State Bank of India (SBI), the country’s largest bank, today

announced that it is enabling the digital disbursement of education

loans in local currency (Indian Rupees) directly to higher

education institutions all over the world by strengthening its

partnership with global payments and software company, Flywire

(Nasdaq: FLYW). The initiative is part of the bank’s commitment to

broaden the scope of education loan disbursements with enhanced

customer experience.

State Bank of India and Flywire’s internet

banking integration have been providing Indian students with a

fully digital experience for their tuition fee payments. Now, as an

extended offering, students can also select SBI’s overseas

education loan option – ‘Global Ed-Vantage’ – as the source of

funds, and remit fees through Bank’s Processing Cells/Branches

disbursing education loans. Institutions accepting payments through

Flywire benefit from receiving payments on time as well as full

transparency into the transaction history, which eases their

reconciliation processes and drives operational efficiencies.

Further, the integration also helps Indian residents comply with

Liberalized Remittance Scheme (LRS) requirements.

State Bank of India, the market leader

in education loans, processes around $890 million in annual loan

volume for international students. With the introduction of this

digital offering, SBI now creates a seamless and digital payment

experience for its resident customers.

Introducing the facility, Sri Vinay M

Tonse, Managing Director (RB&O), State Bank of India,

said, “At State Bank of India, we are committed to

empowering Indian students in pursuing their educational

aspirations globally. Our partnership with Flywire is a testament

to this commitment, as it enables a fully digital and transparent

disbursement of overseas education loans in Indian Rupees, directly

to institutions worldwide. This initiative underscores our

dedication to driving growth in the education loan sector while

delivering a seamless, efficient, and secure experience for our

customers.”

Mohit Kansal, SVP of Global Payments and

Payer Services, Flywire said, “We are thrilled to expand

our successful partnership with SBI and together provide Indian

students an enhanced payment experience for disbursing loans

internationally. As one of the most popular choices for students,

SBI is now offering their borrowers an easier way to pay their

educational institutions in Indian rupees, and will benefit from

full transparency and traceability of overseas payments. We look

forward to working together and solving this critical market

need.”

State Bank of India remains committed to

providing best-in-class banking solutions that cater to the unique

needs of its customers, and this partnership with Flywire

exemplifies that commitment.

About SBIState Bank of India is

the largest commercial bank in terms of assets, deposits, branches,

customers, and employees. It is also one of the largest mortgage

lenders in the country which has so far fulfilled the home buying

dreams of around 30 lakh Indian families. The home loan portfolio

of the bank has crossed Rs. 7.39 lakh crore. As of June 2024, the

bank has a deposit base of over Rs. 49.01 lakh crore with CASA

ratio of 40.70% and advances of more than Rs. 38.12 lakh crore. SBI

commands a market share of 26.3% and 19.6% in home loans and auto

loans respectively. SBI has the largest network of 22,500+ branches

and 62,000+ ATMs / ADWMs in India with close to 83,000 BC outlets.

The number of customers using internet banking and mobile banking

stand at 128 million and 274 million respectively. With SBI’s

digital strategy right on track – the bank witnessed 63% of new

savings accounts being opened through the integrated digital and

lifestyle platform YONO in Q1FY25. YONO, which has more than 7.76

crore registered users, witnessed 34.9 lakh new YONO registrations

in Q1 2025. In terms of digital lending, the bank disbursed

pre-approved personal loans worth Rs. 1,399 crores through YONO

during Q1 FY25. SBI also has the highest number of followers on

Facebook and X amongst all banks worldwide.

About FlywireFlywire is a

global payments enablement and software company. We combine our

proprietary global payments network, next-gen payments platform and

vertical-specific software to deliver the most important and

complex payments for our clients and their customers.

Flywire leverages its vertical-specific software

and payments technology to deeply embed within the existing A/R

workflows for its clients across the education, healthcare and

travel vertical markets, as well as in key B2B industries. Flywire

also integrates with leading ERP systems, such as NetSuite, so

organizations can optimize the payment experience for their

customers while eliminating operational challenges.

Flywire supports more than 4,000 clients with

diverse payment methods in more than 140 currencies across more

than 240 countries and territories around the world. The company is

headquartered in Boston, MA, USA with global offices. For more

information, visit www.flywire.com. Follow Flywire

on X, LinkedIn and

Facebook.

Safe Harbor Statement

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, statements regarding

Flywire’s future operating results and financial position,

Flywire’s business strategy and plans, market growth, and Flywire’s

objectives for future operations. Flywire intends such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 21E

of the Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995. In some cases, you can identify

forward-looking statements by terms such as, but not limited to,

“believe,” “may,” “will,” “potentially,” “estimate,” “continue,”

“anticipate,” “intend,” “could,” “would,” “project,” “target,”

“plan,” “expect,” or the negative of these terms, and similar

expressions intended to identify forward-looking statements. Such

forward-looking statements are based upon current expectations that

involve risks, changes in circumstances, assumptions, and

uncertainties. Important factors that could cause actual results to

differ materially from those reflected in Flywire's forward-looking

statements include, among others, the factors that are described in

the “Risk Factors” and “Management's Discussion and Analysis of

Financial Condition and Results of Operations” sections of

Flywire's Annual Report on Form 10-K for the year ended December

31, 2023, and Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024, which are on file with the Securities and

Exchange Commission (SEC) and available on the SEC's website at

https://www.sec.gov/. Additional factors may be

described in those sections of Flywire’s Annual Report on Form 10-K

for the year ended December 31, 2024, expected to be filed with the

SEC in the first quarter of 2025. The information in this release

is provided only as of the date of this release, and Flywire

undertakes no obligation to update any forward-looking statements

contained in this release on account of new information, future

events, or otherwise, except as required by law.

Media Contacts

Sarah KingMedia@Flywire.com

Investor Relations Contact

Masha Kahnir@flywire.com

Flywire (NASDAQ:FLYW)

Historical Stock Chart

From Jan 2025 to Feb 2025

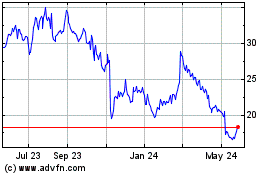

Flywire (NASDAQ:FLYW)

Historical Stock Chart

From Feb 2024 to Feb 2025