0001805521

false

0001805521

2023-08-28

2023-08-28

0001805521

FFIE:ClassCommonStockParValue0.0001PerShareMember

2023-08-28

2023-08-28

0001805521

FFIE:RedeemableWarrantsExercisableForSharesOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-08-28

2023-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 28, 2023

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39395 |

|

84-4720320 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(I.R.S. Employer |

| of incorporation) |

|

|

|

Identification No.) |

|

18455 S. Figueroa Street

Gardena, CA |

|

90248 |

| (Address of principal executive offices) |

|

(Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

FFIE |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

FFIEW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure

On

August 28, 2023, Faraday Future Intelligent Electric Inc. (the “Company”) issued a press release announcing it expects

to finance future growth with its previously announced reverse stock split and Registration Statements on Form S-3, once such

Registration Statements are effective. The Company also announced plans to deliver an FF 91 2.0 Futurist Alliance to its owner and

FF’s Developer Co-Creation Officer, Jason Oppenheim in September. A copy of the press release is attached to this

Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this

Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FARADAY FUTURE INTELLIGENT ELECTRIC INC. |

| |

|

| Date: August 29, 2023 |

By: |

/s/ Jonathan Maroko |

| |

Name: |

Jonathan Maroko |

| |

Title: |

Interim Chief Financial Officer |

2

Exhibit 99.1

Faraday Future Expects Ability to Finance

Future Growth with Reverse Stock Split and the Registration Statements on Form S-3

| ● | The

Company plans to deliver an FF 91 2.0 Futurist Alliance to its owner and FF’s Developer Co-Creation Officer, well-known real estate

agent and Emmy Award nominee Jason Oppenheim in early September, around the same time as the premier of Selling the OC, Season 2, in

which Jason is featured in. |

Los Angeles, CA (August 28, 2023) -- Faraday Future Intelligent

Electric Inc. (NASDAQ: FFIE) (“Faraday Future”, “FF” or “Company”), a California-based global shared

intelligent electric mobility ecosystem company, today announced it expects to finance future growth with its previously announced reverse

stock split and the filing of Registration Statements on Form S-3. Once effective, the Registration Statements, together with the reverse

stock split, are expected to help the Company satisfy certain closing conditions for previously announced financing commitments and secure

new rounds of financing. These actions mark a significant step in a comprehensive plan to attract additional investors which will support

the continued production ramp of the Ultimate AI TechLuxury FF 91 2.0 Futurist Alliance along with the expansion of its sales and service

network.

On Friday, August 25th, the Company announced a reverse

stock split of the issued and outstanding shares of the Company’s common stock, at a ratio of 1-for-80. Commencing at the open of

market today, the Company’s common stock began trading on a split-adjusted basis. The authorized shares of Company’s common

stock were also reduced from 1,765,000,000 to 154,437,500 shares following the reverse stock split.

The Company believes that the reverse stock split together with the

Registration Statements, when effective, will provide investors with long-term value. The Company believes that this development will

also significantly increase our attractiveness to institutional and strategic investors. The Company recently announced the Developer

Co-Creation festival with the first FF 91 2.0 Futurist Alliance delivery and signed the second group of Developer Co-Creation Officers

at Pebble Beach, California, during Monterey Car week.

The Company plans to deliver the FF 91 2.0 Futurist Alliance to its

owner and FF’s Developer Co-Creation Officer Jason Oppenheim soon. As previously disclosed, Mr. Oppenheim is the Owner of the Oppenheim

Group, a well-known luxury real estate agency. He has been the featured star for a combined six seasons of the Netflix series, Selling

Sunset and Selling the OC.

Selling the OC, Season 2 is set to premiere in early September 2023.

The trailer of Selling the OC Season 2 can be found here: https://youtu.be/iHihGCrreTU?si=niRhWwkLZlnqEcRX

Users can preorder an FF 91 vehicle via the

FF Intelligent App or through our website

(English): https://www.ff.com/us/preorder/or

(Chinese): https://www.ff.com/cn/preorder/

Download the new FF Intelligent App: http://appdownload.ff.com

ABOUT FARADAY FUTURE

FF is the pioneer of the Ultimate Intelligent TechLuxury ultra spire

market in the intelligent EV era, and a disruptor of the traditional ultra-luxury car industry. FF is not just an EV company, but also

a software-driven company of intelligent internet AI product.

FOLLOW FARADAY FUTURE

https://www.ff.com/

https://www.ff.com/us/mobile-app/

https://twitter.com/FaradayFuture

https://www.facebook.com/faradayfuture/

https://www.instagram.com/faradayfuture/

www.linkedin.com/company/faradayfuture/

FORWARD LOOKING STATEMENTS

This press release includes “forward looking statements”

within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this

press release the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,”

“plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,”

“future,” “propose” and variations of these words or similar expressions (or the negative versions of such words

or expressions) are intended to identify forward-looking statements. These forward-looking statements, which include statements regarding

the Company’s ability to obtain and maintain effective registration statements, involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes

to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results

or outcomes include, among others: the Company’s ability to continue as a going concern and improve its liquidity and financial

position; the Company’s ability to remain in compliance with its public filing requirements under the Securities Exchange Act of

1934, as amended, the Company’s ability to regain compliance with, and thereafter continue to comply with, the Nasdaq listing requirements;

the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the

Company’s estimates of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree

of market acceptance of the Company’s vehicles; the success of other competing manufacturers; the performance and security of the

Company’s vehicles; potential litigation involving the Company; the market performance generally of the Company’s common stock;

the Company’s ability to satisfy the conditions precedent and close on the various financings described in this press release and

elsewhere by the Company; the result of future financing efforts, the failure of any of which could result in the Company seeking protection

under the Bankruptcy Code; general economic and market conditions impacting demand for the Company’s products; potential cost, headcount

and salary reduction actions may not be sufficient or may not achieve their expected results; and the ability of the Company to attract

and retain employees, any adverse developments in existing legal proceedings or the initiation of new legal proceedings, and volatility

of the Company’s stock price. You should carefully consider the foregoing factors and the other risks and uncertainties described

in the “Risk Factors” section of the Company’s Form 10-K/A filed with the Securities and Exchange Commission (“SEC”)

on August 21, 2023, and other documents filed by the Company from time to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and the Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required by law.

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

v3.23.2

Cover

|

Aug. 28, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 28, 2023

|

| Entity File Number |

001-39395

|

| Entity Registrant Name |

Faraday Future Intelligent Electric Inc.

|

| Entity Central Index Key |

0001805521

|

| Entity Tax Identification Number |

84-4720320

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

18455 S. Figueroa Street

|

| Entity Address, City or Town |

Gardena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90248

|

| City Area Code |

424

|

| Local Phone Number |

276-7616

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

FFIE

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

FFIEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FFIE_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FFIE_RedeemableWarrantsExercisableForSharesOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

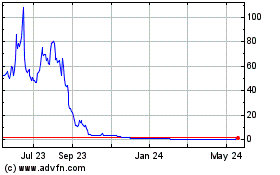

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Oct 2024 to Nov 2024

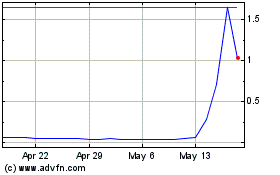

Faraday Future Intellige... (NASDAQ:FFIE)

Historical Stock Chart

From Nov 2023 to Nov 2024