UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy

Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive

Proxy Statement

x Definitive

Additional Materials

¨ Soliciting

Material Pursuant to Rule 14a-12

Consolidated

Communications Holdings, Inc.

(Name of Registrant

as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box)

x No fee required.

¨ Fee paid

previously with preliminary materials.

¨ Fee computed

on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

On January 23, 2024, Consolidated Communications

Holdings, Inc., a Delaware corporation (“Consolidated Communications,” “Consolidated” or the “Company”),

issued the following press release in connection with the Company’s special meeting of shareholders to be held on January 31, 2024.

Leading Independent Proxy Advisory Firm Glass

Lewis Recommends Consolidated Communications Shareholders Vote “FOR” the Proposed Transaction with Searchlight and BCI

Follows Recommendation from Institutional Shareholder

Services (“ISS”) That Shareholders Vote FOR the Proposed Transaction

MATTOON, Ill.—January 23, 2024 – Consolidated Communications

Holdings, Inc. (Nasdaq: CNSL) (the “Company” or “Consolidated”), a top 10 fiber provider in the U.S., today announced

that a leading independent proxy advisory firm, Glass Lewis & Co. (“Glass Lewis”), has joined Institutional Shareholder

Services (“ISS”) in recommending that Consolidated shareholders vote “FOR” the proposed acquisition of the Company

by affiliates of Searchlight Capital Partners, L.P. (“Searchlight”) and British Columbia Investment Management Corporation

(“BCI”) (the “Proposed Transaction”).

The Company’s special meeting of shareholders (the “Special

Meeting”) to vote on the Proposed Transaction is scheduled to be held on January 31, 2024. Shareholders of record as of December

13, 2023, are entitled to vote at the Special Meeting. Consolidated urges its shareholders to vote “FOR” the Proposed Transaction

today.

Consolidated issued the following statement regarding the Glass Lewis

recommendation to vote FOR the Proposed Transaction:

“Glass Lewis joining ISS in its support of the Proposed

Transaction underscores the financially compelling and certain value that this transaction delivers to our shareholders. Following its

extensive and thorough review, the Board believes this transaction is critical for Consolidated’s future and represents the best

risk-adjusted outcome for shareholders.”

In recommending that Company shareholders vote FOR the Proposed Transaction,

Glass Lewis stated1:

| · | “We

also acknowledge that several of the Company’s peers have seen significant declines in their share price during the period following

the announcement of the Consortium’s initial offer. In this context, while optimistic shareholders may believe the long-term upside

of seeing out the fiber investment outweighs the Consortium’s offer, we ultimately believe the certain and immediate value and

liquidity offered in the sale is sufficiently attractive to warrant shareholder support, in the absence of any adverse future developments.” |

| · | “[We]

concur with the board’s view that the Company’s near-term standalone share price would likely fall if the transaction is

not approved.” |

| · | “…we

do not believe there is sufficient evidence to suggest that the risk-adjusted value and premiums offered by the all-cash consideration

are unreasonable. We believe the Advisor’s fairness opinion provides a basis to suggest that the Company is generally being valued

within a reasonable range, and that our supplementary review offers more evidence that the valuation of the Company on a forward multiples

basis is not inconsistent with peers.” |

1 Permission to use quotations from Glass Lewis was neither

sought nor obtained.

Shareholders with questions or who require assistance voting their

shares should contact Consolidated’s proxy solicitor, Morrow Sodali. Shareholders may call toll-free: (800) 662-5200 or +1 (203)

658-9400 (international) or email CNSL@info.morrowsodali.com.

Advisors

Rothschild & Co is acting as financial advisor to the special committee

and Cravath, Swaine & Moore LLP is acting as its legal counsel. Latham & Watkins LLP is providing legal counsel to Consolidated

Communications.

About Consolidated Communications

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) is dedicated

to moving people, businesses and communities forward by delivering the most reliable fiber communications solutions. Consumers, businesses

and wireless and wireline carriers depend on Consolidated for a wide range of high-speed internet, data, phone, security, cloud and wholesale

carrier solutions. With a network spanning nearly 60,000 fiber route miles, Consolidated is a top 10 U.S. fiber provider, turning technology

into solutions that are backed by exceptional customer support.

Forward-Looking Statements

Certain statements in this communication are forward-looking statements

and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements

reflect, among other things, the Company’s current expectations, plans, strategies and anticipated financial results.

There are a number of risks, uncertainties and conditions that may

cause the Company’s actual results to differ materially from those expressed or implied by these forward-looking statements, including:

(i) the risk that the Proposed Transaction may not be completed in a timely manner or at all; (ii) the failure to receive, on a timely

basis or otherwise, the required approvals of the Proposed Transaction by the Company’s stockholders; (iii) the possibility that

any or all of the various conditions to the consummation of the Proposed Transaction may not be satisfied or waived, including the failure

to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions

placed on such approvals); (iv) the possibility that competing offers or acquisition proposals for the Company will be made; (v) the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to

the Proposed Transaction, including in circumstances which would require the Company to pay a termination fee; (vi) the effect of the

announcement or pendency of the Proposed Transaction on the Company’s ability to attract, motivate or retain key executives and

employees, its ability to maintain relationships with its customers, suppliers and other business counterparties, or its operating results

and business generally; (vii) risks related to the Proposed Transaction diverting management’s attention from the Company’s

ongoing business operations; (viii) the amount of costs, fees and expenses related to the Proposed Transaction; (ix) the risk that the

Company’s stock price may decline significantly if the Proposed Transaction is not consummated; (x) the risk of shareholder litigation

in connection with the Proposed Transaction, including resulting expense or delay; and (xi) (A) the risk factors described in Part I,

Item 1A of Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and (B) the other risk

factors identified from time to time in the Company’s other filings with the SEC. Filings with the SEC are available on the SEC’s

website at http://www.sec.gov.

Many of these circumstances are beyond the Company’s ability

to control or predict. These forward-looking statements necessarily involve assumptions on the Company's part. These forward-looking statements

generally are identified by the words “believe,” “expect,” “anticipate,” “intend,” “plan,”

“should,” “may,” “will,” “would” or similar expressions. All forward-looking statements

attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the cautionary

statements that appear throughout this communication. Furthermore, undue reliance should not be placed on forward-looking statements,

which are based on the information currently available to the Company and speak only as of the date they are made. The Company disclaims

any intention or obligation to update or revise publicly any forward-looking statements.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect

of the Proposed Transaction. The Special Meeting will be held on January 31, 2024 at 9:00 A.M. Central Time, at which meeting the stockholders

of the Company will be asked to consider and vote on a proposal to adopt the merger agreement and approve the Proposed Transaction. In

connection with the Proposed Transaction, the Company filed relevant materials with the SEC, including the Proxy Statement. The Company

commenced mailing the Proxy Statement and a proxy card to each stockholder of the Company entitled to vote at the Special Meeting on December

18, 2023. In addition, the Company and certain affiliates of the Company jointly filed an amended transaction statement on Schedule 13e-3

(the “Schedule 13e-3”). INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE

SEC, INCLUDING THE PROXY STATEMENT AND THE SCHEDULE 13E-3, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, SEARCHLIGHT AND

BCI AND THE PROPOSED TRANSACTION. Investors and stockholders of the Company are able to obtain these documents free of charge from the

SEC’s website at www.sec.gov, or free of charge from the Company by directing a request to the Company at 2116 South 17th Street,

Mattoon, IL 61938, Attention: Investor Relations or at tel: +1 (844) 909-2675.

Contacts

Philip Kranz, Investor Relations

+1 217-238-8480

Philip.kranz@consolidated.com

Jennifer Spaude, Media Relations

+1 507-386-3765

Jennifer.spaude@consolidated.com

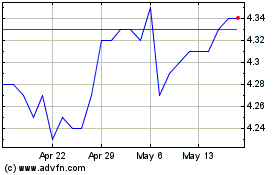

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Feb 2024 to Feb 2025