Data Storage Corporation (Nasdaq: DTST) (“DSC” and the “Company”),

a provider of diverse business continuity solutions for

disaster-recovery, cloud infrastructure, cyber-security, and IT

automation, today provided a business update and reported financial

results for the three and nine months ended September 30, 2024.

“We have made important progress during recent

months,” commented Chuck Piluso, CEO of Data Storage Corporation.

“Specifically, we achieved $19.0 million in sales for the nine

months ended September 30, 2024 and attained profitability for both

the three and nine month periods. For the third quarter, we

generated $5.8 million in sales. While this reflects a slight

decline from the previous year, it does align with our strategic

focus on building high margin recurring subscription revenue, that

typically renew for many years, rather than relying on one-time

sales. As a result of this strategy, we are pleased to report our

gross profit increased by 8.7% and our gross margin increased by

over 400 basis points for the third quarter of 2024. Our primary

objective remains the same - securing high margin service

agreements on our enterprise infrastructure platform, which create

a more stable revenue foundation and support long-term growth and

profitability.”

“These results highlight the success of our

growth strategy, including expanding partnerships with major

industry players, launching a new data center in Chicago, and

establishing a presence in the UK. First, we expanded our

relationship with a billion-dollar insurance firm to enhance its

cloud infrastructure and cybersecurity, reaffirming our role as a

trusted provider for large, compliance-driven organizations. In

healthcare, we secured a contract with a leading medical center for

compliant cloud hosting, further strengthening our position in this

highly regulated sector. Additionally, we secured a six-figure

contract with a music publishing organization in education,

demonstrating our adaptability to meet data-intensive needs across

diverse industries. These agreements highlight our strategic focus

on sectors requiring secure, scalable cloud based solutions.

Furthermore, our strategically located new data center in Chicago

strengthens our ability to support our growing U.S. customer base,

ensuring we meet our clients’ needs with reliability and

capacity.”

“In addition, our recent expansion into the UK

market, along with the successful integration of Flagship

Solutions, has further strengthened our global presence and

operational efficiency, positioning us for accelerated growth and

global reach. We also recently announced the appointment of Colin

Freeman as Managing Director of UK Cloud Host Technologies Ltd., a

wholly-owned subsidiary of CloudFirst Technologies, an important

step in our strategy to expand across the European market and

deliver our solutions to this key market. With Colin’s extensive

leadership experience, we are confident he will be instrumental in

accelerating our growth in the region. In addition to his

appointment, we are establishing strategic infrastructure

deployment in data centers in the UK, positioning us to make a

strong entry and enhance our footprint in this key market. These

achievements are important to our organic growth strategy, allowing

us to capture new opportunities and broaden our impact. We’re proud

of our progress in expanding contracts, extending our international

reach, and increasing industry prominence.”

Chris Panagiotakos, CFO of Data Storage

Corporation, added, “We are in a strong financial position with

approximately $11.9 million in cash and marketable securities and

no long-term debt, providing us the flexibility to make strategic

investments, keeping us well-prepared to pursue growth

opportunities that deliver long-term value for our shareholders. We

look forward to continuing to carefully manage expenses and execute

on our growth strategy.”

Conference Call

The Company plans to host a conference call at

11:00 am ET today, to discuss the Company's financial results for

the third quarter of 2024 which ended September 30, 2024, as well

as corporate progress and other developments.

The conference call will be available via

telephone by dialing toll-free 877-451-6152 for U.S. callers or for

international callers +1-201-389-0879. A webcast of the call may be

accessed

at https://viavid.webcasts.com/starthere.jsp?ei=1677740&tp_key=34d545e620 or

on the Company’s News & Events section of the

website, www.dtst.com/news-events.

A webcast replay of the call will be available

on the Company’s website (www.dtst.com/news-events) through

November 14, 2025. A telephone replay of the call will be available

approximately three hours following the call, through November 21,

2024, and can be accessed by dialing 844-512-2921 for U.S. callers

or + 1-412-317-6671 for international callers and entering

conference ID: 13747396.

About Data Storage

CorporationData Storage Corporation (Nasdaq: DTST) is a

leading provider of fully managed cloud hosting, disaster recovery,

cybersecurity, IT automation, and voice & data solutions. With

strategic technical investments in multiple regions, DTST serves a

diverse clientele, including Fortune 500 companies, in sectors such

as government, education, and healthcare. Focused on the

fast-growing, multi-billion-dollar business continuity market, DTST

is recognized as a stable and emerging growth leader in cloud

infrastructure, support and the migration of data to the cloud. Our

regional data centers across North America enable us to deliver

sustainable services through recurring subscription agreements.

Additional information about the Company is

available at: www.dtst.com and on

X @DataStorageCorp.

Safe Harbor ProvisionThis press

release contains “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995, as amended,

that are intended to be covered by the safe harbor created thereby.

Forward-looking statements are subject to risks and uncertainties

that could cause actual results, performance or achievements to

differ materially from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Statements preceded by, followed by or that otherwise

include the words “believes,” “expects,” “anticipates,” “intends,”

“projects,” “estimates,” “plans” and similar expressions or future

or conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. The forward looking statements in this press release

include statements regarding the Company’s ability to build high

margin recurring subscription revenue, secure high margin service

agreements, meet data-intensive needs across diverse industries and

ensure it meets its clients’ needs with reliability and capacity;

the Company’s recent expansion into the UK market and the

integration of Flagship Solutions further strengthening the

Company’s global presence and operational efficiency, positioning

it for accelerated growth and global reach; the Company’s ability

to expand across the European market and deliver its solutions to

this key market; the success of the Company’s strategic

infrastructure deployment in data centers in the UK positioning it

to make a strong entry and enhance the Company’s footprint in this

key market; the Company’s ability to capture new opportunities and

broaden its impact; continuation of the Company’s progress in

expanding contracts, extending its international reach, and

increasing industry prominence; and the Company’s ability to pursue

growth opportunities that will deliver long-term value for its

shareholders. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, it can

provide no assurance that such expectations will prove to have been

correct. These forward-looking statements are based on management’s

expectations and assumptions as of the date of this press release

and are subject to a number of risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Important factors that could cause actual results to differ

materially from current expectations include the Company’s ability

to build high margin recurring subscription revenue, secure high

margin service agreements, meet data-intensive needs across diverse

industries and ensure it meets its clients’ needs with reliability

and capacity; the Company’s ability to expand across the European

market and deliver its solutions to this key market; the success of

the Company’s strategic infrastructure deployment in data centers

in the UK positioning it to make a strong entry and enhance the

Company’s footprint in this key market; the Company’s ability to

capture new opportunities and broaden its impact; and the Company’s

ability to make strategic investments in order to pursue growth

opportunities that will deliver long-term value for its

shareholders. These risks should not be construed as exhaustive and

should be read together with the other cautionary statements

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K filed with the Securities and

Exchange Commission. Any forward-looking statement speaks only as

of the date on which it was initially made. Except as required by

law, the Company assumes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, changed circumstances or otherwise.

Contact:

Crescendo Communications,

LLC212-671-1020DTST@crescendo-ir.com

[Tables to Follow]

|

DATA STORAGE CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024(Unaudited) |

|

December 31,2023 |

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

513,718 |

|

|

$ |

1,428,730 |

|

|

Accounts receivable (less provision for credit losses of $31,456

and $7,915 in 2024 and 2023, respectively) |

|

|

1,973,153 |

|

|

|

1,259,972 |

|

|

Marketable securities |

|

|

11,374,769 |

|

|

|

11,318,196 |

|

|

Prepaid expenses and other current assets |

|

|

760,564 |

|

|

|

513,175 |

|

|

Total Current Assets |

|

|

14,622,204 |

|

|

|

14,520,073 |

|

|

|

|

|

|

|

|

|

|

|

| Property and Equipment: |

|

|

|

|

|

|

|

|

|

Property and equipment |

|

|

8,925,184 |

|

|

|

7,838,225 |

|

|

Less—Accumulated depreciation |

|

|

(5,865,481 |

) |

|

|

(5,105,451 |

) |

|

Net Property and Equipment |

|

|

3,059,703 |

|

|

|

2,732,774 |

|

|

|

|

|

|

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

4,238,671 |

|

|

|

4,238,671 |

|

|

Operating lease right-of-use assets |

|

|

599,625 |

|

|

|

62,981 |

|

|

Other assets |

|

|

204,599 |

|

|

|

48,436 |

|

|

Intangible assets, net |

|

|

1,493,792 |

|

|

|

1,698,084 |

|

|

Total Other Assets |

|

|

6,536,687 |

|

|

|

6,048,172 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

24,218,594 |

|

|

$ |

23,301,019 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

2,629,414 |

|

|

$ |

2,608,938 |

|

|

Deferred revenue |

|

|

160,237 |

|

|

|

336,201 |

|

|

Finance leases payable |

|

|

79,652 |

|

|

|

263,600 |

|

|

Finance leases payable related party |

|

|

74,077 |

|

|

|

235,944 |

|

|

Operating lease liabilities short term |

|

|

95,545 |

|

|

|

63,983 |

|

|

Total Current Liabilities |

|

|

3,038,925 |

|

|

|

3,508,666 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

548,897 |

|

|

|

— |

|

|

Finance leases payable |

|

|

— |

|

|

|

17,641 |

|

|

Finance leases payable related party |

|

|

— |

|

|

|

20,297 |

|

|

Total Long-Term Liabilities |

|

|

548,897 |

|

|

|

37,938 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

3,587,822 |

|

|

|

3,546,604 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Preferred stock, Series A par

value $0.001; 10,000,000 shares authorized; 0 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively |

|

|

— |

|

|

|

— |

|

| Common stock, par value

$0.001; 250,000,000 shares authorized; 7,014,373 and 6,880,460

shares issued and outstanding as of September 30, 2024, and

December 31, 2023, respectively |

|

|

7,014 |

|

|

|

6,881 |

|

| Additional paid in

capital |

|

|

40,143,684 |

|

|

|

39,490,285 |

|

| Accumulated deficit |

|

|

(19,270,544 |

) |

|

|

(19,505,803 |

) |

| Total Data Storage Corporation

Stockholders’ Equity |

|

|

20,880,154 |

|

|

|

19,991,363 |

|

| Non-controlling interest in

consolidated subsidiary |

|

|

(249,382 |

) |

|

|

(236,948 |

) |

| Total Stockholder’s

Equity |

|

|

20,630,772 |

|

|

|

19,754,415 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

24,218,594 |

|

|

$ |

23,301,019 |

|

|

|

|

DATA STORAGE CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Sales |

|

$ |

5,808,835 |

|

|

$ |

5,986,625 |

|

|

$ |

18,955,074 |

|

|

$ |

18,770,739 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

3,297,164 |

|

|

|

3,656,271 |

|

|

|

11,069,038 |

|

|

|

11,771,886 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

|

|

2,511,671 |

|

|

|

2,330,354 |

|

|

|

7,886,036 |

|

|

|

6,998,853 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative |

|

|

2,537,501 |

|

|

|

2,316,213 |

|

|

|

8,086,857 |

|

|

|

6,918,982 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss) from

Operations |

|

|

(25,830 |

) |

|

|

14,141 |

|

|

|

(200,821 |

) |

|

|

79,871 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

160,770 |

|

|

|

152,471 |

|

|

|

456,580 |

|

|

|

375,953 |

|

|

Interest expense |

|

|

(9,815 |

) |

|

|

(8,874 |

) |

|

|

(31,335 |

) |

|

|

(56,985 |

) |

|

Loss on disposal of equipment |

|

|

(1,599 |

) |

|

|

— |

|

|

|

(1,599 |

) |

|

|

— |

|

|

Total Other Income (Expense) |

|

|

149,356 |

|

|

|

143,597 |

|

|

|

423,646 |

|

|

|

318,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision for

income taxes |

|

|

123,526 |

|

|

|

157,738 |

|

|

|

222,825 |

|

|

|

398,839 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

123,526 |

|

|

|

157,738 |

|

|

|

222,825 |

|

|

|

398,839 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Income) Loss in

Non-controlling interest of consolidated subsidiary |

|

|

(1,129 |

) |

|

|

21,273 |

|

|

|

12,434 |

|

|

|

57,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income attributable to

Common Stockholders |

|

$ |

122,397 |

|

|

$ |

179,011 |

|

|

$ |

235,259 |

|

|

$ |

456,500 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income per Share –

Basic |

|

$ |

0.02 |

|

|

$ |

0.03 |

|

|

$ |

0.03 |

|

|

$ |

0.06 |

|

| Net Income per Share –

Diluted |

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.03 |

|

|

$ |

0.06 |

|

| Weighted Average Number of

Shares - Basic |

|

|

6,999,447 |

|

|

|

6,847,264 |

|

|

|

6,918,253 |

|

|

|

6,834,811 |

|

| Weighted Average Number of

Shares – Diluted |

|

|

7,340,545 |

|

|

|

7,246,250 |

|

|

|

7,269,644 |

|

|

|

7,212,048 |

|

|

|

|

DATA STORAGE CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

2023 |

| Cash Flows from Operating

Activities: |

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

222,825 |

|

|

$ |

398,839 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

991,773 |

|

|

|

928,180 |

|

|

Stock-based compensation |

|

|

564,800 |

|

|

|

338,145 |

|

|

Provision for credit losses |

|

|

25,541 |

|

|

|

— |

|

|

Loss on disposal of equipment |

|

|

1,599 |

|

|

|

— |

|

|

Changes in Assets and Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(738,725 |

) |

|

|

1,158,493 |

|

|

Other assets |

|

|

(156,163 |

) |

|

|

— |

|

|

Prepaid expenses and other current assets |

|

|

(247,389 |

) |

|

|

(287,368 |

) |

|

Right of use asset |

|

|

111,314 |

|

|

|

136,954 |

|

|

Accounts payable and accrued expenses |

|

|

20,478 |

|

|

|

(348,851 |

) |

|

Deferred revenue |

|

|

(175,964 |

) |

|

|

(21,518 |

) |

|

Operating lease liability |

|

|

(67,499 |

) |

|

|

(141,450 |

) |

| Net Cash Provided by Operating

Activities |

|

|

552,590 |

|

|

|

2,161,424 |

|

| Cash Flows from Investing

Activities: |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(1,116,008 |

) |

|

|

(1,246,996 |

) |

|

Purchase of marketable securities |

|

|

(456,573 |

) |

|

|

(1,520,953 |

) |

|

Sale of marketable securities |

|

|

400,000 |

|

|

|

— |

|

| Net Cash Used in Investing

Activities |

|

|

(1,172,581 |

) |

|

|

(2,767,949 |

) |

| Cash Flows from Financing

Activities: |

|

|

|

|

|

|

|

|

|

Repayments of finance lease obligations related party |

|

|

(182,163 |

) |

|

|

(392,287 |

) |

|

Repayments of finance lease obligations |

|

|

(201,590 |

) |

|

|

(294,522 |

) |

|

Proceeds from exercise of stock options |

|

|

88,732 |

|

|

|

— |

|

| Net Cash Used in Financing

Activities |

|

|

(295,021 |

) |

|

|

(686,809 |

) |

| |

|

|

|

|

|

|

|

|

| Decrease in Cash and Cash

Equivalents |

|

|

(915,012 |

) |

|

|

(1,293,334 |

) |

| |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents,

Beginning of Period |

|

|

1,428,730 |

|

|

|

2,286,722 |

|

| |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents, End

of Period |

|

$ |

513,718 |

|

|

$ |

993,388 |

|

| Supplemental Disclosures: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

18,034 |

|

|

$ |

48,471 |

|

|

Cash paid for income taxes |

|

$ |

— |

|

|

$ |

— |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

|

|

|

Assets acquired by operating lease |

|

$ |

647,958 |

|

|

$ |

— |

|

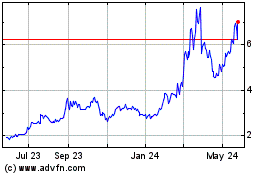

Data Storage (NASDAQ:DTST)

Historical Stock Chart

From Jan 2025 to Feb 2025

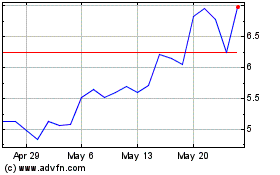

Data Storage (NASDAQ:DTST)

Historical Stock Chart

From Feb 2024 to Feb 2025