false

0001201792

0001201792

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 12, 2024

American

Public Education, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-33810 |

|

01-0724376 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

111 W. Congress Street

Charles Town, West Virginia |

|

25414 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 304-724-3700

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

APEI |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial

Condition.

On November 12, 2024, American Public Education, Inc. (the

“Company”) issued a press release reporting financial results for the three and nine months ended September 30, 2024. A

copy of the Company’s press release is attached to this report as Exhibit 99.1 and is incorporated in this report by reference. The

Company has scheduled a webcast for 5:00 p.m. ET on November 12, 2024 to discuss its financial results, and slides for that

webcast are attached to this report as Exhibit 99.2 and are incorporated in this report by reference.

Section 9 – Financial Statements

and Exhibits

Item 9.01 Financial Statements and

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

American Public Education, Inc. |

| |

|

|

| Date:November 12, 2024 |

By: |

/s/ Richard W. Sunderland, Jr. |

| |

|

Richard W. Sunderland, Jr., |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

American Public Education Reports Third Quarter

2024 Financial Results

Net Income & Adjusted EBITDA Performance

Driven by Further Stabilization and Improvement in Rasmussen and Hondros Segments

CHARLES TOWN, W.V. – November 12, 2024 --

American Public Education, Inc. (Nasdaq: APEI), a portfolio of education companies providing online and campus-based postsecondary education

and career learning to over 125,000 students through four subsidiary institutions, has reported unaudited financial and operational results

for the third quarter ended September 30, 2024.

Key Third Quarter 2024 Highlights

| · | Consolidated revenue for Q3 2024 increased 1.5% year-over-year to $153.1 million. |

| · | Net income available to common stockholders in Q3 2024 was $731,000, compared to a net loss available

to common stockholders of ($4.9) million in the prior year period. |

| · | Net income per diluted common share in Q3 2024 was $0.04, compared to a net loss per diluted common share

of ($0.27) in the same period of 2023. Q3 2023 included a $5.2 million loss on equity investment. Excluding that, net income per diluted

common share would have been $0.02. |

| · | Q3 2024 Adjusted EBITDA was $12.9 million compared to $18.1 million in the third quarter of 2023. |

| · | Q4 enrollments at Rasmussen, which are known at the end of Q3 increased 3.5% compared to Q4 2023, the

first significant increase since the acquisition. |

| · | Narrowing guidance for full year revenue of $620 million to $625 million and updating Adjusted EBITDA

to $64 million to $67 million. |

Management Commentary

"The third quarter demonstrated continued

progress in the goals we set out at the beginning of this year,” said Angela Selden, President and Chief Executive Officer of APEI.

“In the third quarter of 2024, Rasmussen had its first positive year over year enrollment comparison since our acquisition of the

business and we expect continued momentum in that business. Hondros continues to show improvement in the third quarter and we expect further

enrollment growth in the fourth quarter of this year.”

“We remain on track to deliver on the expectations

we set out at the beginning of this year. We maintained that Rasmussen would be EBITDA positive in the second half of 2024 and we are

on track to deliver. We are confident in our revenue, net income and Adjusted EBITDA outlook in 2024.

We believe the steps we have taken throughout

last year and this year are leading to greater student engagement and outcomes and will continue to be reflected in the financial results

and provide greater long term shareholder value," concluded Selden.

Third quarter 2024 Financial Results

| · | Total consolidated revenue for the three months ended September 30, 2024, was $153.1 million, an

increase of $2.3 million, or 1.5%, compared to $150.8 million for the three months ended September 30, 2023. The increase in revenue was

primarily due to a $1.8 million increase in our HCN Segment, a $0.6 million increase in our APUS Segment, and a $0.5 million increase

in revenue in our RU Segment. |

| · | Total costs and expenses for the three months ended September 30, 2024, were $149.0 million, an

increase of $4.6 million, or 3.2%, compared to $144.4 million for the three months ended September 30, 2023. Costs and expenses for the

three months ended September 30, 2024, include $1.1 million of information technology transition services costs in all our segments as

well as Corporate and Other. |

| · | Instructional costs and services expenses for the for the three months ended September 30, 2024,

were $75.4 million, an increase of $2.2 million, or 3.0%, compared to $73.2 million for the three months ended September 30, 2023. |

| · | Selling and promotional expenses for the three months ended September 30, 2024, were $33.5 million,

an increase of $0.1 million, or 0.4%, compared to $33.3 million for the three months ended September 30, 2023. |

| · | General and administrative expenses for the three months ended September 30, 2024, were $35.0 million,

an increase of $4.1 million, or 13.4%, compared to $30.9 million for the three months ended September 30, 2023. The increase in general

and administrative expenses is primarily due to increases in other information technology costs in all our segments, employee compensation

costs in Corporate and Other, professional fees in our APUS Segment and Corporate and Other. |

| · | Net income available to common stockholders was $731,000, or $0.04 per diluted common share for

the three months ended September 30, 2024, compared to a net loss of ($4.9) million, or ($0.27) per diluted common share, for the three

months ended September 30, 2023. Q3 2023 included a $5.2 million net loss on equity investment. |

| · | Adjusted EBITDA was $12.9 million for the three months ended September 30, 2024, compared to $18.1

million for the three months ended September 30, 2023. Adjusted EBITDA excludes adjustment for impairment of goodwill and intangible assets,

severance costs, loss on leases, stock compensation, loss on disposals of long-lived assets, and transition services costs. |

Balance Sheet and Liquidity

| · | Total cash, cash equivalents, and restricted cash were $162.2 million at September 30, 2024, compared

to $144.3 million and December 31, 2023, representing an increase of $17.9 million, or 12.4%. |

Registrations and Enrollment

| |

Q3 2024 |

Q3 2023 |

% Change |

| American Public University System 1 |

|

|

|

For the three months ended September 30,

Net Course Registrations |

92,500 |

92,300 |

0.2% |

| |

|

|

|

| Rasmussen University 2 |

|

|

|

For the three months ended September 30,

Total Student Enrollment |

13,500 |

13,500 |

0% |

| |

|

|

|

| Hondros College of Nursing 3 |

|

|

|

For the three months ended September 30,

Total Student Enrollment |

3,100 |

2,800 |

10.4% |

| 1. | APUS Net Course Registrations represents the approximate aggregate number of courses for which students

remain enrolled after the date by which they may drop a course without financial penalty. Excludes students in doctoral programs. |

| 2. | RU Total Student Enrollment represents students in an active status as of the full-term census or billing

date. |

| 3. | HCN Total Student Enrollment represents the approximate number of students enrolled in a course after

the date by which students may drop a course without financial penalty. |

Fourth Quarter and Full Year 2024 Outlook

The following statements are based on APEI's current

expectations. These statements are forward-looking and actual results may differ materially. APEI undertakes no obligation to update publicly

any forward-looking statements for any reason unless required by law. Refer to APEI's earnings conference call and presentation for further

details.

| |

Fourth Quarter 2024 Guidance |

| |

(Approximate) |

(% Yr/Yr Change) |

| APUS Net course registrations |

94,400 to 96,100 |

4% to 6% |

| HCN Student enrollment |

3,700 |

19 % |

| RU Student enrollment |

14,600 |

4 % |

| - On-ground Healthcare |

6,300 |

-3 % |

| - Online |

8,300 |

9 % |

| |

|

|

| ($ in millions except EPS) |

|

|

| APEI Consolidated revenue |

$159.0 – $164.0 |

4% to 8% |

| APEI Net loss/income available to common stockholders |

$9.0 – $11.0 |

(20%) – (4.0%) |

| APEI Adjusted EBITDA |

$23.0 – $26.0 |

(10%) to 2% |

| APEI Diluted EPS |

$0.47 – $0.56 |

(26%) to (13%) |

| |

|

|

| |

Full Year 2024 Guidance |

| |

(Approximate) |

(% Yr/Yr Change) |

| ($ in millions) |

|

|

| APEI Consolidated Revenue |

$620 – $625 |

3% to 4% |

| APEI Net income available to common stockholders |

$7-$9 |

n.m. |

| APEI Adjusted EBITDA |

$64 – $67 |

7% to 12% |

| APEI Capital Expenditure (CapEx) |

$19 – $22 |

37% to 58% |

Non-GAAP Financial Measures

This press release contains the non-GAAP financial

measures of EBITDA (earnings before interest, taxes, depreciation, and amortization) and adjusted EBITDA (EBITDA less non-cash expenses

such as stock compensation and non-recurring expenses). APEI believes that the use of these measures is useful because they allow investors

to better evaluate APEI's operating profit and cash generation capabilities.

For the three months ended September 30, 2024

and 2023, adjusted EBITDA excludes impairment of goodwill and intangible assets, severance costs, loss on leases, stock compensation,

loss on disposals of long-lived assets, and transition services costs.

These non-GAAP measures should not be considered

in isolation or as an alternative to measures determined in accordance with generally accepted accounting principles in the United States

(GAAP). The principal limitation of our non-GAAP measures is that they exclude expenses that are required by GAAP to be recorded. In addition,

non-GAAP measures are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses are

excluded.

APEI is presenting EBITDA and adjusted EBITDA

in connection with its GAAP results and urges investors to review the reconciliation of EBITDA and adjusted EBITDA to the comparable GAAP

financial measures that is included in the tables following this press release (under the captions "GAAP Net Income to Adjusted EBITDA,"

and "GAAP Outlook Net Income to Outlook Adjusted EBITDA") and not to rely on any single financial measure to evaluate its business.

About American Public Education

American Public Education, Inc. (Nasdaq: APEI),

through its institutions American Public University System (APUS), Rasmussen University, Hondros College of Nursing, and Graduate School

USA (GSUSA), provides education that transforms lives, advances careers, and improves communities.

APUS, which operates through American Military

University and American Public University, is the leading educator to active-duty military and veteran students* and serves approximately

88,000 adult learners worldwide via accessible and affordable higher education.

Rasmussen University is a 120-year-old nursing

and health sciences-focused institution that serves approximately 13,500 students across its 20 campuses in six states and online. It

also has schools of Business, Technology, Design, Early Childhood Education and Justice Studies.

Hondros College of Nursing focuses on educating

pre-licensure nursing students at eight campuses (six in Ohio, one in Indiana, and one in Michigan). It is the largest educator of PN

(LPN) nurses in the state of Ohio** and serves approximately 3,100 total students.

Graduate School USA is a leading training provider

to the federal workforce with an extensive portfolio of government agency customers. It serves the federal workforce through customized

contract training (B2G) to federal agencies and through open enrollment (B2C) to government professionals.

Both APUS and Rasmussen are institutionally accredited

by the Higher Learning Commission (HLC), an institutional accreditation agency recognized by the U.S. Department of Education. Hondros

is accredited by the Accrediting Bureau of Health Education Schools (ABHES). GSUSA is accredited by the Accrediting Council for Continuing

Education & Training (ACCET). For additional information, visit www.apei.com.

*Based on FY 2019 Department of Defense tuition

assistance data, as reported by Military Times, and Veterans Administration student enrollment data as of 2023.

**Based on information compiled by the National

Council of State Boards of Nursing and Ohio Board of Nursing.

Forward Looking Statements

Statements made in this press release regarding

APEI or its subsidiaries that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates

and projections about APEI and the industry. In some cases, forward-looking statements can be identified by words such as "anticipate,"

"believe," "seek," "could," "estimate," "expect," "intend," "may,"

"plan," "should," "will," "would," and similar words or their opposites. Forward-looking statements

include, without limitation, statements regarding the Company's future path, expected growth, registration and enrollments, revenues,

income and adjusted EBITDA and EBITDA, capital expenditures, the growth and profitability of Rasmussen University and plans with respect

to recent, current and future initiatives.

Forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks

and uncertainties include, among others, risks related to: APEI's failure to comply with regulatory and accrediting agency requirements,

including the "90/10 Rule", and to maintain institutional accreditation and the impacts of any actions APEI may take to prevent

or correct such failure; APEI's dependence on the effectiveness of its ability to attract students who persist in its institutions' programs;

changing market demands; declines in enrollments at APEI's subsidiaries; the enactment of legislation that adversely impacts APEI

or its subsidiaries; APEI's inability to effectively market its institutions' programs; APEI's inability to maintain strong relationships

with the military and maintain course registrations and enrollments from military students; the loss or disruption of APEI's ability to

receive funds under tuition assistance programs or the reduction, elimination, or suspension of tuition assistance; adverse effects of

changes APEI makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed;

APEI's need to successfully adjust to future market demands by updating existing programs and developing new programs; APEI's loss of

eligibility to participate in Title IV programs or ability to process Title IV financial aid; economic and market conditions and changes

in interest rates; difficulties involving acquisitions; APEI's indebtedness and preferred stock; APEI's dependence on and the need to

continue to invest in its technology infrastructure, including with respect to third-party vendors; the inability to recognize the anticipated

benefits of APEI's cost savings and revenue generating efforts; APEI's ability to manage and limit its exposure to bad debt; and the various

risks described in the "Risk Factors" section and elsewhere in APEI's Annual Report on Form 10-K for the year ended December 31,

2023, and in other filings with the SEC. You should not place undue reliance on any forward-looking statements. APEI undertakes no obligation

to update publicly any forward-looking statements for any reason, unless required by law, even if new information becomes available or

other events occur in the future.

Company Contact

Frank Tutalo

Director, Public Relations

American Public Education, Inc.

ftutalo@apei.com

571-358-3042

Investor Relations

Brian M. Prenoveau, CFA

MZ North America

Direct: 561-489-5315

APEI@mzgroup.us

| American Public Education, Inc. |

| Consolidated Statement of Income |

| (In thousands, except per share data) |

| | |

Three Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | |

| | |

| | |

| |

| Revenues | |

$ | 153,122 | | |

$ | 150,838 | |

| Costs and expenses: | |

| | | |

| | |

| Instructional costs and services | |

| 75,401 | | |

| 73,228 | |

| Selling and promotional | |

| 33,459 | | |

| 33,315 | |

| General and administrative | |

| 35,030 | | |

| 30,885 | |

| Depreciation and amortization | |

| 5,080 | | |

| 7,026 | |

| Loss (gain) on disposals of long-lived assets | |

| 23 | | |

| (16 | ) |

| Total costs and expenses | |

| 148,993 | | |

| 144,438 | |

| Income from operations before | |

| | | |

| | |

| interest and income taxes | |

| 4,129 | | |

| 6,400 | |

| Interest expense, net | |

| (631 | ) | |

| (792 | ) |

| Income before income taxes | |

| 3,498 | | |

| 5,608 | |

| Income tax expense | |

| 1,236 | | |

| 3,712 | |

| Equity investment loss | |

| - | | |

| (5,224 | ) |

| Net income (loss) | |

$ | 2,262 | | |

$ | (3,328 | ) |

| Preferred stock dividends | |

| 1,531 | | |

| 1,525 | |

| Net income (loss) available to common stockholders | |

$ | 731 | | |

$ | (4,853 | ) |

| | |

| | | |

| | |

| Income (loss) per common share: | |

| | | |

| | |

| Basic | |

$ | 0.04 | | |

$ | (0.27 | ) |

| Diluted | |

$ | 0.04 | | |

$ | (0.27 | ) |

| | |

| | | |

| | |

| Weighted average number of | |

| | | |

| | |

| common shares: | |

| | | |

| | |

| Basic | |

| 17,679 | | |

| 17,778 | |

| Diluted | |

| 18,247 | | |

| 17,820 | |

| | |

Three Months Ended | |

| Segment Information: | |

September 30, | |

| | |

2024 | | |

2023 | |

| Revenues: | |

| | |

| |

| APUS Segment | |

$ | 76,981 | | |

$ | 76,406 | |

| RU Segment | |

$ | 52,604 | | |

$ | 52,073 | |

| HCN Segment | |

$ | 15,493 | | |

$ | 13,741 | |

| Corporate and other1 | |

$ | 8,044 | | |

$ | 8,618 | |

| Income (loss) from operations before | |

| | | |

| | |

| interest and income taxes: | |

| | | |

| | |

| APUS Segment | |

$ | 20,765 | | |

$ | 21,948 | |

| RU Segment | |

$ | (7,609 | ) | |

$ | (10,570 | ) |

| HCN Segment | |

$ | (771 | ) | |

$ | (641 | ) |

| Corporate and other | |

$ | (8,256 | ) | |

$ | (4,337 | ) |

| | |

Nine Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | |

| | |

| | |

| |

| Revenues | |

$ | 460,449 | | |

$ | 447,741 | |

| Costs and expenses: | |

| | | |

| | |

| Instructional costs and services | |

| 224,042 | | |

| 222,115 | |

| Selling and promotional | |

| 99,753 | | |

| 106,205 | |

| General and administrative | |

| 105,733 | | |

| 96,907 | |

| Depreciation and amortization | |

| 15,440 | | |

| 22,735 | |

| Impairment of goodwill and intangible assets | |

| - | | |

| 64,000 | |

| Loss on leases | |

| 3,715 | | |

| - | |

| Loss (gain) on disposals of long-lived assets | |

| 235 | | |

| 17 | |

| Total costs and expenses | |

| 448,918 | | |

| 511,979 | |

| Income (loss) from operations before | |

| | | |

| | |

| interest and income taxes | |

| 11,531 | | |

| (64,238 | ) |

| Interest expense, net | |

| (1,542 | ) | |

| (3,668 | ) |

| Income (loss) before income taxes | |

| 9,989 | | |

| (67,906 | ) |

| Income tax expense (benefit) | |

| 2,433 | | |

| (12,839 | ) |

| Equity investment loss | |

| (4,407 | ) | |

| (5,233 | ) |

| Net income (loss) | |

$ | 3,149 | | |

$ | (60,300 | ) |

| Preferred stock dividends | |

| 4,597 | | |

| 4,469 | |

| Net loss available to common stockholders | |

$ | (1,448 | ) | |

$ | (64,769 | ) |

| | |

| | | |

| | |

| Loss per common share: | |

| | | |

| | |

| Basic | |

$ | (0.08 | ) | |

$ | (3.55 | ) |

| Diluted | |

$ | (0.08 | ) | |

$ | (3.54 | ) |

| | |

| | | |

| | |

| Weighted average number of | |

| | | |

| | |

| common shares: | |

| | | |

| | |

| Basic | |

| 17,604 | | |

| 18,230 | |

| Diluted | |

| 18,076 | | |

| 18,294 | |

| | |

Nine Months Ended | |

| Segment Information: | |

September 30, | |

| | |

2024 | | |

2023 | |

| Revenues: | |

| | |

| |

| APUS Segment | |

$ | 234,685 | | |

$ | 223,941 | |

| RU Segment | |

$ | 158,773 | | |

$ | 161,511 | |

| HCN Segment | |

$ | 48,349 | | |

$ | 41,147 | |

| Corporate and other1 | |

$ | 18,642 | | |

$ | 21,142 | |

| Income (loss) from operations before | |

| | | |

| | |

| interest and income taxes: | |

| | | |

| | |

| APUS Segment | |

$ | 62,143 | | |

$ | 57,963 | |

| RU Segment | |

$ | (25,401 | ) | |

$ | (100,708 | ) |

| HCN Segment | |

$ | (1,819 | ) | |

$ | (2,179 | ) |

| Corporate and other | |

$ | (23,392 | ) | |

$ | (19,314 | ) |

1. Corporate and Other includes tuition and contract training revenue earned by GSUSA and the elimination of intersegment revenue for courses taken by employees of one segment at other segments.

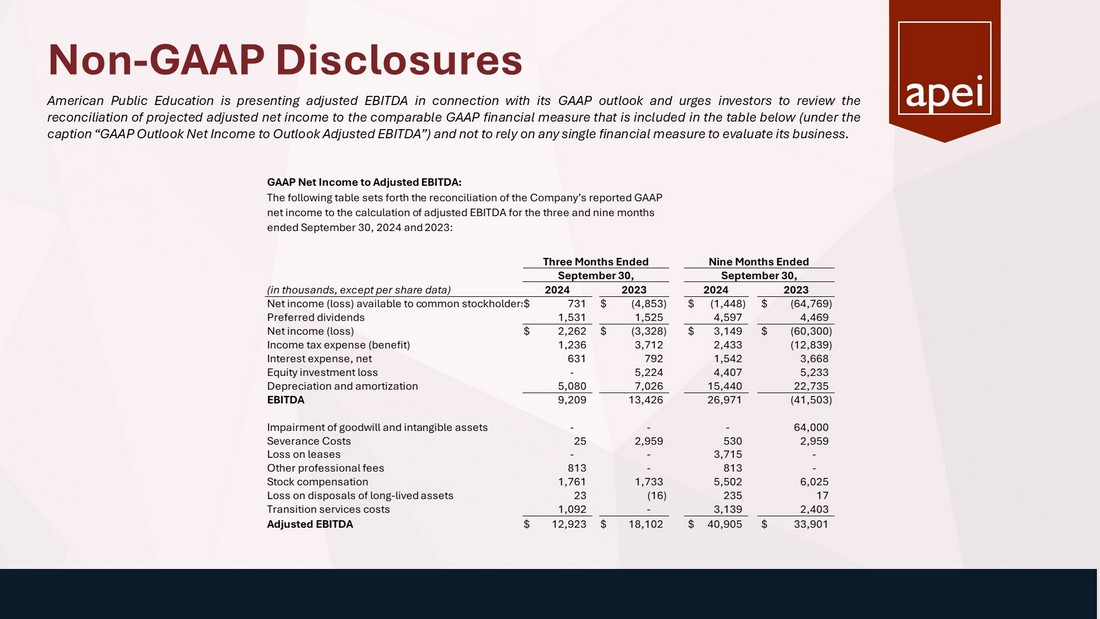

GAAP Net Income to Adjusted EBITDA:

The following table sets forth the reconciliation of the Company’s reported GAAP net income to the calculation of adjusted EBITDA for the three and nine months ended September 30, 2024 and 2023:

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| (in thousands, except per share data) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) available to common stockholders | |

$ | 731 | | |

$ | (4,853 | ) | |

$ | (1,448 | ) | |

$ | (64,769 | ) |

| Preferred dividends | |

| 1,531 | | |

| 1,525 | | |

| 4,597 | | |

| 4,469 | |

| Net income (loss) | |

$ | 2,262 | | |

$ | (3,328 | ) | |

$ | 3,149 | | |

$ | (60,300 | ) |

| Income tax expense (benefit) | |

| 1,236 | | |

| 3,712 | | |

| 2,433 | | |

| (12,839 | ) |

| Interest expense, net | |

| 631 | | |

| 792 | | |

| 1,542 | | |

| 3,668 | |

| Equity investment loss | |

| - | | |

| 5,224 | | |

| 4,407 | | |

| 5,233 | |

| Depreciation and amortization | |

| 5,080 | | |

| 7,026 | | |

| 15,440 | | |

| 22,735 | |

| EBITDA | |

| 9,209 | | |

| 13,426 | | |

| 26,971 | | |

| (41,503 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Impairment of goodwill and intangible assets | |

| - | | |

| - | | |

| - | | |

| 64,000 | |

| Severance Costs | |

| 25 | | |

| 2,959 | | |

| 530 | | |

| 2,959 | |

| Loss on leases | |

| - | | |

| - | | |

| 3,715 | | |

| - | |

| Other professional fees | |

| 813 | | |

| - | | |

| 813 | | |

| - | |

| Stock compensation | |

| 1,761 | | |

| 1,733 | | |

| 5,502 | | |

| 6,025 | |

| Loss (gain) on disposals of long-lived assets | |

| 23 | | |

| (16 | ) | |

| 235 | | |

| 17 | |

| Transition services costs | |

| 1,092 | | |

| - | | |

| 3,139 | | |

| 2,403 | |

| Adjusted EBITDA | |

$ | 12,923 | | |

$ | 18,102 | | |

$ | 40,905 | | |

$ | 33,901 | |

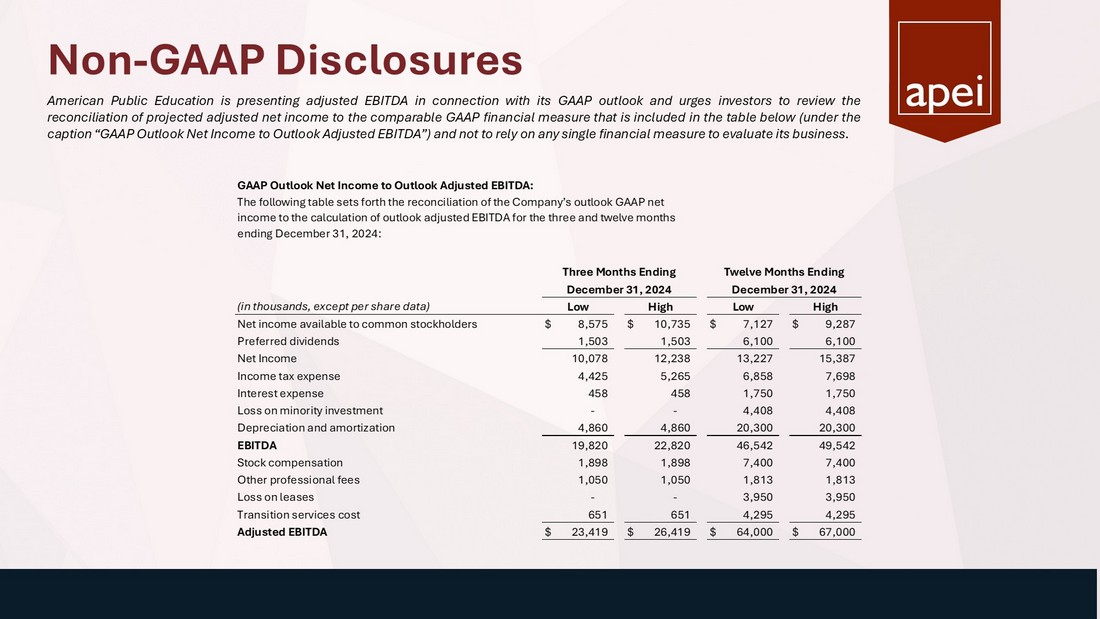

GAAP Outlook Net Income to Outlook Adjusted EBITDA:

The following table sets forth the reconciliation of the Company’s outlook GAAP net income to the calculation of outlook adjusted EBITDA for the three and twelve months ending December 31, 2024:

| | |

Three Months Ending | | |

Twelve Months Ending | |

| | |

December 31, 2024 | | |

December 31, 2024 | |

| (in thousands, except per share data) | |

Low | | |

High | | |

Low | | |

High | |

| Net income available to common stockholders | |

$ | 8,575 | | |

$ | 10,735 | | |

$ | 7,127 | | |

$ | 9,287 | |

| Preferred dividends | |

| 1,503 | | |

| 1,503 | | |

| 6,100 | | |

| 6,100 | |

| Net Income | |

| 10,078 | | |

| 12,238 | | |

| 13,227 | | |

| 15,387 | |

| Income tax expense | |

| 4,425 | | |

| 5,265 | | |

| 6,858 | | |

| 7,698 | |

| Interest expense | |

| 458 | | |

| 458 | | |

| 1,750 | | |

| 1,750 | |

| Loss on minority investment | |

| - | | |

| - | | |

| 4,408 | | |

| 4,408 | |

| Depreciation and amortization | |

| 4,860 | | |

| 4,860 | | |

| 20,300 | | |

| 20,300 | |

| EBITDA | |

| 19,820 | | |

| 22,820 | | |

| 46,542 | | |

| 49,542 | |

| Stock compensation | |

| 1,898 | | |

| 1,898 | | |

| 7,400 | | |

| 7,400 | |

| Other professional fees | |

| 1,050 | | |

| 1,050 | | |

| 1,813 | | |

| 1,813 | |

| Loss on leases | |

| - | | |

| - | | |

| 3,950 | | |

| 3,950 | |

| Transition services cost | |

| 651 | | |

| 651 | | |

| 4,295 | | |

| 4,295 | |

| Adjusted EBITDA | |

$ | 23,419 | | |

$ | 26,419 | | |

$ | 64,000 | | |

$ | 67,000 | |

Exhibit 99.2

3Q24 Earnings Presentation November 2024

FORWARD - LOOKING STATEMENTS Statements made in this presentation regarding American Public Education, Inc . or its subsidiary institutions (“APEI” or the “Company”) that are not historical facts are forward - looking statements based on current expectations, assumptions, estimates and projections about APEI and the industry . In some cases, forward looking statements can be identified by words such as “anticipate,” “believe,” “seek,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “project,” “should,” “will,” “would,” and similar words or their opposites . Forward - looking statements include, without limitation, statements regarding expectations for growth, registration, enrollments, revenues, net income, earnings per share, EBITDA and Adjusted EBITDA, free cash flow, and plans with respect to and future impacts of recent, current and future initiatives . Forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements . Such risks and uncertainties include, among others, risks related to : the Company’s failure to comply with regulatory and accrediting agency requirements, including the “ 90 / 10 Rule”, and to maintain institutional accreditation and the impacts of any actions the Company may take to prevent or correct such failure ; the Company’s dependence on the effectiveness of its ability to attract students who persist in its subsidiary institutions’ programs ; changing market demands ; declines in enrollments at the Company’s subsidiary institutions ; the enactment of legislation that adversely impacts the Company or its subsidiary institutions ; the Company’s inability to effectively brand or market its subsidiary institutions and its subsidiary institutions’ programs ; the Company’s inability to maintain strong relationships with the military and maintain course registrations and enrollments from military students ; the loss or disruption of the Company’s ability to receive funds under tuition assistance programs or the reduction, elimination, or suspension of tuition assistance ; adverse effects of changes the Company makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed ; the Company’s need to successfully adjust to future market demands by updating existing programs and developing new programs ; the Company’s loss of eligibility to participate in Title IV programs or ability to process Title IV financial aid ; economic and market conditions and changes in interest rates ; difficulties involving acquisitions ; the Company’s indebtedness and preferred stock ; the Company’s dependence on and the need to continue to invest in its technology infrastructure, including with respect to third - party vendors ; the inability to recognize the anticipated benefits of the Company’s cost savings and revenue generating efforts ; the Company’s ability to manage and limit its exposure to bad debt ; and the risk factors described in the risk factor section and elsewhere in the Company’s most recent annual report on Form 10 - K and quarterly report on Form 10 - Q and in the Company’s other SEC filings . You should not place undue reliance on any forward - looking statements . The Company undertakes no obligation to update publicly any forward - looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future .

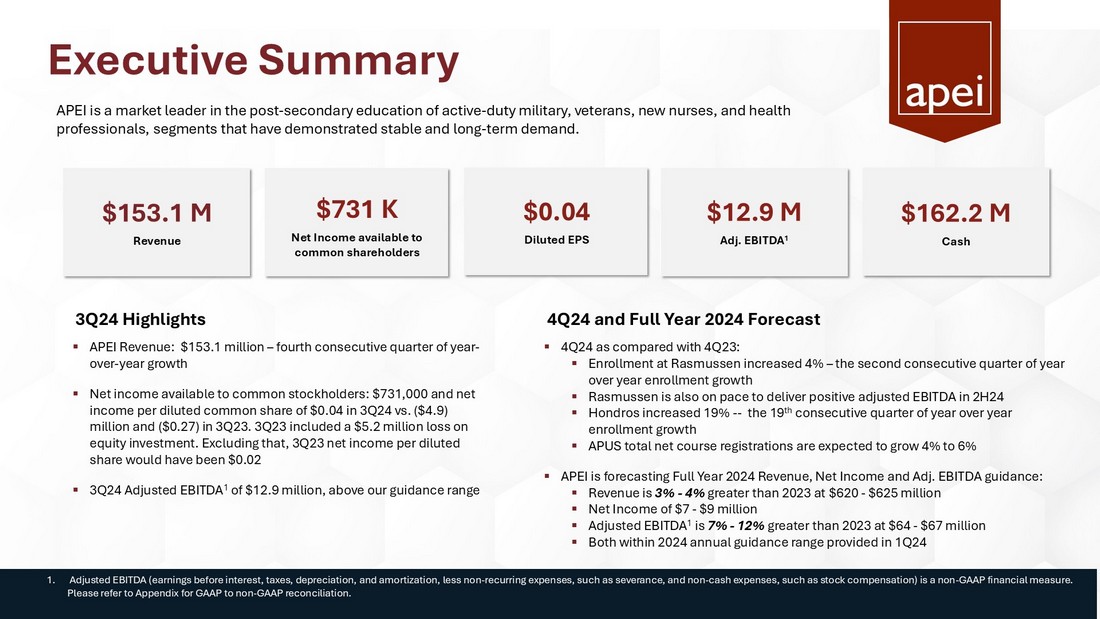

Executive Summary $153.1 M Revenue $12.9 M Adj. EBITDA 1 $731 K Net Income available to common shareholders $162.2 M Cash 1. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization, less non - recurring expenses, such as severanc e, and non - cash expenses, such as stock compensation) is a non - GAAP financial measure. Please refer to Appendix for GAAP to non - GAAP reconciliation. $0.04 Diluted EPS ▪ APEI Revenue: $ 153.1 million – fourth consecutive quarter of year - over - year growth ▪ Net income available to common stockholders: $731,000 and net income per diluted common share of $0.04 in 3Q24 vs. ($4.9) million and ($0.27) in 3Q23. 3Q23 included a $5.2 million loss on equity investment. Excluding that, 3Q23 net income per diluted share would have been $0.02 ▪ 3Q24 Adjusted EBITDA 1 of $12.9 million, above our guidance range 3Q24 Highlights 4Q24 and Full Year 2024 Forecast APEI is a market leader in the post - secondary education of active - duty military, veterans, new nurses, and health professionals, segments that have demonstrated stable and long - term demand. ▪ 4Q24 as compared with 4Q23: ▪ Enrollment at Rasmussen increased 4% – the second consecutive quarter of year over year enrollment growth ▪ Rasmussen is also on pace to deliver positive adjusted EBITDA in 2H24 ▪ Hondros increased 19% -- the 19 th consecutive quarter of year over year enrollment growth ▪ APUS total net course registrations are expected to grow 4% to 6% ▪ APEI is forecasting Full Year 2024 Revenue, Net Income and Adj. EBITDA guidance: ▪ Revenue is 3% - 4% greater than 2023 at $620 - $625 million ▪ Net Income of $7 - $9 million ▪ Adjusted EBITDA 1 is 7% - 12% greater than 2023 at $64 - $67 million ▪ Both within 2024 annual guidance range provided in 1Q24

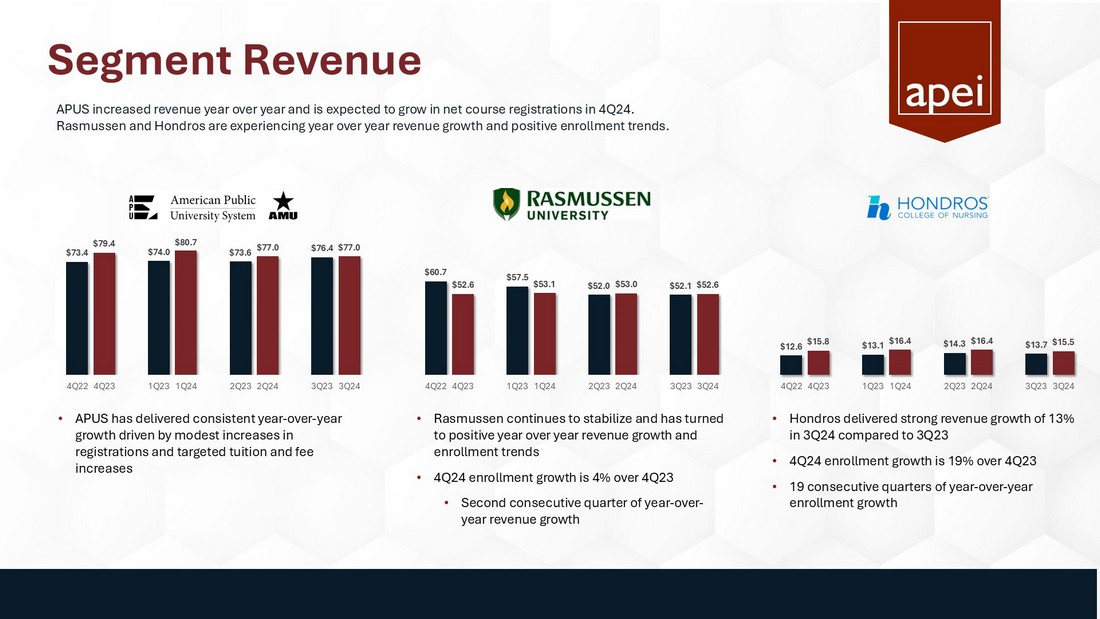

Segment Revenue $73.4 $79.4 $74.0 $80.7 $73.6 $77.0 $76.4 $77.0 4Q22 4Q23 1Q23 1Q24 2Q23 2Q24 3Q23 3Q24 $60.7 $52.6 $57.5 $53.1 $52.0 $53.0 $52.1 $52.6 4Q22 4Q23 1Q23 1Q24 2Q23 2Q24 3Q23 3Q24 $12.6 $15.8 $13.1 $16.4 $14.3 $16.4 $13.7 $15.5 4Q22 4Q23 1Q23 1Q24 2Q23 2Q24 3Q23 3Q24 • APUS has delivered consistent year - over - year growth driven by modest increases in registrations and targeted tuition and fee increases • Rasmussen continues to stabilize and has turned to positive year over year revenue growth and enrollment trends • 4Q24 enrollment growth is 4% over 4Q23 • Second consecutive quarter of year - over - year revenue growth • Hondros delivered strong revenue growth of 13% in 3Q24 compared to 3Q23 • 4Q24 enrollment growth is 19% over 4Q23 • 19 consecutive quarters of year - over - year enrollment growth APUS increased revenue year over year and is expected to grow in net course registrations in 4Q24. Rasmussen and Hondros are experiencing year over year revenue growth and positive enrollment trends.

Profitability ▪ Continued registration growth in 2024 with select tuition/fee increases and lower marketing spend TTM Adj. EBITDA 1 As of 9/30/24 TTM Adj. EBITDA Margin 1 As of 9/30/24 ▪ Stabilizing environment and positive enrollment comp in 3Q24. 4Q24 enrollment trends are even higher ▪ Rasmussen is on a trajectory to positive EBITDA in 2H24 ▪ Hondros enrollments have grown at double - digit rates for the 5 of the last 6 quarters ▪ Government spending uncertainty impacted 1H24 revenue and adjusted EBITDA. Growth returning in 4Q24 $56.8 $46.4 $40.7 $49.3 $59.6 $69.6 $71.8 $66.6 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 9.4% 7.7% 6.8% 8.2% 9.9% 11.5% 11.7% 10.9% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 1. Please refer to appendix for GAAP to non - GAAP reconciliation

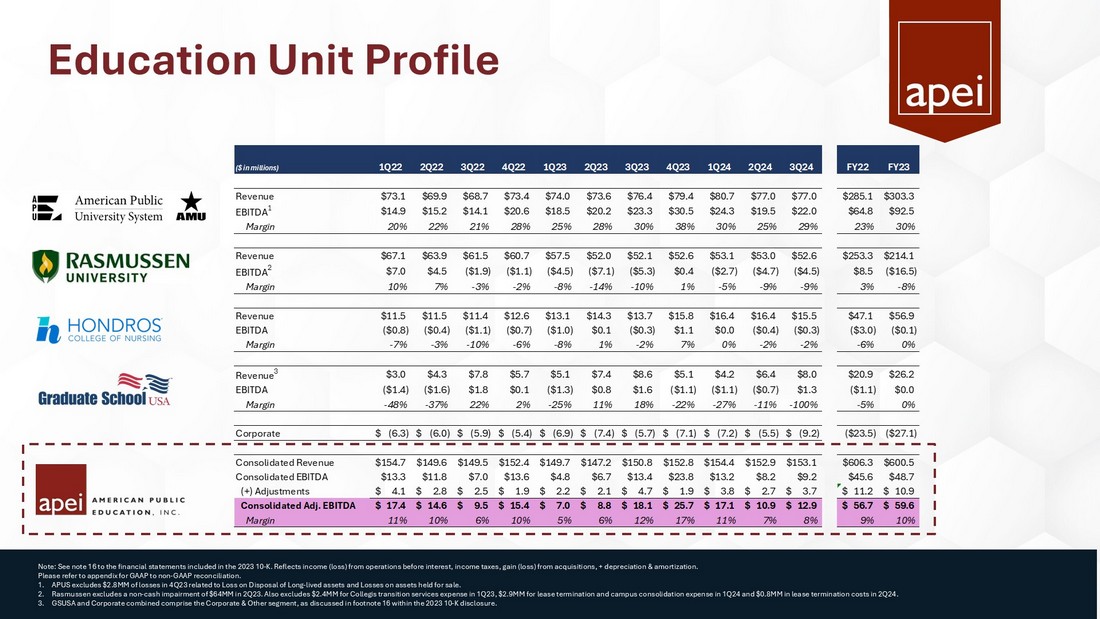

Education Unit Profile Note: See note 16 to the financial statements included in the 2023 10 - K. Reflects income (loss) from operations before interest, income taxes, gain (loss) from acquisitions, + depreciation & amortization. Please refer to appendix for GAAP to non - GAAP reconciliation. 1. APUS excludes $2.8MM of losses in 4Q23 related to Loss on Disposal of Long - lived assets and Losses on assets held for sale. 2. Rasmussen excludes a non - cash impairment of $64MM in 2Q23. Also excludes $2.4MM for Collegis transition services expense in 1Q23, $2.9MM for lease termination and campus consolidation expense in 1Q24 and $0.8MM in leas e termination costs in 2Q24. 3. GSUSA and Corporate combined comprise the Corporate & Other segment, as discussed in footnote 16 within the 2023 10 - K disclosure . ($ in millions) 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 FY22 FY23 Revenue $73.1 $69.9 $68.7 $73.4 $74.0 $73.6 $76.4 $79.4 $80.7 $77.0 $77.0 $285.1 $303.3 EBITDA 1 $14.9 $15.2 $14.1 $20.6 $18.5 $20.2 $23.3 $30.5 $24.3 $19.5 $22.0 $64.8 $92.5 Margin 20% 22% 21% 28% 25% 28% 30% 38% 30% 25% 29% 23% 30% Revenue $67.1 $63.9 $61.5 $60.7 $57.5 $52.0 $52.1 $52.6 $53.1 $53.0 $52.6 $253.3 $214.1 EBITDA 2 $7.0 $4.5 ($1.9) ($1.1) ($4.5) ($7.1) ($5.3) $0.4 ($2.7) ($4.7) ($4.5) $8.5 ($16.5) Margin 10% 7% -3% -2% -8% -14% -10% 1% -5% -9% -9% 3% -8% Revenue $11.5 $11.5 $11.4 $12.6 $13.1 $14.3 $13.7 $15.8 $16.4 $16.4 $15.5 $47.1 $56.9 EBITDA ($0.8) ($0.4) ($1.1) ($0.7) ($1.0) $0.1 ($0.3) $1.1 $0.0 ($0.4) ($0.3) ($3.0) ($0.1) Margin -7% -3% -10% -6% -8% 1% -2% 7% 0% -2% -2% -6% 0% Revenue 3 $3.0 $4.3 $7.8 $5.7 $5.1 $7.4 $8.6 $5.1 $4.2 $6.4 $8.0 $20.9 $26.2 EBITDA ($1.4) ($1.6) $1.8 $0.1 ($1.3) $0.8 $1.6 ($1.1) ($1.1) ($0.7) $1.3 ($1.1) $0.0 Margin -48% -37% 22% 2% -25% 11% 18% -22% -27% -11% -100% -5% 0% Corporate (6.3)$ (6.0)$ (5.9)$ (5.4)$ (6.9)$ (7.4)$ (5.7)$ (7.1)$ (7.2)$ (5.5)$ (9.2)$ ($23.5) ($27.1) Consolidated Revenue $154.7 $149.6 $149.5 $152.4 $149.7 $147.2 $150.8 $152.8 $154.4 $152.9 $153.1 $606.3 $600.5 Consolidated EBITDA $13.3 $11.8 $7.0 $13.6 $4.8 $6.7 $13.4 $23.8 $13.2 $8.2 $9.2 $45.6 $48.7 (+) Adjustments 4.1$ 2.8$ 2.5$ 1.9$ 2.2$ 2.1$ 4.7$ 1.9$ 3.8$ 2.7$ 3.7$ 11.2$ 10.9$ Consolidated Adj. EBITDA 17.4$ 14.6$ 9.5$ 15.4$ 7.0$ 8.8$ 18.1$ 25.7$ 17.1$ 10.9$ 12.9$ 56.7$ 59.6$ Margin 11% 10% 6% 10% 5% 6% 12% 17% 11% 7% 8% 9% 10%

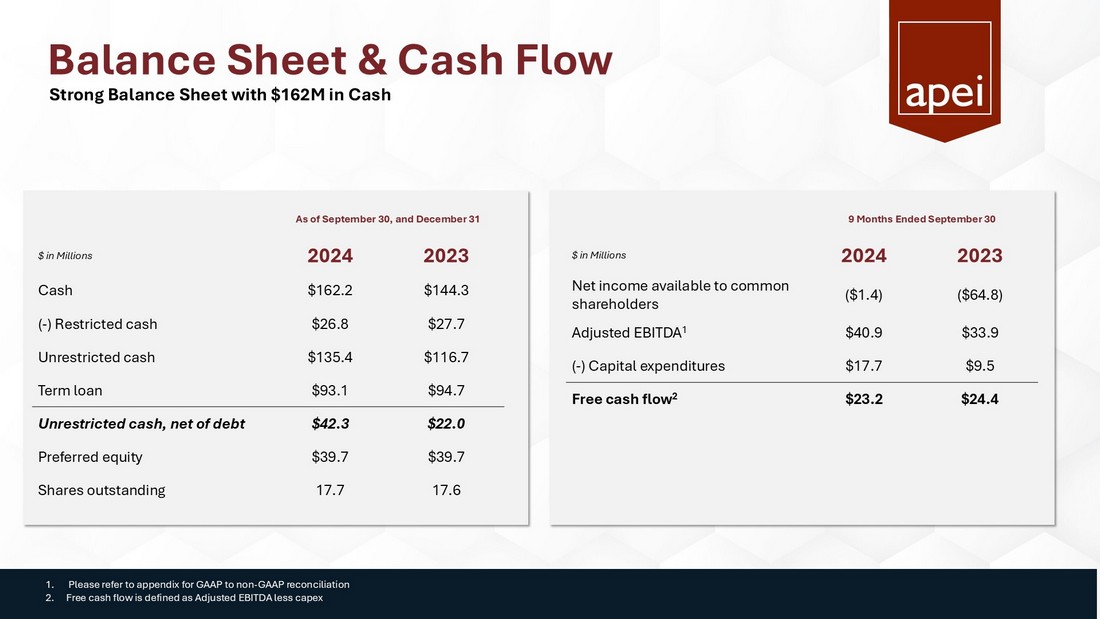

Balance Sheet & Cash Flow 9 Months Ended September 30 2023 2024 $ in Millions ($64.8) ($1.4) Net income available to common shareholders $33.9 $40.9 Adjusted EBITDA 1 $9.5 $17.7 ( - ) Capital expenditures $24.4 $23.2 Free cash flow 2 As of September 30, and December 31 2023 2024 $ in Millions $144.3 $162.2 Cash $27.7 $26.8 ( - ) Restricted cash $116.7 $135.4 Unrestricted cash $94.7 $93.1 Term loan $22.0 $42.3 Unrestricted cash, net of debt $39.7 $39.7 Preferred equity 17.6 17.7 Shares outstanding Strong Balance Sheet with $162M in Cash 1. Please refer to appendix for GAAP to non - GAAP reconciliation 2. Free cash flow is defined as Adjusted EBITDA less capex

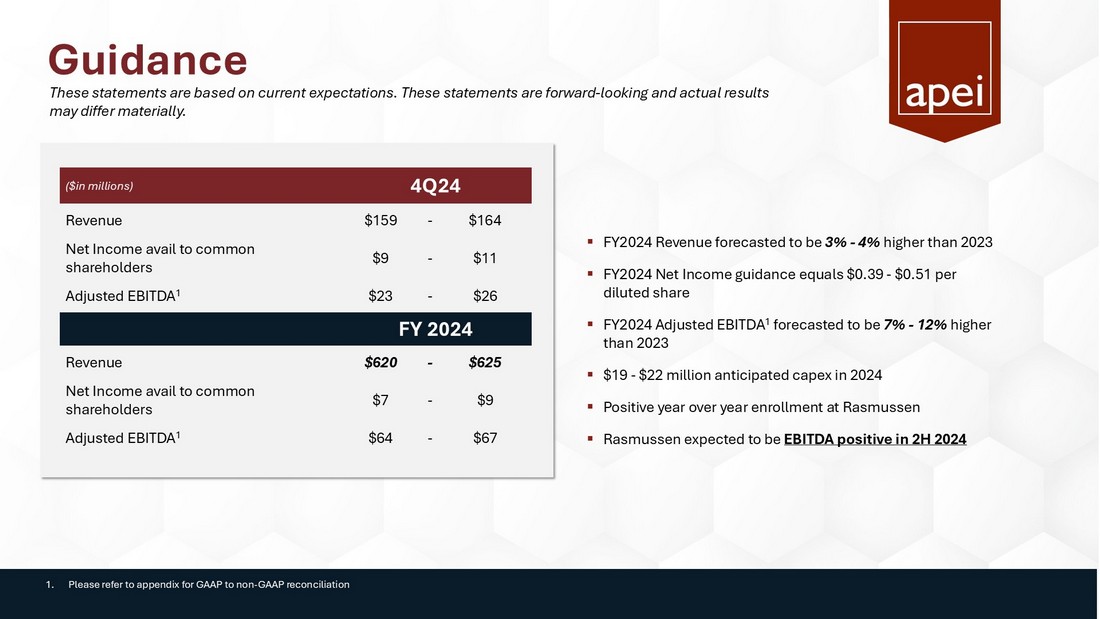

Guidance 4Q24 ($in millions) $164 - $159 Revenue $11 - $9 Net Income avail to common shareholders $26 - $23 Adjusted EBITDA 1 FY 2024 $625 - $620 Revenue $9 - $7 Net Income avail to common shareholders $67 - $64 Adjusted EBITDA 1 ▪ FY2024 Revenue forecasted to be 3% - 4% higher than 2023 ▪ FY2024 Net Income guidance equals $0.39 - $0.51 per diluted share ▪ FY2024 Adjusted EBITDA 1 forecasted to be 7% - 12% higher than 2023 ▪ $19 - $22 million anticipated capex in 2024 ▪ Positive year over year enrollment at Rasmussen ▪ Rasmussen expected to be EBITDA positive in 2H 2024 1. Please refer to appendix for GAAP to non - GAAP reconciliation These statements are based on current expectations. These statements are forward - looking and actual results may differ materially.

About APEI

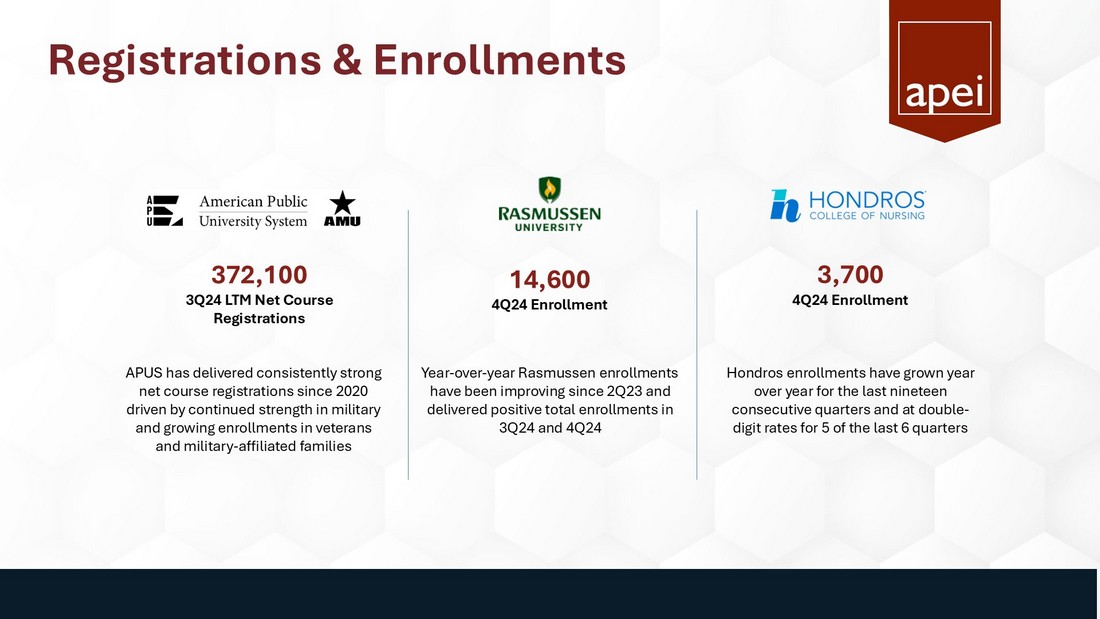

Registrations & Enrollments 372,100 3Q24 LTM Net Course Registrations 3,700 4Q24 Enrollment 14,600 4Q24 Enrollment APUS has delivered consistently strong net course registrations since 2020 driven by continued strength in military and growing enrollments in veterans and military - affiliated families Year - over - year Rasmussen enrollments have been improving since 2Q23 and delivered positive total enrollments in 3Q24 and 4Q24 Hondros enrollments have grown year over year for the last nineteen consecutive quarters and at double - digit rates for 5 of the last 6 quarters

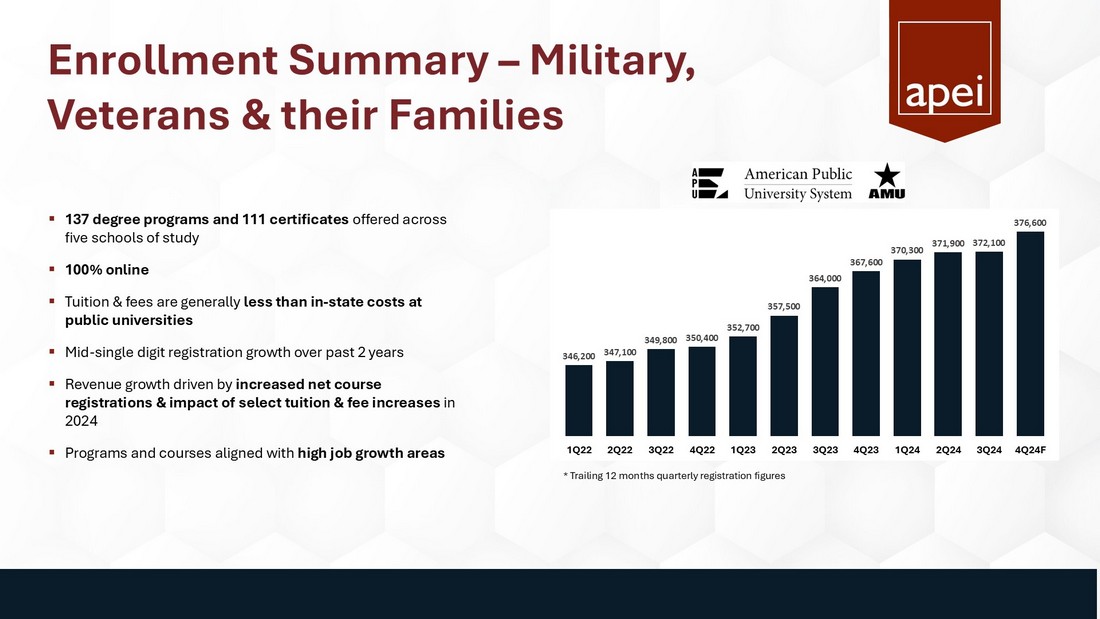

Enrollment Summary – Military, Veterans & their Families * Trailing 12 months quarterly registration figures ▪ 137 degree programs and 111 certificates offered across five schools of study ▪ 100% online ▪ Tuition & fees are generally less than in - state costs at public universities ▪ Mid - single digit registration growth over past 2 years ▪ Revenue growth driven by increased net course registrations & impact of select tuition & fee increases in 2024 ▪ Programs and courses aligned with high job growth areas 346,200 347,100 349,800 350,400 352,700 357,500 364,000 367,600 370,300 371,900 372,100 376,600 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24F

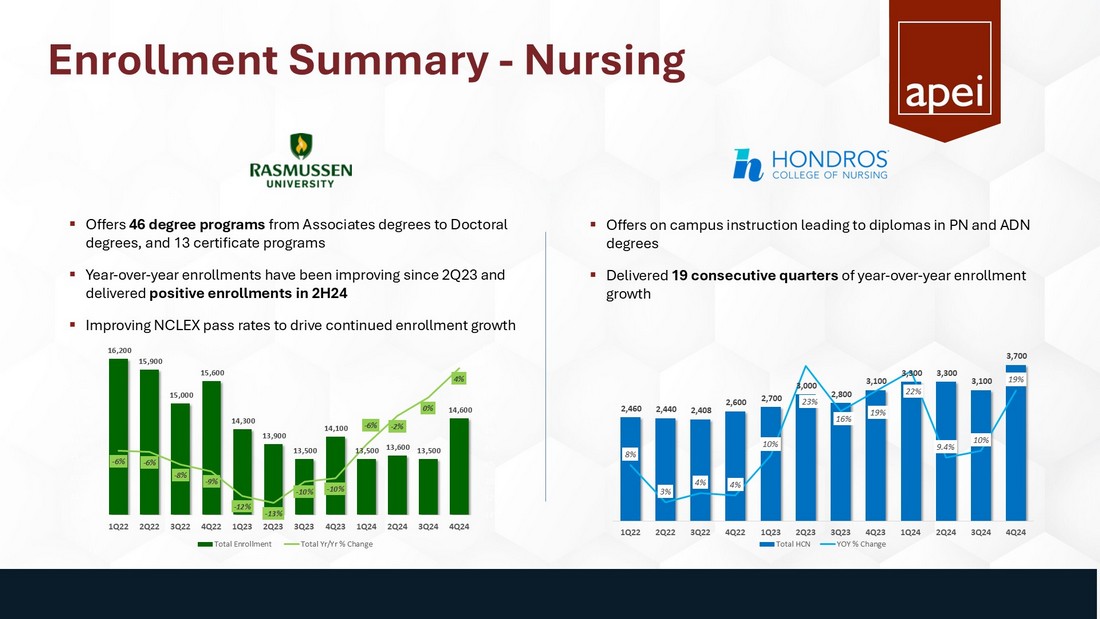

Enrollment Summary - Nursing ▪ Offers 46 degree programs from Associates degrees to Doctoral degrees, and 13 certificate programs ▪ Year - over - year enrollments have been improving since 2Q23 and delivered positive enrollments in 2H24 ▪ Improving NCLEX pass rates to drive continued enrollment growth ▪ Offers on campus instruction leading to diplomas in PN and ADN degrees ▪ Delivered 19 consecutive quarters of year - over - year enrollment growth 16,200 15,900 15,000 15,600 14,300 13,900 13,500 14,100 13,500 13,600 13,500 14,600 - 6% - 6% - 8% - 9% - 12% - 13% - 10% - 10% - 6% - 2% 0% 4% -14% -12% -10% -8% -6% -4% -2% 0% 2% 4% 6% 12,000 12,500 13,000 13,500 14,000 14,500 15,000 15,500 16,000 16,500 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Total Enrollment Total Yr/Yr % Change 2,460 2,440 2,408 2,600 2,700 3,000 2,800 3,100 3,300 3,300 3,100 3,700 8% 3% 4% 4% 10% 23% 16% 19% 22% 9.4% 10% 19% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Total HCN YOY % Change

INVESTMENT HIGHLIGHTS Large Addressable Market Online education expected to increase to >$100 billion in 5 years Solid ROI for Education & Stable Long - Term Demand APUS in top 11% for student return on educational investment Demand for nurses estimated to be 200,000+ per year Improving Performance at Subsidiary Units Solid growth, margins and cash flow performance at APUS Rasmussen turnaround in process and delivering positive enrollment Strong Cash Flow Free cash flow 1 expected to be >$42M in 2024 1. Free cash flow defined as Adjusted EBITDA less Capital Expenditures

Summary

Appendix

Non - GAAP Disclosures American Public Education is presenting adjusted EBITDA in connection with its GAAP outlook and urges investors to review the reconciliation of projected adjusted net income to the comparable GAAP financial measure that is included in the table below (under the caption “GAAP Outlook Net Income to Outlook Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . GAAP Net Income to Adjusted EBITDA: (in thousands, except per share data) Net income (loss) available to common stockholders$ 731 $ (4,853) $ (1,448) $ (64,769) Preferred dividends 1,531 1,525 4,597 4,469 Net income (loss) $ 2,262 $ (3,328) $ 3,149 $ (60,300) Income tax expense (benefit) 1,236 3,712 2,433 (12,839) Interest expense, net 631 792 1,542 3,668 Equity investment loss - 5,224 4,407 5,233 Depreciation and amortization 5,080 7,026 15,440 22,735 EBITDA 9,209 13,426 26,971 (41,503) Impairment of goodwill and intangible assets - - - 64,000 Severance Costs 25 2,959 530 2,959 Loss on leases - - 3,715 - Other professional fees 813 - 813 - Stock compensation 1,761 1,733 5,502 6,025 Loss on disposals of long-lived assets 23 (16) 235 17 Transition services costs 1,092 - 3,139 2,403 Adjusted EBITDA $ 12,923 $ 18,102 $ 40,905 $ 33,901 Nine Months Ended September 30, 2024 2023 The following table sets forth the reconciliation of the Company’s reported GAAP net income to the calculation of adjusted EBITDA for the three and nine months ended September 30, 2024 and 2023: Three Months Ended September 30, 2024 2023

Non - GAAP Disclosures American Public Education is presenting adjusted EBITDA in connection with its GAAP outlook and urges investors to review the reconciliation of projected adjusted net income to the comparable GAAP financial measure that is included in the table below (under the caption “GAAP Outlook Net Income to Outlook Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business . GAAP Outlook Net Income to Outlook Adjusted EBITDA: (in thousands, except per share data) Net income available to common stockholders $ 8,575 $ 10,735 $ 7,127 $ 9,287 Preferred dividends 1,503 1,503 6,100 6,100 Net Income 10,078 12,238 13,227 15,387 Income tax expense 4,425 5,265 6,858 7,698 Interest expense 458 458 1,750 1,750 Loss on minority investment - - 4,408 4,408 Depreciation and amortization 4,860 4,860 20,300 20,300 EBITDA 19,820 22,820 46,542 49,542 Stock compensation 1,898 1,898 7,400 7,400 Other professional fees 1,050 1,050 1,813 1,813 Loss on leases - - 3,950 3,950 Transition services cost 651 651 4,295 4,295 Adjusted EBITDA $ 23,419 $ 26,419 $ 64,000 $ 67,000 December 31, 2024 December 31, 2024 Low High Low High The following table sets forth the reconciliation of the Company’s outlook GAAP net income to the calculation of outlook adjusted EBITDA for the three and twelve months ending December 31, 2024: Three Months Ending Twelve Months Ending

Thank You Company Steve Somers, CFA Chief Strategy & Corporate Development Officer investorrelations@apei.com Investor Relations Brian M. Prenoveau , CFA MZ Group 561 - 489 - 5315 APEI@mzgroup.us

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

American Public Education (NASDAQ:APEI)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Public Education (NASDAQ:APEI)

Historical Stock Chart

From Jan 2024 to Jan 2025