0001000209false00010002092024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

MEDALLION FINANCIAL CORP.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

001-37747

(Commission File Number)

04-3291176

(IRS Employer Identification No.)

437 MADISON AVENUE, 38th Floor

NEW YORK, New York 10022

(Address of Principal Executive Offices) (Zip Code)

(212) 328-2100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

MFIN |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

Medallion Financial Corp. (the “Company”), issued a press release to the news media announcing, among other things, the Company’s results for the quarter ended June 30, 2024.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in the press release is being furnished, not filed, pursuant to Item 2.02. Accordingly, the information in the press release will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed with this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 30, 2024

|

|

|

MEDALLION FINANCIAL CORP. |

|

|

By: |

|

/s/ Anthony N. Cutrone |

|

|

Name: Anthony N. Cutrone |

|

|

Title: Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE:

MEDALLION FINANCIAL CORP. REPORTS 2024 SECOND QUARTER RESULTS

NEW YORK, NY – July 30, 2024 – Medallion Financial Corp. (NASDAQ: MFIN, “Medallion” or the “Company”), a specialty finance company that originates and services loans in various consumer and commercial industries, along with offering loan origination services to fintech strategic partners, announced today its results for the quarter ended June 30, 2024.

2024 Second Quarter Highlights

•Net income was $7.1 million, or $0.30 per share, compared to $14.2 million, or $0.62 per share, in the prior year quarter.

•$2.3 million of cash was collected on taxi medallion-related assets, compared to $10.6 million of cash collected, in the prior year quarter.

•Net interest income grew 7% to $49.9 million from $46.7 million in the prior year quarter.

•Net interest margin on net loans was 8.42%, compared to 8.77% in the prior year quarter, and on gross loans it was 8.12%, compared to 8.48% in the prior year quarter.

•Loan originations were $309.1 million, compared to $346.3 million in the prior year quarter.

•Loans grew 11% to $2.4 billion as of June 30, 2024, compared to $2.2 billion a year ago.

•The credit loss provision increased to $18.6 million from $8.5 million in the prior year quarter. The total provision included $1.0 million of net taxi medallion recoveries in the current quarter compared to $5.3 million of net taxi medallion recoveries in the prior year quarter.

•The Company repurchased 183,900 shares of common stock at an average cost of $8.24 per share.

•The Company declared and paid a quarterly cash dividend of $0.10 per share.

Executive Commentary – Andrew Murstein, President of Medallion

"Overall this was another solid quarter for us. Notable in the quarter, our earnings included approximately $0.12 per share of additional allowance tied to the growth of our loan portfolio, primarily within our recreation segment, which grew 10% from the first quarter to $1.5 billion, with over $200 million in originations this quarter. We continue to be pleased with the credit performance of that segment. Additionally, our results reflect atypical professional fees in the quarter associated with our successful defense of an activist proxy campaign.

Our net interest income reached $49.9 million, an all-time high, grew 4% from the prior quarter, and we saw our net charge-offs drop from what we experienced in the first quarter. We remain cautiously optimistic that the solid performance of our loans and the strong credit quality of our overall loan portfolio will continue. Despite some contraction over the past few years, due mainly to the current interest rate environment, our net interest margin increased two basis points from the first quarter.

Lastly, unlike the first quarter, our commercial division did not have any significant equity gains this quarter. Their net interest margin was more than 9% as they grew their loan portfolio by 19% from last year.”

Business Segment Highlights

Recreation Lending Segment

•Originations were $209.6 million during the quarter, compared to $190.0 million a year ago.

•Recreation loans grew 12% to $1.5 billion as of June 30, 2024, compared to $1.3 billion a year ago.

•Recreation loans were 63% of total loans as of June 30, 2024, compared to 62% a year ago.

•Net interest income grew 9% to $36.5 million for the quarter, from $33.5 million in the prior year quarter.

•The average interest rate was 14.80% at quarter-end, compared to 14.62% a year ago.

•Recreation loans 90 days or more past due were $5.9 million, or 0.41% of gross recreation loans, as of June 30, 2024, compared to $5.0 million, or 0.39%, a year ago.

•Allowance for credit loss rate was 4.35% as of June 30, 2024, compared to 4.07% a year ago.

Home Improvement Lending Segment

•Originations were $68.0 million during the quarter, compared to $117.0 million a year ago.

•Home improvement loans grew 6% to $773.2 million as of June 30, 2024, compared to $728.5 million a year ago.

•Home improvement loans were 32% of total loans as of June 30, 2024, compared to 34% a year ago.

•Net interest income grew 4% to $11.5 million for the quarter, from $11.1 million in the prior year quarter.

•The average interest rate was 9.71% at quarter-end, compared to 9.21% a year ago.

•Home improvement loans 90 days or more past due were $1.3 million, or 0.17% of gross home improvement loans, as of June 30, 2024, compared to $1.1 million, or 0.16%, a year ago.

•Allowance for credit loss rate was 2.38% as of June 30, 2024, compared to 2.26% a year ago.

Commercial Lending Segment

•Commercial loans were $110.2 million at June 30, 2024, compared to $92.6 million a year ago.

•The average interest rate on the portfolio was 13.05%, compared to 12.64 % a year ago.

Taxi Medallion Lending Segment

•The Company collected $2.3 million of cash on taxi medallion-related assets during the quarter.

•Total net taxi medallion assets declined to $10.0 million (comprised of $2.1 million of loans net of allowance for credit losses and $7.9 million of loan collateral in process of foreclosure), a 44% reduction from a year ago, and represented less than half a percent of the Company’s total assets as of June 30, 2024.

Capital Allocation

Quarterly Dividend

•The Board of Directors declared a quarterly dividend of $0.10 per share, payable on August 30, 2024 to shareholders of record at the close of business on August 15, 2024.

Stock Repurchase Plan

•During the second quarter, the Company repurchased 183,900 shares of its common stock at an average cost of $8.24 per share, for a total of $1.5 million.

•As of June 30, 2024 the Company had $16.4 million remaining under its $40 million share repurchase program

Conference Call Information

The Company will host a conference call to discuss its second quarter financial results tomorrow, Wednesday, July 31, 2024 at 9:00 a.m. Eastern time.

In connection with its earnings release, the Company has updated its quarterly supplement presentation, which is now available at www.medallion.com.

How to Participate

•Date: Wednesday, July 31, 2024

•Time: 9:00 a.m. Eastern time

•U.S. dial-in number: (833) 816-1412

•International dial-in number: (412) 317-0504

•Live webcast: Link to Webcast of 2Q24 Earnings Call

A link to the live audio webcast of the conference call will also be available at the Company’s IR website.

Replay Information

The webcast replay will be available at the Company's IR website until the next quarter’s results are announced.

The conference call replay will be available following the end of the call through Wednesday, August 7.

•U.S. dial-in number: (844) 512-2921

•International dial-in number: (412) 317-6671

About Medallion Financial Corp.

Medallion Financial Corp. (NASDAQ:MFIN) and its subsidiaries originate and service a growing portfolio of consumer loans and mezzanine loans in various industries. Key industries served include recreation (towable RVs and marine) and home improvement (replacement roofs, swimming pools, and windows). Medallion Financial Corp. is headquartered in New York City, NY, and its largest subsidiary, Medallion Bank, is headquartered in Salt Lake City, Utah. For more information, please visit www.medallion.com.

Forward-Looking Statements

Please note that this press release contains forward-looking statements that involve risks and uncertainties relating to business performance, cash flow, net interest income and expenses, other expenses, earnings, growth, and our growth strategy. These statements are often, but not always, made using words or phrases such as “will” and “continue” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These statements relate to future public announcements of our earnings, the impact of the pending SEC litigation, expectations regarding our loan portfolio, including collections on our medallion loans, the potential for future asset growth, and market share opportunities. Medallion’s actual results may differ significantly from the results discussed in such forward-looking statements. For example, statements about the effects of the current economy, whether inflation or the risk of recession, operations, financial performance and prospects constitute forward-looking statements and are subject to the risk that the actual impacts may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond Medallion’s control. In addition to risks relating to the current economy, a description of certain risks to which Medallion is or may be subject, including risks related to the pending SEC litigation, please refer to the factors discussed under the heading “Risk Factors” in Medallion’s 2023 Annual Report on Form 10-K.

Company Contact:

Investor Relations

212-328-2176

InvestorRelations@medallion.com

MEDALLION FINANCIAL CORP.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands, except share and per share data) |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

June 30, 2023 |

|

Assets |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and federal funds sold |

|

$ |

157,961 |

|

|

$ |

149,845 |

|

|

$ |

124,554 |

|

Investment and equity securities |

|

|

66,625 |

|

|

|

65,712 |

|

|

|

65,096 |

|

Loans |

|

|

2,385,590 |

|

|

|

2,215,886 |

|

|

|

2,156,998 |

|

Allowance for credit losses |

|

|

(89,788 |

) |

|

|

(84,235 |

) |

|

|

(74,971 |

) |

Net loans receivable |

|

|

2,295,802 |

|

|

|

2,131,651 |

|

|

|

2,082,027 |

|

Goodwill and intangible assets, net |

|

|

170,672 |

|

|

|

171,394 |

|

|

|

172,118 |

|

Property, equipment, and right-of-use lease asset, net |

|

|

14,094 |

|

|

|

14,076 |

|

|

|

13,343 |

|

Accrued interest receivable |

|

|

13,299 |

|

|

|

13,538 |

|

|

|

13,345 |

|

Loan collateral in process of foreclosure |

|

|

9,359 |

|

|

|

11,772 |

|

|

|

16,803 |

|

Other assets |

|

|

33,064 |

|

|

|

29,839 |

|

|

|

31,851 |

|

Total assets |

|

$ |

2,760,876 |

|

|

$ |

2,587,827 |

|

|

$ |

2,519,137 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

Deposits |

|

$ |

2,006,782 |

|

|

$ |

1,866,657 |

|

|

$ |

1,813,785 |

|

Long-term debt |

|

|

230,803 |

|

|

|

235,544 |

|

|

|

178,128 |

|

Short-term borrowings |

|

|

37,500 |

|

|

|

8,000 |

|

|

|

67,880 |

|

Deferred tax liabilities, net |

|

|

22,394 |

|

|

|

21,207 |

|

|

|

26,840 |

|

Operating lease liabilities |

|

|

6,071 |

|

|

|

7,019 |

|

|

|

7,629 |

|

Accrued interest payable |

|

|

7,945 |

|

|

|

6,822 |

|

|

|

4,449 |

|

Accounts payable and accrued expenses |

|

|

26,592 |

|

|

|

30,804 |

|

|

|

32,662 |

|

Total liabilities |

|

|

2,338,087 |

|

|

|

2,176,053 |

|

|

|

2,131,373 |

|

Total stockholders’ equity |

|

|

354,001 |

|

|

|

342,986 |

|

|

|

318,976 |

|

Non-controlling interest in consolidated subsidiaries |

|

|

68,788 |

|

|

|

68,788 |

|

|

|

68,788 |

|

Total equity |

|

|

422,789 |

|

|

|

411,774 |

|

|

|

387,764 |

|

Total liabilities and equity |

|

$ |

2,760,876 |

|

|

$ |

2,587,827 |

|

|

$ |

2,519,137 |

|

Number of shares outstanding |

|

|

23,211,990 |

|

|

|

23,449,646 |

|

|

|

23,345,017 |

|

Book value per share |

|

$ |

15.25 |

|

|

$ |

14.63 |

|

|

$ |

13.66 |

|

MEDALLION FINANCIAL CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

(Dollars in thousands, except share and per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total interest income |

|

$ |

70,704 |

|

|

$ |

61,726 |

|

|

$ |

137,774 |

|

|

$ |

117,568 |

|

Total interest expense |

|

|

20,836 |

|

|

|

15,035 |

|

|

|

39,989 |

|

|

|

27,275 |

|

Net interest income |

|

|

49,868 |

|

|

|

46,691 |

|

|

|

97,785 |

|

|

|

90,293 |

|

Provision for credit losses |

|

|

18,577 |

|

|

|

8,476 |

|

|

|

35,778 |

|

|

|

12,514 |

|

Net interest income after provision for credit losses |

|

|

31,291 |

|

|

|

38,215 |

|

|

|

62,007 |

|

|

|

77,779 |

|

Other income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) on equity investments |

|

|

(512 |

) |

|

|

99 |

|

|

|

3,655 |

|

|

|

9 |

|

Gain on sale of loans and taxi medallions |

|

|

242 |

|

|

|

1,306 |

|

|

|

830 |

|

|

|

3,161 |

|

Write-down of loan collateral in process of foreclosure |

|

|

— |

|

|

|

(21 |

) |

|

|

— |

|

|

|

(273 |

) |

Other income |

|

|

1,369 |

|

|

|

558 |

|

|

|

2,017 |

|

|

|

1,128 |

|

Total other income, net |

|

|

1,099 |

|

|

|

1,942 |

|

|

|

6,502 |

|

|

|

4,025 |

|

Other expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

9,435 |

|

|

|

9,339 |

|

|

|

18,892 |

|

|

|

18,175 |

|

Loan servicing fees |

|

|

2,692 |

|

|

|

2,361 |

|

|

|

5,162 |

|

|

|

4,583 |

|

Collection costs |

|

|

1,659 |

|

|

|

1,608 |

|

|

|

3,126 |

|

|

|

3,146 |

|

Regulatory fees |

|

|

888 |

|

|

|

781 |

|

|

|

1,865 |

|

|

|

1,463 |

|

Professional fees |

|

|

1,845 |

|

|

|

1,368 |

|

|

|

2,616 |

|

|

|

3,075 |

|

Rent expense |

|

|

698 |

|

|

|

603 |

|

|

|

1,355 |

|

|

|

1,226 |

|

Amortization of intangible assets |

|

|

362 |

|

|

|

363 |

|

|

|

723 |

|

|

|

723 |

|

Other expenses |

|

|

2,416 |

|

|

|

2,580 |

|

|

|

4,481 |

|

|

|

5,004 |

|

Total other expenses |

|

|

19,995 |

|

|

|

19,003 |

|

|

|

38,220 |

|

|

|

37,395 |

|

Income before income taxes |

|

|

12,395 |

|

|

|

21,154 |

|

|

|

30,289 |

|

|

|

44,409 |

|

Income tax provision |

|

|

3,782 |

|

|

|

5,472 |

|

|

|

10,140 |

|

|

|

11,854 |

|

Net income after taxes |

|

|

8,613 |

|

|

|

15,682 |

|

|

|

20,149 |

|

|

|

32,555 |

|

Less: income attributable to the non-controlling interest |

|

|

1,512 |

|

|

|

1,512 |

|

|

|

3,024 |

|

|

|

3,024 |

|

Total net income attributable to Medallion Financial Corp. |

|

$ |

7,101 |

|

|

$ |

14,170 |

|

|

$ |

17,125 |

|

|

$ |

29,531 |

|

Basic net income per share |

|

$ |

0.31 |

|

|

$ |

0.63 |

|

|

$ |

0.76 |

|

|

$ |

1.32 |

|

Diluted net income per share |

|

$ |

0.30 |

|

|

$ |

0.62 |

|

|

$ |

0.73 |

|

|

$ |

1.29 |

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

22,598,102 |

|

|

|

22,488,463 |

|

|

|

22,619,743 |

|

|

|

22,416,089 |

|

Diluted |

|

|

23,453,162 |

|

|

|

22,853,927 |

|

|

|

23,609,104 |

|

|

|

22,915,094 |

|

Dividends declared per common share |

|

$ |

0.10 |

|

|

$ |

0.08 |

|

|

$ |

0.20 |

|

|

$ |

0.16 |

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

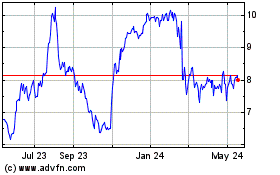

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

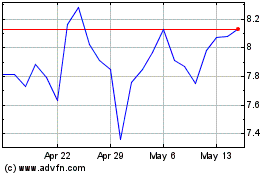

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Jan 2024 to Jan 2025