Cisco Avoids Negative Impact Of Tariffs -- WSJ

15 November 2018 - 7:02PM

Dow Jones News

By Jay Greene and Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 15, 2018).

Cisco Systems Inc. is one of a few tech giants under threat from

the Trump administration's trade fight with China, but the company

said it has evaded damage from tariffs so far.

"I haven't had one conversation with any customer around the

tariffs at this point," Chief Executive Chuck Robbins told analysts

Wednesday after the networking-gear company reported its

fourth-consecutive quarter of growth following eight quarters of

declines.

Still, the company is taking steps to mitigate possible

financial fallout from a tariff increase scheduled for the start of

the new year, moving some manufacturing away from China.

A collection of switches and routers, some of which Cisco makes

in China and imports to the U.S., were hit with 10% tariffs that

went into effect in late September. A Credit Suisse analyst had

speculated Cisco might actually get a bump in revenue as customers

stock up on its products made in China ahead of even steeper

tariffs slated to go into effect next year.

Cisco reported revenue rose 7.7% to $13.07 billion, topping Wall

Street's forecast of $12.86 billion. Shares, which have

outperformed the market with a 16% increase this year, rose 4.9%

after hours, due in part to growth in the flagship

routers-and-switches business.

While Cisco hasn't felt any pain yet from tariffs, that could

change in January when they are scheduled to jump to 25%. The

increased cost would be a "slight headwind" in the current quarter

as it would hit with one month left in the period, Finance Chief

Kelly Kramer said in an interview.

Cisco will try to pass the costs to customers, she said, but if

they balk and Cisco has to absorb the impact, "it would be a

significant margin hit for us."

The company is working to move some manufacturing of tariffed

goods from China to its plants in other countries, including

Mexico, Ms. Kramer said. That shift could come as soon as May, she

said.

Mr. Robbins told analysts he saw reason for hope in the

resumption of trade negotiations between the U.S. and China in

recent days.

The company expanded its restructuring efforts in the just-ended

quarter, resulting in $300 million in pretax charges. That would

add to a $300 million pretax restructuring hit it announced six

months earlier. Cisco said it laid off nearly 500 workers this

month in customer support as part of the expanded plan.

Cisco has sought to offset sluggishness in its legacy

networking-gear business by acquiring software startups, such as

its $2.35 billion deal for Duo Security Inc. earlier this year.

Still, revenue from its infrastructure-platforms business -- the

company's largest -- rose 9% to $7.64 billion.

Security-segment revenue rose 11% to $651 million. Revenue in

its applications business rose 18% to $1.42 billion.

Cisco said its fiscal first-quarter profit rose 48% from a year

earlier to $3.55 billion. Excluding stock-based compensation and

other items, profit rose to 75 cents a share. Analysts polled by

FactSet expected a profit of 72 cents a share on an adjusted

basis.

For the current quarter, Cisco expects adjusted per-share profit

of between 71 cents and 73 cents, with revenue rising between 5%

and 7%.

Write to Jay Greene at Jay.Greene@wsj.com and Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

November 15, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

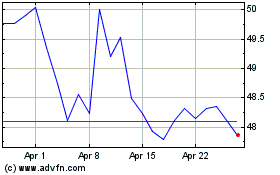

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to May 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From May 2023 to May 2024