Bank of the James Financial Group, Inc. (the “Company”)

(NASDAQ:BOTJ), the parent company of Bank of the James (the

“Bank”), a full-service commercial and retail bank, and Pettyjohn,

Wood & White, Inc. (“PWW”), an SEC-registered investment

advisor, today announced unaudited results of operations for the

three month and nine month periods ended September 30, 2024. The

Bank serves Region 2000 (the greater Lynchburg MSA) and the

Blacksburg, Buchanan, Charlottesville, Harrisonburg, Lexington,

Nellysford, Roanoke, and Wytheville, Virginia markets.

Net income for the three months ended September 30, 2024 was

$1.99 million or $0.44 per basic and diluted share compared with

$2.08 million or $0.46 per basic and diluted share for the three

months ended September 30, 2023. Net income for the nine months

ended September 30, 2024 was $6.33 million or $1.39 per share

compared with $6.60 million or $1.44 per share for the nine months

ended September 30, 2023.

Robert R. Chapman III, CEO of the Bank, commented: “The Company

delivered stable, strong earnings that contributed to building

value, growing stockholders’ equity, and a significant increase in

book value per share. Our performance once again generated positive

returns for shareholders, which have for many years included paying

a quarterly cash dividend.

“Our performance reflected strong interest expense management,

sound investment practices, and a balanced and diversified stream

of interest and noninterest income. Disciplined credit management

has supported superior asset quality, maximizing the value of the

revenue generated. Our team of skilled, dedicated professionals

continue to do an outstanding job meeting customers’ financial

needs, which has led to consistently positive and steady financial

results.

“Even through a period of unusually high interest rates that has

moderated lending activity and provided challenges, we have worked

with customers to find solutions. A healthy loan portfolio has been

a key growth driver as total assets surpassed the $1 billion mark

in the third quarter. Assets have increased more than $30 million

during 2024, primarily reflecting loan portfolio growth, net of

fees, of more than $25 million since the beginning of the year.

“Initiatives to earn new deposits and a focus on retaining

customers’ deposits have led to growth of total deposits since the

beginning of the year. At September 30, 2024, interest bearing

demand accounts have grown by $2.7 million, time deposits have

increased, and noninterest-bearing demand deposits have held

steady. We continue to focus on building this important source of

funding for loans and providing liquidity.

“Strategic locations in Buchanan, Virginia, opened at the end of

the second quarter, and Nellysford, Virginia, opened at the

beginning of the third quarter, are off to strong starts and

further expand the Bank’s footprint and deposit-gathering

capabilities.

“The third quarter reflected healthy year-over-year growth of

noninterest income. Expanding fee income from wealth management,

treasury services for our business customers, and gains on sales of

originated mortgage loans to the secondary market have fueled

noninterest income.

“During the third quarter of 2024, we saw encouraging signs that

stabilizing interest rates, slowing inflation, and continued

economic health in our served markets is supporting positive

trends. We are continuing to see increased commercial lending

demand, positive trends in residential mortgage volume and

origination fees, and continued deposit growth.

“Looking ahead, we feel that the interest rate environment and

continuing economic stabilization and predictability will be clear

positives. We anticipate a gradual lessening of the intense

pressure on margins and slowing of interest expense increases that

have characterized the past two years.

“Our longstanding commitment to building strong, lasting banking

relationships with customers has provided many opportunities to

demonstrate the Bank of the James’ value. As a result, use of our

commercial cash management services and digital banking

capabilities continues to grow, retail customers take advantage of

a wide range of digital and in-person banking options, and

residential mortgage customers and retail banking customers benefit

from our efficient service, digital capabilities and integrated

financial offerings.

“We feel the Company is well-positioned to continue on our path

of providing superior value to our shareholders, customers, and the

communities we serve.”

Third Quarter and First Nine Months of 2024

Highlights

- Total interest income of $11.56 million in the third quarter of

2024 increased 14% from a year earlier, and increased from $10.94

million in the second quarter of 2024. In the first nine months of

2024, total interest income of $33.01 million rose 15% compared

with a year earlier. The growth in the quarter and first nine

months primarily reflected commercial loan interest rates,

commercial real estate (CRE) growth, and the addition of

higher-rate residential mortgages.

- Net interest income after provision for (recovery of) credit

losses in the third quarter of 2024 was down marginally compared

with the third quarter of 2023. For the first nine months of 2024,

net interest income after provision for (recovery of) credit losses

was relatively stable compared with the first nine months of 2023.

The first nine months of 2024 reflected loan loss recoveries driven

by strong asset quality. The third quarter of 2024 reflects a small

credit loss provision based primarily on loan growth. Results in

both 2024 periods reflected the impact of elevated interest

expense.

- Net interest margin in the third quarter of 2024 was 3.16%,

marginally lower than a year earlier but up from second quarter of

2024 net interest margin of 3.02%. Interest spread was 2.81% in the

third quarter of 2024. In the first nine months of 2024, net

interest margin was 3.07% and interest spread was 2.73%.

- Total noninterest income for the third quarter of 2024 rose 19%

compared with the third quarter of 2023, and in the first nine

months of 2024 increased 17% compared with the first nine months of

2023. Growth primarily reflected gains on sale of loans held for

sale, strong wealth management fee income contributions from PWW,

and fee income generated by commercial treasury services and

residential mortgage originations.

- Loans, net of the allowance for credit losses, increased to

$627.11 million at September 30, 2024 compared with $601.92 million

at December 31, 2023, primarily reflecting overall loan stability

and growth in CRE and residential mortgage loans.

- Measures of asset quality included a ratio of nonperforming

loans to total loans of 0.20% at September 30, 2024, minimal levels

of nonperforming loans, and zero other real estate owned

(OREO).

- Total assets increased to $1.01 billion at September 30, 2024

from $969.37 million at December 31, 2023.

- Total deposits increased to $907.61 million at September 30,

2024 compared with $878.46 million at December 31, 2023.

- Shareholder value measures at September 30, 2024 reflected

consistent growth from December 31, 2023 in total stockholders’

equity and retained earnings. Book value per share of $15.15 has

increased significantly from $13.58 at June 30, 2024 and $13.21 at

December 31, 2023.

- On October 15, 2024, the Company’s board of directors approved

a quarterly dividend of $0.10 per common share to stockholders of

record as of November 22, 2024, to be paid on December 6,

2024.

Third Quarter, First Nine Months of 2024 Operational

Review

Net interest income after provision for credit losses for the

third quarter of 2024 was $7.42 million compared to net interest

income after recovery of credit losses of $7.53 million a year

earlier. In the first nine months of 2024, net interest income

after recovery of credit losses was $22.13 million compared with

$22.63 million a year earlier. The Company recorded a small

provision for credit losses in the third quarter of 2024, primarily

due to higher loan levels. The credit loss recovery in the first

nine months of 2024 was $584,000 compared with $278,000 in the

first nine months of 2023.

Total interest income increased to $11.56 million in the third

quarter of 2024 compared with $10.14 million a year earlier. The

first nine months of 2024 total interest income was $33.01 million,

up from $28.82 million in the first nine months of 2023. The

year-over-year increases primarily reflected upward adjustments to

variable rate commercial loans and new loans reflecting the

prevailing rate environment.

Investment portfolio management has enabled the Company to

capitalize on attractive Fed funds rates. In the third quarter of

2024, the yield on all interest-earning assets was 4.86% compared

with 4.43% a year earlier. The yield on interest-bearing loans,

including fees, was 5.65% in the third quarter of 2024 compared

with 5.13% a year earlier. The interest rates on certain existing

commercial loans continue to reprice upward in accordance with

their terms.

Total interest expense in the third quarter and first nine

months of 2024 increased significantly compared with the prior

periods of 2023, primarily reflecting higher deposit rates

commensurate with the prevailing interest rate environment, and

growth of interest-bearing time deposits. Rates on interest-bearing

deposits and total interest-bearing liabilities have placed

continuing pressure on margins. The net interest margin in the

third quarter of 2024 was 3.16% and the interest spread was 2.81%

compared with 3.21% and 2.94%, respectively, in the third quarter

of 2023.

J. Todd Scruggs, Executive Vice President and CFO of the Bank

commented: “Even before the Federal Reserve announced a 50 basis

point reduction in rates, we anticipated that a stabilizing rate

environment would gradually lessen the pressure on margins we have

experienced. While not directly reflecting the Fed rate cut

announced in mid-September, our third quarter net interest margin

of 3.16% improved from the 3.02% margin in the second quarter of

2024. We anticipate continuing gradual margin and spread

improvement in future quarters.”

Noninterest income in the third quarter of 2024 rose 19% to

$3.82 million compared with $3.20 million in the third quarter of

2023. In the first nine months of 2024, noninterest income was up

17% to $11.32 million from $9.70 million a year earlier.

Noninterest income reflected income contributions from debit

card activity, a gain on an investment in an SBIC fund, commercial

treasury services, and the mortgage division. In the third quarter

of 2024, income from wealth management fees increased 19% compared

with a year earlier and gains on sale of loans held for sale rose

34% from a year earlier.

Noninterest expense in the third quarter of 2024 was $8.78

million, up 8% compared with $8.14 million in the first nine months

of 2023. Noninterest expense in the first nine months of 2024 was

$25.60 million, up 6% from $24.09 million a year earlier.

Noninterest expense in the first nine months of 2024 reflected

additional personnel costs related to staffing new locations, and

the decision to begin accruing for anticipated year-end

performance-based compensation ahead of the fourth quarter.

Balance Sheet: Strong Cash Position, Asset Quality,

Stability

Total assets grew to $1.01 billion at September 30, 2024

compared with $969.37 million at December 31, 2023, with the

increase primarily reflecting loan growth.

Loans, net of allowance for credit losses, were $627.11 million

at September 30, 2024 compared with $601.92 million at December 31,

2023, primarily reflecting growth of commercial real estate loans

and strong, stable residential mortgage, consumer, and construction

lending.

Commercial real estate loans (owner-occupied and non-owner

occupied and excluding construction loans) were $333.77 million

compared with $306.86 million at December 31, 2023, reflecting a

decreasing rate of loan payoffs and new loans. Of this amount,

commercial non-owner occupied was approximately $189.98 million and

commercial owner occupied was $143.79 million. The Bank closely

monitors concentrations in these segments. We have no commercial

real estate loans secured by large office buildings in large

metropolitan city centers.

Commercial construction/land loans and residential

construction/land loans were $50.00 million at September 30, 2024

compared with $53.64 million at December 31, 2023. The Company

continued experiencing positive activity and health in commercial

and residential construction projects.

Commercial and industrial loans were $60.34 million at September

30, 2024, reflecting a continuing trend of stability in this loan

segment. Commercial and industrial loans were $64.92 million at

June 30, 2024 and $65.32 million at December 31, 2023.

Residential mortgage loans were $114.99 million at September 30,

2024 compared with $112.73 million at June 30, 2024 and $106.99

million at December 31, 2023. Growth of retained mortgages has been

minimal, as the Bank has continued to focus on selling the majority

of originated mortgage loans to the secondary market. Consumer

loans (open-end and closed-end) were $75.09 million at September

30, 2024, essentially unchanged from totals at December 31,

2023.

Ongoing high asset quality continues to have a positive impact

on the Company’s financial performance. The ratio of nonperforming

loans to total loans at September 30, 2024 was 0.20% compared with

0.06% at December 31, 2023. The allowance for credit losses on

loans to total loans was 1.12% at September 30, 2024 compared with

1.22% on December 31, 2023. Total nonperforming loans were $1.30

million at September 30, 2024. As a result of having no OREO, total

nonperforming assets were the same as total nonperforming

loans.

Total deposits were $907.61 million at September 30, 2024,

compared with $878.46 million at December 31, 2023. Noninterest

bearing demand deposits were $132.22 million compared with $134.28

million at December 31, 2023. Initiatives to attract deposit

business and new locations contributed to the approximately $2.8

million growth in NOW, money market, and savings totals since

December 31, 2023. Time deposits were $234.42 million at September

30, 2024 compared with $205.96 million at December 31, 2023. At

both September 30, 2024 and December 31, 2023, the Bank had no

brokered deposits.

Key measures of shareholder value continued trending positively.

Book value per share rose to $15.15 compared with $13.21 at

December 31, 2023, reflecting strong financial performance and a

smaller unrealized loss in the Company’s available-for-sale

investment portfolio. Total stockholders’ equity rose to $68.83

million from $60.04 million at December 31, 2023. Retained earnings

at September 30, 2024 were $41.64 million compared with $36.68

million at December 31, 2023.

Some balance sheet measures are impacted by interest rate

fluctuations and fair market valuation measurements in the

Company’s available-for-sale securities portfolio and are reflected

in accumulated other comprehensive loss. These mark-to-market

losses are excluded when calculating the Bank’s regulatory capital

ratios. The available-for-sale securities portfolio is composed

primarily of securities with explicit or implicit government

guarantees, including U.S. Treasuries and U.S. agency obligations,

and other highly-rated debt instruments. The Company does not

expect to realize the unrealized losses as it has the intent and

ability to hold the securities until their recovery, which may be

at maturity. Management continues to diligently monitor the

creditworthiness of the issuers of the debt instruments within its

securities portfolio.

About the Company

Bank of the James, a wholly-owned subsidiary of Bank of the

James Financial Group, Inc. opened for business in July 1999 and is

headquartered in Lynchburg, Virginia. The Bank currently services

customers in Virginia from offices located in Altavista, Amherst,

Appomattox, Bedford, Blacksburg, Buchanan, Charlottesville, Forest,

Harrisonburg, Lexington, Lynchburg, Madison Heights, Nellysford,

Roanoke, Rustburg, and Wytheville. The Bank offers full investment

and insurance services through its BOTJ Investment Services

division and BOTJ Insurance, Inc. subsidiary. The Bank provides

mortgage loan origination through Bank of the James Mortgage, a

division of Bank of the James. The Company provides investment

advisory services through its wholly-owned subsidiary, Pettyjohn,

Wood & White, Inc., an SEC-registered investment advisor. Bank

of the James Financial Group, Inc. common stock is listed under the

symbol “BOTJ” on the NASDAQ Stock Market, LLC. Additional

information on the Company is available at

www.bankofthejames.bank.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains statements that constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “believe,”

“estimate,” “expect,” “intend,” “anticipate,” “plan” and similar

expressions and variations thereof identify certain of such

forward-looking statements which speak only as of the dates on

which they were made. Bank of the James Financial Group, Inc. (the

“Company”) undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise. Readers are cautioned

that any such forward-looking statements are not guarantees of

future performance and involve risks and uncertainties, and that

actual results may differ materially from those indicated in the

forward-looking statements as a result of various factors. Such

factors include, but are not limited to, competition, general

economic conditions, potential changes in interest rates, changes

in the value of real estate securing loans made by the Bank as well

as geopolitical conditions. Additional information concerning

factors that could cause actual results to materially differ from

those in the forward-looking statements is contained in the

Company’s filings with the Securities and Exchange Commission.

CONTACT: J. Todd Scruggs, Executive Vice President and Chief

Financial Officer (434) 846-2000.

FINANCIAL RESULTS FOLLOW

Bank of the James Financial Group, Inc. and

SubsidiariesConsolidated Balance

Sheets(dollar amounts in thousands, except per

share amounts)

| |

|

|

|

| |

(unaudited) |

|

|

|

Assets |

9/30/2024 |

|

12/31/2023 |

|

Cash and due from banks |

$ |

22,692 |

|

|

$ |

25,613 |

|

| Federal funds

sold |

|

86,515 |

|

|

|

49,225 |

|

|

Total cash and cash equivalents |

|

109,207 |

|

|

|

74,838 |

|

| |

|

|

|

| Securities

held-to-maturity, at amortized cost (fair value of $3,328 as of

September 30, 2024 and $3,231 as of December 31, 2023) net of

allowance for credit loss of $0 as of September 30, 2024 and

December 31, 2023 |

|

3,610 |

|

|

|

3,622 |

|

| Securities

available-for-sale, at fair value |

|

192,469 |

|

|

|

216,510 |

|

| Restricted stock,

at cost |

|

1,821 |

|

|

|

1,541 |

|

| Loans held for

sale |

|

3,239 |

|

|

|

1,258 |

|

| Loans, net of

allowance for credit losses of $7,078 as of September 30, 2024 and

$7,412 as of December 31, 2023 |

|

627,112 |

|

|

|

601,921 |

|

| Premises and

equipment, net |

|

19,378 |

|

|

|

18,141 |

|

| Interest

receivable |

|

2,697 |

|

|

|

2,835 |

|

| Cash value - bank

owned life insurance |

|

22,716 |

|

|

|

21,586 |

|

| Customer

relationship intangible |

|

6,865 |

|

|

|

7,285 |

|

| Goodwill |

|

2,054 |

|

|

|

2,054 |

|

| Income taxes

receivable |

|

- |

|

|

|

128 |

|

| Deferred tax

asset |

|

7,576 |

|

|

|

8,206 |

|

| Other assets |

|

9,319 |

|

|

|

9,446 |

|

|

Total assets |

$ |

1,008,063 |

|

|

$ |

969,371 |

|

| |

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Deposits |

|

|

|

|

Noninterest bearing demand |

$ |

132,223 |

|

|

$ |

134,275 |

|

|

NOW, money market and savings |

|

540,966 |

|

|

|

538,229 |

|

|

Time |

|

234,421 |

|

|

|

205,955 |

|

| Total

deposits |

|

907,610 |

|

|

|

878,459 |

|

| |

|

|

|

| Capital notes,

net |

|

10,046 |

|

|

|

10,042 |

|

| Other

borrowings |

|

9,444 |

|

|

|

9,890 |

|

| Income taxes

payable |

|

212 |

|

|

|

- |

|

| Interest

payable |

|

758 |

|

|

|

480 |

|

| Other

liabilities |

|

11,159 |

|

|

|

10,461 |

|

|

Total liabilities |

$ |

939,229 |

|

|

$ |

909,332 |

|

| |

|

|

|

| Stockholders'

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock $2.14 par value; authorized 10,000,000 shares; issued

and outstanding 4,543,338 as of September 30, 2024 and December 31,

2023 |

|

9,723 |

|

|

|

9,723 |

|

|

Additional paid-in-capital |

|

35,253 |

|

|

|

35,253 |

|

|

Accumulated other comprehensive (loss) |

|

(17,782 |

) |

|

|

(21,615 |

) |

|

Retained earnings |

|

41,640 |

|

|

|

36,678 |

|

| Total

stockholders' equity |

$ |

68,834 |

|

|

$ |

60,039 |

|

| |

|

|

|

| Total

liabilities and stockholders' equity |

$ |

1,008,063 |

|

|

$ |

969,371 |

|

| |

Bank of the James Financial Group, Inc. and

SubsidiariesConsolidated Statements of

Operation(dollar amounts in thousands, except per

share amounts)

| |

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

Interest Income |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Loans |

$ |

9,004 |

|

$ |

7,990 |

|

|

$ |

25,375 |

|

|

$ |

23,251 |

|

|

Securities |

|

|

|

|

|

|

|

|

US Government and agency obligations |

|

369 |

|

|

321 |

|

|

|

1,068 |

|

|

|

962 |

|

|

Mortgage backed securities |

|

442 |

|

|

435 |

|

|

|

1,974 |

|

|

|

1,255 |

|

|

Municipals - taxable |

|

298 |

|

|

286 |

|

|

|

872 |

|

|

|

853 |

|

|

Municipals - tax exempt |

|

18 |

|

|

18 |

|

|

|

55 |

|

|

|

55 |

|

|

Dividends |

|

12 |

|

|

8 |

|

|

|

59 |

|

|

|

49 |

|

|

Corporates |

|

136 |

|

|

139 |

|

|

|

407 |

|

|

|

423 |

|

|

Interest bearing deposits |

|

303 |

|

|

134 |

|

|

|

628 |

|

|

|

375 |

|

|

Federal Funds sold |

|

981 |

|

|

812 |

|

|

|

2,569 |

|

|

|

1,601 |

|

|

Total interest income |

|

11,563 |

|

|

10,143 |

|

|

|

33,007 |

|

|

|

28,824 |

|

| |

|

|

|

|

|

|

|

| Interest

Expense |

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

NOW, money market savings |

|

1,487 |

|

|

894 |

|

|

|

4,145 |

|

|

|

1,916 |

|

|

Time deposits |

|

2,375 |

|

|

1,683 |

|

|

|

6,731 |

|

|

|

3,918 |

|

|

FHLB borrowings |

|

- |

|

|

- |

|

|

|

- |

|

|

|

31 |

|

|

Finance leases |

|

18 |

|

|

22 |

|

|

|

58 |

|

|

|

66 |

|

|

Other borrowings |

|

92 |

|

|

98 |

|

|

|

278 |

|

|

|

297 |

|

|

Capital notes |

|

82 |

|

|

82 |

|

|

|

245 |

|

|

|

245 |

|

|

Total interest expense |

|

4,054 |

|

|

2,779 |

|

|

|

11,457 |

|

|

|

6,473 |

|

| |

|

|

|

|

|

|

|

|

Net interest income |

|

7,509 |

|

|

7,364 |

|

|

|

21,550 |

|

|

|

22,351 |

|

| |

|

|

|

|

|

|

|

|

Provision for (recovery of) credit losses |

|

92 |

|

|

(164 |

) |

|

|

(584 |

) |

|

|

(278 |

) |

| |

|

|

|

|

|

|

|

|

Net interest income after recovery of provision for credit

losses |

|

7,417 |

|

|

7,528 |

|

|

|

22,134 |

|

|

|

22,629 |

|

| |

|

|

|

|

|

|

|

| Noninterest

income |

|

|

|

|

|

|

|

|

Gain on sales of loans held for sale |

|

1,326 |

|

|

989 |

|

|

|

3,526 |

|

|

|

3,065 |

|

|

Service charges, fees and commissions |

|

991 |

|

|

1,004 |

|

|

|

2,930 |

|

|

|

2,942 |

|

|

Wealth management fees |

|

1,244 |

|

|

1,050 |

|

|

|

3,583 |

|

|

|

3,098 |

|

|

Life insurance income |

|

189 |

|

|

139 |

|

|

|

531 |

|

|

|

405 |

|

|

Gain on sales and calls of securities, net |

|

31 |

|

|

- |

|

|

|

669 |

|

|

|

- |

|

|

Other |

|

42 |

|

|

19 |

|

|

|

82 |

|

|

|

179 |

|

| |

|

|

|

|

|

|

|

|

Total noninterest income |

|

3,823 |

|

|

3,201 |

|

|

|

11,321 |

|

|

|

9,689 |

|

| |

|

|

|

|

|

|

|

| Noninterest

expenses |

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

4,920 |

|

|

4,683 |

|

|

|

14,256 |

|

|

|

13,296 |

|

|

Occupancy |

|

514 |

|

|

458 |

|

|

|

1,493 |

|

|

|

1,389 |

|

|

Equipment |

|

640 |

|

|

501 |

|

|

|

1,879 |

|

|

|

1,813 |

|

|

Supplies |

|

131 |

|

|

118 |

|

|

|

397 |

|

|

|

399 |

|

|

Professional |

|

718 |

|

|

682 |

|

|

|

2,214 |

|

|

|

2,075 |

|

|

Data processing |

|

764 |

|

|

689 |

|

|

|

2,263 |

|

|

|

2,079 |

|

|

Marketing |

|

220 |

|

|

204 |

|

|

|

481 |

|

|

|

683 |

|

|

Credit |

|

190 |

|

|

218 |

|

|

|

612 |

|

|

|

623 |

|

|

Other real estate |

|

- |

|

|

3 |

|

|

|

- |

|

|

|

36 |

|

|

FDIC insurance |

|

94 |

|

|

126 |

|

|

|

329 |

|

|

|

321 |

|

|

Amortization of intangibles |

|

140 |

|

|

46 |

|

|

|

420 |

|

|

|

420 |

|

|

Other |

|

445 |

|

|

412 |

|

|

|

1,258 |

|

|

|

957 |

|

|

Total noninterest expenses |

|

8,776 |

|

|

8,140 |

|

|

|

25,602 |

|

|

|

24,091 |

|

| |

|

|

|

|

|

|

|

|

Income before income taxes |

|

2,464 |

|

|

2,589 |

|

|

|

7,853 |

|

|

|

8,227 |

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

474 |

|

|

511 |

|

|

|

1,527 |

|

|

|

1,631 |

|

|

|

|

|

|

|

|

|

|

|

Net Income |

$ |

1,990 |

|

$ |

2,078 |

|

|

$ |

6,326 |

|

|

$ |

6,596 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding - basic and diluted |

|

4,543,338 |

|

|

4,543,338 |

|

|

|

4,543,338 |

|

|

|

4,568,789 |

|

| |

|

|

|

|

|

|

|

| Earnings per common share -

basic and diluted |

$ |

0.44 |

|

$ |

0.46 |

|

|

$ |

1.39 |

|

|

$ |

1.44 |

|

| |

Bank of the James Financial Group, Inc. and

SubsidiariesDollar amounts in thousands, except

per share dataunaudited

|

Selected Data: |

ThreemonthsendingSep

30,2024 |

ThreemonthsendingSep

30,2023 |

Change |

YeartodateSep

30,2024 |

YeartodateSep

30,2023 |

Change |

|

Interest income |

$ |

11,563 |

|

$ |

10,143 |

|

|

14.00 |

% |

$ |

33,007 |

|

$ |

28,824 |

|

|

14.51 |

% |

|

Interest expense |

|

4,054 |

|

|

2,779 |

|

|

45.88 |

% |

|

11,457 |

|

|

6,473 |

|

|

77.00 |

% |

|

Net interest income |

|

7,509 |

|

|

7,364 |

|

|

1.97 |

% |

|

21,550 |

|

|

22,351 |

|

|

-3.58 |

% |

|

Provision for (recovery of) credit losses |

|

92 |

|

|

(164 |

) |

|

-156.10 |

% |

|

(584 |

) |

|

(278 |

) |

|

110.07 |

% |

|

Noninterest income |

|

3,823 |

|

|

3,201 |

|

|

19.43 |

% |

|

11,321 |

|

|

9,689 |

|

|

16.84 |

% |

|

Noninterest expense |

|

8,776 |

|

|

8,140 |

|

|

7.81 |

% |

|

25,602 |

|

|

24,091 |

|

|

6.27 |

% |

|

Income taxes |

|

474 |

|

|

511 |

|

|

-7.24 |

% |

|

1,527 |

|

|

1,631 |

|

|

-6.38 |

% |

|

Net income |

|

1,990 |

|

|

2,078 |

|

|

-4.23 |

% |

|

6,326 |

|

|

6,596 |

|

|

-4.09 |

% |

|

Weighted average shares outstanding - basic |

|

4,543,338 |

|

|

4,543,338 |

|

|

- |

|

|

4,543,338 |

|

|

4,568,789 |

|

|

(25,451 |

) |

|

Weighted average shares outstanding - diluted |

|

4,543,338 |

|

|

4,543,338 |

|

|

- |

|

|

4,543,338 |

|

|

4,568,789 |

|

|

(25,451 |

) |

|

Basic net incomeper share |

$ |

0.44 |

|

$ |

0.46 |

|

$ |

(0.02 |

) |

$ |

1.39 |

|

$ |

1.44 |

|

$ |

(0.05 |

) |

|

Fully diluted net income per share |

$ |

0.44 |

|

$ |

0.46 |

|

$ |

(0.02 |

) |

$ |

1.39 |

|

$ |

1.44 |

|

$ |

(0.05 |

) |

|

Balance Sheet atperiod end: |

Sep 30,2024 |

Dec 31,2023 |

Change |

Sep 30,2023 |

Dec 31,2022 |

Change |

|

Loans, net |

$ |

627,112 |

|

$ |

601,921 |

|

|

4.19 |

% |

$ |

599,585 |

|

$ |

605,366 |

|

|

-0.95 |

% |

|

Loans held for sale |

|

3,239 |

|

|

1,258 |

|

|

157.47 |

% |

|

3,325 |

|

|

2,423 |

|

|

37.23 |

% |

|

Total securities |

|

196,079 |

|

|

220,132 |

|

|

-10.93 |

% |

|

185,603 |

|

|

189,426 |

|

|

-2.02 |

% |

|

Total deposits |

|

907,610 |

|

|

878,459 |

|

|

3.32 |

% |

|

880,203 |

|

|

848,138 |

|

|

3.78 |

% |

|

Stockholders' equity |

|

68,834 |

|

|

60,039 |

|

|

14.65 |

% |

|

50,129 |

|

|

50,226 |

|

|

-0.19 |

% |

|

Total assets |

|

1,008,063 |

|

|

969,371 |

|

|

3.99 |

% |

|

960,887 |

|

|

928,571 |

|

|

3.48 |

% |

|

Shares outstanding |

|

4,543,338 |

|

|

4,543,338 |

|

|

- |

|

|

4,543,338 |

|

|

4,628,657 |

|

|

(85,319 |

) |

|

Book value per share |

$ |

15.15 |

|

$ |

13.21 |

|

$ |

1.94 |

|

$ |

11.03 |

|

$ |

10.85 |

|

$ |

0.18 |

|

|

Daily averages: |

ThreemonthsendingSep

30,2024 |

ThreemonthsendingSep

30,2023 |

Change |

YeartodateSep

30,2024 |

YeartodateSep

30,2023 |

Change |

|

Loans |

$ |

629,860 |

|

$ |

612,021 |

|

|

2.91 |

% |

$ |

617,582 |

|

$ |

618,152 |

|

|

-0.09 |

% |

|

Loans held for sale |

|

3,845 |

|

|

4,421 |

|

|

-13.03 |

% |

|

3,454 |

|

|

3,548 |

|

|

-2.65 |

% |

|

Total securities (book value) |

|

220,730 |

|

|

222,969 |

|

|

-1.00 |

% |

|

237,215 |

|

|

223,391 |

|

|

6.19 |

% |

|

Total deposits |

|

902,615 |

|

|

869,655 |

|

|

3.79 |

% |

|

895,000 |

|

|

862,212 |

|

|

3.80 |

% |

|

Stockholders' equity |

|

61,576 |

|

|

52,564 |

|

|

17.14 |

% |

|

60,564 |

|

|

51,274 |

|

|

18.12 |

% |

|

Interest earning assets |

|

946,518 |

|

|

909,774 |

|

|

4.04 |

% |

|

937,793 |

|

|

897,364 |

|

|

4.51 |

% |

|

Interest bearing liabilities |

|

785,980 |

|

|

740,516 |

|

|

6.14 |

% |

|

776,672 |

|

|

733,343 |

|

|

5.91 |

% |

|

Total assets |

|

995,101 |

|

|

953,546 |

|

|

4.36 |

% |

|

986,132 |

|

|

945,389 |

|

|

4.31 |

% |

|

Financial Ratios: |

ThreemonthsendingSep

30,2024 |

ThreemonthsendingSep

30,2023 |

Change |

YeartodateSep

30,2024 |

YeartodateSep

30,2023 |

Change |

|

Return on average assets |

|

0.80 |

% |

|

0.86 |

% |

|

(0.06 |

) |

|

0.86 |

% |

|

0.93 |

% |

|

(0.07 |

) |

|

Return on average equity |

|

12.86 |

% |

|

15.68 |

% |

|

(2.82 |

) |

|

13.95 |

% |

|

17.20 |

% |

|

(3.25 |

) |

|

Net interest margin |

|

3.16 |

% |

|

3.21 |

% |

|

(0.05 |

) |

|

3.07 |

% |

|

3.33 |

% |

|

(0.26 |

) |

|

Efficiency ratio |

|

77.44 |

% |

|

77.05 |

% |

|

0.39 |

|

|

77.89 |

% |

|

75.19 |

% |

|

2.70 |

|

|

Average equity toaverage assets |

|

6.19 |

% |

|

5.51 |

% |

|

0.68 |

|

|

6.14 |

% |

|

5.42 |

% |

|

0.72 |

|

|

Allowance for credit losses: |

ThreemonthsendingSep

30,2024 |

ThreemonthsendingSep

30,2023 |

Change |

YeartodateSep

30,2024 |

YeartodateSep

30,2023 |

Change |

|

Beginning balance |

$ |

6,951 |

|

$ |

7,586 |

|

|

-8.37 |

% |

$ |

7,412 |

|

$ |

6,259 |

|

|

18.42 |

% |

|

Retained earnings adjustment related to impact of adoption of ASU

2016-13 |

|

- |

|

|

- |

|

|

N/A |

|

|

- |

|

|

1,245 |

|

|

-100.00 |

% |

|

Provision for (recovery of) credit losses* |

|

106 |

|

|

(130 |

) |

|

-181.54 |

% |

|

(494 |

) |

|

(188 |

) |

|

162.77 |

% |

|

Charge-offs |

|

- |

|

|

(144 |

) |

|

-100.00 |

% |

|

(84 |

) |

|

(196 |

) |

|

-57.14 |

% |

|

Recoveries |

|

21 |

|

|

8 |

|

|

162.50 |

% |

|

244 |

|

|

200 |

|

|

22.00 |

% |

|

Ending balance |

|

7,078 |

|

|

7,320 |

|

|

-3.31 |

% |

|

7,078 |

|

|

7,320 |

|

|

-3.31 |

% |

* does not include provision for or recovery of unfunded loan

commitment liability

|

Nonperforming assets: |

Sep 30,2024 |

Dec 31,2023 |

Change |

Sep 30,2023 |

Dec 31,2022 |

Change |

|

Total nonperforming loans |

$ |

1,295 |

|

$ |

391 |

|

|

231.20 |

% |

$ |

585 |

|

$ |

633 |

|

|

-7.58 |

% |

|

Other real estate owned |

|

- |

|

|

- |

|

|

N/A |

|

|

- |

|

|

566 |

|

|

-100.00 |

% |

|

Total nonperforming assets |

|

1,295 |

|

|

391 |

|

|

231.20 |

% |

|

585 |

|

|

1,199 |

|

|

-51.21 |

% |

|

Asset quality ratios: |

Sep 30,2024 |

Dec 31,2023 |

Change |

Sep 30,2023 |

Dec 31,2022 |

Change |

|

Nonperforming loans to total loans |

|

0.20 |

% |

|

0.06 |

% |

|

0.14 |

|

|

0.10 |

% |

|

0.10 |

% |

|

(0.01 |

) |

|

Allowance for credit losses for loans to total loans |

|

1.12 |

% |

|

1.22 |

% |

|

(0.10 |

) |

|

1.21 |

% |

|

1.02 |

% |

|

0.18 |

|

|

Allowance for credit losses for loans to nonperforming loans |

|

546.56 |

% |

|

1894.56 |

% |

|

1,348.00 |

|

|

1251.28 |

% |

|

989.42 |

% |

|

261.86 |

|

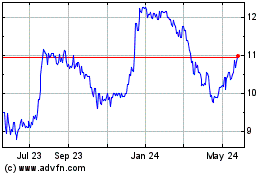

Bank of the James Financ... (NASDAQ:BOTJ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bank of the James Financ... (NASDAQ:BOTJ)

Historical Stock Chart

From Feb 2024 to Feb 2025