0001372514false00013725142023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 8, 2023

KIORA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | |

| 001-36672 | 98-0443284 |

| (Commission File Number) | (IRS Employer Identification No.) |

332 Encinitas Blvd.

Suite 102

Encinitas, CA 92024

(858) 224-9600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Stock, $0.01 par value | | KPRX | | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Conditions.

On August 8, 2023, Kiora Pharmaceuticals, Inc. (the “Company”) issued a press release announcing financial results for the first quarter ended June 30, 2023 and an update on clinical development progress. A copy of the release is attached as Exhibit 99.1.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section. This information will not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the registrant specifically incorporates them by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Title |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant hereby undertakes to furnish copies of any of the omitted schedules and exhibits upon request by the U.S. Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| KIORA PHARMACEUTICALS, INC. |

| | |

| | |

| By: | /s/ Melissa Tosca |

| | Melissa Tosca |

| | Executive Vice President of Finance |

| | (Principal financial and accounting officer) |

| | |

| Date: August 8, 2023 |

Exhibit 99.1

Kiora Pharmaceuticals Announces Q2 2023 Earnings and Business Update, Highlighting Pipeline Updates and Clinical Development Progress

–Positive Preliminary Data Reported in Q2 Demonstrated Clear Clinical Proof-of-Concept of KIO-301 in the Ongoing Phase 1 Study in Retinitis Pigmentosa Supporting Advancement to Planned Higher Doses with Full Topline Results Expected in Q4 2023

–Data Supports Hypothesized Mechanism of Action of KIO-301, Opening Potential to Treat Other Orphan Retinal Disease Programs, Including Choroideremia and Stargardt’s Disease

–Management Sharpens Clinical Development Focus on Rare Retinal Diseases and Will Seek Partnerships to Advance its Promising but Non-Core Anterior Segment Therapeutic Applications

Encinitas, CA – August 8, 2023 -- Kiora Pharmaceuticals, Inc. (NASDAQ: KPRX) (“Kiora” or the “Company”) today announced its second quarter 2023 financial results, reported on the progress of its clinical development pipeline, and provided an update on the Company’s sharpened strategic focus. The most notable milestone of the second quarter was the reported preliminary data from the ABACUS Phase 1b clinical trial in patients with Retinitis Pigmentosa. The data clearly demonstrated that the lowest dose of KIO-301 is safe and tolerable while driving positive objective and subjective impact on vision for the initial trial participants. This reinforced the Company’s plans to complete enrollment using the higher doses of KIO-301. The Company plans to complete all dosing in Q3 and expects to announce topline results across all patients and doses at an upcoming ophthalmic medical conference in the fourth quarter.

The ABACUS study’s preliminary results, along with subsequent internal analysis of additional data, were a major contributor to the Company’s decision to further sharpen its clinical development focus exclusively on rare retinal diseases. Specifically, the Company plans to expand clinical development of KIO-301 to include Choroideremia and Stargardt's Disease. These diseases, like Retinitis Pigmentosa, result in the degeneration of retinal photoreceptors but preserve the downstream retinal ganglion cells, which are the target of KIO-301’s mechanism-of-action. All three indications represent rare, orphan diseases for which there are no available treatments. As a result, the Company may pursue cost-effective and expedited paths to market.

As part of this new focus, Kiora will shift clinical development resources allocated for KIO-101 to treat the ocular presentation of Rheumatoid Arthritis (OPRA) to KIO-104, for the treatment of Posterior Non-Infectious Uveitis, a rare T-cell-mediated, intraocular inflammatory disease. KIO-104, which uses the same active compound in KIO-101 but formulated for intravitreal delivery, is ideally suited to potentially suppress overactive T-cell activity to treat the underlying condition. Data from a previous Phase 1b/2a study, reported in October 2022, showed that a single injection of KIO-104 decreased intraocular inflammation in a dose-dependent fashion and improved visual acuity significantly during the duration of the study. Further, there is evidence of reduced Cystoid Macular Edema from baseline.

Continued development of the anterior segment applications for KIO-101 and KIO-201 will be dependent on potential strategic partnerships. This will allow Kiora to retain the potential upside while working with a partner who has the resources to dedicate to developing and ultimately commercializing these promising therapies.

"Our sharpened focus is due in large part to the preliminary results we’ve observed in the ABACUS study, which reaffirm we’re on the right path,” said Brian M. Strem, Ph.D., President and CEO of Kiora. “There’s a tremendous need for new treatments for RP, Choroideremia and Stargardt’s Disease and KIO-301 has the potential to treat all three in a similar fashion. This includes our newly planned extension of the ABACUS study to include additional RP and Choroideremia patients. By pursuing all three with the same therapeutic, we plan to realize efficiencies that can get a new therapy to patients as quickly as possible.”

Achieved and Upcoming Milestones:

The milestones that Kiora achieved in the first half of 2023 include the following:

•KIO-301: Reported initial results from ABACUS at the Association for Research in Vision and Ophthalmology (ARVO) Annual Meeting in Q2 2023

•Entered into a partnership with the Choroideremia Research Foundation to support strategic clinical development of KIO-301 in Choroideremia

•KIO-201: Reported results from a Phase 2 Persistent Corneal Epithelial Defect study at the ARVO Annual Meeting in Q2 2023

•Business: Raised $6.3 million in funding to extend runway into May 2024

•Business: Received $1.2 million of research tax incentives from Australia and Austria

•Business: Appointed Carmine Stengone to the Board of Directors

The Company anticipates achieving the following clinical and regulatory milestones:

•KIO-301: Complete dosing of high-dose cohort of ABACUS in Q3 2023

•KIO-301: Report topline results in RP from the ABACUS study in Q4 2023

•KIO-301: Discuss the development path for KIO-301 in RP with the FDA in a type 2 pIND meeting

•KIO-301: Initiate phase 2 trials for KIO-301 in RP, Choroideremia and Stargardt’s patients

•KIO-301: Pursue Orphan Drug Designations for KIO-301 for Choroideremia and Stargardt’s Disease

•KIO-104: Pursue Orphan Drug Designation for KIO-104 for Posterior Non-Infectious Uveitis

•KIO-104: Discuss the development path for KIO-104 in Posterior Non-Infectious Uveitis with the FDA in a type 2 pIND meeting

Financial Results

In the first half of 2023, research and development expenses were $1.8 million, compared to $1.3 million for the first half of 2022. Research and development expenses for the second quarter of 2023 were $1.4 million compared to $0.6 million for the second quarter of 2022. The increase was primarily due to clinical trial-related expenses.

General and administrative expenses for the first half of 2023 were $2.4 million compared to $3.5 million for the first half of 2022. General and administrative expenses for the second quarter of 2023 were $1.1 million, compared to $1.8 million in the second quarter of 2022. The reduction is attributable to reduced consulting fees, lower facilities costs due to the consolidation of offices, and lower personnel costs due to staffing optimization and benefit cost savings.

Net loss was $4.5 million for the first half of 2023 compared to $6.0 million for the first half of 2022. Net loss was $2.6 million for the second quarter of 2023 compared to $2.4 million for the second quarter of 2022. This decrease was primarily due to lower personnel and facilities expenses offset by an increased investment in clinical trial activities to support the advancement of KIO-301.

Kiora ended the quarter with $8.0 million in cash and cash equivalents. In June 2023, the Company received an additional $1.2 million in research tax credits related to development research that was performed in Australia and Austria. Additionally, Kiora may in the future draw on a $10 million equity line of credit (subject to certain limitations), of which there is up to approximately $9.6 million available.

About Kiora Pharmaceuticals

Kiora Pharmaceuticals is a clinical-stage biotechnology company developing and commercializing products for the treatment of orphan retinal diseases. KIO-301 is being developed for the treatment of Retinitis Pigmentosa, and Kiora also plans to develop KIO-301 for Choroideremia and Stargardt’s Disease. It is a molecular photoswitch that has the potential to restore vision in patients with inherited and/or age-related retinal degeneration. Kiora plans to develop KIO-104 for the treatment of posterior non-infectious uveitis. It is a next-generation, non-steroidal, immuno-modulatory and small molecule inhibitor of Dihydroorotate Dehydrogenase (DHODH) with what Kiora believes is best-in-class picomolar potency and a validated immune modulating mechanism (blocks T cell proliferation and proinflammatory cytokine release).

In addition to news releases and SEC filings, we expect to post information on our website, www.kiorapharma.com, and social media accounts that could be relevant to investors. We encourage investors to follow us on Twitter and LinkedIn as well as to visit our website and/or subscribe to email alerts.

Forward-Looking Statements

Some of the statements in this press release are "forward-looking" and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These "forward-looking" statements include statements relating to, among other things, the development and commercialization efforts and other regulatory or marketing approval efforts pertaining to Kiora's development-stage products, including KIO-301 and KIO-104, as well as the success thereof, with such approvals or success may not be obtained or achieved on a timely basis or at all, the potential ability of KIO-301 to restore vision in patients with RP, the expecting timing of enrollment, dosing and topline results for the ABACUS study, the ability to develop KIO-301 for Choroideremia and Stargardt's Disease and KIO-104 for posterior non-infectious uveitis, the ability to utilize strategic relationships to develop certain product candidates, Kiora’s ability to draw on its equity line of credit, and Kiora's ability to achieve the specific milestones described herein. These statements involve risks and uncertainties that may cause results to differ materially from the statements set forth in this press release, including, among other things, the ability to conduct clinical trials on a timely basis, the ability to obtain any required regulatory approvals, market and other conditions and certain risk factors described under the heading "Risk Factors" contained in Kiora's Annual Report on Form 10-K filed with the SEC on March 23, 2023, or described in Kiora's other public filings. Kiora's results may also be affected by factors of which Kiora is not currently aware. The forward-looking statements in this press release speak only as of the date of this press release. Kiora expressly disclaims any obligation or undertaking to release publicly any updates or revisions to such statements to reflect any change in its expectations with regard thereto or any changes in the events, conditions, or circumstances on which any such statement is based, except as required by law.

Contact

investors@kiorapharma.com

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

KIORA PHARMACEUTICALS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

98-0443284

|

| Entity File Number |

001-36672

|

| Entity Address, Address Line One |

332 Encinitas Blvd.

|

| Entity Address, Address Line Two |

Suite 102

|

| Entity Address, City or Town |

Encinitas

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92024

|

| City Area Code |

858

|

| Local Phone Number |

224-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

KPRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001372514

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

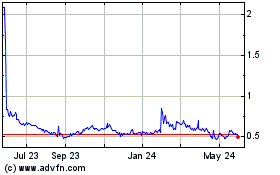

Kiora Pharmaceuticals (NASDAQ:KPRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

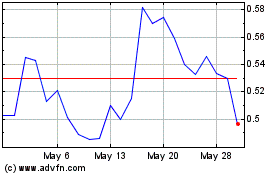

Kiora Pharmaceuticals (NASDAQ:KPRX)

Historical Stock Chart

From Dec 2023 to Dec 2024