Enphase Energy, Inc. (NASDAQ: ENPH), a global energy technology

company and the world’s leading supplier of microinverter-based

solar and battery systems, announced today financial results for

the fourth quarter of 2024, which included the summary below

from its President and CEO, Badri Kothandaraman.

We reported quarterly revenue of

$382.7 million in the fourth quarter of 2024, along with 53.2%

for non-GAAP gross margin. We shipped approximately 2.01 million

microinverters, or 878.0 megawatts DC, and 152.4 megawatt hours of

IQ® Batteries.

Financial highlights for the fourth quarter of 2024 are listed

below:

- Strong U.S. manufacturing: shipped 1.69 million microinverters

and 6.7 megawatt hours of IQ Batteries

- Quarterly revenue

of $382.7 million

- GAAP gross margin

of 51.8%; non-GAAP gross margin of 53.2% with net IRA benefit

- Non-GAAP gross

margin of 39.7%, excluding net IRA benefit of 13.5%

- GAAP operating

income of $54.8 million; non-GAAP operating income of

$120.4 million

- GAAP net income of $62.2 million;

non-GAAP net income of $125.9 million

- GAAP diluted

earnings per share of $0.45; non-GAAP diluted earnings per share of

$0.94

- Free cash flow of

$159.2 million; ending cash, cash equivalents, restricted cash

and marketable securities of $1.72 billion

Our revenue and earnings for the fourth quarter

of 2024 are provided below, compared with the prior quarter:

(In thousands, except per share and percentage

data)

| |

GAAP |

|

Non-GAAP |

| |

Q4 2024 |

|

Q3 2024 |

|

Q4 2023 |

|

Q4 2024 |

|

Q3 2024 |

|

Q4 2023 |

|

Revenue |

$ |

382,713 |

|

|

$ |

380,873 |

|

|

$ |

302,570 |

|

|

$ |

382,713 |

|

|

$ |

380,873 |

|

|

$ |

302,570 |

|

| Gross margin |

|

51.8 |

% |

|

|

46.8 |

% |

|

|

48.5 |

% |

|

|

53.2 |

% |

|

|

48.1 |

% |

|

|

50.3 |

% |

| Operating expenses |

$ |

143,489 |

|

|

$ |

128,383 |

|

|

$ |

156,893 |

|

|

$ |

83,322 |

|

|

$ |

81,612 |

|

|

$ |

86,551 |

|

| Operating income (loss) |

$ |

54,804 |

|

|

$ |

49,788 |

|

|

$ |

(10,231 |

) |

|

$ |

120,434 |

|

|

$ |

101,411 |

|

|

$ |

65,587 |

|

| Net income |

$ |

62,160 |

|

|

$ |

45,762 |

|

|

$ |

20,919 |

|

|

$ |

125,862 |

|

|

$ |

88,402 |

|

|

$ |

73,474 |

|

| Basic EPS |

$ |

0.46 |

|

|

$ |

0.34 |

|

|

$ |

0.15 |

|

|

$ |

0.94 |

|

|

$ |

0.65 |

|

|

$ |

0.54 |

|

| Diluted EPS |

$ |

0.45 |

|

|

$ |

0.33 |

|

|

$ |

0.15 |

|

|

$ |

0.94 |

|

|

$ |

0.65 |

|

|

$ |

0.54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our revenue and earnings for the fiscal year

2024 are provided below, compared with the prior year:

(In thousands, except per share and percentage

data)

| |

GAAP |

|

Non-GAAP |

| |

FY 2024 |

|

FY 2023 |

|

FY 2024 |

|

FY 2023 |

|

Revenue |

$ |

1,330,383 |

|

|

$ |

2,290,786 |

|

|

$ |

1,330,383 |

|

|

$ |

2,290,786 |

|

| Gross margin |

|

47.3 |

% |

|

|

46.2 |

% |

|

|

48.9 |

% |

|

|

47.1 |

% |

| Operating expenses |

$ |

551,846 |

|

|

$ |

612,647 |

|

|

$ |

329,227 |

|

|

$ |

382,115 |

|

| Operating income |

$ |

77,292 |

|

|

$ |

445,741 |

|

|

$ |

321,919 |

|

|

$ |

697,210 |

|

| Net income |

$ |

102,658 |

|

|

$ |

438,936 |

|

|

$ |

321,044 |

|

|

$ |

613,241 |

|

| Basic EPS |

$ |

0.76 |

|

|

$ |

3.22 |

|

|

$ |

2.37 |

|

|

$ |

4.50 |

|

| Diluted EPS |

$ |

0.75 |

|

|

$ |

3.08 |

|

|

$ |

2.37 |

|

|

$ |

4.41 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue for the fourth quarter of 2024 was

$382.7 million, compared to $380.9 million in the third

quarter of 2024. Our revenue in the United States for the fourth

quarter of 2024 increased approximately 6%, compared to the third

quarter. The increase in revenue was due to higher microinverter

sales. Our revenue in Europe decreased approximately 25% for the

fourth quarter of 2024, compared to the third quarter. The decline

in revenue was the result of a further softening in European

demand.

Our non-GAAP gross margin was 53.2% in the

fourth quarter of 2024, compared to 48.1% in the third quarter. Our

non-GAAP gross margin, excluding net IRA benefit, was 39.7% in the

fourth quarter of 2024, compared to 38.9% in the third quarter.

Our non-GAAP operating expenses were

$83.3 million in the fourth quarter of 2024, compared to

$81.6 million in the third quarter. The increase was driven by

higher R&D expense on new products. Our non-GAAP operating

income was $120.4 million in the fourth quarter of 2024,

compared to $101.4 million in the third quarter.

We exited the fourth quarter of 2024 with $1.72

billion in cash, cash equivalents, restricted cash and marketable

securities and generated $167.3 million in cash flow from

operations in the fourth quarter. Our capital expenditures were

$8.1 million in the fourth quarter of 2024, compared to

$8.5 million in the third quarter of 2024.

In the fourth quarter of 2024, we repurchased

2,883,438 shares of our common stock at an average price of $69.25

per share for a total of approximately $199.7 million. We also

spent approximately $5.0 million by withholding shares to cover

taxes for employee stock vesting that reduced the diluted shares by

68,532 shares.

We shipped 152.4 megawatt hours of IQ Batteries

in the fourth quarter of 2024, compared to 172.9 megawatt hours in

the third quarter. More than 10,300 installers worldwide are

certified to install our IQ Batteries, compared to more than 9,000

installers worldwide in the third quarter of 2024.

During the fourth quarter of 2024, we shipped

approximately 1.69 million microinverters from our contract

manufacturing facilities in the United States that we booked for

45X production tax credits. We also expanded our higher domestic

content product offerings, and shipped our IQ8HC™ Microinverters,

IQ8X™ Microinverters, IQ8P-3P™ Commercial Microinverters, and IQ®

Battery 5Ps, all with higher domestic content than previous models

and produced at our contract manufacturing facilities in the United

States.

During the fourth quarter of 2024, we made great

strides with the IQ® Meter Collar, fourth-generation IQ Battery,

and new IQ® Combiner products. We launched the IQ® PowerPack 1500,

a 1.5 kWh smart, portable energy system for home, work, and

on-the-go use. In Europe, we introduced the IQ® EV Charger 2, a

next-generation smart charger that integrates with our solar and

battery systems seamlessly or works as a standalone. In January

2025, we began shipping the IQ® Battery 5P™ with FlexPhase to

Germany, Austria, and Switzerland, delivering reliable backup power

for both single- and three-phase installations.

BUSINESS HIGHLIGHTS

On Jan. 30, 2025, Enphase Energy announced that

it is expanding in Southeast Asia by entering the solar

markets in Vietnam and Malaysia with IQ8P™

Microinverters.

On Jan. 27, 2025, Enphase Energy announced

integration with Octopus Energy’s smart tariffs in the UK, such as

“Intelligent Octopus Flux” (IO Flux), which can help customers save

money on electricity bills.

On Jan. 23, 2025, Enphase Energy announced that

its IQ8™ Microinverters for residential and commercial

applications, are now in compliance with the Build America, Buy

America (BABA) Act.

On Jan. 13, 2025, Enphase Energy announced

shipments of its most powerful and versatile battery yet, the

IQ Battery 5P with FlexPhase, for customers

in Germany, Austria, and Switzerland. With reliable

backup power and support for single- and three-phase systems, it

offers unmatched flexibility for home energy needs.

On Jan. 9, 2025, Enphase Energy announced that

it is expanding into Latin America with IQ8P

Microinverters, bringing solar solutions to Colombia, Panama, and

Costa Rica for residential and commercial use.

On Jan. 7, 2025, Enphase Energy announced that

IQ8 Microinverters were selected for a 2.2 MW solar project at

the Belgoprocess radioactive waste facility in

Dessel, Belgium.

On Dec. 17, 2024, Enphase Energy announced

initial shipments of its most powerful home battery to-date, the

IQ Battery 5P, for customers in India.

On Dec. 5 and Dec. 9, 2024, Enphase Energy

announced collaborations with two energy providers in the

Netherlands, Frank Energie and NextEnergy, to enable participation

in the grid imbalance energy marketplace.

On Dec. 3, 2024, Enphase Energy announced the

launch of Busbar Power Control software that empowers homeowners to

install larger solar and battery systems without costly main

electrical panel upgrades.

On Nov. 11, 2024, Enphase Energy announced an

AI-powered do-it-yourself (DIY) permitting feature on Solargraf®,

to automate the complex solar permitting process for installers in

the USA.

On Nov. 4, 2024, Enphase Energy announced the

launch of its most powerful Enphase Energy System to-date,

featuring the IQ Battery 5P and IQ8 Microinverters, for customers

in Romania.

FIRST QUARTER 2025 FINANCIAL

OUTLOOK

For the first quarter of 2025, Enphase Energy estimates both

GAAP and non-GAAP financial results as follows:

-

Revenue to be within a range of $340.0 million to $380.0 million,

which includes shipments of 150 to 170 megawatt hours of IQ

Batteries. The first quarter of 2025 financial outlook includes

approximately $50.0 million of safe harbor revenue. We define safe

harbor revenue as any sales made to customers who plan to install

the inventory over more than one year.

-

GAAP gross margin to be within a range of 46.0% to 49.0% with net

IRA benefit

-

Non-GAAP gross margin to be within a range of 48.0% to 51.0% with

net IRA benefit and 38.0% to 41.0% excluding net IRA benefit.

Non-GAAP gross margin excludes stock-based compensation expense and

acquisition related amortization

-

Net IRA benefit to be within a range of $36.0 million to $39.0

million based on estimated shipments of 1,200,000 units of U.S.

manufactured microinverters

-

GAAP operating expenses to be within a range of $143.0 million to

$147.0 million

-

Non-GAAP operating expenses to be within a range of $81.0 million

to $85.0 million, excluding $62.0 million estimated for stock-based

compensation expense, acquisition related expenses and

amortization, restructuring and asset impairment charges

For 2025, GAAP and non-GAAP annualized effective

tax rate with IRA benefit, excluding discrete items, is expected to

be within a range of 17.0% to 19.0%.

Follow Enphase Online

- Read the Enphase

blog.

- Follow @Enphase on

X (formerly Twitter).

- Visit us on

Facebook and LinkedIn.

- Watch Enphase

videos on YouTube.

Use of non-GAAP Financial

Measures

Enphase Energy has presented certain non-GAAP

financial measures in this press release. Generally, a non-GAAP

financial measure is a numerical measure of a company’s

performance, financial position, or cash flows that either exclude

or include amounts that are not normally excluded or included in

the most directly comparable measure calculated and presented in

accordance with generally accepted accounting principles in the

United States (GAAP). Reconciliation of each non-GAAP financial

measure to the most directly comparable GAAP financial measure can

be found in the accompanying tables to this press release. Non-GAAP

financial measures presented by Enphase Energy include non-GAAP

gross profit, gross margin, operating expenses, income from

operations, net income, net income per share (basic and diluted),

net IRA benefit, and free cash flow.

These non-GAAP financial measures do not reflect

a comprehensive system of accounting, differ from GAAP measures

with the same captions and may differ from non-GAAP financial

measures with the same or similar captions that are used by other

companies. In addition, these non-GAAP measures have limitations in

that they do not reflect all of the amounts associated with Enphase

Energy’s results of operations as determined in accordance with

GAAP. As such, these non-GAAP measures should be considered as a

supplement to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. Enphase

Energy uses these non-GAAP financial measures to analyze its

operating performance and future prospects, develop internal

budgets and financial goals, and to facilitate period-to-period

comparisons. Enphase Energy believes that these non-GAAP financial

measures reflect an additional way of viewing aspects of its

operations that, when viewed with its GAAP results, provide a more

complete understanding of factors and trends affecting its

business.

As presented in the “Reconciliation of Non-GAAP

Financial Measures” tables below, each of the non-GAAP financial

measures excludes one or more of the following items for purposes

of calculating non-GAAP financial measures to facilitate an

evaluation of Enphase Energy’s current operating performance and a

comparison to its past operating performance:

Stock-based compensation expense. Enphase Energy

excludes stock-based compensation expense from its non-GAAP

measures primarily because they are non-cash in nature. Moreover,

the impact of this expense is significantly affected by Enphase

Energy’s stock price at the time of an award over which management

has limited to no control.

Acquisition related expenses and amortization.

This item represents expenses incurred related to Enphase Energy’s

business acquisitions, which are non-recurring in nature, and

amortization of acquired intangible assets, which is a non-cash

expense. Acquisition related expenses and amortization of acquired

intangible assets are not reflective of Enphase Energy’s ongoing

financial performance.

Restructuring and asset impairment charges.

Enphase Energy excludes restructuring and asset impairment charges

due to the nature of the expenses being unusual and arising outside

the ordinary course of continuing operations. These costs primarily

consist of fees paid for cash-based severance costs, accelerated

stock-based compensation expense and asset write-downs of property

and equipment and acquired intangible assets, and other contract

termination costs resulting from restructuring initiatives.

Non-cash interest expense. This item consists

primarily of amortization of debt issuance costs and accretion of

debt discount because these expenses do not represent a cash

outflow for Enphase Energy except in the period the financing was

secured and such amortization expense is not reflective of Enphase

Energy’s ongoing financial performance.

Non-GAAP income tax adjustment. This item

represents the amount adjusted to Enphase Energy’s GAAP tax

provision or benefit to exclude the income tax effects of GAAP

adjustments such as stock-based compensation, amortization of

purchased intangibles, and other non-recurring items that are not

reflective of Enphase Energy ongoing financial performance.

Non-GAAP net income per share, diluted. Enphase

Energy excludes the dilutive effect of in-the-money portion of

convertible senior notes as they are covered by convertible note

hedge transactions that reduce potential dilution to our common

stock upon conversion of the Notes due 2025, Notes due 2026, and

Notes due 2028, and includes the dilutive effect of employee’s

stock-based awards and the dilutive effect of warrants. Enphase

Energy believes these adjustments provide useful supplemental

information to the ongoing financial performance.

Net IRA benefit. This item represents the

advanced manufacturing production tax credit (AMPTC) from the IRA

for manufacturing microinverters in the United States, partially

offset by the incremental manufacturing cost incurred in the United

States relative to manufacturing in Mexico, India, and China. The

AMPTC is accounted for by Enphase Energy as an income-based

government grants that reduces cost of revenues in the condensed

consolidated statements of operations.

Free cash flow. This item represents net cash

flows from operating activities less purchases of property and

equipment.

Conference Call Information

Enphase Energy will host a conference call for

analysts and investors to discuss its fourth quarter 2024 results

and first quarter 2025 business outlook today at 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time). The call is open to the public by

dialing (833) 634-5018. A live webcast of the conference call will

also be accessible from the “Investor Relations” section of Enphase

Energy’s website at https://investor.enphase.com. Following the

webcast, an archived version will be available on the website for

approximately one year. In addition, an audio replay of the

conference call will be available by calling (877) 344-7529;

replay access code 3831590, beginning approximately one hour after

the call.

Forward-Looking Statements

This press release contains forward-looking

statements, including statements related to Enphase Energy’s

expectations as to its first quarter of 2025 financial outlook,

including revenue, shipments of IQ Batteries by megawatt hours,

gross margin with net IRA benefit and excluding net IRA benefit,

estimated shipments of U.S. manufactured microinverters, operating

expenses, and annualized effective tax rate with IRA benefit; its

expectations regarding the expected net IRA benefit; its

expectations on the timing and introduction of new products and

updates to existing products, including the IQ Meter Collar,

fourth-generation IQ Battery, and new IQ Combiner products; its

expectations regarding higher domestic content product offerings;

and the capabilities, advantages, features, and performance of its

technology and products. These forward-looking statements are based

on Enphase Energy’s current expectations and inherently involve

significant risks and uncertainties. Enphase Energy’s actual

results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of

certain risks and uncertainties including those risks described in

more detail in its most recently filed Annual Report on Form 10-K,

Quarterly Report on Form 10-Q, and other documents on file with the

SEC from time to time and available on the SEC’s website at

www.sec.gov. Enphase Energy undertakes no duty or obligation to

update any forward-looking statements contained in this release as

a result of new information, future events or changes in its

expectations, except as required by law.

A copy of this press release can be found on the

investor relations page of Enphase Energy’s website at

https://investor.enphase.com.

About Enphase Energy, Inc.

Enphase Energy, a global energy technology

company based in Fremont, CA, is the world's leading supplier of

microinverter-based solar and battery systems that enable people to

harness the sun to make, use, save, and sell their own power—and

control it all with a smart mobile app. The company revolutionized

the solar industry with its microinverter-based technology and

builds all-in-one solar, battery, and software solutions. Enphase

has shipped approximately 80.0 million microinverters, and

approximately 4.7 million Enphase-based systems have been deployed

in more than 160 countries. For more information, visit

https://enphase.com/.

©2025 Enphase Energy, Inc. All rights reserved.

Enphase Energy, Enphase, the “e” logo, IQ, IQ8, and certain other

marks listed at

https://enphase.com/trademark-usage-guidelines are

trademarks or service marks of Enphase Energy, Inc. Other names are

for informational purposes and may be trademarks of their

respective owners.

Contact:

Zach FreedmanEnphase Energy, Inc.Investor

Relationsir@enphaseenergy.com

|

ENPHASE ENERGY, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In thousands, except per share data) |

|

(Unaudited) |

| |

| |

Three Months Ended |

Year Ended |

| |

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

|

Net revenues |

$ |

382,713 |

|

|

$ |

380,873 |

|

|

$ |

302,570 |

|

|

$ |

1,330,383 |

|

|

$ |

2,290,786 |

|

| Cost of revenues |

|

184,420 |

|

|

|

202,702 |

|

|

|

155,908 |

|

|

|

701,245 |

|

|

|

1,232,398 |

|

| Gross profit |

|

198,293 |

|

|

|

178,171 |

|

|

|

146,662 |

|

|

|

629,138 |

|

|

|

1,058,388 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

50,390 |

|

|

|

47,843 |

|

|

|

55,291 |

|

|

|

201,315 |

|

|

|

227,336 |

|

|

Sales and marketing |

|

51,799 |

|

|

|

49,671 |

|

|

|

53,409 |

|

|

|

206,552 |

|

|

|

231,792 |

|

|

General and administrative |

|

31,901 |

|

|

|

30,192 |

|

|

|

33,379 |

|

|

|

130,825 |

|

|

|

137,835 |

|

|

Restructuring and asset impairment charges |

|

9,399 |

|

|

|

677 |

|

|

|

14,814 |

|

|

|

13,154 |

|

|

|

15,684 |

|

|

Total operating expenses |

|

143,489 |

|

|

|

128,383 |

|

|

|

156,893 |

|

|

|

551,846 |

|

|

|

612,647 |

|

| Income (loss) from

operations |

|

54,804 |

|

|

|

49,788 |

|

|

|

(10,231 |

) |

|

|

77,292 |

|

|

|

445,741 |

|

| Other income, net |

|

|

|

|

|

|

|

|

|

|

Interest income |

|

18,417 |

|

|

|

19,977 |

|

|

|

20,493 |

|

|

|

77,306 |

|

|

|

69,728 |

|

|

Interest expense |

|

(2,252 |

) |

|

|

(2,237 |

) |

|

|

(2,268 |

) |

|

|

(8,905 |

) |

|

|

(8,839 |

) |

|

Other income (expense), net |

|

(1,270 |

) |

|

|

(16,785 |

) |

|

|

4,233 |

|

|

|

(25,534 |

) |

|

|

6,509 |

|

|

Total other income, net |

|

14,895 |

|

|

|

955 |

|

|

|

22,458 |

|

|

|

42,867 |

|

|

|

67,398 |

|

| Income before income

taxes |

|

69,699 |

|

|

|

50,743 |

|

|

|

12,227 |

|

|

|

120,159 |

|

|

|

513,139 |

|

| Income tax (provision)

benefit |

|

(7,539 |

) |

|

|

(4,981 |

) |

|

|

8,692 |

|

|

|

(17,501 |

) |

|

|

(74,203 |

) |

| Net income |

$ |

62,160 |

|

|

$ |

45,762 |

|

|

$ |

20,919 |

|

|

$ |

102,658 |

|

|

$ |

438,936 |

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.46 |

|

|

$ |

0.34 |

|

|

$ |

0.15 |

|

|

$ |

0.76 |

|

|

$ |

3.22 |

|

|

Diluted |

$ |

0.45 |

|

|

$ |

0.33 |

|

|

$ |

0.15 |

|

|

$ |

0.75 |

|

|

$ |

3.08 |

|

| Shares used in per share

calculation: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

133,815 |

|

|

|

135,329 |

|

|

|

136,092 |

|

|

|

135,167 |

|

|

|

136,376 |

|

|

Diluted |

|

138,128 |

|

|

|

139,914 |

|

|

|

139,205 |

|

|

|

140,004 |

|

|

|

143,290 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENPHASE ENERGY, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands) |

|

(Unaudited) |

| |

| |

December 31,2024 |

|

December 31,2023 |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

369,110 |

|

$ |

288,748 |

|

Restricted cash |

|

95,006 |

|

|

— |

|

Marketable securities |

|

1,253,480 |

|

|

1,406,286 |

|

Accounts receivable, net |

|

223,749 |

|

|

445,959 |

|

Inventory |

|

165,004 |

|

|

213,595 |

|

Prepaid expenses and other assets |

|

220,735 |

|

|

88,930 |

|

Total current assets |

|

2,327,084 |

|

|

2,443,518 |

| Property and equipment,

net |

|

147,514 |

|

|

168,244 |

| Operating lease, right of use

asset, net |

|

24,617 |

|

|

19,887 |

| Intangible assets, net |

|

42,398 |

|

|

68,536 |

| Goodwill |

|

211,571 |

|

|

214,562 |

| Other assets |

|

180,925 |

|

|

215,895 |

| Deferred tax assets, net |

|

315,567 |

|

|

252,370 |

|

Total assets |

$ |

3,249,676 |

|

$ |

3,383,012 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

90,032 |

|

$ |

116,164 |

|

Accrued liabilities |

|

196,887 |

|

|

261,919 |

|

Deferred revenues, current |

|

237,225 |

|

|

118,300 |

|

Warranty obligations, current |

|

34,656 |

|

|

36,066 |

|

Debt, current |

|

101,291 |

|

|

— |

|

Total current liabilities |

|

660,091 |

|

|

532,449 |

| Long-term liabilities: |

|

|

|

|

Deferred revenues, non-current |

|

341,982 |

|

|

369,172 |

|

Warranty obligations, non-current |

|

158,233 |

|

|

153,021 |

|

Other liabilities |

|

55,265 |

|

|

51,008 |

|

Debt, non-current |

|

1,201,089 |

|

|

1,293,738 |

|

Total liabilities |

|

2,416,660 |

|

|

2,399,388 |

|

Total stockholders’ equity |

|

833,016 |

|

|

983,624 |

| Total liabilities and

stockholders’ equity |

$ |

3,249,676 |

|

$ |

3,383,012 |

| |

|

|

|

|

|

|

ENPHASE ENERGY, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In thousands) |

|

(Unaudited) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

62,160 |

|

|

$ |

45,762 |

|

|

$ |

20,919 |

|

|

$ |

102,658 |

|

|

$ |

438,936 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

20,665 |

|

|

|

20,103 |

|

|

|

20,841 |

|

|

|

81,389 |

|

|

|

74,708 |

|

|

Net accretion of discount on marketable securities |

|

(7,490 |

) |

|

|

(2,904 |

) |

|

|

(2,950 |

) |

|

|

(8,599 |

) |

|

|

(15,561 |

) |

|

Provision for doubtful accounts |

|

2,206 |

|

|

|

2,704 |

|

|

|

(129 |

) |

|

|

6,677 |

|

|

|

1,153 |

|

|

Asset impairment |

|

4,702 |

|

|

|

17,568 |

|

|

|

9,700 |

|

|

|

28,843 |

|

|

|

10,603 |

|

|

Non-cash interest expense |

|

2,188 |

|

|

|

2,173 |

|

|

|

2,126 |

|

|

|

8,650 |

|

|

|

8,380 |

|

|

Net loss (gain) from change in fair value of debt securities |

|

(3,697 |

) |

|

|

741 |

|

|

|

(2,670 |

) |

|

|

(1,967 |

) |

|

|

(8,078 |

) |

|

Stock-based compensation |

|

51,830 |

|

|

|

45,940 |

|

|

|

55,222 |

|

|

|

211,360 |

|

|

|

212,857 |

|

|

Deferred income taxes |

|

(30,675 |

) |

|

|

(5,276 |

) |

|

|

(5,053 |

) |

|

|

(58,319 |

) |

|

|

(43,348 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

2,684 |

|

|

|

49,414 |

|

|

|

105,771 |

|

|

|

211,640 |

|

|

|

(12,478 |

) |

|

Inventory |

|

(6,167 |

) |

|

|

17,231 |

|

|

|

(39,481 |

) |

|

|

48,591 |

|

|

|

(63,887 |

) |

|

Prepaid expenses and other assets |

|

(16,487 |

) |

|

|

(64,149 |

) |

|

|

(2,401 |

) |

|

|

(134,343 |

) |

|

|

(59,777 |

) |

|

Accounts payable, accrued and other liabilities |

|

(27,396 |

) |

|

|

32,088 |

|

|

|

(139,277 |

) |

|

|

(85,536 |

) |

|

|

(22,149 |

) |

|

Warranty obligations |

|

8,657 |

|

|

|

7,053 |

|

|

|

221 |

|

|

|

3,802 |

|

|

|

57,641 |

|

|

Deferred revenues |

|

104,112 |

|

|

|

1,690 |

|

|

|

12,611 |

|

|

|

98,847 |

|

|

|

117,780 |

|

|

Net cash provided by operating activities |

|

167,292 |

|

|

|

170,138 |

|

|

|

35,450 |

|

|

|

513,693 |

|

|

|

696,780 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(8,064 |

) |

|

|

(8,533 |

) |

|

|

(20,075 |

) |

|

|

(33,604 |

) |

|

|

(110,401 |

) |

|

Purchases of marketable securities |

|

(93,138 |

) |

|

|

(319,190 |

) |

|

|

(337,757 |

) |

|

|

(1,184,649 |

) |

|

|

(2,081,431 |

) |

|

Maturities and sale of marketable securities |

|

351,843 |

|

|

|

215,241 |

|

|

|

433,869 |

|

|

|

1,346,520 |

|

|

|

1,840,477 |

|

|

Investments in private companies |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15,000 |

) |

|

Net cash provided by (used in) investing activities |

|

250,641 |

|

|

|

(112,482 |

) |

|

|

76,037 |

|

|

|

128,267 |

|

|

|

(366,355 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

Partial settlement of convertible notes |

|

— |

|

|

|

(5 |

) |

|

|

— |

|

|

|

(7 |

) |

|

|

— |

|

|

Repurchase of common stock |

|

(199,666 |

) |

|

|

(49,794 |

) |

|

|

(99,998 |

) |

|

|

(391,364 |

) |

|

|

(409,998 |

) |

|

Payment of excise tax on net stock repurchases |

|

(2,773 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,773 |

) |

|

|

— |

|

|

Proceeds from issuance of common stock under employee equity

plans |

|

4,719 |

|

|

|

14 |

|

|

|

12,555 |

|

|

|

12,688 |

|

|

|

13,870 |

|

|

Payment of withholding taxes related to net share settlement of

equity awards |

|

(5,012 |

) |

|

|

(6,286 |

) |

|

|

(27,546 |

) |

|

|

(78,813 |

) |

|

|

(120,646 |

) |

|

Net cash used in financing activities |

|

(202,732 |

) |

|

|

(56,071 |

) |

|

|

(114,989 |

) |

|

|

(460,269 |

) |

|

|

(516,774 |

) |

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

|

(7,410 |

) |

|

|

2,638 |

|

|

|

2,175 |

|

|

|

(6,323 |

) |

|

|

1,853 |

|

| Net increase (decrease) in

cash and cash equivalents and restricted cash |

|

207,791 |

|

|

|

4,223 |

|

|

|

(1,327 |

) |

|

|

175,368 |

|

|

|

(184,496 |

) |

| Cash and cash

equivalents—Beginning of period |

|

256,325 |

|

|

|

252,102 |

|

|

|

290,075 |

|

|

|

288,748 |

|

|

|

473,244 |

|

| Cash, cash equivalents and

restricted cash—End of period |

$ |

464,116 |

|

|

$ |

256,325 |

|

|

$ |

288,748 |

|

|

$ |

464,116 |

|

|

$ |

288,748 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENPHASE ENERGY, INC. |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(In thousands, except per share data and

percentages) |

|

(Unaudited) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

December 31,2024 |

|

September 30,2024 |

|

December 31,2023 |

|

December 31,2024 |

|

December 31,2023 |

|

Gross profit (GAAP) |

$ |

198,293 |

|

|

$ |

178,171 |

|

|

$ |

146,662 |

|

|

$ |

629,138 |

|

|

$ |

1,058,388 |

|

|

Stock-based compensation |

|

3,678 |

|

|

|

2,948 |

|

|

|

3,582 |

|

|

|

14,538 |

|

|

|

13,357 |

|

|

Acquisition related amortization |

|

1,784 |

|

|

|

1,904 |

|

|

|

1,894 |

|

|

|

7,469 |

|

|

|

7,580 |

|

| Gross profit

(Non-GAAP) |

$ |

203,755 |

|

|

$ |

183,023 |

|

|

$ |

152,138 |

|

|

$ |

651,145 |

|

|

$ |

1,079,325 |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin

(GAAP) |

|

51.8 |

% |

|

|

46.8 |

% |

|

|

48.5 |

% |

|

|

47.3 |

% |

|

|

46.2 |

% |

|

Stock-based compensation |

|

0.9 |

|

|

|

0.8 |

|

|

|

1.2 |

|

|

|

1.0 |

|

|

|

0.6 |

|

|

Acquisition related amortization |

|

0.5 |

|

|

|

0.5 |

|

|

|

0.6 |

|

|

|

0.6 |

|

|

|

0.3 |

|

| Gross margin

(Non-GAAP) |

|

53.2 |

% |

|

|

48.1 |

% |

|

|

50.3 |

% |

|

|

48.9 |

% |

|

|

47.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses

(GAAP) |

$ |

143,489 |

|

|

$ |

128,383 |

|

|

$ |

156,893 |

|

|

$ |

551,846 |

|

|

$ |

612,647 |

|

|

Stock-based compensation (1) |

|

(47,884 |

) |

|

|

(42,992 |

) |

|

|

(51,640 |

) |

|

|

(196,554 |

) |

|

|

(199,500 |

) |

|

Acquisition related expenses and amortization |

|

(2,884 |

) |

|

|

(3,102 |

) |

|

|

(3,888 |

) |

|

|

(12,911 |

) |

|

|

(15,317 |

) |

|

Restructuring and asset impairment charges (1) |

|

(9,399 |

) |

|

|

(677 |

) |

|

|

(14,814 |

) |

|

|

(13,154 |

) |

|

|

(15,715 |

) |

| Operating expenses

(Non-GAAP) |

$ |

83,322 |

|

|

$ |

81,612 |

|

|

$ |

86,551 |

|

|

$ |

329,227 |

|

|

$ |

382,115 |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Includes stock-based

compensation as follows: |

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

20,951 |

|

|

$ |

19,790 |

|

|

$ |

23,839 |

|

|

$ |

85,501 |

|

|

$ |

88,367 |

|

|

Sales and marketing |

|

15,893 |

|

|

|

14,237 |

|

|

|

16,472 |

|

|

|

65,092 |

|

|

|

65,703 |

|

|

General and administrative |

|

11,041 |

|

|

|

8,965 |

|

|

|

11,329 |

|

|

|

45,962 |

|

|

|

45,430 |

|

|

Restructuring and asset impairment charges |

|

267 |

|

|

|

— |

|

|

|

— |

|

|

|

267 |

|

|

|

— |

|

|

Total |

$ |

48,152 |

|

|

$ |

42,992 |

|

|

$ |

51,640 |

|

|

$ |

196,822 |

|

|

$ |

199,500 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations (GAAP) |

$ |

54,804 |

|

|

$ |

49,788 |

|

|

$ |

(10,231 |

) |

|

$ |

77,292 |

|

|

$ |

445,741 |

|

|

Stock-based compensation |

|

51,563 |

|

|

|

45,940 |

|

|

|

55,222 |

|

|

|

211,093 |

|

|

|

212,857 |

|

|

Acquisition related expenses and amortization |

|

4,668 |

|

|

|

5,006 |

|

|

|

5,782 |

|

|

|

20,380 |

|

|

|

22,897 |

|

|

Restructuring and asset impairment charges |

|

9,399 |

|

|

|

677 |

|

|

|

14,814 |

|

|

|

13,154 |

|

|

|

15,715 |

|

| Income from operations

(Non-GAAP) |

$ |

120,434 |

|

|

$ |

101,411 |

|

|

$ |

65,587 |

|

|

$ |

321,919 |

|

|

$ |

697,210 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(GAAP) |

$ |

62,160 |

|

|

$ |

45,762 |

|

|

$ |

20,919 |

|

|

$ |

102,658 |

|

|

$ |

438,936 |

|

|

Stock-based compensation |

|

51,563 |

|

|

|

45,940 |

|

|

|

55,222 |

|

|

|

211,093 |

|

|

|

212,857 |

|

|

Acquisition related expenses and amortization |

|

4,668 |

|

|

|

5,006 |

|

|

|

5,782 |

|

|

|

20,380 |

|

|

|

22,897 |

|

|

Restructuring and asset impairment charges |

|

9,399 |

|

|

|

677 |

|

|

|

14,814 |

|

|

|

13,154 |

|

|

|

15,715 |

|

|

Non-cash interest expense |

|

2,188 |

|

|

|

2,173 |

|

|

|

2,126 |

|

|

|

8,650 |

|

|

|

8,380 |

|

|

Non-GAAP income tax adjustment |

|

(4,116 |

) |

|

|

(11,156 |

) |

|

|

(25,389 |

) |

|

|

(34,891 |

) |

|

|

(85,544 |

) |

| Net income

(Non-GAAP) |

$ |

125,862 |

|

|

$ |

88,402 |

|

|

$ |

73,474 |

|

|

$ |

321,044 |

|

|

$ |

613,241 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share,

basic (GAAP) |

$ |

0.46 |

|

|

$ |

0.34 |

|

|

$ |

0.15 |

|

|

$ |

0.76 |

|

|

$ |

3.22 |

|

|

Stock-based compensation |

|

0.39 |

|

|

|

0.34 |

|

|

|

0.40 |

|

|

|

1.56 |

|

|

|

1.56 |

|

|

Acquisition related expenses and amortization |

|

0.03 |

|

|

|

0.04 |

|

|

|

0.08 |

|

|

|

0.15 |

|

|

|

0.17 |

|

|

Restructuring and asset impairment charges |

|

0.07 |

|

|

|

0.01 |

|

|

|

0.11 |

|

|

|

0.10 |

|

|

|

0.12 |

|

|

Non-cash interest expense |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

Non-GAAP income tax adjustment |

|

(0.03 |

) |

|

|

(0.10 |

) |

|

|

(0.22 |

) |

|

|

(0.26 |

) |

|

|

(0.63 |

) |

| Net income per share,

basic (Non-GAAP) |

$ |

0.94 |

|

|

$ |

0.65 |

|

|

$ |

0.54 |

|

|

$ |

2.37 |

|

|

$ |

4.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

Shares used in basic per share calculation GAAP and Non-GAAP |

|

133,815 |

|

|

|

135,329 |

|

|

|

136,092 |

|

|

|

135,167 |

|

|

|

136,376 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income per share,

diluted (GAAP) |

$ |

0.45 |

|

|

$ |

0.33 |

|

|

$ |

0.15 |

|

|

$ |

0.75 |

|

|

$ |

3.08 |

|

|

Stock-based compensation |

|

0.39 |

|

|

|

0.33 |

|

|

|

0.39 |

|

|

|

1.56 |

|

|

|

1.57 |

|

|

Acquisition related expenses and amortization |

|

0.04 |

|

|

|

0.04 |

|

|

|

0.08 |

|

|

|

0.15 |

|

|

|

0.16 |

|

|

Restructuring and asset impairment charges |

|

0.07 |

|

|

|

0.01 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.11 |

|

|

Non-cash interest expense |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

Non-GAAP income tax adjustment |

|

(0.03 |

) |

|

|

(0.08 |

) |

|

|

(0.19 |

) |

|

|

(0.26 |

) |

|

|

(0.57 |

) |

| Net income per share,

diluted (Non-GAAP) (2) |

$ |

0.94 |

|

|

$ |

0.65 |

|

|

$ |

0.54 |

|

|

$ |

2.37 |

|

|

$ |

4.41 |

|

| |

|

|

|

|

|

|

|

|

|

|

Shares used in diluted per share calculation GAAP |

|

138,128 |

|

|

|

139,914 |

|

|

|

139,205 |

|

|

|

140,004 |

|

|

|

143,290 |

|

|

Shares used in diluted per share calculation Non-GAAP |

|

134,053 |

|

|

|

135,839 |

|

|

|

137,187 |

|

|

|

135,641 |

|

|

|

139,214 |

|

| |

|

|

|

|

|

|

|

|

|

| Income-based

government grants (GAAP) |

$ |

68,040 |

|

|

$ |

46,552 |

|

|

$ |

32,887 |

|

|

$ |

157,538 |

|

|

$ |

53,470 |

|

|

Incremental cost for manufacturing in U.S. |

|

(16,123 |

) |

|

|

(11,396 |

) |

|

|

(7,112 |

) |

|

|

(38,351 |

) |

|

|

(11,603 |

) |

| Net IRA benefit

(Non-GAAP) |

$ |

51,917 |

|

|

$ |

35,156 |

|

|

$ |

25,775 |

|

|

$ |

119,187 |

|

|

$ |

41,867 |

|

| |

|

|

|

|

|

|

|

|

|

| Net cash provided by

operating activities (GAAP) |

$ |

167,292 |

|

|

$ |

170,138 |

|

|

$ |

35,450 |

|

|

$ |

513,693 |

|

|

$ |

696,780 |

|

|

Purchases of property and equipment |

|

(8,064 |

) |

|

|

(8,533 |

) |

|

|

(20,075 |

) |

|

|

(33,604 |

) |

|

|

(110,401 |

) |

| Free cash flow

(Non-GAAP) |

$ |

159,228 |

|

|

$ |

161,605 |

|

|

$ |

15,375 |

|

|

$ |

480,089 |

|

|

$ |

586,379 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) Calculation of non-GAAP diluted net

income per share for the year ended December 31, 2023 excludes

convertible Notes due 2023 interest expense, net of tax of less

than $0.1 million from non-GAAP net income. |

This press release was published by a CLEAR® Verified

individual.

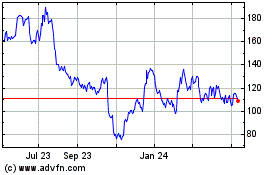

Enphase Energy (NASDAQ:ENPH)

Historical Stock Chart

From Feb 2025 to Mar 2025

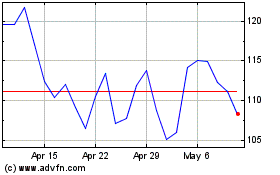

Enphase Energy (NASDAQ:ENPH)

Historical Stock Chart

From Mar 2024 to Mar 2025