0001554818

false

0001554818

2023-10-02

2023-10-02

0001554818

us-gaap:CommonStockMember

2023-10-02

2023-10-02

0001554818

AUUD:CommonStockWarrantsMember

2023-10-02

2023-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 2, 2023

AUDDIA

INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-40071 |

|

45-4257218 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 2100 Central Avenue, Suite 200 |

|

|

| Boulder, Colorado |

|

80301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 219-9771

Not Applicable

Former name or former address, if changed since

last report

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of exchange on which registered |

| Common Stock |

AUUD |

Nasdaq Stock Market |

| Common Stock Warrants |

AUUDW |

Nasdaq Stock Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On October 2, 2023, Auddia Inc. (the “Company”) announced that

it has released an updated investor presentation.

A copy of the Company’s press release announcing the release of the

Company’s updated investor presentation is furnished as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

A copy of the updated investor slide presentation is furnished as Exhibit

99.2 to this Form 8-K and incorporated herein by reference

The information contained in this Item 7.01 of this current report on Form

8-K and in the accompanying exhibits 99.1 and 99.2 incorporated by reference herein shall not be incorporated by reference into any filing

of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless

expressly incorporated by specific reference to such filing. This information, including the exhibits 99.1 and 99.2 hereto, shall not

be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities

of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

AUDDIA INC. |

| |

|

|

October 2, 2023 |

By: |

/s/ Michael Lawless |

| |

|

Name: Michael Lawless |

| |

|

Title: Chief Executive Officer |

Exhibit 99.1

Auddia

Inc. Releases New Investor Presentation

October

2, 2023

Provides updated overview of the faidr 3.0 audio superapp.

Includes strategy to exponentially grow the user base at a far greater cost efficiency

through acquisition.

Updated presentation can be heard at the LD Micro Main Event XVI 2023 on Wednesday, October

4 th at 12:00 PM ET or via webcast.

BOULDER, CO, Oct. 02, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire -- Auddia Inc. (NASDAQ:AUUD)

(NASDAQ:AUUDW) ("Auddia" or the "Company"), developer of a proprietary AI platform for audio and innovative technologies for podcasts

that is reinventing how consumers engage with audio, today announced that it has released a new investor presentation, which can be found

on its website at https://investors.auddiainc.com/ and which will be presented by Jeff Thramann, Executive Chairman of

Auddia, at the LD Micro Main Event XVI 2023 on Wednesday, October 4 th at 12:00

PM ET with the webcast available at this link for conference registrants: https://me23.sequireevents.com

The new investor presentation incorporates several important content updates in addition to a general refresh

of the look and feel of the slides to reflect the recent branding updates and new user interface the company introduced with the launch

of faidr 3.0 earlier this year.

The first meaningful content update brings the presentation current with the significant progress the Company

has made in transitioning the product from faidr 1.0 to faidr 3.0 in 2023. As detailed in press releases throughout the year, this included

the addition of exclusive content to faidr 1.0 under the faidrRadio brand and the addition of podcast listening. Rather than consumers

accessing faidr 1.0 only for streaming AM/FM listening with or without commercials, with faidr 3.0, consumers can now access faidr on

both iOS and Android phones to listen to streaming AM/FM radio, exclusive faidrRadio content, and their favorite podcasts. faidr remains

the only streaming platform where consumers can choose to pay a subscription to listen to every AM/FM radio station without commercials.

The second meaningful content update adds an overview of the Company’s strategy to use acquisitions as

a complimentary path to exponentially grow the faidr 3.0 user base on both the free and subscription tiers. Again, as previously disclosed

in press releases, the new investor presentation brings current the timeline of the proposed acquisitions and quantifies the improvement

in customer acquisition costs (CAC) per user on the free tier, with CAC improving to approximately $3/user in the acquisition strategy

versus $14/user in the direct-to-consumer advertising strategy.

About Auddia Inc.

Auddia, through its proprietary AI platform for audio identification and classification and related technologies,

is reinventing how consumers engage with AM/FM radio, podcasts, and other audio content. Auddia’s flagship audio superapp, called

faidr, brings two industry firsts to the audio-streaming landscape: subscription-based, ad-free listening on any AM/FM radio station and

podcasts with interactive digital feeds that support deeper stories and open untapped revenue streams to podcasters. faidr also delivers

exclusive content and playlists, and showcases exciting new artists, hand-picked by curators and DJs. Both differentiated offerings address

large and rapidly growing audiences with strong purchase intent. For more information, visit: www.auddia.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 about the Company's

current expectations about future results, performance, prospects and opportunities. Statements that are not historical facts, such as

"anticipates," "believes" and "expects" or similar expressions, are forward-looking statements. These forward-looking statements are based

on the current plans and expectations of management and are subject to a number of uncertainties and risks that could significantly affect

the Company's current plans and expectations, as well as future results of operations and financial condition. These and other risks and

uncertainties are discussed more fully in our filings with the Securities and Exchange Commission. Readers are encouraged to review the

section titled "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, as well as other disclosures

contained in the Annual Report and subsequent filings made with the Securities and Exchange Commission. Forward-looking statements contained

in this announcement are made as of this date and the Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Investor Relations:

Kirin Smith, President

PCG Advisory, Inc.

ksmith@pcgadvisory.com

www.pcgadvisory.com

Exhibit 99.2

SEPTEMBER 2023 | NASDAQ: AUUD

The information in this material is provided for general information purposes only and does not take into account the investment objectives, financial situation and particular needs of any individual or entity. This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 about our current expectations about future results, performance, prospects and opportunities of Auddia Inc. (“Auddia” or the “Company”). Statements that are not historical facts, such as "anticipates," "believes" and "expects" or similar expressions, are forward - looking statements. These forward - looking statements are based on the current plans and expectations of management and are subject to a number of uncertainties and risks that could significantly affect the Company's current plans and expectations, as well as future results of operations and financial condition. These and other risks and uncertainties are discussed more fully in our filings with the Securities and Exchange Commission. Readers are encouraged to review the section titled "Risk Factors" in the Company's Annual Report on Form 10 - K for the year ended December 31, 2022, as well as other disclosures contained in the Annual Report and subsequent filings made with the Securities and Exchange Commission. Forward - looking statements contained in this announcement are made as of this date and the Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Unless otherwise indicated, information contained in this presentation concerning Auddia’s industry and markets in which it operates, including its general expectations and market opportunity and market size, is based upon information from various sources, including independent industry publications in presenting information. Auddia makes no representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party and takes no responsibility therefore. The data presented herein were obtained from various third - party sources. While we believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. Auddia has also made assumptions based upon such data and other similar sources, and on Auddia’s knowledge of and its experience to date in the markets for its product candidates. This information involves a number of assumptions and limitations and you are cautioned not to give undue weight to such estimates. The industry in which Auddia operates is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by Auddia . This presentation uses Auddia’s trademarks and trade names such as “ faidr ” and “ Vodacast ." This presentation also includes trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this presentation appear without ® and Ρ symbols, but those references, are not intended to indicate that Auddia will not assert to the fullest extent under applicable law, its rights, or that the applicable owner will not assert its rights to these trademarks and trade names. Auddia does not intend to use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of Auddia by any other companies. Auddia | Disclaimer NASDAQ: AUUD

Audio Superapp Our Differentiated Superapp NASDAQ: AUUD

NASDAQ: AUUD Audio Listening Fragmentation Sources: The Spoken Word Audio Report 2022 Share of Ear ® , & IFPI research What are people listening to?

NASDAQ: AUUD faidr | Superapp Strategy Expand To deliver all audio Music Player Audio - books Text To Speech AM/FM Podcasts With differentiation & margin Lead A.I. Enabled Ad - free Station Aggregator Discovr Artists faidrDJ C hatMusic & Other Generative AI Innovation s Phase 1: Parity With Leading Audio Apps Phase 2: (TBD) Audio Articles Music Casts Music Stations New Artists Phase 1: Parity With Leading Audio apps Phase 2 (coming soon) NASDAQ: AUUD faidrRadio (Exclusive Content) A.I. Enabled Ad - free Digital Feeds Social Interactions

NASDAQ: AUUD Radio eMarketer Dominates Time Spent Listening

NASDAQ: AUUD Radio S&P Global The Problem

NASDAQ: AUUD faidr eMarketer Differentiation

NASDAQ: AUUD faidr A.I. Engine Covers Ad Break Content Manual Skipping Of Radio Stream faidr AI Drives Margin

NASDAQ: AUUD faidr Power of Margin

NASDAQ: AUUD AM/FM Podcasts Music Player Audio - books Text To Speech On - demand, DJ hosted music shows, Updated weekly Music streaming Curated by experts Radio - feel Music Casts Always - on multi - hour playlists Wall - to - wall music Genre - based or activity - based Music Stations Dozens of emerging artists Variety of genres Hours of new music discovery to augment radio New Artists faidrRadio (Exclusive Content) Differentiation | faidrRadio faidr

faidr NASDAQ: AUUD Basic Ability to listen to, download, and follow podcasts Phase 1 Commercial - free listening functionality ( Q4 2023) Enhanced experience for fans & new revenue for podcasters. Phase 2 Differentiation | Podcasts AM/FM Podcasts Music Player Audio - books Text To Speech faidrRadio (Exclusive Content)

NASDAQ: AUUD Enhanced Podcastin g Differentiation

NASDAQ: AUUD Differentiation Parity faidr AM/FM Podcasts Exclusive Content Aggregate Radio Dial Ad - Free Radio Station Streaming Apps

NASDAQ: AUUD Differentiation Parity faidr Ad - Free Personalized Podcasts Local Content Premium AM/FM Music Streaming Apps

NASDAQ: AUUD 2016 GTM Jacobs Media, Techsurvey 2021, May 2021 & Edison Share Of Ear report 2021. 80 % Key 2021 2026 76.3 M 162.8 M 50 % 20 % Audience Listening Via Broadcast Audience Listening Via Digital Stream Auddia Internal Projection Radio Listeners Moving to Stream

NASDAQ: AUUD faidr faidr can achieve profitability with only 0.9 % acquisition of total Smartphone Only segment. 38 M SMARTPHONE + CAR + DESKTOP + SMART SPEAKER 30 M SMARTPHONE + CAR 8 M SMARTPHONE ONLY Three clear segments of streamers based on how they access content. Target: 76 M Radio Streamers in US. 2024 FOCUS 2H 2023 FOCUS 1H 2023 FOCUS Product/Market Expansion

NASDAQ: AUUD faid r Live Radio Manual Switching Podcasts PREMIUM $ 5.99/ MO FREE A.I. Assisted Ad - Free faidrRadio Exclusive Content Freemium Model

NASDAQ: AUUD Time faidr Sources: Van Westendorp's Price Sensitivity Meter is a standard market technique for determining consumer price preferences. $ 11 Key Maximize Market Share Maximize Revenue $ 10 $ 9 $ 8 $ 7 $ 6 $ 5 Optimal Monthly Price (Market share) Optimal Monthly Price (Revenue) PRICE Pricing

NASDAQ: AUUD NASDAQ: AUUD faidr Cost Per Install 7 Day Retention 30 Day Retention Subscription Initial Launch 2.15.22 Mid 2023 Inflection Point Metrics *iOS product only $ 13.98 5 % 1 % NA $ 1.80 17 % * 5 % * 11 % * $ 1.80 20 % 10 % 12 % 1.6 - Year Payback Critical Metric Improvements

NASDAQ: AUUD faidr Key Acquired Apps faidr app Q 4 Q 1 Q 2 Q 3 2023 2024 CarPlay & Android Auto Optimize Ad Revenue Ramp Digital Marketing Spend A c quire Radio Streaming Apps Integrate International Stations Add New Superapp Capabilities Migrate All Acquired Users User Acquisition Strategy CAC of $3/MAU on free tier CAC of $14/MAU on free tier

Auddia | Key Takeaways 1. Leading the audio superapp space with differentiation & margin 2. Demonstrating strong improvement in critical user metrics 3. Executing on transition to revenue 4. Accretive M&A strategy to accelerate revenue & user acquisitions

Auddia Jeff Thramann | Founder & Chairman Jeff@thramann.com 303.995.3036 Michael Lawless | CEO mlawless@auddia.com 303.219.9771 Investor Relations Kirin Smith | PCG ksmith@pcgadvisory.com 646.823.8656 More Information auddia.com auddia.com/products/faidr Thank You

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AUUD_CommonStockWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

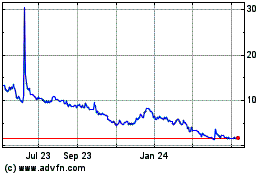

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Dec 2024 to Jan 2025

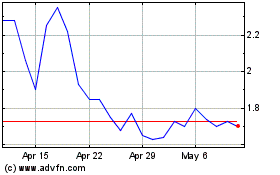

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Jan 2024 to Jan 2025