false

0000925528

HUDSON TECHNOLOGIES INC /NY

0000925528

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported) |

July 30, 2024 |

|

Hudson

Technologies, Inc. |

| (Exact Name of Registrant as Specified in Charter) |

|

New York |

| (State or Other Jurisdiction of Incorporation) |

| 1-13412 |

|

13-3641539 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 300 Tice Boulevard, Suite 290, Woodcliff Lake, New Jersey |

|

07677 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

|

(845) 735-6000 |

| (Registrant's Telephone Number, Including Area Code) |

| |

|

Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbols(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

HDSN |

Nasdaq Capital Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers |

On

July 30, 2024 Hudson Technologies, Inc. (the “Company”) appointed Brian J. Bertaux as its Vice President, Chief Financial

Officer and Secretary. Simultaneously, on such date, Nat Krishnamurti stepped down, effective immediately, from his positions as Vice

President, Chief Financial Officer and Secretary of the Company.

Mr. Bertaux, age 54, has been Chief Financial Officer of Brown Haven

Homes since 2023 and previously served as a consultant and then as Vice President – Finance of vonDrehle Corporation from 2021 until

its sale in December 2022. Mr. Bertaux previously served in various roles of increasing responsibility at Trex Company, Inc., a publicly

traded manufacturer of composite decking and railing products, from 2000 through 2020, including as Interim President of Trex Commercial

Products (2020), Senior Director, Finance and Strategy (2017-2019) and Senior Director – Finance and IT (2012-2017). Mr. Bertaux

earned an MBA from the University of Maryland and a B.S. in Finance and Accounting from Frostburg State University and is a Certified

Public Accountant and Certified Treasury Professional.

Mr. Bertaux will be employed

by the Company on an at-will basis and will receive an initial base salary of $357,000 per year, with a target bonus of 35% of base salary.

He will also receive: (i) an $11,000 sign-on bonus after 30 days of employment and (ii) a grossed-up relocation payment of $15,000 payable

after one year of employment and upon verification of his relocation to New Jersey.

| Item 7.01. | Regulation FD Disclosure. |

On

July 30, 2024, the Company issued a press release announcing the above-referenced management changes. A copy of the press release is furnished

herewith as Exhibit 99.1.

The

information furnished in this Item 7.01, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor

shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: July 30, 2024

| |

HUDSON TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Brian F. Coleman |

| |

Name: |

Brian F. Coleman |

| |

Title: |

Chairman of the Board, President and Chief Executive Officer |

Exhibit 99.1

HUDSON TECHNOLOGIES ANNOUNCES APPOINTMENT OF

BRIAN J. BERTAUX AS CHIEF FINANCIAL OFFICER

Woodcliff Lake, NJ – July 30, 2024–

Hudson Technologies, Inc. (NASDAQ: HDSN) a leading provider of innovative and sustainable

refrigerant products and services to the Heating, Ventilation, Air Conditioning, and Refrigeration industry – and one of the nation’s

largest refrigerant reclaimers – today announced the appointment of Brian J. Bertaux to the role of Chief Financial Officer,

effective immediately. Mr. Bertaux replaces Nat Krishnamurti who is leaving the Company to pursue other endeavors.

Brian Bertaux is a seasoned finance executive

and previously spent 20 years at Trex, an NYSE-traded company that is the world’s largest manufacturer of high performance, low

maintenance composite decking and railing. During Mr. Bertaux’s tenure at Trex, the company grew annual revenue from $100 million

to $900 million, and achieved a market cap of $10 billion. At Trex he served in roles of increasing responsibility, eventually serving

as interim President, Trex Commercial Products. Earlier in his time at Trex, he served as Senior Director, Finance and Strategy with oversight

of the finance, accounting and IT functions. More recently, Mr. Bertaux served as Vice President, Finance for vonDrehle Corporation, a

provider of premium paper products, which was acquired by Marcal Paper in December 2022. He joins Hudson from Brown Haven Homes, a designer

and builder of custom homes in the southeast, where he served as Chief Financial Officer. Brian earned a B.S., Finance and Accounting

from Frostburg State University and an MBA from the University of Maryland. He is a Certified Public Accountant (CPA) and a Certified

Treasury Professional (CTP).

Brian F. Coleman, President and Chief Executive

Officer of Hudson commented, “We are pleased to welcome Brian to Hudson Technologies and believe that with his extensive experience

and proven success as a senior level financial executive at both public and private entities, he brings a skillset and expertise ideally

suited to his new role at our Company. I look forward to working closely with Brian as we focus on expanding Hudson’s leadership

role in the cooling and reclamation industry and driving shareholder value.

“I would also like to thank Nat Krishnamurti

for his many years of service; we wish him well as he pursues new opportunities.”

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider

of innovative and sustainable refrigerant products and services to the Heating Ventilation Air Conditioning and Refrigeration industry.

For nearly three decades, we have demonstrated our commitment to our customers and the environment by becoming one of the first in the

United States and largest refrigerant reclaimers through multimillion dollar investments in the plants and advanced separation technology

required to recover a wide variety of refrigerants and restoring them to Air-Conditioning, Heating, and Refrigeration Institute standard

for reuse as certified EMERALD Refrigerants™. The Company's products and services are primarily used in commercial air conditioning,

industrial processing and refrigeration systems, and include refrigerant and industrial gas sales, refrigerant management services consisting

primarily of reclamation of refrigerants and RefrigerantSide® Services performed at a customer's site, consisting of system decontamination

to remove moisture, oils and other contaminants. The Company’s SmartEnergy OPS® service is a web-based real time continuous

monitoring service applicable to a facility’s refrigeration systems and other energy systems. The Company’s Chiller Chemistry®

and Chill Smart® services are also predictive and diagnostic service offerings. As a component of the Company’s products and

services, the Company also generates carbon offset projects.

Safe Harbor Statement under the Private Securities Litigation Reform

Act of 1995

Statements contained

herein which are not historical facts constitute forward-looking statements. Such forward-looking statements involve a number of known

and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be

materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, but are not limited to, changes in the laws and regulations affecting the industry, changes in the demand and price

for refrigerants (including unfavorable market conditions adversely affecting the demand for, and the price of, refrigerants), the Company's

ability to source refrigerants, regulatory and economic factors, seasonality, competition, litigation, the nature of supplier or customer

arrangements that become available to the Company in the future, adverse weather conditions, possible technological obsolescence of existing

products and services, possible reduction in the carrying value of long-lived assets, estimates of the useful life of its assets, potential

environmental liability, customer concentration, the ability to obtain financing, the ability to meet financial covenants under its existing

credit facility, any delays or interruptions in bringing products and services to market, the timely availability of any requisite permits

and authorizations from governmental entities and third parties as well as factors relating to doing business outside the United States,

including changes in the laws, regulations, policies, and political, financial and economic conditions, including inflation, interest

and currency exchange rates, of countries in which the Company may seek to conduct business, the Company’s ability to successfully

integrate any assets it acquires from third parties into its operations, and other risks detailed in the Company's 10-K for the year ended

December 31, 2023 and other subsequent filings with the Securities and Exchange Commission. The words "believe", "expect",

"anticipate", "may", "plan", "should" and similar expressions identify forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was

made.

Investor Relations Contact:

John Nesbett/Jennifer Belodeau

IMS Investor Relations

(203) 972-9200

jnesbett@imsinvestorrelations.com |

Company Contact:

Brian F. Coleman, President & CEO

Hudson Technologies, Inc.

(845) 735-6000

bcoleman@hudsontech.com |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

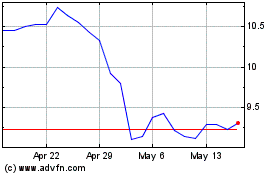

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Feb 2024 to Feb 2025