MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy”)

today announced that, subject to market and other conditions, it

intends to offer, in a public offering registered under the

Securities Act of 1933, as amended (the “Securities Act”),

2,500,000 shares of MicroStrategy’s Series A Perpetual Strike

Preferred Stock (the “perpetual strike preferred stock”).

MicroStrategy intends to use the net proceeds from the offering

for general corporate purposes, including the acquisition of

bitcoin and for working capital.

The perpetual strike preferred stock will have a liquidation

preference of $100 per share and will accumulate cumulative

dividends at a fixed rate that will be determined at the pricing of

the offering. Regular dividends on the perpetual strike preferred

stock will be payable when, as and if declared by MicroStrategy’s

board of directors, out of funds legally available for their

payment to the extent paid in cash, quarterly in arrears on March

31, June 30, September 30 and December 31 of each year, beginning

on March 31, 2025. Declared regular dividends on the perpetual

strike preferred stock will be payable, at MicroStrategy's

election, in cash, shares of class A common stock or a combination

of cash and shares of class A common stock, in the manner, and

subject to the provisions, described in the prospectus supplement

for the offering.

Holders of the perpetual strike preferred stock will have the

right to convert their shares of perpetual strike preferred stock

into shares of MicroStrategy’s class A common stock (together, if

applicable, with cash in lieu of any fractional share of class A

common stock), in certain circumstances and during specified

periods, at the then-applicable conversion rate.

MicroStrategy will have the right, at its election, to redeem

all, and not less than all, of the perpetual strike preferred

stock, at any time, for cash if the total aggregate liquidation

preference of all perpetual strike preferred stock then outstanding

is less than 25% of the aggregate liquidation preference of the

perpetual strike preferred stock issued in the offering. In

addition, MicroStrategy will have the right to redeem all, but not

less than all, of the perpetual strike preferred stock if certain

tax events occur. The redemption price for any perpetual strike

preferred stock to be redeemed will be a cash amount equal to the

liquidation preference of the perpetual strike preferred stock to

be redeemed (or, in the case of a redemption in connection with a

tax event, the greater of (1) the liquidation preference of the

perpetual strike preferred stock to be redeemed; and (2) the

average of the last reported sale prices per share of perpetual

strike preferred stock for the five consecutive trading days ending

on, and including, the trading day immediately before the date on

which MicroStrategy sends the related redemption notice), plus

accumulated and unpaid regular dividends to, but excluding, the

redemption date.

If an event that constitutes a “fundamental change” under the

certificate of designations governing the perpetual strike

preferred stock occurs, then, subject to a limited exception,

holders of the perpetual strike preferred stock will have the right

to require MicroStrategy to repurchase some or all of their shares

of perpetual strike preferred stock at a cash repurchase price

equal to the liquidation preference of the perpetual strike

preferred stock to be repurchased, plus accumulated and unpaid

regular dividends, if any, to, but excluding the fundamental change

repurchase date.

Barclays, Moelis & Company LLC, BTIG, TD Cowen and Keefe,

Bruyette & Woods, A Stifel Company are acting as joint

book-running managers for the offering. AmeriVet, Bancroft Capital

and The Benchmark Company are acting as co-managers for the

offering.

The offering is being made pursuant to an effective shelf

registration statement on file with the Securities and Exchange

Commission (the “SEC”). The offering will be made only by means of

a prospectus supplement and an accompanying prospectus. An

electronic copy of the preliminary prospectus supplement, together

with the accompanying prospectus, is available on the SEC’s website

at www.sec.gov. Alternatively, copies of the preliminary prospectus

supplement, together with the accompanying prospectus, can be

obtained by contacting: Barclays Capital Inc., c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

by email at barclaysprospectus@broadridge.com or telephone at

1-888-603-5847), Moelis & Company LLC, 399 Park Avenue, 4th

Floor, New York, New York 10022 or by telephone at (800) 539-9413,

BTIG, LLC, 65 East 55th Street, New York, NY 10022, by telephone at

(212) 593-7555, TD Securities (USA) LLC, 1 Vanderbilt Avenue, New

York, NY 10017, by email at TD.ECM_Prospectus@tdsecurities.com or

by telephone at (855) 495-9846 or Keefe, Bruyette & Woods,

Inc., 787 Seventh Avenue, 4th Floor, New York, NY 10019, Attention:

Equity Capital Markets, by telephone at (800) 966-1559 or by email

at USCapitalMarkets@kbw.com.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, any securities referred to in this

press release, nor will there be any sale of any such securities,

in any state or other jurisdiction in which such offer, sale or

solicitation would be unlawful prior to registration or

qualification under the securities laws of such state or

jurisdiction.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) is the world’s first and largest

Bitcoin Treasury Company. We are a publicly traded company that has

adopted Bitcoin as our primary treasury reserve asset. By using

proceeds from equity and debt financings, as well as cash flows

from our operations, we strategically accumulate Bitcoin and

advocate for its role as digital capital. Our treasury strategy is

designed to provide investors varying degrees of economic exposure

to Bitcoin by offering a range of securities, including equity and

fixed-income instruments. In addition, we provide industry-leading

AI-powered enterprise analytics software, advancing our vision of

Intelligence Everywhere. We leverage our development capabilities

to explore innovation in Bitcoin applications, integrating

analytics expertise with our commitment to digital asset growth. We

believe our combination of operational excellence, strategic

Bitcoin reserve, and focus on technological innovation positions us

as a leader in both the digital asset and enterprise analytics

sectors, offering a unique opportunity for long-term value

creation.

MicroStrategy, MicroStrategy AI, Intelligence Everywhere,

Intelligent Enterprise, and MicroStrategy Library are either

trademarks or registered trademarks of MicroStrategy Incorporated

in the United States and certain other countries. Other product and

company names mentioned herein may be the trademarks of their

respective owners.

Forward-Looking Statements

Statements in this press release about future expectations,

plans, and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to the size and timing

of the offering, the anticipated use of any proceeds from the

offering and the terms of the securities being offered. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would,” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual

results may differ materially from those indicated by such

forward-looking statements as a result of various important

factors, including the uncertainties related to market conditions

and the completion of the offering on the anticipated terms or at

all, the other factors discussed in the “Risk Factors” section of

MicroStrategy’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on October 31, 2024, the factors

discussed under the header “Risk Factor Updates” in the current

report on Form 8-K filed by MicroStrategy with the Securities and

Exchange Commission on January 6, 2025 and the risks described in

other filings that MicroStrategy may make with the Securities and

Exchange Commission. Any forward-looking statements contained in

this press release speak only as of the date hereof, and

MicroStrategy specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127149953/en/

MicroStrategy Incorporated Shirish Jajodia Corporate Treasurer

ir@microstrategy.com

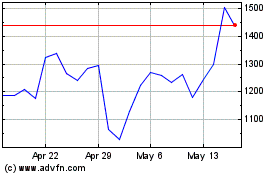

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

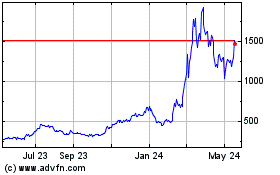

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Jan 2024 to Jan 2025