Berry Corporation (bry) (NASDAQ: BRY) (“Berry” or the “Company”)

announced second quarter 2024 results and declared quarterly

dividends totaling $0.17 per share. The details for today’s

earnings call and webcast are listed below.

Quarterly Highlights & Recent

Announcements

- Produced 25,300 Boe/d, flat to first

quarter; above the midpoint of 2024 annual guidance of 25,200

boe/d

- Cost reductions on pace, highlighted

by 11% sequential quarter decrease in Lease Operating Expenses

- Declared second quarter dividends of

$0.17 per share, including $0.12/share fixed and $0.05/share

variable

- Four horizontal farm-in wells from the

Uinta Basin’s prolific Uteland Butte reservoir performing above

pre-drill estimates

- Reported zero recordable incidents and

zero lost-time incidents for the third consecutive quarter

- Reached 60% completion of, and on

schedule to meet methane emissions reduction target associated with

our existing operations,

“In the second quarter, we delivered strong

financial and operational results. Our teams continue to execute

reliably and with excellence, and we remain on track to deliver

results in line with our full year guidance provided earlier this

year. We are focused on creating value by generating sustainable

free cash flow with high rates of return in low capital intensity

projects, optimizing our cost structure, and maintaining balance

sheet strength while meeting high compliance standards,” said

Fernando Araujo, Berry’s Chief Executive Officer.

He continued, “The Uinta Basin has seen

increased activity and consolidation. Development activity focused

on drilling horizontal wells across the basin is moving towards our

existing acreage. In April 2024, we purchased a 21% working

interest in four, two-to-three mile lateral wells in the Uteland

Butte reservoir, which were put on production in the second quarter

of 2024. These wells are adjacent to our existing operations and

their results will be used to evaluate similar horizontal

opportunities on our own acreage. This four-well horizontal program

is exceeding pre-drill estimates. With a high working interest in

almost 100,000 acres and the majority of acreage held by production

in multiple trends, we are strategically positioned to develop our

own acreage horizontally at an optimal pace.”

Selected Comparative

Results

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)(in millions, except per share amounts) |

|

Oil, natural gas & NGL revenues(1) |

$ |

169 |

|

|

$ |

166 |

|

|

$ |

158 |

|

Net (loss) income |

$ |

(9 |

) |

|

$ |

(40 |

) |

|

$ |

26 |

|

Adjusted Net Income(2) |

$ |

14 |

|

|

$ |

11 |

|

|

$ |

12 |

|

Cash flow from operations |

$ |

71 |

|

|

$ |

27 |

|

|

$ |

63 |

|

Adjusted EBITDA(2) |

$ |

74 |

|

|

$ |

69 |

|

|

$ |

69 |

|

(Loss) earnings per diluted share |

$ |

(0.11 |

) |

|

$ |

(0.53 |

) |

|

$ |

0.33 |

|

Adjusted earnings per diluted share(2) |

$ |

0.18 |

|

|

$ |

0.14 |

|

|

$ |

0.15 |

|

Adjusted free cash flow(2) |

$ |

19 |

|

|

$ |

1 |

|

|

$ |

34 |

|

Capital expenditures |

$ |

42 |

|

|

$ |

17 |

|

|

$ |

22 |

|

Production (mboe/d) |

|

25.3 |

|

|

|

25.4 |

|

|

|

25.9 |

__________(1) Revenues do not include hedge

settlements.(2) Please see “Non-GAAP Financial Measures and

Reconciliations” later in this press release for reconciliation and

more information on these Non-GAAP measures.

“We generated Adjusted EBITDA of $74 million in

the second quarter, a 7% increase over the first quarter of 2024,

with Cash Flow from Operations totaling $71 million and Adjusted

Free Cash Flow of $19 million. Compared to the first quarter of

2024, lease operating expenses per boe in the second quarter were

down 11% to $23.47 per boe, due primarily to lower energy costs. We

continued to drive cost savings throughout the organization and

prioritize debt reduction, reducing our revolver balance by nearly

30% to $36 million at the end of the second quarter. This balance

was further reduced to $28 million at the end of July even after

the final deferred payment from last year’s Macpherson acquisition

of $20 million. In the near term, we are also looking

opportunistically to refinance our notes, which mature in early

2026,” stated Mike Helm, Berry’s CFO.

Second Quarter 2024 Financial and

Operating Results

Q2 2024 Compared to Q1 2024

Oil, natural gas and NGL revenues (excluding

hedging settlements) for the second quarter of 2024 increased from

the first quarter of 2024, driven by slightly higher oil prices.

The net loss for the second quarter of 2024 included a $33 million

after-tax impairment of unproved oil and gas properties driven by

the implementation of California’s SB 1137 set-back regulations.

The improvement of the net loss compared to the first quarter of

2024 included lower lease operating expenses, driven by lower fuel

gas volumes purchased, as a result of our cost savings initiatives

to reduce steam, as well as a decline in fuel prices. The second

quarter of 2024 also included improved hedging results. Adjusted

EBITDA and Adjusted Net Income increased in the second quarter of

2024, compared to the prior quarter. Improved working capital for

the second quarter drove increased cash flows from operations and

Adjusted Free Cash Flow compared to the first quarter of 2024.

Capital expenditures were $42 million in the second quarter of 2024

compared to $17 million in the first quarter of 2024, with the

increase driven by accelerated development in California and

facilities projects, as well as the Utah farm-in development

program. At June 30, 2024, the Company had liquidity of $169

million, consisting of $7 million cash and $162 million available

for borrowings under its revolving credit facilities.

Q2 2024 Compared to Q2 2023

Compared to the second quarter of the prior

year, oil, natural gas and NGL revenues (excluding hedging

settlements) increased, which were driven by higher oil prices,

offset by lower production in the second quarter of 2024. Adjusted

EBITDA for the second quarter of 2024 increased 8% and Adjusted Net

Income increased 21% compared to the second quarter of 2023, driven

by the increased commodity revenues, a 16% decrease in general and

administrative costs and a 1% decrease in lease operating expenses.

Cash flow from operations increased in the second quarter of 2024

and Adjusted Free Cash Flow decreased compared to the second

quarter of 2023, due to higher capital expenditures in the second

quarter of 2024. Capital expenditures for the second quarter of

2024 were $42 million and increased 93% compared to the second

quarter of 2023. For the second quarter of 2024, we drilled 19

wells, of which 15 are in California, plus four vertical wells in

Utah, with production from our drilling activity in California

outperforming expected results.

Quarterly Dividends

The Company’s Board of Directors declared

dividends totaling $0.17 per share on the Company’s outstanding

common stock, consisting of a fixed dividend of $0.12 per share and

variable dividend of $0.05 per share based on the cumulative

Adjusted Free Cash Flow results for the six months ended June 30,

2024. Both dividends are payable on August 20, 2024 to shareholders

of record at the close of business on August 12, 2024.

Earnings Conference Call

The Company will host a conference call to

discuss these results:

| Call

Date: |

Friday, August

9, 2024 |

| Call Time: |

8:30 a.m. Eastern Time / 7:30 am a.m. Central Time / 5:30 a.m.

Pacific Time |

| Join the live listen-only audio webcast at

https://edge.media-server.com/mmc/p/pq98oify |

| or at https://bry.com/category/events |

| |

If you would like to ask a question on the live

call, please preregister at any time using the following

link:https://register.vevent.com/register/BI9f9fa21c30284d749f1657af20bc94dc.Once

registered, you will receive the dial-in numbers and a unique PIN

number. You may then dial-in or have a call back. When you dial in,

you will input your PIN and be placed into the call. If you

register and forget your PIN or lose your registration confirmation

email, you may simply re-register and receive a new PIN.

A web based audio replay will be available

shortly after the broadcast and will be archived at

https://ir.bry.com/reports-resources or visit

https://edge.media-server.com/mmc/p/pq98oify

orhttps://bry.com/category/events

About Berry Corporation

(bry)

Berry is a publicly traded (NASDAQ: BRY) western

United States independent upstream energy company with a focus on

onshore, low geologic risk, low decline, long-lived oil and gas

reserves. We operate in two business segments: (i) exploration and

production (“E&P”) and (ii) well servicing and abandonment. Our

E&P assets are located in California and Utah, are

characterized by high oil content and are predominantly located in

rural areas with low population. Our California assets are in the

San Joaquin basin (100% oil), while our Utah assets are in the

Uinta basin (60% oil and 40% gas). We operate our well servicing

and abandonment segment in California. More information can be

found at the Company’s website at bry.com.

Forward-Looking Statements

The information in this press release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. You can typically identify forward-looking statements

by words such as aim, anticipate, achievable, believe, budget,

continue, could, effort, estimate, expect, forecast, goal,

guidance, intend, likely, may, might, objective, outlook, plan,

potential, predict, project, seek, should, target, will or would

and other similar words that reflect the prospective nature of

events or outcomes. All statements, other than statements of

historical facts, included in this press release that address

plans, activities, events, objectives, goals, strategies, or

developments that the Company expects, believes or anticipates will

or may occur in the future, such as those regarding our financial

position; liquidity; our ability to refinance our indebtedness;

cash flows (including, but not limited to, Adjusted Free Cash

Flow); financial and operating results; capital program and

development and production plans; operations and business strategy;

potential acquisition and other strategic opportunities; reserves;

hedging activities; capital expenditures; return of capital; our

shareholder return model and the payment of future dividends;

future repurchases of stock or debt; capital investments; our ESG

strategy and the initiation of new projects or business in

connection therewith, recovery factors; and other guidance are

forward-looking statements. Actual results may differ from

anticipated results, sometimes materially, and reported results

should not be considered an indication of future performance. For

any such forward-looking statement that includes a statement of the

assumptions or bases underlying such forward-looking statement, we

caution that while we believe such assumptions or bases to be

reasonable and make them in good faith, assumed facts or bases

always vary from actual results, sometimes materially.

Berry cautions you that these forward-looking

statements are subject to all of the risks and uncertainties

incident to acquisition transactions and the exploration for and

development, production, gathering and sale of natural gas, NGLs

and oil most of which are difficult to predict and many of which

are beyond Berry’s control. These risks include, but are not

limited to, commodity price volatility; legislative and regulatory

actions that may prevent, delay or otherwise restrict our ability

to drill and develop our assets, including with respect to existing

and/or new requirements in the regulatory approval and permitting

process; legislative and regulatory initiatives in California or

our other areas of operation addressing climate change or other

environmental concerns; investment in and development of competing

or alternative energy sources; drilling, production and other

operating risks; effects of competition; uncertainties inherent in

estimating natural gas and oil reserves and in projecting future

rates of production; our ability to replace our reserves through

exploration and development activities or strategic transactions;

cash flow and access to capital; the timing and funding of

development expenditures; environmental, health and safety risks;

effects of hedging arrangements; potential shut-ins of production

due to lack of downstream demand or storage capacity; disruptions

to, capacity constraints in, or other limitations on the

third-party transportation and market takeaway infrastructure

(including pipeline systems) that deliver our oil and natural gas

and other processing and transportation considerations; the ability

to effectively deploy our ESG strategy and risks associated with

initiating new projects or business in connection therewith; our

ability to successfully integrate the Macpherson assets into our

operations; we fail to identify risks or liabilities related to

Macpherson, its operations or assets; our inability to achieve

anticipated synergies; our ability to successfully execute other

strategic bolt-on acquisitions; overall domestic and global

political and economic conditions; inflation levels, including

increased interest rates and volatility in financial markets and

banking; changes in tax laws and the other risks described under

the heading “Item 1A. Risk Factors” in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and subsequent

filings with the SEC.

Any forward-looking statement speaks only as of

the date on which such statement is made, and we undertake no

responsibility to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise

except as required by applicable law. Investors are urged to

consider carefully the disclosure in our filings with the

Securities and Exchange Commission, available from us at via our

website or via the Investor Relations contact below, or from the

SEC’s website at www.sec.gov.

Tables Following

The financial information and certain other

information presented have been rounded to the nearest whole number

or the nearest decimal. Therefore, the sum of the numbers in a

column may not conform exactly to the total figure given for that

column in certain tables. In addition, certain percentages

presented here reflect calculations based upon the underlying

information prior to rounding and, accordingly, may not conform

exactly to the percentages that would be derived if the relevant

calculations were based upon the rounded numbers, or may not sum

due to rounding.

SUMMARY OF RESULTS

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)($ and shares in thousands, except per share

amounts) |

|

Consolidated Statement of Operations Data: |

|

|

|

|

|

|

Revenues and other: |

|

|

|

|

|

|

Oil, natural gas and natural gas liquids sales |

$ |

168,781 |

|

|

$ |

166,318 |

|

|

$ |

157,703 |

|

|

Service revenue |

|

31,155 |

|

|

|

31,683 |

|

|

|

47,674 |

|

|

Electricity sales |

|

3,691 |

|

|

|

4,243 |

|

|

|

3,078 |

|

|

(Losses) gains on oil and gas sales derivatives |

|

(5,844 |

) |

|

|

(71,200 |

) |

|

|

20,871 |

|

|

Other revenues |

|

36 |

|

|

|

67 |

|

|

|

36 |

|

|

Total revenues and other |

|

197,819 |

|

|

|

131,111 |

|

|

|

229,362 |

|

| |

|

|

|

|

|

|

Expenses and other: |

|

|

|

|

|

|

Lease operating expenses |

|

53,989 |

|

|

|

60,697 |

|

|

|

54,707 |

|

|

Cost of services |

|

25,021 |

|

|

|

27,304 |

|

|

|

37,083 |

|

|

Electricity generation expenses |

|

552 |

|

|

|

1,093 |

|

|

|

1,273 |

|

|

Transportation expenses |

|

1,039 |

|

|

|

1,059 |

|

|

|

1,096 |

|

|

Acquisition costs |

|

1,394 |

|

|

|

2,617 |

|

|

|

972 |

|

|

General and administrative expenses |

|

18,881 |

|

|

|

20,234 |

|

|

|

22,488 |

|

|

Depreciation, depletion and amortization |

|

42,843 |

|

|

|

42,831 |

|

|

|

39,755 |

|

|

Impairment of oil and gas properties |

|

43,980 |

|

|

|

— |

|

|

|

— |

|

|

Taxes, other than income taxes |

|

12,674 |

|

|

|

15,689 |

|

|

|

13,707 |

|

|

Losses on natural gas purchase derivatives |

|

2,642 |

|

|

|

4,481 |

|

|

|

14,024 |

|

|

Other operating (income) |

|

(3,204 |

) |

|

|

(133 |

) |

|

|

(1,033 |

) |

|

Total expenses and other |

|

199,811 |

|

|

|

175,872 |

|

|

|

184,072 |

|

| |

|

|

|

|

|

|

Other expenses: |

|

|

|

|

|

|

Interest expense |

|

(10,050 |

) |

|

|

(9,140 |

) |

|

|

(8,794 |

) |

|

Other, net |

|

(53 |

) |

|

|

(83 |

) |

|

|

(110 |

) |

|

Total other expenses |

|

(10,103 |

) |

|

|

(9,223 |

) |

|

|

(8,904 |

) |

|

(Loss) income before income taxes |

|

(12,095 |

) |

|

|

(53,984 |

) |

|

|

36,386 |

|

|

Income tax (benefit) expense |

|

(3,326 |

) |

|

|

(13,900 |

) |

|

|

10,616 |

|

|

Net (loss) income |

$ |

(8,769 |

) |

|

$ |

(40,084 |

) |

|

$ |

25,770 |

|

| |

|

|

|

|

|

|

Net (loss) income per share: |

|

|

|

|

|

|

Basic |

$ |

(0.11 |

) |

|

$ |

(0.53 |

) |

|

$ |

0.34 |

|

|

Diluted |

$ |

(0.11 |

) |

|

$ |

(0.53 |

) |

|

$ |

0.33 |

|

| |

|

|

|

|

|

|

Weighted-average shares of common stock outstanding - basic |

|

76,939 |

|

|

|

76,254 |

|

|

|

76,721 |

|

|

Weighted-average shares of common stock outstanding - diluted |

|

76,939 |

|

|

|

76,254 |

|

|

|

79,285 |

|

| |

|

|

|

|

|

|

Adjusted Net Income(1) |

$ |

14,155 |

|

|

$ |

10,910 |

|

|

$ |

11,666 |

|

|

Weighted-average shares of common stock outstanding - diluted |

|

77,161 |

|

|

|

77,373 |

|

|

|

79,285 |

|

|

Diluted earnings per share on Adjusted Net Income(1) |

$ |

0.18 |

|

|

$ |

0.14 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)($ and shares in thousands, except per share

amounts) |

|

Adjusted EBITDA(1) |

$ |

74,329 |

|

|

$ |

68,534 |

|

|

$ |

69,055 |

|

|

Adjusted Free Cash Flow(1) |

$ |

19,333 |

|

|

$ |

1,104 |

|

|

$ |

33,774 |

|

|

Adjusted General and Administrative Expenses(1) |

$ |

17,038 |

|

|

$ |

18,943 |

|

|

$ |

19,109 |

|

|

Effective Tax Rate |

|

28 |

% |

|

|

26 |

% |

|

|

29 |

% |

| |

|

|

|

|

|

|

Cash Flow Data: |

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

70,891 |

|

|

$ |

27,273 |

|

|

$ |

62,538 |

|

|

Net cash used in investing activities |

$ |

(42,486 |

) |

|

$ |

(18,661 |

) |

|

$ |

(27,961 |

) |

|

Net cash used in financing activities |

$ |

(25,174 |

) |

|

$ |

(9,990 |

) |

|

$ |

(40,128 |

) |

__________(1) See further discussion and

reconciliation in “Non-GAAP Financial Measures and

Reconciliations”.

| |

June 30, 2024 |

|

December 31, 2023 |

| |

(unaudited)($ and shares in thousands) |

|

Balance Sheet Data: |

|

|

|

|

Total current assets |

$ |

127,489 |

|

$ |

140,800 |

|

Total property, plant and equipment, net |

$ |

1,349,593 |

|

$ |

1,406,612 |

|

Total current liabilities |

$ |

204,545 |

|

$ |

223,182 |

|

Long-term debt |

$ |

433,656 |

|

$ |

427,993 |

|

Total stockholders' equity |

$ |

672,960 |

|

$ |

757,976 |

|

Outstanding common stock shares as of |

|

76,939 |

|

|

75,667 |

|

|

|

|

|

|

|

The following table represents selected

financial information for the periods presented regarding the

Company's business segments on a stand-alone basis and the

consolidation and elimination entries necessary to arrive at the

financial information for the Company on a consolidated basis.

| |

Three Months EndedJune 30,

2024 |

| |

E&P |

|

Well Servicing and Abandonment |

|

Corporate/Eliminations |

|

ConsolidatedCompany |

| |

(unaudited)(in thousands) |

|

Revenues(1) |

$ |

172,508 |

|

$ |

36,680 |

|

$ |

(5,525 |

) |

|

$ |

203,663 |

|

|

Net (loss) income before income taxes |

$ |

13,860 |

|

$ |

1,122 |

|

$ |

(27,077 |

) |

|

$ |

(12,095 |

) |

|

Capital expenditures |

$ |

41,735 |

|

$ |

468 |

|

$ |

122 |

|

|

$ |

42,325 |

|

|

Total assets |

$ |

1,547,334 |

|

$ |

63,329 |

|

$ |

(77,754 |

) |

|

$ |

1,532,909 |

|

| |

Three Months EndedMarch 31,

2024 |

| |

E&P |

|

Well Servicing and Abandonment |

|

Corporate/Eliminations |

|

ConsolidatedCompany |

| |

(unaudited)(in thousands) |

|

Revenues(1) |

$ |

170,628 |

|

|

$ |

35,468 |

|

|

$ |

(3,785 |

) |

|

$ |

202,311 |

|

|

Net income (loss) before income taxes |

$ |

(24,836 |

) |

|

$ |

(1,269 |

) |

|

$ |

(27,879 |

) |

|

$ |

(53,984 |

) |

|

Capital expenditures |

$ |

15,417 |

|

|

$ |

1,332 |

|

|

$ |

187 |

|

|

$ |

16,936 |

|

|

Total assets |

$ |

1,625,178 |

|

|

$ |

65,948 |

|

|

$ |

(115,610 |

) |

|

$ |

1,575,516 |

|

| |

Three Months EndedJune 30,

2023 |

| |

E&P |

|

Well Servicing andAbandonment |

|

Corporate/Eliminations |

|

ConsolidatedCompany |

| |

(unaudited)(in thousands) |

|

Revenues(1) |

$ |

160,817 |

|

$ |

49,299 |

|

$ |

(1,625 |

) |

|

$ |

208,491 |

|

Net income (loss) before income taxes |

$ |

62,012 |

|

$ |

4,836 |

|

$ |

(30,462 |

) |

|

$ |

36,386 |

|

Capital expenditures |

$ |

19,625 |

|

$ |

1,334 |

|

$ |

936 |

|

|

$ |

21,895 |

|

Total assets |

$ |

1,457,694 |

|

$ |

72,653 |

|

$ |

(8,644 |

) |

|

$ |

1,521,703 |

__________(1) These revenues do not include hedge

settlements.

COMMODITY PRICING

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

|

Weighted Average Realized Prices |

|

|

|

|

|

|

Oil without hedge ($/bbl) |

$ |

78.18 |

|

|

$ |

75.31 |

|

|

$ |

70.68 |

|

|

Effects of scheduled derivative settlements ($/bbl) |

|

(4.60 |

) |

|

|

(2.17 |

) |

|

|

(0.81 |

) |

|

Oil with hedge ($/bbl) |

$ |

73.58 |

|

|

$ |

73.14 |

|

|

$ |

69.87 |

|

|

Natural gas ($/mcf) |

$ |

1.78 |

|

|

$ |

3.76 |

|

|

$ |

2.87 |

|

|

NGLs ($/bbl) |

$ |

24.46 |

|

|

$ |

29.60 |

|

|

$ |

22.16 |

|

| |

|

|

|

|

|

|

Purchased Natural Gas |

|

|

|

|

|

|

Purchase price, before the effects of derivative settlements

($/mmbtu) |

$ |

2.26 |

|

|

$ |

3.99 |

|

|

$ |

3.44 |

|

|

Effects of derivative settlements ($/mmbtu) |

|

2.04 |

|

|

|

0.92 |

|

|

|

2.20 |

|

|

Purchase price, after the effects of derivative

settlements($/mmbtu) |

$ |

4.30 |

|

|

$ |

4.91 |

|

|

$ |

5.64 |

|

| |

|

|

|

|

|

|

Index Prices |

|

|

|

|

|

|

Brent oil ($/bbl) |

$ |

85.03 |

|

|

$ |

81.76 |

|

|

$ |

77.73 |

|

|

WTI oil ($/bbl) |

$ |

80.60 |

|

|

$ |

77.02 |

|

|

$ |

73.73 |

|

|

Natural gas ($/mmbtu) – SoCal Gas city-gate(1) |

$ |

1.86 |

|

|

$ |

4.21 |

|

|

$ |

5.66 |

|

|

Natural gas ($/mmbtu) - Northwest, Rocky Mountains(2) |

$ |

1.40 |

|

|

$ |

3.41 |

|

|

$ |

2.85 |

|

|

Henry Hub natural gas ($/mmbtu)(2) |

$ |

2.07 |

|

|

$ |

2.15 |

|

|

$ |

2.16 |

|

__________

(1) The natural gas we purchase to generate

steam and electricity is primarily based on Rockies price indexes,

including transportation charges, as we currently purchase a

substantial majority of our gas needs from the Rockies, with the

balance purchased in California. SoCal Gas city-gate Index is the

relevant index used only for the portion of gas purchases in

California.(2) Most of our gas purchases and gas sales in the

Rockies are predicated on the Northwest, Rocky Mountains index, and

to a lesser extent based on Henry Hub.

Natural gas prices and differentials are

strongly affected by local market fundamentals, availability of

transportation capacity from producing areas and seasonal impacts.

The Company's key exposure to gas prices is in costs. The Company

purchases substantially more natural gas for California steamfloods

and cogeneration facilities than what is produced and sold in the

Rockies. The Company purchases most of its gas in the Rockies and

transports it to its California operations using the Kern River

pipeline capacity. The Company buys approximately 48,000 mmbtu/d in

the Rockies, and the remainder comes from California markets. The

volume purchased in California fluctuates and averaged 2,000

mmbtu/d in the second quarter of 2024, 5,000 mmbtu/d in the first

quarter of 2024 and 6,000 mmbtu/d in the second quarter of 2023.

The natural gas purchased in the Rockies is shipped to operations

in California to help limit exposure to California fuel gas

purchase price fluctuations. The Company strives to further

minimize the variability of fuel gas costs for steam operations by

hedging a significant portion of gas purchases. Additionally, the

negative impact of higher gas prices on California operating

expenses is partially offset by higher gas sales for the gas

produced and sold in the Rockies. The Kern capacity allows us to

purchase and sell natural gas at the same pricing indices.

CURRENT HEDGING SUMMARY

As of August 6, 2024, we had the following crude

oil production and gas purchases hedges.

| |

|

Q3 2024 |

|

Q4 2024 |

|

FY 2025 |

|

FY 2026 |

|

FY 2027 |

|

FY 2028 |

|

FY 2029 |

|

Brent - Crude Oil production |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Swaps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedged volume (bbls) |

|

|

1,481,749 |

|

|

1,438,656 |

|

|

4,951,125 |

|

|

2,633,268 |

|

|

3,056,000 |

|

|

2,378,000 |

|

|

724,000 |

|

Weighted-average price ($/bbl) |

|

$ |

76.88 |

|

$ |

76.93 |

|

$ |

76.07 |

|

$ |

71.76 |

|

$ |

70.66 |

|

$ |

68.36 |

|

$ |

67.44 |

|

Sold Calls(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedged volume (bbls) |

|

|

92,000 |

|

|

92,000 |

|

|

296,127 |

|

|

1,251,500 |

|

|

318,500 |

|

|

— |

|

|

— |

|

Weighted-average price ($/bbl) |

|

$ |

105.00 |

|

$ |

105.00 |

|

$ |

88.69 |

|

$ |

85.53 |

|

$ |

80.03 |

|

$ |

— |

|

$ |

— |

|

Purchased Puts (net)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedged volume (bbls) |

|

|

322,000 |

|

|

322,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Weighted-average price ($/bbl) |

|

$ |

50.00 |

|

$ |

50.00 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

Purchased Puts (net)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedged volume (bbls) |

|

|

— |

|

|

— |

|

|

296,127 |

|

|

1,251,500 |

|

|

318,500 |

|

|

— |

|

|

— |

|

Weighted-average price ($/bbl) |

|

$ |

— |

|

$ |

— |

|

$ |

60.00 |

|

$ |

60.00 |

|

$ |

65.00 |

|

$ |

— |

|

$ |

— |

|

Sold Puts (net)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedged volume (bbls) |

|

|

46,000 |

|

|

46,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Weighted-average price ($/bbl) |

|

$ |

40.00 |

|

$ |

40.00 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

NWPL - Natural Gas

purchases(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Swaps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedged volume (mmbtu) |

|

|

3,680,000 |

|

|

3,680,000 |

|

|

13,380,000 |

|

|

3,040,000 |

|

|

— |

|

|

— |

|

|

— |

|

Weighted-average price ($/mmbtu) |

|

$ |

3.96 |

|

$ |

3.96 |

|

$ |

4.27 |

|

$ |

4.26 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

__________(1) Purchased calls and sold calls with

the same strike price have been presented on a net basis.(2)

Purchased puts and sold puts with the same strike price have been

presented on a net basis.(3) The term “NWPL” is defined as

Northwest Rocky Mountain Pipeline.

(LOSSES) GAINS ON

DERIVATIVES

A summary of gains and losses on the derivatives

included on the statements of operations is presented below:

| |

Three Months Ended |

| |

June 30,2024 |

|

March 31,2024 |

|

June 30,2023 |

| |

(unaudited)(in thousands) |

|

Realized (losses) on commodity derivatives: |

|

|

|

|

|

|

Realized (losses) on oil sales derivatives |

$ |

(9,801 |

) |

|

$ |

(4,682 |

) |

|

$ |

(1,770 |

) |

|

Realized (losses) on natural gas purchase derivatives |

|

(9,314 |

) |

|

|

(4,412 |

) |

|

|

(10,754 |

) |

|

Total realized (losses) on derivatives |

$ |

(19,115 |

) |

|

$ |

(9,094 |

) |

|

$ |

(12,524 |

) |

| |

|

|

|

|

|

|

Unrealized gains (losses) on commodity

derivatives: |

|

|

|

|

|

|

Unrealized gains (losses) on oil sales derivatives |

$ |

3,957 |

|

|

$ |

(66,518 |

) |

|

$ |

22,641 |

|

|

Unrealized gains (losses) on natural gas purchase derivatives |

|

6,672 |

|

|

|

(69 |

) |

|

|

(3,270 |

) |

|

Total unrealized gains (losses) on derivatives |

$ |

10,629 |

|

|

$ |

(66,587 |

) |

|

$ |

19,371 |

|

|

Total (losses) gains on derivatives |

$ |

(8,486 |

) |

|

$ |

(75,681 |

) |

|

$ |

6,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E&P FIELD OPERATIONS

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)($ in per boe amounts) |

|

Expenses from field operations |

|

|

|

|

|

|

Lease operating expenses |

$ |

23.47 |

|

$ |

26.28 |

|

$ |

23.17 |

|

Electricity generation expenses |

|

0.24 |

|

|

0.47 |

|

|

0.54 |

|

Transportation expenses |

|

0.45 |

|

|

0.46 |

|

|

0.46 |

|

Total |

$ |

24.16 |

|

$ |

27.21 |

|

$ |

24.17 |

| |

|

|

|

|

|

|

Cash settlements paid for gas purchase hedges |

$ |

4.05 |

|

$ |

1.91 |

|

$ |

4.56 |

| |

|

|

|

|

|

|

E&P non-production revenues |

|

|

|

|

|

|

Electricity sales |

$ |

1.60 |

|

$ |

1.84 |

|

$ |

1.30 |

|

Transportation sales |

|

0.02 |

|

|

0.03 |

|

|

0.02 |

|

Total |

$ |

1.62 |

|

$ |

1.87 |

|

$ |

1.32 |

|

|

|

|

|

|

|

|

|

|

Overall, management assesses the efficiency of

the Company's E&P field operations by considering core E&P

operating expenses together with cogeneration, marketing and

transportation activities. In particular, a core component of

E&P operations in California is steam, which is used to lift

heavy oil to the surface. The Company operates several cogeneration

facilities to produce some of the steam needed in operations. In

comparing the cost effectiveness of cogeneration plants against

other sources of steam in operations, management considers the cost

of operating the cogeneration plants, including the cost of the

natural gas purchased to operate the facilities, against the value

of the steam and electricity used in E&P field operations and

the revenues received from sales of excess electricity to the grid.

The Company strives to minimize the variability of its fuel gas

costs for California steam operations with natural gas purchase

hedges. Consequently, the efficiency of E&P field operations

are impacted by the cash settlements received or paid from these

derivatives. The Company also has contracts for the transportation

of fuel gas from the Rockies, which has historically been cheaper

than the California markets. With respect to transportation and

marketing, management also considers opportunistic sales of

incremental capacity in assessing the overall efficiencies of

E&P operations.

Lease operating expenses include fuel, labor,

field office, vehicle, supervision, maintenance, tools and

supplies, and workover expenses. Electricity generation expenses

include the portion of fuel, labor, maintenance, and tools and

supplies from two of the Company's cogeneration facilities

allocated to electricity generation expense; the remaining

cogeneration expenses are included in lease operating expense.

Transportation expenses relate to costs to transport the oil and

gas that is produced within the Company's properties or moved to

the market. Marketing expenses mainly relate to natural gas

purchased from third parties that moves through gathering and

processing systems and then is sold to third parties. Electricity

revenue is from the sale of excess electricity from two of the

Company's cogeneration facilities to a California utility company

under long-term contracts at market prices. These cogeneration

facilities are sized to satisfy the steam needs in their respective

fields, but the corresponding electricity produced is more than the

electricity that is currently required for the operations in those

fields. Transportation sales relate to water and other liquids that

transport on the Company's systems on behalf of third parties and

marketing revenues represent sales of natural gas purchased from

and sold to third parties.

PRODUCTION STATISTICS

| |

Three Months Ended |

|

|

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

|

Net Oil, Natural Gas and NGLs Production Per

Day(1): |

|

|

|

|

|

|

Oil (mbbl/d) |

|

|

|

|

|

|

California |

21.1 |

|

21.3 |

|

20.8 |

|

Utah |

2.3 |

|

2.5 |

|

3.2 |

|

Total oil |

23.4 |

|

23.8 |

|

24.0 |

|

Natural gas (mmcf/d) |

|

|

|

|

|

|

California |

— |

|

— |

|

— |

|

Utah |

8.9 |

|

7.9 |

|

9.2 |

|

Total natural gas |

8.9 |

|

7.9 |

|

9.2 |

|

NGLs (mbbl/d) |

|

|

|

|

|

|

California |

— |

|

— |

|

— |

|

Utah |

0.4 |

|

0.3 |

|

0.4 |

|

Total NGLs |

0.4 |

|

0.3 |

|

0.4 |

|

Total Production (mboe/d)(2) |

25.3 |

|

25.4 |

|

25.9 |

__________(1) Production represents volumes sold

during the period. We also consume a portion of the natural gas we

produce on lease to extract oil and gas.(2) Natural gas volumes

have been converted to boe based on energy content of six mcf of

gas to one bbl of oil. Barrels of oil equivalence does not

necessarily result in price equivalence. The price of natural gas

on a barrel of oil equivalent basis is currently substantially

lower than the corresponding price for oil and has been similarly

lower for a number of years. For example, in the three months ended

June 30, 2024, the average prices of Brent oil and Henry Hub

natural gas were $85.03 per bbl and $2.07 per mmbtu

respectively.

CAPITAL EXPENDITURES

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

June 30, 2023 |

| |

|

|

(unaudited)(in thousands) |

|

|

|

Capital expenditures (1)(2) |

$ |

42,325 |

|

$ |

16,936 |

|

$ |

21,895 |

__________(1) Capital expenditures include

capitalized overhead and interest and excludes acquisitions and

asset retirement spending.(2) Capital expenditures for the three

months ended June 30, 2024, March 31, 2024 and June 30, 2023

included less than $1 million, $1 million and $1 million,

respectively, related to the well servicing and abandonment

business.

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATIONS

Adjusted Net Income (Loss) is not a measure of

net income (loss), Adjusted Free Cash Flow is not a measure of cash

flow, and Adjusted EBITDA is not a measure of either net income

(loss) or cash flow, in all cases, as determined by GAAP. Adjusted

EBITDA, Adjusted Free Cash Flow, Adjusted Net Income (Loss) and

Adjusted General and Administrative Expenses are supplemental

non-GAAP financial measures used by management and external users

of our financial statements, such as industry analysts, investors,

lenders and rating agencies.

We define Adjusted EBITDA as earnings before

interest expense; income taxes; depreciation, depletion, and

amortization; derivative gains or losses net of cash received or

paid for scheduled derivative settlements; impairments; stock

compensation expense; and unusual and infrequent items. Our

management believes Adjusted EBITDA provides useful information in

assessing our financial condition, results of operations and cash

flows and is widely used by the industry and the investment

community. The measure also allows our management to more

effectively evaluate our operating performance and compare the

results between periods without regard to our financing methods or

capital structure. We also use Adjusted EBITDA in planning our

capital expenditure allocation to sustain production levels and to

determine our strategic hedging needs aside from the hedging

requirements of the 2021 RBL Facility.

We define Adjusted Free Cash Flow, which is a

non-GAAP financial measure, as cash flow from operations less

regular fixed dividends and capital expenditures. In 2024, we

updated the definition of Adjusted Free Cash Flow, a non-GAAP

measure, as cash flow from operations less regular fixed dividends

and capital expenditures. This update better aligns with the full

capital expenditure requirements of the Company. For 2023, Adjusted

Free Cash Flow was defined as cash flow from operations less

regular fixed dividends and maintenance capital. Management

believes Adjusted Free Cash Flow may be useful in an investor

analysis of our ability to generate cash from operating activities

from our existing oil and gas asset base after maintaining the

existing production volumes of that asset base to return capital to

stockholders, fund further business expansion through acquisitions

or investments in our existing asset base to increase production

volumes and pay other non-discretionary expenses. Management also

uses Adjusted Free Cash Flow as the primary metric to plan for

future growth.

Adjusted Free Cash Flow does not represent the

total increase or decrease in our cash balance, and it should not

be inferred that the entire amount of Adjusted Free Cash Flow is

available for variable dividends, debt or share repurchases,

strategic acquisitions or other growth opportunities, or other

discretionary expenditures, since we have mandatory debt service

requirements and other non-discretionary expenditures that are not

deducted from this measure.

We define Adjusted Net Income (Loss) as net

income (loss) adjusted for derivative gains or losses net of cash

received or paid for scheduled derivative settlements, unusual and

infrequent items, and the income tax expense or benefit of these

adjustments using our statutory tax rate. Adjusted Net Income

(Loss) excludes the impact of unusual and infrequent items

affecting earnings that vary widely and unpredictably, including

non-cash items such as derivative gains and losses. This measure is

used by management when comparing results period over period. We

believe Adjusted Net Income (Loss) is useful to investors because

it reflects how management evaluates the Company’s ongoing

financial and operating performance from period-to-period after

removing certain transactions and activities that affect

comparability of the metrics and are not reflective of the

Company’s core operations. We believe this also makes it easier for

investors to compare our period-to-period results with our

peers.

We define Adjusted General and Administrative

Expenses as general and administrative expenses adjusted for

non-cash stock compensation expense and unusual and infrequent

costs. Management believes Adjusted General and Administrative

Expenses is useful because it allows us to more effectively compare

our performance from period to period. We believe Adjusted General

and Administrative Expenses is useful to investors because it

reflects how management evaluates the Company’s ongoing general and

administrative expenses from period-to-period after removing

non-cash stock compensation, as well as unusual or infrequent costs

that affect comparability of the metrics and are not reflective of

the Company’s administrative costs. We believe this also makes it

easier for investors to compare our period-to-period results with

our peers.

While Adjusted EBITDA, Adjusted Free Cash Flow,

Adjusted Net Income (Loss) and Adjusted General and Administrative

Expenses are non-GAAP measures, the amounts included in the

calculation of Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted

Net Income (Loss) and Adjusted General and Administrative Expenses

were computed in accordance with GAAP. These measures are provided

in addition to, and not as an alternative for, income and liquidity

measures calculated in accordance with GAAP and should not be

considered as an alternative to, or more meaningful than income and

liquidity measures calculated in accordance with GAAP. Certain

items excluded from Adjusted EBITDA are significant components in

understanding and assessing our financial performance, such as our

cost of capital and tax structure, as well as the historic cost of

depreciable and depletable assets. Our computations of Adjusted

EBITDA, Adjusted Free Cash Flow, Adjusted Net Income (Loss) and

Adjusted General and Administrative Expenses may not be comparable

to other similarly titled measures used by other companies.

Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income

(Loss) and Adjusted General and Administrative Expenses should be

read in conjunction with the information contained in our financial

statements prepared in accordance with GAAP.

ADJUSTED EBITDA

The following tables present reconciliations of

the GAAP financial measures of net income (loss) and net cash

provided (used) by operating activities to the non-GAAP financial

measure of Adjusted EBITDA, as applicable, for each of the periods

indicated.

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)(in thousands) |

|

Adjusted EBITDA reconciliation: |

|

Net (loss) income |

$ |

(8,769 |

) |

|

$ |

(40,084 |

) |

|

$ |

25,770 |

|

|

Add (Subtract): |

|

|

|

|

|

|

Interest expense |

|

10,050 |

|

|

|

9,140 |

|

|

|

8,794 |

|

|

Income tax (benefit) expense |

|

(3,326 |

) |

|

|

(13,900 |

) |

|

|

10,616 |

|

|

Depreciation, depletion, and amortization |

|

42,843 |

|

|

|

42,831 |

|

|

|

39,755 |

|

|

Impairment of oil and gas properties |

|

43,980 |

|

|

|

— |

|

|

|

— |

|

|

Losses (gains) on derivatives |

|

8,486 |

|

|

|

75,681 |

|

|

|

(6,847 |

) |

|

Net cash (paid) for scheduled derivative settlements |

|

(19,115 |

) |

|

|

(9,094 |

) |

|

|

(12,524 |

) |

|

Other operating (income) |

|

(3,204 |

) |

|

|

(133 |

) |

|

|

(1,033 |

) |

|

Stock compensation expense(1) |

|

1,990 |

|

|

|

385 |

|

|

|

3,552 |

|

|

Acquisition costs(2) |

|

1,394 |

|

|

|

2,617 |

|

|

|

972 |

|

|

Non-recurring costs(3) |

|

— |

|

|

|

1,091 |

|

|

|

— |

|

|

Adjusted EBITDA |

$ |

74,329 |

|

|

$ |

68,534 |

|

|

$ |

69,055 |

|

| |

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

70,891 |

|

|

$ |

27,273 |

|

|

$ |

62,538 |

|

|

Add (Subtract): |

|

|

|

|

|

|

Cash interest payments |

|

1,395 |

|

|

|

15,256 |

|

|

|

1,004 |

|

|

Cash income tax payments |

|

491 |

|

|

|

— |

|

|

|

670 |

|

|

Acquisition costs(2) |

|

1,394 |

|

|

|

2,617 |

|

|

|

— |

|

|

Non-recurring costs(3) |

|

— |

|

|

|

1,091 |

|

|

|

— |

|

|

Changes in operating assets and liabilities - working

capital(4) |

|

3,293 |

|

|

|

22,543 |

|

|

|

6,065 |

|

|

Other operating (income) - cash portion(5) |

|

(3,135 |

) |

|

|

(246 |

) |

|

|

(1,222 |

) |

|

Adjusted EBITDA |

$ |

74,329 |

|

|

$ |

68,534 |

|

|

$ |

69,055 |

|

__________(1) Decrease in the first quarter of

2024 is the result of stock award forfeitures.(2) Includes legal

and other professional expenses related to various transactions

activities.(3) In 2024, non-recurring costs included workforce

reduction costs in the first quarter.(4) Changes in other assets

and liabilities consists of working capital and various immaterial

items.(5) Represents the cash portion of other operating (income)

from the income statement, net of the non-cash portion in the cash

flow statement.

ADJUSTED FREE CASH FLOW

The following table presents a reconciliation of

the GAAP financial measure of operating cash flow to the non-GAAP

financial measure of Adjusted Free Cash Flow for each of the

periods indicated. We use Adjusted Free Cash Flow for our

shareholder return model.

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)(in thousands) |

|

Adjusted Free Cash Flow reconciliation: |

|

|

|

|

|

|

Net cash provided by operating activities(1) |

$ |

70,891 |

|

|

$ |

27,273 |

|

|

$ |

62,538 |

|

|

Subtract: |

|

|

|

|

|

Capital expenditures(2) |

|

(42,325 |

) |

|

|

(16,936 |

) |

|

|

(19,625 |

) |

|

Fixed dividends(3) |

|

(9,233 |

) |

|

|

(9,233 |

) |

|

|

(9,139 |

) |

|

Adjusted Free Cash Flow |

$ |

19,333 |

|

|

$ |

1,104 |

|

|

$ |

33,774 |

|

__________(1) On a consolidated basis.(2) In

2024, we updated Adjusted Free Cash Flow to include all capital

expenditures in the calculation of Adjusted Free Cash Flow. This

update better aligns with the full capital expenditure requirements

of the Company. In 2023, the definition of capital expenditures was

the required amount to keep annual production essentially flat

(maintenance capital), calculated as the capital expenditures for

the E&P business for the periods presented. We did not

retrospectively adjust 2023.

| |

Three Months Ended |

| |

June 30, 2023 |

| |

(unaudited)(in thousands) |

|

Consolidated capital expenditures(a) |

$ |

(21,895 |

) |

|

Excluded items(b) |

|

2,270 |

|

|

Maintenance capital |

$ |

(19,625 |

) |

__________(a) Capital

expenditures include capitalized overhead and interest and excludes

acquisitions and asset retirement spending.(b) Comprised of the

capital expenditures in our E&P segment that are related to

strategic business expansion, such as acquisitions of oil and gas

properties and any exploration and development activities to

increase production beyond the prior year’s annual production

volumes and capital expenditures in our well servicing and

abandonment segment and corporate expenditures that are related to

ancillary sustainability initiatives or other expenditures that are

discretionary and unrelated to maintenance of our core business.

For the three months ended June 30, 2023, we excluded approximately

$1.3 million of capital expenditures related to our well servicing

and abandonment segment, which was substantially all used for

sustainability initiatives or other expenditures that are

discretionary and unrelated to maintenance of our core business.

For the three months ended June 30, 2023, we excluded approximately

$0.9 million of corporate capital expenditures, which we determined

was not related to the maintenance of our baseline production.

(3) Represents fixed dividends declared for the

periods presented.

ADJUSTED NET INCOME (LOSS)

The following table presents a reconciliation of

the GAAP financial measures of net income (loss) and net income

(loss) per share — diluted to the non-GAAP financial measures of

Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per share

— diluted for each of the periods indicated.

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(in thousands) |

|

per share - diluted |

|

(in thousands) |

|

per share - diluted |

|

(in thousands) |

|

per share - diluted |

| |

(unaudited) |

|

Adjusted Net Income (Loss) reconciliation: |

|

|

|

|

Net (loss) income |

$ |

(8,769 |

) |

|

$ |

(0.11 |

) |

|

$ |

(40,084 |

) |

|

$ |

(0.52 |

) |

|

$ |

25,770 |

|

|

$ |

0.33 |

|

|

Add (Subtract): |

|

|

|

|

|

|

|

|

|

|

|

|

Losses (gains) on derivatives |

|

8,486 |

|

|

|

0.11 |

|

|

|

75,681 |

|

|

|

0.98 |

|

|

|

(6,847 |

) |

|

|

(0.09 |

) |

|

Net cash (paid) for scheduled derivative settlements |

|

(19,115 |

) |

|

|

(0.25 |

) |

|

|

(9,094 |

) |

|

|

(0.12 |

) |

|

|

(12,524 |

) |

|

|

(0.16 |

) |

|

Other operating (income) |

|

(3,204 |

) |

|

|

(0.05 |

) |

|

|

(133 |

) |

|

|

— |

|

|

|

(1,033 |

) |

|

|

(0.01 |

) |

|

Impairment of oil and gas properties |

|

43,980 |

|

|

|

0.57 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Acquisition costs(1) |

|

1,394 |

|

|

|

0.02 |

|

|

|

2,617 |

|

|

|

0.03 |

|

|

|

972 |

|

|

|

0.01 |

|

|

Non-recurring costs(2) |

|

— |

|

|

|

— |

|

|

|

1,091 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

— |

|

|

Total additions (subtractions), net |

|

31,541 |

|

|

|

0.40 |

|

|

|

70,162 |

|

|

|

0.91 |

|

|

|

(19,432 |

) |

|

|

(0.25 |

) |

|

Income tax (benefit) expense of adjustments(3) |

|

(8,617 |

) |

|

|

(0.11 |

) |

|

|

(19,168 |

) |

|

|

(0.25 |

) |

|

|

5,328 |

|

|

|

0.07 |

|

|

Adjusted Net Income |

$ |

14,155 |

|

|

$ |

0.18 |

|

|

$ |

10,910 |

|

|

$ |

0.14 |

|

|

$ |

11,666 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Basic EPS on Adjusted Net Income |

$ |

0.18 |

|

|

|

|

$ |

0.14 |

|

|

|

|

$ |

0.15 |

|

|

|

|

Diluted EPS on Adjusted Net Income |

$ |

0.18 |

|

|

|

|

$ |

0.14 |

|

|

|

|

$ |

0.15 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares of common stock outstanding - basic |

|

76,939 |

|

|

|

|

|

76,254 |

|

|

|

|

|

76,721 |

|

|

|

|

Weighted average shares of common stock outstanding - diluted |

|

77,161 |

|

|

|

|

|

77,373 |

|

|

|

|

|

79,285 |

|

|

|

__________(1) Includes legal and other professional

expenses related to various transactions activities.(2) In 2024,

non-recurring costs included workforce reduction costs in the first

quarter.(3) The federal and state statutory rates were utilized for

all periods presented.

ADJUSTED GENERAL AND ADMINISTRATIVE

EXPENSES

The following table presents a reconciliation of

the GAAP financial measure of general and administrative expenses

to the non-GAAP financial measure of Adjusted General and

Administrative Expenses for each of the periods indicated.

| |

Three Months Ended |

| |

June 30, 2024 |

|

March 31, 2024 |

|

June 30, 2023 |

| |

(unaudited)($ in thousands) |

|

Adjusted General and Administrative Expense

reconciliation: |

|

General and administrative expenses |

$ |

18,881 |

|

|

$ |

20,234 |

|

|

$ |

22,488 |

|

|

Subtract: |

|

|

|

|

|

|

Non-cash stock compensation expense (G&A portion)(1) |

|

(1,843 |

) |

|

|

(200 |

) |

|

|

(3,379 |

) |

|

Non-recurring costs(2) |

|

— |

|

|

|

(1,091 |

) |

|

|

— |

|

|

Adjusted General and Administrative Expenses |

$ |

17,038 |

|

|

$ |

18,943 |

|

|

$ |

19,109 |

|

| |

|

|

|

|

|

|

Well servicing and abandonment segment |

$ |

2,454 |

|

|

$ |

2,929 |

|

|

$ |

2,958 |

|

| |

|

|

|

|

|

|

E&P segment, and corporate |

$ |

14,584 |

|

|

$ |

16,014 |

|

|

$ |

16,151 |

|

|

E&P segment, and corporate ($/boe) |

$ |

6.34 |

|

|

$ |

6.93 |

|

|

$ |

6.84 |

|

| |

|

|

|

|

|

|

Total mboe |

|

2,300 |

|

|

|

2,310 |

|

|

|

2,361 |

|

__________(1) Decrease in the first quarter of

2024 is the result of stock award forfeitures.(2) In 2024,

non-recurring costs included workforce reduction costs in the first

quarter.

Contact

Contact: Berry Corporation (bry)

Todd Crabtree - Director, Investor Relations

(661) 616-3811

ir@bry.com

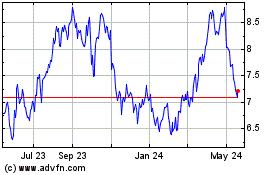

Berry (NASDAQ:BRY)

Historical Stock Chart

From Dec 2024 to Jan 2025

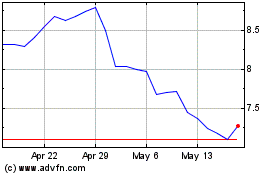

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jan 2024 to Jan 2025