Edible Garden AG Incorporated (“Edible Garden” or the

“Company”) (Nasdaq: EDBL), a leader in

controlled environment agriculture (CEA), locally grown, organic

and sustainable produce and products, today provided a business

update and reported financial results for the three month and full

year periods ended December 31, 2023.

Mr. Jim Kras, Chief Executive Officer of Edible

Garden, commented, “We are extremely pleased to report a 21.6%

increase in our annual revenue for 2023, as well as a notable 32.8%

increase year-over-year for the fourth quarter of 2023. We believe

this significant growth reflects the strength of our relationships

with major retailers and the trust our customers place in our

quality products. We continue to be a leader in our industry, in

terms of both service and reliability, and more retailers are

turning to Edible Garden for their organic and sustainable product

needs. Additionally, by investing in our infrastructure and

refining our patented data analytics capabilities, we continue to

identify additional opportunities to boost profit margins. The

prudent management of our business is reflected in the increase in

our gross profit by 270 basis points in 2023 and in the 767 basis

point improvement in our operating margin.”

“We have further leveraged our platform to enrich and broaden

the scope of our offerings. We recently partnered with Tops

Friendly Markets, bringing our sustainable herbs to 149 stores

across New York, Pennsylvania, and Vermont. Furthermore, we have

also added Uncle Giuseppe's Marketplace, part of RBest Produce,

which is now offering Edible Garden herbs in their 12 locations

throughout New York and New Jersey. The addition of these two

retailers significantly boosts our presence in the Northeastern

U.S. In February, we entered into 3-year agreements with a leading

major U.S. food retailer, enabling us to expand our product lineup

in their stores. This expansion includes a variety of products such

as potted and fresh-cut herbs, fresh-cut basil, and wheatgrass.

More than just expanding our product offerings, this partnership

will see the introduction of fresh and innovative displays aimed at

boosting the brand’s visibility and prominence on the retailers’

shelves. We also began distributing two innovative flavors from our

Vitamin Whey collection to Meijer locations throughout the Midwest

earlier this year, as part of the kickoff for our nationwide

expansion plan. These collaborations highlight the Company’s

commitment to enhancing our relationships with retail partners, to

better meet their needs and make shopping easier for their

customers. Additionally, we enhanced our production capabilities at

our greenhouse operations in New Jersey and Michigan, which has led

to a decreased dependency on contract growers, allowing us greater

control and flexibility in our operations.

Moreover, our investment in Edible Garden Heartland has been

rewarding, incorporating advanced technologies such as our

proprietary GreenThumb greenhouse management system, which

significantly improved the efficiency of our supply chain, allowing

the Company to ship tens of thousands of fall ornamentals just in

time for the fall gardening season. We anticipate increased profit

margins from the ornamentals sector and are confident that

expanding this line of business will have a positive effect on the

Company's overall profitability.”

“A mere year ago, we unveiled Pulp, our cutting-edge collection

of sustainable gourmet sauces and chili-based products, and entered

into the global sauces and condiments sector—a sector projected to

grow from $172.79 billion in 2021 to $240.7 billion by 2028, as per

Research and Markets. Within a short time, Pulp is now carried by

Whole Foods Market, Morton Williams, Dierbergs Markets, Target, and

Woodman’s. We also announced in early March 2024 that our Pulp line

of sauces is now available through KeHE Distributors, the premier

distributor of natural & organic, specialty, and fresh

products, encompassing their 31,000 natural food stores, chain, and

independent grocery stores, e-commerce retailers, and other

specialty products retailers located across North

America. In January 2024, we further broadened access

to our 'Bland to Bold' Pulp sauces through the launch of our Pulp

e-commerce platform, allowing consumers to directly purchase all of

our distinct and flavorful products online. Overall, the reception

to the Pulp line has been overwhelmingly positive, with sauce

enthusiasts quickly becoming aficionados of the unique peppers and

the transformative 'Bland to Bold' flavor they bring to any dish,

reinforcing Edible Garden’s status as 'The Flavor Maker.”

“Earlier this year, the US Patent Trademark Office awarded

Edible Garden two patents. The first patent pertains to GreenThumb,

a web-based greenhouse management and demand planning system that

enables the Company to enhance our supply chain efficiency which

has led to improved shipping and fill rates, alongside notable

sales growth. This is the third distinct patent awarded to this

advanced system. The second patent issued in February highlights

our commitment to innovation through our proprietary Self-Watering

Display technology. This technology has been a game-changer for the

Company, extending plant shelf life, ensuring freshness, and

reducing spoilage at retail outlets. Aligned with our Zero-Waste

Inspired® mission, these self-watering displays allow retailers to

showcase plants at their peak, minimizing waste and delivering

superior products to customers. These patents are a testament to

Edible Garden's leading role in the AgTech industry, further

demonstrating the Company’s unwavering commitment to leading-edge

innovation. Through the deployment of advanced technologies such as

these, these patents are driving operational efficiency and

expected profitability, highlighting Edible Garden's commitment to

sustainable development and its position as a leader in

agricultural technology.”

Financial results for the three months ended December

31, 2023

For the fourth quarter ended December 31, 2023,

revenue totaled $4.1 million, an increase of 32.8%, compared to

$3.1 million for the three months ended December 31, 2022. The

increase was driven by higher demand from the existing customer

base, the expansion of our product lines, and the expansion of our

product footprint in key retail partner stores.

Cost of goods sold was $3.8 million for the

three months ended December 31, 2023, compared to $3.0 million for

the three months ended December 31, 2022. The increase was the

result of costs related to the buildout and staffing of our

Heartland facility, increases in rates charged by our suppliers,

higher packaging costs due to inflation, and higher labor costs due

to the tight labor market.

Selling, general and administrative expenses

were $2.6 million for the three months ended December 31, 2023,

compared to $3.1 million for the three months ended December 31,

2022. The decrease was primarily driven by a reduction of

professional services expenses related to our IPO, along with costs

associated with the buildout of our Heartland

facility.

Net loss was $3.1 million, or ($0.54) per share,

for the three months ended December 31, 2023, compared to a net

loss of $3.0 million, or ($9.13) per share, for the three months

ended December 31, 2022. Net loss for the three months ended

December 31, 2023, also included a one-time, non-cash impairment

expense of $0.7 million related to legacy assets acquired from our

predecessor company.

Financial results for the year ended

December 31, 2023

For the year ended December 31, 2023, revenue

totaled $14.0 million, an increase of $2.5 million, or 21.6%,

compared to $11.6 million for the year ended December 31, 2022. The

increase was attributed to an increase of $2.2 million in sales of

our herb, produce, and floral products, driven by a mix of organic

growth and new customers. Additionally, sales of our vitamins and

supplements increased $324 thousand during the year ended December

31, 2023, driven by consumer demand.

Cost of goods sold was $13.2 million for the

year ended December 31, 2023, compared to $11.2 million for the

year ended December 31, 2022. The increase was primarily due to

$2.6 million of higher costs for operating the Edible Heartland

facility, which transitioned to growing our herbs and lettuce

products during 2023. These increases were offset by a decline of

$264 thousand in costs for supplies and raw materials for our

Edible Garden flagship facility and a $377 thousand decrease in

freight and shipping costs.

Gross profit increased by $458 thousand, or

125.8%, to $822 thousand, or 5.85% of sales, for the year ended

December 31, 2023, compared with $364 thousand, or 3.15% of sales,

for the year ended December 31, 2022. Improvement in margins was

primarily attributed to less reliance on contract growers in 2023

versus 2022.

Selling, general and administrative expenses

were $10.0 million for the year ended December 31, 2023, compared

to $9.4 million for the year ended December 31, 2022. The increase

was primarily driven by $868 thousand of additional costs incurred

to operate the Edible Garden Heartland facility.

Net loss was $10.2 million, or ($3.08) per

share, for the year ended December 31, 2023, compared to a net loss

of $12.5 million, or ($48.68) per share, for the year ended

December 31, 2022. Per share amounts have been adjusted to reflect

all stock splits. Net loss for the twelve months ended

December 31, 2023, also included a one-time, non-cash impairment

expense of $0.7 million related to legacy assets acquired from our

predecessor company.

The complete financial results for the year

ended December 31, 2023, are available in the Company’s Annual

Report on Form 10-K, which will be filed with the Securities and

Exchange Commission and available at: www.sec.gov.

Conference Call

Edible Garden will host a conference call today

at 8:00 A.M. Eastern Time to discuss the Company’s financial

results for the fourth quarter and year ended December 31, 2023, as

well as the Company’s corporate progress and other

developments.

The conference call will be available via

telephone by dialing toll-free 888-506-0062 for U.S. callers or +1

973-528-0011 for international callers and using entry code:

297232. A webcast of the call may be accessed at

https://www.webcaster4.com/Webcast/Page/2914/50246 or on the

investor relations section of the Company’s website at

https://ediblegardenag.com/presentations.

A webcast replay will also be available on the

Company’s Investors section of the website at

https://ediblegardenag.com/presentations through April 1, 2025. A

telephone replay of the call will be available approximately one

hour following the call, through Monday, April 15, 2024, and can be

accessed by dialing 877-481-4010 for U.S. callers or +1

919-882-2331 for international callers and entering conference ID:

50246.

ABOUT EDIBLE GARDEN®

Edible Garden AG Incorporated is a leader in

controlled environment agriculture (CEA), locally grown, organic

and sustainable produce and products backed by Zero-Waste Inspired®

next generation farming. Offered at over 5,000 stores in the US,

Edible Garden is disrupting the CEA and sustainability technology

movement with its safety-in-farming protocols, use of sustainable

packaging, patented GreenThumb software and self-watering in-store

displays. The Company currently operates its own state-of-the-art

greenhouses and processing facilities in Belvidere, New Jersey and

Grand Rapids, Michigan, and has a network of contract growers, all

strategically located near major markets in the U.S. Its

proprietary GreenThumb 2.0 patented (US Nos.: US 11,158,006 B1, US

11,410,249 B2 and US 11,830, 088 B2) software optimizes growing in

vertical and traditional greenhouses while seeking to reduce

pollution-generating food miles. Its proprietary patented (U.S.

Patent No. D1,010,365) Self-watering display is designed to

increase plant shelf life and provide an enhanced in-store plant

display experience. Edible Garden is also a developer of

ingredients and proteins, providing an accessible line of plant and

whey protein powders under the Vitamin Way® and Vitamin Whey®

brands. In addition, the Company offers a line of sustainable food

flavoring products such as Pulp gourmet sauces and chili-based

products. For more information on Edible Garden go to

https://ediblegardenag.com/.

Forward-Looking Statements

This press release contains forward-looking

statements, including with respect to the Company’s ability to

improve its financial results, the Company’s growth strategies, the

Company’s ability to expand into new product lines, and its

performance as a public company. The words “anticipate,” “believe,”

“design,” “expect,” “objective,” “opportunity,” “potential,”

“project,” “seek,” “will,” and similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are subject to a number of risks, uncertainties, and

assumptions, including market and other conditions and the

Company’s ability to achieve its growth objectives. The Company

undertakes no obligation to update any such forward-looking

statements after the date hereof to conform to actual results or

changes in expectations, except as required by law.

Investor Contacts:Crescendo

Communications, LLC212-671-1020EDBL@crescendo-ir.com

(tables follow)

| |

EDIBLE

GARDEN AG INCORPORATED |

| |

CONSOLIDATED

BALANCE SHEETS |

| |

(in

thousands, except shares) |

| |

|

|

|

|

|

|

| |

|

|

|

|

| |

|

December

31, |

|

December

31, |

| |

|

2023 |

|

2022 |

| |

|

|

|

|

| |

ASSETS |

| |

|

|

|

|

| |

Current

assets: |

|

|

|

| |

Cash |

$ |

510 |

|

|

$ |

110 |

|

| |

Accounts receivable, net |

|

1,249 |

|

|

|

1,105 |

|

| |

Inventory, net |

|

678 |

|

|

|

586 |

|

| |

Prepaid expenses and other current assets |

|

210 |

|

|

|

62 |

|

| |

|

|

|

|

|

|

| |

Total current assets |

|

2,647 |

|

|

|

1,863 |

|

| |

|

|

|

|

|

|

| |

Property,

equipment and leasehold improvements, net |

|

3,893 |

|

|

|

4,891 |

|

| |

Intangible

assets, net |

|

47 |

|

|

|

50 |

|

| |

Other

assets |

|

69 |

|

|

|

161 |

|

| |

|

|

|

|

|

|

| |

TOTAL ASSETS |

$ |

6,656 |

|

|

$ |

6,965 |

|

| |

|

|

|

|

|

|

| |

LIABILITIES

AND STOCKHOLDERS' DEFICIT |

| |

LIABILITIES: |

|

|

|

|

|

| |

Current liabilities: |

|

|

|

|

|

| |

Accounts payable and other accrued expenses |

$ |

2,517 |

|

|

$ |

2,787 |

|

| |

Short-term debt |

|

387 |

|

|

|

2,042 |

|

| |

|

|

|

|

|

|

| |

Total current liabilities |

|

2,904 |

|

|

|

4,829 |

|

| |

|

|

|

|

|

|

| |

Long-term liabilities: |

|

|

|

|

|

| |

Long-term debt, net of discounts |

|

4,040 |

|

|

|

4,282 |

|

| |

Long-term lease liabilities |

|

- |

|

|

|

34 |

|

| |

|

|

|

|

|

|

| |

Total long-term liabilities |

|

4,040 |

|

|

|

4,316 |

|

| |

|

|

|

|

|

|

| |

Total Liabilities |

|

6,944 |

|

|

|

9,145 |

|

| |

|

|

|

|

|

|

| |

COMMITMENTS AND CONTINGENCIES (Note 12) |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

STOCKHOLDERS' DEFICIT: |

|

|

|

|

|

| |

Common stock ($0.0001 par value, 100,000,000 shares authorized;

5,705,643 and 362,716 shares outstanding as of December 31, 2023

and 2022, respectively (1)) |

|

1 |

|

|

|

- |

|

| |

Series A Convertible Preferred stock ($0.0001 par value, 10,000,000

shares authorized; nil shares outstanding as of December 31, 2023

and 2022, respectively) |

|

- |

|

|

|

- |

|

| |

Additional paid-in capital |

|

29,971 |

|

|

|

17,892 |

|

| |

Accumulated deficit |

|

(30,260 |

) |

|

|

(20,072 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Total Stockholders' Deficit |

|

(288 |

) |

|

|

(2,180 |

) |

| |

|

|

|

|

|

|

| |

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

$ |

6,656 |

|

|

$ |

6,965 |

|

| |

|

|

|

|

|

|

| |

(1) Adjusted

to reflect the stock splits |

|

|

|

|

|

| |

|

|

|

|

|

|

| EDIBLE

GARDEN AG INCORPORATED |

| CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in

thousands, except share and per-share information) |

|

|

|

|

|

|

|

|

|

Years Ended December 31, |

| |

2023 |

|

2022 |

| |

|

|

|

|

|

| Revenue |

$ |

14,049 |

|

|

$ |

11,552 |

|

| Cost of

goods sold |

|

13,227 |

|

|

|

11,188 |

|

| |

|

|

|

|

|

| Gross

profit |

|

822 |

|

|

|

364 |

|

| |

|

|

|

|

|

| Selling,

general and administrative expenses |

|

10,009 |

|

|

|

9,368 |

|

| Impairment

loss |

|

686 |

|

|

|

- |

|

| Loss from

operations |

|

(9,873 |

) |

|

|

(9,004 |

) |

| |

|

|

|

|

|

| Other income

/ (expense) |

|

|

|

|

|

|

Interest expense, net |

|

(390 |

) |

|

|

(2,033 |

) |

|

Gain (Loss) from extinguishment of debt |

|

70 |

|

|

|

(826 |

) |

|

Other income / (loss) |

|

5 |

|

|

|

(590 |

) |

|

Total other income / (expense) |

|

(315 |

) |

|

|

(3,449 |

) |

| |

|

|

|

|

|

| NET

LOSS |

$ |

(10,188 |

) |

|

$ |

(12,453 |

) |

| |

|

|

|

|

|

| Net Income /

(Loss) per common share - basic and diluted (1) |

$ |

(3.08 |

) |

|

$ |

(48.68 |

) |

| |

|

|

|

|

|

|

Weighted-Average Number of Common Shares Outstanding - Basic and

Diluted (1) |

|

3,303,955 |

|

|

|

255,776 |

|

| |

|

|

|

|

|

| (1) Adjusted

to reflect the stock splits |

|

|

|

|

|

| |

|

|

|

|

|

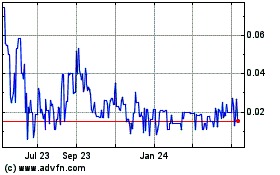

Edible Garden (NASDAQ:EDBLW)

Historical Stock Chart

From Jan 2025 to Feb 2025

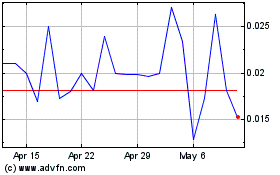

Edible Garden (NASDAQ:EDBLW)

Historical Stock Chart

From Feb 2024 to Feb 2025