GigaCloud Technology Inc Announces $46 Million Share Repurchase Program

03 September 2024 - 9:00PM

GigaCloud Technology Inc (Nasdaq: GCT) (“GigaCloud” or the

“Company”), a pioneer of global end-to-end B2B technology solutions

for large parcel merchandise, today announced that its board of

directors has approved a share repurchase program to repurchase up

to $46 million of its Class A ordinary shares over the next 12

months.

“We believe our shares present a compelling opportunity at their

current price, and share repurchases will represent a

value-enhancing deployment of capital for GigaCloud and its

shareholders,” said Larry Wu, Founder and Chief Executive Officer

of GigaCloud. “While we anticipate continued industry-wide economic

headwinds in the immediate near term, we firmly believe that the

digitization of the global supply chain for large parcel

merchandise is still in its early stages and holds immense

potential for transformation and growth. This new repurchase plan

underscores our confidence in GigaCloud’s long-term growth and our

ability in executing the Company’s strategic initiatives while

maintaining our disciplined approach to capital management.”

“In fiscal year 2023, GigaCloud generated $133.5 million cash

from operating activities. We utilized $86.6 million for strategic

acquisitions and ended 2023 with $46.9 million unspent,” commented

Erica Wei, interim Chief Financial Officer. “With over $200 million

in cash, cash equivalents and liquid investments, no external debt

and operations generating positive cash flows, we are well

positioned to allocate this $46 million to a new share repurchase

program as we remain focused on delivering value to our long-term

shareholders. Subject to market conditions, GigaCloud will enter

into a 10b5-1 plan for share repurchases after the conclusion of

this quarter in accordance with applicable rules and

regulation.”

Under the share repurchase program, the Company may purchase its

ordinary shares through various means, including open market

transactions, privately negotiated transactions, block trades, any

combination thereof or other legally permissible means. The Company

may effect repurchase transactions in compliance with Rule 10b5-1

and Rule 10b-18 of the Securities Exchange Act of 1934, as amended.

The number of shares repurchased and the timing of repurchases will

depend on a number of factors, including, but not limited to,

price, trading volume and general market conditions, along with the

Company’s working capital requirements, general business conditions

and other factors. The Company’s board of directors will review the

share repurchase program periodically, and may modify, suspend or

terminate the share repurchase program at any time. The Company

plans to fund repurchases from its existing cash balance.

About GigaCloud Technology Inc

GigaCloud Technology Inc is a pioneer of global end-to-end B2B

technology solutions for large parcel merchandise. The Company’s

B2B ecommerce platform, which it refers to as the “GigaCloud

Marketplace,” integrates everything from discovery, payments and

logistics tools into one easy-to-use platform. The Company’s global

marketplace seamlessly connects manufacturers, primarily in Asia,

with resellers, primarily in the U.S., Asia and Europe, to execute

cross-border transactions with confidence, speed and efficiency.

The Company offers a truly comprehensive solution that transports

products from the manufacturer’s warehouse to the end customer’s

doorstep, all at one fixed price. The Company first launched its

marketplace in January 2019 by focusing on the global furniture

market and has since expanded into additional categories such as

home appliances and fitness equipment. For more information, please

visit the Company’s

website: https://investors.gigacloudtech.com/.

Forward-Looking Statements

This press release contains “forward-looking statements”.

Forward-looking statements reflect our current view about future

events. These forward-looking statements involve known and unknown

risks and uncertainties and are based on the Company’s current

expectations and projections about future events that the Company

believes may affect its financial condition, results of operations,

business strategy and financial needs. Investors can identify these

forward-looking statements by words or phrases such as “may,”

“will,” “could,” “expect,” “anticipate,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “is/are likely to,” “propose,”

“potential,” “continue” or similar expressions. The Company

undertakes no obligation to update or revise publicly any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from plans and results discussed in

forward-looking statements or those implied in historical results

and trends. The Company encourages investors to review the risks

and uncertainties discussed in its filings with the SEC, including

the Company’s most recent report on Form 10-Q or Form 10-K and

other reports that the Company has filed and will file with the SEC

from time to time, which could cause actual results to vary from

expectations.

For investor and media inquiries, please

contact:

GigaCloud Technology IncInvestor

RelationsEmail: ir@gigacloudtech.com

PondelWilkinson, Inc.Laurie Berman (Investors)

– lberman@pondel.comGeorge Medici (Media) – gmedici@pondel.com

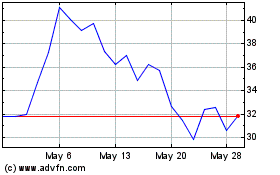

GigaCloud Technology (NASDAQ:GCT)

Historical Stock Chart

From Oct 2024 to Nov 2024

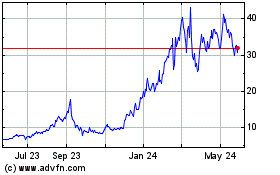

GigaCloud Technology (NASDAQ:GCT)

Historical Stock Chart

From Nov 2023 to Nov 2024