Mesa Provides Update on RASPRO Surplus CRJ Asset Transactions

06 June 2024 - 9:00PM

Mesa Air Group, Inc. (NASDAQ: MESA) (“Mesa” or the

“Company”) today provided an update that the Company has completed

the sales of six of the 15 surplus CRJ-900 airframes, and ten of

the 30 surplus CRJ engines, associated with its Regional Aircraft

Securitization Program (“RASPRO”) finance lease. Mesa previously

entered into agreements to sell the 15 airframes and 30 engines,

respectively, to two separate third parties.

Previously, the RASPRO finance lease carried a $50.4 million

obligation for Mesa to purchase the assets at the end of the lease

in March 2024. As disclosed with its first quarter fiscal 2024

earnings release, Mesa reached an agreement to fulfill the purchase

obligation over the course of May 2024 to September 2024. Based on

the aforementioned sale closings and resulting payments to RASPRO,

Mesa's purchase obligation has been reduced to $27.3 million as of

May 31, 2024. The Company anticipates fully eliminating this

obligation in the coming months as it purchases the remaining

assets from RASPRO and in turn executes their sales to the

respective third parties under agreement.

“Addressing the RASPRO lease has been one of the top priorities

for our surplus asset sale efforts over the past year-and-a-half,”

said Jonathan Ornstein, Mesa Chairman and CEO. “This is a

significant financial obligation that we are putting behind us, and

we are increasingly able to prioritize the future of the company

for our investors and people. We look forward to enhancing our

focus on returning to profitable performance and executing other

strategic actions while closing the remaining transactions related

to the RASPRO assets in the coming months.”

About Mesa Air Group, Inc.

Headquartered in Phoenix, Arizona, Mesa Air Group, Inc. is the

holding company of Mesa Airlines, a regional air carrier providing

scheduled passenger service to 79 cities in 36 states, the District

of Columbia, Canada, Cuba, and Mexico. As of March 31, 2024, Mesa

operated a fleet of 80 aircraft, with approximately 263 daily

departures. The Company had approximately 2,110 employees. Mesa

operates all its flights as United Express pursuant to the terms of

a capacity purchase agreement entered into with United Airlines,

Inc.

Forward-Looking Statements

This press release includes information that constitutes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Words such as

“anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”,

“believe”, “may”, “might”, “will”, “should”, “can have”, “likely”

and similar expressions are used to identify forward-looking

statements. These forward-looking statements are based on the

Company’s current beliefs, assumptions, and expectations regarding

future events, which in turn are based on information currently

available to the Company. By their nature, forward-looking

statements address matters that are subject to risks and

uncertainties. A variety of factors could cause actual events and

results to differ materially from those expressed in or

contemplated by the forward-looking statements. For additional

information about factors that could cause actual results to differ

materially from those described in the forward-looking statements,

please refer to the Company’s filings with the SEC, including the

risk factors contained in its most recent Annual Report on Form

10-K and the Company’s other subsequent filings with the SEC. The

Company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except to the extent required by

applicable laws.

Contact:Mesa Air Group,

Inc.Mediamedia@mesa-air.com

Investor Relationsinvestor.relations@mesa-air.com

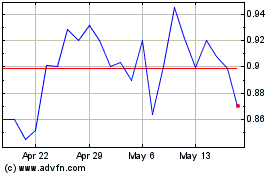

Mesa Air (NASDAQ:MESA)

Historical Stock Chart

From Oct 2024 to Nov 2024

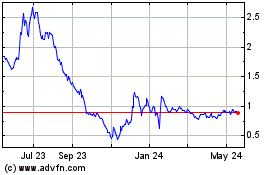

Mesa Air (NASDAQ:MESA)

Historical Stock Chart

From Nov 2023 to Nov 2024