HINGHAM INSTITUTION FOR SAVINGS (NASDAQ: HIFS), Hingham,

Massachusetts announced third quarter results for 2018.

Net income for the quarter ended September 30,

2018 was $8,848,000 or $4.15 per share basic and $4.05 per share

diluted, as compared to $6,484,000 or $3.04 per share basic and

$2.97 per share diluted for the same period last year. The

Bank’s annualized return on average equity for the third quarter of

2018 was 17.06%, and the annualized return on average assets was

1.52%, as compared to 14.60% and 1.21% for the same period in

2017. Net income per share (diluted) for the third quarter of

2018 increased 36% over the same period of 2017.

Excluding the after-tax gains and losses on

securities, both realized and unrealized, core net income for the

third quarter of 2018 was $8,424,000 or $3.95 per share basic and

$3.85 per share diluted, as compared to $6,484,000 or $3.04 per

share basic and $2.97 per share diluted for the same period last

year. The Bank’s annualized core return on average equity for

the third quarter of 2018 was 16.24%, and the annualized core

return on average assets was 1.45%, as compared to 14.60% and 1.21%

for the same period in 2017. Core net income per share

(diluted) for the third quarter of 2018 increased by 30% over the

same period in 2017.

Net income for the nine months ended September

30, 2018 was $25,735,000 or $12.07 per share basic and $11.77 per

share diluted, as compared to $19,066,000 or $8.94 per share basic

and $8.75 per share diluted for the same period last year.

The Bank’s annualized return on average equity for the first nine

months of 2018 was 17.17%, and the annualized return on average

assets was 1.49%, as compared to 14.81% and 1.22% for the same

period last year. Net income per share (diluted) for the

first nine months of 2018 increased 35% over the same period in

2017.

Excluding the after-tax gains and losses on

securities, both realized and unrealized, core net income for the

nine months ended September 30, 2018 was $24,729,000 or $11.60 per

share basic and $11.31 per share diluted, as compared to

$19,017,000 or $8.92 per share basic and $8.72 per share diluted

for the same period last year. The Bank’s annualized core

return on average equity for the first nine months of 2018 was

16.50% and the annualized core return on average assets was 1.43%,

as compared to 14.77% and 1.22% for the same period last

year. Core net income per share (diluted) for the first nine

months of 2018 increased by 30% over the same period in 2017.

Growth in the first nine months of 2018 was

generally satisfactory, as deposits increased to $1.715 billion at

September 30, 2018, representing 19% annualized growth year-to-date

and 18% growth from September 30, 2017. This growth reflected

modest growth in retail and business deposits as well as the

increasing use of more attractively priced wholesale deposits in

lieu of comparable Federal Home Loan Bank advances. Net loans

increased to $1.976 billion, representing 10% annualized growth

year-to-date and 12% growth from September 30, 2017. Total

assets increased to $2.370 billion, representing 5% annualized

growth year-to-date and 7% growth from September 30, 2017.

During the first nine months of 2018, the Bank used a portion of

its cash balances to reduce outstanding Federal Home Loan Bank

advances and listing services time deposits, in order to minimize

the carrying cost of its on-balance sheet liquidity. Book

value per share was $98.35 as of September 30, 2018, representing

17% annualized growth year-to-date and 17% growth from September

30, 2017. In addition to the increase in book value per

share, the Bank declared $1.73 in dividends per share since

September 30, 2017, including a special dividend of $0.34 per share

declared during the fourth quarter of 2017. The Bank

announced increases in its regular quarterly dividend in both June

and September 2018.

Key credit and operational metrics remained

strong in the third quarter of 2018. At September 30, 2018,

non-performing assets totaled 0.02% of total assets, compared to

0.07% at December 31, 2017 and 0.05% at September 30, 2017.

Non-performing loans as a percentage of the total loan portfolio

totaled 0.02% at September 30, 2018, compared to 0.09% at December

31, 2017 and 0.06% at September 30, 2017. The Bank recorded

$1,000 in net recoveries for the first nine months of 2018 and

2017. At September 30, 2018, December 31 and September 30,

2017, the Bank did not own any foreclosed property. The

efficiency ratio was 29.17% for the third quarter of 2018, as

compared to 29.37% for the same period last year.

Non-interest expense as a percentage of average assets fell to

0.86% in the third quarter of 2018, as compared to 0.90% for the

same period last year.

Chairman Robert H. Gaughen, Jr. stated, “We are

pleased to report that returns on equity and assets remained

satisfactory in the third quarter of 2018, although balance sheet

growth was modest relative to capital generation. We remain

focused on careful capital allocation, defensive underwriting and

disciplined cost control - we believe these are the keys to

generating sustained value for our ownership.”

Hingham Institution for Savings is a

Massachusetts-chartered savings bank located in Hingham,

Massachusetts. Incorporated in 1834, it is one of America’s

oldest banks. The Bank’s Main Office is located in Hingham

and the Bank maintains offices on the South Shore, in Boston (South

End and Beacon Hill), and on the island of Nantucket. The

Bank also provides commercial mortgage lending and private banking

services in the Greater Washington D.C. metropolitan area.

The Bank’s shares of common stock are listed and

traded on The NASDAQ Stock Market under the symbol HIFS.

HINGHAM INSTITUTION FOR

SAVINGSSelected Financial Ratios

| |

Three Months

Ended |

|

Nine Months

Ended |

| |

September 30, |

|

September

30, |

| |

2017 |

|

2018 |

|

2017 |

|

2018 |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key Performance

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Return on average

assets (1) |

1.21 |

% |

|

1.52 |

% |

|

1.22 |

% |

|

1.49 |

% |

| Return on average

equity (1) |

14.60 |

|

|

17.06 |

|

|

14.81 |

|

|

17.17 |

|

| Core return on average

assets (1) (5) |

1.21 |

|

|

1.45 |

|

|

1.22 |

|

|

1.43 |

|

| Core return on average

equity (1) (5) |

14.60 |

|

|

16.24 |

|

|

14.77 |

|

|

16.50 |

|

| Interest rate spread

(1) (2) |

2.89 |

|

|

2.67 |

|

|

2.93 |

|

|

2.72 |

|

| Net interest margin (1)

(3) |

3.04 |

|

|

2.93 |

|

|

3.08 |

|

|

2.93 |

|

| Non-interest expense to

average assets (1) |

0.90 |

|

|

0.86 |

|

|

0.94 |

|

|

0.88 |

|

| Efficiency ratio

(4) |

29.37 |

|

|

29.17 |

|

|

30.58 |

|

|

29.84 |

|

| Average equity to

average assets |

8.26 |

|

|

8.91 |

|

|

8.25 |

|

|

8.69 |

|

| Average

interest-earning assets to average interest-bearing

liabilities |

117.69 |

|

|

119.39 |

|

|

117.32 |

|

|

118.61 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,

2017 |

|

|

December 31, 2017 |

|

|

September 30, 2018 |

| (Unaudited) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Asset Quality

Ratios |

|

|

|

|

|

|

|

| Allowance for loan

losses/total loans |

0.68% |

|

0.68% |

|

0.68% |

| Allowance for loan

losses/non-performing loans |

1,078.04 |

|

735.74 |

|

2,807.44 |

| |

|

|

|

|

|

| Non-performing

loans/total loans |

0.06 |

|

0.09 |

|

0.02 |

| Non-performing

loans/total assets |

0.05 |

|

0.07 |

|

0.02 |

| Non-performing

assets/total assets |

0.05 |

|

0.07 |

|

0.02 |

| |

|

|

|

|

|

| Share

Related |

|

|

|

|

|

| Book value per

share |

$ |

84.27 |

|

$ |

87.29 |

|

$ |

98.35 |

| Market value per

share |

$ |

190.27 |

|

$ |

207.00 |

|

$ |

219.81 |

| Shares outstanding at

end of period |

2,132,750 |

|

2,132,750 |

|

2,132,750 |

(1) Annualized.

(2) Interest rate spread represents the difference between the

yield on interest-earning assets and cost of interest-bearing

liabilities.

(3) Net interest margin represents net interest income divided

by average interest-earning assets.

(4) The efficiency ratio represents non-interest expense,

divided by the sum of net interest income and non-interest income,

excluding gain on equity securities, net.

(5) Non-GAAP measurements that represent return on average

assets and return on average equity, excluding the after-tax gain

on equity securities, net.

HINGHAM INSTITUTION FOR

SAVINGSConsolidated Balance Sheets

| (Dollars in

thousands, except per share data) |

September

30, 2017 |

|

December

31,2017 |

September

30, 2018 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

$ |

9,792 |

|

$ |

10,852 |

|

$ |

10,043 |

|

Federal Reserve and other short-term investments |

|

341,294 |

|

|

344,377 |

|

|

286,449 |

| Cash and cash equivalents |

|

351,086 |

|

|

355,229 |

|

|

296,492 |

|

|

|

|

|

|

|

|

|

|

|

CRA investment |

|

7,390 |

|

|

7,341 |

|

|

7,605 |

|

Debt securities available for sale |

|

19 |

|

|

17 |

|

|

15 |

|

Other marketable equity securities |

|

24,892 |

|

|

26,946 |

|

|

32,099 |

| Securities, at fair value |

|

32,301 |

|

|

34,304 |

|

|

39,719 |

|

Federal Home Loan Bank stock, at cost |

|

26,863 |

|

|

27,102 |

|

|

21,682 |

|

Loans, net of allowance for loan losses of $12,128 at September 30,

2017, $12,537 at December 31, 2017 and $13,588 at September

30, 2018 |

|

1,769,830 |

|

|

1,833,987 |

|

|

1,976,422 |

|

Foreclosed assets |

|

— |

|

|

— |

|

|

— |

|

Bank-owned life insurance |

|

12,158 |

|

|

12,221 |

|

|

12,414 |

|

Premises and equipment, net |

|

14,049 |

|

|

14,068 |

|

|

14,458 |

|

Accrued interest receivable |

|

4,079 |

|

|

4,398 |

|

|

5,066 |

|

Deferred income tax asset, net |

|

1,601 |

|

|

1,301 |

|

|

1,128 |

|

Other assets |

|

2,973 |

|

|

1,989 |

|

|

2,981 |

| Total assets |

$ |

2,214,940 |

|

$ |

2,284,599 |

|

$ |

2,370,362 |

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

| Interest-bearing

deposits |

$ |

1,277,157 |

|

$ |

1,320,487 |

|

$ |

1,494,193 |

| Non-interest-bearing

deposits |

171,382 |

|

185,375 |

|

220,943 |

| Total

deposits |

1,448,539 |

|

1,505,862 |

|

1,715,136 |

| Federal Home Loan Bank

advances |

574,395 |

|

579,164 |

|

431,242 |

| Mortgage payable |

826 |

|

812 |

|

766 |

| Mortgagors’ escrow

accounts |

6,228 |

|

6,424 |

|

6,901 |

| Accrued interest

payable |

457 |

|

575 |

|

1,687 |

| Other liabilities |

4,777 |

|

5,604 |

|

4,883 |

| Total

liabilities |

2,035,222 |

|

2,098,441 |

|

2,160,615 |

| |

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

| Preferred

stock, $1.00 par value, 2,500,000 shares authorized, none

issued |

— |

|

— |

|

— |

| Common

stock, $1.00 par value, 5,000,000 shares authorized; 2,132,750

shares issued and outstanding |

2,133 |

|

2,133 |

|

2,133 |

|

Additional paid-in capital |

11,706 |

|

11,750 |

|

11,843 |

| Undivided

profits |

161,554 |

|

165,596 |

|

195,771 |

|

Accumulated other comprehensive income |

4,325 |

|

6,679 |

|

— |

| Total

stockholders’ equity |

179,718 |

|

186,158 |

|

209,747 |

| Total

liabilities and stockholders’ equity |

$ |

2,214,940 |

|

$ |

2,284,599 |

|

$ |

2,370,362 |

| |

|

|

|

|

|

HINGHAM INSTITUTION FOR

SAVINGSConsolidated Statements of

Income

| |

Three Months

Ended |

|

Nine Months

Ended |

| |

September

30, |

|

September

30, |

| (In thousands, except per share amounts) |

|

2017 |

|

|

2018 |

|

2017 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

| Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

| Loans |

$ |

19,211 |

|

$ |

22,523 |

|

$ |

55,663 |

|

$ |

64,306 |

| Equity securities |

|

396 |

|

|

503 |

|

|

1,116 |

|

|

1,487 |

| Federal Reserve and other short-term

investments |

|

1,079 |

|

|

1,317 |

|

|

2,515 |

|

|

3,814 |

| Total interest and dividend income |

|

20,686 |

|

|

24,343 |

|

|

59,294 |

|

|

69,607 |

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

2,854 |

|

|

5,291 |

|

|

8,084 |

|

|

13,202 |

| Federal Home Loan Bank advances |

|

1,742 |

|

|

2,294 |

|

|

3,979 |

|

|

6,653 |

| Mortgage payable |

|

12 |

|

|

12 |

|

|

38 |

|

|

36 |

| Total interest expense |

|

4,608 |

|

|

7,597 |

|

|

12,101 |

|

|

19,891 |

| Net interest income |

|

16,078 |

|

|

16,746 |

|

|

47,193 |

|

|

49,716 |

| Provision for loan losses |

|

558 |

|

|

350 |

|

|

1,098 |

|

|

1,050 |

| Net interest income, after provision for

loan losses |

|

15,520 |

|

|

16,396 |

|

|

46,095 |

|

|

48,666 |

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

| Customer service fees on deposits |

|

216 |

|

|

216 |

|

|

662 |

|

|

638 |

| Increase in bank-owned life insurance |

|

67 |

|

|

65 |

|

|

196 |

|

|

193 |

| Gain on equity securities, net |

|

— |

|

|

544 |

|

|

77 |

|

|

1,290 |

| Miscellaneous |

|

44 |

|

|

42 |

|

|

136 |

|

|

129 |

| Total other income |

|

327 |

|

|

867 |

|

|

1,071 |

|

|

2,250 |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

3,008 |

|

|

3,146 |

|

|

9,245 |

|

|

9,534 |

| Occupancy and equipment |

|

422 |

|

|

421 |

|

|

1,305 |

|

|

1,313 |

| Data processing |

|

321 |

|

|

353 |

|

|

929 |

|

|

1,042 |

| Deposit insurance |

|

279 |

|

|

258 |

|

|

795 |

|

|

757 |

| Foreclosure |

|

11 |

|

|

(33) |

|

|

14 |

|

|

(41) |

| Marketing |

|

85 |

|

|

136 |

|

|

325 |

|

|

428 |

| Other general and administrative |

|

692 |

|

|

698 |

|

|

2,121 |

|

|

2,088 |

| Total operating expenses |

|

4,818 |

|

|

4,979 |

|

|

14,734 |

|

|

15,121 |

| Income before income taxes |

|

11,029 |

|

|

12,284 |

|

|

32,432 |

|

|

35,795 |

| Income tax provision |

|

4,545 |

|

|

3,436 |

|

|

13,366 |

|

|

10,060 |

| Net income |

$ |

6,484 |

|

$ |

8,848 |

|

$ |

19,066 |

|

$ |

25,735 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends declared per share |

$ |

0.34 |

|

$ |

0.36 |

|

$ |

0.98 |

|

$ |

1.05 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

2,133 |

|

|

2,133 |

|

|

2,133 |

|

|

2,133 |

| Diluted |

|

2,180 |

|

|

2,188 |

|

|

2,180 |

|

|

2,187 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

3.04 |

|

$ |

4.15 |

|

$ |

8.94 |

|

$ |

12.07 |

| Diluted |

$ |

2.97 |

|

$ |

4.05 |

|

$ |

8.75 |

|

$ |

11.77 |

HINGHAM INSTITUTION FOR

SAVINGSNet Interest Income Analysis

| |

Three Months Ended September 30, |

| |

2017 |

|

|

2018 |

|

| |

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/RATE

(8) |

|

|

|

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE

(8) |

|

| (Dollars in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

1,733,650 |

|

$ |

19,211 |

|

4.43 |

% |

|

|

$ |

1,973,987 |

|

$ |

22,523 |

|

4.56 |

% |

| Securities (3) (4) |

50,696 |

|

396 |

|

3.12 |

|

|

|

52,166 |

|

503 |

|

3.86 |

|

| Federal Reserve and

other short-term investments |

332,367 |

|

1,079 |

|

1.30 |

|

|

|

262,943 |

|

1,317 |

|

2.00 |

|

| Total

interest-earning assets |

2,116,713 |

|

20,686 |

|

3.91 |

|

|

|

2,289,096 |

|

24,343 |

|

4.25 |

|

| Other assets |

35,471 |

|

|

|

|

|

|

|

38,380 |

|

|

|

|

|

| Total

assets |

$ |

2,152,184 |

|

|

|

|

|

|

|

$ |

2,327,476 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

deposits (5) |

$ |

1,265,731 |

|

2,854 |

|

0.90 |

|

|

|

$ |

1,503,771 |

|

5,291 |

|

1.41 |

|

| Borrowed funds |

532,836 |

|

1,754 |

|

1.32 |

|

|

|

413,497 |

|

2,306 |

|

2.23 |

|

| Total

interest-bearing liabilities |

1,798,567 |

|

4,608 |

|

1.02 |

|

|

|

1,917,268 |

|

7,597 |

|

1.58 |

|

| Demand deposits |

171,680 |

|

|

|

|

|

|

|

197,838 |

|

|

|

|

|

| Other liabilities |

4,242 |

|

|

|

|

|

|

|

4,927 |

|

|

|

|

|

| Total

liabilities |

1,974,489 |

|

|

|

|

|

|

|

2,120,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’

equity |

177,695 |

|

|

|

|

|

|

|

207,443 |

|

|

|

|

|

| Total

liabilities and stockholders’ equity |

$ |

2,152,184 |

|

|

|

|

|

|

|

$ |

2,327,476 |

|

|

|

|

|

| Net interest

income |

|

|

$ |

16,078 |

|

|

|

|

|

|

|

$ |

16,746 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

spread |

|

|

|

|

2.89 |

% |

|

|

|

|

|

|

2.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin

(6) |

|

|

|

|

3.04 |

% |

|

|

|

|

|

|

2.93 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

interest-earning assets to average interest-bearing

liabilities (7) |

|

|

|

|

117.69 |

% |

|

|

|

|

|

|

119.39 |

% |

(1) Before allowance for loan losses.(2) Includes

non-accrual loans.(3) Excludes the impact of the average net

unrealized gain or loss on securities.(4) Includes Federal Home

Loan Bank stock.(5) Includes mortgagors' escrow accounts.(6) Net

interest income divided by average total interest-earning

assets.(7) Total interest-earning assets divided by total

interest-bearing liabilities.(8) Annualized.

HINGHAM INSTITUTION FOR

SAVINGSNet Interest Income Analysis

| |

Nine Months Ended September 30, |

|

| |

2017 |

|

2018 |

|

| |

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE

(8) |

|

|

AVERAGE BALANCE |

|

INTEREST |

|

YIELD/ RATE

(8) |

|

| (Dollars in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

1,675,563 |

|

$ |

55,663 |

|

4.43 |

% |

|

$ |

1,918,239 |

|

$ |

64,306 |

|

4.47 |

% |

| Securities (3) (4) |

49,202 |

|

1,116 |

|

3.02 |

|

|

52,870 |

|

1,487 |

|

3.75 |

|

| Federal Reserve and

other short-term investments |

321,335 |

|

2,515 |

|

1.04 |

|

|

289,018 |

|

3,814 |

|

1.76 |

|

| Total

interest-earning assets |

2,046,100 |

|

59,294 |

|

3.86 |

|

|

2,260,127 |

|

69,607 |

|

4.11 |

|

| Other assets |

35,261 |

|

|

|

|

|

|

38,668 |

|

|

|

|

|

| Total

assets |

$ |

2,081,361 |

|

|

|

|

|

|

$ |

2,298,795 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

deposits (5) |

$ |

1,252,938 |

|

8,084 |

|

0.86 |

|

|

$ |

1,430,524 |

|

13,202 |

|

1.23 |

|

| Borrowed funds |

491,114 |

|

4,017 |

|

1.09 |

|

|

475,050 |

|

6,689 |

|

1.88 |

|

| Total

interest-bearing liabilities |

1,744,052 |

|

12,101 |

|

0.93 |

|

|

1,905,574 |

|

19,891 |

|

1.39 |

|

| Demand deposits |

161,037 |

|

|

|

|

|

|

188,441 |

|

|

|

|

|

| Other liabilities |

4,613 |

|

|

|

|

|

|

4,954 |

|

|

|

|

|

| Total

liabilities |

1,909,702 |

|

|

|

|

|

|

2,098,969 |

|

|

|

|

|

| Stockholders’

equity |

171,659 |

|

|

|

|

|

|

199,826 |

|

|

|

|

|

| Total

liabilities and stockholders’ equity |

$ |

2,081,361 |

|

|

|

|

|

|

$ |

2,298,795 |

|

|

|

|

|

| Net interest

income |

|

|

$ |

47,193 |

|

|

|

|

|

|

$ |

49,716 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

spread |

|

|

|

|

2.93 |

% |

|

|

|

|

|

2.72 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin

(6) |

|

|

|

|

3.08 |

% |

|

|

|

|

|

2.93 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

interest-earning assets to average interest-bearing

liabilities (7) |

|

|

|

|

117.32 |

% |

|

|

|

|

|

118.61 |

% |

(1) Before allowance for loan losses.(2) Includes non-accrual

loans.(3) Excludes the impact of the average net unrealized gain or

loss on securities.(4) Includes Federal Home Loan Bank stock.(5)

Includes mortgagors' escrow accounts.(6) Net interest income

divided by average total interest-earning assets.(7) Total

interest-earning assets divided by total interest-bearing

liabilities.(8) Annualized.

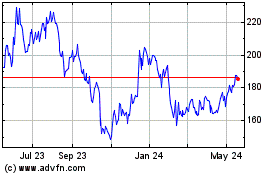

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Jan 2025 to Feb 2025

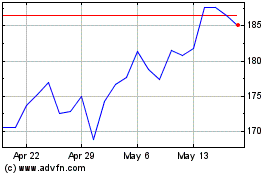

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Feb 2024 to Feb 2025