false

0001817004

0001817004

2024-01-11

2024-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 11, 2024

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Next Charging, LLC Global

Amendments

On

January 11, 2024, EzFill Holdings, Inc. (the “Company”) and Next Charging, LLC (“Next”) entered into a global

amendment (“Global Amendment 1”) to the promissory notes dated as of July 5, 2023; August 2, 2023; August 30, 2023; September

6, 2023; September 13, 2023; November 3, 2023; November 21, 2023; December 4, 2023; December 13, 2023; December 18, 2023; and December

20, 2023 (each a “Note” and collectively the “Notes”).

Global

Amendment 1 revised Section 8, Events of Default, to add:

The

conversion price (as adjusted, the “Conversion Price”) shall equal the greater of the average VWAP over the ten (10) Trading

Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained

in this Note the Lender and the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together

with all other Transaction Documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”),

except that such limitation will not apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to

issue Common Shares to the Lender in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in

cash at the request of the Lender.

Global

Amendment 1 also added Section 10.15, Adjustment Due to Stock Split by Borrower, which provides that the number of shares and the price

for any conversion under the Notes will be adjusted by the same ratios or multipliers of any reverse split the Company effects.

Also

on January 11, 2024, the Company and Next entered into a global amendment (“Global Amendment 2”) to the promissory

notes dated as of December 27, 2023 and January 8, 2023.

Global

Amendment 2 revised Section 8, Events of Default, to remove the final paragraph and replace the paragraph with:

The

conversion price (as adjusted, the “Conversion Price”) shall equal the greater of the average VWAP over the ten (10) Trading

Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained

in this Note the Lender and the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together

with all other Transaction Documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”),

except that such limitation will not apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to

issue Common Shares to the Lender in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in

cash at the request of the Lender.

Next

Promissory Note dated January 16, 2024

On

January 16, 2024, the Company and Next entered into a promissory note (the “January Next Note”) for the sum of $165,000 (the

“January Next Loan”). The January Next Note has an original issue discount (“OID”) equal to $15,000, which is

10% of the aggregate original principal amount of the January Next Loan. The unpaid principal balance of the January Next Note has a

fixed rate of interest of 8% per annum for the first nine months, afterward, the Note will begin to accrue interest on the entire balance

at 18% per annum.

Unless

the January Next Note is otherwise accelerated, or extended in accordance with the terms and conditions therein, the balance of the January

Next Note, along with accrued interest, will be due on March 16, 2024 (the “Maturity Date”). The Maturity Date will automatically

be extended for 2 month periods, unless Next sends 10 days written notice, prior to the end of any 2 month period, that it does not wish

to extend the January Next Note, at which point the end of the then current 2 month period shall be the Maturity Date. Notwithstanding

the foregoing, upon the Company completing a capital raise of at least $3,000,000, the entire outstanding principal and interest through

the Maturity Date will be immediately due.

If

the Company defaults on the January Next Note, (i) the unpaid principal and interest sums, along with all other amounts payable, multiplied

by 150% will be immediately due, and (ii) Next will have the right to convert all or any part of the outstanding and unpaid principal,

interest, penalties, and all other amounts under the January Next Note into fully paid and non-assessable shares of the Company’s

common stock. The conversion price will be the average closing price over the 10 trading days ending on the date of conversion. Subject

to the adjustments described in the January Next Note, the conversion price shall equal the greater of (a) $1.23; or (b) $0.70.

Pursuant

to the January Next Note, the total cumulative number of shares issued to Next may not exceed the requirements of Nasdaq Listing Rule

5635(d) (“Nasdaq 19.99% Cap”), except that such limitation will not apply following Shareholder Approval. If the Company

is unable to obtain Shareholder Approval to issue shares to AJB in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance

of this Note must be repaid in cash at AJB’s request.

Michael

Farkas is the managing member of Next (the “Managing Member”). The Managing Member is also the beneficial owner of approximately

20% of the Company’s issued and outstanding common stock. Additionally and as previously reported on a Current Report on Form 8-K

that was filed with the Securities and Exchange Commission on August 16, 2023, on August 10, 2023, and on November 8, 2023, the Company,

the members (the “Members”) of Next and its Managing Member, as an individual and also as the representative of the Members,

entered into an Exchange Agreement (the “Exchange Agreement”), pursuant to which the Company agreed to acquire from the Members

100% of the membership interests of Next in exchange for the issuance by the Company to the Members of shares of common stock, par value

$0.0001 per share, of the Company. Upon consummation of the transactions contemplated by the Exchange Agreement (the “Closing”),

Next will become a wholly-owned subsidiary of the Company. As of the date of this Current Report on Form 8-K, the Closing has not occurred.

AJB

Capital Investments, LLC Global Amendment

On

January 17, 2024, the Company and AJB Capital Investments, LLC, (“AJB”) entered into a global amendment (the “AJB Global

Amendment”) to the promissory notes dated as of April 19, 2023, as amended by the amended and restated promissory note dated May

17, 2023, September 22, 2023 and October 13, 2023 (each an “AJB Note” and collectively the “AJB Notes”).

Upon

effectiveness, the AJB Global Amendment modified section 1.2(a) and section 1.6 of the AJB Notes. Section 1.2(a) replaced the calculation

of the conversion price. Subject to adjustments described in the AJB Notes, the conversion price will equal (x) until the date of the

Shareholder Approval the greater of (a) $1.23 (the “Nasdaq Minimum Price”), and (b) the lower of the average VWAP over the

ten (10) Trading Day period either (i) ending on date of conversion of this Note or (ii) the date hereof and (y) following the date of

the Shareholder Approval, the greater of the average VWAP over the ten (10) Trading Day period either (i) ending on date of conversion

of this Note or (ii) $0.70 (the “Floor Price”).

The

AJB Global Amendment revised Section 1.6 to incorporate an adjustment due to a stock split by the Company. Pursuant to the new Section

1.6(b), if the Company effectuates a reverse stock split at any time while the AJB Notes are outstanding and prior to conversion of the

AJB Notes, then the AJB Notes will be adjusted by the same ratio of the stock split. Notwithstanding any stock split, the Floor Price

shall not exceed $2.10. If any stock split would result in a Floor Price exceeding $2.10, then AJB can, among other treatments, deem

it an Event of Default.

The

AJB Global Amendment also extended the maturity dates of the September 22, 2023 AJB Note and the October 13, 2023 AJB Note to April 19,

2024. If the Company conducts a capital raise of $10,000,000 or more, then the September 22, 2023 Note will be repaid with the proceeds

of that capital raise. In addition, if the Company conducts a capital raise of $15,000,000, then the proceeds of the raise will repay

both the September 22, 2023 and October 13, 2023 AJB Notes. In exchange for the extensions, the Company agreed to issue 180,000 shares

to AJB (the “Extension Shares”). AJB will never possess an amount of shares greater than 9.99% of the issued and outstanding

shares of the Company. This ownership restriction can be waived by AJB, in whole or in part, upon 61 days’ prior written notice.

In addition, the Company shall not issue such shares until such time as AJB’s ownership is less than 9.99%, or upon request by

AJB, the Company shall issue pre-funded warrants providing AJB with the same economic benefits as if the shares had been issued to it.

It will be considered an immediate default if the Extension Shares are not delivered to AJB within one business day of its request.

The

information set forth above is qualified in its entirety by reference to Global Amendment 1, Global Amendment 2, the January Next Note

and the AJB Global Amendment, which are incorporated herein by reference and attached hereto as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively.

Capitalized terms used but not defined herein shall have the meanings ascribed to them in the respective documents.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

January 17, 2024

| EZFILL

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name:

|

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit

10.1

GLOBAL

AMENDMENT TO PROMISSORY NOTES

This

GLOBAL AMENDMENT TO PROMISSORY NOTES (the “Amendment”) is dated effective as of January 11, 2024 (the “Amendment

Effective Date”), by and between EzFill Holdings, Inc., a Delaware Corporation (the “Company”)

and Next Charging, LLC a Florida limited liability company (“Next” and together with the Company, the

“Parties”).

WHEREAS,

the Company and Next entered into and executed certain Promissory Notes, dated as of, July 5, 2023; August 2, 2023; August 30, 2023;

September 6, 2023; September 13, 2023; November 3, 2023; November 21, 2023; December 4, 2023; December 13, 2023; December 18, 2023; and

December 20, 2023 (collectively the “Notes”); and

WHEREAS,

the Company and Next would like to amend the Notes to add certain terms to the Notes.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1.

Recitals. The recitations set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2.

Capitalized Terms. All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the Notes, except

as otherwise specifically set forth herein.

3.

Conflicts. In the event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and

provisions of the Notes, the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or ambiguity.

4.

Amendment to Notes.

The

following language shall be added to the end of Section 8:

The

conversion price (as adjusted, the “Conversion Price”) shall equal the greater of the average VWAP over the ten (10) Trading

Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained

in this Note the Lender and the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together

with all other Transaction Documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”),

except that such limitation will not apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to

issue Common Shares to the Lender in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in

cash at the request of the Lender.

The

following section shall be added to the Notes as Section 10.15:

10.15

Adjustment Due to Stock Split by Borrower. If, at any time when this Note is issued and outstanding and prior to conversion of

all of the Notes Borrower shall: (i) subdivides outstanding shares of its Common Stock into a larger number of shares, or (ii)

combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each

case the number of shares and the price for any conversion under this Note shall be adjusted in alignment with, in accordance with,

and by the same ratios or multipliers of, any such subdivision, split, reverse split set forth in items (i) and (ii) of this

subsection.

6.

Not a Novation. This Amendment is a modification of the Notes only and not a novation.

7.

Effect on Notes. Except as expressly amended by this Amendment, all of the terms and provisions of the Notes shall remain and

continue in full force and effect after the execution of this Amendment, are hereby ratified and confirmed, and incorporated herein by

this reference.

8.

Execution. This Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered

one and the same Amendment. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf’

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf’ signature page was an

original thereof.

[signature

page follows]

IN

WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the day and year first above written.

| |

NEXT

CHARGING, LLC |

| |

|

|

| |

By:

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

EZFILL

HOLDINGS, INC. |

| |

|

|

| |

By:

|

|

| |

Name:

|

Yehuda

Levy |

| |

Title:

|

Interim

Chief Executive Officer |

Exhibit

10.2

GLOBAL

AMENDMENT TO PROMISSORY NOTES

This

GLOBAL AMENDMENT TO PROMISSORY NOTES (the “Amendment”) is dated effective as of January 11, 2024 (the “Amendment

Effective Date”), by and between EzFill Holdings, Inc., a Delaware Corporation (the “Company”)

and Next Charging, LLC a Florida limited liability company (“Next” and together with the Company, the

“Parties”).

WHEREAS,

the Company and Next entered into and executed certain Promissory Notes, dated as of, December 27, 2023 and January 8, 2024 (collectively

the “Notes”); and

WHEREAS,

the Company and Next would like to amend the Notes to change certain terms to the Notes.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1.

Recitals. The recitations set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2.

Capitalized Terms. All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the Notes, except

as otherwise specifically set forth herein.

3.

Conflicts. In the event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and

provisions of the Notes, the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or ambiguity.

4.

Amendment to Notes.

The

following language shall replace the language in paragraph 3 of Section 8:

The

conversion price (as adjusted, the “Conversion Price”) shall equal the greater of the average VWAP over the ten (10) Trading

Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained

in this Note the Lender and the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together

with all other Transaction Documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”),

except that such limitation will not apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to

issue Common Shares to the Lender in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in

cash at the request of the Lender.

6.

Not a Novation. This Amendment is a modification of the Notes only and not a novation.

7.

Effect on Notes. Except as expressly amended by this Amendment, all of the terms and provisions of the Notes shall remain and

continue in full force and effect after the execution of this Amendment, are hereby ratified and confirmed, and incorporated herein by

this reference.

8.

Execution. This Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered

one and the same Amendment. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf’

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf’ signature page was an

original thereof.

[signature

page follows]

IN

WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the day and year first above written.

| |

NEXT

CHARGING, LLC |

| |

|

|

| |

By:

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

EZFILL

HOLDINGS, INC. |

| |

|

|

| |

By:

|

|

| |

Name:

|

Yehuda

Levy |

| |

Title:

|

Interim

Chief Executive Officer |

Exhibit

10.3

PROMISSORY

NOTE

| $165,000 |

January

16, 2024 |

FOR

VALUE RECEIVED, EZFILL HOLDINGS, INC., a Delaware corporation having an address of 67 NW 183rd St., Aventura, Florida

33169 (the “Borrower”), hereby promises to pay to the order of, the Next Charging, LLC. a Florida company having an

address of 407 Lincoln Road, Ste 9F, Miami Beach, Fl. 33139 (the “Lender”), at Lender’s offices, or such other

place as Lender shall designate in writing from time to time, the principal sum of $165,000.00 (the “Loan”), in US

Dollars, together with interest thereon as hereinafter provided.

1.

ORIGINAL ISSUE DISCOUNT. The Borrower agrees that the funding of the Loan shall be made by the Lender with original issue

discount in an amount equal to 10% of the aggregate original principal amount of the Loan (i.e. $15,000).

2.

INTEREST RATE. The unpaid principal balance of this Promissory Note (the “Note”) from day to day outstanding

shall bear a fixed rate of interest equal to 8% per annum for the first nine months and after the first nine months will begin to accrue

interest on the entire balance at 18% per annum.

3.

PREVIOUS NOTE. The disbursement of funds on the note entered into by the Borrower and Lender on August second has been

completed. This Note is for additional funds.

4.

PAYMENT OF PRINCIPAL AND INTEREST. Unless this Note is otherwise accelerated, or extended in accordance with the terms

and conditions hereof, the entire outstanding principal balance of this Note plus all accrued interest shall be due and payable in full

on March 16, 2024 (the “Maturity Date”). The Maturity Date shall automatically be extended for 2 month periods, unless

Lender sends 10 days written notice, prior to end of any two month period, that it does not wish to extend the note at which point the

end of the then current two month period shall be the Maturity Date. Notwithstanding the above, upon Borrower completing a capital raise

(debt or equity) of at least $3,000,000 the entire outstanding principal and interest through the Maturity Date shall be immediately

due and payable.

5.

APPLICATION OF PAYMENTS. Except as otherwise specified herein, each payment or prepayment, if any, made under this Note

shall be applied to pay late charges, accrued and unpaid interest, principal, and any other fees, costs and expenses which Borrower is

obligated to pay under this Note.

6.

TENDER OF PAYMENT. Payment on this Note is payable on or before 5:00 p.m. on the due date thereof, at the office of Lender

specified above and shall be credited on the date the funds become available, in Lender’s account, in lawful money of the United

States.

7.

REPRESENTATIONS AND WARRANTIES. Borrower represents and warrants to Lender as follows:

7.2.

Execution of Loan Documents. This Note has been duly executed and delivered by Borrower. Execution, delivery and performance

of this Note will not: (i) violate any contracts previously entered into by Borrower, provision of law, order of any court, agency or

other instrumentality of government, or any provision of any indenture, agreement or other instrument to which he is a party or by which

he is bound; (ii) result in the creation or imposition of any lien, charge or encumbrance of any nature; and (iii) require any authorization,

consent, approval, license, exemption of, or filing or registration with, any court or governmental authority.

7.3.

Obligations of Borrower. This Note is a legal, valid and binding obligation of Borrower, enforceable against him in accordance

with its terms, except as the same may be limited by bankruptcy, insolvency, reorganization or other laws or equitable principles relating

to or affecting the enforcement of creditors’ rights generally.

7.4.

Litigation. There is no action, suit or proceeding at law or in equity or by or before any governmental authority, agency

or other instrumentality now pending or, to the knowledge of Borrower, threatened against or affecting Borrower or any of its properties

or rights which, if adversely determined, would materially impair or affect: (i) Borrower’s right to carry on its business substantially

as now conducted (and as now contemplated); (ii) its financial condition; or (iii) its capacity to consummate and perform its obligations

under this Note.

7.5.

No Defaults. Borrower is not in default in the performance, observance or fulfillment of any of the obligations, covenants

or conditions contained herein or in any material agreement or instrument to which he is a party or by which he is bound.

7.6.

No Untrue Statements. No document, certificate or statement furnished to Lender by or on behalf of Borrower contains any

untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein and

therein not misleading. Borrower acknowledges that all such statements, representations and warranties shall be deemed to have been relied

upon by Lender as an inducement to make the Loan to Borrower.

7.7.

Documentary and Intangible Taxes. Borrower shall be liable for all documentary stamp and intangible taxes assessed at the

closing of the Loan or from time to time during the life of the Loan.

7.8.

The loan funds shall be used solely for Borrower’s working capital needs.

8.

EVENTS OF DEFAULT. Each of the following shall constitute an event of default hereunder (an “Event of Default”):

(a) the failure of Borrower to pay any amount of principal or interest hereunder with three (3) business days from when it becomes due

and payable; (b) Borrower becoming insolvent or declaring bankruptcy; (c) the discovery that any of the Borrower representations were

untrue; or (d) the occurrence of any other default in any material term, covenant or condition hereunder, and the continuance of such

breach for a period of ten (10) days after written notice thereof shall have been given to Borrower. Borrower shall promptly notify Lender

of the occurrence of any default, Event of Default, adverse litigation or material adverse change in its financial condition.

If

an Event of Default occurs, (i) all sums of Principal and Interest and all other amounts payable hereunder multiplied by 150% the then

remaining unpaid hereon shall be immediately due and payable, and (ii) The Lender shall have the right to convert all or any part of

the outstanding and unpaid principal, interest, penalties, and all other amounts under this Note into fully paid and non-assessable shares

of Common Stock. The conversion price shall be the average closing price over the 10 trading days ending on the date of conversion.

The conversion price (as adjusted, the “Conversion Price”) shall equal the greater of

the average VWAP over the ten (10) Trading Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained in this Note the Lender and

the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together with all other Transaction Documents

may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”), except that such limitation will not

apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to issue Common Shares to the Lender in

excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in cash at the request of the Lender.

9.

REMEDIES. If an Event of Default exists, Lender may exercise any right, power or remedy permitted by law or as set forth

herein, including, without limitation, the right to declare the entire unpaid principal amount hereof and all interest accrued hereon,

to be, and such principal, interest and other sums shall thereupon become, immediately due and payable.

10.

MISCELLANEOUS.

10.2.

Disclosure of Financial Information. Lender is hereby authorized to disclose any financial or other information about Borrower

to any regulatory body or agency having jurisdiction over Lender and to any present, future or prospective participant or successor in

interest in any loan or other financial accommodation made by Lender to Borrower, so long as there is a mandatory requirement to provide

such disclosure. The information provided may include, without limitation, amounts, terms, balances, payment history, return item history

and any financial or other information about Borrower.

10.3.

Integration. This Note constitutes the sole agreement of the parties with respect to the transaction contemplated hereby

and supersede all oral negotiations and prior writings with respect thereto.

10.4.

Borrower’s Obligations Absolute. The obligations of Borrower under this Note shall be absolute and unconditional

and shall remain in full force and effect without regard to, and shall not be released, suspended, discharged, terminated or otherwise

affected by, any circumstance or occurrence whatsoever, including, without limitation:

10.4.1.

any renewal, extension, amendment or modification of, or addition or supplement to or deletion from, this Note, or any other instrument

or agreement referred to therein, or any assignment or transfer of any thereof;

10.4.2.

any waiver, consent, extension, indulgence or other action or inaction under or in respect of any such agreement or instrument or this

Note;

10.4.3.

any furnishing of any additional security to the Borrower or its assignee or any acceptance thereof or any release of any security by

the Lender or its assignee; or

10.4.4.

any limitation on any party’s liability or obligations under any such instrument or agreement or any invalidity or unenforceability,

in whole or in part, of any such instrument or agreement or any term thereof.

10.5.

No Implied Waiver. Lender shall not be deemed to have modified or waived any of its rights or remedies hereunder unless

such modification or waiver is in writing and signed by Lender, and then only to the extent specifically set forth therein. A waiver

in one event shall not be construed as continuing or as a waiver of or bar to such right or remedy in a subsequent event. After any acceleration

of, or the entry of any judgment on, this Note, the acceptance by Lender of any payments by or on behalf of Borrower on account of the

indebtedness evidenced by this Note shall not cure or be deemed to cure any Event of Default or reinstate or be deemed to reinstate the

terms of this Note absent an express written agreement duly executed by Lender and Borrower.

10.6.

No Usurious Amounts. Notwithstanding anything herein to the contrary, it is the intent of the parties that Borrower shall

not be obligated to pay interest hereunder at a rate which is in excess of the maximum rate permitted by law (the “Maximum Rate”).

If by the terms of this Note, Borrower is at any time required to pay interest at a rate in excess of the Maximum Rate, the rate of interest

under this Note shall be deemed to be immediately reduced to the Maximum Rate and the portion of all prior interest payments in excess

of the Maximum Rate shall be applied to and shall be deemed to have been payments in reduction of the outstanding principal balance,

unless Borrower shall notify Lender, in writing, that Borrower elects to have such excess sum returned to it forthwith. Borrower agrees

that in determining whether or not any interest payable under this Note exceeds the Maximum Rate, any non-principal payment, including,

without limitation, late charges, shall be deemed to the extent permitted by law to be an expense, fee or premium rather than interest.

10.7.

Partial Invalidity. The invalidity or unenforceability of any one or more provisions of this Note shall not render any

other provision invalid or unenforceable. In lieu of any invalid or unenforceable provision, there shall be automatically added hereto

a valid and enforceable provision as similar in terms to such invalid or unenforceable provision as may be possible.

10.8.

Binding Effect. The covenants, conditions, waivers, releases and agreements contained in this Note shall bind, and the

benefits thereof shall inure to, the parties hereto and their respective heirs, executors, administrators, successors and assigns; provided,

however, that this Note cannot be assigned by Borrower without the prior written consent of Lender, and any such assignment or attempted

assignment by Borrower shall be void and of no effect with respect to Lender.

10.9.

Modifications. This Note may not be supplemented, extended, modified or terminated except by an agreement in writing signed

by the party against whom enforcement of any such waiver, change, modification or discharge is sought.

10.10.

Sales or Participations. Lender may, from time to time, sell or assign, in whole or in part, or grant participations in,

the Loan, this Note and/or the obligations evidenced thereby. The holder of any such sale, assignment or participation, if the applicable

agreement between Lender and such holder so provides, shall be: (a) entitled to all of the rights, obligations and benefits of Lender;

and (b) deemed to hold and may exercise the rights of setoff or banker’s lien with respect to any and all obligations of such holder

to Borrower, in each case as fully as though Borrower were directly indebted to such holder. Lender may in its discretion give notice

to Borrower of such sale, assignment or participation; however, the failure to give such notice shall not affect any of Lender’s

or such holder’s rights hereunder.

10.11.

Jurisdiction; etc. Borrower hereby consents that any action or proceeding against him be commenced and maintained in any

court in Miami-Dade County Florida and Borrower agrees that the courts in Miami-Dade County Florida shall have jurisdiction with respect

to the subject matter hereof and the person of Borrower. Borrower agrees not to assert any defense to any action or proceeding initiated

by Lender based upon improper venue or inconvenient forum.

10.12.

Notices. All notices from the Borrower to Lender and Lender to Borrower required or permitted by an provision of this Note

shall be in writing and sent by registered or certified mail or nationally recognized overnight delivery service and addressed to the

address set forth above.

Notice

given as hereinabove provided shall be deemed given on the date of its deposit in the United States Mail and, unless sooner actually

received, shall be deemed received by the party to whom it is address on the third (3rd) calendar day following the date on

which said notice is deposited in the mail, or if a courier system is used, on the date of delivery of the notice. The parties may add,

deleted, or alter any address to which notice is to be provided by providing written notice of such change pursuant to the terms of this

section.

10.13.

Governing Law. This Note shall be governed by and construed in accordance with the substantive laws of the State of Florida

without regard to conflict of laws principles.

10.14.

Waiver of Jury Trial. BORROWER AND LENDER AGREE THAT, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY SUIT, ACTION OR

PROCEEDING, WHETHER CLAIM OR COUNTERCLAIM, BROUGHT BY LENDER OR BORROWER, ON OR WITH RESPECT TO THIS NOTE OR ANY OTHER LOAN DOCUMENT

EXECUTED IN CONNECTION HEREWITH OR THE DEALINGS OF THE PARTIES WITH RESPECT HERETO OR THERETO, SHALL BE TRIED ONLY BY A COURT AND NOT

BY A JURY. LENDER AND BORROWER EACH HEREBY KNOWINGLY, VOLUNTARILY, INTENTIONALLY AND INTELLIGENTLY AND WITH THE ADVICE OF THEIR RESPECTIVE

COUNSEL, WAIVE, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO A TRIAL BY JURY IN ANY SUCH SUIT, ACTION OR PROCEEDING. FURTHER,

BORROWER WAIVES ANY RIGHT IT MAY HAVE TO CLAIM OR RECOVER, IN ANY SUCH SUIT, ACTION OR PROCEEDING, ANY SPECIAL, EXEMPLARY, PUNITIVE,

CONSEQUENTIAL OR OTHER DAMAGES OTHER THAN, OR IN ADDITION TO, ACTUAL DAMAGES. BORROWER ACKNOWLEDGES AND AGREES THAT THIS SECTION IS A

SPECIFIC AND MATERIAL ASPECT OF THIS NOTE AND THAT LENDER WOULD NOT EXTEND CREDIT TO BORROWER IF THE WAIVERS SET FORTH IN THIS SECTION

WERE NOT A PART OF THIS NOTE.

10.15.

Adjustment Due to Stock Split by Borrower. If, at any time when this Note is issued and outstanding and prior to conversion of

all of the Notes Borrower shall: (i) subdivides outstanding shares of its Common Stock into a larger number of shares, or (ii) combines

(including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each case the number

of shares and the price for any conversion under this Note shall be adjusted in alignment with, in accordance with, and by the same ratios

or multipliers of, any such subdivision, split, reverse split set forth in items (i) and (ii) of this subsection.

[signature

page follows]

Borrower,

intending to be legally bound, has duly executed and delivered this Note as of the day and year first above written.

| BORROWER: |

|

| |

|

| EzFill

Holdings, Inc. |

|

| |

|

|

| By:

|

|

|

| Name:

|

Yehuda

Levy |

|

| Title:

|

CEO |

|

Exhibit

10.4

GLOBAL

AMENDMENT TO PROMISSORY NOTES

This

GLOBAL AMENDMENT TO PROMISSORY NOTES (the “Amendment”) is dated effective as of January 17, 2024 (the “Amendment

Effective Date”), by and between EzFill Holdings, Inc., a Delaware Corporation (the “Company”)

and AJB Capital Investments, LLC, a Delaware limited liability company (“AJB” and together with the

Company, the “Parties”).

WHEREAS,

the Company and AJB entered into and executed that certain Promissory Note, dated as of April 19, 2023 (the “April 2023

Note”), and as amended by that certain Amended and Restated Promissory Note, dated May 17, 2023 (the “Amended

and Restated Note”); and

WHEREAS,

on September 22, 2023, the Company issued to AJB an additional Promissory Note in a principal amount of up to $600,000 (the “September

2023 Note”); and

WHEREAS,

on October 13, 2023, the Company issued to AJB an additional Promissory Note in a principal amount of up to $320,000 (the “October

2023 Note,” and together with the April 2023 Note, the Amended and Restated Note, the September 2023 Note, and the October

2023 Note, the “Notes”); and

WHEREAS,

the Company and AJB would like to amend the Notes to change certain terms set forth in the Notes.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1.

Recitals. The recitations set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2.

Capitalized Terms. All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the Notes, except

as otherwise specifically set forth herein.

3.

Conflicts. In the event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and

provisions of the Notes, the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or ambiguity.

4.

Amendment to Notes.

Section

1.2(a) of the Notes is hereby replaced with the following language:

Calculation

of Conversion Price. Subject to the adjustments described herein, the conversion price (as adjusted, the “Conversion Price”)

shall equal (x) until the date of the Shareholder Approval the greater of (a) $1.23 (the “Nasdaq Minimum Price”), and (b)

the lower of the average VWAP over the ten (10) Trading Day period either (i) ending on date of conversion of this Note or (ii) the date

hereof and (y) following the date of the Shareholder Approval, the greater of the average VWAP over the ten (10) Trading Day period either

(i) ending on date of conversion of this Note or (ii) $0.70 (the “Floor Price”). For the avoidance of doubt, no conversion

may be effected under this Note at a price per share less than the Floor Price, notwithstanding the receipt of Shareholder Approval.

To the extent the Conversion Price of the Borrower’s Common Stock closes below the par value per share, the Borrower will take

all steps necessary to solicit the consent of the stockholders to reduce the par value to the lowest value possible under law. The Borrower

agrees to honor all conversions submitted pending this adjustment. If the shares of the Borrower’s Common Stock have not

been delivered within three (3) business days to the Borrower or Borrower’s transfer agent, the Notice of Conversion may be rescinded.

At any time after the Closing Date, if in the case that the Borrower’s Common Stock is not deliverable by DWAC (including if the

Borrower’s transfer agent has a policy prohibiting or limiting delivery of shares of the Borrower’s Common Stock specified

in a Notice of Conversion), an additional 10% discount will apply for all future conversions under all Notes until DWAC delivery becomes

available. If in the case that the Borrower’s Common Stock is “chilled” for deposit into the DTC system and only eligible

for clearing deposit, a 15% discount shall apply for all future conversions under all Note until such chill is lifted. Additionally,

if the Borrower ceases to be a reporting company pursuant to the 1934 Act or if the Note cannot be converted into free trading shares

after one hundred eighty-one (181) days from the Issue Date (other than as a result of the Holder’s status as an affiliate of the

Company), an additional 15% discount will be attributed to the Conversion Price. “VWAP”

shall mean the daily dollar volume-weighted average sale price for the Common Stock on the Trading Market on any particular Trading Day

during the period beginning at 9:30 a.m., New York City Time (or such other time as the Trading Market publicly announces is the official

open of trading), and ending at 4:00 p.m., New York City Time (or such other time as the Trading Market publicly announces is the official

close of trading), as reported by Bloomberg through its “Volume at Price”, or, if no dollar volume-weighted average price

is reported for such security by Bloomberg for such hours, the average of the highest closing bid price and the lowest closing ask price

of any of the market makers for such security as reported in the Trading Market. If the VWAP cannot be calculated for such security on

such date on any of the foregoing bases, the VWAP of such security on such date shall be the fair market value as mutually determined

by the Borrower and the Holder. All such determinations of VWAP shall be appropriately and equitably adjusted in accordance with the

provisions set forth herein for any stock dividend, stock split, stock combination or other similar transaction occurring during any

period used to determine the Market Price (or other period utilizing VWAPs). “Trading Day” shall mean any day on which

the Common Stock is tradable for any period on the Trading Market. “Trading Market” shall mean the Nasdaq Capital Market

or on any other principal securities exchange or other securities market on which the Common Stock is then being traded. The Borrower

shall be responsible for the fees of its transfer agent and all DTC fees associated with any such issuance. Holder shall be entitled

to deduct $500.00 from the conversion amount in each Notice of Conversion to cover Holder’s deposit fees associated with each Notice

of Conversion.

While

this Note is outstanding, each time any 3rd party has the right to convert monies owed to that 3rd party (or receive

shares pursuant to a settlement or otherwise), including but not limited to under Section 3(a)(9) and Section 3(a)(10), at a discount

to market greater than the Conversion Price in effect at that time (prior to all other applicable adjustments in the Note), but excluding

any 3rd party loans that are already outstanding on the Issue Date, then the Holder, in Holder’s sole discretion, may

utilize such greater discount percentage (prior to all applicable adjustments in this Note) until this Note is no longer outstanding.

While this Note is outstanding, each time any 3rd party has a look back period greater than the look back period in effect

under the Note at that time, including but not limited to under Section 3(a)(9) and Section 3(a)(10), excluding any 3rd party

loans that are already outstanding on the Issue Date, then the Holder, in Holder’s sole discretion, may utilize such greater number

of look back days until this Note is no longer outstanding. The Borrower shall give written notice to the Holder within one (1) business

day of becoming aware of any event that could permit the Holder to make any adjustment described in the two immediately preceding sentences.

Section

1.6 of the Notes is hereby amended to read as follows:

Effect

of Certain Events.

(a) Effect

of Merger, Consolidation, Etc. At the option of the Holder, the sale, conveyance or disposition of all or substantially all of the

assets of the Borrower, the effectuation by the Borrower of a transaction or series of related transactions in which more than 50% of

the voting power of the Borrower is disposed of, or the consolidation, merger or other business combination of the Borrower with or into

any other Person (as defined below) or Persons when the Borrower is not the survivor shall either: (i) be deemed to be an Event of Default

(as defined in Article III) pursuant to which the Borrower shall be required to pay to the Holder upon the consummation of and as a condition

to such transaction an amount equal to the Default Amount (as defined in Article III) or (ii) be treated pursuant to Section 1.6(c) hereof.

“Person” shall mean any individual, corporation, limited liability company, partnership, association, trust or other entity

or organization.

(b) Adjustment

Due to Stock Split by Borrower. If, at any time when this Note is issued and outstanding and prior to conversion of all of the Notes

Borrower shall: (i) subdivides outstanding shares of its Common Stock into a larger number of shares, or (ii) combines (including by

way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each case the number of shares

and the price for any conversion under this Note shall be adjusted in alignment with, in accordance with, and by the same ratios or multipliers

of, any such subdivision, split, reverse split set forth in items (i) and (ii) of this subsection. Notwithstanding any reverse stock

split, the Floor Price set forth in Section 1.2(a) shall not exceed $2.10. If any reverse stock split by the Company would result in

the Floor Price exceeding $2.10, Holder may in its sole discretion (i) deem it to be an Event of Default (as defined in Article III)

pursuant to which the Borrower shall be required to pay to the Holder upon the consummation of and as a condition to such transaction

an amount equal to the Default Amount (as defined in Article III) or (ii) be treated pursuant to Section 1.6(b) hereof.

(c) Adjustment

Due to Merger, Consolidation, Etc. If, at any time when this Note is issued and outstanding and prior to conversion of all of the

Notes, there shall be any merger, consolidation, exchange of shares, recapitalization, reorganization, or other similar event, as a result

of which shares of Common Stock of the Borrower shall be changed into the same or a different number of shares of another class or classes

of stock or securities of the Borrower or another entity, or in case of any sale or conveyance of all or substantially all of the assets

of the Borrower other than in connection with a plan of complete liquidation of the Borrower, then the Holder of this Note shall thereafter

have the right to receive upon conversion of this Note, upon the basis and upon the terms and conditions specified herein and in lieu

of the shares of Common Stock immediately theretofore issuable upon conversion, such stock, securities or assets which the Holder would

have been entitled to receive in such transaction had this Note been converted in full immediately prior to such transaction (without

regard to any limitations on conversion set forth herein), and in any such case appropriate provisions shall be made with respect to

the rights and interests of the Holder of this Note to the end that the provisions hereof (including, without limitation, provisions

for adjustment of the Conversion Price and of the number of shares issuable upon conversion of the Note) shall thereafter be applicable,

as nearly as may be practicable in relation to any securities or assets thereafter deliverable upon the conversion hereof. The Borrower

shall not affect any transaction described in this Section 1.6(b) unless (a) it first gives, to the extent practicable, fifteen (15)

days prior written notice (but in any event at least ten (10) days prior written notice) of the record date of the special meeting of

shareholders to approve, or if there is no such record date, the consummation of, such merger, consolidation, exchange of shares, recapitalization,

reorganization or other similar event or sale of assets (during which time the Holder shall be entitled to convert this Note) and (b)

the resulting successor or acquiring entity (if not the Borrower) assumes by written instrument the obligations of this Section 1.6(b).

The above provisions shall similarly apply to successive consolidations, mergers, sales, transfers or share exchanges.

(d) Adjustment

Due to Distribution. If the Borrower shall declare or make any distribution of its assets (or rights to acquire its assets) to holders

of Common Stock as a dividend, stock repurchase, by way of return of capital or otherwise (including any dividend or distribution to

the Borrower’s shareholders in cash or shares (or rights to acquire shares) of capital stock of a subsidiary (i.e., a spin-off))

(a “Distribution”), then the Holder of this Note shall be entitled, upon any conversion of this Note after the date of record

for determining shareholders entitled to such Distribution, to receive the amount of such assets which would have been payable to the

Holder with respect to the shares of Common Stock issuable upon such conversion had such Holder been the holder of such shares of Common

Stock on the record date for the determination of shareholders entitled to such Distribution.

(e) Adjustment

Due to Dilutive Issuance. If, at any time when any Notes are issued and outstanding, the Borrower issues or sells, or in accordance

with this Section 1.6(d) hereof is deemed to have issued or sold, and any shares issued under conversion or exercise of 3rd

party securities that are already outstanding on the Issue Date, any shares of Common Stock for a consideration per share (before deduction

of reasonable expenses or commissions or underwriting discounts or allowances in connection therewith) less than the Conversion Price

in effect on the date of such issuance (or deemed issuance) of such shares of Common Stock (a “Dilutive Issuance”), then

immediately upon the Dilutive Issuance, the Conversion Price will be reduced to the amount of the consideration per share received by

the Borrower in such Dilutive Issuance.

The

Borrower shall be deemed to have issued or sold shares of Common Stock if the Borrower in any manner issues or grants any warrants, rights

or options (not including employee stock option plans), whether or not immediately exercisable, to subscribe for or to purchase Common

Stock or other securities convertible into or exchangeable for Common Stock (“Convertible Securities”) (such warrants, rights

and options to purchase Common Stock or Convertible Securities are hereinafter referred to as “Options”) and the price per

share for which Common Stock is issuable upon the exercise of such Options is less than the Conversion Price then in effect, then the

Conversion Price shall be equal to such price per share. For purposes of the preceding sentence, the “price per share for which

Common Stock is issuable upon the exercise of such Options” is determined by dividing (i) the total amount, if any, received or

receivable by the Borrower as consideration for the issuance or granting of all such Options, plus the minimum aggregate amount of additional

consideration, if any, payable to the Borrower upon the exercise of all such Options, plus, in the case of Convertible Securities issuable

upon the exercise of such Options, the minimum aggregate amount of additional consideration payable upon the conversion or exchange thereof

at the time such Convertible Securities first become convertible or exchangeable, by (ii) the maximum total number of shares of Common

Stock issuable upon the exercise of all such Options (assuming full conversion of Convertible Securities, if applicable). No further

adjustment to the Conversion Price will be made upon the actual issuance of such Common Stock upon the exercise of such Options or upon

the conversion or exchange of Convertible Securities issuable upon exercise of such Options.

Additionally,

the Borrower shall be deemed to have issued or sold shares of Common Stock if the Borrower in any manner issues or sells any Convertible

Securities, whether or not immediately convertible, and the price per share for which Common Stock is issuable upon such conversion or

exchange is less than the Conversion Price then in effect, then the Conversion Price shall be equal to such price per share. For the

purposes of the preceding sentence, the “price per share for which Common Stock is issuable upon such conversion or exchange”

is determined by dividing (i) the total amount, if any, received or receivable by the Borrower as consideration for the issuance or sale

of all such Convertible Securities, plus the minimum aggregate amount of additional consideration, if any, payable to the Borrower upon

the conversion or exchange thereof at the time such Convertible Securities first become convertible or exchangeable, by (ii) the maximum

total number of shares of Common Stock issuable upon the conversion or exchange of all such Convertible Securities. No further adjustment

to the Conversion Price will be made upon the actual issuance of such Common Stock upon conversion or exchange of such Convertible Securities.

(f) Purchase

Rights. If, at any time when any Notes are issued and outstanding, the Borrower issues any convertible securities or rights to purchase

stock, warrants, securities or other property (the “Purchase Rights”) pro rata to the record holders of any class of Common

Stock, then the Holder of this Note will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase

Rights which such Holder could have acquired if such Holder had held the number of shares of Common Stock acquirable upon complete conversion

of this Note (without regard to any limitations on conversion contained herein) immediately before the date on which a record is taken

for the grant, issuance or sale of such Purchase Rights or, if no such record is taken, the date as of which the record holders of Common

Stock are to be determined for the grant, issue or sale of such Purchase Rights.

(g) Notice

of Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price as a result of the events described

in this Section 1.6, the Borrower, at its expense, shall promptly compute such adjustment or readjustment and prepare and furnish to

the Holder a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or

readjustment is based. The Borrower shall, upon the written request at any time of the Holder, furnish to such Holder a like certificate

setting forth (i) such adjustment or readjustment, (ii) the Conversion Price at the time in effect and (iii) the number of shares of

Common Stock and the amount, if any, of other securities or property which at the time would be received upon conversion of the Note.

6.

Extension. The Maturity Date of both the September 2023 Note and the October 2023 Note shall be extended until April 19, 2024.

Notwithstanding: (i) if the Borrower conducts a capital raise of $10 million or above the September 2023 Note shall be repaid with the

proceeds of such capital raise; and (ii) if the Borrower conducts a capital raise of $15 million or above both the September 2023 Note

and the October 2023 Note shall be repaid with the proceeds of such capital raise.

7.

Extension Fee. It is agreed that the number of shares of Common Stock issuable to Holder for the extension under this Amendment

shall be 180,000 shares (the “Extension Shares”). Upon request by the Holder, the Company shall instruct its transfer agent

(the “Transfer Agent”) to issue from time to time following Closing certificate(s) or book entry statement(s) for an aggregate

amount of 180,000 shares of Common Stock, such that the Holder shall never be in possession of an amount of Common Stock greater than

9.99% of the issued and outstanding Common Stock of the Company; provided, however that (i) this ownership restriction described in this

Section may be waived by Holder, in whole or in part, upon 61 days’ prior written notice, (ii) the Company shall not issue such

shares until such time as Holder’s ownership is less than 9.99%, or (iii) upon request by Holder, the Company shall issue pre-funded

warrants providing the Holder with the same economic benefits as if the shares had been issued to it. In the event any certificate or

book entry statement representing the Extension Shares issuable hereunder shall not be delivered to the Holder within one (1) Business

Day following any request hereunder, the same shall be an immediate default under this Agreement, the Note, and any other documents or

agreements executed in connection with the transactions contemplated hereunder (the “Transaction Documents”). The Extension

Shares, when issued, shall be deemed to be validly issued, fully paid, and non-assessable shares of the Company’s Common Stock.

The Extension Shares shall be deemed fully earned as of the date hereof.

8.

Not a Novation. This Amendment is a modification of the Notes only and not a novation.

9.

Effect on Notes and Transaction Documents. Except as expressly amended by this Amendment, all of the terms and provisions of the

Notes and the Transaction Documents shall remain and continue in full force and effect after the execution of this Amendment, are hereby

ratified and confirmed, and incorporated herein by this reference.

10.

Execution. This Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered

one and the same Amendment. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf’

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf’ signature page was an

original thereof.

[signature

page follows]

IN

WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the day and year first above written.

| AJB CAPITAL

INVESTMENTS, LLC |

|

| |

|

|

| By:

|

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| EZFILL HOLDINGS,

INC. |

|

| |

|

|

| By: |

|

|

| Name: |

Yehuda Levy |

|

| Title: |

Interim Chief Executive

Officer |

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

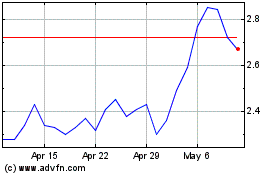

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Apr 2024 to May 2024

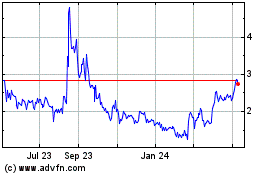

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From May 2023 to May 2024