February

6, 2024 |

| Matthew

Kappers |

|

|

|

|

Exhibit

4.1

AMPLITECH

GROUP INC.

AMENDED

AND RESTATED 2020 EQUITY INCENTIVE PLAN

1.

Purposes of the Plan. The purposes of this Plan are:

| ● |

to

attract and retain the best available personnel for positions of substantial responsibility, |

| |

|

| ● |

to

provide incentives to individuals who perform services for the Company, and |

| |

|

| ● |

to

promote the success of the Company’s business. |

The

Plan permits the grant of Incentive Stock Options, Nonstatutory Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted

Stock Units, Performance Units, Performance Shares and other stock or cash awards as the Administrator may determine.

2.

Definitions. As used herein, the following definitions will apply:

(a)

“Administrator” means the Board or any of its Committees as will be administering the Plan, in accordance with Section 4

hereof.

(b)

“Affiliate” means any corporation or any other entity (including, but not limited to, partnerships and joint ventures) controlling,

controlled by, or under common control with the Company.

(c)

“Applicable Laws” means the requirements relating to the administration of equity-based awards under U.S. federal and state

corporate laws, U.S. federal and state securities laws, the Code, any stock exchange or quotation system on which the Common Stock is

listed or quoted and the applicable laws of any foreign country or jurisdiction where Awards are, or will be, granted under the Plan.

(d)

“Award” means, individually or collectively, a grant under the Plan of Options, Stock Appreciation Rights, Restricted Stock,

Restricted Stock Units, Performance Units, Performance Shares and other stock or cash awards as the Administrator may determine.

(e)

“Award Agreement” means the written or electronic agreement setting forth the terms and provisions applicable to each Award

granted under the Plan. The Award Agreement is subject to the terms and conditions of the Plan.

(f)

“Board” means the Board of Directors of the Company.

(g)

“Change in Control” means the occurrence of any of the following events:

(i)

A change in the ownership of the Company which occurs on the date that any one person, or more than one person acting as a group (“Person”),

acquires ownership of stock in the Company that, together with the stock already held by such Person, constitutes more than 50% of the

total voting power of the stock of the Company; provided, however, that for purposes of this subsection (i), the acquisition of

additional stock by any Person who is considered to own more than 50% of the total voting power of the stock of the Company before the

acquisition will not be considered a Change in Control; or

(ii)

A change in the effective control of the Company, which occurs on the date that a majority of the members of the Board are replaced during

any twelve (12) month period by Directors whose appointment or election is not endorsed by a majority of the members of the Board prior

to the date of the appointment or election. For purposes of this subsection (ii), if any Person is considered to effectively control

the Company, the acquisition of additional control of the Company by the same Person will not be considered a Change in Control;

or

(iii)

A change in the ownership of a substantial portion of the Company’s assets, which occurs on the date that any Person acquires (or

has acquired during the twelve (12) month period ending on the date of the most recent acquisition by such Person) assets from the Company

that have a total gross fair market value equal to or more than 50% of the total gross fair market value of all of the assets of the

Company immediately prior to such acquisition or acquisitions; provided, however, that for purposes of this subsection (iii), the

following will not constitute a change in the ownership of a substantial portion of the Company’s assets or a Change in Control:

(A) a transfer to an entity that is controlled by the Company’s stockholders immediately after the transfer, or (B) a transfer

of assets by the Company to: (1) a stockholder of the Company (immediately before the asset transfer) in exchange for or with respect

to the Company’s stock, (2) an entity, 50% or more of the total value or voting power of which is owned, directly or indirectly,

by the Company, (3) a Person that owns, directly or indirectly, 50% or more of the total value or voting power of all the outstanding

stock of the Company, or (4) an entity, at least 50% of the total equity or voting power of which is owned, directly or indirectly, by

a Person described in subsection (iii)(B)(3) above. For purposes of this subsection (iii), gross fair market value means the value of

the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with

such assets.

Notwithstanding

the foregoing, as to any Award under the Plan that consists of deferred compensation subject to Section 409A of the Code, the definition

of “Change in Control” shall be deemed modified to the extent necessary to comply with Section 409A of the Code.

For

purposes of this Section 2(g), persons will be considered to be acting as a group if they are owners of a corporation or other entity

that enters into a merger, consolidation, purchase or acquisition of stock, or similar business transaction with the Company.

(h)

“Code” means the Internal Revenue Code of 1986, as amended. Any reference to a section of the Code herein will be a reference

to any successor or amended section of the Code.

(i)

“Committee” means a committee of Directors or of other individuals satisfying Applicable Laws appointed by the Board in accordance

with Section 4 hereof.

(j)

“Common Stock” means the common stock, $.001 par value per share, of the Company.

(k)

“Company” means Amplitech Group Inc., a Nevada corporation, or any successor thereto.

(l)

“Consultant” means any person, including an advisor, engaged by the Company or a Parent, Subsidiary or Affiliate to render

services to the Company or a Subsidiary.

(m)

Intentionally omitted.

(n)

“Director” means a member of the Board.

(o)

“Disability” means permanent and total disability as defined in Section 22(e)(3) of the Code, provided that in the case of

Awards other than Incentive Stock Options, the Administrator in its discretion may determine whether a permanent and total disability

exists in accordance with uniform and non-discriminatory standards adopted by the Administrator from time to time.

(p)

“Employee” means any person, including Officers and Directors, employed by the Company or any Parent, Subsidiary or Affiliate

of the Company. Neither service as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment”

by the Company.

(q)

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

(r)

“Exchange Program” means a program under which (i) outstanding Awards are surrendered or cancelled in exchange for Awards

of the same type (which may have lower exercise prices and different terms), Awards of a different type, and/or cash, (ii) Participants

would have the opportunity to transfer any outstanding Awards to a financial institution or other person or entity selected by the Administrator,

and/or (iii) the exercise price of an outstanding Award is reduced. The Administrator will determine the terms and conditions of any

Exchange Program in its sole discretion.

(s)

“Fair Market Value” means, as of any date, the value of the Common Stock determined as follows:

(i)

If the Common Stock is listed on any established stock exchange or a national market system, including without limitation the Nasdaq

Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market of The Nasdaq Stock Market, its Fair Market Value will be

the closing sales price for such stock (or if no closing sales price was reported on that date, as applicable, on the last trading date

such closing sales price was reported) as quoted on such exchange or system on the day of determination, as reported in The Wall Street

Journal or such other source as the Administrator deems reliable;

(ii)

If the Common Stock is regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value

of a Share will be the mean between the high bid and low asked prices for the Common Stock on the day of determination (or, if no bids

and asks were reported on that date, as applicable, on the last trading date such bids and asks were reported), as reported in The Wall

Street Journal or such other source as the Administrator deems reliable; or

(iii)

In the absence of an established market for the Common Stock, or if such Common Stock is not regularly quoted or does not have sufficient

trades or bid prices which would accurately reflect the actual Fair Market Value of the Common Stock, the Fair Market Value will be determined

in good faith by the Administrator upon the advice of a qualified valuation expert.

(t)

“Fiscal Year” means the fiscal year of the Company.

(u)

“Incentive Stock Option” means an Option that by its terms qualifies and is otherwise intended to qualify as an incentive

stock option within the meaning of Section 422 of the Code and the regulations promulgated thereunder.

(v)

“Nonstatutory Stock Option” means an Option that by its terms does not qualify or is not intended to qualify as an Incentive

Stock Option.

(w)

“Officer” means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules

and regulations promulgated thereunder.

(x)

“Option” means a stock option granted pursuant to Section 6 hereof.

(y)

“Parent” means a “parent corporation,” whether now or hereafter existing, as defined in Section 424(e) of the

Code.

(z)

“Participant” means the holder of an outstanding Award.

(aa)

“Performance Objectives” has the meaning set forth in Section 10 hereof.

(bb)

“Performance Period” means any Fiscal Year of the Company or such other period as determined by the Administrator in its

sole discretion.

(cc)

“Performance Share” means an Award denominated in Shares which may be earned in whole or in part upon attainment of Performance

Objectives as the Administrator may determine pursuant to Section 10 hereof.

(dd)

“Performance Unit” means an Award which may be earned in whole or in part upon attainment of Performance Objectives as the

Administrator may determine and which may be settled for cash, Shares or other securities or a combination of the foregoing pursuant

to Section 10 hereof.

(ee)

“Period of Restriction” means the period during which transfers of Shares of Restricted Stock are subject to restrictions

and, therefore, the Shares are subject to a substantial risk of forfeiture. Such restrictions may be based on the passage of time, the

achievement of target levels of performance, or the occurrence of other events as determined by the Administrator.

(ff)

“Plan” means this 2020 Equity Incentive Plan.

(gg)

“Restricted Stock” means Shares issued pursuant to an Award of Restricted Stock under Section 8 hereof, or issued pursuant

to the early exercise of an Option.

(hh)

“Restricted Stock Unit” means a bookkeeping entry representing an amount equal to the Fair Market Value of one Share, granted

pursuant to Section 9 hereof. Each Restricted Stock Unit represents an unfunded and unsecured obligation of the Company.

(ii)

“Rule 16b-3” means Rule 16b-3 of the Exchange Act or any successor to Rule 16b-3, as in effect when discretion is being exercised

with respect to the Plan. (jj) “Section 16(b)” means Section 16(b) of the Exchange Act.

(kk)

“Service Provider” means an Employee, Director, or Consultant.

(ll)

“Share” means a share of the Common Stock, as adjusted in accordance with Section 15 hereof.

(mm)

“Stock Appreciation Right” means an Award, granted alone or in connection with an Option, that pursuant to Section 7 is designated

as a Stock Appreciation Right.

(nn)

“Subsidiary” means a “subsidiary corporation,” whether now or hereafter existing, as defined in Section 424(f)

of the Code.

3.

Stock Subject to the Plan.

(a)

Subject to the provisions of Section 15 hereof, the maximum aggregate number of Shares that may be awarded and sold under the Plan is

2,250,000 Shares. The Shares may be authorized, but unissued, or reacquired Common Stock.

(b)

Lapsed Awards. If an Award expires or becomes unexercisable without having been exercised in full, is surrendered pursuant to an Exchange

Program, or, with respect to Restricted Stock, Restricted Stock Units, Performance Shares or Performance Units, is forfeited to or repurchased

by the Company, the unpurchased Shares (or for Awards other than Options and Stock Appreciation Rights, the forfeited or repurchased

Shares) which were subject thereto will become available for future grant or sale under the Plan (unless the Plan has terminated). Upon

exercise of a Stock Appreciation Right settled in Shares, the gross number of Shares covered by the portion of the Award so exercised

will cease to be available under the Plan. Shares that have actually been issued under the Plan under any Award will not be returned

to the Plan and will not become available for future distribution under the Plan; provided, however, that if unvested Shares of

Restricted Stock, Restricted Stock Units, Performance Shares or Performance Units are repurchased by the Company or are forfeited to

the Company, such Shares will become available for future grant under the Plan. Shares used to pay the tax and/or exercise price of an

Award will become available for future grant or sale under the Plan. To the extent an Award under the Plan is paid out in cash rather

than Shares, such cash payment will not result in reducing the number of Shares available for issuance under the Plan. Notwithstanding

the foregoing provisions of this Section 3(b), subject to adjustment provided in Section 15 hereof, the maximum number of Shares that

may be issued upon the exercise of Incentive Stock Options will equal the aggregate Share number stated in Section 3(a) above, plus,

to the extent allowable under Section 422 of the Code, any Shares that become available for issuance under the Plan under this Section

3(b).

(c)

Share Reserve. The Company, during the term of this Plan, will at all times reserve and keep available such number of Shares as will

be sufficient to satisfy the requirements of the Plan.

(d)

Limitation on Number of Shares Subject to Awards. Notwithstanding any provision in the Plan to the contrary, the maximum aggregate amount

of cash that may be paid in cash during any calendar year (measured from the date of any payment) with respect to one or more Awards

payable in cash shall be $100,000.

4.

Administration of the Plan.

(a)

Procedure.

(i)

Multiple Administrative Bodies. Different Committees with respect to different groups of Service Providers may administer the Plan.

(ii)

Rule 16b-3. To the extent desirable to qualify transactions hereunder as exempt under Rule 16b-3, the transactions contemplated hereunder

will be structured to satisfy the requirements for exemption under Rule 16b-3.

(iii)

Other Administration. Other than as provided above, the Plan will be administered by (A) the Board or (B) a Committee, which committee

will be constituted to satisfy Applicable Laws.

(b)

Powers of the Administrator. Subject to the provisions of the Plan, and in the case of a Committee, subject to the specific duties delegated

by the Board to such Committee, the Administrator will have the authority, in its discretion:

(i)

to determine the Fair Market Value;

(ii)

to select the Service Providers to whom Awards may be granted hereunder;

(iii)

to determine the number of Shares to be covered by each Award granted hereunder;

(iv)

to approve forms of Award Agreements for use under the Plan;

(v)

to determine the terms and conditions, not inconsistent with the terms of the Plan, of any Award granted hereunder;

(vi)

to institute an Exchange Program and to determine the terms and conditions, not inconsistent with the terms of the Plan, for (1) the

surrender or cancellation of outstanding Awards in exchange for Awards of the same type, Awards of a different type, and/or cash, (2)

the transfer of outstanding Awards to a financial institution or other person or entity, or (3) the reduction of the exercise price of

outstanding Awards;

(vii)

to construe and interpret the terms of the Plan and Awards granted pursuant to the Plan;

(viii)

to prescribe, amend and rescind rules and regulations relating to the Plan, including rules and regulations relating to sub-plans established

for the purpose of satisfying applicable foreign laws or for qualifying for favorable tax treatment under applicable foreign laws;

(ix)

to modify or amend each Award (subject to Section 20(c) hereof), including but not limited to the discretionary authority to extend the

post-termination exercisability period of Awards;

(x)

to allow Participants to satisfy withholding tax obligations in a manner described in Section 16 hereof;

(xi)

to authorize any person to execute on behalf of the Company any instrument required to effect the grant of an Award previously granted

by the Administrator;

(xii)

to allow a Participant to defer the receipt of the payment of cash or the delivery of Shares that would otherwise be due to such Participant

under an Award pursuant to such procedures as the Administrator may determine; and

(xiii)

to make all other determinations deemed necessary or advisable for administering the Plan.

(c)

Effect of Administrator’s Decision. The Administrator’s decisions, determinations, and interpretations will be final and

binding on all Participants and any other holders of Awards.

5.

Eligibility. Nonstatutory Stock Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights, Performance Units, Performance

Shares, and such other cash or stock awards as the Administrator determines may be granted to Service Providers. Incentive Stock Options

may be granted only to Employees.

6.

Stock Options.

(a)

Limitations.

(i)

Each Option will be designated in the Award Agreement as either an Incentive Stock Option or a Nonstatutory Stock Option. However, notwithstanding

such designation, to the extent that the aggregate Fair Market Value of the Shares with respect to which Incentive Stock Options are

exercisable for the first time by the Participant during any calendar year (under all plans of the Company and any Parent or Subsidiary)

exceeds $100,000 (U.S.), such Options will be treated as Nonstatutory Stock Options. For purposes of this Section 6(a), Incentive Stock

Options will be taken into account in the order in which they were granted. The Fair Market Value of the Shares will be determined as

of the time the Option with respect to such Shares is granted.

(ii)

The Administrator will have complete discretion to determine the number of Shares subject to an Option granted to any Participant.

(b)

Term of Option. The Administrator will determine the term of each Option in its sole discretion; provided, however, that the term

will be no more than ten (10) years from the date of grant thereof. Moreover, in the case of an Incentive Stock Option granted to a Participant

who, at the time the Incentive Stock Option is granted, owns stock representing more than 10% of the total combined voting power of all

classes of stock of the Company or any Parent or Subsidiary, the term of the Incentive Stock Option will be five (5) years from the date

of grant or such shorter term as may be provided in the Award Agreement.

(c)

Option Exercise Price and Consideration.

(i)

Exercise Price. The per share exercise price for the Shares to be issued pursuant to exercise of an Option will be determined by the

Administrator, but will be no less than 100% of the Fair Market Value per Share on the date of grant. In addition, in the case of an

Incentive Stock Option granted to an Employee who, at the time the Incentive Stock Option is granted, owns stock representing more than

10% of the voting power of all classes of stock of the Company or any Parent or Subsidiary, the per Share exercise price will be no less

than 110% of the Fair Market Value per Share on the date of grant. Notwithstanding the foregoing provisions of this Section 6(c), Options

may be granted with a per Share exercise price of less than 100% of the Fair Market Value per Share on the date of grant pursuant to

a transaction described in, and in a manner consistent with, Section 424(a) of the Code.

(ii)

Waiting Period and Exercise Dates. At the time an Option is granted, the Administrator will fix the period within which the Option may

be exercised and will determine any conditions that must be satisfied before the Option may be exercised.

(iii)