Filed by Aerovate Therapeutics, Inc.

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Aerovate Therapeutics, Inc.

Commission File No.: 001-40544

Date: October 31, 2024

This filing relates to the proposed transaction

pursuant to the terms of that certain Agreement and Plan of Merger, dated as of October 30, 2024, by and among Aerovate Therapeutics,

Inc., an Delaware corporation (“Aerovate”), Jade Biosciences, Inc., a Delaware corporation (“Jade”), Caribbean

Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of Aerovate (“Merger Sub I”), and Caribbean Merger

Sub II, LLC, a Delaware limited liability company and a wholly owned subsidiary of Aerovate (“Merger Sub II” and together

with Merger Sub I, “Merger Subs”) (the “Merger Agreement”), pursuant to which, and subject to the satisfaction

or waiver of the conditions set forth in the Merger Agreement, among other things, Merger Sub I will merge with and into Jade, with Jade

surviving the merger as the surviving corporation (the “First Merger”), and as part of the same overall transaction, Jade

will merge with and into Merger Sub II, with Merger Sub II continuing as a wholly owned subsidiary of Aerovate and the surviving corporation

of the merger (the “Second Merger” and together with the First Merger, the “Merger”).

On October 31, 2024, Jade published the following communication:

Forward-Looking

Statements

Certain

statements in this communication, other than purely historical information, may constitute “forward-looking statements” within

the meaning of the federal securities laws, including for purposes of the “safe harbor” provisions under the Private Securities

Litigation Reform Act of 1995, concerning Aerovate, Jade, the proposed concurrent investment and the proposed Merger (collectively, the

“Proposed Transactions”) and other matters. These forward-looking statements include, but are not limited to, express or implied

statements relating to Aerovate’s and Jade’s management teams’ expectations, hopes, beliefs, intentions or strategies

regarding the future including, without limitation, statements regarding: the Proposed Transactions and the expected effects, perceived

benefits or opportunities of the Proposed Transactions, including investment amounts from investors and expected proceeds, and related

timing with respect thereto; expectations related to Aerovate’s contribution and payment of the cash dividends in connection with

the proposed Merger, including the anticipated timing of the Closing of the proposed transactions (the “Closing”); the expectations

regarding the ownership structure of the combined company; and the expected trading of the combined company’s stock on Nasdaq under

the ticker symbol “JBIO” after the Closing. In addition, any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “opportunity,”

“potential,” “milestones,” “pipeline,” “can,” “goal,” “strategy,”

“target,” “anticipate,” “achieve,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “plan,” “possible,”

“project,” “should,” “will,” “would” and similar expressions (including the negatives

of these terms or variations of them) may identify forward-looking statements, but the absence of these words does not mean that a statement

is not forward-looking. These forward-looking statements are based on current expectations and beliefs concerning future developments

and their potential effects. There can be no assurance that future developments affecting Aerovate, Jade or the Proposed Transactions

will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are

beyond Aerovate’s control) or other assumptions that may cause actual results or performance to be materially different from those

expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that

the conditions to the Closing or consummation of the Proposed Transactions are not satisfied, including Aerovate’s failure to obtain

stockholder approval for the proposed Merger; the risk that the proposed concurrent investment is not completed in a timely manner or

at all; uncertainties as to the timing of the consummation of the Proposed Transactions and the ability of each of Aerovate and Jade to

consummate the transactions contemplated by the Proposed Transactions; risks related to Aerovate’s continued listing on Nasdaq until

closing of the Proposed Transactions and the combined company’s ability to remain listed following the Proposed Transactions; risks

related to Aerovate’s and Jade’s ability to correctly estimate their respective operating expenses and expenses associated

with the Proposed Transactions, as applicable, as well as uncertainties regarding the impact any delay in the closing of any of the Proposed

Transactions would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated

spending and costs that could reduce the combined company’s cash resources; the failure or delay in obtaining required approvals

from any governmental or quasi-governmental entity necessary to consummate the Proposed Transactions; the occurrence of any event, change

or other circumstance or condition that could give rise to the termination of the business combination between Aerovate and Jade; the

effect of the announcement or pendency of the Merger on Aerovate’s or Jade’s business relationships, operating results and

business generally; costs related to the Merger; the risk that as a result of adjustments to the exchange ratio, Jade stockholders and

Aerovate stockholders could own more or less of the combined company than is currently anticipated; the outcome of any legal proceedings

that may be instituted against Aerovate, Jade or any of their respective directors or officers related to the Merger Agreement or the

transactions contemplated thereby; the ability of Aerovate and Jade to protect their respective intellectual property rights; competitive

responses to the Proposed Transactions; unexpected costs, charges or expenses resulting from the Proposed Transactions; potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the Proposed Transactions; failure to

realize certain anticipated benefits of the Proposed Transactions, including with respect to future financial and operating results; the

risk that Aerovate stockholders receive more or less of the cash dividend than is currently anticipated; legislative, regulatory, political

and economic developments; and those uncertainties and factors more fully described in periodic filings with the SEC, including under

the heading “Risk Factors” and “Business” in Aerovate’s most recent Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the SEC on March 25, 2024, subsequent Quarterly Reports on Form 10-Q filed with the SEC, as well as

discussions of potential risks, uncertainties, and other important factors included in other filings by Aerovate from time to time, any

risk factors related to Aerovate or Jade made available to you in connection with the Proposed Transactions, as well as risk factors associated

with companies, such as Jade, that operate in the biopharma industry. Should one or more of these risks or uncertainties materialize,

or should any of Aerovate’s or Jade’s assumptions prove incorrect, actual results may vary in material respects from those

projected in these forward-looking statements. Nothing in this communication should be regarded as a representation by any person that

the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements

will be achieved. You should not place undue reliance on forward-looking statements in this communication, which speak only as of the

date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither Aerovate nor Jade undertakes

or accepts any duty to release publicly any updates or revisions to any forward-looking statements. This communication does not purport

to summarize all of the conditions, risks and other attributes of an investment in Aerovate or Jade.

No Offer or Solicitation

This

communication and the information contained herein is not intended to and does not constitute (i) a solicitation of a proxy, consent or

approval with respect to any securities or in respect of the Proposed Transactions or (ii) an offer to sell or the solicitation of an

offer to subscribe for or buy or an invitation to purchase or subscribe for any securities pursuant to the Proposed Transactions or otherwise,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not

be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction,

or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet)

of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

NEITHER

THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS COMMUNICATION IS TRUTHFUL

OR COMPLETE.

Important Additional Information

about the Proposed Transaction Will be Filed with the SEC

This

communication is not a substitute for the registration statement or for any other document that Aerovate may file with the SEC in connection

with the Proposed Transactions. In connection with the Proposed Transactions, Aerovate intends to file relevant materials with the SEC,

including a registration statement on Form S-4 that will contain a proxy statement/prospectus of Aerovate. AEROVATE URGES INVESTORS AND

STOCKHOLDERS TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AEROVATE, JADE, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders

will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Aerovate with the SEC (when they become

available) through the website maintained by the SEC at www.sec.gov. Stockholders are urged to read the proxy statement/prospectus and

the other relevant materials when they become available before making any voting or investment decision with respect to the Proposed Transactions.

In addition, investors and stockholders should note that Aerovate communicates with investors and the public using its website (https://ir.aerovatetx.com/).

Participants in the Solicitation

Aerovate,

Jade and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders

in connection with the Proposed Transactions. Information about Aerovate’s directors and executive officers, including a description

of their interests in Aerovate, is included in Aerovate’s most recent Annual Report on Form 10-K for the year ended December 31,

2023, filed with the SEC on March 25, 2024, subsequent Quarterly Reports on Form 10-Q filed with the SEC, including any information incorporated

therein by reference, as filed with the SEC, and other documents that may be filed from time to time with the SEC. Additional information

regarding these persons and their interests in the transaction will be included in the proxy statement/prospectus relating to the Proposed

Transactions when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

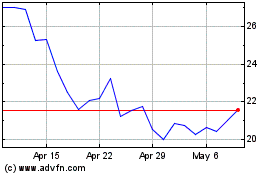

Aerovate Therapeutics (NASDAQ:AVTE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aerovate Therapeutics (NASDAQ:AVTE)

Historical Stock Chart

From Dec 2023 to Dec 2024