Kronos Bio, Inc. (Nasdaq: KRON), a company developing small

molecule therapeutics that address cancers and autoimmune diseases

driven by deregulated transcription, today reported financial

results for the third quarter of 2024 and provided a strategic

update following a recent assessment of its ongoing Phase 1/2

expansion cohort of istisociclib in patients with

platinum-resistant high-grade serous ovarian cancer. Based on a

review of emerging clinical data in the 80mg four-days-on,

three-days-off expansion cohort, the Company and its Board of

Directors has determined that the benefit-risk profile does not

warrant further clinical evaluation of istisociclib. After an

overall review of its business and given the clinical development

timelines of its additional pipeline candidates, the Company will

explore strategic alternatives with the goal of maximizing

stockholder value. Kronos Bio will be implementing significant

expense reduction strategies while it explores options for the

Company and its remaining internally developed preclinical assets,

one of which could include partnering the two p300 lysine

acetyltransferase (KAT) inhibitor programs: an oncology candidate,

KB-9558, for multiple myeloma and HPV-driven cancers expected to be

IND-ready by the end of 2024, and an autoimmune disease candidate,

KB-7898, for Sjögren’s disease which has begun IND-enabling

studies.

“While we believe istisociclib has provided benefit to a small

number of patients in the Phase 1/2 trial, the emerging profile in

patients with platinum-resistant ovarian cancer suggests an

unfavorable risk-benefit profile and does not warrant further

clinical development,” said Norbert Bischofberger, Ph.D., chief

executive officer. “We are very grateful to the patients,

caregivers and medical staff who dedicated their time and energy to

make this clinical trial possible and your commitment to evaluating

novel approaches to treat cancer.”

Charles Lin, Ph.D., Kronos’ chief scientific officer, added, “We

continue to believe in the promise of our proprietary discovery

technology’s application focused on targeting IRF4 where we have

validated the critical role of this transcription factor in driving

tumor cell growth in multiple myeloma and HPV-driven tumors or

inflammation in autoimmune disease. Data from our early-stage p300

KAT inhibitor programs demonstrate that inhibition of key signaling

pathways leads to restoration of tumor suppression activity in

cancer cells or reduction of inflammation in autoimmune disease,

underscoring the potential of this approach for patients that have

limited or no targeted therapies.”

The decision to discontinue the development of istisociclib

resulted from a recent safety assessment from the ongoing Phase 1/2

clinical trial patients with platinum-resistant high-grade serous

ovarian cancer. Out of seven enrolled patients, five exhibited

neurological events as characterized by involuntary movements,

confusion and hallucinations ranging from Grade 1 to Grade 3. Of

those five patients, three discontinued due to adverse events, and

two reduced the dose of istisociclib.

Third Quarter 2024 Financial Highlights

- Cash, cash equivalents and investments: Kronos

Bio has $124.9 million in cash, cash equivalents and investments as

of September 30, 2024.

- R&D

expenses: Research and development expenses were

$12.3 million for the third quarter of 2024, which includes

non-cash stock-based compensation expense of $0.8 million.

- G&A

expenses: General and administrative expenses were

$5.8 million for the third quarter of 2024, which includes non-cash

stock-based compensation expense of $1.2 million.

- Net loss: Net loss for the third quarter

of 2024 was $14.1 million, or $0.23 per share, including non-cash

stock-based compensation expense of $2.0 million.

Process to Explore Strategic Alternatives

Kronos Bio has an exclusive engagement with a financial advisor

to assist in evaluating strategic alternatives which may include,

but is not limited to, an acquisition, merger, reverse merger,

other business combination, sales of assets or other strategic

transactions. There can be no assurance of a transaction, a

successful outcome of these efforts, or the form or the timing of

any such outcome. The Company does not intend to make any further

disclosures that the exploration of strategic alternatives will

result in any agreements or transactions, or that, if executed, any

agreement or transaction will be successfully consummated or on

attractive terms. The Company does not intend to make any further

disclosures regarding the strategic review process unless and until

a specific course of action is approved by the Company's board of

directors or until the Company determines that further disclosure

is appropriate.

About Kronos Bio, Inc.

Kronos Bio is a biopharmaceutical company developing small

molecule therapeutics that address deregulated transcription, a

hallmark of cancer and autoimmune diseases. Our proprietary

discovery engine decodes complex transcription factor regulatory

networks to identify druggable cofactors. We screen for and

optimize small molecules that target these cofactors in a

disease-specific context.

Kronos Bio is based in San Mateo, Calif., and has a research

facility in Cambridge, Mass. For more information, visit

https://www.kronosbio.com or follow the Company on

LinkedIn.

Forward-Looking Statements

Statements in this press release that are not statements of

historical fact are forward-looking statements for purposes of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. The press release, in some cases, uses terms such as

“anticipate,” “believe,” “could,” “expect,” “plan,” “will,” or

other words that convey uncertainty of future events or outcomes to

identify these forward-looking statements. Forward-looking

statements include statements regarding Kronos Bio’s intentions,

beliefs, projections, outlook, analyses or current expectations

concerning, among other things, Kronos Bio’s plans to evaluate and

explore a variety of potential strategic alternatives focused on

maximizing stockholder value, including, but not limited to, an

acquisition, merger, reverse merger, other business combination,

sales of assets or other strategic transactions; the timing for the

expected completion of IND-enabling studies of KB-5998 and KB-7898;

projected cash runway; the potential of Kronos Bio’s product

candidates, pipeline and its proprietary discovery engine; and

other statements that are not historical fact. Actual results and

the timing of events could differ materially from those anticipated

in such forward-looking statements as a result of various risks and

uncertainties, including, without limitation: our activities to

evaluate and pursue potential strategic alternatives may not result

in any transaction or enhance stockholder value; changes in the

macroeconomic environment or competitive landscape that impact

Kronos Bio’s business or partnering landscape; whether Kronos Bio

will be able to progress its preclinical studies on the timelines

anticipated, including due to risks inherent in the development of

novel therapeutics; the risk that results of preclinical studies

and pharmacokinetic modeling are not necessarily predictive of

future results; and risks associated with the sufficiency of Kronos

Bio’s cash resources and need for additional capital. These and

other risks are described in greater detail in Kronos Bio’s filings

with the Securities and Exchange Commission (SEC), including under

the heading “Risk Factors” in its Quarterly Report on Form 10-Q for

the quarter ended June 30, 2024, filed with the SEC on August 8,

2024, and in its Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024, being filed with the SEC later today. Any

forward-looking statements that are made in this press release

speak only as of the date of this press release and are based on

management’s assumptions and estimates as of such date. Except as

required by law, Kronos Bio assumes no obligation to update the

forward-looking statements whether as a result of new information,

future events or otherwise, after the date of this press

release.

Kronos Bio,

Inc.Condensed Statements of Operations and

Comprehensive Loss(in thousands, except per share

amounts)(Unaudited)

| |

|

Three Months

EndedSeptember 30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

2,370 |

|

|

$ |

917 |

|

|

$ |

7,578 |

|

|

$ |

4,002 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

12,268 |

|

|

$ |

25,344 |

|

|

$ |

40,255 |

|

|

$ |

65,811 |

|

|

General and administrative |

|

|

5,818 |

|

|

|

9,398 |

|

|

|

19,692 |

|

|

|

29,761 |

|

|

Impairment of long-lived assets and restructuring |

|

|

— |

|

|

|

— |

|

|

|

13,364 |

|

|

|

2,916 |

|

| Total operating expenses |

|

|

18,086 |

|

|

|

34,742 |

|

|

|

73,311 |

|

|

|

98,488 |

|

| Loss from operations |

|

|

(15,716 |

) |

|

|

(33,825 |

) |

|

|

(65,733 |

) |

|

|

(94,486 |

) |

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

| Interest income and other

expense, net |

|

|

1,608 |

|

|

|

2,451 |

|

|

|

5,467 |

|

|

|

7,133 |

|

| Total other income (expense),

net |

|

|

1,608 |

|

|

|

2,451 |

|

|

|

5,467 |

|

|

|

7,133 |

|

| Net loss |

|

$ |

(14,108 |

) |

|

$ |

(31,374 |

) |

|

|

(60,266 |

) |

|

|

(87,353 |

) |

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

Net unrealized gain (loss) on available-for-sale securities |

|

|

60 |

|

|

|

214 |

|

|

|

5 |

|

|

|

537 |

|

| Net comprehensive loss |

|

$ |

(14,048 |

) |

|

$ |

(31,160 |

) |

|

$ |

(60,261 |

) |

|

$ |

(86,816 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.23 |

) |

|

$ |

(0.54 |

) |

|

$ |

(1.00 |

) |

|

$ |

(1.52 |

) |

| Weighted average shares of

common stock, basic and diluted |

|

|

60,312 |

|

|

|

58,146 |

|

|

|

59,979 |

|

|

|

57,567 |

|

| |

|

|

|

|

|

|

|

|

Kronos Bio, Inc.Selected

Balance Sheet Data(in thousands)(Unaudited)

| |

|

September 30, 2024 |

|

December 31, 2023 |

|

Cash, cash equivalents and investments |

|

$ |

124,857 |

|

$ |

174,986 |

| Total assets |

|

|

150,024 |

|

|

213,279 |

| Total liabilities |

|

|

38,896 |

|

|

54,201 |

| Total stockholders’

equity |

|

|

111,128 |

|

|

159,078 |

| |

|

|

|

|

|

|

Investor & Media Contact:Margaux

BennettVice President, Corporate Development and Investor

Relations, Kronos Biombennett@kronosbio.com

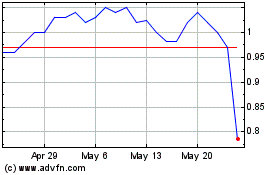

Kronos Bio (NASDAQ:KRON)

Historical Stock Chart

From Jan 2025 to Feb 2025

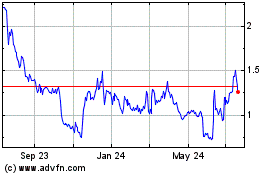

Kronos Bio (NASDAQ:KRON)

Historical Stock Chart

From Feb 2024 to Feb 2025