false

0001114925

0001114925

2024-09-10

2024-09-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 10, 2024

LANTRONIX,

INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-16027 |

|

33-0362767 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

48

Discovery, Suite

250

Irvine, California 92618 |

| (Address of Principal Executive Offices, including zip code) |

| |

|

|

|

|

| Registrant’s telephone number, including area code: (949) 453-3990 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

LTRX |

The Nasdaq Stock Market LLC |

| |

|

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of Securities Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Chief Financial Officer

On September 10, 2024, Jeremy Whitaker informed

Lantronix, Inc. (the “Company”) that he was resigning as the Company’s Chief Financial Officer effective September 13,

2024. The Company is initiating a formal search process for the selection of a new Chief Financial Officer.

Appointment of Chief Accounting Officer and Interim

Chief Financial Officer

On September 14, 2024, the Company’s Board

of Directors (the “Board”) appointed Brent Stringham as the Company’s Chief Accounting Officer and Chief Financial Officer.

Mr. Stringham will serve as Chief Financial Officer on an interim basis until the Company appoints a permanent replacement for Mr. Whitaker.

Mr. Stringham, 46, has served as Senior Director of Finance and Corporate Controller of the Company since February 2012. Prior to that,

Mr. Stringham held controller positions with two technology companies for five years and was an Audit Manager at Ernst & Young LLP

from 2000 to 2007.

In connection with his appointment as Chief Accounting

Officer and interim Chief Financial Officer, the Company entered into a letter agreement with Mr. Stringham on September 14, 2024 (the

“Agreement”), which includes the following compensation and benefits for Mr. Stringham:

• Mr.

Stringham will be entitled to an annual base salary of $267,000.

• Mr.

Stringham will be entitled to an annual incentive bonus opportunity based on the achievement of performance criteria to be established

by the Board (or a committee thereof). Mr. Stringham’s annual target bonus opportunity will be 40% of his base salary for the corresponding

fiscal year.

• Mr.

Stringham will be entitled to a one-time retention bonus opportunity of $100,000, which will be payable if Mr. Stringham remains employed

with the Company through September 14, 2025, or should his employment with the Company be terminated before that date by the Company for

any reason other than for Cause (as defined in the Agreement) or by Mr. Stringham for Good Reason (as defined in the Agreement).

• The

Company will grant Mr. Stringham a restricted stock unit (“RSU”) award under the Company’s Amended And Restated 2020

Performance Incentive Plan covering a number of shares of Company common stock equal to $145,000 divided by the average of the closing

prices (in regular trading) of a share of Company common stock on The Nasdaq Stock Market for the last thirty (30) trading days of the

Company’s first quarter of fiscal year 2025. One-third of the RSUs will be scheduled to vest on September 1, 2025, and the remaining

RSUs will be scheduled to vest ratably on first day of the last month of each fiscal quarter thereafter for a period of eight (8) quarters,

with vesting in each case subject to Mr. Stringham’s continued employment with the Company through such date.

The Agreement provides that if Mr. Stringham’s

employment with the Company is terminated by the Company without Cause or by Mr. Stringham for Good Reason, Mr. Stringham will be entitled

to receive (i) a lump sum payment equal to 6 months of his base salary plus an amount equal to one hundred percent (100%) of his Company

bonus for fiscal year 2025, and (ii) 12 months of continued vesting of his Company equity awards. If, however, Mr. Stringham’s employment

is terminated by the Company without Cause or by Mr. Stringham for Good Reason within 60 days prior to or 12 months following a Change

in Control (as defined in the Agreement), the Agreement provides that (i) all of Mr. Stringham’s outstanding equity awards will

accelerate and become fully vested; (ii) he will receive a cash severance payment in a lump sum equal to 12 months of his base salary

plus an amount equal to 100% of his target bonus; and (iii) he and his eligible dependents will be entitled to continued participation

in the Company’s group health, dental and vision insurance plans on the same terms as existed at the time of his termination for

up to 12 months thereafter. Mr. Stringham’s right to receive the severance benefits described above is subject to his executing

and not revoking a general release of claims in favor of the Company.

The foregoing description of the Agreement is a

summary, does not purport to be complete and is qualified in its entirety by reference to the Agreement, which is attached hereto as Exhibit

10.1 and is incorporated herein by reference.

In connection with Mr. Stringham’s appointment

described above, the Company and Mr. Stringham have also entered into an Indemnification Agreement, the terms of which are identical in

all material respects to the form of indemnification agreement that the Company has previously entered into with each of its executive

officers, which was filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K as filed with the SEC on June 20, 2016.

| Item 7.01 |

Regulation FD Disclosure. |

The information disclosed in Item 2.02 of this Current Report on Form

8-K is incorporated by reference into this Item 7.01.

The information furnished pursuant to this Item

7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing

under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LANTRONIX, INC. |

| |

|

|

| |

By: |

|

/s/ Brent Stringham |

| |

|

|

Brent Stringham |

| |

|

|

Chief Accounting Officer and Interim Chief Financial Officer |

Date: September 16, 2024

Exhibit 10.1

September 14, 2024

Brent Stringham

c/o Lantronix, Inc.

48 Discovery, Suite 250

Irvine, CA 92618

Dear Brent:

We want to thank you for your dedicated service

to Lantronix, Inc (“Lantronix” or “Company”) since 2012 and to confirm the terms of your promotion as set forth

in this letter. Your position and title with the Company will be Chief Accounting Officer effective September 15, 2024 (the “Commencement

Date”).

POSITION EXCLUSIVITY

As Chief Accounting Officer, you will report to

the Company’s Chief Executive Officer (the “CEO”) while the Company conducts a search for a permanent Chief Financial

Officer (“CFO”). As part of such search, you will be considered as one of the candidates. Until a CFO is retained, you will

serve as Interim Chief Financial Officer. Once a CFO is hired, you will report thereafter to the CFO (unless you are chosen as CFO, in

which case you will continue to report to the CEO).

Upon the Commencement Date, your role will be

to serve as the Company’s Principal Accounting Officer and, for any period you serve as Chief Financial Officer (on an interim or

permanent basis), the Company’s Principal Financial Officer. Your primary office will be located at the Lantronix offices in 48

Discovery, Suite 250, Irvine, California 92618. During your employment with Lantronix, you will not render any services to any other person

or entity, whether for compensation or otherwise, or engage in any business activities competitive with or adverse to the Company’s

business or welfare, whether alone, as an employee, as a partner, as a member, or as a shareholder, officer or director of any other corporation,

or as a trustee, fiduciary or in any other similar representative capacity of any other entity, without the prior written consent of the

CEO.

BASE SALARY

While you are employed with the Company as Chief

Accounting Officer, the Company shall pay you a bi-weekly base salary in the amount of $10,269.23 ($267,000.00 on an annualized basis),

less applicable withholdings and deductions, paid on the Company’s regular bi-weekly payroll dates. You will be classified as an

exempt employee, and your salary will be paid on a salary basis and is intended to compensate you for all hours that you work. Your salary

will be reviewed at the time executive salaries are reviewed periodically, and the Company may, in its sole discretion, adjust it to reflect

Company performance, your performance, market conditions, and other factors deemed relevant by the Company.

BONUS

While you are employed with the Company as Chief

Accounting Officer, you will be eligible to participate in Lantronix’s Annual Bonus Program (“Program”) at a target

amount that will be equal to 40% of your base salary. Your bonus percentage is not guaranteed and may be adjusted upward or downward

by the Compensation Committee of the Company’s Board of Directors (the “Compensation Committee”) in its sole discretion.

Your participation will commence with the Fiscal 2025 plan period, which began July 1, 2024 and ends June 30, 2025. Your participation

and payment of a bonus and the amount is subject to the terms of the Program and the performance targets established thereunder by the

Compensation Committee, as such Programs and targets may be amended from time to time and are generally established every year by the

Compensation Committee. Lantronix reserves the right to change or discontinue the Program at any time, and any right to a bonus is subject

to your continued employment with the Company through the date that such bonus is actually paid to you.

RETENTION BONUS

You shall also receive a one-time retention bonus

opportunity of $100,000 (“Retention Bonus”), which shall be subject to standard deductions and withholdings as required

by law and payable with the Company’s first payroll period following either: (i) the first anniversary of the Commencement Date,

(ii) your termination of employment by the Company for any reason other than for Cause (as defined below) before the first anniversary

of the Commencement Date, or (iii) your resignation from employment with the Company for Good Reason (as defined below) before the first

anniversary of the Commencement Date. Your right to a Retention Bonus is subject to your continued employment with the Company through

the first of such dates, and in no event will you be entitled to or considered to have earned the Retention Bonus (or any portion thereof)

if your employment with the Company ends due to any other circumstances prior to the first anniversary of the Commencement Date.

For purposes of this letter, “Good Reason”

shall mean your resignation within one hundred and twenty (120) days after the Company has taken any of the following actions without

your express written consent: (i) a material reduction in your base salary, your target annual bonus opportunity or benefits (unless,

outside of a Change in Control context, such reduction is in connection with a salary or benefit reduction program of general application

at the senior level executives of the Company); (ii) a material breach by the Company of any written agreement with you, including the

Company’s failure to obtain an agreement from any successor to the Company to assume and agree to perform the obligations under

this letter in the same manner and to the same extent that the Company would be required to perform, except where such assumption occurs

by operation of law; (iii) a material adverse change in your title, duties or responsibilities (other than temporarily while you are disabled

or as otherwise permitted by applicable law and other than in connection with the Company hiring or appointing a new Chief Financial Officer);

or (iv) relocation of your principal workplace by more than 25 miles and such change results in a material increase in your one-way commute.

Notwithstanding the foregoing, Good Reason shall not exist unless you provide the Company written notice of the existence of the one or

more of the actions, conditions or events set forth above in this definition of Good Reason within ninety (90) days after the initial

existence or occurrence of such action, condition or event, and if such action, event or condition is curable, the Company fails to cure

such action, event or condition within thirty (30) days after its receipt of such notice. For clarity, if you serve as interim Chief Financial

Officer, the Company hiring or appointing a new Chief Financial Officer (other than you), along with attendant changes in authorities,

duties and responsibilities, will not constitute Good Reason.

For purposes of this letter, “Cause”

shall mean: (i) gross negligence or willful misconduct in the performance of your duties to the Company; (ii) intentional and continual

failure to substantially perform your reasonably assigned duties for the Company; (iii) intentional conduct that is demonstrably and materially

injurious to the Company, including but not limited to committing or cooperating in an act of fraud, theft, or dishonesty against the

Company; (iv) your breach of a fiduciary duty to the Company or its shareholders; (v) your conviction for, or plea of guilty or nolo contendre

to, the commission of any felony or any crime involving deceit, material dishonesty, fraud, embezzlement, theft, any crime that results

in or is intended to result in personal enrichment at the expense of the Company, any crime that involves the use or sale of a controlled

substance, or any other offense that will adversely affect in any material respect the Company’s reputation or your ability to perform

your obligations or duties to the Company; or (vi) your violation of a material written policy of the Company or breach of a written agreement

with Company, including but not limited to a breach of the Employment, Confidential Information, and Invention Assignment Agreement. Notwithstanding

the foregoing, Cause shall not exist under (i), (ii), (iii), (iv) or (vi) unless the Company provides you with written notice of the existence

of one or more of the actions, conditions or events set forth above in such definition of Cause, and if such action, event or condition

is curable, you fail to cure such action, event or condition within thirty (30) days after receipt of such notice.

For the sake of clarity, termination of your employment

in connection with your death or disability will not be considered termination by the Company without Cause hereunder. For purposes of

this letter, you shall be considered disabled if you have been physically or mentally unable to perform your job duties hereunder for

a continuous period of at least one hundred twenty (120) days or a total of one hundred fifty (150) days during any one hundred and eighty

(180) day period, and you have not recovered and returned to the full time performance of your duties within thirty (30) days after written

notice is given to you by the Company following such 120 day period or 180 day period, as applicable.

RESTRICTED STOCK UNITS

In connection with your promotion, you will receive

a one-time grant of restricted stock units from the Company that will be granted to you effective the first day of the month immediately

following the Commencement Date and issued to you shortly thereafter, pursuant to, and subject to the terms and provisions of, the Company’s

Amended and Restated 2020 Performance Incentive Plan, as amended.

The number of restricted stock units (RSUs) subject

to such grant shall equal $145,000 divided by the average of the closing prices (in regular trading) of a share of Company common

stock on The Nasdaq Stock Market for the last thirty (30) trading days of the fiscal quarter preceding the fiscal quarter in which the

date of grant of such award occurs, rounded to the nearest whole share.

The foregoing RSUs shall vest according to the

following schedule: one-third of the foregoing RSUs shall vest on September 1, 2025, subject to your continuing employment with the Company

through such date, and no shares shall vest before such date. The remaining RSUs shall vest ratably on first day of the last month of

each quarter thereafter for a period of eight (8) quarters, subject to your continuing employment with the Company through such dates.

No right to any stock is earned or accrued until such time that vesting occurs, nor does the grant confer any rights to continue vesting

or employment.

SEVERANCE

If your employment with the Company is terminated

by you for Good Reason or by the Company without Cause, then subject to your execution and non-revocation of a release of claims in a

form provided by the Company, then in addition to any base salary earned through the termination date, any earned but as-yet unpaid bonuses,

unpaid expense reimbursements and vested benefits to which you are entitled under the terms of any Company employee benefit plan (which

compensation and benefits will be paid to you or your estate in connection with your ceasing to be employed without regard to the reason

for such cessation), you will be entitled to the following:

| · | Severance pay in a total amount equal to the

sum of (i) six (6) months of your then current base salary, plus (ii) an amount equal to one hundred percent (100%) of your Company bonus

for fiscal year 2025 (collectively, the “Severance Payment”). The Severance Payment shall be less required tax deductions

and withholdings and shall be paid in a lump sum on the 53rd day following your date of termination or such later date as is required

to avoid potentially adverse taxation under Internal Revenue Code Section 409A pursuant to the provisions under the caption “Section

409A” below. |

| · | Continued vesting of any equity award under any

agreement between you and the Company or any of its subsidiaries or under any plan maintained by Lantronix or any of its subsidiaries

in which you participate or participated, including but not limited to the Lantronix 2000 Stock Plan, the Lantronix 2010 Inducement Equity

Incentive Plan, the Lantronix 2010 Stock Incentive Plan, the Amended and Restated 2010 Stock Incentive Plan, the Lantronix 2020 Performance

Incentive Plan, and the Amended and Restated 2020 Performance Incentive Plan (collectively, the “Equity Plans”) for a period

of twelve months after the termination date. |

GENERAL

You acknowledge and confirm that you are eligible

to serve the Company as an officer and that you will comply with all Company policies and guidelines for our senior officers (including,

without limitation, those regarding transactions in Company stock).

The Company is an at-will employer; this means

that employment, compensation and benefits can be terminated with or without cause, and with or without notice, at any time at the option

of either you or the Company. The Company may modify its compensation and benefits programs from time to time. No terms or conditions

of your employment can be modified or changed verbally in any manner.

CHANGE IN CONTROL

If your employment with the Company is terminated

by you for Good Reason or by the Company without Cause within 60 days prior to or 12 months following a Change in Control (as defined

below), then, subject to your execution and non-revocation of a release of claims in a form provided by the Company, in keeping with past

practice, and resignation from any Company-affiliated board positions, all unvested Company equity awards that you then hold shall fully

vest and be settled or become exercisable, as applicable, and you will be entitled to receive (as applicable, the “Change-in-Control

Severance Payment”) severance pay in a total amount equal to the sum of (i) twelve (12) months of your then current Base Salary,

plus (ii) an amount equal to one hundred percent (100%) of your then current target bonus. The Company will also provide you, your spouse

and your eligible dependents with continued group health, dental and vision coverage pursuant to the provisions of COBRA at the level

in effect and upon substantially the same terms and conditions as existed under applicable insurance plans immediately prior to the date

of termination of your employment (including without limitation contributions required by you, if any, for such benefits), for the first

twelve (12) months following the date of termination your employment without Cause or for Good Reason or until you become eligible for

comparable benefits from another employer. If you are entitled to severance under this “Change in Control” section, you will

not be entitled to any severance or other benefits provided for in the “Severance” section above.

Any Change-of-Control Severance Payments shall

be less required tax deductions and withholdings and shall be paid in a lump sum on the 53rd day following your date of termination or

such later date as is required to avoid potentially adverse taxation under Internal Revenue Code Section 409A as described under the caption

“Section 409A” below. Change-of-Control Severance Payments may also be subject to reduction required to avoid potentially

adverse taxation under Internal Revenue Code Section 280G as described under the caption “Section 280G” below.

For purposes of this letter, “Change in

Control” shall mean the occurrence of any of the following events: (i) any “person” (as such term is used in Section

13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), becomes the “beneficial owner”

(as defined in Rule 13d-3 promulgated under the Exchange Act), directly or indirectly, of securities of the Company representing fifty

percent (50%) or, more of the total voting power represented by the Company’s then outstanding voting securities; or (ii) the consummation

of the sale or disposition by the Company of all or substantially all of the Company’s assets; (iii) the consummation of a merger

or consolidation of the Company with any other corporation, other than (A) a merger or consolidation which would result in the voting

securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted

into voting securities of the surviving entity or its parent) at least fifty percent (50%) of the total voting power represented by the

voting securities of the Company or such surviving entity or its parent outstanding immediately after such merger or consolidation; or

(iv) a majority of the members of the Board are replaced during any twelve- month period by directors whose appointment or election is

not endorsed by a majority of the Board before the date of appointment or election. In no event shall a “Change in Control”

be deemed to have occurred for purposes of this letter solely because the Company engages in an internal reorganization, which may include

a transfer of assets to, or a merger or consolidation with, one or more affiliates.

SECTION 409A

This letter is intended to comply with Section

409A of the Internal Revenue Code (“Section 409A”) or an exemption thereunder and shall be construed and administered in accordance

with Section 409A. Notwithstanding any other provision of this offer letter, payments provided under this letter may only be made upon

an event and in a manner that complies with Section 409A or an applicable exemption. Any payments under this letter that may be excluded

from Section 409A either as separation pay due to an involuntary separation from service or as a short-term deferral shall be excluded

from Section 409A to the maximum extent possible. For purposes of Section 409A, each instalment payment provided under this letter shall

be treated as a separate payment. Any payments to be made under this letter upon a termination of employment shall only be made upon a

“separation from service” under Section 409A. Notwithstanding the foregoing, the Company makes no representations that the

payments and benefits provided under this letter comply with Section 409A and in no event shall the Company be liable for all or any portion

of any taxes, penalties, interest or other expenses that may be incurred by you on account of non- compliance with Section 409A.

Notwithstanding any other provision of this letter,

if any payment or benefit provided to you in connection with termination of employment is determined to constitute “nonqualified

deferred compensation” within the meaning of Section 409A and you are determined to be a “specified employee” as defined

in Section 409A(a)(2)(b)(i), then such payment or benefit shall not be paid until the first payroll date to occur following the six-month

anniversary of your termination date (the “Specified Employee Payment Date”) or, if earlier, on the date of your death. The

aggregate of any payments that would otherwise have been paid before the Specified Employee Payment Date shall be paid to you in a lump

sum on the Specified Employee Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with their

original schedule. To the extent necessary to avoid application of any tax under Section 409A applying to any compensation or benefit

included herein that constitutes nonqualified deferred compensation, the definition of “Change in Control” shall be reformed

such that a transaction will only qualify as a Change in Control if it also constitutes a “change in control event” as defined

under Section 409A.

SECTION 280G

Notwithstanding any other provision of this letter

or any other plan, arrangement or agreement to the contrary, if any of the payments or benefits provided or to be provided by the Company

or its affiliates to you or for your benefit pursuant to the terms of this letter or otherwise (“Covered Payments”) constitute

parachute payments (“Parachute Payments”) within the meaning of Section 280G of the Internal Revenue Code (“Section

280G”) and would, but for this section be subject to the excise tax imposed under Section 4999 of the Internal Revenue Code (or

any successor provision thereto) (“Section 4999”) or any similar tax imposed by state or local law or any interest or penalties

with respect to such taxes (collectively, the “Excise Tax”), then prior to making the Covered Payments, a calculation shall

be made comparing (i) the Net Benefit (as defined below) to you of the Covered Payments after payment of the Excise Tax to (ii) the Net

Benefit to you if the Covered Payments are limited to the extent necessary to avoid being subject to the Excise Tax. Only if the amount

calculated under (i) above is less than the amount under (ii) above will the Covered Payments be reduced to the minimum extent necessary

to ensure that no portion of the Covered Payments is subject to the Excise Tax (that amount, the “Reduced Amount”). “Net

Benefit” shall mean the present value of the Covered Payments net of all federal, state, local, foreign income, employment and excise

taxes.

Any such reduction shall be made in accordance

with Section 409A and the following: (i) the Covered Payments which do not constitute nonqualified deferred compensation subject to Section

409A shall be reduced first; and (ii) all other Covered Payments shall then be reduced as follows: (A) cash payments shall be reduced

before non-cash payments; and (B) payments to be made on a later payment date shall be reduced before payments to be made on an earlier

payment date.

Any determination required under this section

shall be made in writing in good faith by the accounting firm that was the Company’s independent registered public accounting firm

immediately before the change in control (the “Accountants”), which shall provide detailed supporting calculations to the

Company and you as requested by the Company or you. The Company and you shall provide the Accountants with such information and documents

as the Accountants may reasonably request in order to make a determination under this section. For purposes of making the calculations

and determinations required by this section, the Accountants may rely on reasonable, good faith assumptions and approximations concerning

the application of Section 280G and Section 4999. The Accountants’ determinations shall be final and binding on the Company and

you. The Company shall be responsible for all fees and expenses incurred by the Accountants in connection with the calculations required

by this section.

ACCEPTANCE

To indicate your acceptance of this offer, please

sign the below and return a scanned copy via email to Human Resources at HR@lantronix.com on or before 5:00 pm Pacific time on September

14, 2024. If we do not receive the signed document within the time frame provided herein, this offer will expire.

This offer letter supersedes and replaces any

prior understandings, agreements or offer letters, whether oral, written, or implied, between you and the Company regarding the matters

described in this letter. All other details related to your employment shall remain the same.

Very truly yours,

LANTRONIX, INC.

/s/ David Goren

David Goren

Vice President of Business Affairs and Corporate

Secretary

ACKNOWLEDGED AND ACCPETED BY:

| Employee Signature: |

/s/ Brent Stringham |

| |

|

| Employee Name: |

Brent Stringham |

Date: |

09/14/2024 |

| |

|

|

|

|

Exhibit 99.1

Lantronix Announces CFO Departure and Transition

Plan

Experienced

Leadership Team to Oversee Transition

Irvine, Calif., Sept. 16, 2024 — Lantronix Inc. (NASDAQ:

LTRX), a global leader in compute and connectivity IoT solutions, today announced the resignation of Chief Financial Officer (CFO) Jeremy

Whitaker, who has accepted the CFO role at a private company. Whitaker departed on September 13, 2024.

Brent Stringham, currently the company’s Controller, is

appointed Interim CFO while the company conducts a search for the next CFO. Stringham, an experienced financial leader, has been with

Lantronix since 2012. He brings deep institutional knowledge and extensive financial expertise to the role. Prior to joining Lantronix,

Brent held financial leadership positions at Iteris Inc., Netlist

Inc., and Ernst & Young.

In addition, David McLennan, former CFO of Sierra

Wireless Inc., who retired in 2020, has been engaged to provide consulting and advisory support during the transition. McLennan

brings a proven track record of driving growth, international expansion, and financial stability during his tenure at leading technology

companies.

Saleel Awsare, CEO of Lantronix, expressed confidence in the

company's financial future: "Lantronix is positioned for financial success with the skilled leadership of Brent and David. I want

to personally thank Jeremy for his 18 years of dedication and exceptional contributions, and I wish him great success in his new role.”

Jeremy Whitaker, outgoing CFO, commented: "In choosing

to depart at this time I have balanced the need to complete the year-end results at Lantronix, with the pressing needs of my new position.

It has been a privilege to contribute to the transformation of Lantronix into a global IoT leader. As I take on this new opportunity,

I leave knowing the company is in excellent hands, with a strong financial foundation."

With this leadership transition plan in place, Lantronix remains firmly

committed to delivering shareholder value and advancing its strategic objectives as a global leader in the IoT industry.

About Lantronix

Lantronix

Inc. is a global leader of compute and connectivity IoT solutions that target high-growth industries including Smart Cities, Automotive

and Enterprise. Lantronix’s products and services empower companies to succeed in the growing IoT markets by delivering customizable

solutions that address each layer of the IoT Stack. Lantronix’s leading-edge solutions include Intelligent Substations infrastructure,

Infotainment systems and Video Surveillance, supplemented with advanced Out-of-Band Management (OOB) for Cloud and Edge Computing. For

more information, please visit www.lantronix.com.

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: This news release contains forward-looking statements within the meaning of federal securities laws, including without

limitation statements related to our leadership transition plan and positioning for financial success. These forward-looking statements

are based on our current expectations and are subject to substantial risks and uncertainties that could cause our actual results, future

business, financial condition, or performance to differ materially from our historical results or those expressed or implied in any forward-looking

statement contained in this news release. The potential risks and uncertainties include, but are not limited to, such factors as the effects

of negative or worsening regional and worldwide economic conditions or market instability on our business, including effects on purchasing

decisions by our customers; our ability to mitigate any disruption in our and our suppliers’ and vendors’ supply chains due

to the COVID-19 pandemic or other outbreaks, wars and recent tensions in Europe, Asia and the Middle East, or other factors; future responses

to and effects of public health crises; cybersecurity risks; changes in applicable U.S. and foreign government laws, regulations, and

tariffs; our ability to successfully implement our acquisitions strategy or integrate acquired companies; difficulties and costs of protecting

patents and other proprietary rights; the level of our indebtedness, our ability to service our indebtedness and the restrictions in our

debt agreements; and any additional factors included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2024, filed

with the Securities and Exchange Commission (the “SEC”) on Sept. 9, 2024; as well as in our other public filings with the

SEC. Additional risk factors may be identified from time to time in our future filings. The forward-looking statements included in this

release speak only as of the date hereof, and we do not undertake any obligation to update these forward-looking statements to reflect

subsequent events or circumstances.

© 2024 Lantronix, Inc. All rights reserved. Lantronix is a registered

trademark. Other trademarks and trade names are those of their respective owners.

# # #

Lantronix Media Contact:

Gail Kathryn Miller

Corporate Marketing &

Communications Manager

media@lantronix.com

Lantronix Analyst and Investor Contact:

investors@lantronix.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

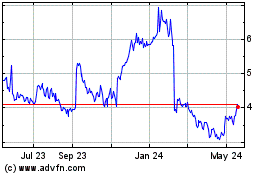

Lantronix (NASDAQ:LTRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

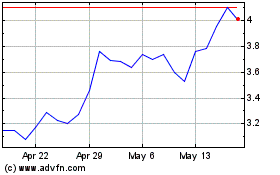

Lantronix (NASDAQ:LTRX)

Historical Stock Chart

From Feb 2024 to Feb 2025