false

0000879585

0000879585

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 13, 2023

ATN INTERNATIONAL, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-12593 |

|

47-0728886 |

| (State or other |

|

(Commission File Number) |

|

(IRS Employer |

| jurisdiction of incorporation) |

|

|

|

Identification No.) |

500 Cummings Center

Beverly, MA 01915

(Address of principal executive offices

and zip code)

(978) 619-1300

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $.01 per share |

|

ATNI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 13, 2023,

the Board of Directors (the “Board”) of ATN International, Inc. (the “Company”), appointed Mr. Prior

as the Company’s Executive Chairman, effective on January 1, 2024. In connection with this appointment, the Board appointed

Brad Martin as Chief Executive Officer and as a director of the Company, effective January 1, 2024.

In addition, on November 13,

2023, the Company received notice from Justin Benincasa, the Company’s current Chief Financial Officer, of his retirement from the

Company, effective March 18, 2024. On November 13, 2023, the Board also appointed Mr. Carlos Doglioli as Chief Financial

Officer of the Company, effective March 18, 2024, coinciding with Mr. Benincasa’s retirement. Mr. Doglioli plans

to join the Company with an effective start date of January 8, 2024 to transition responsibilities from Mr. Benincasa. The Board

had been working closely with both Mr. Prior and Mr. Benincasa on succession planning and on November 15, 2023, the Company

issued a press release regarding the succession plan for its Chief Executive Officer and Chief Financial Officer

Mr. Martin, 48, has been

Chief Operating Officer since joining ATN in 2018. Previously, Mr. Martin served as Chief Operating Officer for Senet Inc., a leading

“low power wide area” network (LPWAN) operator and global service provider. From 2013 through 2015, Mr. Martin served

as Senior Vice President and Chief Quality Officer with Extreme Networks, a global leader in software-driven networking solutions for

Enterprise and Service Provider customers. Between 2008 and 2013, he served as Vice President of Engineering Operations and Quality with

Siemens Enterprise Communications and Enterasys Networks, delivering voice and data networking hardware and software solutions to global

enterprises. Mr. Martin holds a Bachelor of Science, Mechanical Engineering from the University of Maine, is a published author and

featured industry speaker. Mr. Martin brings particular experience to the Board of Directors in his telecommunications industry operating

and strategic experience. There are no arrangements or understandings between Mr. Martin and any other person pursuant to which Mr. Martin

was selected as a director. Mr. Martin was not appointed to any committee of the Board of Directors at the time of his election.

Since the beginning of the Company’s last year, other than with respect to his employment as Chief Operating Officer, there have

not been any transactions, or currently proposed transactions, or series of similar transactions, in which the Company was a party and

in which Mr. Martin had a direct or indirect material interest.

Mr. Doglioli, 53, previously

served as Senior Vice President, Chief Financial Officer & Chief Operating Officer for Centennial Towers, a leading provider

of wireless infrastructure solutions in Latin America. From 1999 to 2014, Mr. Doglioli served in several senior and key finance roles

for portfolio companies of Devonshire Investors and Fidelity Investments, including as the Chief Financial Officer of Backyard Farms from

2012-2014, the Managing Director of Finance of J. Robert Scott from 2008-2012, and Chief Financial Officer of MetroRED Mexico from 2004-2007.

Mr. Doglioli holds a Bachelor of Science in Management Information Systems from Caece University in Buenos Aires, Argentina, and

a Master of Business Administration from Babson College.

Beginning January 1,

2024, Mr. Martin will receive an annual base salary for his services as Chief Executive Officer of $525,000 and is scheduled to receive

an annual grant of equity in March 2024 with an estimated value of $1,500,000 on such terms and conditions to be approved by the

Compensation Committee when issuing the grant. In addition, Mr. Martin will be eligible to receive an annual cash performance

bonus targeted at 100% of his base salary, with the actual amount of such bonus to be determined by the Compensation Committee of the

Board of Directors. Mr. Martin will not receive any compensation for his service as a director of the Company.

Mr. Doglioli will receive

an annual base salary of $400,000 and is scheduled to receive an initial grant of equity in March 2024 with an estimated value of

$850,000 on such terms and conditions to be approved by the Compensation Committee when issuing the grant. In addition, Mr. Doglioli

will be eligible to receive an annual cash performance bonus targeted at 75% of his base salary, with the actual amount of such bonus

to be determined by the Compensation Committee of the Board. Mr. Doglioli is also eligible to participate in the Company’s

medical, dental, 401(k) and other standard benefit plans generally available to Company employees.

Each of Mr. Martin and

Mr. Doglioli entered into executive agreements that provide severance benefits, substantially on the same form set forth as Exhibits

10.12 and 10.11, respectively, to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

With respect to Mr. Martin, the executive agreement has an effective date of January 1, 2024 and with respect to Mr. Doglioli,

the executive agreement has an effective date of January 8, 2025.

There are no family relationships

between Mr. Martin or Mr. Doglioli and any director or executive officer of the Company, and neither of them has a direct or

indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Beginning January 1,

2024, Mr. Prior will receive an annual base salary for his service as Executive Chairman of $525,000 and is scheduled to receive

a grant of equity in March 2024 with an estimated value of $1,500,000 on such terms and conditions to be approved by the Compensation

Committee when issuing the grant. Mr. Prior will continue to be eligible to receive an annual cash performance bonus for the

fiscal year ended December 31, 2023, but beginning in 2024, will no longer be eligible to receive an annual cash performance bonus.

Mr. Prior’s executive agreement that provides severance benefits, substantially on the same form set forth as Exhibits 10.12

to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, will remain in place for the

duration of his employment as Executive Chairman. Mr. Prior will also be eligible to participate in the Company’ s medical,

dental, 401(k), Deferred Compensation Plan and other standard benefit plans generally available to Company employees.

Item 7.01. Regulation FD Disclosure.

On November 15, 2023,

the Company issued a press release regarding the succession plan for its Chief Executive Officer and Chief Financial Officer. A copy of

the press release is furnished herewith as Exhibit 99.1 and hereby incorporated by reference.

Exhibit 99.1 is furnished

and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by

specific reference in such a filing.

Cautionary Language Concerning Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements relating to, among other matters, the Company’s succession plans for its Chief Executive Officer and Chief Financial

Officer roles and the expected timing of the transitions for both roles. These forward-looking statements are based on estimates, projections,

beliefs, and assumptions and are not guarantees of future events or results. Actual future events and results could differ materially

from the events and results indicated in these statements as a result of many factors, including, among others, (1) the general performance

of the Company’s operations, including operating margins, revenues, capital expenditures, and the retention of and future growth

of the Company’s subscriber base and ARPU; (2) loss of, or an inability to recruit skilled personnel in the Company’s

various jurisdictions, including key members of management’ (3) the Company’s ability to realize expansion plans for

its fiber markets; (4) the adequacy and expansion capabilities of the Company’s network capacity and customer service system

to support the Company’s customer growth; (5) the Company’s ability to efficiently and cost-effectively upgrade the Company’s

networks and information technology platforms to address rapid and significant technological changes in the telecommunications industry;

(6) the Company’s continued access to capital and credit markets on terms it deems favorable; (7) government subsidy program

availability and regulation of the Company’s businesses, which may impact the Company’s telecommunications licenses, the Company’s

revenue and the Company’s operating costs; (8) ongoing risk of an economic downturn, political, geopolitical and other risks

and opportunities facing the Company’s operations, including those resulting from the continued inflation and other macroeconomic

headwinds including increased costs and supply chain disruptions; (9) the Company’s ability to find investment or acquisition

or disposition opportunities that fit the strategic goals of the Company; (10) the occurrence of weather events and natural catastrophes

and the Company’s ability to secure the appropriate level of insurance coverage for these assets; (11) increased competition; and

(12) either of Mr. Martin or Mr. Doglioli may decide not to commence employment with the Company in the positions, or at the

expected times, described herein. These and other additional factors that may cause actual future events and results to differ materially

from the events and results indicated in the forward-looking statements above are set forth more fully under Item 1A “Risk Factors”

of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 15,

2023, and the other reports the Company files from time to time with the SEC. The Company undertakes no obligation and has no intention

to update these forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors that may affect

such forward-looking statements, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ATN INTERNATIONAL, INC. |

| |

|

|

| |

By: |

/s/ Justin D. Benincasa |

| |

|

Justin D. Benincasa |

| |

|

Chief Financial Officer |

| |

|

|

| Dated: November 16, 2023 |

|

|

EXHIBIT 10.1

November 9, 2023

Carlos R. Doglioli

42 Upwey Road

Wellesley, MA 02481

Dear Carlos,

We are delighted to offer you a position with

ATN International, Inc. (“ATN” or the “Company”). This letter confirms our offer and includes details

on both the financial arrangements and the Company’s benefit programs.

Our vision at ATN looks to a future where all

people and communities - regardless of geographic or economic circumstance - will have access to the resources and connections of the

global data ecosystem. I believe this mission helps ATN be a very rewarding place to work and contributes to a company culture we

are all very proud of and enjoy. In your discussions with me and other members of management and the board of directors, I

hope you got a good sense of that. As important, I think we have a good business strategy in place that should allow us to deliver

for our shareholders and employees as we move forward. As part of the leadership team going forward, you of course will have a lot to

say on how we might improve on that strategy and execute against it. I am excited to see that unfold.

Your Title, Compensation & Benefits

We have agreed that your start date will be January 8,

2024, and that you will report to the Chief Executive Officer. As discussed, your employment will begin in a non-managerial role as you

get to know the people—especially your prospective direct reports and the company’s broader leadership team. We anticipate

you “shadowing” Justin Benincasa for much of that period, while mixing in meetings or visits with operational leaders, and

getting a basic understanding of the company’s financial close processes. Effective March 18, 2024, you will be the Company’s

Executive Vice President and Chief Financial Officer (“CFO”).

Your annualized base salary will be $400,000,

or $15,384.61 paid bi-weekly. This salary will be subject to adjustment pursuant to the Company’s employee compensation

policies.

You will be eligible to earn an annual cash performance

bonus, targeted at 75% of your base salary (pro-rated for calendar year 2024), pursuant to the Company’s annual bonus

program for senior level executives, including its Compensation Recoupment Policy. The amount of any bonus earned will be based on the

terms of the annual bonus program for 2024, including the corporate and individual performance objectives approved by the Compensation

Committee (“Compensation Committee”) of the Board of Directors of the Company (“Board”). The determination of

whether you have achieved such objectives, and the amount of any bonus payment will be at the sole discretion of the Board. Any bonus

is not earned until the time of payment and you must be an employee of the Company in good standing at the time the bonus is paid to be

eligible to receive it.

You also will be eligible for annual ATN equity

grants as and when considered for other executives, which have typically been determined and granted towards the end of the first quarter

of each calendar year for performance in the preceding calendar year. For 2024, the Compensation Committee has approved the issuance of

an equity grant to you that will be made in 2024 and have a grant date value of no less than $850,000, which typically has determined

based on the average closing price of the Company’s common stock for the twenty trading days prior to and including the Friday before

the Compensation Committee’s meeting to approve such grants. The form and structure of the equity grants will be based on the equity

program to be approved by the Compensation Committee in 2024, but at this time the Compensation Committee has indicated that they expect

this to be 50 percent time-based Restricted Stock Units (RSUs) and 50 percent performance-based Performance Stock Units (PSUs). Historically,

the time-based RSUs will vest 50% upon the second anniversary of the date of grant and 25% in annual installments on each of the third

and fourth anniversaries of the grant date and are typically payable in shares of ATN Common Stock. The PSUs have vested over a

three-year performance period, based on applicable performance objectives determined by the Compensation Committee and are typically payable

in shares of ATN Common Stock. In each case, any grant you may receive will be subject to the terms and conditions of our equity plan,

the forms of equity award approved by the Compensation Committee, and the Company’s Compensation Recoupment policy (a copy of which

is attached to this letter).

Finally, enclosed with this letter is our standard

executive severance agreement for your execution, that provides severance benefits following the one-year anniversary of your start date,

on substantially the same terms and conditions as applicable to other senior executives.

ATN is proud of the benefits we offer to our employees.

In designing the program, we believe we have created a flexible mix of benefits intended to meet your needs and those of your family.

You will be eligible to participate in the Company’s medical, dental, life and disability insurance plans the first of the

month following your date of hire. Additionally, you will be eligible to participate in our 401(k) plan the 1st of the month following

30 days of employment. At such time as you become eligible for these benefits, you will receive enrollment information. You will accrue

Earned Time Off (ETO) at the rate of 7.69 hours per bi-weekly pay period (200 hours annualized). Details of all the benefits

plans, enrollment and employee contributions will be sent separately. The Company reserves the right to modify, suspend or discontinue

any benefit at any time, without advance notice, and in its sole discretion.

Contingencies

This offer of employment is contingent upon your

providing satisfactory documentation to ATN concerning your employment eligibility as required by Congress under applicable immigration

laws. This documentation must be received by the Company within three (3) business days of your start date. Your employment also

is contingent upon ATN’s completion of a satisfactory investigation of your background; if the investigation is unsatisfactory,

it could result in subsequent termination of employment. You agree to release ATN, its employees and agents and any individuals who may

provide the Company with information regarding your background and references from any liability in connection with this investigation.

An electronic copy of the current Employee Handbook

will be provided to you after your start date and will require you to sign and return a form acknowledging you have read and understood

the Company’s policies and have been provided the opportunity to address any questions or concerns you may have. During your employment

with the Company, you will be required to follow all the Company’s internal policies and to always conduct your business activities

in accordance with the highest legal, ethical, and professional standards.

This offer of employment is also contingent upon

your signing the Restrictive Covenants Agreement attached as Exhibit A, which includes provisions designed to protect the Company’s

confidential and proprietary information and trade secrets, including non-solicitation and non-competition restrictions.

At-Will Employment Relationship

If you accept this offer, you will be an employee-at-will,

which means that either you or the Company are free to terminate the employment relationship at any time with or without cause. The Company

is not bound to follow any policy, procedure, or process in connection with employee discipline, employment termination or otherwise.

Should you or the Company terminate your employment for any reason at any time during the calendar year, you will be entitled to receive

only the pro rata portion of your base salary through the date of your termination, along with any other compensation or benefits to which

you are entitled by law or under the terms of the Company’s compensation and benefit plans that are then in effect.

Statement Regarding Obligations to Former Employers

and Other Third Parties

As a further condition of your employment with

the Company, you hereby represent that you are not presently under, and will not become subject to, any obligation to any person or entity

that is inconsistent or in conflict with your employment with the Company or which would prevent, limit, or impair in any way your performance

of your duties to the Company. Specifically, you represent that you have not brought with you any confidential or proprietary information

of any former employer or other third party, and you are not subject to any agreement or obligation with a former employer or other third

party that would prohibit your employment by the Company.

Interpretation, Amendment and Enforcement

This offer letter, together with the policies

and any exhibit referenced herein, contains our entire understanding regarding the terms and conditions of your employment and supersedes

any prior statements regarding your employment made to you at any time by any representative of the Company. Your signature acknowledges

your understanding that your employment with the Company is at-will, as described above, and that neither this letter nor anything referenced

herein, nor any Company practice, other oral or written policies or statements of Company or its agents, shall create an employment contract,

guarantee a definite term of employment, or otherwise modify in any way the agreement and understanding that employment with Company is

at-will. No representative of the Company, except for the General Counsel and/or Head of Human Resources has any authority to enter into

any agreement contrary to the foregoing. By accepting this offer of employment, you agree to all terms outlined in this letter, and you

also certify that you are not under any legal or contractual obligation that would prevent you from performing any of your responsibilities

at ATN.

If the foregoing offer is acceptable to you, please

accept by signing this letter agreement no later than November 14, 2023. If we do not hear from you by then, this offer will

become null and void.

We all are very much

looking forward to working with you and are excited to have you join our team.

Sincerely,

Michael T. Prior

Chief Executive Officer

Date:

November 13, 2023

BY SIGNING THIS OFFER LETTER AGREEMENT, I

ACKNOWLEDGE THAT I HAVE READ IT, I UNDERSTAND IT, AND I AGREE TO COMPLY WITH ITS TERMS. I UNDERSTAND THAT I SHALL BE EMPLOYED AT-WILL

AND THAT THE COMPANY OR I MAY TERMINATE MY EMPLOYMENT AT ANY TIME AND FOR ANY LAWFUL REASON OR NO REASON.

| /s/ Carlos Doglioli |

|

| |

|

| By: |

Carlos Doglioli |

|

| |

|

| Date: |

November 13, 2023 |

|

Restrictive Covenants Agreement

This Restrictive Covenants

Agreement (the “Agreement”), dated as of November 9, 2023 and effective as of of January 8, 2024 (the “Effective

Date”), is made and entered by and between ATN International, Inc., a Delaware corporation (“ATN” or the “Company”),

and Carlos Doglioli (the “Employee”). In consideration and as a condition of Employee’s employment by ATN, and the compensation

now and hereafter paid to Employee, Employee hereby agrees to the terms of this Agreement as follows:

1. Confidentiality.

The Employee hereby covenants and agrees that at all times while employed by the Company and thereafter, he or she will not disclose to

any person not employed by the Company, or use for any purpose other than in furtherance of his or her duties to the Company, any Confidential

Information (as defined below) of the Company.

| (a) | For purposes of this Agreement, the term “Confidential Information” will include all information

of any nature and in any form that is owned by the Company and that is not publicly available (other than by the Employee’s breach

of this Agreement) or generally known to persons engaged in businesses similar or related to those of the Company. Confidential Information

includes, without limitation, information regarding the Company’s financial matters, customers, employees, industry contracts, strategic

business plans, product development (or other proprietary product data), marketing plans, consulting solutions and processes, and all

other secrets and all other information of a confidential and proprietary nature. For purposes of the preceding two sentences, the term

“Company” also includes any subsidiary of the Company. The Employee understands and acknowledges that the above list is not

exhaustive, and that Confidential Information also includes other information that is marked or otherwise identified as confidential,

or that would otherwise appear to a reasonable person to be confidential in the context and circumstances in which the information is

known or used. The Employee understands and agrees that any Confidential Information developed by the Employee in the course of his or

her employment by the Company shall be subject to the terms and conditions of this Agreement as if the Company furnished the same Confidential

Information to the Employee in the first instance. The foregoing obligations imposed by this Section 1 will not apply (i) in

the course of the business of and for the benefit of the Company as required in the performance of any of the Employee’s duties

to the Company (with the prior consent of an authorized officer acting on behalf of the Company in each instance), (ii) if such Confidential

Information has become, through no fault of the Employee, generally known to the public, or (iii) if the Employee is required by

law to make disclosure (after giving the Company notice and an opportunity to contest such requirement). |

| (b) | Nothing in this Agreement is intended to nor shall it limit or prohibit the Employee, or waive any right

on his or her part, to initiate or engage in communication with, respond to any inquiry from, or otherwise provide information to, any

federal or state regulatory, self-regulatory, or enforcement agency or authority regarding possible violations of federal or state law

or regulation including under the whistleblower provisions of federal or state law or regulation. The Employee is advised that federal

law provides that an individual shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure

of a trade secret under either of the following conditions (i) where the disclosure is made (A) in confidence to a federal,

state, or local government official, either directly or indirectly, or to an attorney; and (B) solely for the purpose of reporting

or investigating a suspected violation of law, or (ii) where the disclosure is made in a complaint or other document filed in a lawsuit

or other proceeding, if such filing is made under seal. Federal law also provides that an individual who files a lawsuit for retaliation

by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the

trade secret information in the court proceeding, if the individual files any document containing the trade secret under seal and does

not disclose the trade secret, except pursuant to court order. |

2. Duty

of Loyalty. During the term of the Employee’s employment by the Company, Employee will comply with all policies and rules that

may from time to time be established by the Company, and will not engage directly or indirectly in any business or enterprise or activity

that (a) is in any way competitive or conflicting with the interests or business of the Company; (b) occupies the Employee’s

attention so as to interfere with the proper and efficient performance of the Employee’s duties for the Company; or (c) interferes

with the independent exercise of the Employee’s judgment in the Company’s best interests. The Employee will comply with the

Company’s policies regarding disclosure and approval of work outside of the Company, as those policies are amended and in effect

from time to time. In addition, in consideration of the Employee’s employment by the Company, the Employee recognizes that the Employee

owes a duty of loyalty to the Company and agrees that the Employee will not take personal advantage (whether directly or indirectly through

family members or affiliates) of any business opportunity which is in the same or similar line of business as that engaged in by the Company.

The Employee understands and agrees that the Employee is required to devote the Employee’s full time and use the Employee’s

best efforts in the course of the Employee’s employment with the Company and to act at all times in the best interests of the Company.

3. Covenants

Not to Compete and Not to Solicit.

| (a) | Covenant Not to Compete. To protect the Company’s legitimate business interests as described

herein, including its Confidential Information and goodwill, during the term of the Employee’s employment with the Company and for

the twelve (12) months thereafter, the Employee agrees and covenants not to engage in any activities or services in the United States

that (i) are similar to the activities and services the Employee performed or managed for the Company at any time during the last

two years of employment with the Company, or (ii) may reasonably require the Employee to use or disclose Confidential Information

of the Company. The Employee acknowledges that the geographic scope of this restriction is reasonable and necessary given the national

scope of the Employee’s work for the Company. In the event that the Employee breaches his or her fiduciary duty to the Company or

unlawfully takes property belonging to the Company, the duration of the restrictions in this Section 3(a) shall be extended

to two (2) years from the date of cessation of employment. As mutually-agreed upon consideration for the Employee’s post-employment

covenant in this Section 3(a), the Employee is eligible to receive an ATN equity grant. |

| (b) | Non-solicitation of Employees. The Employee understands and acknowledges that the Company has expended

and continues to expend significant time and expense in recruiting and training its employees and that the loss of employees would cause

significant and irreparable harm to the Company. The Employee agrees and covenants not to directly or indirectly solicit, hire, recruit,

attempt to hire or recruit, or induce the termination of employment of any employee of the Company during the term of the Employee’s

employment with the Company and for the twelve (12) months thereafter. |

| (c) | Non-solicitation of Customers. The Employee understands and acknowledges that the Company has expended

and continues to expend significant time and expense in developing customer relationships, customer information and goodwill, and that

because of the Employee’s experience with and relationship to the Company, the Employee has had access to and learned about much

or all of the Company’s customer information. For purposes of this clause, “customer information” includes, but is not

limited to, names, phone numbers, addresses, e-mail addresses, order history, order preferences, chain of command, pricing information

and other information identifying facts and circumstances specific to the customer. The Employee understands and acknowledges that loss

of this customer relationship and/or goodwill will cause significant and irreparable harm to the Company. |

The Employee agrees and covenants, during

the term of the Employee’s employment with the Company and for the twelve (12) months thereafter, not to directly or indirectly

solicit, transact business with, or contact (including but not limited to by e-mail, regular mail, express mail, telephone, or instant

message) or attempt to contact the Company’s current, former or prospective customers for purposes of offering or accepting goods

or services similar to or competitive with those offered by the Company.

| (d) | Interpretation. The covenants contained in this Section 3 are intended to be construed as

a series of separate covenants. If, in any judicial proceeding, the court shall refuse to enforce any of the separate covenants (or any

part thereof), then such unenforceable covenant (or such part) shall be deemed to be eliminated from this Agreement for the purpose of

those proceedings to the extent necessary to permit the remaining separate covenants (or portions thereof) to be enforced. |

| (e) | Reasonableness. The Employee hereby acknowledges and agrees that the foregoing restrictions in

Section 3 are reasonable, proper and necessitated by the legitimate business interests of the Company and will not prevent the Employee

from earning a living or pursuing the Employee’s career. In the event that the provisions of this Section 3 shall ever be deemed

to exceed the time, scope or geographic limitations permitted by applicable laws, then such provisions shall be reformed to the maximum

time, scope or geographic limitations, as the case may be, permitted by applicable laws. |

4. Remedies.

In the event of a breach or threatened breach by the Employee of any of the provisions of this Agreement, the Employee hereby consents

and agrees that the Company shall be entitled, in addition to other available remedies, to a temporary or permanent injunction or other

equitable relief against such breach or threatened breach from any court of competent jurisdiction, without the necessity of showing any

actual damages or that money damages would not afford an adequate remedy, and without the necessity of posting any bond or other security.

The aforementioned equitable relief shall be in addition to, not in lieu of, legal remedies, monetary damages or other available forms

of relief.

5. Miscellaneous.

| (a) | This Agreement is binding upon and inures to the benefit of the Company and any successor to the Company,

including without limitation any persons acquiring directly or indirectly all or substantially all of the business or assets of the Company

whether by purchase, merger, consolidation, reorganization or otherwise (and such successor will thereafter be deemed the “Company”

for the purposes of this Agreement). |

| (b) | The validity, interpretation, construction and performance of this Agreement will be governed by and construed

in accordance with the substantive laws of the Commonwealth of Massachusetts, without giving effect to the principles of conflict of laws.

The parties hereby expressly consent to the personal jurisdiction of the Business Litigation Session of the Suffolk County Superior Court

of the Commonwealth of Massachusetts for any lawsuit arising from or related to this Agreement. |

| (c) | If any provision of this Agreement or the application of any provision hereof to any person or circumstances

is held by a court of competent jurisdiction to be invalid, unenforceable or otherwise illegal, the remainder of this Agreement and the

application of such provision to any other person or circumstances will not be affected, and the provision so held to be invalid, unenforceable

or otherwise illegal will be reformed to the extent (and only to the extent) necessary to make it enforceable, valid or legal. |

| (d) | No provision of this Agreement may be modified, waived or discharged unless such waiver, modification

or discharge is agreed to in writing signed by the Employee and the Company. No waiver by either party hereto at any time of any breach

by the other party hereto or compliance with any condition or provision of this Agreement to be performed by such other party will be

deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. |

| (e) | This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original

but all of which together will constitute one and the same agreement. |

6. Acknowledgments.

THE EMPLOYEE ACKNOWLEDGES AND AGREES THAT THE EMPLOYEE HAS FULLY READ, UNDERSTANDS AND VOLUNTARILY ENTERS INTO THIS AGREEMENT. THE EMPLOYEE

ACKNOWLEDGES AND AGREES THAT HE/SHE HAS A RIGHT TO CONSULT WITH AN ATTORNEY OF HIS OR HER CHOICE BEFORE SIGNING THIS AGREEMENT AND THAT

HE/SHE HAS HAD AN OPPORTUNITY TO ASK QUESTIONS AND CONSULT WITH AN ATTORNEY OF HIS OR HER CHOICE BEFORE SIGNING THIS AGREEMENT. THE EMPLOYEE

RECEIVED THIS AGREEMENT ON THE EARLIER OF THE DATE THE EMPLOYEE RECEIVED A FORMAL OFFER OF EMPLOYMENT FROM THE COMPANY AND TEN BUSINESS

DAYS BEFORE THE COMMENCEMENT OF EMPLOYMENT.

IN WITNESS WHEREOF, the parties have caused this

Agreement to be duly executed and delivered as of the date first above written.

| |

ATN INTERNATIONAL, INC. |

| |

|

| |

By: |

/s/ Michael T. Prior |

| |

Name: |

Michael T. Prior |

| |

Title: |

Chief Employee Officer |

| EMPLOYEE |

|

| |

|

| Signature: |

/s/ Carlos Doglioli |

|

| Name: Carlos Doglioli

|

|

Exhibit 99.1

ATN Announces Leadership Succession Plan for 2024

November 15, 2023

CEO Michael Prior to Transition to Executive

Chairman;

COO Brad Martin to be Appointed Chief Executive

Officer and Member of the Board;

Justin Benincasa to Retire; Carlos Doglioli to be Named CFO

BEVERLY, Mass., Nov. 15, 2023 (GLOBE NEWSWIRE) -- ATN International, Inc.

(“ATN” or the “Company”) (Nasdaq: ATNI), today announced that Chief Operating Officer Brad Martin will succeed

Michael Prior as President and Chief Executive Officer of ATN effective January 1, 2024, and join the board of directors. At that

time, Mr. Prior will become Executive Chairman of the Company. In addition, Chief Financial Officer Justin Benincasa will retire

from the Company in March 2024 following the completion of our year-end close process and reporting. Carlos Doglioli will join ATN

in January 2024 and will become CFO upon Mr. Benincasa’s retirement.

“This leadership

transition is the result of a detailed succession planning process undertaken by the board of directors and designed to ensure the continuity

of our leadership team and the long-term success of ATN,” Mr. Prior said. “I am grateful to my colleagues and members

of the Board, past and present, for their support, fellowship and guidance during my tenure as CEO, and I will continue to rely on that

support in my new role. We have achieved many successes and weathered many challenges over the years. Through it all we have maintained

our strong corporate culture, our commitment to the people and communities we serve, and our focus on delivering value for our shareholders.

“As we look ahead, we are focused on executing

our Glass & Steel TM and First-to-Fiber strategy, generating higher returns on our extensive investments by growing

our customer base, and enhancing operating and capital efficiency,” said Prior. “With his focus on execution and operational

efficiency, I believe that Brad is the ideal person to lead this next phase of growth for ATN. He has demonstrated his capabilities

and market knowledge over the past five years as our Chief Operating Officer. I am excited to see Brad take this next step in leading

ATN, and I look forward to working closely with him and our global team.”

“Michael

is a visionary leader who has been instrumental in advancing our mission to digitally empower people and communities to connect with the

world and prosper,” said lead independent director, Dr. Bernard Bulkin. “In his 18 years as President and CEO, Michael

has transformed ATN through strategic acquisitions and investments to its present operating footprint spread across markets in North America

and the Caribbean region. He has done this while maintaining a balanced capital allocation approach, which included returning $289 million

to shareholders in the form of dividends and share repurchases. As Executive Chairman, Michael will remain actively involved, continuing

his leadership of the Board and guiding the overall direction of ATN, with a particular focus on strategic opportunities that create value

for our shareholders. Together with Michael, we look forward to working with Brad as he advances ATN’s growth strategy and accelerates

operational improvements.”

Mr. Martin said, “I'm excited to lead

ATN during a period of tremendous opportunity for the Company. I look forward to working closely with our experienced and talented team,

including our incoming CFO, Carlos Doglioli. With the support of Michael and the entire board, we will focus on advancing ATN’s

mission and building upon our strong track record of revenue and subscriber growth, increasing free cash flow and driving long-term shareholder

value.”

Mr. Prior said, “Since joining ATN in 2006, Justin Benincasa

has been an outstanding Chief Financial Officer and an essential partner for me and the entire ATN team. He has built a top-quality finance

and accounting team, strengthened ATN’s processes and controls, provided the tools and insight for our operating teams to execute

at a high level, and supported our strong relationships with the investment community, as well as peers and partners in the telecommunications

industry. I wish him the very best as he embarks on retirement. At the same time, I am excited to welcome Carlos Doglioli to ATN.

He brings significant telecommunications experience, deep knowledge of international markets, and a strong track record of financial and

operational leadership.”

Added Mr. Benincasa, “I am incredibly

honored to have worked nearly two decades at ATN and proud of what both the Company and the finance organization have accomplished. I

look forward to working closely with Carlos and supporting the management team in the transition to this next phase of leadership.”

About Mr. Martin

Martin, (48), has more than 25 years of operational experience and

has been Chief Operating Officer since joining ATN in 2018. Previously he served as Chief Operating Officer for Senet Inc., a leading

“low power wide area” network (LPWAN) operator and global service provider. From 2013 through 2015, Martin served as Senior

Vice President and Chief Quality Officer with Extreme Networks, a global leader in software-driven networking solutions for Enterprise

and Service Provider customers. Between 2008 and 2013, he served as Vice President of Engineering Operations and Quality with Siemens

Enterprise Communications and Enterasys Networks, delivering voice and data networking hardware and software solutions to global enterprises.

Martin holds a Bachelor of Science, Mechanical Engineering from the University of Maine, is a published author and featured industry speaker.

About Mr. Doglioli

Doglioli (53) brings significant telecom experience, having served

as the Chief Financial Officer of Centennial Towers, a developer, owner, and operator of wireless communication towers in Latin America

since 2014, and from 2004 to 2007 at MetroRED Mexico, a leading integrated communications provider that owned and operated state-of-the-art

high-capacity fiber optic communications focused on large and medium size corporate clients, ISPs, Internet-content providers,

and telecommunications carriers in Mexico City. Previously, Doglioli served in multiple senior finance roles for portfolio companies of

Devonshire Investors (the private equity group of Fidelity Investments), including CFO of Backyard Farms and Managing Director of Finance

of J. Robert Scott. Doglioli received a B.S. in Management Information Systems (Lic. en Sistemas) from CAECE University in Buenos Aires,

Argentina, and an MBA from Babson College, and is fluent in English, Spanish and Portuguese.

About ATN

ATN International, Inc. (Nasdaq: ATNI),

headquartered in Beverly, Massachusetts, is a provider of digital infrastructure and communications services in the United States and

internationally, including the Caribbean region, with a focus on rural and remote markets with a growing demand for infrastructure investments.

The Company’s operating subsidiaries today primarily provide: (i) advanced wireless and wireline connectivity to residential,

business and government customers, including a range of high-speed Internet and data services, fixed and mobile wireless solutions, and

video and voice services; and (ii) carrier and enterprise communications services, such as terrestrial and submarine fiber optic

transport, and communications tower facilities. For more information, please visit www.atni.com.

Cautionary Language Concerning Forward-Looking Statements

This press release contains forward-looking

statements relating to, among other matters, the Company’s succession plans for its Chief Executive Officer and Chief

Financial Officer roles and the expected timing of the transitions for both roles, the Company’s business goals and objectives

and expectations regarding the Company’s future performance. These forward-looking statements are based on estimates,

projections, beliefs, and assumptions and are not guarantees of future events or results. Actual future events and results could

differ materially from the events and results indicated in these statements as a result of many factors, including, among others,

(1) the general performance of the Company’s operations, including operating margins, revenues, capital expenditures, and

the retention of and future growth of the Company’s subscriber base and ARPU; (2) loss of, or an inability to recruit

skilled personnel in the Company’s various jurisdictions, including key members of management’ (3) the

Company’s ability to realize expansion plans for its fiber markets; (4) the adequacy and expansion capabilities of the

Company’s network capacity and customer service system to support the Company’s customer growth; (5) the

Company’s ability to efficiently and cost-effectively upgrade the Company’s networks and information technology

platforms to address rapid and significant technological changes in the telecommunications industry; (6) the Company’s

continued access to capital and credit markets on terms it deems favorable; (7) government subsidy program availability and

regulation of the Company’s businesses, which may impact the Company’s telecommunications licenses, the Company’s

revenue and the Company’s operating costs; (8) ongoing risk of an economic downturn, political, geopolitical and other

risks and opportunities facing the Company’s operations, including those resulting from the continued inflation and other

macroeconomic headwinds including increased costs and supply chain disruptions; (9) the Company’s ability to find

investment or acquisition or disposition opportunities that fit the strategic goals of the Company; (10) the occurrence of

weather events and natural catastrophes and the Company’s ability to secure the appropriate level of insurance coverage for

these assets; (11) increased competition; and (12) either of Mr. Martin or Mr. Doglioli may decide not to commence

employment with the Company in the positions, or at the expected times, described above. These and other additional factors that may

cause actual future events and results to differ materially from the events and results indicated in the forward-looking statements

above are set forth more fully under Item 1A “Risk Factors” of the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022, filed with the SEC on March 15, 2023, and the other reports the Company files from time

to time with the SEC. The Company undertakes no obligation and has no intention to update these forward-looking statements to

reflect actual results, changes in assumptions, or changes in other factors that may affect such forward-looking statements, except

as required by law.

| Contact: |

ATN International, Inc. |

| |

Justin Benincasa |

| |

Chief Financial Officer |

| |

978-619-1300 |

| |

|

| |

Ian Rhoades |

| |

Investor Relations |

| |

ATNI@investorrelations.com |

Source: ATN International, Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

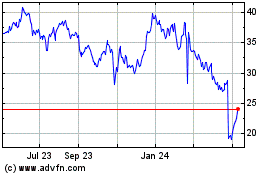

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Dec 2024 to Jan 2025

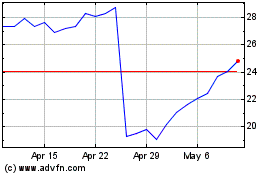

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Jan 2024 to Jan 2025