0000020286false00000202862025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report: January 30, 2025

(Date of earliest event reported)

CINCINNATI FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Ohio | 0-4604 | 31-0746871 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | |

| 6200 S. Gilmore Road | Fairfield, | Ohio | 45014‑5141 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (513) 870-2000

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock | CINF | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§203.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02(e) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2025, the compensation committee of the board of directors of Cincinnati Financial Corporation approved the attached forms of agreement to be used for future award grants under the Cincinnati Financial Corporation 2024 Stock Compensation Plan. The forms of agreement are filed herewith as exhibits 10.1 to 10.5.

Item 5.02(c) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Item 7.01 Regulation FD Disclosure

On January 31, 2025, Cincinnati Financial Corporation issued the attached news release "Cincinnati Financial Corporation and Subsidiaries Recognize Promotions and Appointments." The news release is furnished as Exhibit 99.2 hereto and is incorporated herein by reference. On January 31, 2025, Cincinnati Financial Corporation issued the attached news release “Cincinnati Financial Corporation Increases Regular Quarterly Cash Dividend.” The news release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference. This report should not be deemed an admission as to the materiality of any information contained in the news release.

The foregoing information is being furnished pursuant to this Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise be subject to the liabilities of that section, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

Exhibit 104 – The cover page from this Current Report on Form 8-K, formatted as Inline XBRL

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| CINCINNATI FINANCIAL CORPORATION |

| |

| |

| |

| Date: January 31, 2025 | /S/ Michael J. Sewell |

| Michael J. Sewell, CPA |

| Chief Financial Officer, Senior Vice President and Treasurer |

| (Principal Accounting Officer) |

CINCINNATI FINANCIAL CORPORATION

P.O. BOX 145496

CINCINNATI, OH 45250-5496

513-870-2696

INCENTIVE STOCK OPTION AGREEMENT

PART I – AWARD INFORMATION

Participant Name: Plan:

Grant Date: Expiration Date:

Grant Amount: Vesting Schedule:

Grant Type:

Exercise Price Per Share:

CINCINNATI FINANCIAL CORPORATION (the "Company") hereby grants to the associate identified above (the "Participant") an Incentive Stock Option (the "Award") under the Company's 2024 Stock Compensation Plan (the "Plan") with respect to the number of shares of the Company's Common Stock (the "Shares") specified under Part I-Award Information ("Award Information") above, all in accordance with and subject to the provisions set forth in Part II-Terms and Conditions.

THIS AWARD IS SUBJECT TO FORFEITURE AS PROVIDED IN THIS INCENTIVE STOCK OPTION AGREEMENT AND THE PLAN.

By accepting this Award, the Participant acknowledges the receipt of a copy of this Incentive Stock Option Agreement (including Part II-Terms and Conditions) and a copy of the Prospectus and agrees to be bound by all the terms and provisions contained in them and in the Plan.

IN WITNESS WHEREOF, this Incentive Stock Option Agreement has been duly executed as of the Grant Date specified above.

| | | | | |

| CINCINNATI FINANCIAL CORPORATION |

| By: |

|

/S/ |

| Title: |

PART II – TERMS AND CONDITIONS

1. Incentive Stock Option. The Company hereby grants to the Participant the right and option to purchase the Shares when and as the Award vests (becomes exercisable) for an exercise price per Share payable by the Participant as specified in Part I-Award Information of this Incentive Stock Option Agreement. This Award is intended to be qualified under and is subject to Section 422 of the Internal Revenue Code.

2. Exercise of Award. The participant may exercise this Award, to the extent it has vested, by giving written or electronic notice to the Company that specifies the number of whole Shares to be purchased (which may not be less than 25, or the remaining option shares outstanding if less than 25), accompanied by payment in full of the applicable exercise price. The payment shall be in cash or its equivalent or by such other method of payment approved by the Committee. The exercise of this Award shall only be effective if the notice to exercise and payment of the exercise price is actually received by the Company while the Award is exercisable as specified in this Agreement. Upon receipt of such notice and payment, Shares in the amount exercised by the Participant will be issued to the Participant and will be evidenced by a stock certificate or by a book entry account maintained by either the Company or its transfer agent for the common stock. If for any reason (such as termination of employment before the Company receives notice and payment in full of the exercise price for reasons other than death, disability or normal retirement) the Award exercise does not become effective, the Company shall refund the amount remitted with the exercise notice in payment for the Shares. This Award shall expire (cease to be exercisable) as of the close of business on the Expiration Date specified in Part I which may not be later than the tenth anniversary of the Grant Date specified in Part I (the “Expiration Time”).

3. Vesting. Subject to Sections 4 and 5 below, the Award shall vest (become exercisable) in installments on the vesting dates set forth in the Award Information (each, a “Vesting Date”), provided that the Participant remains employed by the Company (or a subsidiary of the Company) during the entire period ending on and including the relevant Vesting Date (each a “Restriction Period”) commencing on the Grant Date set forth in the Award Information and ending on the applicable Vesting Date.

4. Participant Death, Disability or Retirement During Restriction Period. In the event of the termination of the Participant’s employment with the Company (and with all subsidiaries of the Company) prior to a Vesting Date due to death, or disability, or upon the Participant reaching eligibility for normal retirement, the Award shall become fully vested on the date of death, disability, or normal retirement. In the case of vesting due to normal retirement or disability, the Award shall remain exercisable until the earlier of (i) the Expiration Time or (ii) 90 days after the date of normal retirement or termination of employment due to disability. In the case of the Participant’s death, the Award shall remain exercisable until the earlier of (x) six months after the date of death or (y) the Expiration Time.

5. Other Termination of Employment During Restriction Period. If the Participant’s employment with the Company (and with all subsidiaries of the Company) is terminated for any reason other than death, disability or normal retirement, the remaining options granted in the Award, whether vested or unvested, shall be forfeited.

6. Shareholder Rights. The Participant shall not have the right to vote any Shares or to receive any cash dividends or dividend equivalents payable with respect to any Shares, or otherwise have any rights as a shareholder with respect to any Shares, unless and until the Shares have actually been issued to the Participant hereunder upon the exercise of the Award as provided in this Agreement.

7. Transfer Restrictions. This Award is not transferable and may not be assigned, hypothecated or otherwise pledged, except by designating a beneficiary, or by will or the laws of descent and distribution, and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition or upon the levy of any such process, the Award shall immediately become null and void and shall be forfeited.

8. Death of Participant. If the Award shall vest upon the death of the Participant, the Award shall be registered in the name of (and shall be exercisable by) the estate of the Participant, except that, if the Participant has designated a beneficiary, the Shares shall be registered in the name of the designated beneficiary.

9. Other Terms and Provisions. The terms and provisions of the Plan (a copy of which will be furnished to the Participant upon written request) are incorporated herein by reference. To the extent any provision of this Award is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern. For purposes of this Agreement, (a) the term “Disability” means permanent and total disability as determined under procedures established by the Company from time to time, and (b) the term “Normal Retirement” means (i) retirement from active employment with at least 35 years of service with the Company or its subsidiaries, or (ii) otherwise under a retirement plan of or employment contract with the Company or any subsidiary on or after the date specified as the normal retirement age in the pension plan or employment contract, if any, under which the Participant is at that time accruing retirement benefits for his or her current service (or, in the absence of a specified normal retirement age in the plan or contract, the age at which retirement benefits under such plan or contract become payable without reduction for early commencement and without any requirement of a particular period of prior service). In any case in which either the meaning of “Normal Retirement” is uncertain under the definition contained in the prior sentence or a termination of employment at or after age 65 would not otherwise constitute “Normal Retirement,” a termination of the Participant’s employment shall be treated as a “Normal Retirement” under such circumstances as the Committee, in its sole discretion, deems equivalent to retirement. In any case in which the existence of a “Disability” is uncertain under the applicable definition and procedures hereunder, a final and binding determination shall be made by the Committee in its sole discretion.

CINCINNATI FINANCIAL CORPORATION

P.O. BOX 145496

CINCINNATI, OH 45250-5496

513-870-2696

NONQUALIFIED STOCK OPTION AGREEMENT

PART I – AWARD INFORMATION

Participant Name: Plan:

Grant Date: Expiration Date:

Grant Amount: Vesting Schedule:

Grant Type:

Exercise Price Per Share:

CINCINNATI FINANCIAL CORPORATION (the "Company") hereby grants to the associate identified above (the "Participant") a Nonqualified Stock Option (the "Award") under the Company's 2024 Stock Compensation Plan (the "Plan") with respect to the number of Shares of the Company's Common Stock (the "Shares") specified under Part I – Award Information ("Award Information") above, all in accordance with and subject to the provisions set forth in Part II - Terms and Conditions.

THIS AWARD IS SUBJECT TO FORFEITURE AS PROVIDED IN THIS NONQUALIFIED STOCK OPTION AGREEMENT AND THE PLAN.

By accepting this Award, the Participant acknowledges the receipt of a copy of this Nonqualified Stock Option Agreement (including Part II – Terms and Conditions) and a copy of the Prospectus and agrees to be bound by all the terms and provisions contained in them and in the Plan.

IN WITNESS WHEREOF, this Nonqualified Stock Option Agreement has been duly executed as of the Grant Date specified above.

| | | | | |

| CINCINNATI FINANCIAL CORPORATION |

| By: |

|

/S/ |

| Title: |

PART II – TERMS AND CONDITIONS

1. Nonqualified Stock Option. The Company hereby grants to the Participant the right and option to purchase the Shares when and as the Award vests (becomes exercisable) for an exercise price per Share payable by the Participant as specified in the Award Information of this Nonqualified Stock Option Agreement. This Award is not qualified under or subject to Section 422 of the Internal Revenue Code.

2. Exercise of Award. The participant may exercise this Award, to the extent it has vested, by giving written or electronic notice to the Company that specifies the number of whole Shares to be purchased (which may not be less than 25, or the remaining option shares outstanding if less than 25), accompanied by payment in full of the applicable exercise price. The method of payment shall be in the discretion of the Committee in the form of (i) cash or its equivalent; (ii) tender (by actual delivery of shares or by attestation) of previously acquired Shares (owned for at least six months prior to the date of exercise) having an aggregate fair market value at the time of exercise equal to the total option exercise price; (iii) a combination of (i) or (ii); or (iv) such other method approved by the Committee. The exercise of this Award shall only be effective if the notice to exercise and payment of the exercise price is actually received by the Company while the Award is exercisable as specified in this Agreement. Upon receipt of such notice and payment, Shares in the amount exercised by the Participant will be issued to the Participant and will be evidenced by a stock certificate or by a book entry account maintained by either the Company or its transfer agent for the common stock. If for any reason (such as termination of employment before the Company receives notice and payment in full of the exercise price for reasons other than death, disability or normal retirement) the Award exercise does not become effective, the Company shall refund the amount remitted with the exercise notice in payment for the Shares. This Award shall expire (cease to be exercisable) as of the close of business on the Expiration Date specified in Part I, which may not be later than the tenth anniversary of the Grant Date specified in Part I (the “Expiration Time”).

3. Vesting. Subject to Sections 4 and 5 below, the Award shall vest (become exercisable) in installments on the vesting dates set forth in the Award Information (each, a “Vesting Date”), provided that the Participant remains employed by the Company (or a subsidiary of the Company) during the entire period ending on and including the relevant Vesting Date (each a “Restriction Period”) commencing on the Grant Date set forth in the Award Information and ending on the applicable Vesting Date.

4. Participant Death, Disability or Retirement During Restriction Period. In the event of the termination of the Participant’s employment with the Company (and with all subsidiaries of the Company) prior to a Vesting Date due to death, or disability, or upon the Participant reaching eligibility for normal retirement, the Award shall become fully vested on the date of death, disability, or normal retirement. In the case of vesting due to normal retirement or disability, the Award shall remain exercisable until the earlier of (i) the Expiration Time or (ii) five years after the date of normal retirement or termination of employment due to disability. In the case of the Participant’s death at any time before or after termination due to normal retirement or disability, the Award shall remain exercisable until the earlier of six months after the date of death or the Expiration Time.

5. Other Termination of Employment During Restriction Period. If the Participant’s employment with the Company (and with all subsidiaries of the Company) is terminated for any reason other than death, disability or normal retirement, the remaining options granted in the Award, whether vested or unvested, shall be forfeited.

6. Shareholder Rights. The Participant shall not have the right to vote any Shares or to receive any cash dividends or dividend equivalents payable with respect to any Shares, or otherwise have any rights as a

shareholder with respect to any Shares, unless and until the Shares have actually been issued to the Participant hereunder upon the exercise of the Award as provided in this Agreement.

7. Transfer Restrictions. This Award is not transferable and may not be assigned, hypothecated or otherwise pledged, except by designating a beneficiary or by will or the laws of descent and distribution, and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition, or upon the levy of any such process, the Award shall immediately become null and void and shall be forfeited.

8. Death of Participant. If the Award shall vest upon the death of the Participant, the Award shall be registered in the name of (and shall be exercisable by) the estate of the Participant, except that, if the Participant has designated a beneficiary, the Shares shall be registered in the name of the designated beneficiary.

9. Withholding Taxes. The Company is authorized to satisfy the actual minimum statutory withholding taxes arising from the exercise of this Option, by deducting the number of Shares having an aggregate value equal to the amount of withholding taxes due from the total number of Shares that would otherwise be issuable upon exercise of the Option. Shares deducted in satisfaction of actual minimum withholding tax requirements shall be valued at the fair market value of the Shares on the dates as of which the amount giving rise to the withholding requirement first became includible in the gross income of the Participant under applicable tax laws.

10. Other Terms and Provisions. The terms and provisions of the Plan (a copy of which will be furnished to the Participant upon written request) are incorporated herein by reference. To the extent any provision of this Award is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern. For purposes of this Agreement, (a) the term “Disability” means permanent and total disability as determined under procedures established by the Company from time to time, and (b) the term “Normal Retirement” means (i) retirement from active employment with at least 35 years of service with the Company or its subsidiaries, or (ii) otherwise under a retirement plan of or employment contract with the Company or any subsidiary on or after the date specified as the normal retirement age in the pension plan or employment contract, if any, under which the Participant is at that time accruing retirement benefits for his or her current service (or, in the absence of a specified normal retirement age in the plan or contract, the age at which retirement benefits under such plan or contract become payable without reduction for early commencement and without any requirement of a particular period of prior service). In any case in which either the meaning of “Normal Retirement” is uncertain under the definition contained in the prior sentence or a termination of employment at or after age 65 would not otherwise constitute “Normal Retirement,” a termination of the Participant’s employment shall be treated as a “Normal Retirement” under such circumstances as the Committee, in its sole discretion, deems equivalent to retirement. In any case in which the existence of a “Disability” is uncertain under the applicable definition and procedures hereunder, a final and binding determination shall be made by the Committee in its sole discretion.

CINCINNATI FINANCIAL CORPORATION

P.O. BOX 145496

CINCINNATI, OH 45250-5496

513-870-2696

RESTRICTED STOCK UNIT AGREEMENT

SERVICE BASED/CLIFF

PART I – AWARD INFORMATION

Participant Name: Plan:

Grant Date: Vesting Date:

Grant Amount:

Grant Type:

CINCINNATI FINANCIAL CORPORATION (the "Company") hereby grants to the associate identified above (the "Participant") a Restricted Stock Unit Award (the "Award") under the Company's 2024 Stock Compensation Plan (the "Plan") with respect to the number of Restricted Stock Units (the "Units") specified under Part I – Award Information ("Award Information") above, all in accordance with and subject to the provisions set forth in Part II –Terms and Conditions.

THIS AWARD IS SUBJECT TO FORFEITURE AS PROVIDED IN THIS RESTRICTED STOCK UNIT AGREEMENT AND THE PLAN.

By accepting this Award, the Participant acknowledges the receipt of a copy of this Restricted Stock Unit Agreement (including Part II – Terms and Conditions) and a copy of the Prospectus and agrees to be bound by all the terms and provisions contained in them and in the Plan.

IN WITNESS WHEREOF, this Restricted Stock Unit Agreement has been duly executed as of the Award Date specified above.

| | | | | |

| CINCINNATI FINANCIAL CORPORATION |

| By: |

|

/S/ |

| Title: |

PART II – TERMS AND CONDITIONS

1. Restricted Stock Units. Each Unit represents a hypothetical share of the Company's common stock (the "Shares"), and each Unit will at all times be equal in value to one Share. The Units will be credited to the Participant in an account established for the Participant and maintained by either the Company or its transfer agent. If and when Units vest as provided below, Shares in an amount equal to the number of vested Units will automatically be issued by crediting the Participant’s account.

2. Restrictions. Subject to Sections 3 and 4 below, the restrictions on the Units specified in the Award Information shall lapse and such Units shall vest on the vesting date set forth in Part I (the “Vesting Date”), provided the Participant remains an employee of the Company (or a subsidiary of the Company) during the entire period commencing on the Award Date set forth in Part I and ending on and including the Vesting Date (the “Restriction Period”) . Upon vesting, one Share shall be issued with respect to each vested Unit.

3. Participant Death, Disability or Retirement During Restriction Period. In the event of the termination of the Participant’s employment with the Company (and with all subsidiaries of the Company) prior to a Vesting Date due to death, or disability, or upon the Participant reaching eligibility for normal retirement, all restrictions on the Units shall lapse, all of the Units shall become fully vested on the date of death, disability, or normal retirement, and one Share shall be issued with respect to each such vested Unit.

4. Other Termination of Employment During Restriction Period. If the Participant's employment with the Company (and with all subsidiaries of the Company) is terminated for any reason other than death, disability or normal retirement prior to the end of a Restriction Period, the Participant shall forfeit all rights to any Units (and to the related Shares) as to which a Vesting Date has not yet occurred. Notwithstanding the foregoing, the compensation committee of the board of directors of the Company may, in its sole discretion, waive the restrictions on, and the vesting requirements for, the Units.

5. Shareholder Rights. The Participant shall not have the right to vote any Shares or to receive any cash dividends or dividend equivalents payable with respect to any Shares, or otherwise have any rights as a shareholder with respect to any Shares, unless and until the Shares have actually been issued to the Participant hereunder upon the vesting of Units as provided in this Agreement.

6. Transfer Restrictions. This Award and the Units (until they vest pursuant to the terms hereof and Shares are issued with respect thereto) are not transferable and may not be assigned, hypothecated or otherwise pledged, except by designating a beneficiary, or by will or the laws of descent and distribution, and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition, or upon the levy of any such process, the Award shall immediately become null and void and the Units shall be forfeited.

7. Withholding Taxes. The Company is authorized to satisfy the actual minimum statutory withholding taxes arising from the vesting of this Award, as the case may be by deducting the number of Shares having an aggregate value equal to the amount of withholding taxes due from the total number of Shares that would otherwise be issuable upon any Units vesting or otherwise becoming subject to current taxation. Shares deducted from this Award in satisfaction of actual minimum withholding tax requirements shall be valued at the fair market value of the Shares on the first trading date prior to the Vesting Date.

8. Death of Participant. If any of the Units shall vest upon the death of the Participant, the Shares issued as a result of such vesting shall be registered in the name of the estate of the Participant, except that, if the Participant has designated a beneficiary, the Shares shall be registered in the name of the designated beneficiary.\

9. Other Terms and Provisions. The terms and provisions of the Plan (a copy of which will be furnished to the Participant upon written request) are incorporated herein by reference. To the extent any provision of this Award is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern. For purposes of this Agreement, (a) the term “Disability” means permanent and total disability as determined under

procedures established by the Company from time to time, and (b) the term “Normal Retirement” means retirement from active employment with at least 35 years of service with the Company or its subsidiaries or otherwise under a retirement plan of the Company or any subsidiary or under an employment contract with any of them on or after the date specified as the normal retirement age in the pension plan or employment contract, if any, under which the Participant is at that time accruing retirement benefits for his or her current service (or, in the absence of a specified normal retirement age, the age at which retirement benefits under such plan or contract become payable without reduction for early commencement and without any requirement of a particular period of prior service). In any case in which (i) the meaning of “Normal Retirement” is uncertain under the definition contained in the prior sentence or (ii) a termination of employment at or after age 65 would not otherwise constitute “Normal Retirement,” a termination of the Participant's employment shall be treated as a “Normal Retirement” under such circumstances as the Committee, in its sole discretion, deems equivalent to retirement. In any case in which the existence of a “Disability” is uncertain under the applicable definition and procedures hereunder, a final and binding determination shall be made by the Committee in its sole discretion.

CINCINNATI FINANCIAL CORPORATION

P.O. BOX 145496

CINCINNATI, OH 45250-5496

(513) 870-2696

RESTRICTED STOCK UNIT AGREEMENT

SERVICE-BASED/RATABLE

PART I. AWARD INFORMATION

| | | | | |

| Participant Name: | Vesting Date Schedule: |

| Grant Date: | # units vest on [Date] |

Grant Amount: | # units vest on [Date] |

| Grant Type: | # units vest on [Date] |

CINCINNATI FINANCIAL CORPORATION (the "Company") hereby grants to the associate identified below (the "Participant") a Restricted Stock Unit Award (the "Award") under the Company's 2024 Stock Compensation Plan (the "Plan") with respect to the number of Restricted Stock Units (the "Units") specified under Part I – Award Information ("Award Information") above, all in accordance with and subject to the provisions set forth in Part II--Terms and Conditions.

THIS AWARD IS SUBJECT TO FORFEITURE AS PROVIDED IN THIS RESTRICTED STOCK UNIT AGREEMENT AND THE PLAN.

By accepting this Award, the Participant acknowledges the receipt of a copy of this Restricted Stock Unit Agreement (including Part II -- Terms and Conditions) and a copy of the Prospectus and agrees to be bound by all the terms and provisions contained in them and in the Plan.

IN WITNESS WHEREOF, this Restricted Stock Unit Agreement has been duly executed as of the Award Date specified below.

| | | | | |

| CINCINNATI FINANCIAL CORPORATION |

| By: |

|

/S/ |

| Title: |

PART II. TERMS AND CONDITIONS

1. Restricted Stock Units. Each Unit represents a hypothetical share of the Company's Common Stock (the "Shares"), and each Unit will at all times be equal in value to one Share. The Units will be credited to the Participant in an account established for the Participant and maintained by either the Company or its transfer agent. If and when Units vest as provided below, Shares in an amount equal to the number of vested Units will automatically be issued by crediting the Participant’s account.

2. Restrictions. Subject to Sections 3 and 4 below, the restrictions on the Units specified in the Award Information shall lapse and such Unit shall vest on the vesting date set forth in the Vesting Date Schedule of Part I (each “Vesting Date”), provided the Participant remains an employee of the Company (or a subsidiary of the Company) during the entire period commencing on the Award Date set forth in Part I and ending on and including a Vesting Date (the “Restriction Period”). Upon vesting, one Share shall be issued with respect to each vested Unit.

3. Participant Death or Disability During Restriction Period. In the event of the termination of the Participant’s employment with the Company (and with all subsidiaries of the Company) prior to a Vesting Date due to death or Disability all restrictions on the Units shall lapse, all of the Units shall become fully vested on the date of death or Disability, and one Share shall be issued with respect to each such vested Unit.

4. Other Termination of Employment During Restriction Period. If the Participant's employment with the Company (and with all subsidiaries of the Company) is terminated for any reason other than death or Disability prior to the end of a Restriction Period, the Participant shall forfeit all rights to any Units (and to the related Shares) as to which a Vesting Date has not yet occurred. Notwithstanding the foregoing, the Compensation Committee of the Board of Directors of the Company may, in its sole discretion, waive the restrictions on, and the vesting requirements for, the Units.

5. Shareholder Rights. The Participant shall not have the right to vote any Shares or to receive any cash dividends or dividend equivalents payable with respect to any Shares, or otherwise have any rights as a shareholder with respect to any Shares, unless and until the Shares have actually been issued to the Participant hereunder upon the vesting of Units as provided in this Agreement.

6. Transfer Restrictions. This Award and the Units (until they vest pursuant to the terms hereof and Shares are issued with respect thereto) are non-transferable and may not be assigned, hypothecated or otherwise pledged, except by will or the laws of descent and distribution, and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition, or upon the levy of any such process, the Award shall immediately become null and void and the Units shall be forfeited.

7. Withholding Taxes. The Company is authorized to satisfy the actual minimum statutory withholding taxes arising from the vesting of this Award, as the case may be by deducting the number of Shares having an aggregate value equal to the amount of withholding taxes due from the total number of Shares that would otherwise be issuable upon any Units vesting or otherwise becoming subject to current taxation. Shares deducted from this Award in satisfaction of actual minimum withholding tax requirements shall be valued at the Fair Market Value of the Shares on the first trading date prior to the Vesting Date.

8. Death of Participant. If any of the Units shall vest upon the death of the Participant, the Shares issued as a result of such vesting shall be registered in the name of the estate of the Participant except that, if the Participant has designated a beneficiary, the Shares shall be registered in the name of the designated beneficiary.

9. Other Terms and Provisions. The terms and provisions of the Plan (a copy of which will be furnished to the Participant upon written request) are incorporated herein by reference. To the extent any provision of this Award is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern. For purposes of this Agreement, the term “Disability” means permanent and total disability as determined under procedures established by the Company from time to time. In any case in which the existence of a “Disability” is uncertain under the applicable definition and procedures hereunder, a final and binding determination shall be made by the Committee in its sole discretion.

CINCINNATI FINANCIAL CORPORATION

P.O. BOX 145496

CINCINNATI, OH 45250-5496

513-870-2696

RESTRICTED STOCK UNIT AGREEMENT

PERFORMANCE BASED

Cincinnati Financial Corporation (the “Company”) hereby grants to the associate identified below (the “Participant”) a Restricted Stock Unit Award (the “Award”) under the Company's 2024 Stock Compensation Plan (the “Plan”) with respect to the number of Restricted Stock Units (the “Units”) specified under the “Award Information” section below, all in accordance with and subject to the provisions set forth in Part II – Terms and Conditions.

PART I – AWARD INFORMATION:

Participant Name: ___________

Maximum Number of Units Awarded: ________

Award Date: ________

Vesting Criteria (when Units granted in the Award vest and shares are issued to the Participant):

Units will vest on [Vesting Date] according to the following schedule for threshold, target and maximum awards upon achievement of the applicable performance target. The performance target shall be measured based on [Performance metric used]1 for the Company compared to the Company’s Peer Group for the three calendar years ending ______________. Any member of the peer group that no longer exists as a separate reporting entity at the end of the performance period shall be excluded for purposes of calculations hereunder.

| | | | | | | | |

| Vesting Level | Performance Target | Number of Units |

| Threshold | [Performance metric used] for Company exceeds the ___ percentile of total shareholder return for the peer group, but is less than the ___ percentile for peer group. | ___________________ |

| Target | [Performance metric used] for Company equals or exceeds the ____ percentile of [performance metric used] for the peer group, but is less than the ___ percentile of the peer group. | ___________________ |

| Maximum | [Performance metric used] for the Company equals or exceeds the ____ percentile of [performance metric used] for the peer group. | ___________________ |

THIS AWARD IS SUBJECT TO RECOUPMENT AND FORFEITURE AS PROVIDED IN THIS RESTRICTED STOCK UNIT AGREEMENT, THE PLAN, AND THE COMPANY’S POLICY FOR THE RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION, THE TERMS OF WHICH ARE INCORPORATED HEREIN BY REFERENCE AND WHICH THE PARTICIPANT EXPRESSLY ACCEPTS AND CONFIRMS SEPARATE ACKNOWLEDGMENT, AND OTHER POLICIES IN EFFECT FROM TIME TO TIME WITH RESPECT TO FORFEITURE AND RECOUPMENT OF INCENTIVE COMPENSATION.

By accepting this Award, the Participant acknowledges the receipt of a copy of this Restricted Stock Unit Agreement (including Part II – Terms and Conditions) and a copy of the Prospectus and agrees to be bound by all the terms and provisions contained in them and in the Plan.

IN WITNESS WHEREOF, this Restricted Stock Unit Agreement has been duly executed as of the Award Date specified above.

| | | | | |

| CINCINNATI FINANCIAL CORPORATION |

| By: |

|

/S/ |

| Title: |

1 [Description of performance metric used]

PART II – TERMS AND CONDITIONS

1. Restricted Stock Units. Each Unit represents a hypothetical share of the Company's common stock (the "Shares"), and each Unit will at all times be equal in value to one Share. The Units will be credited to the Participant in an account established for the Participant and maintained by either the Company or its transfer agent. If and when Units vest as provided below, Shares in an amount equal to the number of vested Units will automatically be issued by crediting the Participant’s account.

2. Restrictions. Subject to Sections 3 and 4 below, the restrictions on the Units specified in Part I -- Award Information (the “Award Information”) shall lapse and such Units shall vest on the vesting dates set forth in the Award Information (the “Vesting Date”), provided that: (a) the Performance Target has been met; and (b) the Participant remains an employee of the Company (or a subsidiary of the Company) during the entire period commencing on the Award Date set forth in Part I and ending on and including the Vesting Date (the “Restriction Period”) . Upon vesting, one Share shall be issued with respect to each vested Unit.

3. Participant Death, Disability or Retirement During Restriction Period. In the event of the termination of the Participant’s employment with the Company (and with all subsidiaries of the Company) prior to a Vesting Date due to (a) death or disability, the attainment of the Performance Target is waived, all restrictions on the Units shall lapse, and all of the Units shall become fully vested on the date of death or disability, or (b) the Participant reaching eligibility for normal retirement, restriction 2(b) concerning continuous employment during the Restriction Period is waived and shall lapse and the Units shall remain subject to all other vesting requirements and restrictions including the Vesting Date. Upon vesting, one Share shall be issued with respect to each such vested Unit.

4. Other Termination of Employment During Restriction Period. If the Participant's employment with the Company (and with all subsidiaries of the Company) is terminated for any reason other than death, disability or normal retirement prior to the end of the Restriction Period, the Participant shall forfeit all rights to any Units (and to the related Shares) as to which the Vesting Date has not yet occurred. Notwithstanding the foregoing, the compensation committee of the board of directors of the Company may, in its sole discretion, waive the restrictions on, and the vesting requirements for, the Units.

5. Shareholder Rights. The Participant shall not have the right to vote any Shares or to receive any cash dividends or dividend equivalents payable with respect to any Shares, or otherwise have any rights as a shareholder with respect to any Shares, unless and until the Shares have actually been issued to the Participant hereunder upon the vesting of Units as provided in this Agreement.

6. Transfer Restrictions. This Award and the Units (until they vest pursuant to the terms hereof and Shares are issued with respect thereto) are not transferable and may not be assigned, hypothecated or otherwise pledged, except by designating a beneficiary, or by will or the laws of descent and distribution, and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition, or upon the levy of any such process, the Award shall immediately become null and void and the Units shall be forfeited.

7. Withholding Taxes. The Company is authorized to satisfy the actual minimum statutory withholding taxes arising from the vesting of this Award, by deducting the number of Shares having an aggregate value equal to the amount of withholding taxes due from the total number of Shares that would otherwise be issuable upon any Units vesting or otherwise becoming subject to current taxation. Shares deducted from this Award in satisfaction of actual minimum withholding tax requirements shall be valued at the fair market value of the Shares on the first trading date prior to the Vesting Date.

8. Death of Participant. If any of the Units shall vest upon the death of the Participant, the Shares issued as a result of such vesting shall be registered in the name of the estate of the Participant except that, if the Participant has designated a beneficiary, the Shares shall be registered in the name of the designated beneficiary.

9. Other Terms and Provisions. The terms and provisions of the Plan (a copy of which will be furnished to the Participant upon written request) are incorporated herein by reference. To the extent any provision of this Award is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern. For purposes of this Agreement, (a) the term “Disability” means permanent and total disability as determined under procedures established by the Company from time to time, and (b) the term “Normal Retirement” means retirement from active employment with at least 35 years of service with the Company or its subsidiaries or otherwise under a retirement plan of the Company or any subsidiary or under an employment contract with any of them on or after the date specified as the normal retirement age in the pension plan or employment contract, if any, under which the Participant is at that time accruing retirement benefits for his or her current service (or, in the absence of a specified normal retirement age, the age at which retirement benefits under such plan or contract become payable without reduction for early commencement and without any requirement of a particular period of prior service). In any case in which (i) the meaning of “Normal Retirement” is uncertain under the definition contained in the prior sentence or (ii) a termination of employment at or after age 65 would not otherwise constitute “Normal Retirement,” a termination of the Participant's employment shall be treated as a “Normal Retirement” under such circumstances as the Committee, in its sole discretion, deems equivalent to retirement. In any case in which the existence of a “Disability” is uncertain under the applicable definition and procedures hereunder, a final and binding determination shall be made by the Committee in its sole discretion.

| | | | | | | | |

| | The Cincinnati Insurance Company n The Cincinnati Indemnity Company The Cincinnati Casualty Company n The Cincinnati Specialty Underwriters Insurance Company The Cincinnati Life Insurance Company n CFC Investment Company n CSU Producer Resources Inc. Cincinnati Global Underwriting Ltd. n Cincinnati Global Underwriting Agency Ltd. |

Investor Contact: Dennis E. McDaniel, 513-870-2768

CINF-IR@cinfin.com

Media Contact: Betsy E. Ertel, 513-603-5323

Media_Inquiries@cinfin.com

Cincinnati Financial Corporation Increases Regular Quarterly Cash Dividend

Cincinnati, January 31, 2025 – Cincinnati Financial Corporation (Nasdaq: CINF) announced that at today’s regular meeting, the board of directors declared an 87-cents-per-share regular quarterly cash dividend, increasing by 7% from the previous 81-cents-per-share dividend paid on January 15, 2025. The dividend is payable April 15, 2025, to shareholders of record as of March 24, 2025.

Stephen M. Spray, president and chief executive officer, commented, “For 75 years we’ve focused on building financial strength to meet our insurance obligations, while also creating value for shareholders that we partially return through dividend payments. Today we are simultaneously delivering on these commitments. As we are helping policyholders in California begin to rebuild their lives, our board of directors expressed their ongoing confidence in our overall financial position by increasing our dividend and setting the stage for a 65th consecutive year of dividend increases.

“While no one ever expects to experience the kind of devastation brought on by the recent California wildfires, we know it is why people buy insurance and we are responding. The financial effects of these wildfire losses will have a material effect on earnings for the first quarter of 2025. It will take additional time for us to analyze claim information and provide a meaningful estimate of losses. We take the responsibility of paying our claims seriously and manage our capital to ensure we have ample capacity to absorb insured losses and pay dividends.”

About Cincinnati Financial

Cincinnati Financial Corporation offers primarily business, home and auto insurance through The Cincinnati Insurance Company and its two standard market property casualty companies. The same local independent insurance agencies that market those policies may offer products of our other subsidiaries, including life insurance, fixed annuities and surplus lines property and casualty insurance. For additional information about the company, please visit cinfin.com.

Mailing Address: Street Address:

P.O. Box 145496 6200 South Gilmore Road

Cincinnati, Ohio 45250-5496 Fairfield, Ohio 45014-5141

Safe Harbor Statement

This is our “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995. Our business is subject to certain risks and uncertainties that may cause actual results to differ materially from those suggested by the forward-looking statements in this report. Some of those risks and uncertainties are discussed in our 2023 Annual Report on Form 10-K, Item 1A, Risk Factors, Page 30.

Factors that could cause or contribute to such differences include, but are not limited to:

•Effects of any future pandemic that could affect results for reasons such as:

•Securities market disruption or volatility and related effects such as decreased economic activity and continued supply chain disruptions that affect our investment portfolio and book value

•An unusually high level of claims in our insurance or reinsurance operations that increase litigation-related expenses

•An unusually high level of insurance losses, including risk of court decisions extending business interruption insurance in commercial property coverage forms to cover claims for pure economic loss related to such pandemic

•Decreased premium revenue and cash flow from disruption to our distribution channel of independent agents, consumer self-isolation, travel limitations, business restrictions and decreased economic activity

•Inability of our workforce, agencies or vendors to perform necessary business functions

•Unusually high levels of catastrophe losses due to risk concentrations, changes in weather patterns (whether as a result of climate change or otherwise), environmental events, war or political unrest, terrorism incidents, cyberattacks, civil unrest or other causes and our ability to manage catastrophe models or incomplete data

•Increased frequency and/or severity of claims or development of claims that are unforeseen at the time of policy issuance, due to inflationary trends or other causes

•Inadequate estimates or assumptions, or reliance on third-party data used for critical accounting estimates

•Declines in overall stock market values negatively affecting our equity portfolio and book value

•Interest rate fluctuations or other factors that could significantly affect:

•Our ability to generate growth in investment income

•Values of our fixed-maturity investments, including accounts in which we hold bank-owned life insurance contract assets

•Our traditional life policy reserves

•Domestic and global events, such as the wars in Ukraine and in the Middle East and disruptions in the banking and financial services industry, resulting in insurance losses, capital market or credit market uncertainty, followed by prolonged periods of economic instability or recession, that lead to:

•Significant or prolonged decline in the fair value of a particular security or group of securities and impairment of the asset(s)

•Significant decline in investment income due to reduced or eliminated dividend payouts from a particular security or group of securities

•Significant rise in losses from surety or director and officer policies written for financial institutions or other insured entities or in losses from policies written by Cincinnati Re or Cincinnati Global

•Our inability to manage business opportunities, growth prospects, and expenses for our ongoing operations

•Recession, prolonged elevated inflation or other economic conditions resulting in lower demand for insurance products or increased payment delinquencies

•Ineffective information technology systems or discontinuing to develop and implement improvements in technology may impact our success and profitability

•Difficulties with technology or data security breaches, including cyberattacks, that could negatively affect our or our agents’ ability to conduct business; disrupt our relationships with agents, policyholders and others; cause reputational damage, mitigation expenses and data loss and expose us to liability

•Difficulties with our operations and technology that may negatively impact our ability to conduct business, including cloud-based data information storage, data security, cyberattacks, remote working capabilities, and/or outsourcing relationships and third-party operations and data security

•Disruption of the insurance market caused by technology innovations such as driverless cars that could decrease consumer demand for insurance products

•Delays, inadequate data developed internally or from third parties, or performance inadequacies from ongoing development and implementation of underwriting and pricing methods, including telematics and other usage-based insurance methods, or technology projects and enhancements expected to increase our pricing accuracy, underwriting profit and competitiveness

•Intense competition, and the impact of innovation, artificial intelligence and changing customer preferences on the insurance industry and the markets in which we operate, could harm our ability to maintain or increase our business volumes and profitability

•Changing consumer insurance-buying habits

•Mergers, acquisitions and other consolidations of agencies that result in a concentration of a significant amount of premium in one agency group and/or alter our competitive advantages

•Inability to obtain adequate ceded reinsurance on acceptable terms, amount of reinsurance coverage purchased, financial strength of reinsurers and the potential for nonpayment or delay in payment by reinsurers

•Inability to defer policy acquisition costs for any business segment if pricing and loss trends would lead management to conclude that segment could not achieve sustainable profitability

•Inability of our subsidiaries to pay dividends consistent with current or past levels

•Events or conditions that could weaken or harm our relationships with our independent agencies and hamper opportunities to add new agencies, resulting in limitations on our opportunities for growth, such as:

•Downgrades of our financial strength ratings

•Concerns that doing business with us is too difficult

•Perceptions that our level of service, particularly claims service, is no longer a distinguishing characteristic in the marketplace

•Inability or unwillingness to nimbly develop and introduce coverage product updates and innovations that our competitors offer and consumers expect to find in the marketplace

•Actions of insurance departments, state attorneys general or other regulatory agencies, including a change to a federal system of regulation from a state-based system, that:

•Impose new obligations on us that increase our expenses or change the assumptions underlying our critical accounting estimates

•Place the insurance industry under greater regulatory scrutiny or result in new statutes, rules and regulations

•Restrict our ability to exit or reduce writings of unprofitable coverages or lines of business

•Add assessments for guaranty funds, other insurance‑related assessments or mandatory reinsurance arrangements; or that impair our ability to recover such assessments through future surcharges or other rate changes

•Increase our provision for federal income taxes due to changes in tax law

•Increase our other expenses

•Limit our ability to set fair, adequate and reasonable rates

•Place us at a disadvantage in the marketplace

•Restrict our ability to execute our business model, including the way we compensate agents

•Adverse outcomes from litigation or administrative proceedings, including effects of social inflation and third-party litigation funding on the size of litigation awards

•Events or actions, including unauthorized intentional circumvention of controls, that reduce our future ability to maintain effective internal control over financial reporting under the Sarbanes-Oxley Act of 2002

•Unforeseen departure of certain executive officers or other key employees due to retirement, health or other causes that could interrupt progress toward important strategic goals or diminish the effectiveness of certain longstanding relationships with insurance agents and others

•Our inability, or the inability of our independent agents, to attract and retain personnel in a competitive labor market

•Events, such as an epidemic, natural catastrophe or terrorism, that could hamper our ability to assemble our workforce at our headquarters location or work effectively in a remote environment

Further, our insurance businesses are subject to the effects of changing social, global, economic and regulatory environments. Public and regulatory initiatives have included efforts to adversely influence and restrict premium rates, restrict the ability to cancel policies, impose underwriting standards and expand overall regulation. We also are subject to public and regulatory initiatives that can affect the market value for our common stock, such as measures affecting corporate financial reporting and governance. The ultimate changes and eventual effects, if any, of these initiatives are uncertain.

***

| | | | | | | | |

| | The Cincinnati Insurance Company n The Cincinnati Indemnity Company The Cincinnati Casualty Company n The Cincinnati Specialty Underwriters Insurance Company The Cincinnati Life Insurance Company n CFC Investment Company n CSU Producer Resources Inc. Cincinnati Global Underwriting Ltd. n Cincinnati Global Underwriting Agency Ltd. |

Investor Contact: Dennis E. McDaniel, 513-870-2768

CINF-IR@cinfin.com

Media Contact: Betsy E. Ertel, 513-603-5323

Media_Inquiries@cinfin.com

Cincinnati Financial Corporation and Subsidiaries Recognize

Promotions and Appointments

Cincinnati, January 31, 2025 – Cincinnati Financial Corporation (Nasdaq: CINF) announced today that on January 31, 2025, its U.S. subsidiary companies held their regular shareholder and board meetings, re-electing incumbent directors and appointing corporate officers.

In addition:

•Sean M. Givler, CIC, CRM, was promoted to executive vice president and elected to the board of The Cincinnati Life Insurance Company.

•Will Van Den Heuvel was promoted to executive vice president and elected to the board of the company’s insurance brokerage subsidiary, CSU Producer Resources Inc.

•Dawn S. Chapel, CPCU, RPLU+, AIM, AIS, CRIS, APA, ARe, ASLI, AU, was promoted to senior vice president – Excess & Surplus Lines, named an executive officer and elected to the boards of all property casualty insurance subsidiaries and the insurance brokerage.

•Scott A. Schuler was promoted to senior vice president – Personal Lines, named an executive officer and elected to the boards of all property casualty insurance subsidiaries.

•Chet H. Swisher was promoted to senior vice president – Commercial Lines, named an executive officer and elected to the boards of all standard market property casualty insurance subsidiaries.

About Cincinnati Financial

Cincinnati Financial Corporation offers primarily business, home and auto insurance through The Cincinnati Insurance Company and its two standard market property casualty companies. The same local independent insurance agencies that market those policies may offer products of our other subsidiaries, including life insurance, fixed annuities and surplus lines property and casualty insurance. For additional information about the company, please visit cinfin.com.

Mailing Address: Street Address:

P.O. Box 145496 6200 South Gilmore Road

Cincinnati, Ohio 45250-5496 Fairfield, Ohio 45014-5141

***

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

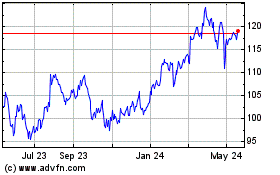

Cincinnati Financial (NASDAQ:CINF)

Historical Stock Chart

From Jan 2025 to Feb 2025

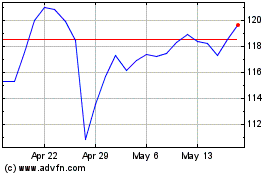

Cincinnati Financial (NASDAQ:CINF)

Historical Stock Chart

From Feb 2024 to Feb 2025