August 7, 20240000918541falseCharlotteNorth Carolina00009185412024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

NN, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39268 | 62-1096725 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 6210 Ardrey Kell Road, Suite 120 | | |

Charlotte, North Carolina | | 28277 |

| (Address of principal executive offices) | | (Zip Code) |

(980) 264-4300

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 | | NNBR | | The Nasdaq Stock Market LLC |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company. | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On August 7, 2024, NN, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (the "Current Report").

Pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), the information furnished pursuant to Item 2.02 of this Current Report (including Exhibit 99.1) is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 7.01 REGULATION FD DISCLOSURE

On August 7, 2024, the Company posted a supplemental presentation to its website, https://investors.nninc.com/, which will be presented during its quarterly investor conference call on August 8, 2024, at 10:00a.m. ET. The supplemental presentation is included as Exhibit 99.2 to this Current Report.

Pursuant to the rules and regulations of the SEC, the information furnished pursuant to Item 7.01 of this Current Report (including Exhibit 99.2) is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description of Exhibit |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

| | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

| Date: | August 7, 2024 |

| | | | | | | | |

| NN, INC. |

| | |

| By: | /s/ Christopher H. Bohnert |

| Name: | Christopher H. Bohnert |

| Title: | Senior Vice President and Chief Financial Officer |

NN, Inc.

6210 Ardrey Kell Road, Suite 120

Charlotte, NC 28277

FOR IMMEDIATE RELEASE

NN, INC. REPORTS SECOND QUARTER 2024 RESULTS

Continued profitability improvement and stronger pace of new business wins driven by strategic transformation plan

Company reaffirms full year 2024 outlook

CHARLOTTE, N.C., August 7, 2024 – NN, Inc. (NASDAQ: NNBR), a global diversified industrial company that engineers and manufactures high-precision components and assemblies, today reported its financial results for the second quarter ended June 30, 2024.

Highlights

•Strategic transformation program drove enhanced results, fourth consecutive quarter of improved year-over-year performance;

•Second quarter net sales of $123.0 million, down 1.8% versus prior year, driven primarily by unfavorable foreign exchange impacts and rationalization of unprofitable business in Mobile Solutions;

•Second quarter operating loss of $2.1 million, an improvement of 47.5% versus prior year;

•Second quarter adjusted EBITDA of $13.4 million, an improvement of 27.6% versus prior year;

•Secured new business awards of $34.3 million year-to-date; and

•Subsequent to quarter-end, the company executed the sale of its lone non-core plastics plant and used $15.4 million of proceeds to pay down debt.

“NN delivered another quarter of improvement, driven by the execution of our strategic transformation plan which is yielding observable momentum across key focus areas of profitability enhancement, operational performance, and accelerated new business wins,” said Harold Bevis, President and Chief Executive Officer. “Our committed efforts to strengthen profitability were evident in the quarter, as our $13.4 million of adjusted EBITDA reflected solid growth over the prior year, which is the fourth consecutive quarter of year-over-year improvement. On a trailing-twelve-month basis we have delivered adjusted EBITDA of $49.2 million, an improvement of 28.7% year-over-year. Our focus on improved operating performance and productivity has helped drive solid margin expansion, advancing our profitability and overcoming the strategic rationalization of volumes which impacted our top-line. ”

Mr. Bevis continued, “We continue to see strong momentum in our commercial efforts as we have won nearly $18 million of new business awards in the second quarter and $97 million over the last six quarters. We are on pace to deliver our 2024 targets for new business wins. The electrical, industrial, and medical markets remain unchanged, healthy, and growing. However, the global auto market is recalibrating the choices of powertrain and low-cost country production.”

Mr. Bevis concluded, “We are pleased with our overall performance for the quarter and remain highly confident in our ability to accelerate our transformation and pace of growth. We are delivering significantly improved plant level performance, which is strengthening our profitability and new business win platform. In the near term, we remain highly focused on optimizing our capital structure and lowering our cost of capital through a strategic refinancing which is currently underway. We are also focusing our commercial growth agenda on expanding our electrical business, across auto and non-auto end markets, as well as our high-value NN Medical business in low-cost geographies. I would like to recognize the efforts of our global team members in supporting our ongoing transformation, as we thank them for delivering results as our improved performance is generated through their hard work.”

Second Quarter GAAP Results

Net sales were $123.0 million, a decrease of 1.8% from the second quarter of 2023, which was primarily due to rationalized volume at plants undergoing transformations and unfavorable foreign exchange effects of 0.8% or $1.0 million, partially offset by the net impact of contractual pricing provisions.

Loss from operations was $2.1 million compared to a loss from operations of $4.0 million in the second quarter of 2023. The decrease in loss from operations was primarily due to improved operating performance within several facilities.

Income from operations for Power Solutions was $5.3 million compared to income from operations of $2.6 million for the same period in 2023. Loss from operations for Mobile Solutions was $1.6 million compared to loss from operations of $1.5 million for the same period in 2023.

Net loss was $2.2 million compared to net loss of $14.4 million for the same period in 2023. The decrease in net loss was primarily due to non-cash derivative mark-to-market gains recognized during the current quarter compared to losses recognized in the second quarter of 2023.

Second Quarter Adjusted Results

Adjusted income from operations for the second quarter of 2024 was $2.1 million compared to adjusted income from operations of $1.3 million for the same period in 2023. Adjusted EBITDA was $13.4 million, or 10.9% of sales, compared to $10.5 million, or 8.4% of sales, for the same period in 2023.

Adjusted net loss was $0.8 million, or $0.02 per diluted share, compared to adjusted net loss of $3.3 million, or $0.08 per diluted share, for the same period in 2023. Free cash flow was a use of cash of $1.3 million compared to a generation of cash of $3.0 million for the same period in 2023.

Power Solutions

Net sales for the second quarter of 2024 were $50.2 million compared to $48.1 million in the second quarter of 2023, an increase of 4.3%, or $2.1 million. The increase in sales was primarily due to higher precious metals pass-through pricing and inflation pricing, partially offset by lower volume during the current quarter.

Adjusted income from operations was $8.0 million compared to adjusted income from operations of $5.6 million in the second quarter of 2023. The increase in adjusted income from operations was primarily due to favorable production volumes and improved operating performance.

Mobile Solutions

Net sales for the second quarter of 2024 were $72.9 million compared to $77.2 million in the second quarter of 2023, a decrease of 5.6%, or $4.3 million. The decrease in sales was primarily due to lower volume at facilities undergoing transformations, contractual reduction in customer pricing, and unfavorable foreign exchange effects.

Adjusted loss from operations was $0.7 million compared to adjusted income from operations of $0.2 million in the second quarter of 2023. The decrease in adjusted income from operations was primarily due to lower production volumes.

Updated 2024 Outlook

NN is reaffirming its full-year 2024 outlook previously provided in its news release on July 2, 2024.

◦Revenue in the range of $465 million to $485 million;

◦Adjusted EBITDA in the range of $47 million to $51 million;

◦Free cash flow in the range of $8 million to $12 million; and

◦New business wins in the range of $55 million to $70 million.

Chris Bohnert, Senior Vice President and Chief Financial Officer, commented, “NN continued to make significant progress on its transformation goals in the quarter and we are maintaining our full year 2024 guidance ranges as market fundamentals and our improved operating performance have been in line with our previous expectations. Additionally, optimizing NN’s capital structure and the proactive strategic re-financing of our term loan remains a top priority for our team in the near-term and will be a key next step in our transformational strategy.”

Conference Call

NN will discuss its results during its quarterly investor conference call on August 8, 2024, at 10 a.m. ET. The call and supplemental presentation may be accessed via NN's website, www.nninc.com. The conference call can also be accessed by dialing 1-877-255-4315 or 1-412-317-6579. For those who are unavailable to listen to the live broadcast, a replay will be available shortly after the call until August 8, 2025.

NN discloses in this press release the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of restructuring and integration expense, acquisition and transition expenses, foreign exchange impacts on inter-company loans, amortization of intangibles and deferred financing costs, and other non-operating impacts on our business.

The financial tables found later in this press release include a reconciliation of adjusted income (loss) from operations, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow to the U.S. GAAP financial measures of income (loss) from operations, net income (loss), net income (loss) per diluted common share, and cash provided (used) by operating activities.

About NN, Inc.

NN, Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, Europe, South America, and Asia. For more information about the company and its products, please visit www.nninc.com.

Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; new laws and governmental regulations; the impact of climate change on our operations; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements.

With respect to any non-GAAP financial measures included in the following document, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Investor & Media Contacts:

Joe Caminiti or Stephen Poe, Investors

Tim Peters or Emma Brandeis, Media

NNBR@alpha-ir.com

312-445-2870

Financial Tables Follow

NN, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (in thousands, except per share data) | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 122,992 | | | $ | 125,206 | | | $ | 244,190 | | | $ | 252,294 | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | 101,257 | | | 107,684 | | | 202,343 | | | 216,105 | |

| Selling, general, and administrative expense | 13,511 | | | 10,975 | | | 26,859 | | | 24,140 | |

| Depreciation and amortization | 11,761 | | | 11,550 | | | 24,308 | | | 23,066 | |

| | | | | | | |

| Other operating expense (income), net | (1,390) | | | (956) | | | (2,390) | | | 105 | |

| Loss from operations | (2,147) | | | (4,047) | | | (6,930) | | | (11,122) | |

| Interest expense | 5,873 | | | 5,457 | | | 11,239 | | | 9,745 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other expense (income), net | (3,461) | | | 5,641 | | | 692 | | | 3,433 | |

| Loss before benefit (provision) for income taxes and share of net income from joint venture | (4,559) | | | (15,145) | | | (18,861) | | | (24,300) | |

| Benefit (provision) for income taxes | 215 | | | (325) | | | (291) | | | (1,626) | |

| Share of net income from joint venture | 2,141 | | | 1,093 | | | 4,412 | | | 1,374 | |

| | | | | | | |

| | | | | | | |

| Net loss | $ | (2,203) | | | $ | (14,377) | | | $ | (14,740) | | | $ | (24,552) | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency transaction loss | (3,387) | | | (2,374) | | | (5,733) | | | (534) | |

| Interest rate swap: | | | | | | | |

| Change in fair value, net of tax | — | | | — | | | — | | | (230) | |

| Reclassification adjustments included in net loss, net of tax | (449) | | | (449) | | | (898) | | | (917) | |

| Other comprehensive loss | $ | (3,836) | | | $ | (2,823) | | | $ | (6,631) | | | $ | (1,681) | |

| Comprehensive loss | $ | (6,039) | | | $ | (17,200) | | | $ | (21,371) | | | $ | (26,233) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted net loss per share | $ | (0.12) | | | $ | (0.38) | | | $ | (0.46) | | | $ | (0.67) | |

| Shares used to calculate basic and diluted net loss per share | 48,839 | | | 46,357 | | | 48,281 | | | 45,836 | |

| | | | | | | |

NN, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (in thousands, except per share data) | June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 13,746 | | | $ | 21,903 | |

| Accounts receivable, net | 68,832 | | | 65,545 | |

| Inventories | 68,291 | | | 71,563 | |

| Income tax receivable | 13,045 | | | 11,885 | |

| Prepaid assets | 4,545 | | | 2,464 | |

| Other current assets | 16,883 | | | 9,194 | |

| Total current assets | 185,342 | | | 182,554 | |

| Property, plant and equipment, net | 171,591 | | | 185,812 | |

| Operating lease right-of-use assets | 41,593 | | | 43,357 | |

| Intangible assets, net | 51,221 | | | 58,724 | |

| Investment in joint venture | 36,330 | | | 32,701 | |

| Deferred tax assets | 771 | | | 734 | |

| Other non-current assets | 10,386 | | | 7,003 | |

| Total assets | $ | 497,234 | | | $ | 510,885 | |

| Liabilities, Preferred Stock, and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 45,470 | | | $ | 45,480 | |

| Accrued salaries, wages and benefits | 14,848 | | | 15,464 | |

| Income tax payable | 380 | | | 524 | |

| Short-term debt and current maturities of long-term debt | 8,041 | | | 3,910 | |

| Current portion of operating lease liabilities | 5,417 | | | 5,735 | |

| Other current liabilities | 16,739 | | | 10,506 | |

| Total current liabilities | 90,895 | | | 81,619 | |

| Deferred tax liabilities | 4,605 | | | 4,988 | |

| | | |

| Long-term debt, net of current maturities | 150,694 | | | 149,369 | |

| Operating lease liabilities, net of current portion | 45,078 | | | 47,281 | |

| Other non-current liabilities | 12,214 | | | 24,827 | |

| Total liabilities | 303,486 | | | 308,084 | |

| Commitments and contingencies | | | |

| Series D perpetual preferred stock | 85,312 | | | 77,799 | |

| Stockholders' equity: | | | |

| Common stock | 500 | | | 473 | |

| Additional paid-in capital | 462,410 | | | 457,632 | |

| Accumulated deficit | (310,088) | | | (295,348) | |

| Accumulated other comprehensive loss | (44,386) | | | (37,755) | |

| Total stockholders’ equity | 108,436 | | | 125,002 | |

| Total liabilities, preferred stock, and stockholders’ equity | $ | 497,234 | | | $ | 510,885 | |

NN, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| (in thousands) | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (14,740) | | | $ | (24,552) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 24,308 | | | 23,066 | |

| Amortization of debt issuance costs and discount | 1,106 | | | 880 | |

| Paid-in-kind interest | 1,436 | | | 744 | |

| | | |

| | | |

| Total derivative loss (gain), net of cash settlements | (1,068) | | | 5,691 | |

| Share of net income from joint venture | (4,412) | | | (1,374) | |

| | | |

| Share-based compensation expense | 1,536 | | | 851 | |

| Deferred income taxes | (479) | | | 110 | |

| Other | (758) | | | (721) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (8,747) | | | (5,078) | |

| Inventories | (1,185) | | | 3,920 | |

| Other operating assets | (2,705) | | | (6,615) | |

| Income taxes receivable and payable, net | (1,326) | | | (730) | |

| Accounts payable | 1,726 | | | 6,927 | |

| Other operating liabilities | 4,739 | | | 5,524 | |

| Net cash provided by (used in) operating activities | (569) | | | 8,643 | |

| Cash flows from investing activities | | | |

| Acquisition of property, plant and equipment | (9,052) | | | (12,196) | |

| | | |

| Proceeds from sale of property, plant, and equipment | 237 | | | 2,777 | |

| | | |

| | | |

| Net cash used in investing activities | (8,815) | | | (9,419) | |

| Cash flows from financing activities | | | |

| Proceeds from long-term debt | 25,000 | | | 35,000 | |

| Repayments of long-term debt | (46,061) | | | (34,725) | |

| | | |

| Cash paid for debt issuance costs | (646) | | | (55) | |

| | | |

| | | |

| Proceeds from sale-leaseback of equipment | 8,324 | | | — | |

| Proceeds from sale-leaseback of land and buildings | 16,863 | | | — | |

| Repayments of financing obligations | (211) | | | — | |

| Proceeds from short-term debt | — | | | 3,648 | |

| Other | (1,700) | | | (1,610) | |

| Net cash provided by financing activities | 1,569 | | | 2,258 | |

| Effect of exchange rate changes on cash flows | (342) | | | 47 | |

| Net change in cash and cash equivalents | (8,157) | | | 1,529 | |

| Cash and cash equivalents at beginning of year | 21,903 | | | 12,808 | |

| Cash and cash equivalents at end of quarter | $ | 13,746 | | | $ | 14,337 | |

Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations

| | | | | | | | | | | |

| Three Months Ended June 30, |

| (in thousands) |

| NN, Inc. Consolidated | 2024 | | 2023 |

| GAAP loss from operations | $ | (2,147) | | | $ | (4,047) | |

| | | |

| | | |

| Professional fees | (12) | | | 119 | |

| Personnel costs (1) | 826 | | | 622 | |

| Facility costs (2) | (51) | | | 1,022 | |

| Amortization of intangibles | 3,456 | | | 3,563 | |

| | | |

| Non-GAAP adjusted income from operations (a) | $ | 2,072 | | | $ | 1,279 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 1.7 | % | | 1.0 | % |

| GAAP net sales | $ | 122,992 | | | $ | 125,206 | |

| | | | | | | | | | | |

| Three Months Ended June 30, |

| (in thousands) |

| Power Solutions | 2024 | | 2023 |

| GAAP income from operations | $ | 5,320 | | | $ | 2,583 | |

| | | |

| | | |

| | | |

| Personnel costs (1) | 33 | | | — | |

| Facility costs (2) | 79 | | | 244 | |

| Amortization of intangibles | 2,617 | | | 2,724 | |

| | | |

| Non-GAAP adjusted income from operations (a) | $ | 8,049 | | | $ | 5,551 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 16.0 | % | | 11.5 | % |

| GAAP net sales | $ | 50,151 | | | $ | 48,062 | |

| | | | | | | | | | | |

| Three Months Ended June 30, |

| (in thousands) |

| Mobile Solutions | 2024 | | 2023 |

| GAAP loss from operations | $ | (1,630) | | | $ | (1,461) | |

| | | |

| | | |

| | | |

| Personnel costs (1) | 265 | | | 40 | |

| Facility costs (2) | (130) | | | 778 | |

| Amortization of intangibles | 839 | | | 838 | |

| | | |

| Non-GAAP adjusted income (loss) from operations (a) | $ | (656) | | | $ | 195 | |

| | | |

| Share of net income from joint venture | 2,141 | | | 1,093 | |

| | | |

| Non-GAAP adjusted income from operations with JV (a) | $ | 1,485 | | | $ | 1,288 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 2.0 | % | | 1.7 | % |

| GAAP net sales | $ | 72,855 | | | $ | 77,153 | |

| | | | | | | | | | | |

| Three Months Ended June 30, |

| (in thousands) |

| Elimination | 2023 | | 2022 |

| GAAP net sales | $ | (14) | | | $ | (9) | |

(1)Personnel costs include recruitment, retention, relocation, and severance costs

(2)Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations

(3)Non-GAAP adjusted operating margin = Non-GAAP adjusted income (loss) from operations / GAAP net sales

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA

| | | | | | | | | | | |

| Three Months Ended June 30, |

| (in thousands) | 2024 | | 2023 |

| GAAP net loss | $ | (2,203) | | | $ | (14,377) | |

| | | |

| Benefit (provision) for income taxes | (215) | | | 325 | |

| Interest expense | 5,873 | | | 5,457 | |

| | | |

| | | |

| Change in fair value of preferred stock derivatives and warrants | (3,949) | | | 5,754 | |

| Depreciation and amortization | 11,761 | | | 11,550 | |

| | | |

| Professional fees | (12) | | | 119 | |

| Personnel costs (1) | 826 | | | 622 | |

| Facility costs (2) | (51) | | | 1,022 | |

| Non-cash stock compensation | 691 | | | 471 | |

| Non-cash foreign exchange (gain) loss on inter-company loans | 684 | | | (445) | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP adjusted EBITDA (b) | $ | 13,405 | | | $ | 10,498 | |

| | | |

| Non-GAAP adjusted EBITDA margin (3) | 10.9 | % | | 8.4 | % |

| GAAP net sales | $ | 122,992 | | | $ | 125,206 | |

| | | | | | | | | | | |

| (1) Personnel costs include recruitment, retention, relocation, and severance costs |

(2) Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations |

(3) Non-GAAP adjusted EBITDA margin = Non-GAAP adjusted EBITDA / GAAP net sales |

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

| | | | | | | | | | | |

| Three Months Ended June 30, |

| (in thousands) | 2024 | | 2023 |

| GAAP net loss | $ | (2,203) | | | $ | (14,377) | |

| | | |

| | | |

| Pre-tax professional fees | (12) | | | 119 | |

| Pre-tax personnel costs | 826 | | | 622 | |

| Pre-tax facility costs | (51) | | | 1,022 | |

| Non-cash foreign exchange (gain) loss on inter-company loans | 684 | | | (445) | |

| | | |

| | | |

| Pre-tax change in fair value of preferred stock derivatives and warrants | (3,949) | | | 5,754 | |

| Pre-tax amortization of intangibles and deferred financing costs | 4,018 | | | 4,090 | |

| | | |

| | | |

| | | |

| Tax effect of adjustments reflected above (c) | (63) | | | (64) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP adjusted net income (loss) (d) | $ | (750) | | | $ | (3,279) | |

| | | |

| Three Months Ended June 30, |

| (per diluted common share) | 2024 | | 2023 |

| GAAP net loss per diluted common share | $ | (0.12) | | | $ | (0.38) | |

| | | |

| | | |

| | | |

| Pre-tax personnel costs | 0.02 | | | 0.01 | |

| Pre-tax facility costs | — | | | 0.02 | |

| Pre-tax foreign exchange (gain) loss on inter-company loans | 0.01 | | | (0.01) | |

| | | |

| | | |

| Pre-tax change in fair value of preferred stock derivatives and warrants | (0.08) | | | 0.12 | |

| Pre-tax amortization of intangibles and deferred financing costs | 0.08 | | | 0.09 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Preferred stock cumulative dividends and deemed dividends | 0.08 | | | 0.07 | |

| Non-GAAP adjusted net income (loss) per diluted common share (d) | $(0.02) | | $(0.08) |

| Shares used to calculate net earnings (loss) per share | 48,839 | | | 46,357 | |

Reconciliation of Operating Cash Flow to Free Cash Flow

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | |

| (in thousands) | 2024 | | 2023 | | | | |

| Net cash provided by (used in) operating activities | $ | (1,281) | | | $ | 8,417 | | | | | |

| Acquisition of property, plant, and equipment | (3,592) | | | (7,199) | | | | | |

| Proceeds from sale of property, plant, and equipment | 139 | | | 1,742 | | | | | |

| Proceeds from sale-leaseback of equipment | 3,415 | | | — | | | | | |

| Free cash flow | $ | (1,319) | | | $ | 2,960 | | | | | |

The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods.

The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results.

(a) Non-GAAP adjusted income (loss) from operations represents GAAP income (loss) from operations, adjusted to exclude the effects of restructuring and integration expense; non-operational charges related to acquisition and transition expense, intangible amortization costs for fair value step-up in values related to acquisitions, non-cash impairment charges, and when applicable, our share of income from joint venture operations. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income (loss) from operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from operations.

(b) Non-GAAP adjusted EBITDA represents GAAP net income (loss), adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value that was recognized in earnings, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations.

(c) This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the respective table. NN, Inc. estimates the tax effect of the adjustment items identified in the reconciliation schedule above by applying the applicable statutory rates by tax jurisdiction unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment.

(d) Non-GAAP adjusted net income (loss) represents GAAP net income (loss) adjusted to exclude the tax-affected effects of charges related to acquisition and transition costs, foreign exchange gain (loss) on inter-company loans, restructuring and integration charges, amortization of intangibles costs for fair value step-up in values related to acquisitions and amortization of deferred financing costs, non-cash impairment charges, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, costs related to divested businesses and litigation settlements, income (loss) from discontinued operations, and preferred stock cumulative dividends and deemed dividends. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry.

NN, Inc. Second Quarter 2024 Earnings Call August 8, 2024

Except for specific historical information, many of the matters discussed in this presentation may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; new laws and governmental regulations; the impact of climate change on our operations; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements. With respect to any non-GAAP financial measures included in the following presentation, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.” Forward Looking Statement & Disclosures 2

Harold Bevis President & Chief Executive Officer Chris Bohnert SVP & Chief Financial Officer 3

4 Transformation Plan Remains On Track, Delivering Results ▪ Profitability improvement is working - fourth consecutive quarter of year over year adjusted EBITDA growth ▪ Operational advancements are aiding business development ▪ Facility improvements continue; culture change is underway; customer scorecards turning “green” ▪ New business program showing momentum in targeted new business areas ▪ Rebooted executive relationships with top customers ▪ ~$600 million pipeline is high quality and producing results; $34.3 million of awards won in 1H’24 Global Business Development Now Fully Engaged with Targeted Accounts – Yielding Participation in Next-Gen Product Development ▪ Actively bidding on R&D projects ▪ Strengthening knowledge of leading-edge competitiveness ▪ Projects underway in medical, electrical, high-end auto (esp. steering/worm gears) Engaged in a Strategic Refinancing ▪ Expect to complete process in Q3 Reaffirming Full-Year 2024 Outlook Issued 7/2/24 ▪ Industrial, electrical, medical, and hybrid auto markets are growing ▪ Global auto market is rebalancing across powertrains and retail inventories have corrected post-COVID-19 Opening Comments

5 NN’s Markets Healthy, Business On-Track Primary End Market Outlook End Market ~% of NN Revenue Market Indicators NN’s Outlook vs. Market Global Passenger Vehicle 40% Market reflecting an expectation of flat to modest growth in Global Vehicle Production Rebalance across drivetrain types (BEV, Hybrid, ICE) NN’s legacy demand is tracking to the broader market; NN new business win programs balanced across drivetrain types The ‘Connect and Protect’ product line is focused onto electrical connector, electrical harness and bus bar for vehicles and chargers General Industrial, Other 30% Statista forecasts approximately 3% growth Demand is generally flat and steady for the industries that we serve Power Grid and Electricity Control 15% Global power grid market modest growth, driven by software and replacement Electrical distribution and control strong in Industrial, weaker in construction Strong smart meter business is healthy and growing; residential construction is flat-ish for circuit breaker products, business is steady Commercial Vehicle 10% Market currently forecasting decline in FY’24; already apparent in OEM market commentary NN’s business is not expected to see much impact from market events Applications where NN operates are stronger than headline market demand Medical Equipment, Surgical Tools, and Implants 5% Orthopedic sales expected to increase approximately 3-4% year-over-year through 2026 Recently re-launched business, adding capacity Adding additional capacity Expanding goal to $100M

6 Leadership Enhancements ▪ Joined as CFO in June 2024 having previously served as an adviser to NN, Inc. ▪ Brings over 30 years of senior financial leadership and operational experience across industrial sectors ▪ Has executed multiple successful corporate transformations, strategic refinancings and recapitalizations, and M&A Chris Bohnert, CFO ▪ Joined as GC in July 2024 ▪ Brings 18 years of corporate legal and compliance experience with broad automotive industry knowledge ▪ Has extensive experience in customer negotiations, global supply chain matters, and litigation Jami Statham, General Counsel

7 Net Sales ▪ Unfavorable foreign exchange impacts of 0.8% or $1.0 million, primarily in Mobile Solutions ▪ Rationalization of unprofitable business in Mobile Solutions, masking growth in Power Solutions Adjusted EBITDA ▪ Fourth consecutive quarter of year-over-year improvement ▪ $49.2 million, or 28.7%, improvement in trailing 12 month adjusted EBITDA, year-over-year ▪ Strong uptick in margin capture – adjusted EBITDA margins overcoming rationalized sales volume ▪ Making progress towards long-term goal of 13 to 14% margins (millions) Q2’23 Q2’24 Net Sales $125.2 $123.0 Adjusted EBITDA $10.5 $13.4 Free Cash Flow $3.0 ($1.3) New Business Wins $4.8 $17.9 $125.2 $123.0 Net Sales ($millions) Q2'23 Q2'24 $10.5 $13.4 Adjusted EBITDA and Adjusted EBITDA Margin ($millions) Q2'23 Q2'24 8.4% 10.9% Quarterly Highlights (1.8%) +250 bps

8 Net Sales ▪ Stable volumes with some rationalization actions; largely offset by organic volume growth in other areas ▪ Unfavorable FX impacts, partially offset by the net impact of contractual pricing provisions (millions, except per share data) Q2’23 Q2’24 Δ Net Sales $125.2 $123.0 ($2.2) Operating Income (Loss) ($4.0) ($2.1) $1.9 Adjusted Operating Income (Loss) $1.3 $2.1 $0.8 Adjusted EBITDA $10.5 $13.4 $2.9 Adjusted EBITDA Margin 8.4% 10.9% 2.5% Income (Loss) per Diluted Common Share ($0.38) ($0.12) $0.26 Adjusted Income (Loss) per Diluted Common Share ($0.08) ($0.02) $0.06 Adjusted EBITDA ▪ Improved operational performance in base business ▪ Strong 1H’24 from China JV – will balance out in 2H’24 ▪ Positive sales mix and cost productivity benefits Q2 2024 Financial Results

Sales Up 4.3%, or $2.1 Million, From Prior Year (+) Precious metals pricing pass-through of $1.4 million (also reflected in increased A/R dollar balance) and inflation pricing (-) Lower volumes Profitability and Margins (+) Higher production volumes (+) Improved product mix and operating performance within several targeted facilities Current Focus & Looking Forward ▪ Cost-out actions have been successful; more programs underway in 2H’24 ▪ Base business remains stable, with targeted wins in ramp-up mode ▪ Adding dedicated business development staff to increase activity ▪ Maintaining focus on operational excellence – on-time and in-full ▪ Strengthening segment’s IT systems and management processes ▪ New product programs underway with electrical connectors and shields 9 $48.1 $50.2 $97.1 $98.4 Second Quarter Year-to-Date Net Sales ($millions) 2023 2024 $6.5 $9.5 $13.3 $17.2 Second Quarter Year-to-Date Adjusted EBITDA and Adjusted EBITDA Margin % ($millions) 2023 2024 13.5% 18.9% 13.7% 17.5% Power Solutions – Stamped Products: Q2’2024 Highlights +293 bps +462 bps

Sales Down 5.6%, or $4.3 Million, From Prior Year (-) Exited specific unprofitable volumes at underperforming facilities (-) Contractual reduction in customer pricing (-) FX negatively impacted by $0.9 million or 1.2% Profitability and Margins (+) Improved operating performance at targeted facilities (+) Increased profits generated by China joint venture (+) Right-sizing indirect labor structure Current Focus & Looking Forward ▪ Continued focus on fixing cost structure in North America ▪ Strategic expansion underway in China ▪ ~$40 million of new business wins over last 6 quarters ▪ ~70 new machines installed YTD - many steering programs for new vehicles ▪ Several next-gen product programs underway that could be door-openers for NN ▪ Recently won a 1st program to machine titanium forgings for medical hip implants with a global powerhouse 10 $77.2 $72.9 $155.2 $145.9 Second Quarter Year-to-Date Net Sales ($millions) 2023 2024 Mobile Solutions – Machined Products: Q2’2024 Highlights $7.5 $8.2 $13.1 $16.8 Second Quarter Year-to-Date Adjusted EBITDA and Adjusted EBITDA Margin % ($millions) 2023 2024 9.7% + 282 bps +93 bps 11.3% 8.4% 11.5%

11 Improved Profitability Setting Stage for Refinancing $38.2 $40.9 $43.1 $46.3 $49.2 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 TTM Adjusted EBITDA ($millions) Strategic Refinancing Process Underway – Will Help Accelerate Future Growth ▪ TTM adjusted EBITDA has improved for fourth consecutive quarter Y/Y; leverage has meaningfully declined Y/Y ▪ Pro-forma leverage multiple of 2.9x for Q2’24, pro-forma application of the $15.4 million Lubbock plastics plant sale proceeds ▪ Refinancing strategy centered on: ▪ Improving flexibility and capacity vs. existing debt structure ▪ Reducing cost of capital ▪ Redeeming a portion of the preferred equity ▪ Expect to complete in Q3’24 - markets are currently favorable 3.9x 3.4x 3.2x 3.1x 3.2x 2.9x Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Pro-forma for sale of Lubbock Leverage* (*) Leverage multiple defined as net debt / trailing twelve month adjusted EBITDA

NN’s Organic Growth Program is Performing Well $19 $37 $63 $80 $97 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Cumulative New Business Wins ($millions) 12 NN has Secured $97 Million of New Awards From January 2023 to June 2024 – Growth Program Remains on Track ▪ Increased opportunities through customer targeting, product development, quoting, and prototyping ▪ Advancing pipeline in higher-margin, higher-growth areas for future mix, and margin improvement ▪ Participating in innovation programs with large key customers ▪ Initiated culture change to be more directly customer-accountable - coupling NN’s leading quality with improved on-time delivery ▪ Growing in China: for the China market as well as low-cost exports to other markets ▪ Winning new business well above market growth rates ▪ On target to achieve goals of $55 to $70 million of new business wins in 2024 Renewed focus on winning new business is driving clear results

13 Upsizing Goal to $100 Million Business ▪ Business is at ~$17 million sales rate now and increasing ▪ New business opportunities are increasing in size and frequency ▪ Evaluating small acquisitions NN Medical Now Entering “Phase 2” of Business Development ▪ Will install manufacturing capacity to meet $50 million organic sales program, and current sales rate is growing. Have ordered first set of new machines, good fit for large percentage of market ▪ New machinery will execute on growing pipeline opportunities and facilitate growth ▪ Pipeline is strengthening, and with large/volume industry players ▪ Will add complexity and deeper specialization and capabilities later NN Positioning Itself to Be a Player in Machined Medical Parts Business ▪ Layering on new higher-margin sales utilizing existing equipment base ▪ Approved supplier status with strong Medical customer base ▪ Selectively investing in new equipment to expand capabilities and sales ▪ Have won our 1st titanium part; the femur implant section of hip implant kit Over $8 Million of High-Probability Prospects in Near-Term Pipeline ▪ Well-established base of targeted medical customers ▪ Many of the opportunities are near-term / 10-week ramp-ups as opposed to automotive ramp-ups Medical Business: Growing and Building Past Medical market experience helping accelerate initial growth

14 Reaffirming 2024 Outlook Guidance Metric Forecast Range Net Sales $465 – $485 million Adjusted EBITDA $47 – $51 million Free Cash Flow $8 – $12 million New Business Wins $55 – $70 million ▪ Reaffirming full-year 2024 outlook issued on July 2, 2024, post-planned sale of non-core facility ▪ Winning new business; targeting power, electrical, and medical markets ▪ Annualized FCF generation and trajectory is expected to be positively impacted post-refinancing, targeted for Q3 completion ▪ Profit and growth transformation continues with success ▪ Markets are stable overall, with noticeable rebalancing in the automotive world across power trains - ICE extensions, EV delays ▪ New Win program driving capacity expansion program in China - expanding our low-cost country footprint at the same time, and increasing our global cost competitiveness, especially in machined products

15 Goal Results Next Steps New Leadership ▪ Have added and strengthened leadership talent across full organization – Executive leadership to plant-level ▪ Strengthening customer relationships ▪ Organizational accountability to end results ▪ Selectively adding experienced team leaders where necessary, more to go Fix Unprofitable Areas ▪ Historically underperforming plants on track for breakeven in FY’24 ▪ Confront, fix, or exit systemically dilutive areas – price clear and cost-out ▪ Refining strategy and tactics for potential footprint consolidation ▪ Footprint rationalization opportunities exist when cashflow permits it, until then optimization and continuous improvement is the key Expand Margins ▪ Cost-Out program is on track with over 1,000 individual projects ▪ Increased scrutiny on contracts as operational performance has increased dramatically ▪ Driving organic growth in higher-margin sales verticals including medical ▪ Progressively reduce conversion cost and overhead costs Pay Down Debt and Refi ▪ Positive cash flow for organic net debt reduction ▪ Strategic actions to lower debt balance including real estate and equipment sale/leaseback and non-core facility sales ▪ Anticipate completing comprehensive refinancing transaction in Q3’24 – lower cost of capital and greater flexibility Grow the Company ▪ Delivered record new business wins in 2023 and expect similar wins in 2024 ▪ Off new business hold company-wide ▪ Entering new and diverse markets where capabilities carry premium value ▪ Growing sales by strengthening presence and scale with key customers ▪ Improve capital structure to provide additional growth capacity and flexibility Transformation: Delivering Results

Appendix 16

17 The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow and net debt. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded, as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow and net debt provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods. The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results. (a) Non-GAAP adjusted EBITDA represents GAAP income (loss) from operations, adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations. Non-GAAP Financial Measures Footnotes

18 Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations and Non-GAAP Adjusted EBITDA

19 Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income (Loss) and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

20 Reconciliation of Operating Cash Flow to Free Cash Flow

Thank You 21 Joe Caminiti or Stephen Poe, Investors Tim Peters or Emma Brandeis, Media NNBR@alpha-ir.com 312-445-2870 Investor & Media Contacts

v3.24.2.u1

Cover Page

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Entity Registrant Name |

NN, Inc.

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2024

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000918541

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39268

|

| Entity Tax Identification Number |

62-1096725

|

| Entity Address, Address Line One |

6210 Ardrey Kell Road, Suite 120

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28277

|

| City Area Code |

980

|

| Local Phone Number |

264-4300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

NNBR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

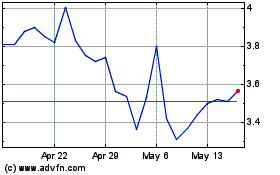

NN (NASDAQ:NNBR)

Historical Stock Chart

From Jul 2024 to Aug 2024

NN (NASDAQ:NNBR)

Historical Stock Chart

From Aug 2023 to Aug 2024