UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d)

OF THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): February 1, 2024

Clover Leaf Capital

Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-40625 |

|

85-2303279 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1450 Brickell Avenue,

Suite 2520

Miami, FL 33131

(Address of principal

executive offices, including zip code)

Registrant’s

telephone number, including area code: (305) 577-0031

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Common Stock, $0.0001 par value and one Right to receive one-eighth (1/8) of one share of Class A Common Stock upon the consummation of an initial business combination |

|

CLOEU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, par value $0.0001 per share |

|

CLOE |

|

The Nasdaq Stock Market LLC |

| Rights, every eight (8) rights entitles the holder to receive one share of Class A Common Stock upon the consummation of an initial business combination |

|

CLOER |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry Into a Material Definitive Agreement.

On February 1, 2024,

Clover Leaf Capital Corp. (“Clover Leaf”), Kustom Entertainment, Inc. (“Kustom Entertainment”) and Digital Ally,

Inc. (“Digital Ally”) entered into an indemnification agreement (the “Indemnification Agreement”), pursuant to

which Kustom Entertainment and Digital Ally agreed to indemnify Clover Leaf and its officers and directors for liabilities incurred in

connection with Digital Ally disclosure incorporated by reference into the Registration Statement or Proxy Statement (each as defined

in the Agreement and Plan of Merger, dated June 1, 2023, between Clover Leaf, Kustom Entertainment, Digital Ally and certain other parties

thereto).

A copy of the Indemnification

Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference, and the foregoing description

of the Indemnification Agreement is qualified in its entirety by reference thereto.

Additional Information and Where to Find

It

In

connection with the business combination between Clover Leaf and Kustom Entertainment (the “Business Combination”), Clover

Leaf has filed a proxy statement and registration statement on Form S-4 (the “Proxy/Registration Statement”) with the SEC

(as defined herein), which includes a preliminary proxy statement to be distributed to holders of Clover Leaf’s common stock in

connection with Clover Leaf’s solicitation of proxies for the vote by Clover Leaf’s stockholders with respect to the Business

Combination and other matters as described in the Proxy/Registration Statement, as well as, a prospectus relating to the offer of the

securities to be issued to Kustom Entertainment’s stockholder in connection with the Business Combination. After the Proxy/Registration

Statement has been declared effective by the SEC, Clover Leaf will mail a definitive proxy statement, to its stockholders. Before making

any voting or investment decision, investors and security holders of Clover Leaf and other interested parties are urged to read the proxy

statement and/or prospectus, any amendments thereto and any other documents filed with the SEC carefully and in their entirety when they

become available because they will contain important information about the Business Combination and the parties to the Business Combination.

Investors and security holders may obtain free copies of the preliminary proxy statement/prospectus and definitive proxy statement/prospectus

(when available) and other documents filed with the U.S. Securities and Exchange Commission (the “SEC”) by Clover Leaf through

the website maintained by the SEC at http://www.sec.gov, or by directing a request to: 1450 Brickell Avenue, Suite 1420, Miami, FL 33131.

Forward-Looking Statements

This

report contains certain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1955. These forward-looking statements include, without limitation, Digital Ally’s, Clover Leaf’s

and Kustom Entertainment’s expectations with respect to the proposed Business Combination between Clover Leaf and Kustom Entertainment,

including statements regarding the benefits of the Business Combination, the anticipated timing of the Business Combination, the implied

valuation of Kustom Entertainment, the products offered by Kustom Entertainment and the markets in which it operates, and Kustom Entertainment’s

projected future results. Words such as “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to significant risks and uncertainties that could cause the actual results to differ materially from the expected

results. Most of these factors are outside of Digital Ally’s, Clover Leaf’s and Kustom Entertainment’s control and are

difficult to predict. Factors that may cause actual future events to differ materially from the expected results, include, but are not

limited to: (i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the

price of Digital Ally’s and Clover Leaf’s securities, (ii) the risk that the Business Combination may not be completed by

Clover Leaf’s business combination deadline, even if extended by its stockholders, (iii) the potential failure to obtain an extension

of the business combination deadline if sought by Clover Leaf; (iv) the failure to satisfy the conditions to the consummation of the Business

Combination, including the adoption of the agreement and plan of merger (“Merger Agreement”) by the stockholders of Clover

Leaf, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi)

the failure to obtain any applicable regulatory approvals required to consummate the Business Combination, (vii) the receipt of an unsolicited

offer from another party for an alternative transaction that could interfere with the Business Combination, (viii) the effect of the announcement

or pendency of the Business Combination on Kustom Entertainment’s business relationships, performance, and business generally, (ix)

the inability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition

and the ability of the post-combination company to grow and manage growth profitability and retain its key employees, (x) costs related

to the Business Combination, (xi) the outcome of any legal proceedings that may be instituted against Kustom Entertainment or Clover Leaf

following the announcement of the proposed Business Combination, (xii) the ability to maintain the listing of Clover Leaf’s securities

on the Nasdaq prior to the Business Combination, (xiii) the ability to implement business plans, forecasts, and other expectations after

the completion of the proposed Business Combination, and identify and realize additional opportunities, (xiv) the risk of downturns and

the possibility of rapid change in the highly competitive industry in which Kustom Entertainment operates, (xv) the risk that demand for

Kustom Entertainment’s services may be decreased due to a decrease in the number of large-scale sporting events, concerts and theater

shows, (xvi) the risk that any adverse changes in Kustom Entertainment’s relationships with buyer, sellers and distribution partners

may adversely affect the business, financial condition and results of operations, (xvii) the risk that changes in Internet search engine

algorithms and dynamics, or search engine disintermediation, or changes in marketplace rules could have a negative impact on traffic for

Kustom Entertainment’s sites and ultimately, its business and results of operations, (xviii) the risk that any decrease in the willingness

of artists, teams and promoters to continue to support the secondary ticket market may result in decreased demand for Kustom Entertainment’s

services, (xix) the risk that Kustom Entertainment is not able to maintain and enhance its brand and reputation in its marketplace, adversely

affecting Kustom Entertainment’s business, financial condition and results of operations, (xx) the risk of the occurrence of extraordinary

events, such as terrorist attacks, disease epidemics or pandemics, severe weather events and natural disasters, (xxi) the risk that because

Kustom Entertainment’s operations are seasonal and its results of operations vary from quarter to quarter and year over year, its

financial performance in certain financial quarters or years may not be indicative of, or comparable to, Kustom Entertainment’s

financial performance in subsequent financial quarters or years, (xxii) the risk that periods of rapid growth and expansion could place

a significant strain on Kustom Entertainment’s resources, including its employee base, which could negatively impact Kustom Entertainment’s

operating results, (xxiii) the risk that Kustom Entertainment may never achieve or sustain profitability, (xxiv) the risk that Kustom

Entertainment may need to raise additional capital to execute its business plan, which many not be available on acceptable terms or at

all; (xxv) the risk that third-parties suppliers and manufacturers are not able to fully and timely meet their obligations, (xxvi) the

risk that Kustom Entertainment is unable to secure or protect its intellectual property, (xxvii) the risk that the post-combination company’s

securities will not be approved for listing on Nasdaq or if approved, maintain the listing and (xxviii) other risks and uncertainties

indicated from time to time in the proxy statement and/or prospectus to be filed relating to the Business Combination. There may be additional

risks that Digital Ally and Kustom Entertainment presently do not know or that Digital Ally and Kustom Entertainment currently believe

are immaterial that could also cause results to differ from those contained in any forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Digital Ally,

Kustom Entertainment and Clover Leaf assume no obligation and do not intend to update or revise these forward-looking statements, whether

as a result of new information, future events, or otherwise.

The

foregoing list of factors is not exhaustive. Recipients should carefully consider such factors, with respect to the proposed Business

Combination, and the other risks and uncertainties described and to be described in the “Risk Factors” section of Clover Leaf’s

Annual Report on Form 10-K filed for the year ended December 31, 2022 filed with the SEC on April 14, 2023 and subsequent periodic reports

filed by Clover Leaf with the SEC, the Proxy Statement and Registration Statement and other documents filed or to be filed by Clover Leaf

from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the forward-looking statements with respect to the proposed Business Combination.

Forward-looking statements speak only as of the date they are made. Recipients are cautioned not to put undue reliance on forward-looking

statements with respect to the proposed Business Combination, and neither Kustom Entertainment nor Clover Leaf assume any obligation to,

nor intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise,

except as required by law. Neither Kustom Entertainment nor Clover Leaf gives any assurance that either Kustom Entertainment or Clover

Leaf, or the combined company, will achieve its expectations.

Participants in the Solicitation

Clover

Leaf and Kustom Entertainment and their respective directors and certain of their respective executive officers and other members of management

and employees may be considered participants in the solicitation of proxies from the stockholders of Clover Leaf with respect to the Business

Combination. Information about the directors and executive officers of Clover Leaf is set forth in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 filed with the SEC on April 14, 2023. Additional information regarding the participants in the

proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the

proxy statement and/or prospectus and other relevant materials to be filed with the SEC regarding the Business Combination when they become

available. Stockholders, potential investors and other interested persons should read the proxy statement and/or prospectus carefully

when it becomes available before making any voting or investment decisions. When available, these documents can be obtained free of charge

from the sources indicated above.

No Offer or Solicitation

This

communication shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of

the proposed Business Combination. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, or

an exemption therefrom.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

See the Exhibit Index below, which is incorporated

by reference herein.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Clover Leaf Capital Corp. |

| |

|

|

| Date: February 7, 2024 |

By: |

/s/ Felipe MacLean |

| |

|

Name: |

Felipe MacLean |

| |

|

Title: |

Chief Executive Officer |

4

Exhibit 10.1

INDEMNIFICATION AGREEMENT

THIS INDEMNIFICATION

AGREEMENT (this “Agreement”) is made and entered into as of February 1, 2024 by and between (i) Clover Leaf

Capital Corp., a Delaware corporation (including any successor entity thereto, the “Purchaser”), (ii)

Kustom Entertainment, Inc., a Nevada corporation (“Company”), and (iii) Digital Ally, Inc., a Nevada

corporation (“Company Stockholder” and along with the Company, each a “Company

Party” and together the “Company Parties”). Any capitalized term used but not defined in

this Agreement will have the meaning ascribed to such term in the Merger Agreement.

WHEREAS, on June 1,

2023, (i) the Purchaser, (ii) CL Merger Sub, Inc. a Nevada corporation and a wholly-owned subsidiary of the Purchaser (“Merger

Sub”), (iii) Yntegra Capital Investments, LLC, a Delaware limited liability company, in the capacity under the Merger

Agreement as the Purchaser Representative (including any successor Purchaser Representative appointed in accordance the Merger Agreement,

the “Purchaser Representative”), (iv) the Company and (v) the Company Stockholder, the sole stockholder of the

Company, entered into that certain Agreement and Plan of Merger (as amended from time to time in accordance with the terms thereof, the

“Merger Agreement”), pursuant to which Merger Sub will merge with and into the Company, with the Company continuing

as the surviving entity (the “Merger”), and as a result of which, (a) all of the issued and outstanding capital

stock of the Company, immediately prior to the consummation of the Merger, shall no longer be outstanding and shall automatically be cancelled

and shall cease to exist, in exchange for the Merger Consideration Shares, all upon the terms and subject to the conditions set forth

in the Merger Agreement and in accordance with the applicable provisions of the of the Delaware General Corporation Law and the Nevada

Revised Statutes; and

WHEREAS, in accordance

with the Merger Agreement, the Company Parties have provided information to be incorporated into the Registration Statement and Proxy

Statement.

NOW, THEREFORE, in

consideration of the premises set forth above, which are incorporated in this Agreement as if fully set forth below, and intending to

be legally bound hereby, the parties hereby agree as follows:

1. The

Company Parties agree to indemnify and hold harmless the Purchaser, its directors, officers and its affiliates against any and all loss,

liability, claim, damage and expense whatsoever (including but not limited to any and all legal or other expenses reasonably incurred

in investigating, preparing or defending against any litigation, commenced or threatened, or any claim whatsoever, whether arising out

of any action between the Purchaser and the Company Parties or between the Purchaser and any third party or otherwise) to which they or

any of them may become subject under the Securities Act, the Exchange Act or any other federal, state or local statute, law, rule, regulation

or ordinance or at common law or otherwise or under the laws, rules and regulation of foreign countries, arising out of or based upon

any untrue statement or alleged untrue statement of a material fact provided by or on behalf of a Company Party contained in the Registration

Statement or Proxy Statement (as from time to time each may be amended and supplemented), or the omission or alleged omission therefrom

of a material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under

which they were made, not misleading. The Company Parties agree promptly to notify the Purchaser of the commencement of any litigation

or proceedings against a Company Party or any of its officers or directors in connection with the Registration Statement or the Proxy

Statement.

2. If

any action is brought against the Purchaser in respect of which indemnity may be sought against the Company Parties pursuant to Section

1, the Purchaser shall promptly notify the Company Parties in writing of the institution of such action and the Company Parties shall

assume the defense of such action, including the employment and fees of counsel (subject to the reasonable approval of the Purchaser)

and payment of actual expenses. The Purchaser shall have the right to employ its own counsel in any such case, but the fees and expenses

of such counsel shall be at the expense of the Purchaser unless: (i) the employment of such counsel at the expense of the Company Parties

shall have been authorized in writing by the Company Parties in connection with the defense of such action within reasonable time under

the circumstances; (ii) the Company Parties shall not have employed counsel to have charge of the defense of such action; or (iii) such

indemnified party or parties shall have reasonably concluded that there may be defenses available to it or them which are different from

or additional to those available to the Company Parties (in which case the Company Parties shall not have the right to direct the defense

of such action on behalf of the indemnified party or parties), in any of which events the reasonable fees and expenses of not more than

one additional firm of attorneys selected by the Purchaser, which firm shall be from a list previously approved by the Company Parties,

shall be borne by the Company Parties. Notwithstanding anything to the contrary contained herein, if the Purchaser shall assume the defense

of such action as provided above, the Company Parties shall have the right to approve the terms of any settlement of such action which

approval shall not be unreasonably withheld.

3. Within

fifteen (15) days after receipt by a Company Party or the Purchaser of notice of the commencement of any action, suit or proceeding, such

party will, if a claim for contribution in respect thereof is to be made against another party (“Contributing Party”),

notify the Contributing Party of the commencement thereof, but the omission to so notify the Contributing Party will not relieve it from

any liability which it may have to any other party other than for contribution hereunder. In case any such action, suit or proceeding

is brought against any party, and such party notifies a Contributing Party or its representative of the commencement thereof within the

aforesaid fifteen (15) days, the Contributing Party will be entitled to participate therein with the notifying party and any other Contributing

Party similarly notified. Any such Contributing Party shall not be liable to any party seeking contribution on account of any settlement

of any claim, action or proceeding effected by such party seeking contribution without the written consent of such Contributing Party.

The contribution provisions contained in this Section are intended to supersede, to the extent permitted by law, any right to contribution

under the Securities Act, the Exchange Act or otherwise available.

4. This

Agreement and any dispute or controversy arising out of or relating to this Agreement shall be governed by and construed in accordance

with the laws of the State of New York, without regard to the conflict of law principles thereof. All actions arising out of or relating

to this Agreement shall be heard and determined exclusively in any state or federal court located in New York, New York (or in any appellate

court thereof) (the “Specified Courts”). Each party hereto hereby (i) submits to the exclusive jurisdiction

of any Specified Court for the purpose of any action arising out of or relating to this Agreement brought by any party hereto and (ii)

irrevocably waives, and agrees not to assert by way of motion, defense or otherwise, in any such action, any claim that it is not subject

personally to the jurisdiction of the above-named courts, that its property is exempt or immune from attachment or execution, that the

action is brought in an inconvenient forum, that the venue of the action is improper, or that this Agreement or the transactions contemplated

hereby may not be enforced in or by any Specified Court. Each party agrees that a final judgment in any action shall be conclusive and

may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by Law. Each party irrevocably consents

to the service of the summons and complaint and any other process in any other action or proceeding relating to the transactions contemplated

by this Agreement, on behalf of itself, or its property, by personal delivery of copies of such process to such party at the applicable

address set forth in Section 10.1 of the Merger Agreement. Nothing in this Section 4 shall affect the right of any party to serve legal

process in any other manner permitted by applicable law.

5. EACH

OF THE PARTIES HERETO HEREBY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT

TO ANY ACTION DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

EACH PARTY HERETO (i) CERTIFIES THAT NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY

WOULD NOT, IN THE EVENT OF ANY ACTION, SEEK TO ENFORCE THAT FOREGOING WAIVER AND (ii) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO

HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 5.

6. In

the event either party institutes litigation to enforce its rights under this Agreement, the parties agree that the prevailing party(ies)

in any such action shall be entitled to recover from the other party(ies) all of its reasonable attorneys’ fees and expenses relating

to such action or proceeding and/or incurred in connection with the preparation therefor.

7. This

agreement may be executed in one or more counterparts, and by the different parties hereto in separate counterparts, each of which shall

be deemed to be an original, but all of which taken together shall constitute one and the same agreement, and shall become effective when

one or more counterparts has been signed by each of the parties hereto and delivered to each of the other parties hereto. Delivery of

a signed counterpart of this agreement by fax or email/.pdf transmission shall constitute valid and sufficient delivery thereof.

8. The

failure of any of the parties hereto to at any time enforce any of the provisions of this agreement shall not be deemed or construed to

be a waiver of any such provision, nor to in any way effect the validity of this agreement or any provision hereof or the right of any

of the parties hereto to thereafter enforce each and every provision of this agreement. No waiver of any breach, non-compliance or non-fulfillment

of any of the provisions of this agreement shall be effective unless set forth in a written instrument executed by the party or parties

against whom or which enforcement of such waiver is sought; and no waiver of any such breach, non- compliance or non-fulfillment shall

be construed or deemed to be a waiver of any other or subsequent breach, non-compliance or non-fulfillment.

[Remainder of Page Intentionally Left Blank;

Signature Pages Follow]

IN WITNESS WHEREOF, the parties have executed

this Agreement as of the date first written above.

| |

The Purchaser: |

| |

|

|

|

| |

CLOVER LEAF CAPITAL CORP. |

| |

|

|

|

| |

By: |

/s/ Felipe MacLean |

| |

|

Name: |

Felipe MacLean |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

The Company: |

| |

|

|

|

| |

KUSTOM ENTERTAINMENT, INC. |

| |

|

|

|

| |

By: |

/s/ Stanton E. Ross |

| |

|

Name: |

Stanton E. Ross |

| |

|

Title: |

CEO |

| |

|

|

|

| |

The Company Stockholder: |

| |

|

|

|

| |

DIGITAL ALLY, INC. |

| |

|

|

|

| |

By: |

/s/ Stanton E. Ross |

| |

|

Name: |

Stanton E. Ross |

| |

|

Title: |

CEO |

[Signature Page to Indemnification Agreement]

4

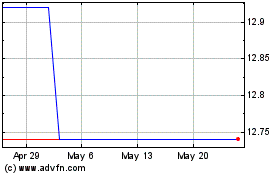

Clover Leaf Capital (NASDAQ:CLOEU)

Historical Stock Chart

From Apr 2024 to May 2024

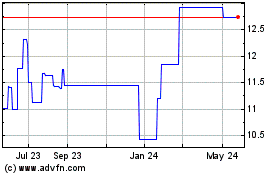

Clover Leaf Capital (NASDAQ:CLOEU)

Historical Stock Chart

From May 2023 to May 2024