OptimumBank Holdings, Inc. (the “Company”) (OPHC-NASDAQ) Announces Full Year Results

13 March 2024 - 7:55AM

OptimumBank Holdings, Inc., (NASDAQ: OPHC) The Company had net

earnings of $6.3 million for the year ended December 31, 2023,

compared to net earnings of $4.0 million for the year ended

December 31, 2022 an increase of 56%; and with $70 million of

Stockholders’ equity. The Company’s only business is the ownership

and operation of OptimumBank. To facilitate growth, the Company

issued 72,221 shares of its common stock in a private placement

transaction to two accredited investors during the first quarter of

2023.

The Company ended the year with total assets of

$791 million, net loans of $671 million, and total deposits of $640

million. The loan portfolio increased 41% to $680 million from the

prior year end balance of $483 million. Noninterest income

generated was $3.4 million, an increase of 17% from the prior year

amount of $2.9 million. This growth was accomplished while staying

well capitalized by regulatory adequacy requirements throughout the

year with the Company’s capital to total assets ratio at 10.00%,

year-ended, December 31, 2023.

Chairman Moishe Gubin

commented: “Our strategic plan, clear performance

objectives and dedicated leadership have achieved a

classic turnaround and the board and management continue to focus

on maximizing shareholder value marked by improved asset quality,

well managed capital ratios, and finding the right opportunities to

improve short and long-term financial performance. Chairman Gubin

continued “the Bank is on solid footing with strong support

from our loyal business customers who continue to use us as their

bank of choice as well as referring us to their many friends and

business associates. As of January 31, 2024, the Bank’s secured

lending limit has reached $18,749,670 and our unsecured lending

limit to $11,249,670. Loan approval decisions are accomplished

quickly when necessary to meet the needs of our customers. Our

outreach efforts in the communities throughout South Florida over

the past several years have proven to be extremely rewarding.”

About OptimumBank Holdings, Inc.

OptimumBank Holdings, Inc. operates as the bank

holding company for OptimumBank that provides a range of consumer

and commercial banking services to individuals and businesses.

The company accepts demand interest-bearing and

noninterest-bearing savings, money market, NOW and time deposit

accounts, as well as certificates of deposit; and offers

residential and commercial real estate, commercial, and consumer

loans, as well as lending lines for working capital needs. It also

provides debit and ATM cards; investment, cash management, and

notary and night depository services; and direct deposits, money

orders, cashier's checks, domestic collections, drive-in tellers,

and banking by mail, as well as Internet banking services. In

addition, the company engages in holding, managing, and disposal of

foreclosed real estate. It operates through banking offices located

in Broward County, Florida. OptimumBank Holdings, Inc. was founded

in 2000 and is based in Fort Lauderdale, Florida.

Safe Harbor Statement:

This press release contains forward-looking

statements that can be identified by terminology such as

"believes," "expects," "potential," "plans," "suggests," "may,"

"should," "could," "intends," or similar expressions. Many

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results or implied by such

statements. These factors include, but are not limited to, our

limited operating history, managing our expected growth, risks

associated with integration of acquired websites, possible

inadvertent infringement of third-party intellectual property

rights, our ability to effectively compete, our acquisition

strategy, and a limited public market for our common stock, among

other risks. OptimumBank Holdings, Inc.'s future results may also

be impacted by other risk factors listed from time-to-time in its

SEC filings. Many factors are difficult to predict accurately and

are generally beyond the company's control. Forward looking

statements speak only as to the date they are made and OptimumBank

Holdings, Inc. does not undertake to update forward-looking

statements to reflect circumstances or events that occur after the

date the forward-looking statements are made.

Investor Relations:OptimumBank Holdings.

Inc.investor@optimumbank.com+1.954.900.2850

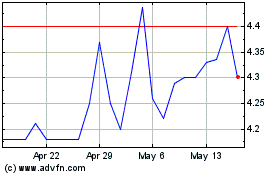

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Feb 2025 to Mar 2025

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Mar 2024 to Mar 2025