- Annual Recurring Revenue was $312 million, up 11%

year-over-year

- Remaining performance obligations of $308.6 million, up 29%

year-over-year

- Fourth quarter revenue of $78.1 million, up 9%

year-over-year

- Fourth quarter Cash Flow from Operations of $3.2 million and

Free Cash Flow of $1.5 million

Amplitude, Inc. (Nasdaq: AMPL), the leading digital analytics

platform, today announced financial results for its fourth quarter

and fiscal year ended December 31, 2024.

"Amplitude closed 2024 strong. Our platform strategy is

resonating with customers, and we're making great progress with

enterprises," said Spenser Skates, CEO and co-founder of Amplitude.

"Every company needs three things: data they can trust, an

understanding of what customers are doing in the product, and ways

to take action. This is exactly what Amplitude delivers in one

integrated platform."

Fourth Quarter 2024 Financial

Highlights:

(in millions, except per share and

percentage amounts)

Fourth Quarter 2024

Fourth Quarter 2023

Y/Y Change

Annual Recurring Revenue

$312

$281

11%

Revenue

$78.1

$71.4

9%

GAAP Loss from Operations

$(35.5)

$(21.5)

$(14.0)

Non-GAAP Income (Loss) from Operations

$0.2

$2.3

$(2.1)

GAAP Net Loss Per Share, Basic and

Diluted

$(0.26)

$(0.16)

$(0.10)

Non-GAAP Net Income (Loss) Per Share,

Diluted

$0.02

$0.04

$(0.02)

Net Cash Provided by (Used in) Operating

Activities

$3.2

$2.3

$0.9

Free Cash Flow

$1.5

$1.5

$0.0

Fiscal Year 2024 Financial

Highlights:

(in millions, except per share and

percentage amounts)

FY 2024

FY 2023

Y/Y Change

Annual Recurring Revenue

$312

$281

11%

Revenue

$299.3

$276.3

8%

GAAP Loss from Operations

$(107.4)

$(102.5)

$(4.9)

Non-GAAP Income (Loss) from Operations

$(4.0)

$(3.5)

$(0.5)

GAAP Net Loss Per Share, Basic and

Diluted

$(0.76)

$(0.77)

$0.01

Non-GAAP Net Income (Loss) Per Share,

Diluted

$0.06

$0.06

$0.00

Net Cash Provided by (Used in) Operating

Activities

$18.5

$25.6

$(7.1)

Free Cash Flow

$11.7

$22.4

$(10.7)

Non-GAAP income (loss) from operations and non-GAAP net income

(loss) per share exclude expenses related to stock-based

compensation expense and related employer payroll taxes,

amortization of acquired intangible assets, and non-recurring costs

such as restructuring and other related charges. Stock-based

compensation expense, exclusive of those related to our

restructuring, and the related employer payroll taxes were $35.5

million in the fourth quarter of 2024 compared to $23.6 million in

the fourth quarter of 2023, and $102.6 million in the full year

2024 compared to $89.5 million in the full year 2023. Free cash

flow is GAAP net cash provided by (used in) operating activities,

less cash used for purchases of property and equipment and

capitalized internal-use software costs. The section titled

"Non-GAAP Financial Measures" below contains a description of the

non-GAAP financial measures and reconciliations between historical

GAAP and non-GAAP information are contained in the tables

below.

Fourth Quarter and Recent Business Highlights:

- Annual Recurring Revenue was $312 million, an increase of 11%

year-over-year and an increase of $13 million compared to the third

quarter of 2024.

- GAAP Net Loss per share was $0.26, based on 127.8 million

shares, compared to a loss of $0.16 per share, based on 119.2

million shares, in the fourth quarter of 2023.

- Non-GAAP Net Income per share was $0.02, based on 135.7 million

diluted shares, compared to $0.04 per share, based on 129.2 million

diluted shares, in the fourth quarter of 2023.

- Cash Flow from Operations was $3.2 million, a $0.9 million

increase year-over-year.

- Free Cash Flow was $1.5 million with no change

year-over-year.

- Number of customers greater than $100,000 in ARR increased to

591, or 16% year-over-year growth.

- Acquired Command AI and released Guides and Surveys to make

in-product guidance more timely, personalized, and effective.

- Awarded 2024 AWS Partner of the Year for Innovation in Digital

Experiences.

Financial Outlook:

The first quarter and full year 2025 outlook information

provided below is based on Amplitude’s current estimates and is not

a guarantee of future performance. These statements are

forward-looking and actual results may differ materially. Refer to

the “Forward-Looking Statements” section below for information on

the factors that could cause Amplitude’s actual results to differ

materially from these forward-looking statements.

For the first quarter and full year 2025, the Company

expects:

First Quarter 2025

Full Year 2025

Revenue

$78.5 - $80.5 million

$324.8 - $330.8 million

Non-GAAP Operating Income (Loss)

$(5.5) - $(3.5) million

$(3.5) - $4.5 million

Non-GAAP Net Income (Loss) Per Share,

Diluted

$(0.03) - $(0.01)

$0.05 - $0.10

Weighted Average Shares Outstanding

130.0 million, basic

142.1 million, diluted

An outlook for GAAP income (loss) from operations, GAAP net

income (loss), GAAP net income (loss) per share and a

reconciliation of expected non-GAAP income (loss) from operations

to GAAP income (loss) from operations, expected non-GAAP net income

(loss) to GAAP net income (loss), and expected non-GAAP net income

(loss) per share to GAAP net income (loss) per share have not been

provided as the quantification of certain items included in the

calculation of GAAP income (loss) from operations, GAAP net income

(loss) and GAAP net income (loss) per share cannot be reasonably

calculated or predicted at this time without unreasonable efforts.

For example, the non-GAAP adjustment for stock-based compensation

expense requires additional inputs such as the number and value of

awards granted that are not currently ascertainable, and the

non-GAAP adjustment for amortization of acquired intangible assets

depends on the timing and value of intangible assets acquired that

cannot be accurately forecasted.

Conference Call Information:

Amplitude will host a live video webcast to discuss its

financial results for its fourth quarter and fiscal year ended

December 31, 2024, as well as the financial outlook for its first

quarter and full year 2025 today at 2:00 PM Pacific Time / 5:00 PM

Eastern Time. Interested parties may access the webcast, earnings

press release, and investor presentation on the events section of

Amplitude’s investor relations website at investors.amplitude.com.

A replay will be available in the same location a few hours after

the conclusion of the live webcast.

Forward-Looking Statements:

This press release contains express and implied "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements regarding the Company’s

financial outlook for the first quarter and full year 2025, the

Company’s growth strategy and business aspirations and its market

position and market opportunity. These statements are often, but

not always, made through the use of words or phrases such as “may,”

“should,” “could,” “predict,” “potential,” “believe,” “expect,”

“continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,”

“plan,” “projection,” “would,” and “outlook,” or the negative

version of those words or phrases or other comparable words or

phrases of a future or forward-looking nature. These

forward-looking statements are not statements of historical fact,

and are based on current expectations, estimates, and projections

about the Company’s industry as well as certain assumptions made by

management, many of which, by their nature, are inherently

uncertain and beyond the Company’s control. These statements are

subject to numerous uncertainties and risks that could cause actual

results, performance, or achievement to differ materially and

adversely from those anticipated or implied in the statements,

including risks related to: the Company’s limited operating history

and rapid growth over the last several years, which makes it

difficult to forecast the Company’s future results of operations;

the Company’s history of losses; any decline in the Company’s

customer retention or expansion of its commercial relationships

with existing customers or an inability to attract new customers;

expected fluctuations in the Company’s financial results, making it

difficult to project future results; the Company’s focus on sales

to larger organizations and potentially increased dependency on

those relationships, which may increase the variability of the

Company’s sales cycles and results of operations; downturns or

upturns in new sales, which may not be immediately reflected in the

Company’s results of operations and may be difficult to discern;

unfavorable conditions in the Company’s industry or the global

economy, or reductions in information technology spending, which

could limit the Company’s ability to grow its business; the market

for SaaS applications, which may develop more slowly than the

Company expects or decline; the Company’s intellectual property

rights, which may not protect its business or provide the Company

with a competitive advantage; and evolving privacy and other

data-related laws; and the impact of sanctions related to Russia on

the Company’s ability to collect receivables. Additional risks and

uncertainties that could cause actual outcomes and results to

differ materially from those contemplated by the forward-looking

statements are or will be included under the caption "Risk Factors"

and elsewhere in the reports and other documents that the Company

files with the Securities and Exchange Commission from time to

time, including the Company’s Annual Report on Form 10-K being

filed at or around the date hereof. The forward-looking statements

made in this press release relate only to events as of the date on

which the statements are made. The Company undertakes no obligation

to update any forward-looking statements made in this press release

to reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events, except as required by law.

Non-GAAP Financial Measures:

This press release includes financial information that has not

been prepared in accordance with GAAP. The Company uses non-GAAP

financial measures internally in analyzing its financial results

and believes they are useful to investors, as a supplement to GAAP

measures, in evaluating the Company’s ongoing operational

performance. The Company believes that the use of these non-GAAP

financial measures provides an additional tool for investors to use

in evaluating ongoing operating results and trends and in comparing

the Company’s financial results with other companies in the

industry, many of which present similar non-GAAP financial measures

to investors. There are a number of limitations related to the use

of non-GAAP financial measures versus comparable financial measures

determined under GAAP. For example, other companies in the

Company’s industry may calculate these non-GAAP financial measures

differently or may use other measures to evaluate their

performance. In addition, free cash flow does not reflect the

Company’s future contractual commitments and the total increase or

decrease of its cash balance for a given period.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. A reconciliation of the Company’s

non-GAAP financial measures to their most directly comparable GAAP

measures has been provided in the financial statement tables

included below in this press release. Investors are encouraged to

review the reconciliation of these non-GAAP financial measures to

their most directly comparable GAAP financial measures below.

Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP

Operating Expenses, Non-GAAP Income (Loss) from Operations,

Non-GAAP Operating Margin, Non-GAAP Net Income (Loss), and Non-GAAP

Net Income (Loss) per Share. The Company defines these non-GAAP

financial measures as their respective GAAP measures, excluding

expenses related to stock-based compensation expense and related

employer payroll taxes, amortization of acquired intangible assets,

and non-recurring costs such as restructuring and other related

charges. The Company excludes stock-based compensation expense and

related employer payroll taxes, which is a non-cash expense, from

certain of its non-GAAP financial measures because it believes that

excluding this item provides meaningful supplemental information

regarding operational performance. The Company excludes

amortization of intangible assets, which is a non-cash expense,

related to business combinations from certain of its non-GAAP

financial measures because such expenses are related to business

combinations and have no direct correlation to the operation of the

Company’s business. Although the Company excludes these expenses

from certain non-GAAP financial measures, the revenue from acquired

companies subsequent to the date of acquisition is reflected in

these measures and the acquired intangible assets contribute to the

Company’s revenue generation. The Company excludes non-recurring

costs from certain of its non-GAAP financial measures because such

expenses do not repeat period over period and are not reflective of

the ongoing operation of the Company’s business.

The Company uses non-GAAP gross profit, non-GAAP gross margin,

non-GAAP operating expenses, non-GAAP income (loss) from

operations, non-GAAP operating margin, non-GAAP net income (loss),

and non-GAAP net income (loss) per share in conjunction with its

traditional GAAP measures to evaluate the Company’s financial

performance. The Company believes that these measures provide its

management, board of directors, and investors consistency and

comparability with its past financial performance and facilitate

period-to-period comparisons of operations.

Free Cash Flow and Free Cash Flow Margin. The Company

defines free cash flow as net cash provided by (used in) operating

activities, less cash used for purchases of property and equipment

and capitalized internal-use software costs. Free cash flow margin

is calculated as free cash flow divided by total revenue. The

Company believes that free cash flow and free cash flow margin are

useful indicators of liquidity that provide its management, board

of directors, and investors with information about its future

ability to generate or use cash to enhance the strength of its

balance sheet and further invest in its business and pursue

potential strategic initiatives.

Definitions of Business Metrics:

Annual Recurring Revenue

The Company defines Annual Recurring Revenue (“ARR”) as the

annual recurring revenue of subscription agreements at a point in

time based on the terms of customers’ contracts, including certain

premium services that are subject to contractual subscription terms

and Plus customers that we expect to recur. ARR should be viewed

independently of revenue, and does not represent the Company’s GAAP

revenue on an annualized basis, as it is an operating metric that

can be impacted by contract start and end dates and renewal rates.

ARR is also not intended to be a forecast of revenue.

Dollar-Based Net Retention Rate

The Company calculates dollar-based net retention rate as of a

period end by starting with the ARR from the cohort of all

customers as of 12 months prior to such period-end (the “Prior

Period ARR”). The Company then calculates the ARR from these same

customers as of the current period-end (the “Current Period ARR”).

Current Period ARR includes any expansion and is net of contraction

or attrition over the last 12 months, but excludes ARR from new

customers as well as any overage charges in the current period. The

Company then divides the total Current Period ARR by the total

Prior Period ARR to arrive at the dollar-based net retention rate

("NRR"). The Company then calculates the weighted average of the

trailing 12-month dollar-based net retention rates, to arrive at

the dollar-based net retention rate (“NRR (TTM)”).

About Amplitude

Amplitude is a leading digital analytics platform that helps

companies unlock the power of their products. Over 3,800 customers,

including Atlassian, NBCUniversal, Under Armour, Shopify, and

Jersey Mike’s, rely on Amplitude to gain self-service visibility

into the entire customer journey. Amplitude guides companies every

step of the way as they capture data they can trust, uncover clear

insights about customer behavior, and take faster action. When

teams understand how people are using their products, they can

deliver better product experiences that drive growth. Amplitude is

the best-in-class analytics solution for product, data, and

marketing teams, ranked #1 in multiple categories in G2’s Winter

2024 Report. Learn how to optimize your digital products and

business at amplitude.com.

AMPLITUDE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands) December 31, 2024 December

31, 2023 Assets Current assets: Cash and cash

equivalents

$

171,678

$

248,491

Restricted cash, current

881

—

Marketable securities, current

69,419

73,909

Accounts receivable, net

26,346

29,496

Prepaid expenses and other current assets

20,353

16,624

Deferred commissions, current

14,954

11,444

Total current assets

303,631

379,964

Marketable securities, noncurrent

57,242

—

Property and equipment, net

16,333

10,068

Intangible assets, net

4,364

609

Goodwill

24,370

4,073

Restricted cash, noncurrent

—

869

Deferred commissions, noncurrent

27,697

26,942

Operating lease right-of-use assets

5,286

6,856

Other noncurrent assets

6,988

4,303

Total assets

$

445,911

$

433,684

Liabilities and Stockholders' Equity Current liabilities: Accounts

payable

$

991

$

3,063

Accrued expenses

33,851

26,657

Deferred revenue

109,671

102,573

Total current liabilities

144,513

132,293

Operating lease liabilities, noncurrent

1,772

3,604

Noncurrent liabilities

3,070

3,034

Total liabilities

149,355

138,931

Stockholders’ equity: Common stock

1

1

Additional paid-in capital

754,398

658,463

Accumulated other comprehensive income (loss)

6

(181

)

Accumulated deficit

(457,849

)

(363,530

)

Total stockholders’ equity

296,556

294,753

Total liabilities and stockholders’ equity

$

445,911

$

433,684

AMPLITUDE, INC. CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (In thousands, except per share amounts)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Revenue

$

78,131

$

71,403

$

299,272

$

276,284

Cost of revenue (1)

19,806

18,265

76,924

71,923

Gross profit

58,325

53,138

222,348

204,361

Operating expenses: Research and development (1)

$

34,430

$

22,198

$

97,565

$

90,138

Sales and marketing (1)

42,482

37,780

168,306

153,714

General and administrative (1)

16,918

14,749

63,860

54,887

Restructuring and other related charges (1)

—

(52

)

—

8,142

Total operating expenses

93,830

74,675

329,731

306,881

Loss from operations

(35,505

)

(21,537

)

(107,383

)

(102,520

)

Other income (expense), net

3,333

3,537

14,855

13,426

Loss before provision for (benefit from) income taxes

(32,172

)

(18,000

)

(92,528

)

(89,094

)

Provision for (benefit from) income taxes

418

543

1,791

1,269

Net loss

$

(32,590

)

$

(18,543

)

$

(94,319

)

$

(90,363

)

Net loss per share Basic and diluted

$

(0.26

)

$

(0.16

)

$

(0.76

)

$

(0.77

)

Weighted-average shares used in calculating net loss per share:

Basic and diluted

127,759

119,246

123,900

116,938

(1) Amounts include stock-based compensation expense as

follows:

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Cost of revenue

$

1,891

$

1,874

$

6,472

$

7,300

Research and development

20,316

9,470

44,421

36,643

Sales and marketing

8,268

7,727

32,119

29,404

General and administrative

4,630

4,209

17,007

14,085

Restructuring and other related charges

—

—

—

853

Total stock-based compensation expense

$

35,105

$

23,280

$

100,019

$

88,285

AMPLITUDE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Cash flows from operating activities: Net loss

$

(32,590

)

$

(18,543

)

$

(94,319

)

$

(90,363

)

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities Depreciation and amortization

1,970

1,420

6,107

5,620

Stock-based compensation expense

35,105

23,280

100,019

88,285

Other

316

633

283

(301

)

Non-cash operating lease costs

1,038

969

3,985

3,917

Changes in operating assets and liabilities: Accounts receivable

2,908

2,328

2,205

(8,448

)

Prepaid expenses and other current assets

4,911

3,076

(2,324

)

3,711

Deferred commissions

(2,047

)

(976

)

(4,264

)

(1,670

)

Other noncurrent assets

450

263

(3,181

)

2,050

Accounts payable

(1,680

)

(3,256

)

(1,987

)

2,498

Accrued expenses

(77

)

793

10,516

11,873

Deferred revenue

(5,979

)

(6,447

)

6,354

12,580

Operating lease liabilities

(1,169

)

(1,219

)

(4,888

)

(4,122

)

Net cash provided by (used in) operating activities

3,156

2,321

18,506

25,630

Cash flows provided by (used in) investing activities: Cash

received from maturities of marketable securities

2,500

12,500

93,750

12,500

Purchase of marketable securities

(127,918

)

—

(146,270

)

—

Purchase of property and equipment

(746

)

(284

)

(1,725

)

(1,279

)

Capitalization of internal-use software costs

(883

)

(555

)

(5,053

)

(1,904

)

Cash paid for acquisitions, net of cash acquired

(16,068

)

—

(16,068

)

—

Net cash provided by (used in) investing activities

(143,115

)

11,661

(75,366

)

9,317

Cash flows provided by (used in) financing activities: Proceeds

from the exercise of stock options

903

1,050

6,506

4,619

Cash received for tax withholding obligations on equity award

settlements

355

397

4,578

13,427

Cash paid for tax withholding obligations on equity award

settlements

(7,066

)

(5,459

)

(31,025

)

(22,334

)

Repurchase of unvested stock options

—

—

—

(648

)

Net cash provided by (used in) financing activities

(5,808

)

(4,012

)

(19,941

)

(4,936

)

Net increase (decrease) in cash, cash equivalents, and restricted

cash

(145,767

)

9,970

(76,801

)

30,011

Cash, cash equivalents, and restricted cash at beginning of the

period

318,326

239,390

249,360

219,349

Cash, cash equivalents, and restricted cash at end of the period

$

172,559

$

249,360

$

172,559

$

249,360

AMPLITUDE, INC.

Reconciliation of GAAP to

Non-GAAP Data

(In thousands, except

percentages and per share amounts)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of gross profit and gross margin GAAP gross

profit

$

58,325

$

53,138

$

222,348

$

204,361

Plus: stock-based compensation expense and related employer payroll

taxes

1,891

1,874

6,472

7,300

Plus: amortization of acquired intangible assets

158

273

490

1,238

Non-GAAP gross profit

$

60,374

$

55,285

$

229,310

$

212,899

GAAP gross margin

74.7

%

74.4

%

74.3

%

74.0

%

Non-GAAP adjustments

2.6

%

3.0

%

2.3

%

3.1

%

Non-GAAP gross margin

77.3

%

77.4

%

76.6

%

77.1

%

Reconciliation of operating expenses GAAP research and

development

$

34,430

$

22,198

$

97,565

$

90,138

Less: stock-based compensation expense and related employer payroll

taxes

(20,479

)

(9,591

)

(45,644

)

(37,519

)

Non-GAAP research and development

$

13,951

$

12,607

$

51,921

$

52,619

GAAP research and development as percentage of revenue

44.1

%

31.1

%

32.6

%

32.6

%

Non-GAAP research and development as percentage of revenue

17.9

%

17.7

%

17.3

%

19.0

%

GAAP sales and marketing

$

42,482

$

37,780

$

168,306

$

153,714

Less: stock-based compensation expense and related employer payroll

taxes

(8,394

)

(7,854

)

(33,015

)

(30,206

)

Less: amortization of acquired intangible assets

(113

)

(44

)

(244

)

(175

)

Non-GAAP sales and marketing

$

33,975

$

29,882

$

135,047

$

123,333

GAAP sales and marketing as percentage of revenue

54.4

%

52.9

%

56.2

%

55.6

%

Non-GAAP sales and marketing as percentage of revenue

43.5

%

41.8

%

45.1

%

44.6

%

GAAP general and administrative

$

16,918

$

14,749

$

63,860

$

54,887

Less: stock-based compensation expense and related employer payroll

taxes

(4,709

)

(4,270

)

(17,514

)

(14,447

)

Non-GAAP general and administrative

$

12,209

$

10,479

$

46,346

$

40,440

GAAP general and administrative as percentage of revenue

21.7

%

20.7

%

21.3

%

19.9

%

Non-GAAP general and administrative as percentage of revenue

15.6

%

14.7

%

15.5

%

14.6

%

Reconciliation of operating loss and operating margin GAAP

loss from operations

$

(35,505

)

$

(21,537

)

$

(107,383

)

$

(102,520

)

Plus: stock-based compensation expense and related employer payroll

taxes

35,473

23,589

102,645

89,472

Plus: amortization of acquired intangible assets

271

317

734

1,413

Plus: restructuring and other related charges

—

(52

)

—

8,142

Non-GAAP income (loss) from operations

$

239

$

2,317

$

(4,004

)

$

(3,493

)

GAAP operating margin

(45.4

%)

(30.2

%)

(35.9

%)

(37.1

%)

Non-GAAP adjustments

45.7

%

33.4

%

34.5

%

35.8

%

Non-GAAP operating margin

0.3

%

3.2

%

(1.3

%)

(1.3

%)

Reconciliation of net income (loss) GAAP net income (loss)

$

(32,590

)

$

(18,543

)

$

(94,319

)

$

(90,363

)

Plus: stock-based compensation expense and related employer payroll

taxes

35,473

23,589

102,645

89,472

Plus: amortization of acquired intangible assets

271

317

734

1,413

Plus: restructuring and other related charges

—

(52

)

—

8,142

Less: income tax effect of non-GAAP adjustments

(152

)

(578

)

(571

)

(708

)

Non-GAAP net income (loss)

$

3,002

$

4,733

$

8,489

$

7,956

Reconciliation of net income (loss) per share GAAP net

income (loss) per share, basic

$

(0.26

)

$

(0.16

)

$

(0.76

)

$

(0.77

)

Non-GAAP adjustments to net income (loss)

0.28

0.20

0.83

0.84

Non-GAAP net income (loss) per share, basic

$

0.02

$

0.04

$

0.07

$

0.07

Non-GAAP net income (loss) per share, diluted

$

0.02

$

0.04

$

0.06

$

0.06

Weighted-average shares used in GAAP and non-GAAP per share

calculation, basic

127,759

119,246

123,900

116,938

Weighted-average shares used in GAAP and non-GAAP per share

calculation, diluted(1)

135,714

129,158

131,973

127,364

Note: Certain figures may not sum due to rounding (1) For the three

and twelve months ended December 31, 2024 and for the three and

twelve months ended December 31, 2023, the weighted average shares

used in the GAAP per share calculation excludes 8.0 million shares,

8.1 million shares, 9.9 million shares, and 10.4 million shares,

respectively, as the effect is anti-dilutive in the period.

AMPLITUDE, INC.

Reconciliation of GAAP Cash

Flows from Operations to Free Cash Flow

(In thousands, except

percentages)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net cash provided by (used in) operating activities

$

3,156

$

2,321

$

18,506

$

25,630

Less: Purchases of property and equipment

(746

)

(284

)

(1,725

)

(1,279

)

Capitalization of internal-use software costs

(883

)

(555

)

(5,053

)

(1,904

)

Free cash flow

$

1,527

$

1,482

$

11,728

$

22,447

Net cash provided by (used in) operating activities margin

4.0

%

3.3

%

6.2

%

9.3

%

Non-GAAP adjustments

(2.1

%)

(1.2

%)

(2.3

%)

(1.2

%)

Free cash flow margin

2.0

%

2.1

%

3.9

%

8.1

%

Note: Certain figures may not sum due to rounding

AMPLITUDE, INC.

Historicals - Key Business

Metrics

(In millions, except

percentages)

(unaudited)

September 30, 2023

December 31, 2023

March 31, 2024

June 30, 2024

September 30, 2024

December 31, 2024

Annual Recurring Revenue (ARR)

$

273

$

281

$

285

$

290

$

298

$

312

Dollar-based Net Retention Rate (NRR)

99

%

98

%

97

%

96

%

98

%

100

%

Dollar-based Net Retention Rate (NRR TTM)

105

%

101

%

99

%

98

%

97

%

97

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218176149/en/

Investor Relations John Streppa ir@amplitude.com Media Contact

Darah Easton press@amplitude.com

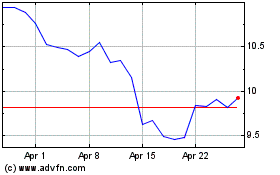

Amplitude (NASDAQ:AMPL)

Historical Stock Chart

From Jan 2025 to Feb 2025

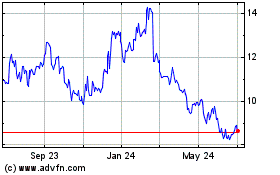

Amplitude (NASDAQ:AMPL)

Historical Stock Chart

From Feb 2024 to Feb 2025