Guardant Health Announces Debt Exchange Transactions

07 February 2025 - 10:30PM

Business Wire

Guardant Health, Inc. (Nasdaq: GH), a leading precision oncology

company, today announced that on February 6, 2025, it entered into

privately negotiated exchange agreements (the “Exchange

Agreements”) with certain holders of its outstanding 0% Convertible

Senior Notes due 2027 (the “2027 Notes”), pursuant to which the

Company will issue $600 million aggregate principal amount of 1.25%

Convertible Senior Notes due 2031 (the “New Notes”) in exchange for

the retirement of approximately $659.3 million principal amount of

2027 Notes (the “Transactions”). The initial conversion rate of the

New Notes will be 16.0716 shares of Guardant Health’s common stock

(the “common stock”), per $1,000 principal amount of New Notes,

which represents an initial conversion price of approximately

$62.22 per share of common stock, which reflects a conversion

premium of approximately 35% to the last reported sale price of

Guardant Health’s common stock on February 6, 2025. The maturity

date of the New Notes is February 15, 2031. Following the closing

of the Transactions, which is expected to occur on or about

February 14, 2025, subject to customary closing conditions,

approximately $490.7 million in aggregate principal amount of 2027

Notes will remain outstanding with terms unchanged, in addition to

$600 million aggregate principal amount of the New Notes.

In connection with the Transactions, Guardant Health intends to

repurchase approximately $45 million of shares of its common stock

from certain participants in the Transactions through a financial

intermediary at the last reported sale price of the common stock on

February 6, 2025, and Guardant Health has been advised that the

exchange agent for the Transactions intends to purchase

approximately $35 million of shares of Guardant Health’s common

stock from certain participants in the Transactions through a

financial intermediary at the last reported sale price of the

common stock on February 6, 2025 (the “Share Repurchases”).

Additional information regarding this announcement may be found

in a Current Report on Form 8-K that Guardant Health intends to

file today with the U.S. Securities and Exchange Commission (the

“SEC”).

J. Wood Capital Advisors LLC acted as exchange agent to Guardant

Health in connection with the Transactions.

The New Notes and any shares of common stock issuable upon

conversion of the New Notes have not been registered under the

Securities Act of 1933, as amended, or any state securities law and

may not be offered or sold in the United States absent registration

or an applicable exemption from registration requirements. This

press release does not constitute an offer to sell, nor is it a

solicitation of an offer to buy, the 2027 Notes, the New Notes or

Guardant Health’s common stock, nor shall there be any sale of the

New Notes or Guardant Health’s common stock in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any state or any jurisdiction.

About Guardant Health

Guardant Health is a leading precision oncology company focused

on guarding wellness and giving every person more time free from

cancer. Founded in 2012, Guardant is transforming patient care and

accelerating new cancer therapies by providing critical insights

into what drives disease through its advanced blood and tissue

tests, real-world data and AI analytics. Guardant tests help

improve outcomes across all stages of care, including screening to

find cancer early, monitoring for recurrence in early-stage cancer,

and treatment selection for patients with advanced cancer.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws, including statements

regarding the closing of the Transactions and the effect of the

Transactions and Share Repurchases on Guardant Health’s common

stock, which involve risks and uncertainties that could cause the

actual results to differ materially from the anticipated results

and expectations expressed in these forward-looking statements.

These statements are based on current expectations, forecasts and

assumptions, and actual outcomes and results could differ

materially from these statements due to a number of factors. These

and additional risks and uncertainties that could affect Guardant

Health’s financial and operating results and cause actual results

to differ materially from those indicated by the forward-looking

statements made in this press release include those discussed under

the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operation” and

elsewhere in its Annual Report on Form 10-K for the year ended

December 31, 2023, and in its other reports filed with or furnished

to the Securities and Exchange Commission thereafter. The

forward-looking statements in this press release are based on

information available to Guardant Health as of the date hereof, and

Guardant Health disclaims any obligation to update any

forward-looking statements provided to reflect any change in its

expectations or any change in events, conditions, or circumstances

on which any such statement is based, except as required by law.

These forward-looking statements should not be relied upon as

representing Guardant Health’s views as of any date subsequent to

the date of this press release.

Source: Guardant Health, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250207317853/en/

Investor Contact: Zarak

Khurshid investors@guardanthealth.com

Media Contact: Melissa

Marasco press@guardanthealth.com +1 650-647-3711

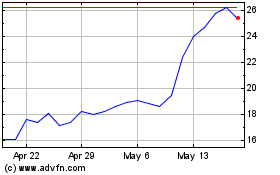

Guardant Health (NASDAQ:GH)

Historical Stock Chart

From Jan 2025 to Feb 2025

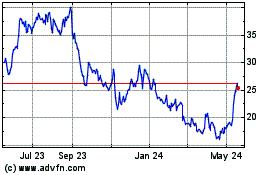

Guardant Health (NASDAQ:GH)

Historical Stock Chart

From Feb 2024 to Feb 2025