Form 8-K - Current report

10 December 2024 - 8:34AM

Edgar (US Regulatory)

0000750004FALSE00007500042024-12-062024-12-06

| | | | | | | | | | | | | | |

| | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | |

| | FORM 8-K | |

| | | | |

| | CURRENT REPORT | |

| | | | |

| Pursuant to Section 13 or 15(d) of the |

| Securities Exchange Act of 1934 |

| | | | |

| Date of Report (Date of earliest event reported): December 6, 2024 |

| | | | |

| LIGHT & WONDER, INC. |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Nevada | 001-11693 | 81-0422894 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

| 6601 Bermuda Road, Las Vegas, NV 89119 |

| (Address of registrant’s principal executive office) |

| | | | |

| (702) 897-7150 |

| (Registrant’s telephone number, including area code) |

| | | |

| | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | |

| Securities registered pursuant to Section 12(b) of the Exchange Act: |

| | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $.001 par value | LNW | The Nasdaq Stock Market |

| | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | |

| | ☐ | Emerging growth company |

| | | | |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

|

Item 7.01. Regulation FD Disclosure.

On December 6, 2024, Light & Wonder, Inc. (the “Company”) provided the Australian Securities Exchange (the “ASX”) a Statement of CHESS Depositary Interests on Issue (“Appendix 4A”). A copy of Appendix 4A is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01 as well as in Exhibit 99.1 is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | LIGHT & WONDER, INC. |

| | | |

Dated: | December 9, 2024 | By: | /s/ James Sottile |

| | Name: | James Sottile |

| | Title: | Executive Vice President, Chief Legal Officer and Corporate Secretary |

| | |

This appendix is available as an online form Only use this form if the online version is not available |

Appendix 4A Statement of CDIs on issue

Information and documents given to ASX become ASX’s property and may be made public.

*Denotes minimum information required for first lodgement of this form.

Part 1 – Entity and announcement details

| | | | | | | | |

Question no | Question | Answer |

| 1.1 | *Name of entity We (the entity named above) provide the following information about our issued capital.1 |

LIGHT & WONDER INC. |

| 1.2 | *Registration type and number Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). |

666710836 |

| 1.3 | *ASX issuer code | LNW |

| 1.4 |

*The announcement is Tick whichever is applicable. | ☒ New announcement ☐ Update/amendment to previous announcement ☐ Cancellation of previous announcement |

| 1.4a | *Reason for update Mandatory only if “Update” ticked in Q1.4 above. A reason must be provided for an update. |

N/A |

| 1.4b | *Date of previous announcement to this update Mandatory only if “Update” ticked in Q1.4 above. |

N/A |

| 1.4c | *Reason for cancellation Mandatory only if “Cancellation” ticked in Q1.4 above. |

N/A |

| 1.4d | *Date of previous announcement to this cancellation Mandatory only if “Cancellation” ticked in Q1.4 above. |

N/A |

| 1.5 | *Date of this announcement | December 6, 2024 |

____________________

1 Listing rule 4.11 requires an entity that has a dual listing on ASX and an overseas exchange and has CDIs issued over quoted securities, to complete an Appendix 4A and give it to ASX within 5 business days of the end of each month. An entity that has a dual listing on ASX and an overseas exchange and that is proposing to issue new equity securities and to have quoted CDIs over some or all of them, should notify ASX of the proposed issue of the underlying securities using an Appendix 3B and apply for the CDIs to be quoted using an Appendix 2A.

+ See Chapter 19 for defined terms

1 December 2019 Page 1

| | |

This appendix is available as an online form

|

| | |

Appendix 4A Statement of CDIs on issue |

Part 2 – Details of CDIs and other securities on issue

| | | | | | | | | | | | | | | | | | | | |

Question no | Question | Answer

|

| 2.1 |

*Statement for month and year

Appendix 4A should be provided within 5 business days of the calendar month end, regardless of whether there is a change or not.

|

Month: November Year: 2024 |

| 2.2 |

*Number and class of all ASX quoted CDIs

Repeat the following information for each class of CDIs quoted on ASX:

|

| ASX security code

LNW | Security description CDI 1:1 FOREIGN EXEMPT XNGS

| CDI ratio2: 1:1

| |

Total number of CDIs quoted on ASX at end of statement month (A):

26,448,314 | Total number of CDIs quoted on ASX at end of previous month (B):

25,466,884 | Net difference3 (A-B):

981,430 |

If the total number of CDIs quoted on ASX at the end of the statement month (A), is greater than the total number of CDIs for which the entity has previously paid an initial listing fee or an additional listing fee under Table 1A and 1C of Guidance Note 15A (C), the entity hereby applies for +quotation of the difference (A – C) and agrees to the matters set out in Appendix 2A of the ASX Listing Rules.

Reason for Change:

Net transfers of securities between CDIs and Common Stock As quoted/ held on NASDAQ

|

| 2.3 |

*Number and class of all issued securities not represented by CDIs quoted on ASX:

Repeat the following table for each class of issued securities not represented (in whole or in part) by CDIs quoted on ASX

|

| ASX security code:

LNWAA

| Security description:

COMMON STOCK | |

Total number of securities at end of statement month (A):

60,721,438 | Total number of securities

at end of previous month (B):

62,872,017 | Net difference (A-B):

-2,150,579

|

Reason for change: Transfer of securities between CDIs and Common Shares, decreases in Common Shares repurchased by the issuer's ongoing share repurchase program offset by an increase in total shares outstanding pursuant to vesting of issuer's outstanding RSUs & exercise of previously issued options to Common Shares. |

________________________________

2 This is the ratio at which CDIs can be transmuted into the underlying security (e.g. 4:1 means 4 CDIs represent 1 underlying security whereas 1:4 means 1 CDI represents 4 underlying securities).

3 The net difference should equal the number of underlying securities transmuted into CDIs during the month less the number of CDIs transmuted into underlying securities during the month..

+ See Chapter 19 for defined terms

1 December 2019 Page 2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

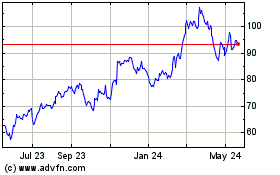

Light and Wonder (NASDAQ:LNW)

Historical Stock Chart

From Dec 2024 to Jan 2025

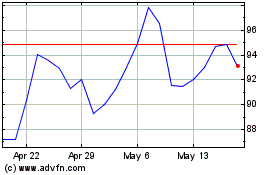

Light and Wonder (NASDAQ:LNW)

Historical Stock Chart

From Jan 2024 to Jan 2025