- Company to host conference call today at 8.30 a.m. ET

- Continued progress within core activities in RNA delivery,

supported by move into new R&D facilities

- Publications by independent research groups provide fresh

evidence of effective mRNA delivery to extrahepatic targets

- Major territory expansion with two distribution partners for

Bentrio®

- Financial results presented for first time in US dollars rather

than Swiss francs

Altamira Therapeutics Ltd. (“Altamira” or the

“Company”) (Nasdaq:CYTO), a company dedicated to developing and

commercializing RNA delivery technology for targets beyond the

liver, today provided a business update and reported its first half

2024 financial results.

"We are excited to continue to gain momentum

with our new core activities in RNA delivery," commented Thomas

Meyer, Altamira Therapeutics' founder, Chairman, and CEO. "Fresh in

vivo data, recently published in a top-ranking scientific journal,

show dramatic reductions in sarcoma and breast cancer growth

following treatment with Zbtb46 mRNA delivered with our SemaPhore

nanoparticle technology. The antitumor effect was further augmented

when combined with anti-PD1 treatment. These impressive outcomes

add to the growing body of evidence supporting the great potential

of RNA therapeutics and the ability of our platform to deliver RNA

molecules effectively and safely into target cells outside the

liver, especially in cancer and inflammatory diseases.”

Mr. Meyer added: “We are progressing with the

development of both the OligoPhore and the SemaPhore platforms as

well as with our AM-401 and AM-411 flagship programs in KRAS driven

cancers and in rheumatoid arthritis, benefiting from our new access

to laboratory space at the Switzerland Innovation Park in the Basel

area. At the same time, we are evaluating our platforms for use in

cardiac regeneration and for mRNA vaccines in joint projects with

two partners and pursuing additional collaboration opportunities

with other pharma and biotech companies. Further, we keep working

towards completion of our strategic repositioning around RNA

delivery through partnering of our legacy assets in inner ear

therapeutics. Lastly, thanks to the recent public offering of

shares, we have been able to strengthen our financial position for

our transition to a much less capital-intensive business model

based on contract development and licensing of our RNA delivery

technology.”

RNA Delivery Technology

Research and development activities in

Altamira’s core business of RNA delivery – built on its peptide

based OligoPhore™ and SemaPhore™ nanoparticle platforms – continue

to progress. The key focus is on nanoparticle formulation and

process development around the platforms, the evaluation and

development of nanoparticles for delivery of specific siRNA or mRNA

payloads for collaboration partners, and the two flagship programs

AM-401 or AM-411 for treatment of KRAS driven cancers and

rheumatoid arthritis (RA), respectively. In August 2024, part of

the Company’s expanding research and development team moved to the

Switzerland Innovation Park in Allschwil near Basel. At the new

location, the Company has access to modern and well-equipped lab

facilities to support its growing activities.

Evidence for the effectiveness and versatility

of Altamira’s RNA delivery platforms keeps growing, as shown by two

recent scientific publications:

- In a peer reviewed article in

Nature Immunology, a research group from Washington University, St.

Louis, MO, showed that systemic delivery of Zbtb46 mRNA with

SemaPhore nanoparticles in mouse models of sarcoma and metastatic

breast cancer resulted in sustained Zbtb46 expression, a restored

immunostimulatory tumor microenvironment and a highly significant

reduction in tumor growth (p<0.0001).1 When combined with an

immune checkpoint inhibitor (anti-PD1) treatment, outcomes were

even more pronounced. According to the authors, the “Zbtb46

nanoparticles induced dramatic anti-PD1 response in both

anti-PD1-responsive [sarcoma] and anti-PD1-refractory [breast

cancer] tumor models, generating long-term complete remission of

tumor in many of the treated animals.” Extended monotherapy with

Zbtb46 nanoparticles produced complete remission even in mice

refractory to anti-PD1 treatment. Mice whose sarcoma was eliminated

through treatment did not develop additional tumors following

repeated challenge, indicating the development of a protective

immunological memory.

- Another research group from

Washington University presented in a preprint publication the

results of a study showing that treatment with Sod2 mRNA delivered

systemically with SemaPhore nanoparticles to mice with abdominal

aortic aneurysm (AAA) resulted in a significant reduction in aorta

dilation (p<0.05), delayed rupture and a significant improvement

in survival rates (p<0.01).2 AAA is an inflammatory disease

involving oxidative stress caused by excessive levels of reactive

oxygen species, which results in an abnormal enlargement (bulge) of

the abdominal aorta. AAA rupture may be life-threatening.

Meanwhile, Altamira’s own development work has

resulted in significant enhancement of nanoparticle stability,

which has been one of the key challenges in the handling and

transport of RNA formulations. Thanks to its new flow process

production method, the Company obtained formulations of OligoPhore

nanoparticles which are stable in liquid form when stored at 4°C

for a period of at least one month. These formulations were, in

addition, able to withstand shaking stress without significant

physicochemical changes. The ability of nanoformulations to

maintain their attributes during shaking stress is essential for

transportation and one of the key limitations of lipid

nanoparticles, the most common type of RNA delivery vehicles.

For its proprietary development programs AM-401

and AM-411, Altamira filed in the first half of 2024 patent

applications with the US Patent and Trademark Office. These aim to

complement the existing intellectual property and extend the

duration of protection. For AM-401, coverage of different KRAS

mutations in cancer treatment with nanoparticles comprising the

OligoPhore platform and a single siRNA sequence, polyKRASmut is

sought. In vitro data confirmed the ability of polyKRASmut siRNA to

knock down KRAS carrying the following mutations: G12C, G12V, G12D,

G12R, G12A, and A146T, which account for the majority of KRAS

mutations in pancreatic, colorectal and non-small cell lung cancer.

For AM-411, coverage of nanoparticles comprising siRNA sequences

targeting the p65 protein, a component of the NF-κB transcription

factor, and OligoPhore is sought. Activation of p65 has been

observed in multiple types of cancer as well as in many

inflammatory diseases. For instance, p65 is a well-known key

checkpoint in RA inflammation, and thought to regulate cell

proliferation, cell death, and stimulate metastasis in cancer. The

Company aims to advance both AM-401 and AM-411 to an

Investigational New Drug (IND) filing with the Food and Drug

Administration (FDA) in 2026 and to out-license them either

following the IND or after a Phase 1 clinical trial at the

latest.

Altamira is pursuing with the RNA delivery

business a ‘picks and shovels’ strategy based on the licensing of

its platform technology to partners in the biotech and pharma

industry for use in their own RNA drug product development

programs. The first such collaborations have been set up:

- With Heqet Therapeutics s.r.l., a

spin-out from King’s College London, Altamira is working on

nanoparticles based on the OligoPhore platform and comprising

certain non-coding RNAs (ncRNAs) for the regeneration of damaged

heart tissue following myocardial infarction in animal models.

- With Belgium-based Univercells

Group Altamira is evaluating the use of the SemaPhore platform for

the delivery of mRNA vaccines. Thanks to lower mRNA loss during

cell entrance, the nanoparticles may allow for using lower doses

and thus result in potentially more effective and efficient

vaccines.

Upon positive outcomes from these evaluations,

Altamira and its partners intend to discuss and negotiate licensing

agreements. Through its business development activities, the

Company is pursuing additional collaboration opportunities with

other pharma and biotech companies.

Bentrio® Nasal Spray

The Company’s associate Altamira Medica AG

(“Medica”) made further progress on implementing its growth

strategy with Bentrio®, a drug free, preservative free nasal spray

for the treatment of allergic rhinitis. With two of its

international distributors, it recently agreed on the expansion of

their exclusive distribution territories:

- With Nuance Pharma (“Nuance”) to

extend the territory across South East and East Asia. Under the

amended agreement, Nuance’s territory will expand from China, Hong

Kong, Macau and South Korea to also include Singapore, Malaysia,

Thailand, the Philippines, Indonesia, Vietnam and Taiwan, with a

combined population of greater than 630 million people. Nuance has

been marketing Bentrio since late 2022 in Hong Kong and recently

submitted the request for marketing approval for Mainland

China.

- With Pharma Nordic to extend the

territory from Norway to also include Sweden and Denmark, which

together have a population of 16.5 million. Pharma Nordic launched

Bentrio successfully in Norway in 2024 and intends to introduce the

product to Sweden and Denmark in 2025.

In addition, discussions and negotiations for

distribution in the US, Europe and other key markets are

ongoing.

The efficacy and safety of Bentrio has been

demonstrated in a total of four clinical trials. Results from the

largest among them (the “NASAR” study), which enrolled 100 patients

suffering from seasonal allergic rhinitis in Australia, were

recently published in a peer reviewed article in one of the leading

scientific journals in allergology.3 In NASAR, participants

self-administered either Bentrio or saline nasal spray for two

weeks 3 times per day. The study showed a statistically significant

reduction in the mean daily reflective Total Nasal Symptom Score

(rTNSS) for Bentrio compared to saline (p = 0.013), as well as a

statistically highly significant improvement in health-related

quality of life (Rhinoconjunctivitis Quality of Life Questionnaire,

p < 0.001) and superior global ratings of efficacy by patients

and investigators alike (p < 0.001). In addition, Bentrio showed

good safety and tolerability, similar to saline controls, and fewer

Bentrio treated patients used relief medication and more of them

enjoyed symptom-free days compared to saline treatment.

In the context of its strategic pivot towards

RNA delivery, Altamira divested in November 2023 a 51% stake in

Medica to a Swiss private equity investor for a cash consideration

of approximately $2.3 million. Altamira will be entitled to receive

25% of the future licensing income of Medica and of Medica’s value

appreciation in case of a sale, which captures an additional share

of the business’ upside potential.

Inner Ear Therapeutics

Altamira continues to work towards the

partnering of its inner ear therapeutics assets, in particular

AM-125, a patented nasal spray for the treatment of acute

vestibular syndrome (AVS), which may be developed also for various

other disorders of the central nervous system. AM-125 is a

reformulation of betahistine, a histamine analog, which – in the

traditional oral formulation – is the standard of care treatment

for vertigo in many countries around the world. A phase 2 clinical

trial in Europe demonstrated that a four-week treatment course with

AM-125 in AVS patients was well tolerated and helped to accelerate

vestibular compensation, enabling patients to regain balance and

recover faster. In the U.S., where oral betahistine exceptionally

has not been marketed for decades, Altamira received in summer 2023

IND clearance from the FDA for a phase 2 clinical trial in benign

paroxysmal positional vertigo (BPPV), the most frequent type of

AVS. BPPV accounts for 17 to 42% of all diagnosed cases; U.S.

healthcare costs associated with the diagnosis of BPPV alone

approach $2 billion per year.4

Continued simplification of group

structure

Following the partial divestiture of the Bentrio

activities in late 2023, Altamira has continued its efforts to

simplify its corporate structure and align it with the strategic

repositioning around its RNA delivery platform. The Company

transferred its Irish subsidiary Auris Medical Ltd. to Altamira

Medica AG and merged two of its subsidiaries in Basel

(Switzerland), Auris Medical AG and Altamira Therapeutics AG. The

merged entity is called Altamira Therapeutics AG and continues to

serve as the core operating subsidiary of the Company. Following

this restructuring, the Altamira Group comprises the parent company

Altamira Therapeutics Ltd. (Hamilton, Bermuda), and its

subsidiaries Altamira Therapeutics AG (Basel, Switzerland),

Altamira Therapeutics Inc. (Newark DE, USA), Otolanum AG (Basel,

Switzerland) as well as the associated company Altamira Medica AG

(Basel, Switzerland).

First Half 2024 Financial Results and

Outlook

Following the partial divestiture of the Bentrio

business, related activities have been reclassified and are

reported as discontinued operations. Continuing operations thus

comprise the RNA delivery development programs as well as those

related to AM-125. The financial results are reported for the first

time in US dollars, which the Company adopted as its new

presentation currency, replacing the Swiss franc.

- Total operating loss from

continuing operations was $3.9 million in the first half of 2024,

compared against $3.6 million in the first half of 2023. The

increase was primarily related to higher expenditures on research

and development (+32.6% to $2.0 million), which was partially

compensated by lower general and administrative expenses (-11.7% to

$2.0 million).

- Net loss from continuing operations

reached $4.3 million in the first half of 2024, which was 4.0%

lower than in the corresponding reporting period in 2023. Finance

expense decreased markedly ($0.2 million vs. $0.9 million); on the

other hand, the Company recorded a pro rata loss of its associate

company Altamira Medica of $0.2 million (first half of 2023:

none)5.

- The Company’s net loss for the

first half of 2024 amounted to $4.3 million, which was 27.0% lower

than in the first half of 2023 ($5.9 million). During the first six

months of 2023 the Company had recorded an after-tax loss of $1.4

million from discontinued operations (first half of 2024:

none)5.

- Cash used in operations decreased

from $8.4 million in the first half of 2023 to $3.2 million in the

first half of 2024. Financing activities provided $8.4 million in

the first six months of 2023 vs. $2.5 million in the first six

months of 2024. Cash and cash equivalents on June 30, 2024 totaled

$65 thousand compared with $55 thousand at June 30, 2023.

- Shareholders’ equity amounted to

$6.3 million as of June 30, 2024 compared with $7.7 million at

year-end 2023. There was no financial debt outstanding at either

timepoint.

Altamira expects total cash needs in 2024 to be

in the range of $5.8 million to $7.0 million. During the third

quarter of 2024, the Company raised $0.7 million from share

issuances under the 2022 Commitment Purchase Agreement with Lincoln

Park Capital Fund and gross proceeds of $4.0 million upfront from a

public offering of common shares with milestone-linked

warrants.

First Half 2024 and Business Update

Conference Call & Webcast Details

Altamira’s Senior Management will hold an

investor call today, Tuesday, September 24, 2024, at

8:30 a.m. EDT its business update and first half 2024

results. Founder, Chairman, and CEO Thomas Meyer and COO Covadonga

Pañeda will deliver prepared remarks followed by a Q&A session

where they will address questions from investors and analysts.

- Event: Altamira Therapeutics First Half 2024

Financial Results and Business Update Call

- Date: Tuesday, September 24, 2024

- Time: 8:30 am EDT

- Webcast URL:

https://edge.media-server.com/mmc/p/4wp8659n

Registration for Call

-

https://register.vevent.com/register/BI039aac00f0eb4f228e9662f9b90a1ea4

- Click on the call link and complete the online registration

form.

- Upon registering you will receive the dial-in info and a unique

PIN to join the call as well as an email confirmation with the

details.

- Select a method for joining the call:

- Dial-In: A dial in number and unique PIN are displayed to

connect directly from your phone.

- Call Me: Enter your phone number and click “Call Me” for an

immediate callback from the system. The call will come from a US

number.

Conference Call Replay

A replay of the call will be available after the

live event and accessible through the webcast link:

https://edge.media-server.com/mmc/p/4wp8659n

Consolidated Statement of Profit or Loss and

Other Comprehensive Income/(Loss) For the six months ended June

30, 2024 and 2023 (in US$)

|

|

Six months ended June 30 |

|

|

2024 |

|

20231) 2) |

|

Other operating income |

34,298 |

|

77,474 |

|

Research and development |

(1,963,664) |

|

(1,480,708) |

|

General and administrative |

(1,987,972) |

|

(2,252,587) |

|

Operating loss |

(3,917,338) |

|

(3,655,821) |

|

Finance expense |

(186,000) |

|

(937,585) |

|

Finance income |

513 |

|

69,540 |

|

Share of loss of an associate |

(237,007) |

|

- |

|

Net loss from continuing operations |

(4,339,832) |

|

(4,523,866) |

|

Discontinued operations: |

|

|

|

|

Loss after tax from discontinued operations |

- |

|

(1,420,862) |

|

Net loss attributable to owners of the Company |

(4,339,832) |

|

(5,944,728) |

|

Other comprehensive income/(loss): |

|

|

|

|

Items that will never be reclassified to profit or loss |

|

|

|

|

Remeasurements of defined benefit liability, net of taxes of

$0 |

198,277 |

|

(31,634) |

|

Items that are or may be reclassified to profit or loss |

|

|

|

|

Foreign currency translation differences, net of taxes of $0 |

14,662 |

|

(80,121) |

|

Share of other comprehensive income of an associate |

(43,712) |

|

- |

|

Other comprehensive income/(loss), net of taxes of $0 |

169,227 |

|

(111,755) |

|

Total comprehensive loss attributable to owners of the

Company |

(4,170,605) |

|

(6,056,483) |

|

|

|

|

|

|

Basic and diluted loss per share3) |

(2.11) |

|

(28.31) |

|

Basic and diluted loss per share from continuing

operations3) |

(2.11) |

|

(21.55) |

1) Amounts have been re-presented from those previously

published to reflect the change in the Company’s presentation

currency from Swiss francs to US dollars

2) Revised for the reclassification of certain activities as

discontinued operations.

3) Weighted average number of shares outstanding: first half

2024: 2,060,714; first half 2023: 209,955.

Consolidated Statement of Financial

Position As of June 30, 2024 and December 31, 2023 (in US$)

| |

June 30, |

|

June 30, |

| |

2024 |

|

2023 1) |

|

ASSETS |

|

|

|

| Non-current

assets |

|

|

|

| Property and

equipment |

1 |

|

1 |

| Right-of-use

assets |

417,619 |

|

95,198 |

| Intangible

assets |

4,627,072 |

|

4,627,072 |

| Other

non-current financial assets |

88,999 |

|

95,070 |

| Investment in

an associate |

2,411,469 |

|

2,872,623 |

| Total

non-current assets |

7,545,160 |

|

7,689,964 |

| |

|

|

|

| Current

assets |

|

|

|

| Other

receivables |

121,310 |

|

88,916 |

|

Prepayments |

75,213 |

|

337,293 |

| Derivative

financial instruments |

262,035 |

|

293,630 |

| Cash and cash

equivalents |

65,455 |

|

733,701 |

| Total

current assets |

524,013 |

|

1,453,540 |

| Total

assets |

8,069,173 |

|

9,143,504 |

| |

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

Equity |

|

|

|

| Share

capital |

5,341 |

|

2,956 |

| Share

premium |

- |

|

23,889,332 |

| Other

reserves |

5,054,761 |

|

5,129,585 |

| Retained

earnings/(Accumulated deficit) |

1,258,213 |

|

(21,346,630) |

| Total

shareholders’ equity/(deficit) attributable to owners of the

Company |

6,318,315 |

|

7,675,243 |

| |

|

|

|

| Non-current

liabilities |

|

|

|

| Non-current

lease liabilities |

304,053 |

|

- |

| Employee

benefit liability |

218,940 |

|

411,917 |

| Total

non-current liabilities |

522,993 |

|

411,917 |

| |

|

|

|

| Current

liabilities |

|

|

|

| Current lease

liabilities |

123,384 |

|

118,430 |

| Trade and

other payables |

526,571 |

|

523,367 |

| Accrued

expenses |

577,910 |

|

414,547 |

| Total

current liabilities |

1,227,865 |

|

1,056,344 |

| Total

liabilities |

1,750,858 |

|

1,468,261 |

| Total

equity and liabilities |

8,069,173 |

|

9,143,504 |

1) Amounts have been re-presented from those previously

published to reflect the change in the Company’s presentation

currency from Swiss francs to US dollars

About Altamira Therapeutics

Altamira Therapeutics (Nasdaq: CYTO) is

developing and supplying peptide-based nanoparticle technologies

for efficient RNA delivery to extrahepatic tissues (OligoPhore™ /

SemaPhore™ platforms). The Company currently has two flagship siRNA

programs using its proprietary delivery technology: AM-401 for KRAS

driven cancer and AM-411 for rheumatoid arthritis, both in

preclinical development beyond in vivo proof of concept. The

versatile delivery platform is also suited for mRNA and other RNA

modalities and made available to pharma or biotech companies

through out-licensing. In addition, Altamira holds a 49% stake

(with additional economic rights) in Altamira Medica AG, which

holds its commercial-stage legacy asset Bentrio®, an OTC nasal

spray for allergic rhinitis. Further, the Company is in the process

of partnering / divesting its inner ear legacy assets. Founded in

2003, Altamira is headquartered in Hamilton, Bermuda, with its main

operations in Basel, Switzerland. For more information, visit:

https://altamiratherapeutics.com/

Forward-Looking Statements

This press release may contain statements that

constitute "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are statements other than historical

facts and may include statements that address future operating,

financial or business performance or Altamira’s strategies or

expectations. In some cases, you can identify these statements by

forward-looking words such as "may", "might", "will", "should",

"expects", "plans", "anticipates", "believes", "estimates",

"predicts", "projects", "potential", "outlook" or "continue", or

the negative of these terms or other comparable terminology.

Forward-looking statements are based on management's current

expectations and beliefs and involve significant risks and

uncertainties that could cause actual results, developments and

business decisions to differ materially from those contemplated by

these statements. These risks and uncertainties include, but are

not limited to the clinical utility of Altamira’s product

candidates, the timing or likelihood of regulatory filings and

approvals, Altamira’s intellectual property position and Altamira’s

financial position. These risks and uncertainties also include, but

are not limited to, those described under the caption "Risk

Factors" in Altamira’s Annual Report on Form 20-F for the year

ended December 31, 2023, and in Altamira’s other filings with the

Securities Exchange Commission (“SEC”), which are available free of

charge on the SEC’s website at: www.sec.gov. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated. All forward-looking statements and all

subsequent written and oral forward-looking statements attributable

to Altamira or to persons acting on behalf of Altamira are

expressly qualified in their entirety by reference to these risks

and uncertainties. You should not place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date they are made, and Altamira does not undertake any

obligation to update them in light of new information, future

developments or otherwise, except as may be required under

applicable law.

Investor Contact:

Hear@altamiratherapeutics.com

1 Kabir AU et al. (2024), ZBTB46 coordinates angiogenesis and

immunity to control tumor outcome, Nat Immunol

https://www.nature.com/articles/s41590-024-01936-4.

2 Yan et al. (2024), Systemic delivery of murine SOD2 mRNA to

experimental abdominal aortic aneurysm mitigates expansion and

rupture, bioRxiv: 2024.06.17.599454.

https://www.biorxiv.org/content/10.1101/2024.06.17.599454v1.

3 Becker S et al. (2024), AM-301, a barrier-forming nasal spray,

versus saline spray in seasonal allergic rhinitis: A randomized

clinical trial, Allergy 79(7):1858-67.

https://onlinelibrary.wiley.com/doi/10.1111/all.16116

4 Özgirgin et al. (2024), Residual dizziness after BPPV

management: exploring pathophysiology and treatment beyond canalith

repositioning maneuvers, Front Neurol 15:1382196.

https://www.frontiersin.org/journals/neurology/articles/10.3389/fneur.2024.1382196/full

5 Altamira Medica was deconsolidated and classified as associate

upon its partial divestiture in November 2023.

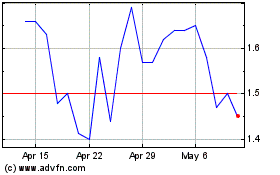

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

From Jan 2024 to Jan 2025