Corsair Gaming, Inc. (Nasdaq: CRSR) (“Corsair” or the

“Company”), a leading global provider and innovator of

high-performance products for gamers, streamers, content-creators,

and gaming PC builders, today announced financial results for the

second quarter ended June 30, 2024, and its updated financial

outlook for the full year 2024.

Second Quarter 2024 Select Financial Metrics

- Net revenue was $261.3 million compared to $325.4 million in

the second quarter of 2023, a decrease of 19.7%. Gaming Components

and Systems segment net revenue was $167.1 million compared to

$246.7 million in the second quarter of 2023, while Gamer and

Creator Peripherals segment net revenue was $94.2 million compared

to $78.8 million in the second quarter of 2023.

- Net loss attributable to common shareholders was $29.6 million,

or a net loss of $0.28 per diluted share, compared to net income of

$1.1 million, or a net income of $0.01 per diluted share, in the

second quarter of 2023.

- Adjusted net loss was $6.8 million, or an adjusted net loss of

$0.07 per diluted share, compared to adjusted net income of $9.8

million, or an adjusted net income of $0.09 per diluted share, in

the second quarter of 2023.

- Adjusted EBITDA was a loss of $1.2 million, compared to

adjusted EBITDA of $17.8 million in the second quarter of

2023.

- Cash and restricted cash was $94.6 million as of June 30,

2024.

First Half 2024 Select Financial Metrics

- Net revenue was $598.6 million compared to $679.4 million in

the first six months of 2023, a decrease of 11.9%. Gaming

Components and Systems segment net revenue was $397.4 million

compared to $511.7 million in the first six months of 2023, while

Gamer and Creator Peripherals segment net revenue was $201.2

million compared to $167.7 million in the first six months of

2023.

- Net loss attributable to common shareholders was $42.1 million,

or a net loss of $0.41 per diluted share, compared to net income of

$43 thousand, or a net income of $0.00 per diluted share, in the

first six months of 2023.

- Adjusted net income was $2.7 million, or an adjusted net income

of $0.03 per diluted share, compared to adjusted net income of

$21.8 million, or an adjusted net income of $0.20 per diluted

share, in the first six months of 2023.

- Adjusted EBITDA was $16.8 million, compared to adjusted EBITDA

of $38.3 million in the first six months of 2023.

Andy Paul, Chief Executive Officer of Corsair, stated, “Clearly

we are disappointed by our Q2 2024 results, which were driven by a

softer-than-expected self-built PC market. The surge of activity

during the COVID lock-down period, where the number of gaming PCs

that were built approximately doubled from the prior year, and

headset sales almost tripled, which we believe means that the

installed base of gaming hardware is now at an all-time high. Even

with this surge, we now are seeing the market for headsets, which

is usually the entry point for first-time gaming hardware

purchases, almost twice the size of the market before COVID

lock-downs. We believe this shows the gaming market is continuing

to grow.

“For the self-built PC market, where our components and memory

product lines are used, we see the market a little softer than it

was pre COVID, but we believe it is still at a healthy level. We

are expecting an 'echo' of the COVID surge to occur as we move into

a natural refresh cycle, which based on prior cycles is typically a

3 to 5 year period. This is very dependent on consumer spending

power, inflation, and of course new games and the timing of new

graphics hardware. Our expectation last year was that this coming

refresh surge would happen in 2024 through 2026, 3 to 5 years after

the COVID lock-down. It now appears that is more likely going to

start a little later than expected, since we expect to see new GPUs

from NVIDIA launching around the end of 2024, with many highly

anticipated games expected to launch in late 2024 and 2025, notably

Call of Duty: Black Ops 6 later this year and Grand Theft Auto VI

in 2025. This will affect our sales of products in our Gaming

Components and Systems segment and we have reforecast this

accordingly. For Q2 2024, we did see some adjustments downwards of

our channel inventory in our Memory product line, meaning that the

sales out of our channel were ahead of our sales in by

approximately 15%.

“In our Gamer and Creator Peripherals segment, we are seeing

strong growth. While the market for those products is showing

slight improvement, we also continue to launch products in new

categories. Notably, this year we launched teleprompters, PC

controllers and mobile controllers, as well as many other

innovative new products in our existing categories. We also

announced our entry into the Sim racing market, with our own

designed products, which we recently showcased at Computex. We

remain interested in the Sim racing brand Fanatec, owned by ENDOR

AG. Although we were disappointed to see the company file for

insolvency, we intend to continue exploring a potential

acquisition. Such acquisition would likely be within the framework

of the pending insolvency proceedings, and as a result, we cannot

provide any assurance our bid will be successful. Q2 2024 was

another good quarter for this segment as it grew by 19.6% YoY,

which is the third successive quarter of strong, high-teens to 20%

growth. We intend to continue to grow the Gamer and Creator

Peripherals segment organically, as well as with strategic

acquisitions. We believe this business has the potential to become

larger than our traditional components business within a few years.

For our Gaming Components and Systems segment, which includes our

memory business, we continue to dominate the market with leading

market share in most categories. We intend to continue that trend,

while running these businesses as efficiently as we can from a cost

standpoint, while we wait for the market to recover and return to

growth.”

Michael G. Potter, Chief Financial Officer of Corsair, stated,

“We are executing on cost savings, and took additional action in

July 2024, including the reduction of approximately 100 employees,

and will reduce some external expenses which we anticipate will

lower operating expenses in the second half of 2024. We remain

committed to controlling operating expenses, while continuing to

support growth in our Gamer and Creator Peripherals segment, which

generally has higher operating expense demands for R&D and

marketing. We continue to see inflation and high interest rates

having a negative effect on high-value consumer purchases, and are

seeing higher-than-average credit declines on system purchases.

Adding to this, we had a 1% to 2% margin impact from fixed costs

allocated over lower than expected volumes. We continue to maintain

a healthy balance sheet, with sufficient cash to fund the

development of our expanding product portfolio. We expect to

further reduce inventory during the third quarter, as we move into

the traditionally stronger second half, which we expect will also

generate additional cash. Finally, we further reduced our channel

inventory, ending the quarter in a healthy position, which will

benefit us in the second half of 2024 as we focus on driving

revenue growth and profitability.”

Updated 2024 Financial Outlook

Corsair updated its financial outlook for the full year 2024.

The Company continues to expect revenue to improve through 2024,

with a further improvement in adjusted EBITDA led by an additional

improvement in margin, stabilized shipping costs and continued

tight operating expense controls.

- Net revenue to be in the range of $1.25 billion to $1.35

billion.

- Adjusted operating income to be in the range of $48 million to

$63 million.

- Adjusted EBITDA to be in the range of $60 million to $75

million.

Certain non-GAAP measures included in our financial outlook were

not reconciled to the comparable GAAP financial measures because

the GAAP measures are not accessible on a forward-looking basis. We

are unable to reconcile these forward-looking non-GAAP financial

measures to the most directly comparable GAAP measures without

unreasonable efforts because we are currently unable to predict

with a reasonable degree of certainty the type and extent of

certain items that would be expected to impact GAAP measures for

these periods but would not impact the non-GAAP measures. Such

items may include stock-based compensation charges, amortization,

and other items. The unavailable information could have a

significant impact on our GAAP financial results.

The foregoing forward-looking statements reflect our

expectations as of today’s date. Given the number of risk factors,

uncertainties and assumptions discussed below, actual results may

differ materially. We do not intend to update our financial outlook

until our next quarterly results announcement.

Recent Product Developments

- Entered Popular Sim Racing Category: Our initial launch

includes a ground up designed sleek cockpit, constructed with a

robust steel frame, and engineered to withstand the rigors of

intense, high-octane racing.

- New Mobile Controller: The SCUF Nomad is an innovative

iPhone® Bluetooth controller providing a premium mobile gaming

experience in a compact design that can be taken anywhere. SCUF +

Nomad is accompanied by a free iOS companion app that does not

require a paid subscription.

- Customization: CORSAIR Custom Lab is a personalized

shopping experience where gamers can choose from multiple

peripherals with customized matching patterns or themes.

- K65 achieves #1 Revenue position in the United States for

Q2. Third party data shows the newly launched K65 wireless

keyboard achieved the highest revenue in the gaming keyboard

category for Q2.

Conference Call and Webcast Information

Corsair will host a conference call to discuss the second

quarter 2024 financial results today at 2:00 p.m. Pacific Time. The

conference call will be accessible on Corsair’s Investor Relations

website at https://ir.corsair.com, or by dialing 1-844-825-9789

(USA) or 1-412-317-5180 (International) with conference ID

10190926. A replay will be available approximately 2 hours after

the live call ends on Corsair's Investor Relations website, or

through August 8, 2024 by dialing 1-844-512-2921 (USA) or

1-412-317-6671 (International), with passcode 10190926.

About Corsair Gaming

Corsair (Nasdaq: CRSR) is a leading global developer and

manufacturer of high-performance products and technology for

gamers, content creators, and PC enthusiasts. From award-winning PC

components and peripherals, to premium streaming equipment and

smart ambient lighting, Corsair delivers a full ecosystem of

products that work together to enable everyone, from casual gamers

to committed professionals, to perform at their very best. Corsair

also sells products under its Elgato brand, which provides premium

studio equipment and accessories for content creators, SCUF Gaming

brand, which builds custom-designed controllers for competitive

gamers, Drop, the leading community-driven mechanical keyboard

brand and ORIGIN PC brand, a builder of custom gaming and

workstation desktop PCs.

Forward Looking Statements

Except for the historical information contained herein, the

matters set forth in this press release are forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, including,

but not limited to, Corsair’s expectations regarding market

headwinds and tailwinds, including its expectations regarding the

gaming market’s continued growth, as well as the timing and impact

from product refresh cycles; its expectations regarding sales and

revenue growth in 2024 and 2025; statements regarding new product

launches, the entry into new product categories and demand for new

products; its ability to successfully close and integrate

acquisitions, including its bid for ENDOR AG; its plans and

expectations regarding continuing to grow its Gaming and Creator

Peripherals segment and the size of this segment in the future; the

impact of the Company’s cost-saving measures; its plans regarding

reducing inventory; and its estimated full year 2024 net revenue,

adjusted operating income and adjusted EBITDA. Forward-looking

statements are based on our management’s beliefs, as well as

assumptions made by, and information currently available to them.

Because such statements are based on expectations as to future

financial and operating results and are not statements of fact,

actual results may differ materially from those projected. Factors

which may cause actual results to differ materially from current

expectations include, but are not limited to: current macroeconomic

conditions, including the impacts of high inflation and risk of

recession, on demand for our products, consumer confidence and

financial markets generally; the lingering impacts and future

outbreaks of the COVID-19 pandemic and its impacts on our

operations and the operations of our manufacturers, retailers and

other partners, as well as its impacts on the economy overall,

including capital markets; our ability to build and maintain the

strength of our brand among gaming and streaming enthusiasts and

our ability to continuously develop and successfully market new

products and improvements to existing products; the introduction

and success of new third-party high-performance computer hardware,

particularly graphics processing units and central processing units

as well as sophisticated new video games; fluctuations in operating

results; the risk that we are not able to compete with competitors

and/or that the gaming industry, including streaming and esports,

does not grow as expected or declines; the loss or inability to

attract and retain key management; the impacts from geopolitical

events and unrest; delays or disruptions at our or third-parties’

manufacturing and distribution facilities; the risk that we are not

able to successfully identify and close acquisitions, as well as

integrate any companies or assets we have acquired or may acquire;

currency exchange rate fluctuations or international trade disputes

resulting in our products becoming relatively more expensive to our

overseas customers or resulting in an increase in our manufacturing

costs; and the other factors described under the heading “Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the Securities and Exchange Commission

(“SEC”) and our subsequent filings with the SEC. Copies of each

filing may be obtained from us or the SEC. All forward-looking

statements reflect our beliefs and assumptions only as of the date

of this press release. We undertake no obligation to update

forward-looking statements to reflect future events or

circumstances. Our results for the quarter ended June 30, 2024 are

also not necessarily indicative of our operating results for any

future periods.

Use and Reconciliation of Non-GAAP Financial Measures

To supplement the financial results presented in accordance with

GAAP, this earnings release presents certain non-GAAP financial

information, including adjusted operating income (loss), adjusted

net income (loss), adjusted net income (loss) per diluted share and

adjusted EBITDA. These are important financial performance measures

for us, but are not financial measures as defined by GAAP. The

presentation of this non-GAAP financial information is not intended

to be considered in isolation of or as a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP.

We use adjusted operating income (loss), adjusted net income

(loss), adjusted net income (loss) per share and adjusted EBITDA to

evaluate our operating performance and trends and make planning

decisions. We believe that these non-GAAP financial measures help

identify underlying trends in our business that could otherwise be

masked by the effect of the expenses and other items that we

exclude in such non-GAAP measures. Accordingly, we believe that

these non-GAAP financial measures provide useful information to

investors and others in understanding and evaluating our operating

results, enhancing the overall understanding of our past

performance and future prospects, and allowing for greater

transparency with respect to the key financial metrics used by our

management in our financial and operational decision-making. We

also present these non-GAAP financial measures because we believe

investors, analysts and rating agencies consider it useful in

measuring our ability to meet our debt service obligations.

Our use of these terms may vary from that of others in our

industry. These non-GAAP financial measures should not be

considered as an alternative to net revenue, operating income

(loss), net income (loss), cash provided by operating activities,

or any other measures derived in accordance with GAAP as measures

of operating performance or liquidity. Reconciliations of these

measures to the most directly comparable GAAP financial measures

are presented in the attached schedules.

We calculate these non-GAAP financial measures as follows:

- Adjusted operating income (loss), non-GAAP, is determined by

adding back to GAAP operating income (loss), the impact from

amortization, stock-based compensation, one-time costs related to

legal and other matters, acquisition and related integration costs,

restructuring and other charges, and acquisition accounting impact

related to recognizing acquired inventory at fair value.

- Adjusted net income (loss), non-GAAP, is determined by adding

back to GAAP net income (loss), the impact from amortization,

stock-based compensation, one-time costs related to legal and other

matters, acquisition and related integration costs, restructuring

and other charges, acquisition accounting impact related to

recognizing acquired inventory at fair value, and the related tax

effects of each of these adjustments.

- Adjusted net income (loss) per diluted share, non-GAAP, is

determined by dividing adjusted net income (loss), non-GAAP by the

respective weighted average shares outstanding, inclusive of the

impact of other dilutive securities.

- Adjusted EBITDA is determined by adding back to GAAP net income

(loss), the impact from amortization, stock-based compensation,

one-time costs related to legal and other matters, depreciation,

interest expense, net, acquisition and related integration costs,

restructuring and other charges, acquisition accounting impact

related to recognizing acquired inventory at fair value, and tax

expense (benefit).

We encourage investors and others to review our financial

information in its entirety, not to rely on any single financial

measure and to view these non-GAAP financial measures in

conjunction with the related GAAP financial measures.

Corsair Gaming, Inc.

Condensed Consolidated

Statements of Operations

(Unaudited, in thousands, except

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenue

$

261,300

$

325,432

$

598,557

$

679,396

Cost of revenue

198,215

242,600

448,833

511,160

Gross profit

63,085

82,832

149,724

168,236

Operating expenses:

Sales, general and administrative

70,388

69,953

150,605

137,482

Product development

17,411

15,593

34,052

32,431

Total operating expenses

87,799

85,546

184,657

169,913

Operating loss

(24,714

)

(2,714

)

(34,933

)

(1,677

)

Other (expense) income:

Interest expense

(3,436

)

(4,496

)

(7,127

)

(8,798

)

Interest income

1,158

1,978

2,723

3,452

Other expense, net

(516

)

(1,134

)

(977

)

(1,630

)

Total other expense, net

(2,794

)

(3,652

)

(5,381

)

(6,976

)

Loss before income taxes

(27,508

)

(6,366

)

(40,314

)

(8,653

)

Income tax benefit

4,001

2,287

5,778

2,926

Net loss

(23,507

)

(4,079

)

(34,536

)

(5,727

)

Less: Net income attributable to

noncontrolling interest

687

401

1,223

765

Net loss attributable to Corsair Gaming,

Inc.

$

(24,194

)

$

(4,480

)

$

(35,759

)

$

(6,492

)

Calculation of net loss per share

attributable to common stockholders of Corsair Gaming, Inc.:

Net loss attributable to Corsair Gaming,

Inc.

$

(24,194

)

$

(4,480

)

$

(35,759

)

$

(6,492

)

Change in redemption value of redeemable

noncontrolling interest

(5,385

)

5,577

(6,360

)

6,535

Net income (loss) attributable to common

stockholders of Corsair Gaming, Inc.

$

(29,579

)

$

1,097

$

(42,119

)

$

43

Net income (loss) per share attributable

to common stockholders of Corsair Gaming, Inc.:

Basic

$

(0.28

)

$

0.01

$

(0.41

)

$

0.00

Diluted

$

(0.28

)

$

0.01

$

(0.41

)

$

0.00

Weighted-average common shares

outstanding:

Basic

103,956

102,304

103,760

101,996

Diluted

103,956

106,502

103,760

106,169

Corsair Gaming, Inc.

Segment Information

(Unaudited, in thousands, except

percentages)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenue:

Gamer and Creator Peripherals

$

94,229

$

78,755

$

201,202

$

167,697

Gaming Components and Systems

167,071

246,677

397,355

511,699

Total Net revenue

$

261,300

$

325,432

$

598,557

$

679,396

Gross Profit:

Gamer and Creator Peripherals

$

35,699

$

25,509

$

79,342

$

52,157

Gaming Components and Systems

27,386

57,323

70,382

116,079

Total Gross Profit

$

63,085

$

82,832

$

149,724

$

168,236

Gross Margin:

Gamer and Creator Peripherals

37.9

%

32.4

%

39.4

%

31.1

%

Gaming Components and Systems

16.4

%

23.2

%

17.7

%

22.7

%

Total Gross Margin

24.1

%

25.5

%

25.0

%

24.8

%

Corsair Gaming, Inc.

Condensed Consolidated Balance

Sheets

(Unaudited, in thousands)

June 30, 2024

December 31, 2023

Assets

Current assets:

Cash and restricted cash

$

94,344

$

178,325

Accounts receivable, net

188,564

253,268

Inventories

265,537

240,172

Prepaid expenses and other current

assets

31,179

39,824

Total current assets

579,624

711,589

Restricted cash, noncurrent

243

239

Property and equipment, net

30,960

32,212

Goodwill

354,394

354,705

Intangible assets, net

168,715

188,009

Other assets

100,305

70,709

Total assets

$

1,234,241

$

1,357,463

Liabilities

Current liabilities:

Debt maturing within one year, net

$

12,218

$

12,190

Accounts payable

167,608

239,957

Other liabilities and accrued expenses

142,904

166,340

Total current liabilities

322,730

418,487

Long-term debt, net

168,050

186,006

Deferred tax liabilities

11,112

17,395

Other liabilities, noncurrent

57,920

41,595

Total liabilities

559,812

663,483

Temporary equity

Redeemable noncontrolling interest

21,667

15,937

Permanent equity

Corsair Gaming, Inc. stockholders’

equity:

Common stock and additional paid-in

capital

649,245

630,652

(Accumulated deficit) retained

earnings

(1,709

)

40,410

Accumulated other comprehensive loss

(4,807

)

(3,487

)

Total Corsair Gaming, Inc. stockholders'

equity

642,729

667,575

Nonredeemable noncontrolling interest

10,033

10,468

Total permanent equity

652,762

678,043

Total liabilities, temporary equity and

permanent equity

$

1,234,241

$

1,357,463

Corsair Gaming, Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited, in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cash flows from operating

activities:

Net loss

$

(23,507

)

$

(4,079

)

$

(34,536

)

$

(5,727

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Stock-based compensation

8,010

8,174

15,701

15,420

Depreciation

3,093

3,036

6,180

5,933

Amortization

9,501

9,757

19,016

19,498

Deferred income taxes

(9,206

)

(3,490

)

(15,265

)

(5,699

)

Other

623

2,154

1,381

2,282

Changes in operating assets and

liabilities:

Accounts receivable

28,891

(697

)

75,819

13,926

Inventories

(13,769

)

(24,014

)

(25,870

)

(19,342

)

Prepaid expenses and other assets

2,897

(4,510

)

7,334

(5,587

)

Accounts payable

(24,056

)

7,404

(72,018

)

25,560

Other liabilities and accrued expenses

(939

)

8,411

(22,521

)

(2,292

)

Net cash (used in) provided by operating

activities

(18,462

)

2,146

(44,779

)

43,972

Cash flows from investing

activities:

Purchase of property and equipment

(2,509

)

(2,780

)

(5,029

)

(7,457

)

Purchase of intangible asset

(100

)

—

(100

)

—

Purchase price adjustment related to

business acquisition

—

—

1,041

—

Bridge loan receivable

(12,310

)

—

(12,310

)

—

Net cash used in investing activities

(14,919

)

(2,780

)

(16,398

)

(7,457

)

Cash flows from financing

activities:

Repayment of debt

(3,125

)

(1,250

)

(18,125

)

(11,250

)

Payment of deferred and contingent

consideration

—

—

(4,942

)

(950

)

Proceeds from issuance of shares through

employee equity incentive plans

949

4,262

3,300

6,379

Payment of taxes related to net share

settlement of equity awards

(17

)

(231

)

(415

)

(787

)

Dividend paid to noncontrolling

interest

—

—

(1,960

)

—

Payment of other offering costs

—

—

—

(497

)

Net cash (used in) provided by financing

activities

(2,193

)

2,781

(22,142

)

(7,105

)

Effect of exchange rate changes on

cash

(22

)

(188

)

(658

)

542

Net (decrease) increase in cash and

restricted cash

(35,596

)

1,959

(83,977

)

29,952

Cash and restricted cash at the beginning

of the period

130,183

182,053

178,564

154,060

Cash and restricted cash at the end of the

period

$

94,587

$

184,012

$

94,587

$

184,012

Corsair Gaming, Inc.

GAAP to Non-GAAP

Reconciliations

Non-GAAP Operating Income

(Loss) Reconciliations

(Unaudited, in thousands, except

percentages)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating Loss – GAAP

$

(24,714

)

$

(2,714

)

$

(34,933

)

$

(1,677

)

Amortization

9,501

9,757

19,016

19,498

Stock-based compensation

8,010

8,174

15,701

15,420

One-time costs related to legal and other

matters

1,056

—

7,470

—

Acquisition and related integration

costs

1,677

634

2,379

774

Restructuring and other charges

440

—

1,566

—

Acquisition accounting impact related to

recognizing acquired inventory at fair value

209

—

378

—

Adjusted Operating Income (Loss) –

Non-GAAP

$

(3,821

)

$

15,851

$

11,577

$

34,015

As a % of net revenue – GAAP

-9.5

%

-0.8

%

-5.8

%

-0.2

%

As a % of net revenue - Non-GAAP

-1.5

%

4.9

%

1.9

%

5.0

%

Corsair Gaming, Inc.

GAAP to Non-GAAP

Reconciliations

Non-GAAP Net Income (Loss) and

Net Income (Loss) Per Share Reconciliations

(Unaudited, in thousands, except

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss) attributable to common

stockholders of Corsair Gaming, Inc. (1)

$

(29,579

)

$

1,097

$

(42,119

)

$

43

Less: Change in redemption value of

redeemable noncontrolling interest

(5,385

)

5,577

(6,360

)

6,535

Net loss attributable to Corsair Gaming,

Inc.

(24,194

)

(4,480

)

(35,759

)

(6,492

)

Add: Net income attributable to

noncontrolling interest

687

401

1,223

765

Net Loss – GAAP

(23,507

)

(4,079

)

(34,536

)

(5,727

)

Adjustments:

Amortization

9,501

9,757

19,016

19,498

Stock-based compensation

8,010

8,174

15,701

15,420

One-time costs related to legal and other

matters

1,056

—

7,470

—

Acquisition and related integration

costs

1,677

634

2,379

774

Restructuring and other charges

440

—

1,566

—

Acquisition accounting impact related to

recognizing acquired inventory at fair value

209

—

378

—

Non-GAAP income tax adjustment

(4,214

)

(4,665

)

(9,286

)

(8,215

)

Adjusted Net Income (Loss) -

Non-GAAP

$

(6,828

)

$

9,821

$

2,688

$

21,750

Diluted net income (loss) per

share:

GAAP

$

(0.28

)

$

0.01

$

(0.41

)

$

0.00

Adjusted, Non-GAAP

$

(0.07

)

$

0.09

$

0.03

$

0.20

Weighted-average common shares

outstanding - Diluted:

GAAP

103,956

106,502

103,760

106,169

Adjusted, Non-GAAP

103,956

106,502

106,537

106,169

(1) Numerator for calculating net income

(loss) per share-GAAP

Corsair Gaming, Inc.

GAAP to Non-GAAP

Reconciliations

Adjusted EBITDA

Reconciliations

(Unaudited, in thousands, except

percentages)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net Loss – GAAP

$

(23,507

)

$

(4,079

)

$

(34,536

)

$

(5,727

)

Amortization

9,501

9,757

19,016

19,498

Stock-based compensation

8,010

8,174

15,701

15,420

One-time costs related to legal and other

matters

1,056

—

7,470

—

Depreciation

3,093

3,036

6,180

5,933

Interest expense, net of interest

income

2,278

2,518

4,404

5,346

Acquisition and related integration

costs

1,677

634

2,379

774

Restructuring and other charges

440

—

1,566

—

Acquisition accounting impact related to

recognizing acquired inventory at fair value

209

—

378

—

Income tax benefit

(4,001

)

(2,287

)

(5,778

)

(2,926

)

Adjusted EBITDA - Non-GAAP

$

(1,244

)

$

17,753

$

16,780

$

38,318

Adjusted EBITDA margin - Non-GAAP

-0.5

%

5.5

%

2.8

%

5.6

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801004727/en/

Investor Relations Contact: Ronald van Veen

ir@corsair.com 510-578-1407 Media Contact: David Ross

david.ross@corsair.com +4411 8208 0542

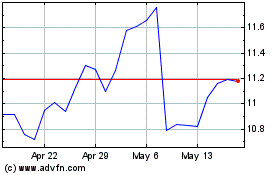

Corsair Gaming (NASDAQ:CRSR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Corsair Gaming (NASDAQ:CRSR)

Historical Stock Chart

From Feb 2024 to Feb 2025