false

--12-31

0001600983

0001600983

2024-09-13

2024-09-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 13, 2024

Knightscope, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41248 |

|

46-2482575 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1070 Terra Bella Avenue

Mountain View, California 94043

(Address of principal executive offices)(Zip

Code)

Registrant’s telephone number, including

area code: (650) 924-1025

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 per share |

|

KSCP |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.. |

On August 16, 2024, Knightscope, Inc. (the “Company”)

held an annual meeting of stockholders (the “Annual Meeting”) at which the Company’s stockholders approved, among other

items, amendments (the “Amendments”) to the Company’s amended and restated certificate of incorporation, as amended

to date, to:

| 1. | effect a reverse stock split of the Company’s Class A Common Stock at a ratio ranging from any whole number between 1-for-5

and 1-for-50, as determined by the Company’s Board of Directors (the “Board”) in its discretion, subject to the Board’s

authority to abandon such amendments (the “Class A Reverse Stock Split Amendment”); |

| 2. | effect a reverse stock split of the Company’s Class B Common Stock at a ratio ranging from any whole number between 1-for-5

and 1-for-50 (which ratio shall be the same ratio as the reverse stock split determined by the Board with respect to the Class A Common

Stock), as determined by the Board in its discretion, subject to the Board’s authority to abandon such amendments (the “Class

B Reverse Stock Split Amendment” and, together with the Class A Reverse Stock Split Amendment, the “Reverse Stock Split Amendment”); |

| 3. | (i) authorize 40,000,000 shares of “blank check” preferred stock, issuable in one or more series, and (ii) implement ancillary

and conforming changes in connection with the authorization of “blank check” preferred stock and to remove provisions related

to the Company’s former Super Voting Preferred Stock and Ordinary Preferred Stock (in each case as defined in the Company’s

amended and restated certificate of incorporation), which are no longer outstanding; |

| 4. | provide for exculpation of officers from breaches of fiduciary duty to the extent permitted by the Delaware General Corporation Law;

and |

| 5. | provide the exclusive forums in which certain claims relating to the Company may be brought. |

The Amendments were described in the Company’s

Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on July 5, 2024 (the “Proxy Statement”).

The Board previously approved the Amendments.

On September 4, 2024, the Board selected a reverse stock split of the Class A Common Stock at a final ratio

of 1-for-50 and a reverse stock split of the Class B Common Stock at a final ratio of 1-for-50 and abandoned all other reverse stock split

amendments at different ratios. On September 13, 2024, the Company filed Certificates of Amendment to the amended and restated

certificate of incorporation, as amended to date (the “Certificates of Amendment”) with the Secretary of State of the State

of Delaware to effect the Amendments. The Reverse Stock Split Amendment became effective at 5:00 p.m. Eastern Time on the date of filing

of the related Certificate of Amendment, and the remaining Amendments became effective upon filing with the Secretary of State.

The foregoing descriptions of the Certificates

of Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of each respective Certificate

of Amendment, which are filed as Exhibits 3.1, 3.2, 3.3, and 3.4 to this Current Report on Form 8-K, and are each incorporated herein

by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

|

Description |

| |

|

| 3.1 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Knightscope, Inc., dated September 13, 2024. |

| 3.2 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Knightscope, Inc., dated September 13, 2024. |

| 3.3 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Knightscope, Inc., dated September 13, 2024. |

| 3.4 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Knightscope, Inc., dated September 13, 2024. |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

knightscope, INC. |

| |

|

| Date: September 16, 2024 |

By: |

/s/ William Santana Li |

| |

Name: |

William Santana Li |

| |

Title: |

Chief Executive Officer and President |

Exhibit 3.1

CERTIFICATE

OF AMENDMENT OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF KNIGHTSCOPE, INC.

Knightscope, Inc., a

corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”),

does hereby certify as follows:

| FIRST: | That the Board of Directors of the Corporation duly adopted resolutions recommending and declaring advisable that the Amended and

Restated Certificate of Incorporation of the Corporation be amended and that such amendments be submitted to the stockholders of the Corporation

for their consideration, as follows: |

RESOLVED, that the Amended and

Restated Certificate of Incorporation, as amended to date, be further amended by amending Article IV of the Amended and Restated

Certificate of Incorporation to add the following paragraph (the “Class A Reverse Stock Split Paragraph”) to

immediately follow the existing paragraph in Article IV (which existing paragraph will, for the avoidance of doubt, remain unchanged):

“Effective as of 5:00 p.m. Eastern

Time on the date this Certificate of Amendment of Amended and Restated Certificate of Incorporation is filed with the Office of the Secretary

of State of the State of Delaware (the “RSS Effective Time”), a one-for-fifty reverse stock split of the Corporation’s

Class A Common Stock shall become effective, pursuant to which each fifty shares of Class A Common Stock outstanding and held of record

by each stockholder of the Corporation (including treasury shares) immediately prior to the RSS Effective Time shall be reclassified and

combined into one validly issued, fully-paid and nonassessable share of Class A Common Stock automatically and without any action by the

holder thereof upon the RSS Effective Time and shall represent one share of Class A Common Stock from and after the RSS Effective Time

(such reclassification and combination of shares, the “Class A Reverse Stock Split”). The par value of the Class

A Common Stock following the Class A Reverse Stock Split shall remain at $0.001 per share. No fractional shares of Class A Common Stock

shall be issued as a result of the Class A Reverse Stock Split. In lieu thereof, (i) with respect to holders of one or more certificates

which formerly represented shares of Class A Common Stock that were issued and outstanding immediately prior to the RSS Effective Time,

upon surrender after the RSS Effective Time of such certificate or certificates, any holder who would otherwise be entitled to a fractional

share of Class A Common Stock as a result of the Class A Reverse Stock Split, following the RSS Effective Time, shall be entitled to receive

a cash payment (the “Class A Fractional Share Payment”) equal to the fraction of which such holder would otherwise

be entitled multiplied by the closing price per share of the Class A Common Stock as reported by The Nasdaq Stock Market LLC (as adjusted

to give effect to the Class A Reverse Stock Split) on the date of the RSS Effective Time; provided that, whether or not fractional shares

would be issuable as a result of the Class A Reverse Stock Split shall be determined on the basis of (a) the total number of shares of

Class A Common Stock that were issued and outstanding immediately prior to the RSS Effective Time formerly represented by certificates

that the holder is at the time surrendering and (b) the aggregate number of shares of Class A Common Stock after the RSS Effective Time

into which the shares of Class A Common Stock formerly represented by such certificates shall have been reclassified; and (ii) with respect

to holders of shares of Class A Common Stock in book-entry form in the records of the Corporation’s transfer agent that were issued

and outstanding immediately prior to the RSS Effective Time, any holder who would otherwise be entitled to a fractional share of Class

A Common Stock as a result of the Class A Reverse Stock Split, following the RSS Effective Time, shall be entitled to receive the Class

A Fractional Share Payment automatically and without any action by the holder.”

RESOLVED FURTHER, that the Amended

and Restated Certificate of Incorporation, as amended to date, be amended by further amending Article IV of the Amended and Restated

Certificate of Incorporation to add the following paragraph to immediately succeed the Class A Reverse Stock Split Paragraph:

“Effective as of the RSS Effective

Time, a one-for-fifty reverse stock split of the Corporation’s Class B Common Stock shall become effective, pursuant to which each

fifty shares of Class B Common Stock outstanding and held of record by each stockholder of the Corporation (including treasury shares)

immediately prior to the RSS Effective Time shall be reclassified and combined into one validly issued, fully-paid and nonassessable share

of Class B Common Stock automatically and without any action by the holder thereof upon the RSS Effective Time and shall represent one

share of Class B Common Stock from and after the RSS Effective Time (such reclassification and combination of shares, the “Class

B Reverse Stock Split”). The par value of the Class B Common Stock following the Class B Reverse Stock Split shall remain

at $0.001 per share. No fractional shares of Class B Common Stock shall be issued as a result of the Class B Reverse Stock Split. In lieu

thereof, (i) with respect to holders of one or more certificates which formerly represented shares of Class B Common Stock that were issued

and outstanding immediately prior to the RSS Effective Time, upon surrender after the RSS Effective Time of such certificate or certificates,

any holder who would otherwise be entitled to a fractional share of Class B Common Stock as a result of the Class B Reverse Stock Split,

following the RSS Effective Time, shall be entitled to receive a cash payment (the “Class B Fractional Share Payment”)

equal to the fraction of which such holder would otherwise be entitled multiplied by the closing price per share of the Class A Common

Stock as reported by The Nasdaq Stock Market LLC (as adjusted to give effect to the Class A Reverse Stock Split) on the date of the RSS

Effective Time; provided that, whether or not fractional shares would be issuable as a result of the Class B Reverse Stock Split shall

be determined on the basis of (a) the total number of shares of Class B Common Stock that were issued and outstanding immediately prior

to the RSS Effective Time formerly represented by certificates that the holder is at the time surrendering and (b) the aggregate number

of shares of Class B Common Stock after the RSS Effective Time into which the shares of Class B Common Stock formerly represented by such

certificates shall have been reclassified; and (ii) with respect to holders of shares of Class B Common Stock in book-entry form in the

records of the Corporation’s transfer agent that were issued and outstanding immediately prior to the RSS Effective Time, any holder

who would otherwise be entitled to a fractional share of Class B Common Stock as a result of the Class B Reverse Stock Split, following

the RSS Effective Time, shall be entitled to receive the Class B Fractional Share Payment automatically and without any action by the

holder.”

| SECOND: | That, at an annual meeting of stockholders of the Corporation, the aforesaid amendments were duly adopted by the stockholders of the

Corporation. |

| THIRD: | That, the aforesaid amendments were duly adopted in accordance with the applicable provisions of Section 242 of the General Corporation

Law of the State of Delaware. |

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 13th day of September, 2024.

| |

|

KNIGHTSCOPE, INC. |

| |

|

|

| |

By: |

/s/ William Santana Li |

| |

|

William Santana Li |

| |

|

Chairman, Chief Executive Officer and President |

Exhibit

3.2

CERTIFICATE

OF AMENDMENT OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF KNIGHTSCOPE, INC.

Knightscope, Inc., a corporation

organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”),

does hereby certify as follows:

| FIRST: | That the Board of Directors of the Corporation duly adopted resolutions recommending and declaring advisable

that the Amended and Restated Certificate of Incorporation of the Corporation, as amended, be further amended and that such amendment

be submitted to the stockholders of the Corporation for their consideration, as follows: |

RESOLVED, that the Amended and

Restated Certificate of Incorporation, as amended, be further amended by amending and restating the first paragraph of Article IV of the

Amended and Restated Certificate of Incorporation, as amended, in its entirety to read as follows:

The Corporation is authorized to issue

three classes of stock which shall be designated, respectively, “Class A Common Stock,” “Class B

Common Stock” and “Preferred Stock.” The total number of shares of stock that the corporation

shall have authority to issue is 298,000,000 shares, consisting of 228,000,000 shares of Class A Common Stock, $0.001 par value per share,

30,000,000 shares of Class B Common Stock, $0.001 par value per share, and 40,000,000 shares of Preferred Stock, $0.001 par value per

share.

RESOLVED FURTHER, that the Amended

and Restated Certificate of Incorporation, as amended, be further amended by amending and restating Article V of the Amended and Restated

Certificate of Incorporation, as amended, in its entirety to read as follows:

The terms and provisions

of the Common Stock and Preferred Stock are as follows:

1. Definitions.

For purposes of this ARTICLE V, the following definitions shall apply:

(a) “Change

of Control” means (i) the acquisition of the Corporation by another entity by means of any transaction or series of related

transactions to which the Corporation is party (including, without limitation, any stock acquisition, reorganization, merger or consolidation

but excluding any sale of stock for capital raising purposes) other than a transaction or series of related transactions in which the

holders of the voting securities of the Corporation outstanding immediately prior to such transaction or series of related transactions

retain, immediately after such transaction or series of related transactions, as a result of shares in the Corporation held by such holders

prior to such transaction or series of related transactions, at least a majority of the total voting power represented by the outstanding

voting securities of the Corporation or such other surviving or resulting entity (or if the Corporation or such other surviving or resulting

entity is a wholly-owned subsidiary immediately following such acquisition, its parent); or (ii) a sale, lease or other disposition of

all or substantially all of the assets of the Corporation and its subsidiaries taken as a whole by means of any transaction or series

of related transactions, except where such sale, lease or other disposition is to a wholly-owned subsidiary of the Corporation.

(b) “Class

B Common Stockholder” means (i) the registered holder of a share of Class B Common Stock at the Effective Time, (ii) the

initial registered holder of any shares of Class B Common Stock that are originally issued by the Corporation after the Effective Time

pursuant to the exercise of, conversion of or settlement of Convertible Securities issued prior to the Effective Time and (iii) each natural

person who Transferred shares of Class B Common Stock or Convertible Securities prior to the Effective Time to a Permitted Entity that,

as of the Effective Time, complies with the applicable exception for such Permitted Entity in Section 2(d)(ii).

(c) “Common

Stock” shall mean the Class A Common Stock and Class B Common Stock, collectively.

(d) “Convertible

Securities” shall mean any evidences of indebtedness, shares or other securities convertible into or exchangeable for Common

Stock.

(e) “Corporation”

shall mean Knightscope, Inc.

(f) “Distribution”

shall mean either (i) the transfer of cash or other property without consideration whether by way of dividend or otherwise, other than

dividends on Common Stock payable in Common Stock; or (ii) the purchase or redemption of shares of the Corporation by the Corporation

or its subsidiaries for cash or property other than, in each case (A) repurchases of Common Stock issued to or held by employees, officers,

directors or consultants of the Corporation or its subsidiaries upon termination of their employment or services pursuant to agreements

providing for the right of said repurchase; (B) repurchases of Common Stock issued to or held by employees, officers, directors or consultants

of the Corporation or its subsidiaries pursuant to rights of first refusal contained in agreements providing for such right; and (C) repurchase

of capital stock of the Corporation in connection with the settlement of disputes with any stockholder.

(g) “Effective

Time” shall mean the time on May 17, 2019 at which the first Amended and Restated Certificate of Incorporation was filed

with the Secretary of State of Delaware.

(h) “Liquidation

Event” shall mean (i) a Change of Control; or (ii) any liquidation, dissolution or winding up of the Corporation, whether

voluntary or involuntary.

(i) “Options”

shall mean rights, options or warrants to subscribe for, purchase or otherwise acquire Common Stock or Convertible Securities.

(j) “Permitted

Entity” shall mean with respect to any Class B Common Stockholder, any trust, account, plan, corporation, partnership, or

limited liability company specified in Section 2(d)(ii) established by or for such Class B Common Stockholder, so long as such entity

meets the requirements set forth in Section 2(d)(ii).

(k) “Recapitalization”

shall mean any stock dividend, stock split, combination of shares, reorganization, recapitalization, reclassification or other similar

event.

(l) “Transfer”

of a share of Class B Common Stock shall mean any sale, assignment, transfer, conveyance, hypothecation or other transfer or disposition

of such share or any legal or beneficial interest in such share, whether or not for value and whether voluntary or involuntary or by operation

of law. A “Transfer” shall also include, without limitation, (i) a transfer of a share of Class B Common Stock

to a broker or other nominee (regardless of whether or not there is a corresponding change in beneficial ownership), (ii) the transfer

of, or entering into a binding agreement with respect to, Voting Control over a share of Class B Common Stock by proxy or otherwise, (iii)

any Transfer in connection with a divorce proceeding, domestic relations order or similar legal requirement; provided, however, that the

following shall not be considered a “Transfer” within the meaning of Section 1(l):

(i) the

granting of a proxy to officers or directors of the Corporation at the request of the Board of Directors of the Corporation in connection

with actions to be taken at an annual or special meeting of stockholders;

(ii) entering

into a voting trust, agreement or arrangement (with or without granting a proxy) solely with stockholders who are Class B Common Stockholders,

that (A) is disclosed either in a Schedule 13D filed with the Securities and Exchange Commission or in writing to the Secretary of the

Corporation, (B) either has a term not exceeding one (1) year or is terminable by the Class B Common Stockholder at any time and (C) does

not involve any payment of cash, securities, property or other consideration to the Class B Common Stockholder other than the mutual promise

to vote shares in a designated manner; or

(iii) the

pledge of shares of Class B Common Stock by a Class B Common Stockholder that creates a mere security interest in such shares pursuant

to a bona fide loan or indebtedness transaction so long as the Class B Common Stockholder continues to exercise Voting Control over such

pledged shares; provided, however, that a foreclosure on such shares of Class B Common Stock or other similar action by the pledgee shall

constitute a “Transfer.”

(m) “Voting

Control” shall mean the power to vote or direct the voting of the applicable voting security by proxy, voting agreement

or otherwise.

2. Common Stock

(a) General.

The voting, dividend, liquidation, and other rights and powers of the Common Stock are subject to and qualified by the rights, powers

and preferences of any series of Preferred Stock as may be designated by the Board of Directors of the Corporation and outstanding from

time to time.

(b) Dividends.

Subject to applicable law and the rights and preferences of any holders of any outstanding series of Preferred Stock, the holders of Common

Stock, as such, shall be entitled to the payment of dividends on the Common Stock when, as and if declared by the Board of Directors in

accordance with applicable law.

(c) Liquidation

Rights. Subject to the rights and preferences of any holders of any shares of any outstanding series of Preferred Stock, in the

event of any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, the funds and assets of the

Corporation that may be legally distributed to the Corporation’s stockholders shall be distributed among the holders of the then

outstanding Common Stock pro rata in accordance with the number of shares of Common Stock held by each such holder.

(d) Conversion

of Class B Common Stock.

(i) Optional

Conversion. Each share of Class B Common Stock shall be convertible into one (1) fully paid and nonassessable share of Class A

Common Stock at the option of the holder thereof at any time upon written notice to the transfer agent of the Corporation.

(ii) Automatic

Conversion upon Transfer. Each share of Class B Common Stock shall automatically, without any further action, convert into one

(1) fully paid and nonassessable share of Class A Common Stock upon the Transfer of such share; provided, however, the following exceptions

(the “Exempted Transfers”) shall not trigger an automatic conversion:

(a) a

Transfer of Class B Common Stock by a Class B Common Stockholder or such Class B Common Stockholder’s Permitted Entities to another

Class B Common Stockholder or such Class B Common Stockholder’s Permitted Entities;

(b) a

Transfer by a Class B Common Stockholder to any of the following Permitted Entities, and from any of the following Permitted Entities

back to such Class B Common Stockholder and/or any other Permitted Entity by or for such Class B Common Stockholder:

(1) a trust

for the benefit of such Class B Common Stockholder and for the benefit of no other person, provided such Transfer does not involve any

payment of cash, securities, property or other consideration (other than an interest in such trust) to the Class B Common Stockholder;

and, provided, further, that in the event such Class B Common Stockholder is no longer the exclusive beneficiary of such trust, each share

of Class B Common Stock then held by such trust shall automatically convert into one (1) fully paid and nonassessable share of Class A

Common Stock;

(2) a trust

for the benefit of persons other than the Class B Common Stockholder so long as the Class B Common Stockholder has sole dispositive power

and exclusive Voting Control with respect to the shares of Class B Common Stock held by such trust, provided such Transfer does not involve

any payment of cash, securities, property or other consideration (other than an interest in such trust) to the Class B Common Stockholder;

and, provided, further, that in the event the Class B Common Stockholder no longer has sole dispositive power and exclusive Voting Control

with respect to the shares of Class B Common Stock held by such trust, each share of Class B Common Stock then held by such trust shall

automatically convert into one (1) fully paid and nonassessable share of Class A Common Stock;

(3) a trust

under the terms of which such Class B Common Stockholder has retained a “qualified interest” within the meaning of §2702(b)(1)

of the Internal Revenue Code (the “Code”) and/or a reversionary interest so long as the Class B Common Stockholder

has sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock held by such trust; provided,

however, that in the event the Class B Common Stockholder no longer has sole dispositive power and exclusive Voting Control with respect

to the shares of Class B Common Stock held by such trust, each share of Class B Common Stock then held by such trust shall automatically

convert into one (1) fully paid and nonassessable share of Class A Common Stock;

(4) an Individual

Retirement Account, as defined in Section 408(a) of the Code, or a pension, profit sharing, stock bonus or other type of plan or trust

of which such Class B Common Stockholder is a participant or beneficiary and which satisfies the requirements for qualification under

Section 401 of the Code; provided that in each case such Class B Common Stockholder has sole dispositive power and exclusive Voting Control

with respect to the shares of Class B Common Stock held in such account, plan or trust, and provided, further, that in the event the Class

B Common Stockholder no longer has sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock

held by such account, plan or trust, each share of Class B Common Stock then held by such trust shall automatically convert into one (1)

fully paid and nonassessable share of Class A Common Stock;

(5) a corporation

in which such Class B Common Stockholder directly, or indirectly through one or more Permitted Entities, owns shares with sufficient Voting

Control in the corporation, or otherwise has legally enforceable rights, such that the Class B Common Stockholder retains sole dispositive

power and exclusive Voting Control with respect to the shares of Class B Common Stock held by such corporation; provided that in the event

the Class B Common Stockholder no longer owns sufficient shares or has sufficient legally enforceable rights to enable the Class B Common

Stockholder to retain sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock held by such

corporation, each share of Class B Common Stock then held by such corporation shall automatically convert into one (1) fully paid and

nonassessable share of Class A Common Stock;

(6) a partnership

in which such Class B Common Stockholder directly, or indirectly through one or more Permitted Entities, owns partnership interests with

sufficient Voting Control in the partnership, or otherwise has legally enforceable rights, such that the Class B Common Stockholder retains

sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock held by such partnership; provided

that in the event the Class B Common Stockholder no longer owns sufficient partnership interests or has sufficient legally enforceable

rights to enable the Class B Common Stockholder to retain sole dispositive power and exclusive Voting Control with respect to the shares

of Class B Common Stock held by such partnership, each share of Class B Common Stock then held by such partnership shall automatically

convert into one (1) fully paid and nonassessable share of Class A Common Stock; or

(7) a limited

liability company in which such Class B Common Stockholder directly, or indirectly through one or more Permitted Entities, owns membership

interests with sufficient Voting Control in the limited liability company, or otherwise has legally enforceable rights, such that the

Class B Common Stockholder retains sole dispositive power and exclusive Voting Control with respect to the shares of Class B Common Stock

held by such limited liability company; provided that in the event the Class B Common Stockholder no longer owns sufficient membership

interests or has sufficient legally enforceable rights to enable the Class B Common Stockholder to retain sole dispositive power and exclusive

Voting Control with respect to the shares of Class B Common Stock held by such limited liability company, each share of Class B Common

Stock then held by such limited liability company shall automatically convert into one (1) fully paid and nonassessable share of Class

A Common Stock.

(iii) Automatic

Conversion Post January 27, 2022 upon Election of Founders. At any time following January 27, 2022, each outstanding share of

Class B Common Stock shall automatically be converted into one (1) fully paid and nonassessable share of Class A Common Stock (and any

outstanding right to receive shares of Class B Common Stock upon the exercise of, conversion of or settlement of Convertible Securities

shall be automatically converted into the right to receive shares of Class A Common Stock on the same one-for-one basis) upon the affirmative

vote or written consent of the holders of a majority of the Class B Common Stock then outstanding and held by the Founders and Permitted

Entities of the Founders, or, if later, the effective date for such conversion specified by such vote or written consent. For purposes

of this Section 2(d)(iii) only, “Founders” shall mean each of William Santana Li and Stacy Dean Stephens.

(iv) Effect

of Conversion. In the event of a conversion of shares of Class B Common Stock into shares of Class A Common Stock pursuant to

this Section 2(d), such conversion shall be deemed to have been made at the time that the Corporation’s transfer agent receives

the written notice required pursuant to Section 2(d)(i) or the time of the affirmative vote or written consent of the applicable holders

of Class B Common Stock pursuant to Section 2(d)(iii) (or a later date specified by such vote or written consent), as applicable. Upon

any conversion of Class B Common Stock to Class A Common Stock, all rights of the holder of such shares of Class B Common Stock shall

cease and the person or persons in whose name or names the certificate or certificates representing the shares of Class B Common Stock

are to be issued, if any, shall be treated for all purposes as having become the record holder or holders of such number of shares of

Class A Common Stock into which such Class B Common Stock were convertible. Shares of Class B Common Stock that are converted into shares

of Class A Common Stock as provided in this Section 2(d) shall be retired and shall not be reissued.

(v) Adjustments

for Subdivisions or Combinations of Common Stock. In the event that the Corporation in any manner subdivides or combines the outstanding

shares of Class A Common Stock, then the outstanding shares of Class B Common Stock shall be subdivided or combined in the same proportion

and manner. In the event that the Corporation in any manner subdivides or combines the outstanding shares of Class B Common Stock, then

the outstanding shares of Class A Common Stock shall be subdivided or combined in the same proportion and manner.

(vi) Reservation

of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued

shares of Class A Common Stock solely for the purpose of effecting the conversion of the shares of Class B Common Stock, such number of

its shares of Class A Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding shares of

Class B Common Stock into shares of Class A Common Stock; and if at any time the number of authorized but unissued shares of Class A Common

Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Class B Common Stock, the Corporation will

take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Class

A Common Stock to such number of shares as shall be sufficient for such purpose.

(vii) Administration.

The Corporation may, from time to time, establish such policies and procedures relating to the conversion of the Class B Common Stock

to Class A Common Stock and the general administration of this dual class Common Stock structure, including the issuance of stock certificates

with respect thereto, as it may deem necessary or advisable, provided that the rights of the holders are not adversely affected, and may

request that holders of shares of Class B Common Stock furnish affidavits or other proof to the Corporation as it deems necessary to verify

the ownership of Class B Common Stock and to confirm that a conversion to Class A Common Stock has not occurred.

(e) Voting.

(i) Restricted

Class Voting. Except as otherwise expressly provided herein or as required by law, the holders of Class A Common Stock and the

holders of Class B Common Stock shall vote together and not as separate classes. Except as otherwise expressly provided herein or as required

by law, holders of Common Stock, as such, shall not be entitled to vote on any amendment to this Amended and Restated Certificate of Incorporation

(including any Certificate of Designation) that relates solely to the rights, powers, preferences (or the qualifications, limitations

or restrictions thereof) or other terms of one or more outstanding series of Preferred Stock if the holders of such affected series are

entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to this Amended and

Restated Certificate of Incorporation (including any Certificate of Designation) or pursuant to the General Corporation Law of Delaware.

(ii) No

Series Voting. Other than as provided herein or required by law, there shall be no series voting.

(iii) Common

Stock. Each holder of Class B Common Stock shall be entitled to ten (10) votes for each share of Class B Common Stock held by

such holder as of the applicable record date. Each holder of Class A Common Stock shall be entitled to one (1) vote for each share of

Class A Common Stock held by such holder as of the applicable record date. Except as otherwise expressly provided herein or by applicable

law, the holders of Class A Common Stock and the holders of Class B Common Stock shall at all times vote together as one class on all

matters (including the election of directors) submitted to a vote or for the written consent of the stockholders of the Corporation.

(iv) Adjustment

in Authorized Class A Common Stock and Class B Common Stock. Subject to the rights of any holders of any outstanding series of

Preferred Stock, the number of authorized shares of Class A Common Stock may be increased or decreased (but not below the number of such

applicable shares then outstanding) by an affirmative vote of the holders of a majority of voting power of the outstanding shares of Common

Stock of the Corporation (voting together as a single class), irrespective of the provisions of Section 242(b)(2) of the General Corporation

Law and without a separate class vote of the holders of the Common Stock. The number of authorized shares of Class B Common Stock may

not be increased or decreased unless approved by a majority in interest of the outstanding shares of Class B Common Stock.

(f) Equal

Treatment in a Liquidation Event or Change of Control. In connection with any Liquidation Event, shares of Class A Common Stock

and Class B Common Stock shall be treated equally, identically and ratably, on a per share basis, with respect to any consideration into

which such shares are converted or any consideration paid or otherwise distributed to stockholders of the Corporation.

3. Preferred

Stock. Shares of Preferred Stock may be issued from time to time in one or more series, each of such series to have such terms as

stated or expressed herein and in the resolution or resolutions providing for the creation and issuance of such series adopted by the

Corporation’s Board of Directors as hereinafter provided.

Authority is hereby

expressly granted to the Board of Directors from time to time to issue the Preferred Stock in one or more series, and in connection with

the creation of any such series, by adopting a resolution or resolutions providing for the issuance of the shares thereof and by filing

a certificate of designation relating thereto in accordance with the General Corporation Law of Delaware (a “Certificate of

Designation”), to determine and fix the number of shares of such series and such voting powers, full or limited, or no voting

powers, and such designations, preferences and relative participating, optional or other special rights, and qualifications, limitations

or restrictions thereof, including without limitation thereof, dividend rights, conversion rights, redemption privileges and liquidation

preferences, and to increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of

any series as shall be stated and expressed in such resolutions, all to the fullest extent now or hereafter permitted by the General Corporation

Law of Delaware. Without limiting the generality of the foregoing, the resolution or resolutions providing for the creation and issuance

of any series of Preferred Stock may provide that such series shall be superior or rank equally or be junior to any other series of Preferred

Stock to the extent permitted by law and this Amended and Restated Certificate of Incorporation (including any Certificate of Designation).

Except as otherwise required by law, holders of any series of Preferred Stock shall be entitled only to such voting rights, if any, as

shall expressly be granted thereto by this Amended and Restated Certificate of Incorporation (including any Certificate of Designation).

The number of authorized

shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative

vote of the holders of a majority of voting power of the outstanding capital stock of the Corporation entitled to vote, irrespective of

the provisions of Section 242(b)(2) of the General Corporation Law of Delaware.

The Corporation

is to have perpetual existence.

| SECOND: | That, at an annual meeting of stockholders of the Corporation, the aforesaid amendments were duly adopted

by the stockholders of the Corporation. |

| THIRD: | That, the aforesaid amendments were duly adopted in accordance with the applicable provisions of Section

242 of the General Corporation Law of the State of Delaware. |

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 13th day of September, 2024.

| |

|

KNIGHTSCOPE, INC. |

| |

|

|

| |

By: |

/s/ William Santana Li |

| |

|

William Santana Li |

| |

|

Chairman, Chief Executive Officer and President |

Exhibit 3.3

CERTIFICATE

OF AMENDMENT OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF KNIGHTSCOPE, INC.

Knightscope, Inc., a corporation

organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”),

does hereby certify as follows:

| FIRST: | That the Board of Directors of the Corporation duly adopted resolutions recommending and declaring advisable

that the Amended and Restated Certificate of Incorporation of the Corporation, as amended, be further amended and that such amendment

be submitted to the stockholders of the Corporation for their consideration, as follows: |

RESOLVED, that the Amended and

Restated Certificate of Incorporation, as amended, be further amended by amending and restating Section 1 of Article IX of the Amended

and Restated Certificate of Incorporation, as amended, in its entirety to read as follows:

1. To the fullest

extent permitted by the Delaware General Corporation Law as the same exists or as may hereafter be amended, a director or officer of the

Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for a breach of fiduciary duty

as a director or officer, as applicable. If the Delaware General Corporation Law is amended to authorize corporate action further eliminating

or limiting the personal liability of directors or officers, then the liability of a director or officer, as applicable, of the Corporation

shall be eliminated or limited to the fullest extent permitted by the Delaware General Corporation Law, as so amended. Neither any amendment

nor repeal of this Section 1, nor the adoption of any provision of this Corporation’s Amended and Restated Certificate of Incorporation

inconsistent with this Section 1, shall eliminate or reduce the effect of this Section 1, in respect of any matter occurring, or any action

or proceeding accruing or arising or that, but for this Section 1, would accrue or arise, prior to such amendment, repeal or adoption

of an inconsistent provision.

| SECOND: | That, at an annual meeting of stockholders of the Corporation, the aforesaid amendments were duly adopted

by the stockholders of the Corporation. |

| THIRD: | That, the aforesaid amendments were duly adopted in accordance with the applicable provisions of Section

242 of the General Corporation Law of the State of Delaware. |

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 13th day of September, 2024.

| |

|

KNIGHTSCOPE, INC. |

| |

|

|

| |

By: |

/s/ William Santana Li |

| |

|

William Santana Li |

| |

|

Chairman, Chief Executive Officer and President |

Exhibit

3.4

CERTIFICATE

OF AMENDMENT OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF KNIGHTSCOPE, INC.

Knightscope, Inc., a corporation

organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”),

does hereby certify as follows:

| FIRST: | That the Board of Directors of the Corporation duly adopted resolutions recommending and declaring advisable

that the Amended and Restated Certificate of Incorporation of the Corporation, as amended, be further amended and that such amendment

be submitted to the stockholders of the Corporation for their consideration, as follows: |

RESOLVED, that the Amended and

Restated Certificate of Incorporation, as amended, be further amended by adding Article XI to the Amended and Restated Certificate of

Incorporation, as amended, to read as follows:

Unless the Corporation

consents in writing to the selection of an alternative forum, (a) the Court of Chancery (the “Chancery Court”)

of the State of Delaware (or, in the event that the Chancery Court does not have jurisdiction, the federal district court for the District

of Delaware or other state courts of the State of Delaware) shall, to the fullest extent permitted by law, be the sole and exclusive forum

for (i) any derivative action, suit or proceeding brought on behalf of the Corporation, (ii) any action, suit or proceeding asserting

a claim of breach of a fiduciary duty owed by any director, officer or stockholder of the Corporation to the Corporation or to the Corporation’s

stockholders, (iii) any action, suit or proceeding arising pursuant to any provision of the Delaware General Corporation Law or the Bylaws

or this Amended and Restated Certificate of Incorporation (as either may be amended from time to time) or (iv) any action, suit or proceeding

asserting a claim against the Corporation governed by the internal affairs doctrine; and (b) subject to the preceding provisions of this

Article XI, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint

asserting a cause or causes of action arising under the Securities Act of 1933, as amended, including all causes of action asserted against

any defendant to such complaint. If any action the subject matter of which is within the scope of clause (a) of the immediately preceding

sentence is filed in a court other than the courts in the State of Delaware (a “Foreign Action”) in the name

of any stockholder, such stockholder shall be deemed to have consented to (x) the personal jurisdiction of the state and federal courts

in the State of Delaware in connection with any action brought in any such court to enforce the provisions of clause (a) of the immediately

preceding sentence and (y) having service of process made upon such stockholder in any such action by service upon such stockholder’s

counsel in the Foreign Action as agent for such stockholder.

Any person or entity

purchasing or otherwise acquiring any interest in any security of the Corporation shall be deemed to have notice of and consented to this

Article XI. This Article XI is intended to benefit and may be enforced by the Corporation, its officers and directors, the underwriters

to any offering giving rise to such complaint, and any other professional or entity whose profession gives authority to a statement made

by that person or entity and who has prepared or certified any part of the documents underlying the offering. Notwithstanding the foregoing,

the provisions of this Article XI shall not apply to suits brought to enforce any liability or duty created by the Securities Exchange

Act of 1934, as amended, or any other claim for which the federal courts of the United States have exclusive jurisdiction.

If any provision

or provisions of this Article XI shall be held to be invalid, illegal or unenforceable as applied to any circumstance for any reason whatsoever,

(a) the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Article

XI (including, without limitation, each portion of any paragraph of this Article XI containing any such provision held to be invalid,

illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) shall not in any way be affected or impaired

thereby and (b) the application of such provision to other persons or entities and circumstances shall not in any way be affected or impaired

thereby.

| SECOND: | That, at an annual meeting of stockholders of the Corporation, the aforesaid amendments were duly adopted

by the stockholders of the Corporation. |

| THIRD: | That, the aforesaid amendments were duly adopted in accordance with the applicable provisions of Section

242 of the General Corporation Law of the State of Delaware. |

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this 13th day of September, 2024.

| |

|

KNIGHTSCOPE, INC. |

| |

|

|

| |

By: |

/s/ William Santana Li |

| |

|

William Santana Li |

| |

|

Chairman, Chief Executive Officer and President |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

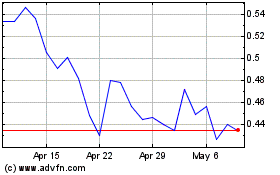

Knightscope (NASDAQ:KSCP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Knightscope (NASDAQ:KSCP)

Historical Stock Chart

From Dec 2023 to Dec 2024