0001334036false00013340362025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 13, 2025

CROCS, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | |

Delaware |

| 0-51754 |

| 20-2164234 |

(State or other jurisdiction |

| (Commission File Number) |

| (I.R.S. Employer |

of incorporation) |

| |

| Identification No.) |

|

|

|

| 500 Eldorado Blvd., Building 5 |

| | | |

| Broomfield, | | Colorado | | 80021 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 848-7000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class: | Trading symbol: | Name of each exchange on which registered: | |

| Common Stock, par value $0.001 per share | CROX | The Nasdaq Global Select Market | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.45) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 13, 2025, Crocs, Inc. (the “Company”) issued a press release reporting its results of operations for the three and twelve months ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

Item 8.01. Other Events.

On February 13, 2025, the Company also announced that its Board of Directors (the “Board”) has increased the Company’s existing common stock repurchase authorization by $1.0 billion. Including this increase, approximately $1.3 billion remains available for repurchase under the Company’s common stock repurchase authorization as of the date of this Current Report on Form 8-K.

The number, price, structure and timing of the repurchases, if any, will be at the Company’s sole discretion and future repurchases will be evaluated by the Company depending on market conditions, liquidity needs, restrictions under the Company’s debt arrangements, and other factors. Share repurchases may be made in the open market or in privately negotiated transactions. The repurchase authorization does not have an expiration date and does not oblige the Company to acquire any particular amount of the Company’s common stock. The Board may suspend, modify, or terminate the repurchase program at any time without prior notice.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

99.1 |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CROCS, INC. |

| | |

| Date: February 13, 2025 | By: | /s/ Susan Healy |

| | Susan Healy |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| | | | | | | | |

| Investor Contact: | Erinn Murphy, Crocs, Inc. |

| | (303) 848-7005 |

| | emurphy@crocs.com |

| | |

| PR Contact: | Melissa Layton, Crocs, Inc. |

| | (303) 848-7885 |

| | mlayton@crocs.com |

Crocs, Inc. Reports Record 2024 Results with Annual Revenues of $4.1 Billion, Growing 4% Over 2023

•Full-Year 2024 Diluted EPS Up 24% to $15.88 and Adjusted Diluted EPS Up 9% to $13.17

•Expects 2025 To Be Another Year of Positive Revenue Growth for Crocs, Inc., Led by the Crocs Brand

•Upsizes Share Repurchase Authorization by $1 Billion Resulting in Total Authorization Outstanding of Approximately $1.3 Billion

___________________________________________________________________________

BROOMFIELD, COLORADO — February 13, 2025 — Crocs, Inc. (NASDAQ: CROX), a world leader in innovative casual footwear for all, today announced its fourth quarter and full year 2024 financial results.

“We delivered another record year for Crocs, Inc. highlighted by revenue growth of 4% to $4.1 billion and adjusted earnings-per-share growth of 9%. We generated exceptional operating cash flow of approximately $990 million, which enabled us to return value to shareholders through more than $550 million in share repurchases, while fortifying our balance sheet through the pay down of approximately $320 million of debt,” said Andrew Rees, Chief Executive Officer.

Mr. Rees continued, “Our fourth quarter performance exceeded expectations across all metrics led by Crocs Brand growth of 4%, as the North American business outperformed our plan and China growth accelerated from the third quarter. HEYDUDE revenue was flat to last year, higher than anticipated as direct-to-consumer sales inflected to growth.”

“For 2025, we are expecting another year of revenue growth, led by mid-single digit growth in the Crocs Brand. We are pleased by the early signs of progress we made for HEYDUDE during the fourth quarter and are taking a prudent approach to how we shape 2025 guidance for HEYDUDE as we focus on reigniting the brand.”

Susan Healy, Chief Financial Officer added, “In 2024, we stepped up our investment in our brands while driving industry leading margins. We expect operating margin to be approximately 24.0% for 2025, and beyond this year, we are committed to maintaining an annual operating margin at or above this level. We believe that our continued investments in our brands and exceptional cash flow generation will support Crocs, Inc. for sustained growth and value creation over the long-term.”

Amounts referred to as “Adjusted” or “Non-GAAP” are Non-GAAP measures and include adjustments that are described under the heading “Reconciliation of GAAP Measures to Non-GAAP Measures.” A reconciliation of these amounts to their GAAP counterparts are contained in the schedules below.

Fourth Quarter 2024 Operating Results (Compared to the Same Period Last Year)

•Consolidated revenues were $990 million, an increase of 3.1%, or 3.8% on a constant currency basis. Direct-to-consumer (“DTC”) revenues grew 5.5%, or 6.1% on a constant currency basis. Wholesale revenues contracted 0.2%, or grew 0.7% on a constant currency basis.

•Gross margin was 57.9% compared to 55.3%. Adjusted gross margin improved 220 basis points to 57.9% compared to 55.7%.

•Selling, general, and administrative expenses (“SG&A”) of $373 million increased 16.1% from $321 million, and represented 37.7% of revenues compared to 33.5%. Adjusted SG&A of $373 million increased 23.0% from $303 million, and represented 37.7% of revenues compared to 31.6%.

•Income from operations of $200 million decreased 4.6% from $210 million, resulting in operating margin of 20.2% compared to 21.8%. Adjusted income from operations of $200 million decreased 13.5% from $231 million, resulting in adjusted operating margin of 20.2% compared to 24.1%.

•Diluted earnings per share of $6.36 increased 52.9% from $4.16. Adjusted diluted earnings per share of $2.52 decreased 2.3% from $2.58, which excludes the current period tax impact of intra-entity transactions.

•During the quarter, we repaid $75 million of debt. We repurchased approximately 2.0 million shares for $225 million at the average share price of $111.51, and at quarter-end, $324 million of share repurchase authorization remained available for future repurchases.

2024 Operating Results (Compared to Last Year)

•Consolidated revenues were $4,102 million, an increase of 3.5%, or 4.3% on a constant currency basis. DTC revenues grew 7.2%, or 7.8% on a constant currency basis. Wholesale revenues grew 0.2%, or 1.1% on a constant currency basis.

•Gross margin was 58.8% compared to 55.8%. Adjusted gross margin improved 230 basis points to 58.8% compared to 56.5%.

•SG&A of $1,388 million increased 18.3% from $1,173 million, and represented 33.8% of revenues compared to 29.6%. Adjusted SG&A of $1,363 million increased 19.7% from $1,139 million, and represented 33.2% of revenues compared to 28.7%.

•Income from operations of $1,022 million decreased 1% from $1,037 million, resulting in operating margin of 24.9% compared to 26.2%. Adjusted income from operations of $1,050 million decreased 4% from $1,099 million, resulting in adjusted operating margin of 25.6% compared to 27.7%.

•Diluted earnings per share of $15.88 increased 24.2% from $12.79. Adjusted diluted earnings per share of $13.17 increased 9.5% from $12.03, which excludes the current period tax impact of intra-entity transactions.

•During the year, we repaid $323 million of debt. We repurchased approximately 4.3 million shares for $551 million at an average share price of $127.94, and at year-end, $324 million of share repurchase authorization remained available for future repurchases.

Fourth Quarter 2024 Brand Summary (Compared to the Same Period Last Year)

•Crocs Brand: Revenues increased 4.0% to $762 million, or 4.9% on a constant currency basis.

◦Channel

▪DTC revenues increased 5.0% to $447 million, or 5.7% on a constant currency basis.

▪Wholesale revenues increased 2.7% to $315 million, or 3.8% on a constant currency basis.

◦Geography

▪North America revenues were flat at $471 million, and flat on a constant currency basis.

▪International revenues increased 11.5% to $291 million, or 13.7% on a constant currency basis.

•HEYDUDE Brand: Revenues were flat at $228 million.

◦Channel

▪DTC revenues increased 7.2% to $133 million.

▪Wholesale revenues decreased 8.6% to $95 million.

2024 Brand Summary (Compared to Last Year)

•Crocs Brand: Revenues increased 8.8% to $3,278 million, or 9.8% on a constant currency basis.

◦Channel

▪DTC revenues increased 9.9% to $1,670 million, or 10.7% on a constant currency basis.

▪Wholesale revenues increased 7.6% to $1,608 million, or 8.8% on a constant currency basis.

◦Geography

▪North America revenues increased 3.1% to $1,833 million, or 3.2% on a constant currency basis.

▪International revenues increased 17.0% to $1,445 million, or 19.2% on a constant currency basis.

•HEYDUDE Brand: Revenues decreased 13.2% to $824 million.

◦Channel

▪DTC revenues decreased 3.9% to $368 million.

▪Wholesale revenues decreased 19.5% to $456 million.

Balance Sheet and Cash Flow (December 31, 2024 as compared to December 31, 2023)

•Cash and cash equivalents were $180 million compared to $149 million.

•Inventories were $356 million compared to $385 million.

•Total borrowings were $1,349 million compared to $1,664 million.

•Capital expenditures were $69 million compared to $116 million.

Crocs, Inc. Upsizes Share Repurchase Authorization To $1.3 Billion

Earlier this month, the Board approved a $1.0 billion increase to our share repurchase authorization, after which approximately $1.3 billion remained available for future common stock repurchases.

Financial Outlook

First Quarter 2025

With respect to the first quarter of 2025, we expect:

•Revenues to be down approximately 3.5% compared to the first quarter of 2024, at currency rates as of February 10, 2025. This includes an anticipated negative impact of approximately $19 million from foreign currency.

◦Crocs Brand to be down approximately 1% to flat compared to the first quarter of 2024.

◦HEYDUDE Brand to be down approximately 16% to 14% compared to the first quarter of 2024.

•Adjusted operating margin of approximately 21.5%, including an anticipated negative impact of approximately 80 bps from both foreign currency and announced and pending tariffs.

•Adjusted diluted earnings per share of $2.38 to $2.52. Adjusted diluted earnings per share guidance does not assume any impact from potential future share repurchases.

Full Year 2025

With respect to 2025, we expect:

•Revenue growth of approximately 2% to 2.5% compared to full year 2024, at currency rates as of February 10, 2025. This includes an anticipated negative impact of approximately $62 million from foreign currency.

◦Crocs Brand to grow approximately 4.5% compared to full year 2024.

◦HEYDUDE Brand to be down approximately 9% to 7% compared to full year 2024.

•Adjusted operating margin of approximately 24.0%, including an anticipated negative impact of approximately 60 bps from both foreign currency and announced and pending tariffs.

•Combined GAAP tax rate of approximately 21.5% and non-GAAP effective tax rate of approximately 18.0%.

•Adjusted diluted earnings per share of $12.70 to $13.15. Adjusted diluted earnings per share guidance does not assume any impact from potential future share repurchases.

•Capital expenditures of $80 million to $100 million.

Conference Call Information

A conference call to discuss fourth quarter and full-year 2024 results is scheduled for today, Thursday, February 13, 2025, at 8:30 am ET. To receive conference call details, please register at the Investor Relations section of the Crocs website, investors.crocs.com. The webcast will also be available live and on replay through February 13, 2026 at this site.

About Crocs, Inc.:

Crocs, Inc. (Nasdaq: CROX), headquartered in Broomfield, Colorado, is a world leader in innovative casual footwear for all, combining comfort and style with a value that consumers know and love. The Company's brands include Crocs and HEYDUDE, and its products are sold in more than 80 countries through wholesale and direct-to-consumer channels. For more information on Crocs, Inc. visit investors.crocs.com. To learn more about our brands, visit www.crocs.com or www.heydude.com. Individuals can also visit https://investors.crocs.com/news-and-events/ and follow both Crocs and HEYDUDE on their social platforms.

Forward Looking Statements

This press release includes estimates, projections, and statements relating to our business plans, commitments, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements include, but are not limited to, statements regarding our financial condition, brand and liquidity outlook, and expectations regarding our future financial results, share repurchases, our strategy, plans, objectives, expectations (financial or otherwise) and intentions, future financial results and growth potential, statements regarding first quarter and full year 2025 financial outlook and future profitability, cash flows, and brand strength, anticipated product portfolio and our ability to deliver sustained, highly profitable growth and create significant shareholder value. These statements involve known and unknown risks, uncertainties, and other factors, which may cause our actual results, performance, or achievements to be materially different from any future results, performances, or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include the factors described in our most recent Annual Report on Form 10-K under the heading "Risk Factors" and our subsequent filings with the Securities and Exchange Commission. Readers are encouraged to review that section and all other disclosures appearing in our filings with the Securities and Exchange Commission.

All information in this document speaks only as of February 13, 2025. We do not undertake any obligation to update publicly any forward-looking statements, whether as a result of the receipt of new information, future events, or otherwise, except as required by applicable law.

Category:Investors

CROCS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 989,773 | | | $ | 960,097 | | | $ | 4,102,108 | | | $ | 3,962,347 | |

| Cost of sales | 416,847 | | | 429,400 | | | 1,691,850 | | | 1,752,337 | |

| Gross profit | 572,926 | | | 530,697 | | | 2,410,258 | | | 2,210,010 | |

| Selling, general and administrative expenses | 373,011 | | | 321,183 | | | 1,388,347 | | | 1,173,227 | |

| Income from operations | 199,915 | | | 209,514 | | | 1,021,911 | | | 1,036,783 | |

| Foreign currency losses, net | (2,849) | | | 382 | | | (6,777) | | | (1,240) | |

| Interest income | 576 | | | 1,181 | | | 3,484 | | | 2,406 | |

| Interest expense | (23,337) | | | (36,444) | | | (109,264) | | | (161,351) | |

| Other income, net | 929 | | | (774) | | | 1,231 | | | (326) | |

| Income before income taxes | 175,234 | | | 173,859 | | | 910,585 | | | 876,272 | |

| Income tax expense | (193,675) | | | (79,727) | | | (39,486) | | | 83,706 | |

| Net income | $ | 368,909 | | | $ | 253,586 | | | $ | 950,071 | | | $ | 792,566 | |

| Net income per common share: | | | | | | | |

| Basic | $ | 6.40 | | | $ | 4.19 | | | $ | 16.00 | | | $ | 12.91 | |

| Diluted | $ | 6.36 | | | $ | 4.16 | | | $ | 15.88 | | | $ | 12.79 | |

Weighted average common shares outstanding: | | | | | | | |

| Basic | 57,615 | | | 60,543 | | | 59,381 | | | 61,386 | |

| Diluted | 58,027 | | | 60,977 | | | 59,832 | | | 61,952 | |

CROCS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except share and par value amounts)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 180,485 | | | $ | 149,288 | |

| Restricted cash — current | — | | | 2 | |

| Accounts receivable, net of allowances of $31,579 and $27,591, respectively | 257,657 | | | 305,747 | |

| Inventories | 356,254 | | | 385,054 | |

| Income taxes receivable | 4,046 | | | 4,413 | |

| Other receivables | 22,204 | | | 21,071 | |

| Prepaid expenses and other assets | 51,623 | | | 45,129 | |

| Total current assets | 872,269 | | | 910,704 | |

| Property and equipment, net | 244,335 | | | 238,315 | |

| Intangible assets, net | 1,777,080 | | | 1,792,562 | |

| Goodwill | 711,491 | | | 711,588 | |

| Deferred tax assets, net | 872,350 | | | 667,972 | |

| Restricted cash | 3,193 | | | 3,807 | |

| Right-of-use assets | 307,228 | | | 287,440 | |

| Other assets | 24,207 | | | 31,446 | |

| Total assets | $ | 4,812,153 | | | $ | 4,643,834 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 264,901 | | | $ | 260,978 | |

| Accrued expenses and other liabilities | 298,068 | | | 285,771 | |

| Income taxes payable | 108,688 | | | 65,952 | |

| Current borrowings | — | | | 23,328 | |

| Current operating lease liabilities | 68,551 | | | 62,267 | |

| Total current liabilities | 740,208 | | | 698,296 | |

| Deferred tax liabilities, net | 4,086 | | | 12,912 | |

| Long-term income taxes payable | 595,434 | | | 565,171 | |

| Long-term borrowings | 1,349,339 | | | 1,640,996 | |

| Long-term operating lease liabilities | 283,406 | | | 269,769 | |

| Other liabilities | 3,948 | | | 2,767 | |

| Total liabilities | 2,976,421 | | | 3,189,911 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| | | |

| Common stock, par value $0.001 per share, 110.4 million and 110.1 million issued, 56.5 million and 60.5 million shares outstanding, respectively | 110 | | | 110 | |

| Treasury stock, at cost, 53.9 million and 49.6 million shares, respectively | (2,453,473) | | | (1,888,869) | |

| Additional paid-in capital | 859,904 | | | 826,685 | |

| Retained earnings | 3,561,836 | | | 2,611,765 | |

| Accumulated other comprehensive loss | (132,645) | | | (95,768) | |

| Total stockholders’ equity | 1,835,732 | | | 1,453,923 | |

| Total liabilities and stockholders’ equity | $ | 4,812,153 | | | $ | 4,643,834 | |

| | | |

CROCS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 950,071 | | | $ | 792,566 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 69,840 | | | 54,304 | |

| Loss on disposal of assets | 958 | | | 419 | |

| Operating lease cost | 85,130 | | | 79,543 | |

| Inventory donations | 812 | | | 2,078 | |

| Provision for doubtful accounts, net | 1,352 | | | 3,568 | |

| Share-based compensation | 33,053 | | | 29,072 | |

| Asset impairments | 24,081 | | | 9,287 | |

| Deferred taxes | (254,454) | | | (410,319) | |

| Other non-cash items | 13,213 | | | 3,401 | |

| Changes in operating assets and liabilities, net of acquired assets and assumed liabilities: | | | |

| Accounts receivable, net of allowances | 42,587 | | | (13,317) | |

| Inventories | 22,055 | | | 86,350 | |

| Prepaid expenses and other assets | (13,892) | | | (31,839) | |

| Accounts payable | 3,951 | | | 37,197 | |

| Accrued expenses and other liabilities | 9,971 | | | 46,695 | |

| Right-of-use assets and operating lease liabilities | (88,772) | | | (75,107) | |

| Income taxes | 92,530 | | | 316,546 | |

| Cash provided by operating activities | 992,486 | | | 930,444 | |

| Cash flows from investing activities: | | | |

| Purchases of property, equipment, and software | (69,347) | | | (115,625) | |

| | | |

| | | |

| Other | — | | | (46) | |

| Cash used in investing activities | (69,347) | | | (115,671) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from bank borrowings | 102,156 | | | 257,905 | |

| Repayments of bank borrowings | (425,405) | | | (923,703) | |

| Deferred debt issuance costs | (2,277) | | | (1,736) | |

| Repurchases of common stock, including excise taxes paid | (552,451) | | | (175,019) | |

| Repurchases of common stock for tax withholding | (8,239) | | | (17,086) | |

| Other | 168 | | | — | |

| Cash provided by (used in) financing activities | (886,048) | | | (859,639) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (6,510) | | | 3,078 | |

| Net change in cash, cash equivalents, and restricted cash | 30,581 | | | (41,788) | |

| Cash, cash equivalents, and restricted cash — beginning of year | 153,097 | | | 194,885 | |

| Cash, cash equivalents, and restricted cash — end of year | $ | 183,678 | | | $ | 153,097 | |

CROCS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES

In addition to financial measures presented on the basis of accounting principles generally accepted in the United States of America (“GAAP”), we present "Non-GAAP gross profit," “Non-GAAP gross margin,” “Non-GAAP gross margin by brand,” "Non-GAAP selling, general, and administrative expenses,” “Non-GAAP selling, general and administrative expenses as a percent of revenues,” “Non-GAAP income from operations,” “Non-GAAP operating margin,” “Non-GAAP income before income taxes,” “Non-GAAP income tax expense,” “Non-GAAP effective tax rate,” “Non-GAAP net income,” and “Non-GAAP basic and diluted net income per common share," which are non-GAAP financial measures. We also present future period guidance for “Non-GAAP operating margin,” “Non-GAAP effective tax rate,” “Non-GAAP diluted earnings per share,” and “Free cash flow.” Non-GAAP results exclude the impact of items that management believes affect the comparability or underlying business trends in our condensed consolidated financial statements in the periods presented.

We also present certain information related to our current period results of operations through “constant currency,” which is a non-GAAP financial measure and should be viewed as a supplement to our results of operations and presentation of reportable segments under GAAP. Constant currency represents current period results that have been retranslated using exchange rates used in the prior year comparative period to enhance the visibility of the underlying business trends excluding the impact of foreign currency exchange rate fluctuations.

Management uses non-GAAP results to assist in comparing business trends from period to period on a consistent basis in communications with the board of directors, stockholders, analysts, and investors concerning our financial performance. We believe that these non-GAAP measures, in addition to corresponding GAAP measures, are useful to investors and other users of our condensed consolidated financial statements as an additional tool for evaluating operating performance and trends by providing meaningful information about operations compared to our peers by excluding the impacts of various differences. The calculation of our non-GAAP financial metrics may vary from company to company. As a result, our calculation of these metrics may not be comparable to similarly titled metrics used by other companies.

Management believes Non-GAAP gross profit, Non-GAAP gross margin, and Non-GAAP gross margin by brand are useful performance measures for investors because they provide investors with a means of comparing these measures between periods without the impact of certain expenses that we believe are not indicative of our routine cost of sales. Our routine cost of sales includes core product costs and distribution expenses primarily related to receiving, inspecting, warehousing, and packaging product and transportation costs associated with delivering products from distribution centers. Costs not indicative of our routine cost of sales may or may not be recurring in nature and include costs to expand and transition to new distribution centers.

Management believes Non-GAAP selling, general and administrative expenses and Non-GAAP selling, general and administrative expenses as a percent of revenues are useful performance measures for investors because they provide a more meaningful comparison to prior periods and may be indicative of the level of such expenses to be incurred in future periods. These measures exclude the impact of certain expenses not related to our normal operations, such as costs related to the integration of HEYDUDE and other costs that are expected to be non-recurring in nature.

Non-GAAP income from operations and Non-GAAP operating margin reflect the impact of Non-GAAP gross profit and Non-GAAP selling, general, and administrative expenses, as discussed above. We believe these are useful performance measures for investors because they provide a useful basis to compare performance in the period to prior periods.

Non-GAAP income before income taxes reflects the impact of Non-GAAP income from operations, as discussed above. We believe this is a useful performance measure for investors because it provides a useful basis to compare performance in the period to prior periods.

Management believes Non-GAAP income tax expense is a useful performance measure for investors because it provides a basis to compare our tax rates to historical tax rates, and because the adjustment is necessary in order to calculate Non-GAAP net income.

Management believes Non-GAAP effective tax rate is a useful performance measure for investors because it provides an ongoing effective tax rate that they can use for historical comparisons and forecasting.

Management believes Non-GAAP net income is a useful performance measure for investors because it focuses on underlying operating results and trends and improves the comparability of our results to prior periods. This measure reflects the impact of

Non-GAAP gross profit, Non-GAAP selling, general, and administrative expenses, and Non-GAAP income tax expense, as described above.

Management believes Non-GAAP basic and diluted net income per common share are useful performance measures for investors because they focus on underlying operating results and trends and improve the comparability of our results to prior periods. These measures reflect the impact of Non-GAAP gross profit, Non-GAAP selling, general, and administrative expenses, and Non-GAAP income tax expense, as described above.

Free cash flow is calculated as ‘Cash provided by operating activities’ less ‘Purchases of property, equipment, and software.’ Management believes free cash flow is useful for investors because it provides a clear measure of our ability to generate cash for discretionary uses such as funding growth opportunities, repurchasing shares, and reducing debt.

For the three and twelve months ended December 31, 2024, management believes it is helpful to evaluate our results excluding the impacts of various adjustments relating to special or non-recurring items. Investors should not consider these non-GAAP measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP.

Non-GAAP Financial Guidance

Our forward-looking guidance for consolidated “adjusted operating margin” and “adjusted diluted earnings per share” represents non-GAAP financial measures that may exclude or otherwise have been adjusted for special items from our U.S. GAAP financial statements. By their very nature, special and other non-core items are difficult to anticipate with precision because they are generally associated with unexpected and unplanned events that impact our company and its financial results. Therefore, we are unable to provide a reconciliation of these measures for the guidance related to the first quarter of 2025. As of the date hereof, we do not anticipate any adjustments to full year 2025 operating margin, combined tax rate, or earnings per share such that our guidance for full year 2025 “adjusted operating margin,” “non-GAAP effective income tax rate,” and “adjusted diluted earnings per share” is the equivalent of guidance to their respective most directly comparable GAAP financial measure. As a result, we have not included reconciliations of these non-GAAP financial measures to their respective most directly comparable GAAP financial measures.

CROCS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES

(UNAUDITED)

Non-GAAP gross profit and gross margin reconciliation:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| GAAP revenues | $ | 989,773 | | | $ | 960,097 | | | $ | 4,102,108 | | | $ | 3,962,347 | |

| | | | | | | |

| GAAP gross profit | $ | 572,926 | | | $ | 530,697 | | | $ | 2,410,258 | | $ | 2,210,010 | |

Distribution centers (1) | — | | | 3,667 | | | 3,242 | | 27,331 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP gross profit | $ | 572,926 | | | $ | 534,364 | | | $ | 2,413,500 | | $ | 2,237,341 | |

| | | | | | | |

GAAP gross margin | 57.9 | % | | 55.3 | % | | 58.8% | | 55.8 | % |

Non-GAAP gross margin | 57.9 | % | | 55.7 | % | | 58.8% | | 56.5 | % |

(1) During the year ended December 31, 2024, adjustments primarily relate to costs to transition to our new HEYDUDE distribution center in Las Vegas, Nevada. During the three months and year ended December 31, 2023, adjustments represent expenses, including expansion costs and duplicate rent costs, related to our distribution centers in Dayton, Ohio and Las Vegas, Nevada.

Non-GAAP gross margin reconciliation by brand:

Crocs Brand:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| |

| GAAP Crocs Brand gross margin | 60.9 | % | | 59.4 | % | | 61.6% | | 60.0 | % |

| Non-GAAP adjustments: | | | | | | | |

Distribution centers (1) | — | % | | 0.1 | % | | — | % | | 0.2 | % |

| Non-GAAP Crocs Brand gross margin | 60.9 | % | | 59.5 | % | | 61.6 | % | | 60.2 | % |

(1) Represents prior year expenses, including expansion costs and duplicate rent costs, primarily related to our distribution centers in Dayton, Ohio.

HEYDUDE Brand:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | |

| GAAP HEYDUDE Brand gross margin | 47.7 | % | | 44.3 | % | | 47.7 | % | | 44.0 | % |

| Non-GAAP adjustments: | | | | | | | |

Distribution centers (1) | — | % | | 1.2 | % | | 0.4 | % | | 2.2 | % |

| | | | | | | |

| Non-GAAP HEYDUDE Brand gross margin | 47.7 | % | | 45.5 | % | | 48.1 | % | | 46.2 | % |

(1) Represents prior year expenses, including expansion costs, duplicate rent costs, and transitional storage costs, related to our distribution center in Las Vegas, Nevada.

Non-GAAP selling, general and administrative reconciliation:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| GAAP revenues | $ | 989,773 | | | $ | 960,097 | | | $ | 4,102,108 | | | $ | 3,962,347 | |

| | | | | | | |

GAAP selling, general and administrative expenses | $ | 373,011 | | | $ | 321,183 | | | $ | 1,388,347 | | | $ | 1,173,227 | |

Impairment related to information technology systems (1) | — | | | — | | | (18,172) | | | |

Impairment related to distribution centers (2) | — | | | — | | | (6,933) | | | |

| Information technology project discontinuation | — | | | — | | | — | | | (4,119) | |

| HEYDUDE integration costs | — | | | (1,064) | | | — | | | (3,025) | |

Duplicate headquarters rent (3) | — | | | (9,992) | | | — | | | (13,161) | |

Other (4) | — | | | (6,861) | | | — | | | (14,218) | |

| Total adjustments | — | | | (17,917) | | | (25,105) | | | (34,523) | |

Non-GAAP selling, general and administrative expenses (5) | $ | 373,011 | | | $ | 303,266 | | | $ | 1,363,242 | | | $ | 1,138,704 | |

| | | | | | | |

GAAP selling, general and administrative expenses as a percent of revenues | 37.7 | % | | 33.5 | % | | 33.8 | % | | 29.6 | % |

Non-GAAP selling, general and administrative expenses as a percent of revenues | 37.7 | % | | 31.6 | % | | 33.2 | % | | 28.7 | % |

(1) Represents an impairment of information technology systems related to the HEYDUDE integration.

(2) Primarily represents an impairment of the right-of-use assets for our former HEYDUDE Brand warehouses in Las Vegas, Nevada associated with our move to our new distribution center and an impairment of the right-of-use asset for our former Crocs Brand warehouse in Oudenbosch, the Netherlands.

(3) Represents duplicate rent costs associated with our move to a new headquarters.

(4) Includes various restructuring costs, as well as costs associated with the implementation of a new enterprise resource planning system.

(5) Non-GAAP selling, general and administrative expenses are presented gross of tax.

Non-GAAP income from operations and operating margin reconciliation: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| GAAP revenues | $ | 989,773 | | | $ | 960,097 | | | $ | 4,102,108 | | | $ | 3,962,347 | |

| | | | | | | |

| GAAP income from operations | $ | 199,915 | | | $ | 209,514 | | | $ | 1,021,911 | | | $ | 1,036,783 | |

Non-GAAP gross profit adjustments (1) | — | | | 3,667 | | | 3,242 | | | 27,331 | |

Non-GAAP selling, general and administrative expenses adjustments (2) | — | | | 17,917 | | | 25,105 | | | 34,523 | |

| Non-GAAP income from operations | $ | 199,915 | | | $ | 231,098 | | | $ | 1,050,258 | | | $ | 1,098,637 | |

| | | | | | | |

| GAAP operating margin | 20.2 | % | | 21.8 | % | | 24.9 | % | | 26.2 | % |

| Non-GAAP operating margin | 20.2 | % | | 24.1 | % | | 25.6 | % | | 27.7 | % |

(1) See 'Non-GAAP gross profit and gross margin reconciliation' above for more details.

(2) See 'Non-GAAP selling, general and administrative expenses and selling, general and administrative expenses as a percent of revenues reconciliation' above for more details.

Non-GAAP income tax expense (benefit) and effective tax rate reconciliation: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| GAAP income from operations | $ | 199,915 | | | $ | 209,514 | | | $ | 1,021,911 | | | $ | 1,036,783 | |

| GAAP income before income taxes | 175,234 | | | 173,859 | | | 910,585 | | | 876,272 | |

| | | | | | | |

Non-GAAP income from operations (1) | $ | 199,915 | | | $ | 231,098 | | | $ | 1,050,258 | | | $ | 1,098,637 | |

| GAAP non-operating income (expenses): | | | | | | | |

| Foreign currency losses, net | (2,849) | | | 382 | | | (6,777) | | | (1,240) | |

| Interest income | 576 | | | 1,181 | | | 3,484 | | | 2,406 | |

| Interest expense | (23,337) | | | (36,444) | | | (109,264) | | | (161,351) | |

| Other income, net | 929 | | | (774) | | | 1,231 | | | (326) | |

| Non-GAAP income before income taxes | $ | 175,234 | | | $ | 195,443 | | | $ | 938,932 | | | $ | 938,126 | |

| | | | | | | |

| GAAP income tax expense | $ | (193,675) | | | $ | (79,727) | | | $ | (39,486) | | | $ | 83,706 | |

| Tax effect of non-GAAP operating adjustments | (211) | | | 5,515 | | | 6,929 | | | 15,591 | |

Impact of intra-entity IP transactions (2) | 222,117 | | | 112,483 | | | 182,785 | | | 93,250 | |

| Non-GAAP income tax expense | $ | 28,231 | | | $ | 38,271 | | | $ | 150,228 | | | $ | 192,547 | |

| | | | | | | |

| GAAP effective income tax rate | (110.5) | % | | (45.9) | % | | (4.3) | % | | 9.6 | % |

| Non-GAAP effective income tax rate | 16.1 | % | | 19.6 | % | | 16.0 | % | | 20.5 | % |

(1) See ‘Non-GAAP income from operations and operating margin reconciliation’ above for more details.

(2) In the fourth quarter of 2024, and previously in 2023, 2021 and 2020, we made changes to our international legal structure, including an intra-entity transaction related to certain intellectual property rights, primarily to align with current and future international operations. The transactions resulted in a step-up in the tax basis of intellectual property rights and correlated increases in foreign deferred tax assets based on the fair value of the transferred intellectual property rights. This adjustment represents the current period impact of these transactions.

Non-GAAP net income per share reconciliation: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands, except per share data) |

| Numerator: | | | | | | | |

| GAAP net income | $ | 368,909 | | | $ | 253,586 | | | $ | 950,071 | | | $ | 792,566 | |

Non-GAAP gross profit adjustments (1) | — | | | 3,667 | | | 3,242 | | | 27,331 | |

Non-GAAP selling, general and administrative expenses adjustments (2) | — | | | 17,917 | | | 25,105 | | | 34,523 | |

Non-GAAP other income adjustment (3) | (842) | | | — | | | (842) | | | — | |

Tax effect of non-GAAP adjustments (4) | (221,906) | | | (117,998) | | | (189,714) | | | (108,841) | |

Non-GAAP net income | $ | 146,161 | | | $ | 157,172 | | | $ | 787,862 | | | $ | 745,579 | |

| Denominator: | | | | | | | |

GAAP weighted average common shares outstanding - basic | 57,615 | | | 60,543 | | | 59,381 | | | 61,386 | |

Plus: GAAP dilutive effect of stock options and unvested restricted stock units | 412 | | | 434 | | | 451 | | | 566 | |

GAAP weighted average common shares outstanding - diluted | 58,027 | | | 60,977 | | | 59,832 | | | 61,952 | |

| | | | | | | |

| GAAP net income per common share: | | | | | | | |

| Basic | $ | 6.40 | | | $ | 4.19 | | | $ | 16.00 | | | $ | 12.91 | |

| Diluted | $ | 6.36 | | | $ | 4.16 | | | $ | 15.88 | | | $ | 12.79 | |

| | | | | | | |

| Non-GAAP net income per common share: | | | | | | | |

| Basic | $ | 2.54 | | | $ | 2.60 | | | $ | 13.27 | | | $ | 12.15 | |

| Diluted | $ | 2.52 | | | $ | 2.58 | | | $ | 13.17 | | | $ | 12.03 | |

(1) See 'Non-GAAP gross profit and gross margin reconciliation' above for more information.

(2) See 'Non-GAAP selling, general and administrative expenses and selling, general and administrative expenses as a percent of revenues reconciliation' above for more information.

(3) Represents the impact of the early lease termination for our former HEYDUDE Brand warehouse in Las Vegas, Nevada for which we previously recognized impairment associated with our move to our new distribution center.

(4) See ‘Non-GAAP income tax expense (benefit) and effective tax rate reconciliation’ above for more information.

Free cash flow reconciliation:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| Cash provided by operating activities | $ | 321,937 | | | $ | 349,718 | | | $ | 992,486 | | $ | 930,444 | |

| Purchases of property, equipment, and software | (18,490) | | | (29,247) | | | (69,347) | | | (115,625) | |

Free cash flow | $ | 303,447 | | | $ | 320,471 | | | $ | 923,139 | | | $ | 814,819 | |

CROCS, INC. AND SUBSIDIARIES

REVENUES BY SEGMENT, CHANNEL, AND GEOGRAPHY

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | % Change | | Constant Currency % Change (1) |

| | | Favorable (Unfavorable) |

| 2024 | | 2023 | | 2024 | | 2023 | | Q4 2024-2023 | | YTD 2024-2023 | | Q4 2024-2023 | | YTD 2024-2023 |

| ($ in thousands) |

| Crocs Brand: | | | | | | | | | | | | | | | |

| North America: | | | | | | | | | | | | | | | |

| Wholesale | $ | 128,084 | | | $ | 134,884 | | | $ | 644,511 | | | $ | 652,943 | | | (5.0) | % | | (1.3) | % | | (4.9) | % | | (1.2) | % |

| Direct-to-consumer | $ | 342,893 | | | $ | 336,392 | | | $ | 1,188,911 | | | $ | 1,124,942 | | | 1.9 | % | | 5.7 | % | | 2.1 | % | | 5.8 | % |

Total North America (2) | 470,977 | | | 471,276 | | | 1,833,422 | | | 1,777,885 | | | (0.1) | % | | 3.1 | % | | 0.1 | % | | 3.2 | % |

| International: | | | | | | | | | | | | | | | |

| Wholesale | 186,615 | | | 171,572 | | | 963,035 | | | 840,594 | | | 8.8 | % | | 14.6 | % | | 10.7 | % | | 16.7 | % |

| Direct-to-consumer | 104,472 | | | 89,609 | | | 481,510 | | | 394,475 | | | 16.6 | % | | 22.1 | % | | 19.4 | % | | 24.7 | % |

| Total International | 291,087 | | | 261,181 | | | 1,444,545 | | | 1,235,069 | | | 11.5 | % | | 17.0 | % | | 13.7 | % | | 19.2 | % |

| Total Crocs Brand | $ | 762,064 | | | $ | 732,457 | | | $ | 3,277,967 | | | $ | 3,012,954 | | | 4.0 | % | | 8.8 | % | | 4.9 | % | | 9.8 | % |

| | | | | | | | | | | | | | | |

| Crocs Brand: | | | | | | | | | | | | | | | |

| Wholesale | $ | 314,699 | | | $ | 306,456 | | | $ | 1,607,546 | | | $ | 1,493,537 | | | 2.7 | % | | 7.6 | % | | 3.8 | % | | 8.8 | % |

| Direct-to-consumer | 447,365 | | | 426,001 | | | 1,670,421 | | | 1,519,417 | | | 5.0 | % | | 9.9 | % | | 5.7 | % | | 10.7 | % |

| Total Crocs Brand | 762,064 | | | 732,457 | | | 3,277,967 | | | 3,012,954 | | | 4.0 | % | | 8.8 | % | | 4.9 | % | | 9.8 | % |

| HEYDUDE Brand: | | | | | | | | | | | | | | | |

| Wholesale | 94,872 | | | 103,748 | | | 456,472 | | | 566,937 | | | (8.6) | % | | (19.5) | % | | (8.3) | % | | (19.5) | % |

| Direct-to-consumer | 132,837 | | | 123,892 | | | 367,669 | | | 382,456 | | | 7.2 | % | | (3.9) | % | | 7.2 | % | | (3.9) | % |

Total HEYDUDE Brand (3) | 227,709 | | | 227,640 | | | 824,141 | | | 949,393 | | | — | % | | (13.2) | % | | 0.1 | % | | (13.2) | % |

| Total consolidated revenues | $ | 989,773 | | | $ | 960,097 | | | $ | 4,102,108 | | | $ | 3,962,347 | | | 3.1 | % | | 3.5 | % | | 3.8 | % | | 4.3 | % |

(1) Reflects year over year change as if the current period results were in constant currency, which is a non-GAAP financial measure. See ‘Reconciliation of GAAP Measures to Non-GAAP Measures’ above for more information.

(2) North America includes the United States and Canada.

(3) The vast majority of HEYDUDE Brand revenues are derived from North America.

CROCS, INC. AND SUBSIDIARIES

DIRECT-TO-CONSUMER COMPARABLE SALES

(UNAUDITED)

Direct-to-consumer (“DTC”) comparable sales were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Constant Currency (1) |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Direct-to-consumer comparable sales: (2) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Crocs Brand | 0.3 | % | | 10.7 | % | | 7.2 | % | | 15.5 | % |

| HEYDUDE Brand | (8.3) | % | | (14.2) | % | | (14.6) | % | | 3.6 | % |

(1) Reflects period over period change on a constant currency basis, which is a non-GAAP financial measure. See “Use of Non-GAAP Financial Measures” for more information.

(2) Comparable store status, as included in the DTC comparable sales figures above, is determined on a monthly basis. Comparable store sales include the revenues of stores that have been in operation for more than twelve months. Stores in which selling square footage has changed more than 15% as a result of a remodel, expansion, or reduction are excluded until the thirteenth month in which they have comparable prior year sales. Temporarily closed stores are excluded from the comparable store sales calculation during the month of closure and in the same month in the following year. Location closures in excess of three months are excluded until the thirteenth month post re-opening. E-commerce comparable revenues are based on same site sales period over period. E-commerce sites that are temporarily offline or unable to transact or fulfill orders (“site disruption”) are excluded from the comparable sales calculation during the month of site disruption and in the same month in the following year. E-commerce site disruptions in excess of three months are excluded until the thirteenth month after the site has re-opened. Additionally, comparable sales do not include leap days in leap years.

v3.25.0.1

Document and Entity Information Document

|

Feb. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 13, 2025

|

| Entity Registrant Name |

CROCS, INC.

|

| Entity Central Index Key |

0001334036

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

0-51754

|

| Entity Tax Identification Number |

20-2164234

|

| Entity Address, Address Line One |

500 Eldorado Blvd., Building 5

|

| Entity Address, City or Town |

Broomfield,

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80021

|

| City Area Code |

303

|

| Local Phone Number |

848-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CROX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

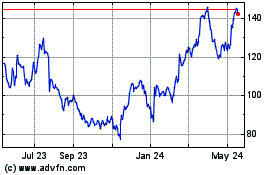

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jan 2025 to Feb 2025

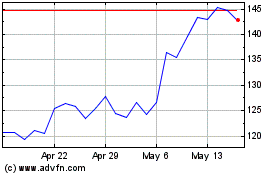

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Feb 2024 to Feb 2025