FALSE2024Q30000886163December 31http://fasb.org/us-gaap/2024#GainLossOnInvestmentshttp://fasb.org/us-gaap/2024#GainLossOnInvestmentshttp://fasb.org/us-gaap/2024#GainLossOnInvestmentshttp://www.ligand.com/20240930#NonCashChangeInEstimatedFairValueOfContingentValueRightsxbrli:sharesiso4217:USDiso4217:USDxbrli:shareslgnd:segmentlgnd:positionxbrli:purelgnd:contractlgnd:cvrlgnd:purelgnd:milestoneiso4217:EURlgnd:complaint00008861632024-01-012024-09-3000008861632024-11-0500008861632024-09-3000008861632023-12-310000886163lgnd:IntangibleRoyaltyAssetsMember2024-07-012024-09-300000886163lgnd:IntangibleRoyaltyAssetsMember2023-07-012023-09-300000886163lgnd:IntangibleRoyaltyAssetsMember2024-01-012024-09-300000886163lgnd:IntangibleRoyaltyAssetsMember2023-01-012023-09-300000886163lgnd:FinancialRoyaltyAssetsMember2024-07-012024-09-300000886163lgnd:FinancialRoyaltyAssetsMember2023-07-012023-09-300000886163lgnd:FinancialRoyaltyAssetsMember2024-01-012024-09-300000886163lgnd:FinancialRoyaltyAssetsMember2023-01-012023-09-300000886163us-gaap:RoyaltyMember2024-07-012024-09-300000886163us-gaap:RoyaltyMember2023-07-012023-09-300000886163us-gaap:RoyaltyMember2024-01-012024-09-300000886163us-gaap:RoyaltyMember2023-01-012023-09-300000886163lgnd:MaterialSalesCaptisolMember2024-07-012024-09-300000886163lgnd:MaterialSalesCaptisolMember2023-07-012023-09-300000886163lgnd:MaterialSalesCaptisolMember2024-01-012024-09-300000886163lgnd:MaterialSalesCaptisolMember2023-01-012023-09-300000886163lgnd:ContractRevenueAndOtherIncomeMember2024-07-012024-09-300000886163lgnd:ContractRevenueAndOtherIncomeMember2023-07-012023-09-300000886163lgnd:ContractRevenueAndOtherIncomeMember2024-01-012024-09-300000886163lgnd:ContractRevenueAndOtherIncomeMember2023-01-012023-09-3000008861632024-07-012024-09-3000008861632023-07-012023-09-3000008861632023-01-012023-09-300000886163us-gaap:CommonStockMember2023-12-310000886163us-gaap:AdditionalPaidInCapitalMember2023-12-310000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000886163us-gaap:RetainedEarningsMember2023-12-310000886163us-gaap:CommonStockMember2024-01-012024-03-310000886163us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100008861632024-01-012024-03-310000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000886163us-gaap:RetainedEarningsMember2024-01-012024-03-310000886163us-gaap:CommonStockMember2024-03-310000886163us-gaap:AdditionalPaidInCapitalMember2024-03-310000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000886163us-gaap:RetainedEarningsMember2024-03-3100008861632024-03-310000886163us-gaap:CommonStockMember2024-04-012024-06-300000886163us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-3000008861632024-04-012024-06-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000886163us-gaap:RetainedEarningsMember2024-04-012024-06-300000886163us-gaap:CommonStockMember2024-06-300000886163us-gaap:AdditionalPaidInCapitalMember2024-06-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000886163us-gaap:RetainedEarningsMember2024-06-3000008861632024-06-300000886163us-gaap:CommonStockMember2024-07-012024-09-300000886163us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000886163us-gaap:RetainedEarningsMember2024-07-012024-09-300000886163us-gaap:CommonStockMember2024-09-300000886163us-gaap:AdditionalPaidInCapitalMember2024-09-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000886163us-gaap:RetainedEarningsMember2024-09-300000886163us-gaap:CommonStockMember2022-12-310000886163us-gaap:AdditionalPaidInCapitalMember2022-12-310000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000886163us-gaap:RetainedEarningsMember2022-12-3100008861632022-12-310000886163us-gaap:CommonStockMember2023-01-012023-03-310000886163us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100008861632023-01-012023-03-310000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000886163us-gaap:RetainedEarningsMember2023-01-012023-03-310000886163us-gaap:CommonStockMember2023-03-310000886163us-gaap:AdditionalPaidInCapitalMember2023-03-310000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000886163us-gaap:RetainedEarningsMember2023-03-3100008861632023-03-310000886163us-gaap:CommonStockMember2023-04-012023-06-300000886163us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000008861632023-04-012023-06-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000886163us-gaap:RetainedEarningsMember2023-04-012023-06-300000886163us-gaap:CommonStockMember2023-06-300000886163us-gaap:AdditionalPaidInCapitalMember2023-06-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000886163us-gaap:RetainedEarningsMember2023-06-3000008861632023-06-300000886163us-gaap:CommonStockMember2023-07-012023-09-300000886163us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000886163us-gaap:RetainedEarningsMember2023-07-012023-09-300000886163us-gaap:CommonStockMember2023-09-300000886163us-gaap:AdditionalPaidInCapitalMember2023-09-300000886163us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000886163us-gaap:RetainedEarningsMember2023-09-3000008861632023-09-300000886163lgnd:APEIRONMember2024-09-300000886163lgnd:NovanIncMember2023-09-300000886163lgnd:APEIRONMember2024-01-012024-09-300000886163lgnd:NovanIncMember2023-01-012023-09-300000886163lgnd:KyprolisMember2024-07-012024-09-300000886163lgnd:KyprolisMember2023-07-012023-09-300000886163lgnd:KyprolisMember2024-01-012024-09-300000886163lgnd:KyprolisMember2023-01-012023-09-300000886163lgnd:EvomelaMember2024-07-012024-09-300000886163lgnd:EvomelaMember2023-07-012023-09-300000886163lgnd:EvomelaMember2024-01-012024-09-300000886163lgnd:EvomelaMember2023-01-012023-09-300000886163lgnd:TeriparatideInjectionMember2024-07-012024-09-300000886163lgnd:TeriparatideInjectionMember2023-07-012023-09-300000886163lgnd:TeriparatideInjectionMember2024-01-012024-09-300000886163lgnd:TeriparatideInjectionMember2023-01-012023-09-300000886163lgnd:RylazeMember2024-07-012024-09-300000886163lgnd:RylazeMember2023-07-012023-09-300000886163lgnd:RylazeMember2024-01-012024-09-300000886163lgnd:RylazeMember2023-01-012023-09-300000886163lgnd:FilspariMember2024-07-012024-09-300000886163lgnd:FilspariMember2023-07-012023-09-300000886163lgnd:FilspariMember2024-01-012024-09-300000886163lgnd:FilspariMember2023-01-012023-09-300000886163lgnd:VaxneuvanceMember2024-07-012024-09-300000886163lgnd:VaxneuvanceMember2023-07-012023-09-300000886163lgnd:VaxneuvanceMember2024-01-012024-09-300000886163lgnd:VaxneuvanceMember2023-01-012023-09-300000886163lgnd:RoyaltyOtherMember2024-07-012024-09-300000886163lgnd:RoyaltyOtherMember2023-07-012023-09-300000886163lgnd:RoyaltyOtherMember2024-01-012024-09-300000886163lgnd:RoyaltyOtherMember2023-01-012023-09-300000886163lgnd:MilestoneAndOtherMember2024-07-012024-09-300000886163lgnd:MilestoneAndOtherMember2023-07-012023-09-300000886163lgnd:MilestoneAndOtherMember2024-01-012024-09-300000886163lgnd:MilestoneAndOtherMember2023-01-012023-09-300000886163lgnd:ContractAndRevenueIncomeOtherMember2024-07-012024-09-300000886163lgnd:ContractAndRevenueIncomeOtherMember2023-07-012023-09-300000886163lgnd:ContractAndRevenueIncomeOtherMember2024-01-012024-09-300000886163lgnd:ContractAndRevenueIncomeOtherMember2023-01-012023-09-300000886163us-gaap:MutualFundMember2024-09-300000886163us-gaap:USTreasurySecuritiesMember2024-09-300000886163us-gaap:DemandDepositsMember2024-09-300000886163us-gaap:CorporateDebtSecuritiesMember2024-09-300000886163us-gaap:CommercialPaperMember2024-09-300000886163us-gaap:EquitySecuritiesMember2024-09-300000886163us-gaap:CommonStockMember2024-09-300000886163us-gaap:MutualFundMember2023-12-310000886163us-gaap:DemandDepositsMember2023-12-310000886163us-gaap:CorporateDebtSecuritiesMember2023-12-310000886163us-gaap:CommercialPaperMember2023-12-310000886163us-gaap:USTreasurySecuritiesMember2023-12-310000886163us-gaap:MunicipalBondsMember2023-12-310000886163us-gaap:EquitySecuritiesMember2023-12-310000886163us-gaap:CommonStockMember2023-12-310000886163lgnd:MaterialSalesCaptisolMember2024-09-300000886163lgnd:MaterialSalesCaptisolMember2023-12-310000886163us-gaap:PatentedTechnologyMember2024-09-300000886163us-gaap:PatentedTechnologyMember2023-12-310000886163us-gaap:TradeNamesMember2024-09-300000886163us-gaap:TradeNamesMember2023-12-310000886163us-gaap:CustomerRelationshipsMember2024-09-300000886163us-gaap:CustomerRelationshipsMember2023-12-310000886163us-gaap:ContractualRightsMember2024-09-300000886163us-gaap:ContractualRightsMember2023-12-310000886163lgnd:AgenusPartneredProgramMember2024-05-290000886163lgnd:AgenusPartneredProgramMember2023-09-180000886163lgnd:AgenusPartneredProgramMemberlgnd:PrimordialGeneticsMember2023-09-180000886163us-gaap:StockOptionMemberlgnd:AgenusInc.Member2024-09-300000886163us-gaap:StockOptionMemberlgnd:AgenusInc.Member2023-12-310000886163lgnd:CollarsMemberlgnd:VikingMember2024-09-300000886163lgnd:CollarsMemberlgnd:VikingMember2023-12-310000886163lgnd:PrimroseBioMember2024-09-300000886163lgnd:PrimroseBioMember2023-12-310000886163lgnd:PartnerProgramsMemberlgnd:AgenusInc.Member2024-09-300000886163lgnd:PartnerProgramsMemberlgnd:AgenusInc.Member2023-12-310000886163us-gaap:StockOptionMemberlgnd:AgenusInc.Member2024-01-012024-09-300000886163lgnd:CollarsMemberlgnd:VikingMember2024-07-012024-09-300000886163lgnd:CollarsMemberlgnd:VikingMember2024-01-012024-09-300000886163lgnd:PartnerProgramsMemberlgnd:AgenusInc.Member2024-01-012024-09-300000886163lgnd:PartnerProgramsMemberlgnd:AgenusInc.Member2024-07-012024-09-300000886163lgnd:OtherDerivativesMember2024-07-012024-09-300000886163lgnd:OtherDerivativesMember2024-01-012024-09-300000886163lgnd:PrimroseBioMember2024-01-012024-09-300000886163lgnd:PrimroseBioMember2024-07-012024-09-300000886163lgnd:PrimroseBioMember2023-01-012023-09-300000886163lgnd:PrimroseBioMember2023-07-012023-09-300000886163lgnd:PrimroseBioMemberus-gaap:EquitySecuritiesMember2024-09-300000886163lgnd:PrimroseBioMemberus-gaap:EquitySecuritiesMember2023-12-310000886163lgnd:InvIOsMemberus-gaap:EquitySecuritiesMember2024-09-300000886163lgnd:InvIOsMemberus-gaap:EquitySecuritiesMember2023-12-310000886163us-gaap:WarrantMember2024-09-300000886163us-gaap:WarrantMember2023-12-310000886163us-gaap:PreferredStockMember2024-09-300000886163us-gaap:PreferredStockMember2023-12-310000886163us-gaap:RoyaltyAgreementsMemberlgnd:PalvellaTherapeuticsIncMember2024-09-300000886163lgnd:PalvellaTherapeuticsIncMembersrt:MinimumMember2024-09-300000886163lgnd:PalvellaTherapeuticsIncMembersrt:MaximumMember2024-09-300000886163us-gaap:RoyaltyAgreementsMemberlgnd:PalvellaTherapeuticsIncMember2024-01-012024-09-300000886163lgnd:PalvellaTherapeuticsIncMember2024-06-300000886163lgnd:ZelsuvmiMember2024-09-300000886163lgnd:ZelsuvmiMember2023-12-310000886163lgnd:MetabasisMember2010-01-012010-01-310000886163us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300000886163us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300000886163us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300000886163us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300000886163us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300000886163us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300000886163us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300000886163us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300000886163us-gaap:PerformanceSharesMember2024-01-012024-09-300000886163us-gaap:PerformanceSharesMembersrt:MinimumMember2024-01-012024-09-300000886163us-gaap:PerformanceSharesMembersrt:MaximumMember2024-01-012024-09-300000886163us-gaap:RestrictedStockMember2024-07-012024-09-300000886163us-gaap:RestrictedStockMember2023-07-012023-09-300000886163us-gaap:RestrictedStockMember2024-01-012024-09-300000886163us-gaap:RestrictedStockMember2023-01-012023-09-300000886163us-gaap:EmployeeStockOptionMember2024-07-012024-09-300000886163us-gaap:EmployeeStockOptionMember2023-07-012023-09-300000886163us-gaap:EmployeeStockOptionMember2024-01-012024-09-300000886163us-gaap:EmployeeStockOptionMember2023-01-012023-09-300000886163us-gaap:ConvertibleDebtSecuritiesMember2024-07-012024-09-300000886163us-gaap:ConvertibleDebtSecuritiesMember2023-07-012023-09-300000886163us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-09-300000886163us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-09-300000886163us-gaap:StockCompensationPlanMember2024-07-012024-09-300000886163us-gaap:StockCompensationPlanMember2023-07-012023-09-300000886163lgnd:AgenusInc.Member2024-05-290000886163lgnd:AgenusInc.Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:INCAGN2390Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:BMS986442Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:AGEN2373Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:MK4830Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:UGN301Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:INCAGN2385Member2024-05-292024-05-290000886163lgnd:AgenusInc.Memberlgnd:BOTBALMember2024-05-292024-05-290000886163us-gaap:MeasurementInputExpectedTermMemberlgnd:AgenusInc.Member2024-05-290000886163us-gaap:MeasurementInputExpectedTermMemberlgnd:AgenusInc.Member2024-09-300000886163us-gaap:MeasurementInputOptionVolatilityMemberlgnd:AgenusInc.Member2024-05-290000886163us-gaap:MeasurementInputOptionVolatilityMemberlgnd:AgenusInc.Member2024-09-300000886163us-gaap:MeasurementInputRiskFreeInterestRateMemberlgnd:AgenusInc.Member2024-05-290000886163us-gaap:MeasurementInputRiskFreeInterestRateMemberlgnd:AgenusInc.Member2024-09-300000886163us-gaap:MeasurementInputSharePriceMemberlgnd:AgenusInc.Member2024-05-290000886163us-gaap:MeasurementInputSharePriceMemberlgnd:AgenusInc.Member2024-09-300000886163lgnd:PelicanTechnologyHoldingsIncMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:CommonStockMember2023-09-182023-09-180000886163lgnd:PelicanTechnologyHoldingsIncMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:PreferredStockMember2023-09-182023-09-180000886163lgnd:PelicanTechnologyHoldingsIncMemberus-gaap:RestrictedStockMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-09-182023-09-180000886163lgnd:PrimroseBioMember2023-09-180000886163lgnd:BelowMilestoneMemberlgnd:PrimroseBioMemberlgnd:PeliCRM197Membersrt:ScenarioForecastMember2025-01-010000886163lgnd:PrimroseBioMemberlgnd:PeliCRM197Membersrt:ScenarioForecastMember2025-01-010000886163lgnd:AboveMilestoneMemberlgnd:PrimroseBioMemberlgnd:PeliCRM197Membersrt:ScenarioForecastMember2025-01-010000886163us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberlgnd:PelicanTechnologyHoldingsIncMember2023-09-180000886163lgnd:PelicanTechnologyHoldingsIncMemberlgnd:EquityMethodInvestmentsAllocationMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-09-180000886163lgnd:PelicanTechnologyHoldingsIncMemberlgnd:EquitySecuritiesAllocationMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-09-180000886163lgnd:PelicanTechnologyHoldingsIncMemberlgnd:DerivativeAssetsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-09-180000886163us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberlgnd:PelicanTechnologyHoldingsIncMember2023-01-012023-09-300000886163us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberlgnd:PelicanTechnologyHoldingsIncMember2023-07-012023-09-300000886163us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberlgnd:PelicanTechnologyHoldingsIncMember2023-09-182023-09-1800008861632023-09-180000886163lgnd:AgenusPartneredProgramMemberlgnd:PrimordialGeneticsMember2024-07-012024-09-300000886163lgnd:AgenusPartneredProgramMemberlgnd:PrimordialGeneticsMember2024-01-012024-09-300000886163lgnd:PrimroseBioMember2024-01-012024-09-300000886163lgnd:PrimroseBioMember2024-07-012024-09-300000886163lgnd:APEIRONMember2024-07-152024-07-150000886163lgnd:APEIRONMember2024-07-150000886163lgnd:InvIOsHoldingAGMember2024-07-152024-07-150000886163lgnd:InvIOsHoldingAGMember2024-07-150000886163lgnd:InvIOsHoldingAGMemberus-gaap:InvestorMember2024-07-152024-07-150000886163lgnd:NovanIncMember2023-09-272023-09-270000886163lgnd:NovanIncMemberus-gaap:BridgeLoanMember2023-09-272023-09-270000886163lgnd:NovanIncMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-09-270000886163lgnd:NovanIncMember2023-09-270000886163lgnd:NovanIncMember2023-01-012023-12-310000886163lgnd:NovanIncMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2023-09-270000886163us-gaap:SegmentDiscontinuedOperationsMember2022-10-260000886163lgnd:QARZIBAMember2024-09-300000886163lgnd:QARZIBAMember2023-12-310000886163lgnd:AgenusInc.Member2024-09-300000886163lgnd:AgenusInc.Member2023-12-310000886163lgnd:ElutiaAndCorMatrixMember2024-09-300000886163lgnd:ElutiaAndCorMatrixMember2023-12-310000886163lgnd:SelexisMember2024-09-300000886163lgnd:SelexisMember2023-12-310000886163lgnd:OvidTherapeuticsMember2024-09-300000886163lgnd:OvidTherapeuticsMember2023-12-310000886163lgnd:ToleranceTherapeuticsMember2024-09-300000886163lgnd:ToleranceTherapeuticsMember2023-12-310000886163lgnd:EnsifentrineMember2024-09-300000886163lgnd:EnsifentrineMember2023-12-310000886163lgnd:OvidTherapeuticsMember2024-01-012024-09-300000886163lgnd:SelexisMember2024-01-012024-09-300000886163lgnd:SelexisMember2023-07-012023-09-300000886163lgnd:SelexisMember2023-01-012023-09-300000886163lgnd:ElutiaAndCorMatrixMember2017-05-312017-05-310000886163lgnd:ElutiaAndCorMatrixMember2017-05-310000886163lgnd:ElutiaAndCorMatrixMembersrt:MaximumMember2017-05-310000886163lgnd:ElutiaAndCorMatrixMember2024-07-012024-09-300000886163lgnd:ElutiaAndCorMatrixMember2024-01-012024-09-300000886163lgnd:ElutiaAndCorMatrixMember2023-01-012023-09-300000886163lgnd:ElutiaAndCorMatrixMember2023-07-012023-09-300000886163lgnd:OvidTherapeuticsMemberlgnd:SoticlestatMember2023-10-310000886163us-gaap:MeasurementInputDiscountRateMemberlgnd:OvidTherapeuticsMember2024-09-300000886163lgnd:ToleranceTherapeuticsMember2023-11-012023-11-300000886163lgnd:ToleranceTherapeuticsMember2023-11-300000886163lgnd:EnsifentrineMember2024-03-310000886163lgnd:EnsifentrineMember2024-08-310000886163us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2024-09-300000886163us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2024-09-300000886163us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2024-09-300000886163us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2024-09-300000886163us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-12-310000886163us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-12-310000886163us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-12-310000886163us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-12-310000886163us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300000886163us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300000886163us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300000886163us-gaap:FairValueMeasurementsRecurringMember2024-09-300000886163us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000886163us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000886163us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000886163us-gaap:FairValueMeasurementsRecurringMember2023-12-3100008861632023-01-012023-12-310000886163lgnd:CyDexMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:CyDexMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:CyDexMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:CyDexMemberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:CyDexMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:CyDexMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:CyDexMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:CyDexMemberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:MetabasisMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:MetabasisMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:MetabasisMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:MetabasisMemberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2024-09-300000886163lgnd:MetabasisMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:MetabasisMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:MetabasisMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163lgnd:MetabasisMemberus-gaap:FairValueMeasurementsRecurringMemberlgnd:ContingentLiabilitiesMember2023-12-310000886163us-gaap:MeasurementInputDiscountRateMemberlgnd:AgenusPartneredProgramMembersrt:MinimumMember2024-09-300000886163us-gaap:MeasurementInputDiscountRateMemberlgnd:AgenusPartneredProgramMembersrt:MaximumMember2024-09-300000886163us-gaap:MeasurementInputDiscountRateMemberlgnd:AgenusPartneredProgramMember2023-12-3100008861632010-01-012010-01-310000886163us-gaap:TransferredOverTimeMemberlgnd:DevelopmentRegulatoryCommercialMilestonesAndTieredRoyaltiesMembersrt:MaximumMember2024-09-300000886163us-gaap:TransferredOverTimeMemberlgnd:Phase3ClinicalTrialMember2024-09-300000886163lgnd:MetabasisMember2024-07-012024-09-300000886163lgnd:MetabasisMember2024-01-012024-09-300000886163lgnd:MetabasisMember2023-07-012023-09-300000886163lgnd:MetabasisMember2023-01-012023-09-300000886163us-gaap:RevolvingCreditFacilityMember2023-10-120000886163us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2023-10-122023-10-120000886163us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2023-10-122023-10-120000886163us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2023-10-122023-10-120000886163us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2023-10-122023-10-120000886163srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2023-10-122023-10-120000886163srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2023-10-122023-10-120000886163us-gaap:RevolvingCreditFacilityMember2024-07-080000886163us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300000886163us-gaap:EmployeeStockOptionMemberlgnd:TwoThousandTwoStockIncentivePlanMember2024-06-012024-06-300000886163us-gaap:RestrictedStockMember2023-12-310000886163us-gaap:RestrictedStockMember2024-01-012024-09-300000886163us-gaap:RestrictedStockMember2024-09-300000886163lgnd:AmendedESPPMember2024-01-012024-09-300000886163lgnd:AtTheMarketEquityOfferingMember2022-09-300000886163lgnd:AtTheMarketEquityOfferingMember2024-01-012024-09-300000886163lgnd:AtTheMarketEquityOfferingMember2024-07-012024-09-3000008861632023-04-300000886163lgnd:USDistrictCourtForTheNorthernDistrictOfOhioMember2019-10-312019-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________________

FORM 10-Q

________________________________________________________________________________________ | | | | | |

☒ | Quarterly Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2024

or | | | | | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period From ______ to ______ .

Commission File Number: 001-33093

LIGAND PHARMACEUTICALS INCORPORATED

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 77-0160744 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 555 Heritage Drive, Suite 200 | |

| Jupiter | |

| Florida | 33458 |

| (Address of principal executive offices) | (Zip Code) |

(858) 550-7500

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class: |

Trading symbol: | Name of each exchange on which registered: |

| Common Stock, par value $0.001 per share | LGND | The Nasdaq Global Market |

________________________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one) | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☐ | | Smaller Reporting Company | ☐ |

| Emerging Growth Company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 5, 2024, the registrant had 18,895,373 shares of common stock outstanding.

LIGAND PHARMACEUTICALS INCORPORATED

QUARTERLY REPORT

FORM 10-Q

TABLE OF CONTENTS | | | | | | | | |

PART I. FINANCIAL INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART II. OTHER INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | |

| GLOSSARY OF TERMS AND ABBREVIATIONS |

| Abbreviation | Definition |

| 2023 Annual Report | Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 |

| 2023 Notes | $750.0 million aggregate principal amount of convertible senior unsecured notes due 2023 |

| APAC | Avista Public Acquisition Corp. II (prior to its domestication in Delaware and change of name to OmniAb, Inc.) |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| Company | Ligand Pharmaceuticals Incorporated, including subsidiaries |

| CVR | Contingent value right |

| CyDex | CyDex Pharmaceuticals, Inc. |

| Distribution | The separation of OmniAb Business through a spin-off of OmniAb to Ligand’s shareholders of record as of October 26, 2022 on a pro rata basis |

| ESPP | Ligand Pharmaceuticals Incorporated Employee Stock Purchase Plan, as amended and restated, effective June 6, 2019 |

| FASB | Financial Accounting Standards Board |

| FDA | Food and Drug Administration |

| GAAP | Generally accepted accounting principles in the United States |

| Ligand | Ligand Pharmaceuticals Incorporated, including subsidiaries |

| Merger Agreement | Agreement and Plan of Merger, dated as of March 23, 2022, among APAC, Ligand, OmniAb and Merger Sub |

| Merger Sub | Orwell Merger Sub, Inc., a wholly owned subsidiary of APAC |

| Metabasis | Metabasis Therapeutics, Inc. |

| NDA | New Drug Application |

| New OmniAb | OmniAb, Inc. (formerly known as Avista Public Acquisition Corp. II and after it domestication in Delaware) |

| OmniAb | OmniAb Operations, Inc. (formerly known as OmniAb, Inc. and prior to being spun off by the Company) |

| OmniAb Business | Ligand's antibody discovery business (prior to being spun off by the Company) |

| PDUFA | Prescription Drug User Fee Act |

| Q3 2023 | The Company's fiscal quarter ended September 30, 2023 |

| Q3 2024 | The Company's fiscal quarter ended September 30, 2024 |

| SBC | Share-based compensation expense |

| SEC | Securities and Exchange Commission |

| Separation Agreement | Separation and Distribution Agreement, dated as of March 23, 2022, among APAC, Ligand and OmniAb |

| Takeda | Takeda Pharmaceutical Company Limited |

| Travere | Travere Therapeutics, Inc. |

| Viking | Viking Therapeutics, Inc. |

Cautionary Note Regarding Forward-Looking Statements:

You should read the following report together with the more detailed information regarding our company, our common stock and our financial statements and notes to those statements appearing elsewhere in this document.

This report contains forward-looking statements that involve a number of risks and uncertainties. Although our forward-looking statements reflect the good faith judgment of our management, these statements can only be based on facts and factors currently known by us. Consequently, these forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from results and outcomes discussed in the forward-looking statements.

Forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “plan,” “intends,” “estimates,” “would,” “continue,” “seeks,” “pro forma,” or “anticipates,” or other similar words (including their use in the negative), or by discussions of future matters such as those related to our future results of operations and financial position, royalties and milestones under license agreements, Captisol material sales, product development, and product regulatory filings and approvals, and the timing thereof, the anticipated benefits from the Apeiron transaction, Ligand's status as a high-growth company, as well as other statements that are not historical.

The cautionary statements made in this report are intended to be applicable to all related forward-looking statements wherever they may appear in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we assume no obligation to update our forward-looking statements, even if new information becomes available in the future. This caution is made under the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended.

PART I - FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

LIGAND PHARMACEUTICALS INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except par value) | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 63,619 | | | $ | 22,954 | |

| Short-term investments | 156,024 | | | 147,355 | |

| Accounts receivable, net | 34,318 | | | 32,917 | |

| Inventory | 16,740 | | | 23,969 | |

| Income taxes receivable | 7,813 | | | 6,395 | |

| Current derivative assets | 11,133 | | | — | |

| Other current assets | 19,741 | | | 3,839 | |

| Total current assets | 309,388 | | | 237,429 | |

| Intangible assets, net | 274,905 | | | 299,606 | |

| Goodwill | 105,250 | | | 103,370 | |

| Long-term portion of financial royalty assets, net | 199,251 | | | 62,291 | |

| Noncurrent derivative assets | 19,246 | | | 3,531 | |

| Property and equipment, net | 15,094 | | | 15,607 | |

| Operating lease right-of-use assets | 7,157 | | | 6,062 | |

| Finance lease right-of-use assets | 2,940 | | | 3,393 | |

| Equity method investment in Primrose Bio | 1,245 | | | 12,595 | |

| Other investments | 11,908 | | | 36,726 | |

Deferred income taxes, net | 78 | | | 214 | |

| Other assets | 8,404 | | | 6,392 | |

| Total assets | $ | 954,866 | | | $ | 787,216 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,694 | | | $ | 2,427 | |

| Accrued liabilities | 15,600 | | | 12,467 | |

| Income taxes payable | 2,108 | | | — | |

| Deferred revenue | 1,152 | | | 1,222 | |

| Current contingent liabilities | 128 | | | 256 | |

| Current operating lease liabilities | 1,066 | | | 403 | |

| Current finance lease liabilities | 24 | | | 7 | |

| Total current liabilities | 24,772 | | | 16,782 | |

| Long-term deferred revenue | 2,508 | | | 1,444 | |

| Long-term contingent liabilities | 3,863 | | | 2,942 | |

| Long-term operating lease liabilities | 6,267 | | | 5,755 | |

Deferred income taxes, net | 46,404 | | | 31,622 | |

| Other long-term liabilities | 29,874 | | | 27,758 | |

| Total liabilities | 113,688 | | | 86,303 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Preferred stock, $0.001 par value; 5,000 shares authorized; zero issued and outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

Common stock, $0.001 par value; 60,000 shares authorized; 18,760 and 17,556 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 19 | | | 18 | |

| Additional paid-in capital | 309,341 | | | 198,696 | |

| Accumulated other comprehensive loss | 1,746 | | | (817) | |

| Retained earnings | 530,072 | | | 503,016 | |

| Total stockholders' equity | 841,178 | | | 700,913 | |

| Total liabilities and stockholders' equity | $ | 954,866 | | | $ | 787,216 | |

See accompanying notes to unaudited condensed consolidated financial statements.

LIGAND PHARMACEUTICALS INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues and other income: | | | | | | | |

| Revenue from intangible royalty assets | $ | 26,552 | | | $ | 23,863 | | | $ | 67,512 | | | $ | 61,447 | |

| Income from financial royalty assets | 5,157 | | | 25 | | | 6,454 | | | 1,026 | |

| Royalties | 31,709 | | | 23,888 | | | 73,966 | | | 62,473 | |

| Captisol | 6,255 | | | 8,608 | | | 22,967 | | | 24,450 | |

| Contract revenue and other income | 13,848 | | | 372 | | | 27,388 | | | 16,290 | |

| Total revenues and other income | 51,812 | | | 32,868 | | | 124,321 | | | 103,213 | |

| Operating costs and expenses: | | | | | | | |

| Cost of Captisol | 2,449 | | | 3,485 | | | 8,237 | | | 8,871 | |

| Amortization of intangibles | 8,258 | | | 8,238 | | | 24,701 | | | 25,316 | |

| Research and development | 5,675 | | | 5,532 | | | 17,000 | | | 19,049 | |

| General and administrative | 24,475 | | | 14,656 | | | 53,049 | | | 36,798 | |

| Financial royalty assets impairment | — | | | — | | | 26,491 | | | — | |

| Fair value adjustments to partner program derivatives | 7,812 | | | — | | | 7,812 | | | — | |

| Total operating costs and expenses | 48,669 | | | 31,911 | | | 137,290 | | | 90,034 | |

| Gain on sale of Pelican | — | | | (2,121) | | | — | | | (2,121) | |

| Operating income (loss) from continuing operations | 3,143 | | | 3,078 | | | (12,969) | | | 15,300 | |

| Non-operating income and expenses: | | | | | | | |

| Gain (loss) from short-term investments | 2,407 | | | (13,184) | | | 98,923 | | | 30,340 | |

| Interest income | 1,347 | | | 2,263 | | | 6,124 | | | 6,018 | |

| Interest expense | (741) | | | (1) | | | (2,154) | | | (525) | |

| Other non-operating expense, net | (12,495) | | | (4,300) | | | (48,206) | | | (4,570) | |

| Total non-operating (expenses) income, net | (9,482) | | | (15,222) | | | 54,687 | | | 31,263 | |

| (Loss) income before income taxes from continuing operations | (6,339) | | | (12,144) | | | 41,718 | | | 46,563 | |

| Income tax benefit (expense) | (833) | | | 1,871 | | | (14,662) | | | (10,932) | |

| Net (loss) income from continuing operations | (7,172) | | | (10,273) | | | 27,056 | | | 35,631 | |

| Net loss from discontinued operations | — | | | — | | | — | | | (1,665) | |

| Net (loss) income | $ | (7,172) | | | $ | (10,273) | | | $ | 27,056 | | | $ | 33,966 | |

| | | | | | | |

| Basic net (loss) income from continuing operations per share | $ | (0.39) | | | $ | (0.59) | | | $ | 1.50 | | | $ | 2.07 | |

| Basic net loss from discontinued operations per share | $ | — | | | $ | — | | | $ | — | | | $ | (0.10) | |

| Basic net (loss) income per share | $ | (0.39) | | | $ | (0.59) | | | $ | 1.50 | | | $ | 1.97 | |

| Shares used in basic per share calculation | 18,419 | | | 17,380 | | | 18,061 | | | 17,241 | |

| | | | | | | |

| Diluted net (loss) income from continuing operations per share | $ | (0.39) | | | $ | (0.59) | | | $ | 1.46 | | | $ | 2.00 | |

| Diluted net loss from discontinued operations per share | $ | — | | | $ | — | | | — | | | $ | (0.09) | |

| Diluted net (loss) income per share | $ | (0.39) | | | $ | (0.59) | | | 1.46 | | | $ | 1.91 | |

| Shares used in diluted per share calculation | 18,419 | | | 17,380 | | | 18,574 | | | 17,784 | |

| | | | | | | |

See accompanying notes to unaudited condensed consolidated financial statements.

LIGAND PHARMACEUTICALS INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net (loss) income | $ | (7,172) | | | $ | (10,273) | | | $ | 27,056 | | | $ | 33,966 | |

| Unrealized net (loss) gain on available-for-sale securities, net of tax | 121 | | | 23 | | | 3 | | | 40 | |

Foreign currency translation adjustment, net of tax | 2,560 | | | — | | | 2,560 | | | — | |

| Comprehensive (loss) income | $ | (4,491) | | | $ | (10,250) | | | $ | 29,619 | | | $ | 34,006 | |

| | | | | | | |

See accompanying notes to unaudited condensed consolidated financial statements.

LIGAND PHARMACEUTICALS INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | |

| Common Stock | Additional paid in capital | Accumulated other comprehensive loss | Retained earnings | Total stockholders' equity |

| Shares | Amount |

| Balance at December 31, 2023 | 17,556 | | $ | 18 | | $ | 198,696 | | $ | (817) | | $ | 503,016 | | $ | 700,913 | |

| Issuance of common stock under employee stock compensation plans, net of shares withheld for payroll taxes | 368 | | — | | 12,228 | | — | | — | | 12,228 | |

| Share-based compensation | — | | — | | 7,334 | | — | | — | | 7,334 | |

| Unrealized loss on available-for-sale securities, net of tax | — | | — | | — | | (93) | | — | | (93) | |

| Net income | — | | — | | — | | — | | 86,139 | | 86,139 | |

| Balance at March 31, 2024 | 17,924 | | $ | 18 | | $ | 218,258 | | $ | (910) | | $ | 589,155 | | $ | 806,521 | |

| Issuance of common stock under employee stock compensation plans, net of shares withheld for payroll taxes | 179 | | 1 | | 9,552 | | — | | — | | 9,553 | |

| Share-based compensation | — | | — | | 11,060 | | — | | — | | 11,060 | |

| Unrealized net loss on available-for-sale securities, net of tax | — | | — | | — | | (25) | | — | | (25) | |

| Net loss | — | | — | | — | | — | | (51,911) | | (51,911) | |

| Balance at June 30, 2024 | 18,103 | | $ | 19 | | $ | 238,870 | | $ | (935) | | $ | 537,244 | | $ | 775,198 | |

| Issuance of common stock under employee stock compensation plans, net of shares withheld for payroll taxes | 323 | | — | | 21,270 | | — | | — | | 21,270 | |

Issuance of common stock under ATM, net of commissions and fees | 334 | | — | | 34,030 | | — | | — | | 34,030 | |

| Share-based compensation | — | | — | | 15,171 | | — | | — | | 15,171 | |

| Unrealized net gain on available-for-sale securities, net of tax | — | | — | | — | | 121 | | — | | 121 | |

Foreign currency translation adjustment, net of tax | — | | — | | | 2,560 | | — | | 2,560 | |

| Net loss | — | | — | | — | | — | | (7,172) | | (7,172) | |

| Balance at September 30, 2024 | 18,760 | | $ | 19 | | $ | 309,341 | | $ | 1,746 | | $ | 530,072 | | $ | 841,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | Additional paid in capital | Accumulated other comprehensive income (loss) | Retained earnings | Total stockholders' equity | | | | | |

| Shares | Amount | | | | | |

| Balance at December 31, 2022 | 16,951 | | $ | 17 | | $ | 147,590 | | $ | (984) | | $ | 450,862 | | $ | 597,485 | | | | | | |

| Issuance of common stock under employee stock compensation plans, net of shares withheld for payroll taxes | 183 | | — | | (762) | | — | | — | | (762) | | | | | | |

| Share-based compensation | — | | — | | 5,931 | | — | | — | | 5,931 | | | | | | |

| Unrealized net gain on available-for-sale securities, net of tax | — | | — | | — | | 49 | | — | | 49 | | | | | | |

| Final distribution of OmniAb | — | | — | | 1,665 | | — | | — | | 1,665 | | | | | | |

| Net income | — | | — | | — | | — | | 41,949 | | 41,949 | | | | | | |

| Balance at March 31, 2023 | 17,134 | | $ | 17 | | $ | 154,424 | | $ | (935) | | $ | 492,811 | | $ | 646,317 | | | | | | |

| Issuance of common stock under employee stock compensation plans, net of shares withheld for payroll taxes | 218 | | — | | 9,110 | | — | | — | | 9,110 | | | | | | |

| Share-based compensation | — | | — | | 7,207 | | — | | — | | 7,207 | | | | | | |

| Unrealized net loss on available-for-sale securities, net of tax | — | | — | | — | | (32) | | — | | (32) | | | | | | |

| Net income | — | | — | | — | | — | | 2,290 | | 2,290 | | | | | | |

| Balance at June 30, 2023 | 17,352 | | $ | 17 | | $ | 170,741 | | $ | (967) | | $ | 495,101 | | $ | 664,892 | | | | | | |

| Issuance of common stock under employee stock compensation plans, net of shares withheld for payroll taxes | 69 | | 1 | | 3,284 | | — | | — | | 3,285 | | | | | | |

| Share-based compensation | — | | — | | 6,884 | | — | | — | | 6,884 | | | | | | |

| Unrealized net gain on available-for-sale securities, net of tax | — | | — | | — | | 23 | | — | | 23 | | | | | | |

| Tax return to provision | — | | — | | 3,085 | | — | | — | | 3,085 | | | | | | |

| Net loss | — | | — | | — | | — | | (10,273) | | (10,273) | | | | | | |

| Balance at September 30, 2023 | 17,421 | | $ | 18 | | $ | 183,994 | | $ | (944) | | $ | 484,828 | | $ | 667,896 | | | | | | |

See accompanying notes to unaudited condensed consolidated financial statements.

LIGAND PHARMACEUTICALS INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands) | | | | | | | | | | | |

| Nine months ended |

| September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 27,056 | | | $ | 33,966 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Change in estimated fair value of contingent liabilities | 993 | | | 132 | |

| Depreciation and amortization of intangible assets | 26,612 | | | 27,605 | |

| Amortization of premium on investments, net | (725) | | | (938) | |

| Amortization of debt discount and issuance fees | 314 | | | 159 | |

| Non-cash income from financial royalty assets | (4,687) | | | (883) | |

| CECL adjustment to financial royalty assets | (3,463) | | | 3,190 | |

| Impairment loss of financial royalty assets | 26,491 | | | 924 | |

Loss on derivative assets | 14,655 | | | — | |

| Gain on sale of Pelican | — | | | (2,121) | |

| Losses from equity method investment in Primrose Bio | 11,576 | | | — | |

| Fair value adjustment to Primrose Bio securities investments | 25,788 | | | — | |

| Share-based compensation | 33,565 | | | 20,022 | |

| Deferred income taxes | (3,108) | | | 6,761 | |

| Gain from short-term investments | (98,923) | | | (30,340) | |

| Lease amortization expense | 1,555 | | | 1,231 | |

| Other | 3,123 | | | 215 | |

Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (794) | | | (5,436) | |

| Inventory | 7,053 | | | (11,577) | |

| Accounts payable and accrued liabilities | 2,617 | | | (7,461) | |

| Income tax receivable and payable | (607) | | | 5,818 | |

| Deferred revenue | (1,172) | | | 226 | |

| Other assets and liabilities | 657 | | | 19 | |

| Net cash provided by operating activities | 68,576 | | | 41,512 | |

| | | |

| Cash flows from investing activities: | | | |

Acquisition of financial royalty assets | (17,819) | | | — | |

| Proceeds from financial royalty assets | 4,892 | | | 349 | |

| Purchase of short-term investments | (133,629) | | | (107,262) | |

| Proceeds from sale of short-term investments | 189,563 | | | 96,318 | |

| Proceeds from maturity of short-term investments | 27,751 | | | 37,941 | |

| Cash paid for investment in Primrose Bio | (998) | | | (15,235) | |

| Cash paid for Palvella notes receivable | (2,500) | | | — | |

| Cash paid for Novan acquisition, net of restricted cash received | — | | | (10,405) | |

| Cash paid for the Agenus transaction | (75,000) | | | — | |

Cash paid for Apeiron acquisition, net of cash received | (91,996) | | | — | |

Cash paid for InvIOs investment | (4,196) | | | — | |

| Purchase of property and equipment | (1,109) | | | (3,104) | |

| Net cash (used in) provided by investing activities | (105,041) | | | (1,398) | |

| | | |

| Cash flows from financing activities: | | | |

Proceeds from ATM sales, net of commissions and fees | 34,030 | | | — | |

| Repayment at maturity/repurchase of 2023 Notes | — | | | (76,854) | |

| Payments under finance lease obligations | (19) | | | (40) | |

| Net proceeds from stock option exercises and ESPP | 46,251 | | | 15,922 | |

| Taxes paid related to net share settlement of equity awards | (3,201) | | | (4,290) | |

| Cash paid for debt issuance costs | (308) | | | — | |

| Net cash provided by (used in) financing activities | 76,753 | | | (65,262) | |

Effect of exchange rate changes on cash and cash equivalents | 377 | | | — | |

| Net increase in cash and cash equivalents | 40,665 | | | (25,148) | |

| Cash and cash equivalents at beginning of period | 22,954 | | | 45,006 | |

| Cash and cash equivalents at end of period | $ | 63,619 | | | $ | 19,858 | |

| | | | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | |

| Interest paid | $ | 262 | | | $ | 288 | |

| Taxes paid | $ | 17,346 | | | $ | 10 | |

| Restricted cash in other assets | $ | — | | | $ | 583 | |

Acquisitions: | | | |

| Fair value of tangible assets acquired, net of cash and restricted cash received | $ | 8,965 | | | $ | 17,887 | |

| Goodwill | — | | | 3,709 | |

Financial royalty assets | 106,156 | | | — | |

| Intangible assets | — | | | 10,700 | |

| Liabilities assumed | (23,125) | | | (21,891) | |

Net cash paid for acquisitions | $ | 91,996 | | | $ | 10,405 | |

| | | |

| Supplemental schedule of non-cash activity: | | | |

| Accrued Primrose transaction costs | $ | — | | | $ | 1,013 | |

| | | |

Addition of right-of-use assets and lease liabilities | $ | 1,769 | | | $ | — | |

| Accrued fixed asset purchases | $ | 289 | | | $ | 409 | |

Accrued debt issuance costs | $ | 8 | | | $ | — | |

Unrealized gain on AFS investments, net of tax | $ | 3 | | | $ | 40 | |

See accompanying notes to unaudited condensed consolidated financial statements.

LIGAND PHARMACEUTICALS INCORPORATED

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Unless the context requires otherwise, references in this report to “Ligand,” “we,” “us,” the “Company,” and “our” refer to Ligand Pharmaceuticals Incorporated and its consolidated subsidiaries.

1. Basis of Presentation and Summary of Significant Accounting Policies

Business

We are a biopharmaceutical company enabling scientific advancement through supporting the clinical development of high-value medicines. We do this by providing financing, licensing our technologies or both. We operate in one reportable segment: development and licensing of biopharmaceutical assets.

Basis of Presentation

Our unaudited condensed consolidated financial statements include the financial statements of Ligand and its wholly-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation. We have included all adjustments, consisting only of normal recurring adjustments, which we considered necessary for a fair presentation of our financial results. These unaudited condensed consolidated financial statements and accompanying notes should be read together with the audited consolidated financial statements included in our 2023 Annual Report. Interim financial results are not necessarily indicative of the results that may be expected for the full year.

Reclassification

Certain reclassifications have been made to the previously issued audited consolidated financial statements to conform with the current period presentation. Specifically, within the consolidated balance sheet as of December 31, 2023, our commercial license and other economic rights line has been reclassified to long-term portion of financial royalty assets, net, and to other assets, and a portion of other investments has been reclassified from other assets. Moreover, noncurrent derivative assets as of December 31, 2023, have been reclassified from other assets.

In addition, within the unaudited condensed consolidated statement of operations for the three and nine months ended September 30, 2023, royalties have been reclassified to revenue from intangible royalty assets, and a portion of the contract revenue has been reclassified to income from financial royalty assets.

Discontinued Operations

The Company determined that the spin-off of the OmniAb Business in November 2022 met the criteria for classification as a discontinued operation in accordance with ASC Subtopic 205-20, Discontinued Operations (“ASC 205-20”). Accordingly, the accompanying condensed consolidated financial statements have been updated to present the results of all discontinued operations reported as a separate component of loss in the condensed consolidated statements of operations and comprehensive loss (see Note 5, Spin-off of OmniAb). All disclosures have been adjusted to reflect continuing operations.

Significant Accounting Policies

We have described our significant accounting policies in Note 1, Basis of Presentation and Summary of Significant Accounting Policies of the Notes to Consolidated Financial Statements in our 2023 Annual Report.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with GAAP requires the use of estimates and assumptions that affect the amounts reported in the unaudited condensed consolidated financial statements and the accompanying notes. Actual results may differ from those estimates.

Revenue and Other Income

Our revenue is generated primarily from royalties on sales of products commercialized by our partners, Captisol material sales, income from financial royalty assets, and contract revenue for license fees, technical, regulatory and sales-based milestone payments. Other operating income is primarily related to milestone income received for financial royalty assets that have been fully amortized or where there is no underlying asset recognized on the consolidated balance sheets.

We apply the following five-step model in accordance with ASC 606, Revenue from Contracts with Customers, in order to determine the revenue: (i) identification of the promised goods or services in the contract; (ii) determination of whether the promised goods or services are performance obligations, including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance obligations; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

Revenue from Intangible Royalty Assets

We receive royalty revenue from intangible royalty assets on sales by our partners of products covered by patents that we or our partners own under contractual agreements. We do not have future performance obligations under these license arrangements. We generally satisfy our obligation to grant intellectual property rights on the effective date of the contract. However, we apply the royalty recognition constraint required under the guidance for sales-based royalties which requires a royalty to be recorded no sooner than when the underlying sale occurs. Therefore, royalties on sales of products commercialized by our partners are recognized in the quarter the product is sold. Our partners generally report sales information to us on a one quarter lag. Thus, we estimate the expected royalty proceeds based on an analysis of historical experience and interim data provided by our partners including their publicly announced sales. Differences between actual and estimated royalty revenues, which have not been material, are adjusted in the period in which they become known, typically the following quarter.

Income from Financial Royalty Assets

Effective January 1, 2024, we introduced a new line item “income from financial royalty assets”, which was included in “contract revenue” in prior periods. Accordingly, the prior year period amounts have been reclassified to align with the current period presentation.

We recognize income from financial royalty assets when there is a reasonable expectation about the timing and amount of cash flows expected to be collected. Income is calculated by multiplying the carrying value of the financial royalty asset by the periodic effective interest rate.

We account for financial royalty assets related to developmental pipeline or recently commercialized products on a non-accrual basis. Developmental pipeline products are non-commercialized, non-approved products that require FDA or other regulatory approval, and thus have uncertain cash flows. Newly commercialized products typically do not have an established reliable sales pattern, and thus have uncertain cash flows.

Captisol Sales

Revenue from Captisol sales is recognized when control of Captisol material is transferred or intellectual property license rights are granted to our customers in an amount that reflects the consideration we expect to receive from our customers in exchange for those products or rights. A performance obligation is considered distinct from other obligations in a contract when it provides a benefit to the customer either on its own or together with other resources that are readily available to the customer and is separately identified in the contract. For Captisol material or intellectual property license rights, we consider our performance obligation satisfied once we have transferred control of the product or granted the intellectual property rights, meaning the customer has the ability to use and obtain the benefit of the Captisol material or intellectual property license right. We recognize revenue for satisfied performance obligations only when we determine there are no uncertainties regarding payment terms or transfer of control. Sales tax and other taxes we collect concurrent with revenue-producing activities are excluded from revenue. We have elected to recognize the cost of freight and shipping when control over Captisol material has transferred to the customer as an expense in cost of Captisol. We expense incremental costs of obtaining a contract when incurred if the expected amortization period of the asset that we would have recognized is one year or less or the amount is immaterial. We did not incur any incremental costs of obtaining a contract during the periods reported.

Contract Revenue and Other Income

Our contracts with customers often include variable consideration in the form of contingent milestone payments. We include contingent milestone payments in the estimated transaction price when it is probable a significant reversal in the amount of cumulative revenue recognized will not occur. These estimates are based on historical experience, anticipated results and our best judgment at the time. If the contingent milestone payment is based on sales, we apply the royalty recognition constraint and record revenue when the underlying sale has taken place. Significant judgments must be made in determining the transaction price for our sales of intellectual property. Because of the risk that products in development with our partners will not reach development milestones or receive regulatory approval, we generally recognize any contingent payments that would be due to us upon the development milestone or regulatory approval.

Some customer contracts are sublicenses which require that we make payments to an upstream licensor related to license fees, milestones and royalties which we receive from customers. In such cases, we evaluate the determination of gross revenue as a principal versus net revenue as an agent reporting based on each individual agreement.

Other income is primarily related to milestone income received for financial royalty assets that have been fully amortized or where there is no underlying asset recognized on the consolidated balance sheets.

Deferred Revenue

Depending on the terms of the arrangement, we may also defer a portion of the consideration received because we have to satisfy a future obligation. The timing of revenue recognition, billings and cash collections results in billed accounts receivable, unbilled receivables (contract assets), and customer advances and deposits (contract liabilities) on the consolidated balance sheet. Except for royalty revenue and certain service revenue, we generally receive payment at the point we satisfy our obligation or soon after. Any fees billed in advance of being earned are recorded as deferred revenue. During the three and nine months ended September 30, 2024, the amount recognized as revenue that was previously deferred was $0.2 million and $1.2

million, respectively. During the three and nine months ended September 30, 2023, the amount recognized as revenue that was previously deferred was immaterial.

Disaggregation of Revenue

The following table represents disaggregation of royalties, Captisol and contract revenue and other income (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Royalties | | | | | | | |

| Kyprolis | $ | 11,599 | | | $ | 10,537 | | | $ | 27,229 | | | $ | 24,862 | |

| Evomela | 1,747 | | | 2,497 | | | 5,877 | | | 7,404 | |

| Teriparatide injection | 2,376 | | | 2,800 | | | 6,520 | | | 9,913 | |

| Rylaze | 3,886 | | | 3,678 | | | 10,070 | | | 9,315 | |

| Filspari | 3,206 | | | 1,122 | | | 7,402 | | | 1,707 | |

| Vaxneuvance | 1,466 | | | 1,313 | | | 3,962 | | | 2,990 | |

| Other | 2,272 | | | 1,916 | | | 6,452 | | | 5,256 | |

| Revenue from intangible royalty assets | 26,552 | | | 23,863 | | | 67,512 | | | 61,447 | |

| Income from financial royalty assets | 5,157 | | | 25 | | 6,454 | | | 1,026 | |

| 31,709 | | | 23,888 | | | 73,966 | | | 62,473 | |

| | | | | | | |

| Captisol | 6,255 | | | 8,608 | | | 22,967 | | | 24,450 | |

| | | | | | | |

| Contract revenue and other income | | | | | | | |

| Milestone and other | 13,848 | | | 372 | | | 25,444 | | | 16,290 | |

| Other income | — | | | — | | | 1,944 | | | — | |

| Contract revenue and other income | 13,848 | | | 372 | | | 27,388 | | | 16,290 | |

| | | | | | | |

| Total | $ | 51,812 | | | $ | 32,868 | | | $ | 124,321 | | | $ | 103,213 | |

Short-term Investments

Our short-term investments consist of the following at September 30, 2024 and December 31, 2023 (in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

September 30, 2024 | Amortized cost | | | Gross unrealized gains | | | Gross unrealized losses | | | Estimated fair value |

| Bond fund | $ | 39,512 | | | | $ | — | | | | $ | (265) | | | | $ | 39,247 | |

| U.S. government securities | 19,051 | | | | 31 | | | | — | | | | 19,082 | |

| Bank deposits | 12,280 | | | | 21 | | | | — | | | | 12,301 | |

| Corporate bonds | 10,969 | | | | 30 | | | | (3) | | | | 10,996 | |

| Commercial paper | 10,591 | | | | 5 | | | | (1) | | | | 10,595 | |

| Corporate equity securities | 6,551 | | | | — | | | | (6,058) | | | | 493 | |

| | | | | | | | | | |

| $ | 98,954 | | | | $ | 87 | | | | $ | (6,327) | | | | 92,714 | |

| Viking common stock | | | | | | | | | | 63,310 | |

| Total short-term investments | | | | | | | | | | $ | 156,024 | |

| | | | | | | | | | |

December 31, 2023 | | | | | | | | | | |

| Bond fund | $ | 63,763 | | | | $ | — | | | | $ | (537) | | | | $ | 63,226 | |

| Bank deposits | 17,165 | | | | 12 | | | | (1) | | | | 17,176 | |

| Corporate bonds | 14,850 | | | | 40 | | | | (2) | | | | 14,888 | |

| Commercial paper | 11,578 | | | | 9 | | | | (1) | | | | 11,586 | |

| U.S. government securities | 6,736 | | | | 18 | | | | (3) | | | | 6,751 | |

| Municipal bonds | 1,007 | | | | — | | | | (4) | | | | 1,003 | |

| Corporate equity securities | 5,775 | | | | — | | | | (5,235) | | | | 540 | |

| $ | 120,874 | | | | $ | 79 | | | | $ | (5,783) | | | | 115,170 | |

| Viking common stock | | | | | | | | | | 32,185 | |

| Total short-term investments | | | | | | | | | | $ | 147,355 | |

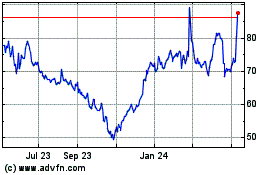

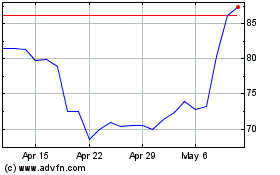

During the nine months ended September 30, 2024, we sold 0.7 million shares of Viking common stock and recognized a realized gain of $60.0 million in total. We did not sell Viking common stock during the three months ended September 30, 2024. During the nine months ended September 30, 2023, we sold 4.5 million shares of Viking common stock and recognized a realized gain of $37.2 million in total. During the three months ended September 30, 2023, there were no sales of Viking common stock.

Gain (loss) from short-term investments in our condensed consolidated statements of operations includes both realized and unrealized gain (loss) from our short-term investments in public equity and warrant securities.

Allowances are recorded for available-for-sale debt securities with unrealized losses. This limits the amount of credit losses that can be recognized for available-for-sale debt securities to the amount by which carrying value exceeds fair value and requires the reversal of previously recognized credit losses if fair value increases. The provisions of the credit losses standard did not have a material impact on our available-for-sale debt securities during the three and nine months ended September 30, 2024 and 2023.

The following table summarizes our available-for-sale debt securities by contractual maturity (in thousands):

| | | | | | | | | | | |

| September 30, 2024 |

| Amortized Cost | | Fair Value |

| Within one year | $ | 91,072 | | | $ | 91,152 | |

| After one year through five years | 4,647 | | | 4,655 | |

| Total | $ | 95,719 | | | $ | 95,807 | |

Our investment policy is capital preservation and we only invest in U.S.-dollar denominated investments. We held a total of 32 investments which were in an unrealized loss position with a total of $0.01 million unrealized losses as of September 30, 2024. We believe that we will collect the principal and interest due on our debt securities that have an amortized cost in excess of fair value. The unrealized losses are largely due to changes in interest rates and not to unfavorable changes in the credit quality associated with these securities that impacted our assessment on collectability of principal and interest. In July 2024, we sold certain securities before the recovery of the amortized cost basis to fund the Apeiron acquisition. Accordingly, we wrote down the amortized cost of $0.05 million during the nine months ended September 30, 2024. We do not intend to sell these securities and it is not more-likely-than-not that we will be required to sell these securities before the recovery of the amortized cost basis as of September 30, 2024. Accordingly, there was no credit loss recognized for the three months ended September 30, 2024. There were no credit losses recognized for the three and nine months ended September 30, 2023.

Accounts Receivable and Allowance for Credit Losses

Our accounts receivable arise primarily from sales on credit to customers. We establish an allowance for credit losses to present the net amount of accounts receivable expected to be collected. The allowance is determined by using the loss-rate method, which requires an estimation of loss rates based upon historical loss experience adjusted for factors that are relevant to determining the expected collectability of accounts receivable. Some of these factors include macroeconomic conditions that correlate with historical loss experience, delinquency trends, aging behavior of receivables and credit and liquidity quality indicators for industry groups, customer classes or individual customers. During the three and nine months ended September 30, 2024, we considered the current and expected economic and market conditions and concluded a decrease of $0.01 million and a decrease of $0.13 million in the allowance for credit losses, respectively. During the three and nine months ended September 30, 2023, we considered the current and expected economic and market conditions and concluded an increase of $0.10 million and an increase of $0.14 million in the allowance for credit losses, respectively.

Inventory

Inventory, which consists of finished goods (Captisol), is stated at the lower of cost or net realizable value. We determine cost using the specific identification method.

We analyze our inventory levels periodically and write down inventory to net realizable value if it has become obsolete, has a cost basis in excess of its expected net realizable value or is in excess of expected requirements. There was a $0.1 million and $0.2 million write-down recorded against inventory for the three and nine months ended September 30, 2024, respectively. There was no write-down recorded against inventory for the three and nine months ended September 30, 2023. In addition to finished goods, as of September 30, 2024 and December 31, 2023, inventory included prepayments of $3.3 million and $4.6 million, respectively, to our supplier for Captisol.

Goodwill and Other Identifiable Intangible Assets

Goodwill and other identifiable intangible assets consist of the following (in thousands):

| | | | | | | | | | | |

| September 30, | | December 31, |

| 2024 | | 2023 |

| Indefinite-lived intangible assets | | | |

| Goodwill | $ | 105,250 | | | $ | 103,370 | |

| Definite lived intangible assets | | | |

| Complete technology | 39,249 | | | 42,911 | |

| Less: accumulated amortization | (19,072) | | | (20,894) | |

| Trade name | 2,642 | | | 2,642 | |

| Less: accumulated amortization | (1,810) | | | (1,710) | |

| Customer relationships | 29,600 | | | 29,600 | |

| Less: accumulated amortization | (20,280) | | | (19,161) | |

| Contractual relationships | 360,000 | | | 360,000 | |

| Less: accumulated amortization | (115,424) | | | (93,782) | |

| Total goodwill and other identifiable intangible assets, net | $ | 380,155 | | | $ | 402,976 | |

Financial Royalty Assets, net (formerly known as Commercial License Rights)

Financial royalty assets represent a portfolio of future milestone and royalty payment rights acquired that are passive in nature (i.e., we do not own the intellectual property or have the right to commercialize the underlying products).

Although a financial royalty asset does not have the contractual terms typical of a loan (such as contractual principal and interest), we account for financial royalty assets under ASC 310, Receivables. Our financial royalty assets are classified similar to loans receivable and are measured at amortized cost using the prospective effective interest method described in ASC 835-30 Imputation of Interest.

The effective interest rate is calculated by forecasting the expected cash flows to be received over the life of the asset relative to the initial invested amount. The effective interest rate is recalculated in each reporting period as the difference between expected cash flows and actual cash flows are realized and as there are changes to expected future cash flows.

The gross carrying value of a financial royalty asset is made up of the opening balance, or net purchase price for a new financial royalty asset, which is increased by accrued interest income (except for assets under the non-accrual method) and decreased by cash receipts in the period to arrive at the ending balance.

We evaluate financial royalty assets for recoverability on an individual basis by comparing the effective interest rate at each reporting date to that of the prior period. If the effective interest rate is lower for the current period than the prior period, and if the gross cash flows have declined (expected and collected), we record provision expense for the change in expected cash flows. The provision is measured as the difference between the financial royalty asset’s amortized cost basis and the net present value of the expected future cash flows, calculated using the prior period’s effective interest rate.

In addition to the above allowance, we recognize an allowance for current expected credit losses under ASC 326, Financial Instruments – Credit Losses on our financial royalty assets. The credit rating, which is primarily based on publicly available data and updated quarterly, is the primary credit quality indicator used to determine the credit loss provision.

The carrying value of financial royalty assets is presented net of the cumulative allowance for changes in expected future cash flows and expected credit losses. The initial amount and subsequent revisions in allowances for changes in expected future cash flows and expected credit losses are recorded as part of general and administrative expenses on the condensed consolidated statements of operations.

When we are reasonably certain that a part of a financial royalty asset’s net carrying value (or all of it) is not recoverable, we recognize a permanent impairment which is recorded in a financial royalty asset impairment on the condensed consolidated statements of operations. To the extent there was an allowance previously recorded for this asset, the amount of such impairment is written off against the allowance at the time that such a determination is made. Any future recoveries from such impairment are recognized when cash is collected in a respective period earnings.

The current portion of financial royalty assets represents an estimation for current quarter royalty receipts which are collected during the subsequent quarter. This portion is presented in other current assets on our consolidated balance sheets, net of the allowance for expected credit losses.

For additional information, see Note 6, Financial Royalty Assets, net (formerly known as Commercial License Rights).

Derivative Assets

Derivative assets include instruments used for risk-management purposes, and other instruments. Derivative assets which are not used for risk management purposes, include: (a) acquired rights in future milestone and royalty payments from Agenus Partnered Programs (as defined below), (b) Agenus Warrant (as defined below), (c) option to invest up to $25 million to milestone and royalty rights which expires on June 30, 2025 ("Upsize Option"), and (d) rights to receive from Primrose Bio 50% of milestones on two contracts previously entered into by Primordial Genetics.

In addition, we have entered into a collar arrangement to hedge against the fluctuation risk in Viking's share price (the “Viking Share Collar”). However, because the Viking stock investment is remeasured at fair value through earnings under ASC 321, the Viking Share Collar is not eligible for hedge accounting, but is considered as an economic hedge. All derivatives are measured at fair value on the consolidated balance sheets.

Derivative assets consist of the following (in thousands):

| | | | | | | | | | | |

| September 30, | | December 31, |

| 2024 | | 2023 |

Agenus Upsize Option (expires on 6/30/25) | $ | 3,815 | | | $ | — | |

| Viking shares collar | 7,318 | | | — | |

| Total current derivative assets | $ | 11,133 | | | $ | — | |

| | | |

Primrose mRNA | $ | 2,921 | | | $ | 3,531 | |

Agenus Partner Programs | 14,099 | | | — | |

Agenus Warrant (5 years contractual term) | 2,226 | | | — | |

Total noncurrent derivative assets | $ | 19,246 | | | $ | 3,531 | |

A change in the fair value of the Viking Shares Collar that amounted to $(7.9) million and $7.3 million during the three and nine months ended September 30, 2024, respectively, are included in gain (loss) from short-term investments within the condensed consolidated statements of operations. A change in the fair value of Agenus Partner Programs that amounted to $(7.2) million during the three and nine months ended September 30, 2024 is included in fair value adjustments to partner program derivatives within the condensed consolidated statements of operations. A change in the fair value of other derivatives that amounted to $(8.0) million and $(6.8) million during the three and nine months ended September 30, 2024, respectively, are recognized in other non-operating expense, net within the condensed consolidated statements of operations. We acquired the Primrose mRNA derivative on September 18, 2023 with the sale of Pelican business and investment in Primrose Bio transaction. A change in the fair value of the Primrose mRNA derivative that amounted to $(0.6) million during the three and nine months ended September 30, 2024 is included in fair value adjustments to partner program derivatives within the condensed consolidated statements of operations. We did not have any other derivative instruments during the three and nine months ended September 30, 2023.

Equity Method Investment

Investments that we do not consolidate but in which we have significant influence over the operating and financial policies of the investee are classified as equity method investments and are accounted for using the equity method of accounting.

In applying the equity method of accounting, investments are initially recorded at cost and are subsequently adjusted based on our proportionate share of net income or loss of the investee, net of any distributions received from the investee and any impairment.

Other Investments

Other investments represent our investments in equity securities of third parties in which we do not have control or significant influence. Our equity securities investments do not have a readily determinable or estimable fair value and are measured using the measurement alternative, which is cost less impairment, if any, and adjustments resulting from observable price changes in orderly transactions for the identical or similar investment of the same issuer. The amount of such impairment or adjustment recognized during the period is presented in other non-operating income (expense) in our condensed consolidated statements of operations.

Other investments consist of the following (in thousands):

| | | | | | | | | | | |

| September 30, | | December 31, |

| 2024 | | 2023 |