COLUMBUS MCKINNON CORP false 0001005229 0001005229 2025-03-11 2025-03-11

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2025

COLUMBUS McKINNON CORPORATION

(Exact name of registrant as specified in its charter)

New York

(State or other

jurisdiction of incorporation)

|

|

|

| 001-34362 |

|

16-0547600 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 13320 Ballantyne Corporate Place, Suite D Charlotte NC |

|

28277 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area code: (716) 689-5400

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.01 par value per share |

|

CMCO |

|

Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| ☐ |

Emerging Growth Company |

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

As previously announced, Columbus McKinnon Corporation (the “Company”) will be presenting at the J.P. Morgan 2025 Industrials Conference on Tuesday, March 11, 2025. A copy of the slides to be used for this presentation are attached hereto as Exhibit 99.1 and are incorporated herein by reference. These presentation slides will also be available in the Investor Relations section of Company’s website.

The presentation slides are being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section. Furthermore, the information contained in Exhibit 99.1 shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

| COLUMBUS McKINNON CORPORATION |

|

|

| By: |

|

/s/ Gregory P. Rustowicz |

| Name: |

|

Gregory P. Rustowicz |

| Title: |

|

Executive Vice President - Finance and Chief Financial Officer |

|

|

(Principal Financial Officer) |

Dated: March 11, 2025

Exhibit 99.1 March 11, 2025 2025 J.P. Morgan Industrials Conference

David Wilson Gregory Rustowicz Kristine Moser Executive Vice President Finance President & Vice President, Investor Relations & Chief Financial Officer Chief Executive Officer & Treasurer

Safe Harbor Statement This presentation and the accompanying oral

discussion contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward- looking statements are generally identified by the use of forward-looking terminology, including

the terms anticipate, “believe,” “continue,” “could,” “estimate,” “expect,” “illustrative,” “intend,” “likely,” “may,”

“opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “shall,” “should,” “target,” “will,” “would”

and, in each case, their negative or other various or comparable terminology, and include statements regarding (1) our strategy, outlook and growth prospects and our future financial results and financial condition; (2) our operational and financial

targets and capital allocation policy and the timing for the closing of the acquisition of Kito Crosby and our ability to obtain necessary regulatory approvals thereafter and the financial benefits of the transaction, including amount of synergies

to be achieved; (3) general economic trends and trends in our industry and markets and the impact of tariffs on our business; (4) the amount of debt to be paid down by the Company, amount of free cash flow and net leverage ratio during future

period; (6) the competitive environment in which we operate; All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Columbus McKinnon and Kito Crosby to

differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk that the cost synergies and any revenue synergies from the Kito Crosby transaction may not be fully realized

or may take longer than anticipated to be realized, (2) disruption to the parties' businesses as a result of the announcement and pendency of the transaction, (3) the risk that the integration of Kito Crosby's business and operations into Columbus

McKinnon will be materially delayed or will be more costly or difficult than expected, or that Columbus McKinnon is otherwise unable to successfully integrate Kito Crosby's businesses into its own, including as a result of unexpected factors or

events; (4) the ability by each of Columbus McKinnon and Kito Crosby to obtain required governmental approvals of the transaction on the timeline expected, or at all, and the risk that such approvals may result in the imposition of conditions that

could adversely affect Columbus McKinnon after the closing of the transaction or adversely affect the expected benefits of the transaction; (5) reputational risk and the reaction of each company's customers, suppliers, employees or other business

partners to the transaction; (6) the failure of the closing conditions in the purchase agreement to be satisfied, or any unexpected delay in closing the transaction or the occurrence of any event, change or other circumstances that could give rise

to the termination of the purchase agreement; (7) the dilution caused by the issuance of perpetual convertible preferred equity to CD&R; (8) the possibility that the transaction may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; (9) risks related to management and oversight of the expanded business and operations of Columbus McKinnon following the transaction due to the increased size and complexity of its business, (10) the outcome

of any legal or regulatory proceedings that may be currently pending or later instituted against Columbus McKinnon before or after the transaction, or against Kito Crosby, and (11) general competitive, economic, political and market conditions and

other factors that may affect future results of Columbus McKinnon and Kito Crosby. These risks also include, but are not limited to, the risk factors that are described under the section titled “Risk Factors” in our Annual Report on Form

10-K for the fiscal year ended March 31, 2024 as well as in our other filings with the Securities and Exchange Commission, which are available on its website at www.sec.gov. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. Forward-looking statements speak only as of the date they are made. Columbus McKinnon undertakes no duty to update publicly any such forward-looking statement, whether as a result of new information, future events or

otherwise, except as may be required by applicable law, regulation or other competent legal authority. Non-GAAP Financial Measures and Forward-looking Non-GAAP Financial Measures This presentation will discuss some non-GAAP (“adjusted”)

financial measures which we believe are useful in evaluating Columbus McKinnon and Kito Crosby’s performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in

accordance with GAAP. The non-GAAP financial measures are noted and reconciliations of comparable historical GAAP measures with historical non-GAAP financial measures can be found in tables either included in the Supplemental Information portion of

this presentation or our filings with the Securities and Exchange Commission. These include Adjusted EBITDA and Adjusted EBITDA Margin, Free Cash Flow and Free Cash Flow Conversion, Net Debt and Net Leverage Ratio 2

CMCO is a Global Leader in Intelligent Motion Solutions for Material

Handling PRODUCT MIX • Leading global lifting and automation company providing professional-grade solutions Linear Motion for solving customers’ critical material handling requirements 9% Automation 13% • Enhanced strategic

positioning through expansion into secular growth categories and Lifting Solutions REVENUE 61% positioned to capitalize on megatrends in lifting, hoisting, precision conveyance, automation and linear motion Specialty Conveying 17% • Delivering

growth and margin expansion and executing our transformation through our GEOGRAPHIC MIX growth framework, “CMBS” business system and 80/20 Process LatAm 4% APAC 7% North America REVENUE 1 1 60% Total Addressable Market Total Addressable

Market World-Wide Employees Year History EMEA 29% $20B ~3,500 150 VERTICALS MIX 5 Other General Industrial 12% 22% Chemical & Paper 5 Year Sales Free Cash Flow Processing 2 2,3 Net Sales Adj. EBITDA Margin 4% 2 2,3,4 Growth CAGR Conversion Oil

& Gas, 5% Material Handling REVENUE 16% Aerospace & Gov't 5% Construction, 6% Transportation ~$1.0B ~4% ~16% >100% Food, Beverage & 14% Consumer, 8% Energy & Utilities, 8% Seasoned Leader With Extensive History Of Safely,

Efficiently And Ergonomically Positioning Materials 1 2 3 Per Management Estimate; Financial data represents fiscal year ended March 31, 2025; Adjusted EBITDA Margin and Free Cash Flow Conversion are non-GAAP financial measures. See supplemental

information for additional information on non-GAAP financial measures. Forward-looking guidance for Adjusted EBITDA Margin and Free Cash Flow Conversion are made in a manner consistent with the relevant definitions and assumptions noted herein, but

reconciliations are not available on a forward-looking basis without 3 4 5 unreasonable effort; Free Cash Flow is defined as net cash provided by (used for) operating activities less capital expenditures divided by net income; Other represents Life

Sciences/Pharma (3%), Elevator (2%), Metals Processing (2%), Entertainment (2%), E-Commerce (2%), and Forestry (1%) as of fiscal year 2024.

Intelligent Motion Solutions Four Categories of Solutions to Address

Customers’ Unique Motion Control Needs LIFTING (61%) PRECISION CONVEYANCE (17%) AUTOMATION (13%) LINEAR MOTION (9%) 1 1 1 1 ~$8.0B TAM ~$5.2B TAM ~$4.5B TAM ~$2.3B TAM • Leading global position in lifting • Develops and

manufactures complex • Linear actuators with lifting capacity up • Design and develop drives and controls intralogistics solutions connecting robots to 50 tons, screw jacks, rotary unions and for lifting, linear motion and conveying

• Lifting capacity from 1/8 ton to and workspaces with asynchronous super cylinders systems ~140 tons conveying technology • Demonstrated leadership and • Used in intelligent material handling • Manual chain, electric chain

and differentiated offering • Specialty conveying provides growth solutions from ceiling to floor across wire rope hoists platform in fragmented market entire product portfolio • Serving a breadth of end uses and • Reliable,

high-quality products applications from rail to warehousing to • Tailwinds from megatrends like • Solutions designed to increase uptime, defense automation, onshoring, ecommerce, enhance productivity and improve • End-to-end

digital solutions electrification and life sciences customer safety 1 $20B Total Addressable Market With Tailwinds From Megatrends In Attractive Verticals 1 Per Management Estimates. 4

Strong Track Record Creating Value Through M&A Path and Executing on

Previously Communicated Synergies Legend: Acquisition Divestiture December 2021 May 2023 September 2015 January 2017 January 2017 April 2021 April 2021 December 2021 May 2023 2025 Acquisition of STAHL Acquisition of Dorner for Acquisition of

Magnetek, CraneSystems from $485M advances Intelligent Acquisition of Garvey for Acquisition of montratec® Announced the acquisition Inc. for ~$182M added Konecranes for ~$218M Motion strategy and $74M expands conveying for $110M expands of

Kito Crosby for $2.7B automation capabilities strengthens leading global creates platform for solutions platform precision conveyance and position in lifting solutions scalable growth automation M&A Pipeline Target Screen 2015 2016 2017 2018

2019 2020 2021 2022 2023 2024 2025 Acquisition Committee Feedback Outreach Due Diligence December 2018 February 2019 February 2019 Decision Tire Shredder Divestiture of Stahlhammer Programmatic Programmatic Divestiture of Tire Shredder Divestiture

of Crane Bommern GmbH to Turbo Business Equipment and Service, Inc. M&A M&A Investment BV Transforming Columbus McKinnon Into A Top-Tier, Higher Growth, Higher Margin Enterprise 5

Kito Crosby At-a-Glance 1 KEY INDUSTRY BRANDS KITO CROSBY BY THE NUMBERS

KEY PRODUCTS PRODUCT MIX Technology & Specialty Solutions Chains & 14% Lifting & Securement Fittings Consumables REVENUE 54% 4,000 4,000 600K+ 600K+ Installed Lifting Solutions Channel Channel End-Users End-Users 32% Shackles Partners

Partners Trained Trained 1 DIVERSIFIED GLOBAL PRESENCE Wire Rope LatAm 4% Fittings APAC 250+ 250+ 50+ 50+ 19% Years Of Years Of REVENUE Countries Countries North America Wire Rope & 56% Brand Heritage Brand Heritage Served Served ECH Hoists EMEA

21% 1 Crane Blocks DIVERSIFIED END USES IN KEY VERTICALS Other, & Sheaves 2 10% $1.1B $1.1B 7% 7% Manufacturing Food 32% 6% 2024 Revenue 2024 Revenue 2021-2024 2021-2024 Load Monitoring Power & Renewables, 7% Revenue CAGR Revenue CAGR

REVENUE Dynamometers Non-Res Construction, 7% Infrastructure Energy, 10% 16% 1 2 Based on Kito Crosby Management Estimates; Reflects Consumer, Entertainment, Government, Forestry and Other/Miscellaneous verticals. Metals & Mining 12%

6

Significant Strategic and Financial Benefits Enhances scale and

strengthens competitiveness 1 Growth supported by tailwinds from industry megatrends 2 Highly attractive financial profile 3 Value creation with significant synergies 4 Strong cash flow enables de-leveraging and capacity to reinvest 5 Kito Crosby

Acquisition Accelerates the Realization of Intelligent Motion Strategy Faster than Standalone, Organic Path Enhanced Scale and Positioning Streamlined Integration Approach l Acquisition expected to more than double revenue and nearly triple

Adjusted l Well-prepared to integrate Kito Crosby, leveraging the Columbus McKinnon 1,2 EBITDA Business System throughout combined Columbus McKinnon and Kito Crosby l Provides broader product portfolio that leads to improvements in

customer experience through enhanced operational capabilities and geographic reach l Confidence in synergy attainment given complementary nature of the l Stronger financial profile and enhanced scale strengthens core business and

combination, including common customers, manufacturing processes and generates cash flow to de-lever, reinvest and drive growth in Intelligent supply chain Motion l Acquisition further supported by key industry megatrends, such as l

Potential upside from revenue synergies through geographic expansion on automation, reshoring, and infrastructure investment, driving long-term top of substantial cost savings growth and competitive differentiation 1 Adjusted EBITDA and Free Cash

Flow Conversion are non-GAAP financial measures. See supplemental information for additional information on non-GAAP financial measures. Forward-looking guidance for Adjusted EBITDA and Pro Forma Free Cash Flow Conversion are 2 3 made in a manner

consistent with the relevant definitions and assumptions noted herein, but reconciliations are not available on a forward-looking basis without unreasonable effort; Adjusted EBITDA is pro forma for $70 million of net run rate synergies; Pro Forma

Free 7 Cash Flow Conversion is defined as net cash provided by (used for) operating activities less capital expenditures divided by net income. While the Company expects Pro Forma Free Cash Flow Conversion of greater than 100% over time inclusive of

synergies, the Company expects that metric may be impacted in the short-term by one-time costs.

Combined Financial Profile Expected to Drive Premium Long-Term Public

Valuation BROADER MARKET ~2,020 Companies Public U.S. Industrial Companies PUBLIC VALUE ~260 Companies Market Cap: $2B – $8B SCALE ~100 Companies 2025E Revenue: $1B – $3B PROFITABILITY ~50 Companies 2025E EBITDA Margin: 20%+ Average EV /

2025E EBITDA Multiple: ~12x Companies with Similar Profiles Command Higher Valuations Over Time Source: FactSet as of 03/07/2025 based on consensus estimates. 8

Significant Cost Synergies Support Value Creation and Present Growth

Opportunities ~$80M ~$80M ~$10M ~$10M ~$70M ~$70M Expected Annual Expected Annual Gross Synergies Gross Synergies Expected Annual Expected Annual Dis-Synergies Dis-Synergies Expected Annual Expected Annual Net Net Run Rate Synergies Run Rate

Synergies Summary Of Key Synergy Areas And Corresponding Strategic Initiatives Procurement Facility Optimization SG&A l Harmonize supply chain contracts for best l Optimize supply chain and factory logisticsl Eliminate overlapping

technology and pricing (i.e., materials, MRO, freight) duplicate third party spending (i.e., T&E, l Higher volume on standard runs with less professional services) machine change over l Leverage combined spend resulting in l

Footprint simplification reducing facility increased pricing power given scale and l G&A and sales redundancies without overhead and improving efficiency operational similarities impacting customer experience l Optimized distribution /

warehousing resulting in improved customer experience rd Source: Company estimates and 3 party analysis; Synergy estimate is preliminary and subject to change. 9 OVERVIEW

Value Creation with Significant Synergies Strong Track Record Of

Successful Integrations And Cost Synergy Realization Expected Net Run Rate Synergies of ~$70M Annually Additional Upside Expected from Revenue Synergies 100% l Increase breadth and depth of product offerings to existing customers l

Geographic expansion opportunities: 60% ‒ Kito Crosby’s strong APAC footprint for CMCO products ‒ CMCO’s LATAM & EMEA footprint for Kito Crosby products l Attract new customers with enhanced scale and combined

capabilities 20% l Capture share of wallet by streamlining the customer experience Year 1 Year 2 Year 3 10

Strong Cash Flow Enables De-leveraging and Capacity to Reinvest in the

Business 1,3,4 EXPECTED PRO FORMA FREE CASH FLOW PRO FORMA NET LEVERAGE RATIO KEY GROWTH HIGHLIGHTS ($M) Year 1 4.8x Credit Agreement Adjusted EBITDA Growth: 1 Pro Forma Adjusted EBITDA $486 l Base business growth (+) Adjusted EBITDA Growth 36

(-) Synergies to be Achieved in Year 2 & 3 (56) l Execution of CMCO’s margin expansion plans (+) Stock-Based Compensation & Deferred Financing Fees 12 ~3.0x Free Cash Flow Growth: Credit Agreement Adjusted EBITDA $478 ~2.0x (-)

CapEx (55) l Base business growth (-) Cash Taxes (35) l Achievement of synergies over 3 years (-) Interest Expense (200) 2l Debt paydown quarterly reduces interest cost (-) Other Adjustments (11) (+) Change in Net Working Capital 25

l Execution of CMCO’s margin expansion plans 1 At Closing Year 2 Year 3+ Free Cash Flow $202 1 Non-GAAP financial measure; see definition at the end of this Presentation; Forward-looking guidance is made in a manner consistent with the

relevant definitions and assumptions noted herein, but reconciliations are not available on a forward-looking basis without 2 3 unreasonable effort; Other Adjustments include (+) Non-Cash Expense offset by (-) Integration Costs of $15M / One-Time

Cost to Achieve Synergies of $80M over 3 years; Net Leverage Ratio is calculated in accordance with the terms and conditions in the Company’s 11 4 credit agreement and is defined as Net Debt over trailing-twelve month Adjusted EBITDA as

defined in the Company’s credit agreement and in accordance with the Company’s previous filings with the Securities and Exchange Commission; Net Leverage Ratio projects current assumptions assuming all else equal and no additional

changes to the business.

Historical Track Record of De-Leveraging Post-Acquisition 1

Demonstrated History Of Net Leverage Ratio Reduction Following Acquisitions 1,2 1,2 DORNER AND GARVEY ACQUISITIONS MONTRATEC ACQUISITION Dorner acquisition Montratec acquisition (closed April 2021) 4.5 (closed May 2023) 4 3.7x 3.5 Pro Forma at Close

2.9x 3 2.4x 2.5 2.2x 2 1.5 2.8x 1 0.5 0 Q1 FY22 Q4 FY23 Q1 FY24 Q4 FY24 1 2 Non-GAAP financial measure; see definition and reconciliation at the end of this Presentation; Net Leverage Ratio is calculated in accordance with the terms and conditions

in the Company’s credit agreement and is defined as Net Debt over trailing-twelve month Adjusted EBITDA as defined in the Company’s credit agreement and in accordance with the Company’s previous filings with the Securities and

Exchange Commission 12

Clear Pathway to Closing Financing Process Regulatory Approval l

HSR filing to be completed in March 2025 ü On February 10, 2024, the Company obtained $3.05B in l Required regulatory approvals include: committed debt financing to fund the acquisition l Clearance under U.S. Hart-Scott-Rodino Act of

1976, ü Committed financing has been successfully syndicated merger clearance, and foreign-direct investment filings in with new $500M revolving credit facility select other jurisdictions l Finalized financing expected to be secured in the

coming l CMCO believes it will secure necessary clearances given months, which would not delay or prevent closing compelling pro-competitive transaction rationale and highly complementary nature of the parties’ product portfolios

Significant Progress Made Towards Accelerated Closing 13

Highly Compelling Combination for All Stakeholders + Holistic Provider

Of Intelligent Motion Solutions In Materials Handling >30% 23% $2B+ >100% ~8x Of Sales from Pro Forma Revenue Pro Forma Adjusted Pro Forma Free Cash TTM Adjusted EBITDA 1,2 1,3 Consumables EBITDA Margin Multiple Net of Synergies Flow

Conversion Scaled, Market Leading Geographic Diversification Geographic Diversification ~$70M Net Run Rate ~$70M Net Run Rate Strong Cash Flow Enables Strong Cash Flow Enables Compelling Compelling Platform Enhances & Increased Portfolio &

Increased Portfolio Synergies & Top-Tier Synergies & Top-Tier Rapid De-Leveraging to Rapid De-Leveraging to Value Creation Value Creation Competitiveness Resiliency Resiliency Margin Profile Margin Profile ~3.0x by Year 2 ~3.0x by Year 2 1

Note: Figures represent forward-looking estimates; Adjusted EBITDA Margin and Free Cash Flow Conversion are non-GAAP financial measures. See supplemental information for additional information on non-GAAP financial measures. Forward-looking guidance

for 2 Adjusted EBITDA Margin and Free Cash Flow Conversion are made in a manner consistent with the relevant definitions and assumptions noted herein, but reconciliations are not available on a forward-looking basis without unreasonable effort;

Adjusted EBITDA is pro 3 14 forma for $70 million of net run rate synergies; Free Cash Flow is defined as net cash provided by (used for) operating activities less capital expenditures divided by net income. While the Company expects Pro Forma Free

Cash Flow Conversion of greater than 100% over time inclusive of synergies, the Company expects that metric may be impacted in the short-term by one-time costs.

Supplement

Transaction Overview CONSIDERATION l CMCO to acquire 100% of Kito

Crosby in an all-cash transaction at an estimated value of $2.7B 1 l Represents ~8x Trailing-Twelve Month Adjusted EBITDA inclusive of synergies & VALUATION l Committed financing package of $3.05B to fund the acquisition and refinance

existing debt, including a $500 million revolving credit facility l CD&R committed to provide $0.8 billion of perpetual convertible preferred equity; Terms of the CD&R investment include a 7% coupon, payable in cash or payment-in-kind

at Columbus McKinnon’s option, and a conversion price of $37.68 FINANCING 1 l ~4.8x Net Leverage Ratio at close, expected to decrease to ~3.0x by the second-year post closing driven by ~$200M+ Annual Free 1 Cash Flow l >$500M of

liquidity upon closing, including cash and availability on the revolver and AR Securitization l CD&R represents sophisticated capital and provides greater certainty to deal execution in a competitive process as CD&R brings a strong

track record in driving operational excellence across the industrials sector l CD&R as-converted ownership at close is expected to be approximately 40% of the Company OWNERSHIP & l CD&R has agreed to a customary lock-up on its

shares and customary standstill restrictions GOVERNANCE l CD&R has the right to add three Board members to the Company’s Board upon closing and intends to designate Mike Lamach, Nate Sleeper and Andrew Campelli l Anticipated

close later this calendar year l Subject to regulatory approvals and satisfactory completion of customary closing conditions TIMING l Agreement has no financing condition l Shareholder approval is not required to close the transaction

1 Adjusted EBITDA, Net Leverage Ratio and Free Cash Flow are non-GAAP financial measures. See supplemental information for additional information on non-GAAP financial measures. Forward-looking guidance for Adjusted EBITDA, Net Leverage Ratio and

Free Cash Flow are made in a manner consistent with the relevant definitions and assumptions noted herein, but reconciliations are not available on a forward-looking basis without unreasonable effort. 16

Sources & Uses and Pro Forma Capitalization Sources & Uses Pro

Forma Capitalization 1 Sources: ($M) ($M) As of Close Revolving credit facility $0 New $500M revolving credit facility $0 New secured debt 2,550 New secured debt 2,550 Capital lease 12 Deferred financing fees (80) PIPE convertible preferred equity

800 Total debt $2,482 Total Sources $3,350 (-) Cash and cash equivalents 68 Net debt $2,414 (+) Standby letters of credit 20 Uses: ($M) 4 Credit Agreement Net Debt $2,434 2 Refinance debt $463 5 Pro Forma Synergized Adjusted EBITDA $486 Purchase

price 2,700 (+) CMCO stock-based and deferred compensation 12 3 Other (includes financing fees and expenses) 171 (+) Assumed EBITDA growth 7 4 Credit Agreement Adjusted EBITDA $505 Cash to balance sheet 16 Total Uses: $3,350 4,6,7 Net Leverage Ratio

(Credit Agreement) ~4.8x 1 Note: Figures represent forward-looking estimates, which are made in a manner consistent with the relevant definitions and assumptions noted herein, but reconciliations are not available on a forward-looking basis without

unreasonable effort; Assumes close in CY Q3 2 3 4 2025; Refinanced debt excludes capital leases; Reflects adjustments for tax attributes, pension liabilities treated as debt, and fees & expenses (which include debt financing fees, PIPE financing

fees, M&A fees, and diligence fees); Non-GAAP financial measure; see 5 6 17 definition at the end of this Presentation; Includes Columbus McKinnon EBITDA, Kito Crosby EBITDA, and Net Run Rate Synergies; Net Leverage Ratio is calculated in

accordance with the terms and conditions in the Company’s credit agreement and is defined as Net 7 Debt over trailing-twelve month Adjusted EBITDA as defined in the Company’s credit agreement and in accordance with the Company’s

previous filings with the Securities and Exchange Commission; Net Leverage Ratio projects current assumptions assuming all else equal and no additional changes to the business.

Enhances Scale and Strengthens Competitiveness Across Products and

Markets Increased Verticals And Geographic Diversity Tethered To Markets With Strong Tailwinds PRO FORMA PRO FORMA PRO FORMA 1 1 1 PRODUCT PLATFORMS : GEOGRAPHIES : VERTICAL END USES : Precision 2 Other LATAM Conveyance Aerospace & 9% APAC 4%

Automation 6% Government Manufacturing 11% 8% 3% 24% Oil & Gas 7% Linear Motion 10% Metals & Mining 7% REVENUE REVENUE REVENUE Lifting Construction North 46% America 7% EMEA 57% Infrastructure 28% Food & Bev Lifting Hardware 19% 7% &

Consumables Transport Energy 30% 7% 9% Diversified End Uses with Strong Market Leadership position in Lifting; Complementary Footprint in EMEA and APAC Presence in Key Verticals Platform to Grow in Intelligent Motion 1 2 Based on Columbus McKinnon

Company data and Kito Crosby Management Estimates; Other verticals include: Entertainment, E-Commerce, Forestry, Life Sciences, Elevator and Other/Miscellaneous. 18

Growth Supported with Tailwinds from Industry Megatrends Growth

Supported By Exposure To Secular Mega Trends Across The Full Portfolio Nearshoring & Supply Chain Resilience Lifting Automation • Broad increased global • Key enabler of productivity demand for lifting solutions and safety

improvements Labor Shortages Driving Demand • Heightened emphasis on • Ceiling to floor applications productivity, uptime and support customer safety requirements Industrial Resurgence & Growth Precision Conveyance Linear Motion

• Increased demand for • Bolsters a comprehensive Infrastructure specialized solutions intelligent motion portfolio Investment • Tailwinds from automation • Channel access to specialty and electrification trends verticals

Safety & Sustainability Focus 19

Columbus McKinnon is Well-Positioned to Navigate Tariffs Potentially

Impacted Fund Flow Imports / Exports ($M) To $44 To 1 4 To l Project marginal impact to business based on current tariff expectations $50 Total Imports l A 25% tariff on both Mexico and Canada combined with an additional $9 10% tariff on

China impacts ~$50M of To imports To 24 l Potential retaliatory actions impact To 1 another ~$34M of exports $34 Total Exports l Proven history of passing price increases to channel partners to offset rising input costs $84 Total Flows

Expect to Offset ~$20M Adj. EBITDA Impact From Tariffs Through Supply Chain Optimization and Pricing 20

Non-GAAP Measures The following information provides definitions and

reconciliations of the non-GAAP financial measures presented in this presentation to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP). The Company has

provided this non-GAAP financial information, which is not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in this presentation that are calculated and presented in

accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in this presentation. The

non-GAAP financial measures in this presentation may differ from similarly titled measures used by other companies. l Adjusted EBITDA and Adjusted EBITDA Margin l Free Cash Flow and Free Cash Flow Conversion l Net Debt and Net

Leverage Ratio Forward-Looking: The Company has not reconciled the Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Free Cash Flow Conversion, Net Debt and Net Leverage Ratio guidance to the most comparable GAAP measure because it is not

possible to do so without unreasonable efforts due to the uncertainty and potential variability of reconciling items, which are dependent on future events and often outside of management’s control and which could be significant. Because such

items cannot be reasonably predicted with the level of precision required, we are unable to provide guidance for the comparable GAAP financial measures. Forward-looking guidance regarding Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Free

Cash Flow Conversion,Net Debt and Net Leverage Ratio for fiscal 2025 is made in a manner consistent with the relevant definitions and assumptions noted herein. 21

Non-GAAP Measures: Adjusted EBITDA and Adjusted EBITDA Margin ($ in

thousands) Quarter Q3 FY24 Q4 FY24 Q1 FY25 Q2 FY25 Q3 FY25 Net income $ 9,728 $ 11,809 $ 8,629 $ (15,043) $ 3,960 Add back (deduct): Income tax expense (benefit) 3,911 2,497 3,421 (4,908) 1,929 Interest and debt expense 8,352 7,698 9,952 9,169 8,235

Investment (income) loss (758) (547) (209) (610) (54) Foreign currency exchange (gain) loss (792) 3,128 (1,155) 752 395 Other (income) expense, net 5,234 1,757 676 23,806 1,029 Depreciation and amortization expense 12,188 12,202 11,570 11,893 11,840

Acquisition deal and integration costs 113 3 — — — Business realignment costs 281 987 1,452 — 850 Factory and warehouse consolidation 11,904 653 — 545 — Headquarter relocation costs 51 175 510 175 96 Hurricane

Helene cost impact — — — 171 — Cost of debt repricing — 1,190 — — — Mexico customs duty assessment — — — — 1,500 1 Customer bad debt — — — — 1,299

Monterrey, MX new factory start-up costs 755 3,734 3,566 3,751 3,270 Adjusted EBITDA $ 39,151 $ 37,776 $ 41,312 $ 42,977 $ 37,499 Net sales $ 254,143 $ 265,504 $ 239,726 $ 242,274 $ 234,138 Net income margin (6.2)% 1.7 % 3.8% 4.4% 3.6% Adjusted

EBITDA Margin 16.2 % 16.1 % 16.3% 16.2% 15.6% Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net

sales. Adjusted EBITDA and Adjusted EBITDA Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted EBITDA and Adjusted EBITDA Margin as used by other companies. Nevertheless, Columbus McKinnon believes that

providing non-GAAP financial measures, such as Adjusted EBITDA and Adjusted EBITDA Margin, are important for investors and other readers of the Company’s financial statements. 1 Customer bad debt represents a reserve of $1,299,000 against an

accounts receivable balance for a customer who declared bankruptcy in January of 2025. 22

Non-GAAP Measures: Free Cash Flow (FCF) and Free Cash Flow Conversion

($ in thousands) Fiscal Year TTM 2021 2022 2023 2024 Q3 FY25 Net cash provided by (used for) operating activities $ 98,890 $ 48,881 $ 83,636 $ 67,198 $ 48,607 Capital expenditures (12,300) (13,104) (12,632) (24,813) (23,745) Free Cash Flow (FCF) $

86,590 $ 35,777 $ 71,004 $ 42,385 $ 24,862 Net income $ 9,106 $ 29,660 $ 48,429 $ 46,625 $ 9,355 Free Cash Flow Conversion 951% 121% 147% 91% 266% Free Cash Flow is defined as GAAP net cash provided by (used for) operating activities less capital

expenditures included in the investing activities section of the consolidated statement of cash flows. Free Cash Flow Conversion is defined as Free Cash Flow divided by net income. Free Cash Flow and Free Cash Flow Conversion are not measures

determined in accordance with GAAP and may not be comparable with the measures as defined or used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Free Cash Flow and Free Cash Flow

Conversion, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current periods’ Free Cash Flow and Free Cash Flow Conversion to Free Cash Flow and Free

Cash Flow Conversion for historical periods. 23

Non-GAAP Measures: Historical Net Debt and Net Leverage Ratio ($ in

thousands) Trailing Twelve Month Net Debt is defined in the credit agreement Q1 FY22 Q4 FY23 Q1 FY24 Q4 FY24 as total debt plus standby letters of credit, Net income $ 4,812 $ 48,429 $ 49,313 $ 46,625 net of cash and cash equivalents. Net Add back

(deduct): Leverage Ratio is defined as Net Debt 1 Annualize EBITDA for acquisitions 25,356 - 7,994 1,331 divided by the Credit Agreement Trailing 1 Annualize synergies for acquisitions 5,387 - 401 73 Twelve Month (“TTM”) Adjusted EBITDA.

(585) Income tax expense (benefit) 26,046 20,547 14,902 Credit Agreement TTM Adjusted EBITDA is Interest and debt expense 29,507 27,942 30,364 37,957 defined in the Company’s credit agreement Non-Cash loss related to asset retirement - 175 2 -

as net income before interest expense, Gain on sale of Facility (2,638) (232) (232) - income taxes, depreciation, amortization, 2 Non-cash pension settlement - - - 4,984 and other adjustments. Credit Agreement Amortization of deferred financing

costs 2,452 - 1,774 2,349 Adjusted EBITDA Margin is defined as Stock compensation expense 8,213 10,425 11,655 12,039 Credit Agreement TTM Adjusted EBITDA - Garvey contingent consideration 1,230 1,230 - divided by net sales. Net Debt, Net

Depreciation and amortization expense 31,540 41,947 42,368 45,945 Leverage Ratio, Credit Agreement TTM Acquisition deal and integration costs 13,193 616 3,117 3,211 Adjusted EBITDA and Credit Agreement Acquisition amortization of backlog 2,981 - - 3

Adjusted EBITDA Margin are not measures (1,002) Excluded integration costs and realignment costs - (529) - determined in accordance with GAAP and Business realignment costs 649 5,140 3,857 1,867 3 may not be comparable with the measures Excluded

business realignment costs - - (3,482) - as used by other companies. Nevertheless, Monterrey, MX new factory start-up costs - - - 4,489 the Company believes that providing non- 1,522 Factory and warehouse consolidation - 117 744 GAAP financial

measures, such as Net Headquarter relocation costs - 996 2,224 2,059 Debt, Net Leverage Ratio, Credit Agreement Insurance settlement 88 - - - TTM Adjusted EBITDA and Credit Cost of debt refinancing 14,803 - - 1,190 Credit Agreement TTM Adjusted

EBITDA $ 136,278 $ 162,714 $ 170,720 $ 179,765 Agreement Adjusted EBITDA Margin are Total debt 459,296 471,592 579,769 530,236 important for investors and other readers Standby letters of credit 16,935 14,921 15,364 15,368 of the Company’s

financial statements. Cash and cash equivalents (88,654) (133,176) (106,994) (114,126) Net Debt $ 387,577 $ 353,337 $ 488,139 $ 431,477 Net Leverage Ratio 2.8x 2.2x 2.9 x 2.4x 1 2 EBITDA is normalized to include a full year of the acquired entity

and assuming that deal related synergies are achieved for montratec in fiscal year 2024 and Dorner and Garvey in fiscal year 2023; During the quarter ending December 31, 2023, certain employees in one of the Company’s U.S pension plans

accepted an offer to settle their pension obligation with a lump sum payment. These lump sum settlements are one of the steps the Company is taking to terminate the plan by transferring the liabilities to a third-party. As a result, the 24 3 Company

recorded a non-cash settlement charge in the amount $4,599,000; The Company’s credit agreement definition of Adjusted EBITDA excludes certain acquisition deal and integration costs that are incurred beyond one year after the close of an

acquisition, as well as excludes any cash restructuring costs in excess of $10 million per fiscal year

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

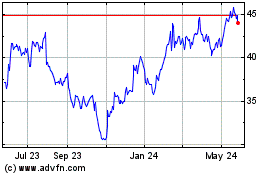

Columbus McKinnon (NASDAQ:CMCO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Columbus McKinnon (NASDAQ:CMCO)

Historical Stock Chart

From Mar 2024 to Mar 2025