Kentucky First Federal Bancorp Announces Retirement of Tony D. Whitaker, Chairman of the Board

06 August 2024 - 6:27AM

Kentucky First Federal Bancorp (Nasdaq: KFFB) the holding company

for First Federal Savings and Loan Association of Hazard, Kentucky

and First Federal Savings Bank of Kentucky, Frankfort, Kentucky,

announced today that Tony D. Whitaker, Chairman of the Board of

Kentucky First Federal Bancorp (the “Company”) is retiring from his

position as Company Chairman, as well as Chairman of the Board of

the Company’s subsidiary, First Federal Savings Bank of Kentucky.

Mr. Whitaker’s retirement is effective August 1, 2024.

The Company’s President and Chief Executive Officer Don D.

Jennings stated, “It is with a mixture of joy and sadness that we

announce the retirement of our long-time Chairman and friend, Tony

Whitaker. Tony has served as Chairman since the Company’s inception

in 2005, and served as the Company’s Chief Executive Officer from

2005 through 2012. He has also previously served as Chief Executive

Officer of First Federal Savings and Loan of Hazard from 1997

through 2012, and served on the bank’s board since 1993. His

banking career dates back over 50 years with additional tenures at

First Federal Savings Bank of Richmond and Great Financial Bank.

While Tony will be missed in the boardroom, we are excited that he

will have the opportunity to enjoy a well-earned retirement.”

Mr. Whitaker, 78, stated, “After more than 50 years in banking,

it is finally time for me to retire. I will always be supportive of

Kentucky First Federal Bancorp, of its two banks, and especially of

my adopted hometown of Hazard, Kentucky.” Mr. Jennings

continued, “On behalf of the board of Kentucky First Federal, we

express the Company’s gratitude for Tony’s many years of dedicated

service. We look forward to continuing our deep friendship and to

sharing our commitment to the communities served by the Company and

its two banks.”

This press release may contain certain statements that are not

historical facts and are considered “forward-looking statements”

under the Private Securities Litigation Reform Act of 1995, that

are subject to certain risks and uncertainties. These

forward-looking statements may be identified by the use of words

such as “believe,” “expect,” “anticipate,” “plan,” “estimate,”

“intend” and “potential,” or words of similar meaning, or future or

conditional verbs such as “should,” “could,” or “may.”

Forward-looking statements include statements of our goals,

intentions and expectations; statements regarding our business

plans, prospects, growth and operating strategies; statements

regarding the quality of our loan and investment portfolios; and

estimates of our risks and future costs and benefits. Kentucky

First Federal Bancorp’s actual results, performance or achievements

may materially differ from those expressed or implied in the

forward-looking statements. Risks and uncertainties that could

cause or contribute to such material differences include, but are

not limited to general economic conditions; prices for real estate

in the Company’s market areas; the interest rate environment and

the impact of the interest rate environment on our business,

financial condition and results of operations; our ability to

successfully execute our strategy to increase earnings, increase

core deposits, reduce reliance on higher cost funding sources and

shift more of our loan portfolio towards higher-earning loans; our

ability to pay future dividends and if so at what level; our

ability to receive any required regulatory approval or

non-objection for the payment of dividends from First Federal

Savings and Loan Association of Hazard and First Federal Savings

Bank of Kentucky to the Company or from the Company to

shareholders; competitive conditions in the financial services

industry; changes in the level of inflation; changes in the demand

for loans, deposits and other financial services that we provide;

the possibility that future credit losses may be higher than

currently expected; competitive pressures among financial services

companies; the ability to attract, develop and retain qualified

employees; our ability to maintain the security of our data

processing and information technology systems; the outcome of

pending or threatened litigation, or of matters before regulatory

agencies; changes in law, governmental policies and regulations,

rapidly changing technology affecting financial services, and the

other matters mentioned in Item 1A of the Company’s Annual Report

on Form 10-K for the year ended June 30, 2023 and in the Company’s

Quarterly Report on Form 10-Q for the period ended December 31,

2023 and for the period ended September 30, 2023. Except as

required by applicable law or regulation, the Company does not

undertake the responsibility, and specifically disclaims any

obligation, to release publicly the result of any revisions that

may be made to any forward-looking statements to reflect events or

circumstances after the date of the statements or to reflect the

occurrence of anticipated or unanticipated events.

Kentucky First Federal Bancorp is the parent company of First

Federal Savings and Loan Association, which operates one banking

office in Hazard, Kentucky and First Federal Savings Bank of

Kentucky, which operates six banking offices in Kentucky, including

three in Frankfort, two in Danville, and one in Lancaster. Kentucky

First Federal Bancorp shares are traded on the NASDAQ National

Market under the symbol KFFB. At June 30, 2024, the Company had

approximately 8,086,715 shares outstanding of which approximately

58.5% was held by First Federal MHC.

Contact:

Kentucky First

Federal BancorpDon Jennings, President (502) 223-1638

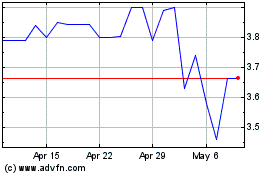

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Feb 2025 to Mar 2025

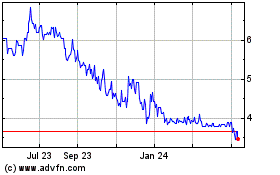

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Mar 2024 to Mar 2025