UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

(Rule

13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO

§ 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§

240.13d-2(a)

Amendment

No 2.

Forte

Biosciences, Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

34962G109

(CUSIP

Number)

Eric

Shahinian

Camac

Partners, LLC

350

Park Avenue, 13th Floor

New

York, New York 10022

(914)

629-8496 |

Gabriel

Gliksberg

ATG

Capital Management

805

N. Milwaukee Avenue, Suite 301

Chicago,

Illinois

(786)

519-0995 |

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

June

14, 2024

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME

OF REPORTING PERSON

Camac

Partners, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,277,176 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,277,176 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,277,176 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.5% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

Camac

Capital, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,277,176 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,277,176 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,277,176 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.5% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

Camac

Fund, LP |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,277,176 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,277,176 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,277,176 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.5% |

| 14 |

TYPE

OF REPORTING PERSON

PN |

| 1 |

NAME

OF REPORTING PERSON

Eric

Shahinian |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,277,176 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,277,176 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,277,176 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.5% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| 1 |

NAME

OF REPORTING PERSON

ATG

Fund II LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,462,000 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,462,000 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,462,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.0% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

ATG

Capital Management, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,462,000 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,462,000 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,462,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.0% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

Gabriel

Gliksberg |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,462,000 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,462,000 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,462,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.0% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| 1 |

NAME

OF REPORTING PERSON

Michael

G. Hacke |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| 1 |

NAME

OF REPORTING PERSON

McIntyre

Partnerships, LP |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

39,824 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

39,824 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,824 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

| 14 |

TYPE

OF REPORTING PERSON

PN |

| 1 |

NAME

OF REPORTING PERSON

McIntyre

Capital GP, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

39,824 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

39,824 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,824 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

McIntyre

Capital Management, LP |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

39,824 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

39,824 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,824 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

| 14 |

TYPE

OF REPORTING PERSON

PN |

| 1 |

NAME

OF REPORTING PERSON

McIntyre

Capital Management GP, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

39,824 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

39,824 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,824 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

Chris

McIntyre |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

☒

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

AF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

39,824 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

39,824 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

39,824 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

The

following constitutes the Schedule 13D filed by the undersigned (the “Schedule 13D”).

| Item

1. |

Security

and Issuer. |

This

Amendment No. 2 (this “Amendment”) amends and supplements the Schedule 13D filed on August 23, 2023, as amended on January

5, 2024, with the Securities and Exchange Commission, by the Reporting Person (defined below) with respect to the Common Stock of Forte

Biosciences Inc. (the “Issuer” or the “Company”). Information reported in the Schedule 13D remains in effect

except to the extent that it is amended, restated or superseded by information contained in this Amendment. Capitalized terms used but

not defined in this Amendment have the respective meanings set forth in the Schedule 13D. All references in the Schedule 13D and this

Amendment to the “Statement” will be deemed to refer to the Schedule 13D as amended and supplemented by this Amendment.

| Item

2. |

Identity

and Background. |

| |

(a) |

This

Schedule 13D is filed by: |

| |

|

i. |

Camac

Partners, LLC, a Delaware limited liability company (“Camac Partners”); |

| |

|

|

|

| |

|

ii. |

Camac

Capital, LLC, a Delaware limited liability company (“Camac Capital”); |

| |

|

|

|

| |

|

iii. |

Camac

Fund, LP, a Delaware limited partnership (“Camac Fund”); |

| |

|

|

|

| |

|

iv. |

Eric

Shahinian, as the manager of Camac Capital; |

| |

|

|

|

| |

|

v. |

ATG

Fund II LLC, a Delaware limited liability company (“ATG Fund II”); |

| |

|

|

|

| |

|

vi. |

ATG

Capital Management, LLC, a Delaware limited liability company (“ATG Management”); |

| |

|

|

|

| |

|

vii. |

Gabriel

Gliksberg, as the managing member of ATG Management; |

| |

|

|

|

| |

|

viii. |

Michael

G. Hacke, as a nominee for the Board of Directors of the Issuer (the “Board”); |

| |

|

|

|

| |

|

ix. |

McIntyre

Partnerships, LP, a Delaware limited partnership (“McIntyre Partnerships”); |

| |

|

|

|

| |

|

x. |

McIntyre

Capital GP, LLC, a Delaware limited liability company (“McIntyre GP”); |

| |

|

|

|

| |

|

xi. |

McIntyre

Capital Management, LP, a Delaware limited partnership (“McIntyre Capital”); |

| |

|

|

|

| |

|

xii. |

McIntyre

Capital Management GP, LLC, a Delaware limited liability company (“McIntyre IM GP”); and |

| |

|

|

|

| |

|

xiii. |

Chris

McIntyre, as Chief Investment Officer and managing partner of McIntyre Capital and as the managing member of each of McIntyre GP

and McIntyre IM GP, and as a nominee for the Board. |

Each

of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting Persons”. Each of

the Reporting Persons is party to that certain Group Agreement, as further described in Item 6 and filed as an exhibit to this Schedule

13D. Accordingly, the Reporting Persons are hereby filing a joint Schedule 13D.

| |

(b) |

The

principal business address of each of Camac Fund, Camac Partners, Camac Capital and Mr. Shahinian (collectively, “Camac”)

is 350 Park Avenue, 13th Floor, New York, New York 10022. The principal business address of each of ATG Fund II, ATG Management and

Mr. Gliksberg (collectively, “ATG”) is 805 N. Milwaukee Avenue, Suite 301, Chicago, Illinois 60642. The address of the

principal office of Mr. Hacke is c/o Steel City Capital Investments, LLC, 820 Ridgeview Drive, Pittsburgh, Pennsylvania 15228. The

principal business address of each of McIntyre Partnerships, McIntyre GP, McIntyre Capital, McIntyre IM GP and Mr. McIntyre is c/o

McIntyre Partnerships, LP, 433 Broadway, Suite 633, New York, New York 10013. |

| |

|

|

| |

(c) |

The

principal business of Camac Fund is investing in securities. The principal business of Camac Partners is serving as the investment

manager of Camac Fund. The principal business of Camac Capital is serving as the managing member of Camac Partners and the general

partner of Camac Fund. The principal occupation of Mr. Shahinian is serving as the manager of Camac Capital. The principal business

of ATG Fund II is investing in securities. The principal business of ATG Management is to serve as the managing member to certain

private investment funds, including ATG Fund II. The principal occupation of Mr. Gliksberg is serving as the managing member of ATG

Management. The principal occupation of Mr. Hacke is serving as the managing member of Steel City Capital Investments, LLC, the general

partner of Steel City Capital, LP, a long-biased investment partnership which employs a value-oriented investing strategy. The principal

business of McIntyre Partnerships is investing in securities. The principal business of McIntyre GP is serving as the general partner

of McIntyre Partnerships. The principal business of McIntyre Capital is serving as the investment manager of McIntyre Partnerships.

The principal business of McIntyre IM GP is serving as the general partner of McIntyre Capital. The principal occupation of Mr. McIntyre

is serving as Chief Investment Officer and managing partner of McIntyre Capital and as the managing member of each of McIntyre GP

and McIntyre IM GP. |

| |

|

|

| |

(d) |

During

the last five years, none of the Reporting Persons have been convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors). |

| |

|

|

| |

(e) |

During

the last five years, none of the Reporting Persons have been a party to a civil proceeding of a judicial or administrative body of

competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with

respect to such laws. |

| |

|

|

| |

(f) |

Camac

Partners, Camac Capital, Camac Fund, ATG Fund II, ATG Management, McIntyre Partnerships, McIntyre GP, McIntyre Capital and McIntyre

IM GP are organized under the laws of Delaware. Messrs. Shahinian, Gliksberg, Hacke and McIntyre are citizens of the United States

of America. |

| Item

3. |

Source

and Amount of Funds or Other Consideration. |

The

shares of Common Stock purchased by Camac Fund, ATG Fund II and McIntyre Partnerships were purchased with working capital. The aggregate

purchase price of the 1,277,176 shares of Common Stock beneficially owned by Camac Fund is approximately $1,434,089, including brokerage

commissions. The aggregate purchase price of the 1,462,000 shares of Common Stock beneficially owned by ATG Fund II is approximately

$1,825,572, including brokerage commissions. The aggregate purchase price of the 39,824 shares of Common Stock beneficially owned by

McIntyre Partnerships is approximately $41,161, excluding brokerage commissions.

| Item

4. |

Purpose

of Transaction. |

Item

4 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

On

June 11, 2024, Camac Fund, LP entered into a settlement agreement (the “Settlement Agreement”) with the Issuer and

the Board, pursuant to which the Issuer will form a committee of the Board to explore strategic alternatives for the Issuer, and in addition:

| ● | The

Board will be expanded to nine seats, one incumbent director will resign, and two directors

selected by Camac from a list of five candidates identified by the Issuer will be appointed

to the Board. |

| ● | The

Issuer will not renew its Preferred Stock Rights Agreement, dated as of July 12, 2022, as

amended on June 26, 2023, when it expires by its terms in July 2024. |

| ● | If

approved, the settlement will include payment of certain attorneys’ fees and expenses

to Camac, as may be approved by the Court. |

| ● | The

Issuer

has entered into a Standstill and Voting Agreement (the “Standstill Agreement”)

with Camac Fund, LP, Camac Partners, LLC, Camac Capital, LLC, and Eric Shahinian (collectively,

the “Camac Group”) which is included as Exhibit 99.4 hereto. |

| ● | The

Issuer has agreed to reimburse Camac for its out-of-pocket expenses in connection with Camac’s

proxy contest in advance of the 2023 annual meeting. |

The

foregoing summary of the Settlement Agreement is not complete and is qualified in its entirety by the full text of the Settlement Agreement,

which is included as Exhibit 99.5 hereto and is incorporated herein by reference.

| Item

5. |

Interest

in Securities of the Issuer . |

(a)

The aggregate percentage of shares of Common Stock reported owned by each person named herein is based upon 36,442,380 shares of Common

Stock outstanding as of May 10, 2024, as reported in the Issuer’s quarterly report on Form 10-Q filed with the SEC on May 13, 2024.

As

of the date hereof, Camac Fund beneficially owned 1,277,176 shares of Common Stock, constituting approximately 3.5% of the shares of

Common Stock outstanding. Camac Partners, as investment manager of Camac Fund, may be deemed to beneficially own the 1,277,176 shares

of Common Stock owned by Camac Fund, constituting approximately 3.5% of the shares of Common Stock outstanding. Camac Capital, as the

managing member of Camac Partners and the general partner of Camac Fund, may be deemed to beneficially own the 1,277,176 shares of Common

Stock owned by Camac Fund, constituting approximately 3.5% of the shares of Common Stock outstanding. Mr. Shahinian, as the manager of

Camac Capital, may be deemed to beneficially own the 1,277,176 shares of Common Stock owned by Camac Fund, constituting approximately

3.5% of the shares of Common Stock outstanding.

As

of the date hereof, ATG Fund II beneficially owned 1,462,000 shares of Common Stock, constituting approximately 4.0% of the shares of

Common Stock outstanding. ATG Management, as the managing member of ATG Fund II, may be deemed to beneficially own the 1,462,000 shares

of Common Stock owned by ATG Fund II, constituting approximately 4.0% of the shares of Common Stock outstanding. Mr. Gliksberg, as the

managing member of ATG Management, may be deemed to beneficially own the 1,462,000 shares of Common Stock owned by ATG Fund II, constituting

approximately 4.0% of the shares of Common Stock outstanding.

As

of the date hereof, Mr. Hacke does not beneficially own any shares of Common Stock, constituting 0% of the shares of Common Stock outstanding.

As

of the date hereof, McIntyre Partnerships beneficially owned 39,824 shares of Common Stock, constituting less than 1% of the shares of

Common Stock outstanding. McIntyre GP, as the general partner of McIntyre Partnerships, may be deemed to beneficially own the 39,824

shares of Common Stock owned by McIntyre Partnerships, constituting less than 1% of the shares of Common Stock outstanding. McIntyre

Capital, as the investment manager of McIntyre Partnerships, may be deemed to beneficially own the 39,824 shares of Common Stock owned

by McIntyre Partnerships, constituting less than 1% of the shares of Common Stock outstanding. McIntyre IM GP, as the general partner

of McIntyre Capital, may be deemed to beneficially own the 39,824 shares of Common Stock owned by McIntyre Partnerships, constituting

less than 1% of the shares of Common Stock outstanding. Mr. McIntyre, as the managing member of each of McIntyre GP and McIntyre IM GP,

may be deemed to beneficially own the 39,824 shares of Common Stock owned by McIntyre Partnerships, constituting less than 1% of the

shares of Common Stock outstanding.

As

of the date hereof, the Reporting Persons collectively beneficially owned an aggregate of 2,779,000 shares of Common Stock, constituting

approximately 7.6% of the shares of Common Stock outstanding.

(b)

By virtue of their respective relationships with Camac Fund, each of Camac Partners, Camac Capital and Mr. Shahinian may be deemed to

have shared power to vote and dispose of the shares of Common Stock reported owned by Camac Fund.

By

virtue of their respective relationships with ATG Fund II, each of ATG Management and Mr. Gliksberg may be deemed to have shared power

to vote and dispose of the shares of Common Stock reported owned by ATG Fund II.

By

virtue of their respective relationships with McIntyre Partnerships, each of McIntyre GP, McIntyre Capital, McIntyre IM GP and Mr. McIntyre

may be deemed to have shared power to vote and dispose of the shares of Common Stock reported owned by McIntyre Partnerships.

(c)

Schedule A annexed hereto lists all transactions in the securities of the Issuer by the Reporting Persons during the past sixty days.

(d)

No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from,

or proceeds from the sale of, the shares of Common Stock.

(e)

Not applicable.

| Item

6. |

Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item

6 is hereby amended and supplemented as follows:

On

June 14, 2024, the Group Agreement by and among Camac Partners, LLC, Camac Capital, LLC, Camac Fund, LP, Eric Shahinian, ATG Fund II

LLC, ATG Capital Management, LLC, Gabriel Gliksberg, Michael G. Hacke, McIntyre Partnerships, LP, McIntyre Capital GP, LLC, McIntyre

Capital Management, LP, McIntyre Capital Management GP, LLC and Chris McIntyre (the “Investor Group”), dated August 16, 2023

was terminated pursuant to a Termination of Group Agreement. All members of the Investor Group ceased to be Reporting Persons in connection

with this Schedule 13D, immediately upon execution of the Termination of Group Agreement. A copy of the Termination of Group Agreement

is attached hereto as Exhibit 99.6 and is incorporated herein by reference.

| Item

7. |

Material

to be Filed as Exhibits. |

| |

Exhibit

99.1 |

Group Agreement by and among Camac Partners, LLC, Camac Capital, LLC, Camac Fund, LP, Eric Shahinian, ATG Fund II LLC, ATG Capital Management, LLC, Gabriel Gliksberg, Michael G. Hacke, McIntyre Partnerships, LP, McIntyre Capital GP, LLC, McIntyre Capital Management, LP, McIntyre Capital Management GP, LLC and Chris McIntyre, dated August 16, 2023. |

| |

|

|

| |

Exhibit

99.2 |

Powers of Attorney. |

| |

|

|

| |

Exhibit

99.3 |

Complaint filed in the United States District Court for the Northern District of Texas, Dallas Division.

|

| |

|

|

| |

Exhibit

99.4 |

Standstill Agreement (incorporated by reference to Exbibit 10.1 of the Issuer’s Current Report in Form 8-K filed June 14, 2024).

|

| |

|

|

|

Exhibit

99.5 |

Settlement Agreement (incorporated by reference to Exhibit 99.2 of the Issuer’s Current Report on Form 8-K filed June 14, 2024). |

| |

|

|

| |

Exhibit

99.6 |

Termination of Group Agreement, dated June 14, 2024. |

SIGNATURES

After

reasonable inquiry and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement

is true, complete, and correct.

Dated:

June 17, 2024

| |

CAMAC

FUND, LP |

| |

|

|

| |

By: |

Camac

Capital, LLC

its

General Partner |

| |

|

|

| |

By: |

/s/

Eric Shahinian |

| |

Name: |

Eric

Shahinian |

| |

Title: |

Manager |

| |

CAMAC

PARTNERS, LLC |

| |

|

|

| |

By: |

Camac

Capital, LLC

its

Managing Member |

| |

|

|

| |

By: |

/s/

Eric Shahinian |

| |

Name: |

Eric

Shahinian |

| |

Title: |

Manager |

| |

CAMAC

CAPITAL, LLC |

| |

|

|

| |

By: |

/s/

Eric Shahinian |

| |

Name: |

Eric

Shahinian |

| |

Title: |

Manager |

| |

|

|

| |

/s/

Eric Shahinian |

| |

Eric

Shahinian

Individually

and as attorney-in-fact for Michael G. Hacke |

| |

ATG

FUND II LLC |

| |

|

|

| |

By: |

ATG

Capital Management, LLC

Managing Member |

| |

|

|

| |

By: |

/s/

Gabriel Gliksberg |

| |

Name: |

Gabriel

Gliksberg |

| |

Title: |

Managing

Member |

| |

ATG

CAPITAL MANAGEMENT, LLC |

| |

|

|

| |

By: |

/s/

Gabriel Gliksberg |

| |

Name: |

Gabriel

Gliksberg |

| |

Title: |

Managing

Member |

| |

/s/

GABRIEL GLIKSBERG |

| |

GABRIEL

GLIKSBERG |

| |

MCINTYRE

PARTNERSHIPS, LP |

| |

|

|

| |

By: |

McIntyre

Capital GP, LLC

its

General Partner |

| |

|

|

| |

By: |

/s/

Chris McIntyre |

| |

Name: |

Chris

McIntyre |

| |

Title: |

Managing

Member |

| |

MCINTYRE

CAPITAL GP, LLC |

| |

|

|

| |

By: |

/s/

Chris McIntyre |

| |

Name: |

Chris

McIntyre |

| |

Title: |

Managing

Member |

| |

MCINTYRE

CAPITAL MANAGEMENT, LP |

| |

|

|

| |

By: |

McIntyre

Capital Management GP, LLC

its

General Partner |

| |

|

|

| |

By: |

/s/

Chris McIntyre |

| |

Name: |

Chris

McIntyre |

| |

Title: |

Managing

Member |

| |

MCINTYRE

CAPITAL MANAGEMENT GP, LLC |

| |

|

|

| |

By: |

/s/

Chris McIntyre |

| |

Name: |

Chris

McIntyre |

| |

Title: |

Managing

Member |

| |

|

|

| |

/s/

Chris McIntyre |

| |

Chris

McIntyre |

Exhibit

99.6

June

14th, 2024

Re:

Termination of Group Agreement, dated August 16, 2023

The

undersigned constitute all the parties to that certain Group Agreement dated August 16, 2023 (the “Agreement”).

Effective immediately, the undersigned hereby terminate the Agreement in its entirety.

[Remainder

of this page intentionally left blank; signature pages follow]

| |

CAMAC PARTNERS, LLC |

| |

|

|

| |

By: |

Camac

Capital, LLC

its

Managing Member |

| |

|

|

| |

By: |

/s/ Eric

Shahinian |

| |

Name: |

Eric Shahinian |

| |

Title: |

Manager |

Signature

Page to

Termination

of Group Agreement

| |

CAMAC CAPITAL, LLC |

| |

|

|

| |

By: |

/s/ Eric

Shahinian |

| |

Name: |

Eric Shahinian |

| |

Title: |

Manager |

Signature

Page to

Termination

of Group Agreement

| |

CAMAC FUND, LP |

| |

|

|

| |

By: |

Camac

Capital, LLC

its

General Partner |

| |

|

|

| |

By: |

/s/ Eric

Shahinian |

| |

Name: |

Eric Shahinian |

| |

Title: |

Manager |

Signature

Page to

Termination

of Group Agreement

| |

/s/

Eric Shahinian |

| |

Eric

Shahinian

Individually

and as attorney-in-fact for Michael G. Hacke |

Signature

Page to

Termination

of Group Agreement

| |

ATG FUND II LLC |

| |

|

|

| |

By: |

ATG

Capital Management, LLC

Managing

Member |

| |

|

|

| |

By: |

/s/ Gabriel

Gliksberg |

| |

Name: |

Gabriel Gliksberg |

| |

Title: |

Managing Member |

Signature

Page to

Termination

of Group Agreement

| |

ATG CAPITAL MANAGEMENT, LLC |

| |

|

|

| |

By: |

/s/ Gabriel

Gliksberg |

| |

Name: |

Gabriel Gliksberg |

| |

Title: |

Managing Member |

Signature

Page to

Termination

of Group Agreement

| |

/s/

GABRIEL GLIKSBERG |

| |

GABRIEL GLIKSBERG |

Signature

Page to

Termination

of Group Agreement

| |

MCINTYRE PARTNERSHIPS, LP |

| |

|

|

| |

By: |

McIntyre

Capital GP, LLC

its

General Partner |

| |

|

|

| |

By: |

/s/ Chris

McIntyre |

| |

Name: |

Chris McIntyre |

| |

Title: |

Managing Member |

Signature

Page to

Termination

of Group Agreement

| |

MCINTYRE CAPITAL GP, LLC |

| |

|

|

| |

By: |

/s/ Chris

McIntyre |

| |

Name: |

Chris McIntyre |

| |

Title: |

Managing Member |

Signature

Page to

Termination

of Group Agreement

| |

MCINTYRE CAPITAL MANAGEMENT, LP |

| |

|

|

| |

By: |

McIntyre

Capital Management GP, LLC

its

General Partner |

| |

|

|

| |

By: |

/s/ Chris

McIntyre |

| |

Name: |

Chris McIntyre |

| |

Title: |

Managing Member |

Signature

Page to

Termination

of Group Agreement

| |

MCINTYRE CAPITAL MANAGEMENT GP, LLC |

| |

|

|

| |

By: |

/s/ Chris

McIntyre |

| |

Name: |

Chris McIntyre |

| |

Title: |

Managing Member |

Signature

Page to

Termination

of Group Agreement

| |

/s/

Chris McIntyre |

| |

Chris McIntyre |

Signature

Page to

Termination

of Group Agreement

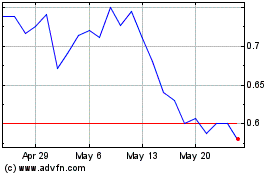

Forte Biosciences (NASDAQ:FBRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Forte Biosciences (NASDAQ:FBRX)

Historical Stock Chart

From Feb 2024 to Feb 2025