Orthofix Medical Inc. (NASDAQ:OFIX) today reported its financial

results for the second quarter ended June 30, 2024 and increased

its full-year 2024 financial guidance.

Recent Highlights

- Second quarter 2024 net sales of $198.6 million, an increase

of 6% on a reported and constant currency basis compared to second

quarter 2023

- Bone Growth Therapies (BGT) net sales growth of 12% compared

to second quarter 2023, marking six consecutive quarters with

double-digit net sales increases

- U.S. Spine Fixation1 net sales growth of 12% compared to

second quarter 2023, driven by distribution expansion and further

penetration in existing accounts

- Global Orthopedics net sales growth of 5% on a reported

basis and 6% on a constant currency basis compared to second

quarter 2023

- Second quarter 2024 net loss of $(33.4) million; Non-GAAP

adjusted EBITDA of $16.6 million, an increase of $6.7 million, with

adjusted EBITDA margin expanding 310 basis points compared to

second quarter 2023

- Significant improvement in cash usage, paving the way for

earlier than expected positive free cash flow for the second half

of 2024

- Announced appointments of four new executive team members,

further strengthening the breadth and depth of the Company's

leadership team

- Increases full-year 2024 net sales guidance to $795 million

to $800 million from $790 million to $795 million; Raises full-year

2024 non-GAAP adjusted EBITDA guidance to $64 million to $69

million from $62 million to $67 million

Second quarter net sales were $198.6 million, an increase of 6%

on a reported and constant currency basis. Net loss was $(33.4)

million and earnings per share ("EPS") was $(0.88) on a reported

basis, representing an improvement of 18% when compared to the

prior year period. Non-GAAP adjusted EBITDA was $16.6 million for

the second quarter, representing adjusted EBITDA margin expansion

of 310 basis points over the prior year period.

“We delivered another strong quarter driven by successful

execution of our key growth priorities,” said Massimo Calafiore,

President and Chief Executive Officer. “Highlights in the quarter

included notable revenue growth across each of our business

segments where our performance was led primarily by strength in our

U.S. markets, including Bone Growth Therapies, which grew 12%, and

further highlights the benefit of cross-selling in our integrated

spine channel. In addition, we delivered growth of 12% in U.S.

Spine fixation, more than twice the market rate. Based on continued

positive momentum, the strength of our differentiated and expanding

product portfolio, which continues to win share, and our confidence

in sustainable growth trends, we are raising our full-year net

sales and adjusted EBITDA guidance. We also are on track to achieve

positive free cash flow for the second half of this year, much

earlier than we originally anticipated.”

1

Spine fixation is comprised of the

Company's Spinal Implants product category, excluding motion

preservation product offerings

Financial Results Overview

Second Quarter 2024 Net Sales and Financial Results

The following table provides net sales by major product category

by reporting segment:

Three Months Ended June

30,

(Unaudited, U.S. Dollars, in

millions)

2024

2023

Change

Constant Currency

Change

Bone Growth Therapies

$

59.1

$

52.7

12.3

%

12.3

%

Spinal Implants, Biologics and Enabling

Technologies

108.9

105.3

3.4

%

3.4

%

Global Spine

168.0

158.0

6.4

%

6.4

%

Global Orthopedics

30.6

29.0

5.3

%

6.3

%

Net sales

$

198.6

$

187.0

6.2

%

6.4

%

Gross margins were 67.8% for the quarter and were 71.3% on a

non-GAAP adjusted basis.

Net loss was $(33.4) million, or $(0.88) per share, compared to

net loss of $(39.4) million, or $(1.07) per share in the prior year

period. Non-GAAP adjusted EBITDA was $16.6 million, or 8.4% of net

sales, compared to non-GAAP adjusted EBITDA of $9.9 million, or

5.3% of net sales, in the prior year period.

Liquidity

Cash, cash equivalents, and restricted cash on June 30, 2024,

totaled $28.9 million compared to $29.5 million on March 31,

2024.

Business Outlook

The Company is increasing its 2024 full-year guidance as

follows:

- Net sales are expected to range between $795 million to $800

million, representing implied growth of 6.7% to 7.4% year-over-year

on a constant currency basis, an increase from the previous

guidance range of $790 million to $795 million. These expectations

are based on the current foreign currency exchange rates and do not

take into account any additional potential exchange rate changes

that may occur this year.

- Non-GAAP adjusted EBITDA is expected to range from $64 million

to $69 million, an increase from the previous guidance range of $62

million to $67 million.

- Company now expects to be free cash flow positive for the

second half of 2024.

Conference Call

Orthofix will host a conference call today at 8:30 AM Eastern

time to discuss the Company's financial results for the quarter

ended June 30, 2024. Interested parties may access the conference

call by dialing (888) 330-2508 in the U.S., and (240) 789-2735 in

all other locations, and referencing the access code 9556380. A

replay of the call will be available for three weeks by dialing

(800) 770-2030 in the U.S., and (647) 362-9199 in all other

locations, and entering the access code 9556380. A webcast of the

conference call may be accessed at ir.Orthofix.com.

About Orthofix

Orthofix is a leading global spine and orthopedics company with

a comprehensive portfolio of biologics, innovative spinal hardware,

bone growth therapies, specialized orthopedic solutions and a

leading surgical navigation system. Its products are distributed in

more than 60 countries worldwide. The Company is headquartered in

Lewisville, Texas and has primary offices in Carlsbad, CA, with a

focus on spine and biologics product innovation and surgeon

education, and Verona, Italy, with an emphasis on product

innovation, production, and medical education for orthopedics. The

combined company’s global R&D, commercial and manufacturing

footprint also includes facilities and offices in Irvine, CA,

Toronto, Canada, Sunnyvale, CA, Maidenhead, UK, Munich, Germany,

Paris, France, and São Paulo, Brazil. For more information, please

visit www.orthofix.com.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and Section 27A of the Securities Act of 1933, as

amended, relating to our business and financial outlook, which are

based on our current beliefs, assumptions, expectations, estimates,

forecasts and projections. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “projects,” “intends,” “predicts,” “potential,” or

“continue” or other comparable terminology. Forward-looking

statements in this communication include the Company's expectations

regarding net sales, adjusted EBITDA, and free cash flow for the

year ended December 31, 2024. Forward-looking statements are not

guarantees of our future performance, are based on our current

expectations and assumptions regarding our business, the economy

and other future conditions, and are subject to risks,

uncertainties and changes in circumstances that are difficult to

predict, including the risks described in Part I, Item 1A under the

heading Risk Factors in our Annual Report on Form 10-K for the year

ended December 31, 2023 (the “2023 Form 10-K”), and in Part II,

Item 1A under the heading Risk Factors in our Quarterly Report on

Form 10-Q for the quarter ended June 30, 2024. Factors that could

cause future results to differ from those expressed by

forward-looking statements include, but are not limited to, (i) our

ability to maintain operations to support our customers and

patients in the near-term and to capitalize on future growth

opportunities, (ii) risks associated with acceptance of surgical

products and procedures by surgeons and hospitals, (iii)

development and acceptance of new products or product enhancements,

(iv) clinical and statistical verification of the benefits achieved

via the use of our products, (v) our ability to adequately manage

inventory, (vi) our ability to recruit and retain management and

key personnel, and (vii) the other risks and uncertainties more

fully described in our periodic filings with the Securities and

Exchange Commission (the “SEC”). As a result of these various

risks, our actual outcomes and results may differ materially from

those expressed in these forward-looking statements.

This list of risks, uncertainties, and other factors is not

complete. We discuss some of these matters more fully, as well as

certain risk factors that could affect our business, financial

condition, results of operations, and prospects, in reports we file

from time-to-time with the SEC, which are available to read at

www.sec.gov. Any or all forward-looking statements that we make may

turn out to be wrong (due to inaccurate assumptions that we make or

otherwise), and our actual outcomes and results may differ

materially from those expressed in these forward-looking

statements. You should not place undue reliance on any of these

forward-looking statements. Further, any forward-looking statement

speaks only as of the date hereof, unless it is specifically

otherwise stated to be made as of a different date. We undertake no

obligation to update, and expressly disclaim any duty to update,

our forward-looking statements, whether as a result of

circumstances or events that arise after the date hereof, new

information, or otherwise, except as required by law.

The Company is unable to provide expectations of GAAP income

(loss) before income taxes, the closest comparable GAAP measures to

adjusted EBITDA (which is a non-GAAP measure), on a forward-looking

basis because the Company is unable to predict without unreasonable

efforts the ultimate outcome of matters (including

acquisition-related expenses, accounting fair value adjustments,

and other such items) that will determine the quantitative amount

of the items excluded in calculating adjusted EBITDA, which items

are further described in the reconciliation tables and related

descriptions below. These items are uncertain, depend on various

factors, and could be material to the Company’s results computed in

accordance with GAAP.

ORTHOFIX MEDICAL INC.

Condensed Consolidated

Statements of Operations

Three Months Ended

Six Months Ended

June 30,

June 30,

(Unaudited, U.S. Dollars, in thousands,

except share and per share data)

2024

2023

2024

2023

Net sales

$

198,620

$

187,016

$

387,228

$

362,220

Cost of sales

63,871

67,465

125,237

132,340

Gross profit

134,749

119,551

261,991

229,880

Sales and marketing

100,224

99,249

200,267

193,040

General and administrative

33,994

34,177

65,642

82,988

Research and development

18,049

19,424

37,541

42,731

Acquisition-related amortization and

remeasurement

7,388

3,333

12,784

7,467

Operating loss

(24,906

)

(36,632

)

(54,243

)

(96,346

)

Interest expense, net

(4,943

)

(1,266

)

(9,501

)

(2,555

)

Other income (expense), net

(2,510

)

(20

)

(3,784

)

656

Loss before income taxes

(32,359

)

(37,918

)

(67,528

)

(98,245

)

Income tax expense

(1,084

)

(1,508

)

(1,935

)

(2,119

)

Net loss

$

(33,443

)

$

(39,426

)

$

(69,463

)

$

(100,364

)

Net loss per common share:

Basic

$

(0.88

)

$

(1.07

)

$

(1.84

)

$

(2.77

)

Diluted

(0.88

)

(1.07

)

(1.84

)

(2.77

)

Weighted average number of common shares

(in millions):

Basic

38.0

36.8

37.8

36.3

Diluted

38.0

36.8

37.8

36.3

ORTHOFIX MEDICAL INC.

Condensed Consolidated Balance

Sheets

(U.S. Dollars, in thousands, except par

value data)

June 30, 2024

December 31, 2023

(Unaudited)

Assets

Current assets

Cash and cash equivalents

$

26,366

$

33,107

Restricted Cash

2,500

4,650

Accounts receivable, net of allowances of

$8,368 and $7,130, respectively

125,361

128,098

Inventories

210,040

222,166

Prepaid expenses and other current

assets

21,798

32,422

Total current assets

386,065

420,443

Property, plant, and equipment, net

154,111

159,060

Intangible assets, net

108,310

117,490

Goodwill

194,934

194,934

Other long-term assets

38,578

33,388

Total assets

$

881,998

$

925,315

Liabilities and shareholders’

equity

Current liabilities

Accounts payable

$

50,362

$

58,357

Current portion of long-term debt

4,688

1,250

Current portion of finance lease

liability

734

708

Other current liabilities

100,183

104,908

Total current liabilities

155,967

165,223

Long-term debt

113,315

93,107

Long-term portion of finance lease

liability

18,160

18,532

Other long-term liabilities

48,552

49,723

Total liabilities

335,994

326,585

Contingencies

Shareholders’ equity

Common shares $0.10 par value; 100,000

shares authorized; 38,039 and 37,165 issued and outstanding as of

June 30, 2024, and December 31, 2023, respectively

3,804

3,717

Additional paid-in capital

764,538

746,450

Accumulated deficit

(219,607

)

(150,144

)

Accumulated other comprehensive loss

(2,731

)

(1,293

)

Total shareholders’ equity

546,004

598,730

Total liabilities and shareholders’

equity

$

881,998

$

925,315

ORTHOFIX MEDICAL INC.

Non-GAAP Financial Measures

The following tables present

reconciliations of various financial measures calculated in

accordance with U.S. generally accepted accounting principles

(“GAAP”), to various non-GAAP financial measures that exclude (or

in the case of free cash flow, include) items specified in the

tables. The GAAP measures shown in the tables below represent the

most comparable GAAP measure to the applicable non-GAAP measure(s)

shown in the table. For further information regarding the nature of

these exclusions, why the Company believes that these non-GAAP

financial measures provide useful information to investors, the

specific manner in which management uses these measures, and some

of the limitations associated with the use of these measures,

please refer to the Company's Current Report on Form 8-K regarding

this press release filed today with the SEC available on the SEC's

website at www.sec.gov and on the “Investors” page of the Company’s

website at www.orthofix.com.

Adjusted Gross Profit and Adjusted

Gross Margin

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

Gross profit

$

134,749

$

119,551

$

261,991

$

229,880

Share-based compensation expense

497

482

1,034

953

SeaSpine merger-related costs

3,115

3,782

4,418

4,486

Strategic investments

63

29

128

210

Acquisition-related fair value

adjustments

3,047

9,449

6,094

21,085

Amortization/depreciation of acquired

long-lived assets

209

544

527

544

Medical device regulation

—

41

—

669

Adjusted gross profit

$

141,680

$

133,878

$

274,192

$

257,827

Adjusted gross margin

71.3

%

71.6

%

70.8

%

71.2

%

Adjusted EBITDA

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

Net loss

$

(33,443

)

$

(39,426

)

$

(69,463

)

$

(100,364

)

Income tax expense (benefit)

1,084

1,508

1,935

2,119

Interest expense, net

4,943

1,266

9,501

2,555

Depreciation and amortization

14,032

13,327

28,894

25,997

Share-based compensation expense

9,959

13,246

18,759

26,266

Foreign exchange impact

851

(269

)

2,439

(852

)

SeaSpine merger-related costs

5,897

8,206

10,376

28,946

Strategic investments

311

309

431

970

Acquisition-related fair value

adjustments

6,117

8,149

10,334

19,785

Interest and loss on investments

1,813

—

1,553

—

Litigation and investigation costs

(277

)

1,291

1,983

1,760

Succession charges

5,346

262

7,556

262

Medical device regulation

—

2,050

—

5,679

Adjusted EBITDA

$

16,633

$

9,919

$

24,298

$

13,123

Adjusted EBITDA as a percentage of net

sales

8.4

%

5.3

%

6.3

%

3.6

%

Adjusted Net Income

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

Net loss

$

(33,443

)

$

(39,426

)

$

(69,463

)

$

(100,364

)

Share-based compensation expense

9,959

13,246

18,759

26,266

Foreign exchange impact

851

(269

)

2,439

(852

)

SeaSpine merger-related costs

5,967

8,049

10,815

30,353

Strategic investments

371

348

497

1,046

Acquisition-related fair value

adjustments

6,117

8,149

10,334

19,785

Amortization/depreciation of acquired

long-lived assets

4,648

5,810

9,440

9,944

Litigation and investigation costs

(277

)

1,291

1,983

1,760

Succession charges

5,346

262

7,556

262

Medical device regulation

—

2,055

—

5,689

Interest and loss on investments

1,764

—

1,504

—

Long-term income tax rate adjustment

416

1,224

3,112

3,238

Adjusted net income (loss)

$

1,719

$

739

$

(3,024

)

$

(2,873

)

Cash Flow and Free Cash Flow

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

Net cash from operating activities

$

(9,611

)

$

(39,536

)

Net cash from investing activities

(20,583

)

4,265

Net cash from financing activities

21,678

21,791

Effect of exchange rate changes on

cash

(375

)

387

Net change in cash and cash

equivalents

$

(8,891

)

$

(13,093

)

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

Net cash from operating activities

$

(9,611

)

$

(39,536

)

Capital expenditures

(20,533

)

(24,654

)

Free cash flow

$

(30,144

)

$

(64,190

)

Reconciliation of Non-GAAP Financial Measures to Reported

Operating Expenses

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

Sales and marketing expense, as

reported

$

100,224

$

99,249

$

200,267

$

193,040

Reconciling items impacting sales and

marketing:

Strategic investments

(1,193

)

(1,422

)

(3,412

)

(3,521

)

Litigation and investigation costs

—

(752

)

—

(857

)

Medical device regulation

—

—

—

(5

)

Amortization/depreciation of acquired

long-lived assets

(119

)

(297

)

(297

)

(297

)

Sales and marketing expense, as

adjusted

$

98,912

$

96,778

$

196,558

$

188,360

Sales and marketing expense as a

percentage of net sales, as adjusted

49.8

%

51.7

%

50.8

%

52.0

%

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

General and administrative expense, as

reported

$

33,994

$

34,177

$

65,642

$

82,988

Reconciling items impacting general and

administrative:

Strategic investments

(1,623

)

(2,694

)

(2,834

)

(19,992

)

Amortization/depreciation of acquired

long-lived assets

(2

)

(336

)

(72

)

(336

)

Litigation and investigation costs

277

(538

)

(1,983

)

(902

)

Succession charges

(5,346

)

(262

)

(7,556

)

(262

)

General and administrative expense, as

adjusted

$

27,300

$

30,347

$

53,197

$

61,496

General and administrative expense as a

percentage of net sales, as adjusted

13.7

%

16.2

%

13.7

%

17.0

%

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

Research and development expense, as

reported

$

18,049

$

19,424

$

37,541

$

42,731

Reconciling items impacting research and

development:

Strategic investments

(340

)

(490

)

(576

)

(2,374

)

Medical device regulation

—

(2,027

)

—

(5,017

)

Research and development expense, as

adjusted

$

17,709

$

16,907

$

36,965

$

35,340

Research and development expense as a

percentage of net sales, as adjusted

8.9

%

9.0

%

9.5

%

9.8

%

Reconciliation of Non-GAAP Financial

Measures to Reported Non-Operating (Income) Expense

Three Months Ended June

30,

Six Months Ended June

30,

(Unaudited, U.S. Dollars, in

thousands)

2024

2023

2024

2023

Non-operating expense

$

7,453

$

1,286

$

13,285

$

1,899

Reconciling items impacting non-operating

expense:

Foreign exchange impact

(851

)

269

(2,439

)

852

Strategic investments

—

(15

)

—

(895

)

Interest and (gain) loss on

investments

(1,787

)

30

(1,504

)

60

Non-operating expense, as

adjusted

$

4,815

$

1,570

$

9,342

$

1,916

Non-operating expense as a percentage of

net sales, as adjusted

2.4

%

0.8

%

2.4

%

0.5

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806732152/en/

Investor Relations Julie Dewey, Chief Investor Relations

and Communications Officer JulieDewey@Orthofix.com (209) 613-6945

Media Relations Denise Landry, Vice President, Global

Corporate Communications DeniseLandry@Orthofix.com (214)

937-2529

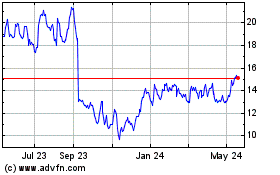

Orthofix Medical (NASDAQ:OFIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

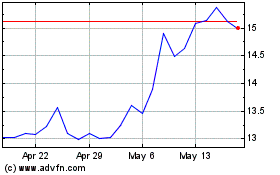

Orthofix Medical (NASDAQ:OFIX)

Historical Stock Chart

From Nov 2023 to Nov 2024