UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of September 2024

Commission file number: 001-41482

Jeffs’

Brands Ltd

(Translation of registrant’s name into English)

7 Mezada St.

Bnei Brak, Israel 5126112

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

This Report of Foreign Private Issuer on Form 6-K (this “Form

6-K”) consists of Jeffs’ Brands Ltd’s (the “Company”): (i) Unaudited Condensed Consolidated Financial Statements

as of, and for the six months ended, June 30, 2024, which are attached hereto as Exhibit 99.1; and (ii) Management’s Discussion

and Analysis of Financial Condition and Results of Operations for the six months ended June 30, 2024, which is attached hereto as Exhibit

99.2.

This Form 6-K is

incorporated by reference into the Company’s Registration Statement on Form F-3 (File No. 333-277188)

and Registration Statements on Form S-8 (File No. 333-269119

and File No. 333-280459),

to be a part thereof from the date on which this Form 6-K is submitted, to the extent not superseded by documents or reports

subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Jeffs’ Brands Ltd |

| |

|

| Date: September 30, 2024 |

By: |

/s/ Ronen Zalayet |

| |

|

Ronen Zalayet |

| |

|

Chief Financial Officer |

Exhibit 99.1

JEFFS’ BRANDS

LTD

UNAUDITED CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

JEFFS’ BRANDS LTD

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

| |

June 30, | | |

December 31, | |

| | |

Note | |

2024 | | |

2023 | |

| | |

| |

Unaudited | |

| | |

| |

USD in thousands | |

| ASSETS | |

| |

| | |

| |

| CURRENT ASSETS: | |

| |

| | | |

| | |

| Cash and cash equivalents | |

| |

| 2,815 | | |

| 535 | |

| Restricted deposit | |

| |

| 17 | | |

| 17 | |

| Trade receivables | |

| |

| 396 | | |

| 629 | |

| Other receivables | |

| |

| 445 | | |

| 597 | |

| Related party receivables | |

9 | |

| 53 | | |

| - | |

| Inventory | |

| |

| 4,354 | | |

| 2,386 | |

| Total current assets | |

| |

| 8,080 | | |

| 4,164 | |

| NON-CURRENT ASSETS: | |

| |

| | | |

| | |

| Property and equipment, net | |

| |

| 61 | | |

| 59 | |

| Investment accounted for using the equity method | |

| |

| 1,695 | | |

| 1,940 | |

| Investment at fair value | |

| |

| 11 | | |

| 67 | |

| Intangible assets, net | |

5 | |

| 5,330 | | |

| 5,714 | |

| Deferred taxes | |

| |

| 195 | | |

| 168 | |

| Operating lease right-of-use assets | |

| |

| 86 | | |

| 127 | |

| Total non-current assets | |

| |

| 7,378 | | |

| 8,075 | |

| TOTAL ASSETS | |

| |

| 15,458 | | |

| 12,239 | |

| | |

| |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| |

| | | |

| | |

| CURRENT LIABILITIES: | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Trade payables | |

| |

| 521 | | |

| 709 | |

| Other payables | |

| |

| 1,293 | | |

| 1,533 | |

| Related party payables | |

9 | |

| 31 | | |

| 66 | |

| Total current liabilities | |

| |

| 1,845 | | |

| 2,308 | |

| NON-CURRENT LIABILITIES: | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Derivative liabilities | |

7 | |

| 6,406 | | |

| 1,375 | |

| Operating lease liabilities | |

| |

| 14 | | |

| 45 | |

| Total non-current liabilities | |

| |

| 6,420 | | |

| 1,420 | |

| TOTAL LIABILITIES | |

| |

| 8,265 | | |

| 3,728 | |

| | |

| |

| | | |

| | |

| SHAREHOLDERS’ EQUITY: | |

| |

| | | |

| | |

| Ordinary shares, no par value per share - Authorized: 43,567,567 as of June 30, 2024 and December 31, 2023; Issued and outstanding: 9,177,100 shares as of June 30, 2024; and 1,215,512 shares as of December 31, 2023 | |

| |

| - | | |

| - | |

| Additional paid-in-capital | |

| |

| 19,344 | | |

| 16,787 | |

| Accumulated deficit | |

| |

| (12,151 | ) | |

| (8,276 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | |

| |

| 7,193 | | |

| 8,511 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| |

| 15,458 | | |

| 12,239 | |

The accompanying notes are an integral part

of the interim condensed consolidated financial statements.

JEFFS’ BRANDS LTD

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

| | |

Six months ended

June 30, |

|

| | |

| | |

U.S. dollars in thousands (*) |

|

| | |

| | |

Unaudited |

|

| | |

Note | | |

2024 | | |

2023 |

|

| Revenues | |

| | | |

| 6,198 | | |

| 3,871 |

|

| Cost of sales | |

| | | |

| 5,441 | | |

| 3,498 |

|

| | |

| | | |

| | | |

| |

|

| Gross profit | |

| | | |

| 757 | | |

| 373 |

|

| | |

| | | |

| | | |

| |

|

| Operating expenses: | |

| | | |

| | | |

| |

|

| | |

| | | |

| | | |

| |

|

| Sales and marketing | |

| | | |

| 603 | | |

| 342 |

|

| General and administrative | |

| | | |

| 2,413 | | |

| 2,067 |

|

| Equity losses | |

| | | |

| 245 | | |

| 89 |

|

| Other income | |

| | | |

| (60 | ) | |

| (158 |

) |

| | |

| | | |

| | | |

| |

|

| Operating loss | |

| | | |

| (2,444 | ) | |

| (1,967 |

) |

| | |

| | | |

| | | |

| |

|

| Financial expenses (income), net | |

| 8 | | |

| 1,367 | | |

| (148 |

) |

| | |

| | | |

| | | |

| |

|

| Loss before taxes | |

| | | |

| (3,811 | ) | |

| (1,819 |

) |

| | |

| | | |

| | | |

| |

|

| Tax expenses | |

| | | |

| 64 | | |

| 9 |

|

| | |

| | | |

| | | |

| |

|

| Net loss for the period | |

| | | |

| (3,875 | ) | |

| (1,828 |

) |

| | |

| | | |

| | | |

| |

|

| Loss per ordinary share (basic and diluted) | |

| | | |

| (0.69 | ) | |

| (1.54 |

)(**) |

| | |

| | | |

| | | |

| |

|

| Weighted-average ordinary shares used in computing net loss per share, basic and diluted | |

| | | |

| 5,586,274 | | |

| 1,173,097 |

(**) |

The accompanying notes are an integral part

of the interim condensed consolidated financial statements.

JEFFS’ BRANDS LTD

CONDENSED CONSOLIDATED STATEMENTS OF

CHANGES IN SHAREHOLDERS’ EQUITY

Six Months Ended June 30, 2024 (Unaudited)

| | |

Ordinary

Shares | | |

Additional

paid-in- | | |

Accumulated | | |

| |

| | |

Number | | |

Amount | | |

capital | | |

deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| BALANCE AT DECEMBER 31, 2023 | |

| 1,215,512 | | |

| - | | |

| 16,787 | | |

| (8,276 | ) | |

| 8,511 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| (3,875 | ) | |

| (3,875 | ) |

| Issuance of ordinary shares pre-funded warrants and warrants, net (note 4a.) | |

| 1,884,461 | | |

| - | | |

| 2,557 | | |

| - | | |

| 2,557 | |

| Exercise of Series B Warrants (note 4a.) | |

| 5,257,127 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercise of Pre-Funded Warrants (note 4a.) | |

| 820,000 | | |

| - | | |

| - | | |

| - | | |

| - | |

| BALANCE AT JUNE 30, 2024 | |

| 9,177,100 | | |

| - | | |

| 19,344 | | |

| (12,151 | ) | |

| 7,193 | |

Six Months Ended June 30, 2023 (Unaudited)

| | |

Ordinary

Shares | | |

Additional

paid-in- | | |

Accumulated | | |

| |

| | |

Number | | |

Amount | | |

capital | | |

deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| BALANCE AT DECEMBER 31, 2022 | |

| 1,180,167 | | |

| - | | |

| 16,499 | | |

| (3,678 | ) | |

| 12,821 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| (1,828 | ) | |

| (1,828 | ) |

| Issuance of ordinary shares to SciSparc Ltd. (see note 3b.) | |

| 35,345 | | |

| - | | |

| 288 | | |

| - | | |

| 288 | |

| BALANCE AT JUNE 30, 2023 | |

| 1,215,512 | | |

| - | | |

| 16,787 | | |

| (5,506 | ) | |

| 11,281 | |

The accompanying notes are an integral part

of the interim condensed consolidated financial statements.

JEFFS’ BRANDS LTD

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

U.S. dollars in thousands | |

| | |

| Unaudited | | |

| | |

| CASH FLOWS USED IN OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss for the period | |

| (3,875 | ) | |

| (1,828 | ) |

| Adjustments to reconcile net loss to net cash from (used in) operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Exchange differences on cash and cash equivalent | |

| 5 | | |

| 46 | |

| Finance expenses on lease liabilities | |

| (3 | ) | |

| - | |

| Amortization of intangible assets | |

| 384 | | |

| 347 | |

| Depreciation | |

| 6 | | |

| 3 | |

| Loss from change in the fair value of a financial asset at fair value | |

| 57 | | |

| 90 | |

| Equity losses | |

| 245 | | |

| 89 | |

| Change in fair value of derivative liabilities | |

| 730 | | |

| (341 | ) |

| Changes in deferred taxes, net | |

| (27 | ) | |

| (27 | ) |

| Issuance costs of financial instruments classified as derivative liabilities | |

| 603 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Decrease in trade receivables | |

| 233 | | |

| 196 | |

| Increase in related parties balance | |

| (88 | ) | |

| (2 | ) |

| Decrease (increase) in operating lease right-of-use assets | |

| 42 | | |

| (30 | ) |

| Increase (decrease) in operating lease liabilities | |

| (42 | ) | |

| 31 | |

| Decrease in other receivables | |

| 151 | | |

| 219 | |

| Increase in inventory | |

| (1,968 | ) | |

| (752 | ) |

| Increase (decrease) in accounts payable and other payables | |

| 13 | | |

| 790 | |

| Net cash used in operating activities | |

| (3,534 | ) | |

| (1,169 | ) |

| | |

| | | |

| | |

| CASH FLOWS USED IN INVESTING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of property and equipment | |

| (8 | ) | |

| (8 | ) |

| Purchase of investment accounted for using the equity method (see note 3.a) | |

| (98 | ) | |

| (2,993 | ) |

| Purchase of intangible asset (see note 5) | |

| (330 | ) | |

| (1,682 | ) |

| Net cash used in investing activities | |

| (436 | ) | |

| (4,683 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM (USED IN) FINANCING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Short term loan repaid | |

| - | | |

| (86 | ) |

| Issuance of ordinary shares, pre-funded warrants and warrants, net | |

| 6,255 | | |

| - | |

| Net cash from (used in) financing activities | |

| 6,255 | | |

| (86 | ) |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | |

| 2,285 | | |

| (5,938 | ) |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF THE PERIOD | |

| 535 | | |

| 8,137 | |

| LOSSES FROM EXCHANGE DIFFERENCES ON CASH AND CASH EQUIVALENTS | |

| (5 | ) | |

| (46 | ) |

| CASH AND CASH EQUIVALENTS AT END OF THE PERIOD | |

| 2,815 | | |

| 2,153 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Taxes paid | |

| 92 | | |

| 28 | |

| Interest paid | |

| - | | |

| 2 | |

| Supplemental disclosure of noncash investing and financing activities: | |

| | | |

| | |

| Issuance of ordinary shares to SciSparc Ltd. in consideration for ordinary shares (see note 3.b) | |

| - | | |

| 288 | |

| Consideration payable to sellers of Fort Products Ltd. included in other payables | |

| - | | |

| 349 | |

| Consideration payable to seller of SciSparc Nutraceuticals Inc. shares included in other payables | |

| - | | |

| 41 | |

The accompanying notes are an integral part

of the interim condensed consolidated financial statements.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 — GENERAL INFORMATION

Jeffs’ Brands Ltd (the “Company”

or “Jeffs’ Brands”) was incorporated in Israel on March 7, 2021. As of September 30, 2024, the Company has five

wholly owned subsidiaries — Smart Repair Pro (“Smart Pro”), Top Rank Ltd. (“Top Rank”), Jeffs’

Brands Holdings Inc. (“Jeffs’ Brands Holdings”), Fort Products Ltd. (“Fort”) and Fort Products

LLC (“Fort US”), and together with Smart Pro, Top Rank and Jeffs’ Brands Holdings, the “Subsidiaries”).

The Company and the Subsidiaries (“Group”) are engaged in the acquisition, improvement and operation of virtual stores

(the “Brands”) mainly on the Amazon marketplace (“Amazon”) website.

References to the Company hereinafter,

unless the context otherwise provides, include Jeffs’ Brands and the Subsidiaries on a consolidated basis.

Smart Pro, a corporation incorporated

under the laws of the State of California, was established on December 20, 2017, and commenced its operations in June 2019. As of June

30, 2024, Smart Pro operated four Brands on the Amazon website.

In April 2021, Top Rank, an Israeli company,

was incorporated as a wholly owned subsidiary of Jeffs’ Brands.

On February 23, 2023, Jeffs’

Brands Holdings was incorporated and registered under the laws of the State of Delaware as a wholly owned subsidiary of Jeffs’ Brands.

On February 23, 2023, the Company purchased

approximately 49% of the issued and outstanding shares of SciSparc Nutraceuticals Inc. (“SciSparc U.S.”). For additional

information see note 3a.

On March 9, 2023, the Company purchased

all of the issued and outstanding share capital of Fort, a company incorporated under the laws of England and Wales. For additional information

see note 5.

On April 23, 2023, Fort US was incorporated

and registered under the laws of the State of Delaware as a wholly owned subsidiary of Jeffs’ Brands Holdings.

The Group’s activities are mainly

conducted through Amazon’s commercial platform. Any material change, whether temporary or permanent, including changes in Amazon’s

terms of use and/or its policies, may affect sales performance, and may have a material effect on the Group’s financial position

and the results of its operations.

In addition, the Group is engaged with

a small number of suppliers as part of the production process of its brands. Any material changes in the supply process, whether temporary

or permanent, may affect sales performance, and may have a material effect on the Group’s financial position and the results of

its operations.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 — GENERAL INFORMATION (cont.)

During the six months ended June 30,

2024, the Group incurred a net loss of $3,875 thousand and cash flows used in operating activities were $ 3,534 thousand. As of June 30,

2024, the Group had an accumulated deficit of approximately $12,151 thousand.

The Group intends to continue to finance

its operating activities through the sale of products via the Brands and through raising additional capital, as needed.

On January 29, 2024, the Company completed

a private placement transaction (the “Private Placement”), pursuant to a Securities Purchase Agreement with certain

institutional investors for aggregate gross proceeds of approximately $7.275 million, before deduction of fees to the placement agent

and other expenses payable by the Company in connection with the Private Placement. For additional information see note 4.a.

The Company’s negative cash flow from operations resulted, among

other things, from purchase of inventory of $4,001 thousand during the six months period ended June 30, 2024. While the Company generated

negative cash flow from operations during the six months ended June 30, 2024, the Company’s management believes that its current

cash resources of $1.53 million, together with the realization of inventory in the near future will generate sufficient cash flow for

the Company to carry out its operations during the 12 months from September 30, 2024, the date of issuance of these financial statements.

NOTE 2 — BASIS OF PRESENTATION AND SIGNIFICANT

ACCOUNTING POLICIES

| a. | Unaudited Interim Financial Statements |

The accompanying unaudited consolidated condensed financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S.

GAAP”) for interim financial information. Accordingly, they do not include all the information and footnotes required by generally

accepted accounting principles for complete financial statements. In the opinion of management, all adjustments considered necessary for

a fair presentation have been included (consisting only of normal recurring adjustments except as otherwise discussed). For further information,

reference is made to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form

20-F for the year ended December 31, 2023.

| b. | Principles of Consolidation |

The accompanying condensed consolidated

financial statements include the accounts of the Group. All intercompany balances and transactions have been eliminated in consolidation.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 2 — BASIS OF PRESENTATION AND SIGNIFICANT

ACCOUNTING POLICIES (cont.)

The preparation of financial statements

in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue

and expenses during the reporting period. The Company evaluates on an ongoing basis its assumptions, including those related to contingencies,

deferred taxes, inventory impairment, derivative liability, useful lives of intangible assets, intangible assets impairment as well as

in estimates used in applying the revenue recognition policy. Actual results may differ from those estimates.

In the preparation of these condensed

consolidated financial statements, the significant judgments exercised by management in the application of the Group’s accounting

policies and the uncertainty involved in the key sources of those estimates were identical to the ones used in the Group’s consolidated

financial statements for the year ended December 31, 2023.

| d. | Significant Accounting Policies |

The significant accounting policies followed in the preparation of

these unaudited interim condensed consolidated financial statements are identical to those applied in the preparation of the Group’s

financial statements for the year ended December 31, 2023.

| | e. | Recent Accounting Pronouncements not yet adopted |

In December 2023, the Financial Accounting Standards Board (the “FASB”)

issued an Accounting Standards Update (“ASU”) No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures.

This ASU requires disclosure of specific categories in the rate reconciliation and additional information for reconciling items that meet

a quantitative threshold. The ASU also includes other changes to improve the effectiveness of income tax disclosures, including further

disaggregation of income taxes paid for individually significant jurisdictions. This ASU is effective for annual periods beginning after

December 15, 2024. Adoption of this ASU should be applied on a prospective basis. Early adoption is permitted. The Company is currently

evaluating the impact of adopting this ASU on its consolidated financial statements and disclosures.

In November 2023, the FASB issued

ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The ASU expands public entities’ segment

disclosures by requiring disclosure of significant segment expenses that are regularly reviewed by the chief operating decision maker

(“CODM”) and included within each reported measure of segment profit or loss, an amount and description of its composition

for other segment items, and interim disclosures of a reportable segment’s profit or loss and assets. The ASU also allows, in addition

to the measure that is most consistent with U.S. GAAP, the disclosure of additional measures of segment profit or loss that are used

by the CODM in assessing segment performance and deciding how to allocate resources. The ASU is effective for the Company’s Annual

Report on Form 20F for the fiscal year ended December 31, 2024, and subsequent interim periods, with early adoption permitted. The Company

is currently evaluating the impact of adopting this ASU on its consolidated financial statements and disclosures.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3 — INVESTMENT IN AFFILIATE

| | a. | On February

23, 2023, the Company and Jeffs’ Brands Holdings entered into a stock purchase agreement (as amended on March 22, 2023, the “Wellution

Agreement”), with SciSparc Ltd. (“SciSparc”), pursuant to which, on March 22, 2023, Jeffs’ Brands

Holdings acquired from SciSparc 57 shares of common stock of SciSparc U.S., a wholly-owned subsidiary of SciSparc that owns and operates

Wellution, an Amazon food supplements and cosmetics brand, representing approximately 49% of the issued and outstanding common stock

of SciSparc U.S., for approximately $3.0 million in cash. The Company reviewed the transaction and deemed it to be the purchase of assets

for accounting purposes under ASC Subtopic 805 “Business Combinations” (“ASC 805”), and not as a business

combination. The Company reviewed the guidance under ASC 805 for the transaction and determined that the fair value of the gross assets

acquired was concentrated in a single identifiable asset, a brand. |

In connection with the closing of the

Wellution Agreement, on March 22, 2023, the Company entered into a consulting agreement with SciSparc U.S. (the “SciSparc Consulting

Agreement”), pursuant to which the Company will provide management services to SciSparc U.S. for the Wellution brand for a monthly

fee of $20 thousand and the Company received a one-time signing bonus in the amount of $51 thousand. The SciSparc Consulting Agreement

is for an undefined period of time and may be terminated by either party with 30 days advance notice. On September 4, 2024, the Company

and SciSparc U.S. entered into an amendment to the SciSparc Consulting Agreement. Pursuant to the amendment to the SciSparc Consulting

Agreement, the monthly fee was reduced to $10 thousand beginning on November 2023.

Jeffs’ Brands Holdings owns 49% of

the voting rights in SciSparc U.S and has the right to appoint two out of five directors. Management has determined that it has significant

influence over SciSparc U.S and accordingly accounts for its investment under the equity method.

The Company did not obtain any substantive

processes, assembled workforce, or employees capable of producing outputs in connection with the acquisition. Therefore, the transaction

was accounted for as an asset acquisition, as the acquired assets did not meet the definition of a business as defined by ASC 805, Business

Combinations.

The activity in the investment accounted for using the equity method

was as follows:

| | |

January 1,

2024 –

June 30,

2024 | |

| | |

USD in

thousands | |

| Balance as of January 1, 2024 | |

| 1,940 | |

| Equity losses | |

| (245 | ) |

| Balance as of June 30, 2024 | |

| 1,695 | |

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 3 — INVESTMENT IN AFFILIATE (cont.)

Summarized financial information:

Summarized statement of operations:

| | |

January 1, 2024 –

June 30,

2024 | | |

February 23, 2023 –

June 30,

2023 | |

| | |

USD in thousands | |

| Revenues | |

| 840 | | |

| 1,186 | |

| Net loss | |

| (500 | ) | |

| (151 | ) |

| | b. | Pursuant to the Wellution Agreement, in connection with the closing of the Wellution Agreement, on March 22, 2023, the Company issued 35,345 ordinary shares, no par value per share (“Ordinary Shares”) to SciSparc and SciSparc issued 13,858 (after giving effect to a 1-for-26 reverse share split effected by SciSparc on September 28, 2023), of its ordinary shares to the Company in a share exchange (collectively, the “Exchange Shares”), representing approximately 2.97% and 4.99%, respectively, of the Company’s and SciSparc’s issued and outstanding ordinary shares. The number of Exchange Shares acquired by each company was calculated by dividing $288 thousand by the average closing price of the relevant company’s shares on the Nasdaq Capital Market for the 30 consecutive trading days ending on the third trading day immediately prior to the closing. |

The investment in SciSparc was accounted

for as financial asset through profit and loss.

The activity in investment at fair value was as

follows:

| | |

January 1,

2024 –

June 30,

2024 | |

| | |

USD in

thousands | |

| Balance as of January 1, 2024 | |

| 67 | |

| Revaluation losses | |

| (56 | ) |

| Balance as of June 30, 2024 | |

| 11 | |

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 4 — SIGNIFICANT

EVENTS DURING THE PERIOD

| | a. | On January 25, 2024, the Company entered into

a Securities Purchase Agreement with certain institutional investors for aggregate gross proceeds of $7.275 million, before deducting

fees to the placement agent and other expenses payable by the Company in connection with the Private Placement. The Private Placement

closed on January 29, 2024 (“Issuance Date”).

As part of the Securities Purchase Agreement, the Company issued an

aggregate of (i) 1,884,461 Ordinary Shares; (ii) Pre-Funded Warrants to purchase up to 820,000 Ordinary Shares at an exercise price of

$0.00001 per Ordinary Share; (iii) Series A Warrants to purchase up to 3,380,586 Ordinary Shares at an exercise price of $2.69 per Ordinary

Share (subject to certain anti-dilution and share combination event protections) and have a term of sixty-six (66) months from the date

of issuance; and (iv) Series B Warrants to purchase, upon the satisfaction of certain conditions, up to 7,994,181 Ordinary Shares at an

exercise price of $0.00001 Ordinary Share (following the end of an adjustment period as further described below). The Pre-Funded Warrants

are exercisable as of the date of the issuance and will not expire until exercised in full.

L.I.A. Pure Capital Ltd. (“Pure Capital”) participated

in the private placement as a purchaser and purchased securities in the amount of $300 thousand. see note 9.c.2.

The number of Ordinary Shares issuable under the Series A and Series B Warrant was subject to an adjustment determined by the trading price of the Ordinary Shares following the effectiveness of a resale registration statement (the “Resale Registration Statement”) (see below) that the Company undertook to file, subject to a pricing floor of $0.68 per Ordinary Share. Pursuant to such, the maximum number of Ordinary Shares underlying each of the Series A and Series B Warrants would have been an aggregate of 13,373,177 Ordinary Shares and 7,994,181 Ordinary Shares, respectively. Following the effectiveness of the Resale Registration Statement, on

March 11, 2024 (i) Series A Warrants are exercisable into a total number of 13,373,177 Ordinary Shares (subject to certain anti-dilution

and share combination event protections) and have an exercise price of $0.68 per Ordinary Share; and (ii) Series B Warrants are exercisable

into a total number of 7,904,181 Ordinary Shares at an exercise price of per Ordinary Share $0.00001, following the adjustment. Subsequent

to such adjustment, the Series B Warrants have a term of sixty-six (66) months from the date of issuance. |

As of the date of these consolidated

financial statements, pre-funded warrants to purchase 820,000 Ordinary Shares and Series B Warrants to purchase 5,257,127 Ordinary Shares

were exercised for an aggregate issuance of 6,077,127 Ordinary Shares.

In connection with the Private Placement,

the Company also entered into a placement agent agreement (the “Placement Agent Agreement”) with Aegis Capital Corp.

(“Aegis”) dated January 25, 2024, pursuant to which Aegis agreed to serve as the exclusive placement agent for the

Company in connection with the Private Placement. The Company agreed to pay Aegis a cash placement fee equal to 8.50% of the gross cash

proceeds received in the Private Placement and to pay for expenses of the purchasers’ and Aegis’ legal counsel up to an aggregate

amount of $90 thousand.

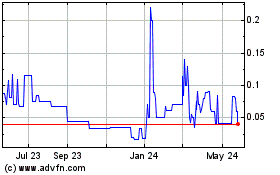

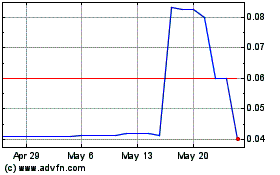

| | b. | On April 25, 2024, the Company received a written notification from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”), notifying that the Company was not in compliance with the minimum bid price requirement for continued listing on Nasdaq, as set forth under Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”), because the closing bid price of the Ordinary Shares was below $1.00 per Ordinary Share for the previous 30 consecutive business days. The Company was granted 180 calendar days, or until October 22, 2024, to regain compliance with the Minimum Bid Price Requirement. The Company can regain compliance if, at any time during this 180-day period, the closing bid price of the Company’s Ordinary Shares is at least $1.00 for a minimum of ten consecutive business days. In the event that the Company does not regain compliance after the initial 180-day period, the Company may then be eligible for an additional 180-day compliance period if the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq. |

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 5 — INTANGIBLE ASSETS

Total intangible assets consisted of the following

as of June 30, 2024 and December 31, 2023:

| | |

June 30, 2024 | |

| | |

Gross Amount | | |

Accumulated Amortization | | |

Net Balance | |

| | |

U.S. dollars in thousands | |

| Brands | |

| 7,774 | | |

| (2,444 | ) | |

| 5,330 | |

| | |

December 31, 2023 | |

| | |

Gross Amount | | |

Accumulated Amortization | | |

Net Balance | |

| | |

U.S. dollars in thousands | |

| Brands | |

| 7,774 | | |

| (2,060 | ) | |

| 5,714 | |

Amortization expense was $384 thousand and $347

thousand, for the six months ended June 30, 2024, and 2023, respectively.

| | a. | On March 2, 2023, the Company entered into a share purchase agreement (the “Fort SPA”), with the holders (the “Sellers”), of all of the issued and outstanding share capital of Fort, a company incorporated under the laws of England and Wales and engaged in the sale of pest control products primarily through Amazon.uk, pursuant to which on March 9, 2023, the Company acquired all of the issued and outstanding share capital of Fort, for approximately £2 million (approximately $2.4 million) (the “Fort Acquisition”). |

On February 29, 2024, the Company entered

into a side letter to the Fort SPA with the Sellers, pursuant to which the Company agreed to increase certain adjustment amount payments

to the Sellers by approximately £100 thousand (approximately $128 thousand).

On March 9, 2023, the Company recognized the amount of $1,991

thousand paid in connection with the Fort Acquisition amortized over a period of ten (10) years.

As part of the Fort SPA, the employment of these employees

was terminated within three months, with all termination costs to be borne by the Sellers.

Also, in connection with the

closing of the Fort Acquisition, on March 9, 2023, Fort and the Sellers entered into a consulting agreement, pursuant to which the

Sellers will provide the Company with consultancy services for a period of six months following the closing, at a monthly fee of

£2.5 thousand (approximately $3 thousand). On September 20, 2023, the Company and the Sellers entered into a new consulting

agreement for indefinite period at a monthly fee of £3.5 thousand (approximately $4.5 thousand) effective as of June 1, 2023

(the “Fort Consulting Agreement”). On July 9, 2024 the Fort Consulting Agreement was terminated.

The Company did not obtain any substantive processes, assembled workforce, or employees capable of producing

outputs in connection with the acquisition. Therefore, the transaction was accounted for as an asset acquisition, as the acquired assets

did not meet the definition of a business as defined by ASC 805, Business Combinations.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 6 — OTHER PAYABLES

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

USD in thousands | |

| Government institutions | |

| 561 | | |

| 428 | |

| Employees and related benefits | |

| 120 | | |

| 85 | |

| Operating lease liabilities | |

| 69 | | |

| 82 | |

| Liability to sellers | |

| - | | |

| (*)430 | |

| Revenue Sharing Payment payable | |

| 141 | | |

| 140 | |

| Accrued expenses and other payables | |

| 402 | | |

| 368 | |

| | |

| 1,293 | | |

| 1,533 | |

NOTE 7 — DERIVATIVE LIABILITIES

Additional Warrants

On November 28, 2022, the Company issued additional

warrants (the “Additional Warrants”), following certain adjustments pursuant to the terms of the warrants issued as

part of the Company’s Initial Public Offering (the “IPO Warrants”), to purchase up to 403,504 Ordinary Shares

to certain qualified buyers, as defined in the IPO Warrants. The term of each Additional Warrant is five years from the issuance date.

Each Additional Warrant holder receives semi-annual payments equal to approximately 2.3% of the Company’s gross revenues, calculated

for the first and second six-month fiscal periods, shared pro rata among qualified holders (“Revenue Sharing Payment”).

As of June 30, 2024, the Revenue Sharing Payment was equal to approximately 2.3% of the Company’s revenues for the six months ended

June 30, 2024. The Company determined that the Additional Warrants preclude equity classification due to the Revenue Sharing Payment feature.

As such, the Additional Warrants were classified as a derivative liability. The derivative liability is recorded at fair value and amounted

to $922 thousand as of June 30, 2024.

Additionally, the revenue forecast over the life

of the Additional Warrants is a significant input in determining the price of the Additional Warrants as of June 30, 2024.

Series A Warrants

As part of the Private Placement, the Company issued Series A Warrants

to purchase up to an aggregate of 3,380,586 Ordinary Shares at an exercise price of $2.69 per Ordinary Share (subject to certain anti-dilution

and share combination event protections) as of the Issuance Date. Following effectiveness of the Resale Registration Statement, on March

11, 2024, the Series A Warrants are exercisable into an aggregate of 13,373,208 Ordinary Shares at an exercise price of $0.68 per Ordinary

Share (subject to certain anti-dilution and share combination event protections). The Series A Warrants were immediately exercisable,

and set to expire within sixty-six (66) months from the date of issuance. According to terms of the Series A Warrants, in an event of

a Dilutive Issuance (as defined in the Series A Warrant) or a Share Combination Event (as defined in the Series A Warrant), if the lowest

share price during the five consecutive trading days commencing on the date on which the Share Combination Event is effected is less than

the exercise price per Ordinary Share (“Exercise Price”), and the total exercise price will be reduced and the number

of Series A Warrant shares issuable hereunder shall be increased in such that the aggregate exercise price payable hereunder, after taking

into account the decrease in the Exercise Price, shall be equal to the aggregate Exercise Price on the issue date.

The Company determined that the Series A Warrants

preclude equity classification due to the anti-dilutive protection feature. As such, the Series A Warrants were classified as a derivative

liability. The derivative liability is recorded at fair value and amounted to $5,484 thousand as of June 30, 2024.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 7 — DERIVATIVE LIABILITIES

(cont.)

The following table presents changes in the fair

value of the derivative Series A Warrants and the Additional Warrants liability during the period (in thousands)

| | |

Series A Warrants | | |

Additional

Warrants | | |

Total | |

| | |

| | |

| | |

| |

| Balance as of December 31, 2023 | |

| - | | |

| 1,375 | | |

| 1,375 | |

| Issuance on January 29, 2024 | |

| 4,301 | | |

| - | | |

| 4,301 | |

| Change in fair value | |

| 1,183 | | |

| (453 | ) | |

| 730 | |

| Balance as of June 30, 2024 | |

| 5,484 | | |

| 922 | | |

| 6,406 | |

The following table lists the significant unobservable

inputs used for calculation of fair value of the Additional Warrants:

| | |

June 30,

2024 | | |

December 31,

2023 | |

| Expected volatility | |

| 121.91 | % | |

| 101.39 | % |

| Exercise price | |

$ | 14.14 | | |

| 14.14 | |

| Share price | |

$ | 0.30 | | |

| 3.05 | |

| Risk-free interest rate | |

| 4.47 | % | |

| 3.93 | % |

| Dividend yield | |

| - | | |

| - | |

| Expected life | |

| 3.41 | | |

| 3.91 | |

| Weighted average cost of capital (WACC) | |

| 20.7 | % | |

| 20.4 | % |

The following table lists the significant unobservable inputs used

for calculation of fair value of Series A Warrants:

| | |

June 30,

2024 | |

| Expected volatility | |

| 125.6 | % |

| Exercise price | |

$ | 0.68 | |

| Share price | |

$ | 0.30 | |

| Risk-free interest rate | |

| 4.33 | % |

| Dividend yield | |

| - | |

| Expected life | |

| 5.08 | |

NOTE 8 — FINANCIAL EXPENSES (INCOME), NET

| | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

U.S. dollars in thousands | |

| | |

| | |

| |

| Change in fair value of derivative liabilities | |

| 730 | | |

| (341 | ) |

| Exchange rate differences | |

| 20 | | |

| 102 | |

| Interest income | |

| (60 | ) | |

| (4 | ) |

| Issuance costs of financial instruments classified as derivative liabilities | |

| 603 | | |

| - | |

| Revaluation of securities -fair value through profit or loss | |

| 57 | | |

| 90 | |

| Other finance expenses | |

| 17 | | |

| 5 | |

| | |

| 1,367 | | |

| (148 | ) |

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 9 — RELATED PARTIES — TRANSACTIONS

AND BALANCES

| a. | Transactions

with interested and related parties: |

| | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

U.S. dollars in thousands | |

| Labor cost and related expenses (included in general and administrative) (c1) | |

| 140 | | |

| 133 | |

| Inventory storage (included in cost of sale) (c2) | |

| 207 | | |

| 313 | |

| Consulting fees (included in general and administrative) (c2) | |

| 78 | | |

| 95 | |

| Consulting fees (included in general and administrative) (c3) | |

| 120 | | |

| - | |

| Other income (c4) | |

| (60 | ) | |

| (158 | ) |

| Revenue Sharing Payment (included in general and administrative) (c5) | |

| 21 | | |

| 19 | |

| | |

| 506 | | |

| 402 | |

| | b. | Balances with interested and related parties: |

| | |

Period ended | |

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

U.S. dollars in thousands | |

| ASSETS: | |

| | |

| |

| Related parties (c4) | |

| 53 | | |

| - | |

| | |

| 53 | | |

| - | |

| LIABILITIES: | |

| | | |

| | |

| Related parties (c7) | |

| 31 | | |

| 66 | |

| Chief executive officer salary (included in other account payable) (c1) | |

| 19 | | |

| 18 | |

| Revenue Sharing Payment (included in other account payable) (c5) | |

| 21 | | |

| 21 | |

| Liability to SciSparc (included in other account payable) (c6) | |

| - | | |

| 98 | |

| Liability to Xylo (included in other account payable) (c3) | |

| 20 | | |

| - | |

| Liability to supplier (included in trade payable) (c2) | |

| 33 | | |

| 69 | |

| Liability to consultant (included in other account payable and trade payable) (c2) | |

| 18 | | |

| 17 | |

| | |

| 142 | | |

| 289 | |

| c. | Additional

information: |

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 9 — RELATED PARTIES — TRANSACTIONS

AND BALANCES (cont.)

| 2. | On October 26, 2022, the Company and Pure Capital entered into a consulting agreement (the “Pure Capital Consulting Agreement”) pursuant to which Pure Capital will provide consultancy services to the Company for a monthly fee of NIS 57.75 thousand (approximately $16 thousand). Pursuant to the Pure Capital Consulting Agreement, Pure Capital is also entitled during the term of the Pure Capital Consulting Agreement to the following payments: (i) an amount equal to 7% of the gross proceeds paid to the Company in connection with any exercise of warrants, whether or not currently outstanding, and (ii) 8% of the total consideration paid in connection with any purchase of a new brand, businesses, or similar events initiated or assisted by Pure Capital and approved by the Chief Executive Officer and Chairman of the board of directors based on the Pure Capital Consulting Agreement. In March 2023, the Company paid Pure Capital $352 thousand in accordance with the terms of the Pure Capital Consulting Agreement. The consultancy fees were paid in consideration for the investments in Fort and SciSparc. Additionally, on October 26, 2022, the Company and Pure NJ Logistics LLC, a company wholly-owned by Pure Capital and a director of the Company, entered into a warehouse storage agreement located in New Jersey. |

On February 5, 2024, the Company paid

Pure Capital $100 thousand pursuant to the terms of Pure Capital Consulting Agreement in connection with the Company’s initial public

offering.

On September, 4, 2024, the Company and

Pure Capital signed an amendment to the Pure Capital Consulting Agreement. According to the amendment Pure Capital will be entitled to

a special bonus upon the consummation of an offering of securities of the Company, including proceeds received from exercise of warrants

issued, according to the below distribution, which is based on gross proceeds: (i) up to $2.5 million, Pure Capital will be entitled to

a bonus payment of $50,000; (ii) between $2.5 million and $5 million, Pure Capital will be entitled to a bonus payment of $100 thousand;

(iii) between $5 million and $10 million, Pure Capital will be entitled to a bonus payment of $200 thousand; (iv) above $10 million, Pure

Capital will be entitled to a bonus payment of $300 thousand, instead of 7% of the gross proceed paid to the Company.

JEFFS’ BRANDS LTD

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 9 — RELATED PARTIES — TRANSACTIONS

AND BALANCES (cont.)

NOTE 10 — SUBSEQUENT EVENTS

| | a. | On July 1, 2024, Fort entered into a lease agreement for a new warehouse in the UK. The lease agreement is for a period of five years and the annual rent fees £52,000. |

| | | |

| | b. | On July 17, 2024, the shareholders of the Company approved at the annual general meeting the following: (i) the re-election of the directors Liron Carmel and Eliyahu Yoresh until the close of the annual general meeting to be held in 2027, or earlier by resignation or removal, as applicable, (ii) the adoption of a new compensation policy for the Company’s executive officers and directors, (iii) the amendment to the articles of association of the Company, adoption of new compensation terms to each of the chairman and the chief executive officer of the Company, (iv) a reverse split of the Company’s issued and outstanding Ordinary Shares in a range between 1:2 and 1:22, to be affected at the discretion of, and at such ratio and on such date to be determined by, the board of directors and (v) the re-appointment of Brightman Almagor Zohar & Co., a firm in the Deloitte Global Network, as the Company’s independent registered public accounting firm for the year ending December 31, 2024 and until the next annual general meeting of shareholders. |

false

--12-31

Q2

2024-06-30

0001885408

0001885408

2024-01-01

2024-06-30

0001885408

2024-06-30

0001885408

2023-12-31

0001885408

2023-01-01

2023-06-30

0001885408

us-gaap:CommonStockMember

2023-12-31

0001885408

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001885408

us-gaap:RetainedEarningsMember

2023-12-31

0001885408

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001885408

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001885408

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001885408

us-gaap:CommonStockMember

2024-06-30

0001885408

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001885408

us-gaap:RetainedEarningsMember

2024-06-30

0001885408

us-gaap:CommonStockMember

2022-12-31

0001885408

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001885408

us-gaap:RetainedEarningsMember

2022-12-31

0001885408

2022-12-31

0001885408

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001885408

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001885408

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001885408

us-gaap:CommonStockMember

2023-06-30

0001885408

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001885408

us-gaap:RetainedEarningsMember

2023-06-30

0001885408

2023-06-30

0001885408

2023-02-23

2023-02-23

0001885408

2024-01-29

2024-01-29

0001885408

jfbr:SciSparcLtdMember

2023-02-23

0001885408

jfbr:SciSparcConsultingAgreementMember

2024-01-01

2024-06-30

0001885408

jfbr:SciSparcConsultingAgreementMember

2023-11-01

2023-11-30

0001885408

jfbr:JeffsBrandsHoldingMember

2024-06-30

0001885408

jfbr:WellutionAgreementMember

2023-03-22

0001885408

jfbr:SciSparcLtdMember

2023-03-22

0001885408

2023-09-28

2023-09-28

0001885408

jfbr:SciSparcLtdMember

2023-03-22

2023-03-22

0001885408

2023-03-22

2023-03-22

0001885408

jfbr:WellutionAgreementMember

2024-01-01

2024-06-30

0001885408

jfbr:WellutionAgreementMember

2023-02-23

2023-06-30

0001885408

us-gaap:PrivatePlacementMember

2024-01-25

2024-01-25

0001885408

jfbr:PreFundedWarrantsMember

2024-01-25

0001885408

jfbr:SeriesAWarrantsMember

2024-01-25

0001885408

2024-01-25

0001885408

jfbr:SeriesBWarrantsMember

2024-01-25

0001885408

jfbr:PureCapitalLtdMember

2024-01-01

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

jfbr:ResaleRegistrationStatementMember

2024-01-25

0001885408

jfbr:SeriesAWarrantsMember

2024-03-11

0001885408

jfbr:SeriesBWarrantsMember

2024-03-11

0001885408

2024-03-11

0001885408

jfbr:PreFundedWarrantsMember

2024-06-30

0001885408

jfbr:SeriesBWarrantsMember

2024-06-30

0001885408

2024-04-25

2024-04-25

0001885408

us-gaap:CommonStockMember

2024-04-25

2024-04-25

0001885408

2023-03-09

0001885408

jfbr:FortAcquisitionMember

2023-03-09

0001885408

2024-02-29

2024-02-29

0001885408

jfbr:FortSPAMember

2024-02-29

2024-02-29

0001885408

2024-03-09

0001885408

2023-03-09

2023-03-09

0001885408

2023-09-20

2023-09-20

0001885408

jfbr:BrandsMember

2024-06-30

0001885408

jfbr:BrandsMember

2023-12-31

0001885408

us-gaap:CommonStockMember

2022-11-28

0001885408

jfbr:AdditionalWarrantsMember

2022-11-28

0001885408

2022-11-28

2022-11-28

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:PrivatePlacementMember

2024-06-30

0001885408

us-gaap:CommonStockMember

us-gaap:PrivatePlacementMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

2024-01-01

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

2023-12-31

0001885408

jfbr:AdditionalWarrantsMember

2023-12-31

0001885408

jfbr:AdditionalWarrantsMember

2024-01-01

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2023-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2023-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2023-06-30

0001885408

jfbr:AdditionalWarrantsMember

jfbr:MeasureInputWeightedAverageCostOfCapitalMember

2024-06-30

0001885408

jfbr:AdditionalWarrantsMember

jfbr:MeasureInputWeightedAverageCostOfCapitalMember

2023-06-30

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-06-30

0001885408

jfbr:SeriesAWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2024-06-30

0001885408

srt:ChiefExecutiveOfficerMember

2024-01-01

2024-06-30

0001885408

2022-10-10

2022-10-26

0001885408

2023-03-01

2023-03-31

0001885408

jfbr:PureCapitalLtdMember

us-gaap:IPOMember

2024-02-05

2024-02-05

0001885408

2024-04-30

2024-04-30

0001885408

jfbr:SciSparcConsultingAgreementMember

2023-03-22

2023-03-22

0001885408

2023-11-01

2023-11-30

0001885408

jfbr:XyloTechnologiesLtdMember

2024-04-01

2024-04-30

0001885408

jfbr:PureCapitalLtdMember

2024-04-01

2024-04-30

0001885408

jfbr:XyloTechnologiesLtdMember

2024-06-30

0001885408

jfbr:PureCapitalLtdMember

2024-06-30

0001885408

jfbr:SciSparcConsultingAgreementMember

2024-01-31

2024-01-31

0001885408

us-gaap:RelatedPartyMember

us-gaap:RelatedPartyMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

us-gaap:RelatedPartyMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

jfbr:ChiefExecutiveOfficerSalaryMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

jfbr:ChiefExecutiveOfficerSalaryMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

jfbr:RevenueSharingPaymentMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

jfbr:RevenueSharingPaymentMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToSciSparcMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToSciSparcMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToXyloMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToXyloMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToSupplierMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToSupplierMember

2023-12-31

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToConsultantMember

2024-06-30

0001885408

us-gaap:RelatedPartyMember

jfbr:LiabilityToConsultantMember

2023-12-31

0001885408

us-gaap:SubsequentEventMember

2024-07-01

2024-07-01

0001885408

srt:MinimumMember

srt:BoardOfDirectorsChairmanMember

us-gaap:SubsequentEventMember

2024-07-01

2024-07-17

0001885408

srt:MaximumMember

srt:BoardOfDirectorsChairmanMember

us-gaap:SubsequentEventMember

2024-07-01

2024-07-17

0001885408

srt:MinimumMember

srt:ChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2024-07-01

2024-07-17

0001885408

srt:MaximumMember

srt:ChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2024-07-01

2024-07-17

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:shares

xbrli:pure

iso4217:GBP

iso4217:ILS

Exhibit 99.2

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

For the Six Months

Ended June 30, 2024.

Cautionary Note Regarding Forward-Looking Statements

Certain

information included herein may be deemed to be “forward-looking statements”. Forward-looking statements are often characterized

by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,”

“estimate,” “continue,” “believe,” “should,” “intend,” “project”

or other similar words, but are not the only way these statements are identified.

These

forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements

that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating

to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that

address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking

statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements

on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current

conditions, expected future developments and other factors they believe to be appropriate.

Important

factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking

statements include, among other things:

| |

● |

our ability to raise capital through the issuance of additional securities; |

| |

|

|

| |

● |

our belief that our existing cash and cash equivalents as of June 30, 2024, will be sufficient to fund our operations through the next twelve months; |

| |

|

|

| |

● |

our ability to adapt to significant future alterations in Amazon’s policies; |

| |

|

|

| |

● |

our ability to sell our existing products and grow our brands and product offerings, including by acquiring new brands and expanding into new territories; |

| |

|

|

| |

● |

our ability to meet our expectations regarding the revenue growth and the demand for e-commerce; |

| |

|

|

| |

● |

our ability to enter into definitive agreements for our current letters of intent and term sheet; |

| |

|

|

| |

● |

the overall global economic environment; |

| |

|

|

| |

● |

the impact of competition and new e-commerce technologies; |

| |

|

|

| |

● |

general market, political and economic conditions in the countries in which we operate; |

| |

|

|

| |

● |

projected capital expenditures and liquidity; |

| |

|

|

| |

● |

the impact of competition and new e-commerce technologies; |

| |

|

|

| |

● |

our ability to retain key executive members; |

| |

|

|

| |

● |

the impact of possible changes in Amazon’s policies and terms of use; |

| |

● |

projected capital expenditures and liquidity; |

| |

● |

our expectations regarding our tax classifications; |

| |

|

|

| |

● |

how long we will qualify as an emerging growth company or a foreign private issuer; |

| |

|

|

| |

● |

interpretations of current laws and the passages of future laws; |

| |

|

|

| |

● |

changes in our strategy; |

| |

|

|

| |

● |

general market, political and economic conditions in the countries in which we operate including those related to recent unrest and actual or potential armed conflict in Israel and other parts of the Middle East, such as the Israel-Hamas war; and |

| |

|

|

| |

● |

litigation. |

The foregoing list is intended

to identify only certain of the principal factors that could cause actual results to differ. For a more detailed description of the risks

and uncertainties affecting our company, reference is made to our Annual Report on Form 20-F for the year ended December 31, 2023, or

our Annual Report, filed with the Securities and Exchange Commission, or the SEC, on April 1, 2024, and the other risk factors discussed

from time to time by our company in reports filed or furnished to the SEC.

Except as otherwise required

by law, we undertake no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events.

General

Introduction

Unless indicated otherwise

by the context, all references in this report to “Jeffs’ Brands”, the “Company”,

“we”, “us” or “our” are to Jeffs’ Brands Ltd. When the following terms and abbreviations

appear in the text of this report, they have the meanings indicated below:

| |

● |

“dollars” or “$” means United States dollars; and |

| |

|

|

| |

● |

“NIS” means New Israeli Shekels. |

You should read the following

discussion and analysis in conjunction with our unaudited consolidated financial statements for the six months ended June 30, 2024, and

notes thereto, and together with our audited consolidated financial statements for the year ended December 31, 2023 and notes thereto

included in our Annual Report filed with the SEC.

Unless otherwise indicated,

dollars are in thousands.

Overview

We

are an e-commerce consumer products goods, or CPG, company, operating primarily on Amazon. We were incorporated in Israel in March 2021,

under the name Jeffs’ Brands Ltd. Together with five of our wholly-owned subsidiaries – Smart Repair Pro, Top Rank Ltd, or

Top Rank, Fort Products LLC, or Fort, and Jeffs’ Brands Holdings Inc., or Jeffs’ Brands Holdings, we operate online stores

for the sale of various consumer products on the Amazon marketplace online marketplace, or Amazon, utilizing the fulfillment by Amazon,

or the FBA model.

In

addition to executing the FBA business model, we utilize internal methodologies to analyze sales data and patterns on Amazon in order

to identify existing stores, niches and products that have the potential for development and growth, and for maximizing sales of existing

proprietary products. We also use our own skills, know-how and profound familiarity with the Amazon algorithm and all the tools that the

FBA platform FBA has to offer. In some circumstances we scale the products and improve them.

Comparison of the Six Months Ended June 30,

2024, and 2023

Results of Operations

The

following table summarizes our results of operations for the periods presented:

| | |

Six Months Ended

June 30, | |

| U.S. dollars in thousands | |

2024 | | |

2023 | |

| Revenues | |

| 6,198 | | |

| 3,871 | |

| Cost of sales | |

| 5,441 | | |

| 3,498 | |

| Gross profit | |

| 757 | | |

| 373 | |

| Sales and marketing | |

| 603 | | |

| 342 | |

| General and administrative | |

| 2,413 | | |

| 2,067 | |

| Equity losses | |

| 245 | | |

| 89 | |

| Other income, net | |

| (60 | ) | |

| (158 | ) |

| Operating loss | |

| (2,444 | ) | |

| (1,967 | ) |

| Financial expenses (income), net | |

| 1,367 | | |

| (148 | ) |

| Tax expenses | |

| 64 | | |

| 9 | |

| Net loss for the period | |

| (3,875 | ) | |

| (1,828 | ) |

Revenues

Our revenues consist of revenue

which mainly derived from sales on Amazon marketplace.

Our revenues for the six months

ended June 30, 2024, were $6,198 compared to $3,871 for the six months ended June 30, 2023. This

represents an increase of $2,327 or 60%. The increase was primarily attributable to the increase in revenues generated by

Fort of approximately $2,410, during the six months ended June 30, 2024, compared to the period beginning on March 9, 2023 (the date on

which we acquired Fort) until June 30, 2023, partially offset by a decrease in revenues of $85 for our remaining brands.

Cost of goods sold

Our cost of goods sold consist

of the purchase of finished goods, freight, cost of commissions to Amazon and other e-commerce platforms, salary and change in inventory.

The following table sets forth

the breakdown of cost of goods sold for the periods set forth below:

| | |

Six Months Ended

June 30, | |

| U.S. dollars in thousands | |

2024 | | |

2023 | |

| Purchases of finished goods and changes in inventory | |

$ | 1,971 | | |

$ | 1,270 | |

| Freight | |

| 310 | | |

| 158 | |

| Storage | |

| 264 | | |

| 363 | |

| Salaries | |

| 71 | | |

| 48 | |

| Cost of commissions | |

| 2,825 | | |

| 1,659 | |

| Total | |

| 5,441 | | |

| 3,498 | |

Our cost of goods sold for

the six months ended June 30, 2024, was $5,441 compared to $3,498 for the six months ended June 30, 2023. This represents an increase

of $1,943 or 58%. The increase was primarily attributable to: (i) an increase in purchases of finished goods and changes in inventory

of $701, associated with the increase in revenues generated by Fort during the six months ended June 30, 2024, compared to the period

beginning on March 9, 2023 (the date on which we acquired Fort) until June 30, 2023; (ii) a decrease in storage expenses of $99 due to

a decrease in inventory kept in warehouses; (iii) an increase in cost of commissions, mainly paid to Amazon, of $1,166 due to an increase

in sales; (iv) an increase in freight charges of $152 attributable to purchases of inventory from suppliers abroad by Fort; and (v) an

increase in shipment costs as a result of the attacks conducted by the Houthi movement in Yemen against marine vessels traversing the

Red Sea and thought to either be in route towards Israel or to be partly owned by Israeli businessmen.

Gross Profit

Our gross profit for the six

months ended June 30, 2024 was $757 compared to gross profit of $373 for the six months ended June 30, 2023. This

represents an increase of $384, or 102.9%. The increase was primarily due to an increase in revenues offset by increase in

cost of sales, as described above.

Operating Expenses, net

Our current operating expenses

consist of four components: marketing and sales expenses: general and administrative expenses; equity losses; and other income.

Marketing and Sales Expenses

Our marketing and sales expenses

consist primarily of Amazon marketing fees, consultant fees and other marketing and sales expenses.

The following table sets forth

the breakdown of marketing and sales expenses for the periods set forth below:

| | |

Six Months Ended

June 30, | |

| U.S. dollars in thousands | |

2024 | | |

2023 | |

| Advertising | |

$ | 567 | | |

$ | 330 | |

| Other | |

| 36 | | |

| 12 | |

| Total | |

| 603 | | |

| 342 | |

Our marketing and sales expenses

for the six months ended June 30, 2024 were $603 compared to expenses of $342 for the six months ended June 30, 2023, representing an

increase of $261, or 76%. The increase was primarily attributable to the increase in our advertising costs on Amazon.

General and Administrative Expenses

Our general and administrative

expenses consist primarily of salaries and related expenses, professional service fees, legal, amortization of intellectual property assets

and other general and administrative expenses.

The following table sets forth

the breakdown of our general and administrative expenses for the periods set forth below:

| | |

Six Months Ended

June 30, | |

| U.S. dollars in thousands | |

2024 | | |

2023 | |

| Payroll and related expenses | |

$ | 641 | | |

$ | 500 | |

| Subcontractors | |

| 7 | | |

| 46 | |

| Professional services and consulting fees | |

| 731 | | |

| 547 | |

| Director fees | |

| 143 | | |

| 158 | |

| Rent and office maintenance | |

| 99 | | |

| 71 | |

| Amortization of intangible assets | |

| 390 | | |

| 350 | |

| Insurance | |

| 136 | | |

| 196 | |

| Other expenses | |

| 266 | | |

| 199 | |

| Total | |

| 2,413 | | |

| 2,067 | |

Our general and administrative expenses for the six months ended June

30, 2024 were $2,413 compared to $2,067 for the six months ended June 30, 2023, representing an increase of $346, or 16.7%. The increase

was primarily attributable to an increase in the number of employees of the Company, payments to consultants and increase in revenue sharing

costs due to an increase in the Company’s revenue.

Other Income

Our other income for the six

months ended June 30, 2024 was $60 compared to $158 for the six months ended June 30, 2023. The decrease is primarily attributable to

a decrease in management fees paid to SciSparc Nutraceuticals Inc. from $20 to $10, effective as of November 2023, pursuant to the amendment,

dated as of September 4, 2024 to our existing agreement with SciSparc Nutraceuticals Inc.

Share of Losses Accounted for at Equity

Our share of losses accounted

for as equity for the six months ended June 30, 2024 was $245 compared to $89 for the six months ended June 30, 2023. The increase was

attributable to losses derived from our investment in SciSparc Nutraceuticals Inc.

Operating Loss

Our operating loss for the

six months ended June 30, 2024 was $2,444, compared to operating loss of $1,967 for the six months ended June 30, 2023, an increase of

$477, or 24%. The increase was attributable to the changes in revenues, cost of sales and operating expenses, as described above.

Financial expenses (income),

net

Our financial expenses, net was $1,367 for the six months ended June 30, 2024, compared to financial income, net of $148 for the six months

ended June 30, 2023, an increase of $1,515. The increase in financial expenses, net was primarily attributable to an increase in losses

mainly in connection with the January 2024 PIPE (as defined below), Series A Warrants revaluation losses of approximately $1,071, issuance

cost on derivative liabilities of $603 offset by an increase of $56 in interest from short term deposit, and a decrease in exchange rate

fluctuations of $82, mainly attributed to lower amounts of NIS held in bank accounts.

Net loss for the period

Our net loss for the six months

ended June 30, 2024 was $3,875, compared to net loss of $1,828 for the six months ended June 30, 2023, an increase of $2,047, or 112%.

The increase was primarily attributable to an increase in operating expenses and a decrease in gross profit, as described above.

Critical Accounting Estimates

We

describe our significant accounting policies more fully in Note 2 to our unaudited financial statements for the six months ended June

30, 2024. There have been no material changes to our critical accounting policies as described in our Annual Report other than as described

in Note 2 to our unaudited consolidated financial statements for the six months ended June 30, 2024. We believe that the accounting policies

described below and in Note 2 to unaudited financial statements for the six months ended June 30, 2024, are critical in order to fully

understand and evaluate our financial condition and results of operations.

The

preparation of financial statements and related disclosures in conformity with U.S. GAAP requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial

statements, and income and expenses during the periods reported. Actual results could materially differ from those estimates.

Liquidity and Capital

Resources

Overview

Since Jeffs’ Brands’

inception in March 2021 to date, we have financed our operations primarily through funds we received from loans and proceeds from sales

on Amazon (after deducting FBA fees and advertising fees) and the issuance of ordinary shares, no par value per share, or Ordinary Shares,

and warrants. As of June 30, 2024 and 2023, we had approximately $2,815 and $2,153, respectively, in cash and cash equivalents.

The table below presents our

cash flow for the periods indicated:

| | |

Six Months Ended

June 30, | |

| U.S. dollars in thousands | |

2024 | | |

2023 | |

| Net cash used in operating activities | |

$ | (3,534 | ) | |

$ | (1,169 | ) |

| Net cash used in investing activities | |

| (436 | ) | |

| (4,683 | ) |