- Results Reflect Strong Fourth Quarter 2024 Revenue Growth of

5.5%; Full-Year Revenue Growth of 6.4%

- Company Provides 2025 Growth Outlook

- Recently Announced Strategic Collaboration with Yuwell to

Expand Product Portfolio, Global Reach

Inogen, Inc. (Nasdaq: INGN), a medical technology company

offering innovative respiratory products for use in the homecare

setting, today announced financial results for the quarter and the

full year ended December 31, 2024.

“2024 was a stellar year for Inogen. With our new leadership

team in place, we returned the Company to growth, achieved

significant milestones, and made meaningful steps towards

profitability,” said Kevin Smith, President and Chief Executive

Officer. “With our leading portfolio of innovative respiratory care

products, the pending introduction of Simeox in the U.S. and our

recently announced collaboration with Yuwell, we believe we are

well positioned to drive future growth, profitability and sustained

success.”

Fourth Quarter 2024 Financial Results

Total revenue in the fourth quarter of 2024 increased 5.5% to

$80.1 million from $75.9 million in the fourth quarter of 2023,

primarily driven by higher demand and new customers in

international and domestic business-to-business sales. This

performance was partially offset by lower direct-to-consumer sales

and lower rental revenue as a result of the Company’s initiatives

to enhance overall profitability.

Total gross margin of 45.3% in the fourth quarter of 2024

improved from 37.1% in the comparable period in 2023, driven

primarily by lower raw material costs and operational

efficiencies.

Total operating loss of $11.4 million improved from a loss of

$29.0 million in the fourth quarter of 2023. The year-over-year

improvement was primarily due to material cost reductions and

operational efficiencies, and a favorable comparison to the

prior-year period which included certain acquisition-related and

other one-time costs.

GAAP net loss for the fourth quarter of 2024 was $9.8 million

compared to $26.6 million in the fourth quarter of 2023. Adjusted

net loss for the fourth quarter of 2024 was $5.8 million, an

improvement from adjusted net loss of $19.4 million in the fourth

quarter of 2023.

Adjusted EBITDA was negative $3.6 million in the fourth quarter

of 2024 compared to negative $17.3 million in the fourth quarter of

2023.

Cash, cash equivalents, and restricted cash were $117.4 million

as of December 31, 2024, with no debt outstanding.

Full Year 2024 Financial Results

Total revenue in the full year 2024 increased 6.4% to $335.7

million from $315.7 million in 2023, primarily driven by higher

demand and new customers in international and domestic

business-to-business sales, partially offset by lower

direct-to-consumer sales and rental revenue.

Total gross margin of 46.1% in the full year 2024 improved from

40.1% in the comparable period in 2023, driven primarily by lower

raw material costs and operational efficiencies compared to the

prior year period.

Total operating loss of $42.5 million in the full year 2024

improved from a loss of $109.4 million in the full year of 2023.

The year-over-year improvement was primarily due to lower goodwill

impairment, material cost reductions, and an increase in sales

revenue.

GAAP net loss for the full year 2024 was $35.9 million compared

to GAAP net loss of $102.4 million for the full year 2023. Adjusted

net loss for the full year 2024 was $20.4 million, an improvement

from adjusted net loss of $48.3 million in the full year 2023.

Adjusted EBITDA was negative $9.5 million for the full year 2024

compared to negative $37.8 million for the full year 2023.

Reconciliations of adjusted EBITDA and adjusted net loss for the

three and twelve months ended December 31, 2024 and 2023 are

provided in the financial schedules that are a part of this press

release. An explanation of these non-GAAP financial measures is

also included below under the heading “Reconciliation of U.S. GAAP

to Non-GAAP Financial Measures.”

First Quarter and Full Year 2025 Financial Outlook

For the first quarter 2025, Inogen expects revenue in the range

of $79 million to $81 million, reflecting 1% to 4% reported growth

relative to the Company’s first quarter 2024 revenue.

For the full year 2025, Inogen expects revenue in the range of

$352 million to $355 million, reflecting 5% to 6% growth relative

to the Company’s 2024 revenue.

For the full year 2025, Inogen expects gross margin in the range

of 43% to 45% of total revenue, reflecting channel mix shift and

costs associated with the introduction of Simeox and Yuwell.

Yuwell Collaboration and Closing of Related Equity

Investment

As previously announced, in January 2025, the Company entered

into a strategic collaboration with Jiangsu Yuyue Medical Equipment

& Supply Co., Ltd. (“Yuwell”). In connection with the strategic

collaboration, the Company entered into a Securities Purchase

Agreement with Yuwell (Hong Kong) Holdings Limited, a wholly-owned

subsidiary of Yuwell, pursuant to which the subsidiary agreed to

purchase 2,626,425 shares of the Company’s common stock, par value

$0.001 per share, for an aggregate purchase price of approximately

$27.2 million. The equity investment closed on February 21, 2025.

Following the closing of the equity investment, Yuwell holds

approximately 9.9% of the Company’s outstanding common stock.

Quarterly Conference Call Information

On Tuesday, February 25, 2025, the Company will host a

conference call at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern

Time.

Individuals interested in listening to the conference call may

do so by dialing:

US domestic callers (877) 841-3961 Non-US

callers (201) 689-8589

Please reference Inogen to join the call. A live audio webcast

and archived recording of the conference call will be available to

all interested parties through the News / Events page on the Inogen

Investor Relations website. This webcast will also be archived on

the website for 6 months.

A replay of the call will be available approximately three hours

after the live webcast ends and will be accessible through March 4,

2025. To access the replay, dial (877) 660-6853 or (201) 612-7415

and reference Conference ID: 13750589.

Inogen has used, and intends to continue to use, its Investor

Relations website, http://investor.inogen.com/, as a means of

disclosing material non-public information and for complying with

its disclosure obligations under Regulation FD.

About Inogen

Inogen, Inc. (Nasdaq: INGN) is a leading global medical

technology company offering innovative respiratory products for use

in the homecare setting. Inogen supports patient respiratory care

by developing, manufacturing, and marketing innovative

best-in-class respiratory therapy devices used to deliver care to

patients suffering from chronic respiratory conditions. Inogen

partners with patients, prescribers, home medical equipment

providers, and distributors to make its respiratory therapy

products widely available, allowing patients the chance to manage

the impact of their disease.

For more information, please visit www.inogen.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this communication that are not

historical facts, including, but not limited to, statements

regarding Inogen’s future business plans, market opportunities,

financial outlook, growth strategies, and anticipated operational

results, are forward-looking statements. Words such as “aims,”

“believes,” “anticipates,” “plans,” “expects,” “will,” “intends,”

“potential,” “possible,” and similar expressions are intended to

identify forward-looking statements. Forward-looking statements are

subject to numerous risks and uncertainties that could cause actual

results to differ materially from currently anticipated results,

including but not limited to, risks and uncertainties relating to

the potential benefits of Inogen’s collaboration with Yuwell;

market acceptance of its products; competition; its sales,

marketing and distribution capabilities; its planned sales,

marketing, and research and development activities; and risks

associated with international operations. For a detailed discussion

of these and other risks that could impact Inogen’s operations and

financial performance, please refer to the “Risk Factors” section

of its Annual Report on Form 10-K for the period ended December 31,

2023, its Quarterly Reports on Form 10-Q for the calendar quarters

ended March 31, 2024, June 30, 2024, and September 30, 2024 and in

its other filings with the Securities and Exchange Commission.

These forward-looking statements speak only as of the date hereof.

Inogen disclaims any obligation to update these forward-looking

statements except as may be required by law.

Non-GAAP Financial Measures

Inogen has presented certain financial information in accordance

with U.S. GAAP and also on a non-GAAP basis for the three and

twelve months ended December 31, 2024, and December 31, 2023.

Management believes that non-GAAP financial measures, taken in

conjunction with U.S. GAAP financial measures, provide useful

information for both management and investors by excluding certain

non-cash and other expenses that are not indicative of Inogen’s

core operating results. Management uses non-GAAP measures to

compare Inogen’s performance relative to forecasts and strategic

plans, to benchmark Inogen’s performance externally against

competitors, and for certain compensation decisions. Non-GAAP

information is not prepared under a comprehensive set of accounting

rules and should only be used to supplement an understanding of

Inogen's operating results as reported under U.S. GAAP. Inogen

encourages investors to carefully consider its results under U.S.

GAAP, as well as its supplemental non-GAAP information and the

reconciliation between these presentations, to more fully

understand its business. Reconciliations between U.S. GAAP and

non-GAAP results are presented in the accompanying tables of this

release.

Consolidated Statements of

Comprehensive Loss

(unaudited)

(amounts in thousands, except

share and per share amounts)

Three months ended

Twelve months ended

December 31,

December 31,

2024

2023

2024

2023

Revenue

Sales revenue

$

66,307

$

59,404

$

278,756

$

251,607

Rental revenue

13,774

16,492

56,949

64,053

Total revenue

80,081

75,896

335,705

315,660

Cost of revenue

Cost of sales revenue

35,499

39,936

148,655

158,636

Cost of rental revenue, including

depreciation of $3,038 and $3,213 for the three months ended and

$12,592 and $12,893 for the twelve months ended, respectively

8,293

7,802

32,309

30,325

Total cost of revenue

43,792

47,738

180,964

188,961

Gross profit

36,289

28,158

154,741

126,699

Operating expense

Research and development

5,898

6,714

21,610

20,840

Sales and marketing

24,155

25,653

103,069

107,091

General and administrative

17,622

24,773

72,578

75,260

Impairment charges

—

—

—

32,894

Total operating expense

47,675

57,140

197,257

236,085

Loss from operations

(11,386

)

(28,982

)

(42,516

)

(109,386

)

Other income (expense)

Interest income, net

1,413

1,602

5,190

6,574

Other income (expense)

(114

)

292

850

468

Total other income, net

1,299

1,894

6,040

7,042

Loss before provision (benefit) for

income taxes

(10,087

)

(27,088

)

(36,476

)

(102,344

)

Provision (benefit) for income

taxes

(330

)

(533

)

(588

)

105

Net loss

(9,757

)

(26,555

)

(35,888

)

(102,449

)

Other comprehensive income (loss), net

of tax

Change in foreign currency translation

adjustment

(2,923

)

1,933

(2,590

)

1,358

Change in net unrealized losses on foreign

currency hedging

(324

)

(78

)

(324

)

—

Less: reclassification adjustment for net

gains included in net loss

324

25

324

—

Total net change in unrealized losses on

foreign currency hedging

—

(53

)

—

—

Change in net unrealized gains (losses) on

marketable securities

(297

)

(72

)

(136

)

110

Total other comprehensive income

(loss), net of tax

(3,220

)

1,808

(2,726

)

1,468

Comprehensive loss

$

(12,977

)

$

(24,747

)

$

(38,614

)

$

(100,981

)

Basic net loss per share attributable

to common stockholders (1)

$

(0.41

)

$

(1.14

)

$

(1.52

)

$

(4.42

)

Diluted net loss per share attributable

to common stockholders (1) (2)

$

(0.41

)

$

(1.14

)

$

(1.52

)

$

(4.42

)

Weighted-average number of shares used

in calculating net loss per share attributable to common

stockholders:

Basic shares of common stock

23,846,666

23,313,495

23,654,395

23,176,098

Diluted shares of common stock

23,846,666

23,313,495

23,654,395

23,176,098

(1)

Reconciliations of net loss attributable

to common stockholders basic and diluted can be found in Inogen’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2024 to be filed with the Securities and Exchange Commission.

(2)

Due to a net loss for the three and twelve

months ended December 31, 2024 and December 31, 2023, diluted loss

per share is the same as basic.

Consolidated Balance

Sheets

(unaudited)

(amounts in thousands, except

share and per share amounts)

December 31,

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

113,795

$

125,492

Marketable securities

—

2,979

Restricted cash

3,620

—

Accounts receivable, net

29,563

42,241

Inventories, net

24,812

21,840

Income tax receivable

538

669

Prepaid expenses and other current

assets

13,123

13,846

Total current assets

185,451

207,067

Property and equipment, net

44,400

50,316

Goodwill

9,465

10,057

Intangible assets, net

30,493

34,591

Operating lease right-of-use

asset

18,295

20,338

Other assets

8,081

3,825

Total assets

$

296,185

$

326,194

Liabilities and stockholders'

equity

Current liabilities

Accounts payable and accrued expenses

$

27,153

$

30,142

Accrued payroll

17,189

11,066

Warranty reserve - current

9,736

9,628

Operating lease liability - current

2,812

3,653

Earnout liability

13,000

10,000

Deferred revenue - current

6,654

7,980

Income tax payable

142

27

Total current liabilities

76,686

72,496

Long-term liabilities

Warranty reserve - noncurrent

16,350

13,850

Operating lease liability - noncurrent

16,594

18,270

Deferred revenue - noncurrent

5,747

8,227

Deferred tax liability

6,948

8,539

Total liabilities

122,325

121,382

Stockholders' equity

Common stock

24

23

Additional paid-in capital

328,174

320,513

Accumulated deficit

(152,837

)

(116,949

)

Accumulated other comprehensive income

(loss)

(1,501

)

1,225

Total stockholders' equity

173,860

204,812

Total liabilities and stockholders'

equity

$

296,185

$

326,194

Condensed Consolidated Cash

Flow

(unaudited)

(amounts in thousands)

Years Ended December

31,

2024

2023

Cash flows from operating

activities

Net loss

$

(35,888

)

$

(102,449

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

21,004

18,152

Loss on rental units and other assets

4,535

4,508

Gain on sale of former rental assets

(165

)

(84

)

Provision for sales revenue returns and

doubtful accounts

10,890

10,730

Provision for inventory losses

233

2,691

Loss on purchase commitments

448

2,057

Stock-based compensation expense

7,397

7,427

Deferred income taxes

(1,150

)

(251

)

Change in fair value of earnout

liability

3,000

6,822

Impairment charges

—

32,894

Changes in operating assets and

liabilities

(4,390

)

14,269

Net cash provided by (used in) operating

activities

5,914

(3,234

)

Cash flows from investing

activities

Purchases of available-for-sale

securities

(32,657

)

(26,869

)

Maturities of available-for-sale

securities

35,500

24,000

Investment in intangible assets

(2,090

)

(494

)

Investment in property and equipment

(3,360

)

(5,218

)

Production and purchase of rental

equipment

(11,643

)

(21,299

)

Proceeds from sale of former assets

275

198

Acquisition of business, net of cash

acquired

—

(29,633

)

Net cash used in investing activities

(13,975

)

(59,315

)

Cash flows from financing

activities

Proceeds from stock options exercised

—

384

Proceeds from employee stock purchases

811

1,094

Payment of employment taxes related to

release of restricted stock

(546

)

(518

)

Net cash provided by financing

activities

265

960

Effect of exchange rates on cash

(281

)

67

Net decrease in cash, cash equivalents

and restricted cash

$

(8,077

)

$

(61,522

)

Supplemental Financial

Information

(unaudited)

(in thousands, except units

and patients)

Three months ended December

31,

Change 2024 vs. 2023

Constant

Currency Change

Revenue by region and category

2024

2023

$

%

%

Business-to-business domestic sales

$

22,397

$

18,051

$

4,346

24.1

%

24.1

%

Business-to-business international

sales

28,313

21,524

6,789

31.5

%

28.2

%

Direct-to-consumer domestic sales

15,597

19,829

(4,232

)

-21.3

%

-21.3

%

Direct-to-consumer domestic rentals

13,774

16,492

(2,718

)

-16.5

%

-16.5

%

Total revenue

$

80,081

75,896

4,185

5.5

%

4.6

%

Additional financial measures

Units Sold

38,400

34,100

Net rental patients as of period-end

51,000

51,900

Twelve months ended December

31,

Change 2024 vs. 2023

Constant Currency

Change

Revenue by region and category

2024

2023

$

%

%

Business-to-business domestic sales

$

83,555

$

66,196

$

17,359

26.2

%

26.2

%

Business-to-business international

sales

117,207

89,401

27,806

31.1

%

30.2

%

Direct-to-consumer domestic sales

77,994

96,010

(18,016

)

-18.8

%

-18.8

%

Direct-to-consumer domestic rentals

56,949

64,053

(7,104

)

-11.1

%

-11.1

%

Total revenue

$

335,705

315,660

20,045

6.4

%

6.1

%

Additional financial measures

Units Sold

157,500

130,500

Net rental patients as of period-end

51,000

51,900

Reconciliation of U.S. GAAP to

Non-GAAP Financial Measures

(unaudited)

(in thousands)

Three months ended

Twelve months ended

December 31,

December 31,

Non-GAAP EBITDA and Adjusted

EBITDA

2024

2023

2024

2023

Net loss (GAAP)

$

(9,757

)

$

(26,555

)

$

(35,888

)

$

(102,449

)

Non-GAAP adjustments:

Interest income, net

(1,413

)

(1,602

)

(5,190

)

(6,574

)

Provision (benefit) for income taxes

(330

)

(533

)

(588

)

105

Depreciation and amortization

5,080

5,144

21,004

18,152

EBITDA (non-GAAP)

(6,420

)

(23,546

)

(20,662

)

(90,766

)

Stock-based compensation

1,693

(1,057

)

7,397

7,427

Acquisition-related expenses

—

432

784

2,413

Restructuring-related and other

charges

—

—

—

3,426

Impairment charges

—

—

—

32,894

Change in fair value of earnout

liability

1,170

6,822

3,000

6,822

Adjusted EBITDA (non-GAAP)

$

(3,557

)

$

(17,349

)

$

(9,481

)

$

(37,784

)

Three months ended December

31,

Net Loss

Diluted EPS

Non-GAAP Adjusted Net Loss and Diluted

EPS

2024

2023

2024

2023

Financial Results (GAAP)

$

(9,757

)

$

(26,555

)

$

(0.41

)

$

(1.14

)

Non-GAAP adjustments:

Amortization of intangibles

1,103

918

Stock-based compensation

1,693

(1,057

)

Acquisition-related expenses

—

432

Change in fair value of earnout

liability

1,170

6,822

Adjusted

$

(5,791

)

$

(19,440

)

$

(0.24

)

$

(0.83

)

Twelve months ended December

31,

Net Loss

Diluted EPS

Non-GAAP Adjusted Net Loss and Diluted

EPS

2024

2023

2024

2023

Financial Results (GAAP)

$

(35,888

)

$

(102,449

)

$

(1.52

)

$

(4.42

)

Non-GAAP adjustments:

Amortization of intangibles

4,330

1,202

Stock-based compensation

7,397

7,427

Acquisition-related expenses

784

2,413

Restructuring-related and other charges

(1)

—

3,426

Impairment charges

—

32,894

Change in fair value of earnout

liability

3,000

6,822

Adjusted

$

(20,377

)

$

(48,265

)

$

(0.86

)

$

(2.08

)

(1)

Charges represent the costs associated

with workforce reductions and other restructuring-related

activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225701496/en/

ir@inogen.net

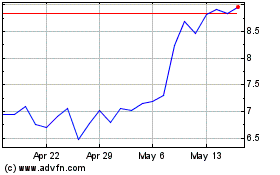

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Mar 2024 to Mar 2025