American Rebel Holdings, Inc. (NASDAQ: AREB) ("American Rebel" or

the "Company"), a designer, manufacturer, and marketer of branded

safes, personal security and self-defense products and apparel, and

American Rebel Beer (americanrebelbeer.com), announced its

financial results for the quarter (“Q2 2024”) and first half ended

June 30, 2024. Investors are encouraged to read the Company’s

quarterly report on Form 10-Q, which was filed with the Securities

and Exchange Commissions (the “SEC”) and contains additional

information and is posted at

https://americanrebel.com/investor-relations.

First Half 2024 Financial

Summary:

|

Revenue |

|

$ |

7.3 Million |

|

|

Gross Profit |

|

$ |

0.87 Million |

|

|

EBITDA (GAAP) |

|

$ |

(6.4) Million |

|

|

Adjusted EBITDA (Non-GAAP)1 |

|

$ |

(3.7) Million |

|

Second Quarter 2024 Financial

Summary:

|

Revenue |

|

$ |

3.3 Million |

|

|

Gross Profit |

|

$ |

0.31 Million |

|

|

EBITDA (GAAP) |

|

$ |

(4.2) Million |

|

|

Adjusted EBITDA (Non-GAAP)1 |

|

$ |

(2.6) Million |

|

1 - Adjusted EBITDA is a non-GAAP measure. Refer

to the tables at the end of this press release for a reconciliation

to GAAP.

Recent Business Highlights:

- American Rebel Beer will enter full

scale production in August of 2024

- Successfully launched American

Rebel Beer at Country Stampede in Bonner Springs, KS

- Reached premier distribution

partnerships for American Rebel Beer in the following

regions:

- Bonbright Distributors - Ohio

- Best Brands - Tennessee

- Standard Beverage – Kansas

- Dichello Distributors -

Connecticut

- Multiple distributors in numerous

territories are engaged and we look forward to announcing

additional distribution agreements during Q3 2024.

- American Rebel Light Beer surpassed

150+ retail locations throughout Kansas as of August 2024.

- Continued improvement in our

subsidiary Champion Safe’s financial performance with tighter cost

controls and increasing inventory.

Andy Ross, Chief Executive Officer of American

Rebel, commented, “America’s Patriotic, God-Fearing,

Constitution-Loving, National Anthem-Singing, Stand Your Ground

Beer – Rebel Light is coming to a store near you. We made great

strides during the quarter toward the market launch of our beer,

with initial retail distribution in Kansas of our first production

run. Our second run, which is much larger, is scheduled for late

August. With our second run, we will be able to provide beer

throughout our network of distributors while signing on new

distributors, increasing our distribution network and footprint.

This distribution network is key to positioning our beer to compete

within the $110+ billion beer market.”

Ross continued, “We have experienced some

seasonality challenges in June and July of 2024 with our Champion

safe business, which is common within the outdoor durable goods

industry. Meanwhile, we will continue to posture our legacy safe

business for growth while incorporating operational improvements to

increase efficiencies and reduce expenses. With improved

operational efficiencies and new products, we can sell safes at

higher margins which should also drive profitability in 2025.”

About American Rebel Holdings,

Inc.

American Rebel Holdings, Inc. (NASDAQ: AREB) has

operated primarily as a designer, manufacturer and marketer of

branded safes and personal security and self-defense products and

has recently transitioned into the beverage industry through the

introduction of American Rebel Beer. The Company also designs and

produces branded apparel and accessories. To learn more, visit

www.americanrebel.com and www.americanrebelbeer.com. For investor

information, visit www.americanrebel.com/investor-relations.

Non-GAAP Financial Measures

American Rebel Holdings, Inc reports its

financial results in accordance with accounting principles

generally accepted in the U.S. (GAAP). In addition, the Company is

providing in this news release financial information in the form of

Adjusted EBITDA (earnings before interest, taxes, depreciation,

amortization, other income/expense, stock compensation,

restructuring, receivables adjustment and non-cash lease charges)

and Adjusted Net Loss. Management believes these non-GAAP financial

measures are useful to investors and lenders in evaluating the

overall financial health of the Company in that they allow for

greater transparency of additional financial data routinely used by

management to evaluate performance. Adjusted EBITDA can be useful

for investors or lenders as an indicator of available earnings.

Non-GAAP financial measures should not be considered in isolation

from, or as an alternative to, the financial information prepared

in accordance with GAAP.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. American Rebel Holdings, Inc., (NASDAQ: AREB;

AREBW) (the “Company,” "American Rebel,” “we,” “our” or “us”)

desires to take advantage of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 and is including

this cautionary statement in connection with this safe harbor

legislation. The words "forecasts" "believe," "may," "estimate,"

"continue," "anticipate," "intend," "should," "plan," "could,"

"target," "potential," "is likely," "expect" and similar

expressions, as they relate to us, are intended to identify

forward-looking statements. We have based these forward-looking

statements primarily on our current expectations and projections

about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy,

and financial needs. Important factors that could cause actual

results to differ from those in the forward-looking statements

include continued increase in revenues, actual receipt of funds

under the Reg A Offering, effects of the offering on the trading

price of our securities, implied or perceived benefits resulting

from the receipt of funds from the offering, actual launch timing

and availability of American Rebel Beer, our ability to effectively

execute our business plan, and the Risk Factors contained within

our filings with the SEC, including our Annual Report on Form 10-K

for the year ended December 31, 2023. Any forward-looking statement

made by us herein speaks only as of the date on which it is made.

Factors or events that could cause our actual results to differ may

emerge from time to time, and it is not possible for us to predict

all of them. We undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information,

future developments or otherwise, except as may be required by

law.

Reconciliation of Net Income (Loss)

attributable to American Rebel Holdings, Inc., to

Adjusted EBITDA for the Three Months Ended June 30, 2024

Unaudited

| Net Loss |

|

$ |

(5,253,004 |

) |

|

Interest expense |

|

|

1,055,282 |

|

|

Depreciation and amortization |

|

|

30,681 |

|

| EBITDA |

|

$ |

(4,167,041 |

) |

|

Stock compensation expense |

|

|

1,344,125 |

|

|

Loss on settlement of debt instrument |

|

|

250,000 |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

(2,572,916 |

) |

Reconciliation of Net Income (Loss)

attributable to American Rebel Holdings, Inc., to

Adjusted EBITDA for the Six Months Ended June 30, 2024

Unaudited

| Net Loss |

|

$ |

(7,954,282 |

) |

|

Interest expense |

|

|

1,479,141 |

|

|

Depreciation and amortization |

|

|

54,996 |

|

| EBITDA |

|

$ |

(6,420,145 |

) |

|

Stock compensation expense |

|

|

2,478,125 |

|

|

Loss on settlement of debt instrument |

|

|

250,000 |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

(3,692,020 |

) |

Company Contact:info@americanrebel.com

Investor Relations:Brian PrenoveauMZ North

America+1 (561) 489-5315 AREB@mzgroup.us

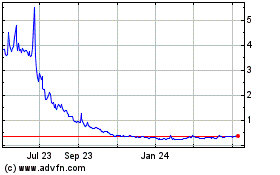

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From Dec 2024 to Jan 2025

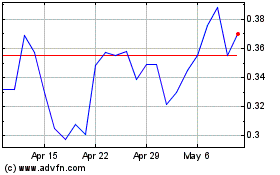

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From Jan 2024 to Jan 2025