false

0000788920

0000788920

2024-12-23

2024-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 23, 2024

PRO-DEX, INC.

(Exact name of registrant as specified in charter)

| Colorado |

0-14942 |

84-1261240 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

2361 McGaw Avenue

Irvine, California 92614

(Address of principal executive offices, zip

code)

(949) 769-3200

(Registrant’s telephone number including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

PDEX |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

Amendment

to Credit Agreement & Amended and Restated Revolving Credit Note

On

December 23, 2024, Pro-Dex, Inc. (the “Company”) entered into Amendment No. 5 to Amended and Restated Credit Agreement (the

“Amendment”) with Minnesota Bank and Trust, a division of HTLF Bank (“MBT”), successor by merger to Minnesota

Bank and Trust, which amends the Company’s Amended and Restated Credit Agreement with MBT (as amended, the “Credit Agreement”),

as well as an Amended and Restated Revolving Credit Note with MBT (the “Revolving Note” and, together with the Amendment,

the “Credit Agreement Amendments”). The Credit Agreement Amendments extend the maturity date of the Company’s $7,000,000

revolving line of credit (the “Revolving Loan”) with MBT from December 29, 2025, to December

29, 2026. The Revolving Loan may be borrowed against from time to time by the Company through its maturity date on the terms set

forth in the Credit Agreement. As of the date of this Current Report on Form 8-K, the Company has drawn $3,500,000 against the Revolving

Loan, the entire amount of which remains outstanding. The Company paid a loan extension fee in the amount of $10,000 to MBT in conjunction

with the Credit Agreement Amendments.

The

Revolving Loan bears interest at an annual rate equal to the greater of (a) 4.0% or (b) SOFR for a one-month period from the website of

the CME Group Benchmark Administration Limited, plus 2.5%. Commencing on the first day of each month after the Company initially borrows

against the Revolving Loan and each month thereafter until maturity, the Company is required to pay all accrued and unpaid interest on

the Revolving Loan through the date of payment. Any principal on the Revolving Loan that is not previously prepaid by the Company shall

be due and payable in full on the maturity date (or earlier termination of the Revolving Loan).

Upon

the occurrence and during the continuance of an event of default, the interest rate of the Revolving Loan is increased by 3% and MBT may,

at its option, declare the entire balance of the Revolving Loan immediately due and payable in full.

The

Credit Agreement and the Revolving Note contain representations and warranties, affirmative, negative and financial covenants, and events

of default that are customary for loans of this type.

A

copy of the Amendment and the Revolving Note are attached as exhibits to this Current Report on Form 8-K. The above descriptions are qualified

by reference to the complete text of the Amendment and the Revolving Note. The representations, warranties, and covenants contained in

those documents were made only for purposes of the transactions represented thereby as of the specific dates therein, are solely for the

benefit of the Company and MBT, may be subject to limitations agreed upon by the Company and MBT, including, among others, being qualified

by disclosures made for the purposes of allocating contractual risk between the parties instead of establishing these matters as facts,

and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors

are not third-party beneficiaries under those documents and should not rely on the representations, warranties and covenants, or any descriptions

thereof, as characterizations of the actual state of facts or condition of the Company. Moreover, information concerning the subject matter

of representations and warranties contained in those documents may change after the date of those documents, which subsequent information

may or may not be fully reflected in the Company’s public disclosures. Rather, investors and the public should look to the disclosures

contained in the Company’s reports under the Securities Exchange Act of 1934, as amended, for information concerning the Company.

| Item 2.03. | Creation

of a Direct Financial Obligation or an Obligation under an Off- Balance Sheet Arrangement

of a Registrant. |

The

disclosures concerning the Amendment and the Revolving Note contained in Item 1.01 above are incorporated into this Item 2.03 by this

reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 27, 2024 |

Pro-Dex, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Alisha K. Charlton |

| |

|

Alisha K. Charlton |

| |

|

Chief Financial Officer |

Exhibit 10.1

AMENDMENT NO. 5

TO AMENDED AND RESTATED CREDIT AGREEMENT

This AMENDMENT NO.

5 TO AMENDED AND RESTATED CREDIT AGREEMENT, dated as of December 23, 2024 (the “Amendment”), between

Pro-Dex, Inc., a Colorado corporation (the “Borrower”), and Minnesota Bank & Trust, a division of HTLF Bank, successor

by merger to Minnesota Bank and Trust (the “Lender”).

RECITALS:

A.

The Borrower and the Lender are parties to that certain Amended and Restated Credit Agreement dated

as of November 6, 2020, as amended by that certain Amendment No. 1 to Amended and Restated Credit Agreement dated as of November 5, 2021,

by that certain Amendment No. 2 to Amended and Restated Credit Agreement dated as of December 29, 2022, by that certain Amendment No.

3 to Amended and Restated Credit Agreement dated as of December 29, 2023, and by that certain Amendment No. 4 to Amended and Restated

Credit Agreement and Security Agreement dated as of July 31, 2024 (as so amended, the “Original Credit Agreement”).

B.

The Borrower has requested that the Lender extend the “Revolving Credit Termination Date”

defined in the Original Credit Agreement.

C.

Subject to the terms and conditions of this Amendment, the Lender will agree to the foregoing request

of the Borrower.

NOW,

THEREFORE, the parties agree as follows:

1.

Defined Terms. All capitalized terms used in this Amendment shall, except where the

context otherwise requires, have the meanings set forth in the Original Credit Agreement as amended hereby.

2.

Amendment. The definition of the term “Revolving Credit Termination Date”

appearing in Section 1.01 of the Original Credit Agreement is hereby amended in its entirety to read as follows:

“

‘Revolving Credit Termination Date’ means the earliest to occur of (a) December 29, 2026, (b) the date the Revolving

Credit Commitment is reduced to zero pursuant to Section 2.04, and (c) the termination of the Revolving Credit Commitment pursuant to

Section 8.02.”

3.

Conditions to Effectiveness. This Amendment shall become effective on the date (the “Effective

Date”) when, and only when, the Lender shall have received:

| (a) | | this Amendment, duly executed by the Borrower; |

| (b) | | an Amended and Restated Revolving Credit Note (the “A&R

Revolving Credit Note”), in the form provided by Lender,

duly executed by Borrower; |

| (c) | | a non-refundable extension fee in the amount of $10,000, payable

in immediately available funds; and |

| (d) | | such other documents as the Lender may reasonably request. |

4.

Representations and Warranties. To induce the Lender to enter into this Amendment,

the Borrower represents and warrants to the Lender as follows:

(a)

The execution, delivery and performance by the Borrower of this Amendment, the A&R Revolving

Credit Note and each other Loan Document to which the Borrower is a party have been duly authorized by all necessary corporate action,

do not require any approval or consent of, or any registration, qualification or filing with, any government agency or authority or any

approval or consent of any other person (including, without limitation, any shareholder), do not and will not conflict with, result in

any violation of or constitute any default under, any provision of the Borrower’s articles of incorporation or bylaws, any agreement

binding on or applicable to the Borrower or any of its property, or any law or governmental regulation or court decree or order, binding

upon or applicable to the Borrower or of any of its property and will not result in the creation or imposition of any security interest

or other lien or encumbrance in or on any of its property pursuant to the provisions of any agreement applicable to the Borrower or any

of its property;

(b)

The representations and warranties contained in the Original Credit Agreement are true and correct

as of the date hereof as though made on that date except: (i)

to the extent that such representations and warranties relate solely to an earlier date; and (ii)

that the representations and warranties set forth in Section 5.04 of the Original Credit Agreement

to the audited annual financial statements and internally-prepared interim financial statements of the Borrower shall be deemed to be

a reference to the audited financial statements and interim financial statements, as the case may be, of the Borrower most recently delivered

to the Lender pursuant to Section 6.01(a) or 6.01(b) of the Original Credit Agreement;

(c)

No events have taken place and no circumstances exist at the date hereof which would give the Borrower

the right to assert a defense, offset or counterclaim to any claim by the Lender for payment of the Obligations;

(d)

The Original Credit Agreement, as amended by this Amendment, , the A&R Revolving Credit Note

and each other Loan Document to which the Borrower is a party are the legal, valid and binding obligations of the Borrower and are enforceable

in accordance with their respective terms, subject only to bankruptcy, insolvency, reorganization, moratorium or similar laws, rulings

or decisions at the time in effect affecting the enforceability of rights of creditors generally and to general equitable principles

which may limit the right to obtain equitable remedies; and

(e)

Before and after giving effect to this Amendment, there does not exist any Default or Event of Default.

5. Release.

The Borrower hereby releases and forever discharges the Lender and its successors, assigns, directors, officers, agents, employees and

participants from any and all actions, causes of action, suits, proceedings, debts, sums of money, covenants, contracts, controversies,

claims and demands, at law or in equity, which the Borrower ever had or now has against the Lender or its successors, assigns, directors,

officers, agents, employees or participants by virtue of the Lender’s relationship to the Borrower in connection with the Loan

Documents and the transactions related thereto

6.

Reference to and Effect on the Loan Documents.

(a)

From and after the date of this Amendment, each reference in:

(i)

the Original Credit Agreement to “this Agreement”, “hereunder”, “hereofi’,

“herein” or words of like import referring to the Original Credit Agreement, and each reference to the “Credit Agreement”,

the “Credit Agreement”, “thereunder”, “thereof’, “therein” or words of like import referring

to the Original Credit Agreement in any other Loan Document shall mean and be a reference to the Original Credit Agreement as amended

hereby; and except as specifically set forth above, the Original Credit Agreement remains in full force and effect and is hereby ratified

and confirmed; and

(ii)

any Loan Document to the “Revolving Credit Note”, “thereunder”, “thereof’,

“therein” or words of like import referring to the Revolving Credit Note shall mean and be a reference to the A&R Revolving

Credit Note executed and delivered pursuant to this letter amendment.

(b) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided

herein, operate as a waiver of any right, power or remedy of the Lender under the Agreement or any other Loan Document, nor constitute

a waiver of any provision of the Agreement or any such other Loan Document.

7.

Costs, Expenses and Taxes. The Borrower agrees to pay on demand all costs and expenses

of the Lender in connection with the preparation, reproduction, execution and delivery of this Amendment and the other documents to be

delivered hereunder or thereunder, including their reasonable attorneys’ fees and legal expenses. In addition, the Borrower shall

pay any and all stamp and other taxes and fees payable or determined to be payable in connection with the execution and delivery, filing

or recording of this Amendment and the other instruments and documents to be delivered hereunder and agrees to save the Lender harmless

from and against any and all liabilities with respect to, or resulting from, any delay in the Borrower’s paying or omission to

pay, such taxes or fees.

8.

Governing Law. THE VALIDITY, CONSTRUCTION AND ENFORCEABILITY OF THIS AMENDMENT

SHALL BE GOVERNED BY THE INTERNAL LAWS OF THE STATE OF MINNESOTA, WITHOUT GIVING EFFECT TO CONFLICT OF LAWS PRINCIPLES THEREOF.

9.

Headings. Section headings in this Amendment are included herein for convenience of

reference only and shall not constitute a part of this Amendment for any other purpose.

10.

Counterparts. This Amendment may be executed in counterparts and by separate parties

in separate counterparts, each of which shall be an original and all of which taken together shall constitute one and the same document.

Receipt by telecopy, pdf file or other electronic means of any executed signature page to this Amendment shall constitute effective delivery

of such signature page.

11.

Recitals. The Recitals hereto are incorporated herein by reference and constitute

a part of this Amendment.

[signature page follows]

IN WITNESS

WHEREOF, the parties hereto have caused this Amendment to be executed as of the date first above.

|

BORROWER:

|

PRO-DEX,

INC. |

| |

|

| |

By: |

/s/ Richard L. Van Kirk |

| |

Name:

Its: |

Richard L. Van Kirk

Chief Executive Officer |

|

LENDER:

|

MINNESOTA BANK & TRUST, a division of HTLF Bank, successor by merger to Minnesota Bank and Trust |

| |

|

| |

By: |

/s/ Dianne Wegscheid |

| |

Name:

Its: |

Dianne Wegscheid

Senior Vice President |

[signature page Amendment No. 5 to Amended and Restated

Credit Agreement]

Exhibit 10.2

AMENDED AND RESTATED REVOLVING CREDIT NOTE

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

Minnetonka, Minnesota |

FOR VALUE RECEIVED,

on the Revolving Credit Termination Date (as defined in the Credit Agreement hereinafter defined) the undersigned, PRO-DEX, INC., a Colorado

corporation (the “Borrower”), promises to pay to the order of MINNESOTA BANK & TRUST, a division of HTLF Bank,

successor by merger to Minnesota Bank and Trust (the “Lender”), the principal sum of SEVEN MILLION AND NO/100THS DOLLARS

(U.S. $7,000,000.00) or, if less, the

aggregate

unpaid principal amount of all Revolving Credit Loans (as hereinafter defined) made by the Lender to the Borrower pursuant to the Credit

Agreement.

VARIABLE INTEREST

RATE. The interest rate on this Note is subject to change from time to time and interest shall accrue on the outstanding amounts under

this Note at the greater of: (a) four percent (4.0%) or (b) the following floating rate of interest per annum (the “Index”):

an adjusted rate (the “Adjusted Term SOFR Rate”) that is equal to: (1) the greater of(A) zero percent (0.0%) (the “Floor”)

and (B) the forward-looking term rate based on SOFR for a one month period (to the extent that such tenor is available to Lender and Lender

has determined it can be administered), as quoted by Lender based on the website of the CME Group Benchmark Administration Limited (CBA)

(or a successor administrator of the Term SOFR Rate selected by Lender (the “Term SOFR Administrator”))(“Term SOFR”),

based on the applicable Term SOFR rate as determined by Lender and as in effect on each applicable date of determination, in each case,

as such Term SOFR rate changes and is recalculated from time to time in accordance with the terms below, and as adjusted for all applicable

reserve requirements and any costs arising from time to time in connection with a change in government regulation as reasonably determined

by Lender (such higher amount, the “Term SOFR Rate”), plus (2) two and one half percent (2.5%) (the “Term SOFR Margin”);

provided, that in the event Borrower enters into an interest swap with Lender with respect to interest accruing under this Note, the Floor

will automatically be deemed not to apply to the principal portion of this Note that is so hedged for the duration of such interest rate

swap transaction and the foregoing is limited solely to an interest rate swap transaction with the Lender and shall not apply to any other

derivative product, such as in interest rate cap or collar.

Interest

accrued during each calendar month shall be due and payable on the first day of the following calendar month, with the first such interest

payment due on January 1, 2025.

Subject

to the terms of this Note, so long as the amounts outstanding under this Note are accruing interest at the Adjusted Term SOFR Rate, then

the Term SOFR Rate will be reset on each Business Day (the “Reset Date”) using the Term SOFR Rate as determined two U.S. Government

Securities Business Days preceding the applicable Reset Date (the “Daily Reference Date”); provided, that

AMENDED AND RESTATED REVOLVING

CREDIT NOTE

Page

2

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

in the

event Borrower enters into an interest rate hedge, swap, collar or other similar derivative transaction with Lender with respect to interest

accruing under this Note, the Term SOFR Rate will be reset on the first (1st) day or the fifteenth (15th) day of each month, as applicable,

using the Term SOFR Rate as determined two U.S. Government Securities Business Days preceding such applicable day of the month (the “Monthly

Reference Date”); provided, further, that if Term SOFR for a one month interest period is not published for any applicable Daily

Reference Date or Monthly Reference Date, and Lender determines in its sole discretion that such failure is temporary, the applicable

Term SOFR Rate shall be the Term SOFR Rate for a one month period as published on the most recent applicable Business Day that Lender

determines such Term SOFR Rate was available prior to the applicable Daily Reference Date or Monthly Reference Date. The term "Business

Day" means any day that is not a Saturday, Sunday or other day that is a legal holiday under the laws of the State of New York or

is a day on which banking institutions in such state are authorized or required by law to close. The term “U.S. Government Securities

Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association

recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. Government Securities.

The term “Federal Reserve Board” means the Board of Governors of the Federal Reserve System of the United States. The term

“SOFR” means a rate equal to the secured overnight financing rate as administered by the SOFR Administrator.

FOR REFERENCE

ONLY, on the date hereof, the Term SOFR Rate is 4.33654% per annum and the Adjusted Term SOFR Rate is 4.33654%. The

Term SOFR Rate is an index used by Lender for the determination of interest and Term SOFR Rate and the Adjusted Term SOFR Rate are not

necessarily the lowest interest rates charged by Lender on other loans to other customers. Borrower understands and agrees that Lender

may make loans to other customers based on other rates of interest as well. Lender will inform Borrower of the current Adjusted Term

SOFR Rate from time to time upon request by Borrower.

INTEREST CALCULATION

METHOD. Interest on this Note is computed on a 365/360 basis; that is, by applying the ratio of the applicable interest rate over

a year of 360 days, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal balance is

outstanding. All interest payable under this Note is computed using this method. This calculation method results in a higher effective

interest rate than the numeric interest rate stated in this Note. The Term SOFR Rate shall be determined by Lender in accordance with

the terms hereof, and such determination shall be conclusive absent manifest error.

CONFORMING

CHANGES ADJUSTMENT. In connection with the use or administration of Term SOFR, the Term SOFR Rate and Adjusted Term SOFR Rate, Lender

will have the right to

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

3

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

make Conforming

Changes from time to time and, notwithstanding anything to the contrary in this Note or in any other promissory notes, loan documents

or security documents, or other agreements between Borrower and Lender (each a “Loan Document”), and any amendments implementing

such Conforming Changes will become effective without any further action or consent of any other party to this Note or any other Loan

Document. Lender will notify Borrower from time to time of the effectiveness of any Conforming Changes in connection with the use or administration

of Term SOFR, the Term SOFR Rate or Adjusted Term SOFR Rate. The term “Conforming Changes” means, with respect to either the

use or administration of Term SOFR, the Term SOFR Rate or the Adjusted Term SOFR Rate or the use, administration, adoption or implementation

of any Benchmark (as defined below) replacement, any technical, administrative or operational changes (including changes to the definition

of“Business Day”), timing and frequency of determining rates and making payments of interest, timing of borrowing requests

or prepayment, conversion or continuation notices, the applicability and length of lookback periods, and other technical, administrative

or operational matters) that Lender decides may be appropriate to reflect the adoption and implementation of any such rate or to permit

the use and administration thereof by Lender in a manner substantially consistent with market practice (or, if Lender decides that adoption

of any portion of such market practice is not administratively feasible or if Lender determines that no market practice for the administration

of any such rate exists, in such other manner of administration as Lender decides is reasonably necessary in connection with the administration

of this Note and the other Loan Documents).

UNAVAILABILITY OF

SOFR/BENCHMARK REPLACEMENT. Subject to the Benchmark Replacement provisions below, if, in connection with the implementation and

use of the Term SOFR Rate: (a) Lender determines (which determination shall be conclusive and binding absent manifest error) that the

“Term SOFR Rate” cannot be determined pursuant to the definition thereof, (b)

Lender reasonably determines that the Adjusted Term SOFR Rate does not adequately and fairly reflect

the cost to Lender, or (c) Lender determines that any applicable law has made it unlawful, or that any governmental authority has asserted

that it is unlawful, for Lender or its applicable lending office to make, maintain or fund loans or advances whose interest is determined

by reference to SOFR, Term SOFR, or the Term SOFR Rate, or to determine or charge interest rates based upon SOFR, Term SOFR, or the Term

SOFR Rate; then upon notice of any such occurrence or determination by Lender to Borrower, any obligation of Lender to make available

the Adjusted Term SOFR Rate, and any right of Borrower to use the Adjusted Term SOFR Rate, shall be suspended until Lender revokes such

notice. Upon receipt of such notice, all amounts outstanding under this Note will be deemed to accrue at the Benchmark Replacement rate,

if applicable, or if such Benchmark Replacement rate is not available or does not adequately and fairly reflect the cost to Lender, at

the Adjusted Prime Rate. The term “Adjusted Prime Rate” means a variable rate of interest that is equal to: (1) the greater

of(A) five percent (5.0%), and (B)

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

4

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

the rate

last quoted by The Wall Street Journal as the “Prime Rate” in the United States or, if The Wall Street Journal ceases to quote

such rate, the highest per annum interest rate published by the Federal Reserve Board in Federal Reserve Statistical Release H.15 (519)

(Selected Interest Rates) as the “bank prime loan” rate or, if such rate is no longer quoted therein, any similar rate quoted

therein (as determined by Lender) or any similar release by the Federal Reserve Board (as determined by Lender) (such higher amount, the

“Prime Rate”), plus (2) an applicable percentage selected by Lender, taking into consideration any selection or recommendation

of a replacement rate by any relevant agency or authority, and evolving or prevailing market practice, to reasonably approximate the Adjusted

Term SOFR Rate or otherwise adequately and fairly reflect the cost to Lender, as determined in its discretion (the “Prime Margin”).

BENCHMARK REPLACEMENT.

(a)

Benchmark Replacement. Notwithstanding anything to the contrary, if Lender has determined in its

sole discretion that (i) the administrator of Term SOFR, or any relevant agency or authority for such administrator, of Term SOFR (or

any substitute index which replaces the Term SOFR (Term SOFR or such replacement, the “Benchmark”)) has announced that such

Benchmark will no longer be provided, (ii) any relevant agency or authority has announced that such Benchmark is no longer representative,

or (iii) any similar circumstance exists such that such Benchmark has become permanently unavailable or ceased to exist (each a “Benchmark

Transition Event”), then Lender shall (x) replace such Benchmark with a replacement rate or (y) if one or more such circumstances

apply to fewer than all tenors of such Benchmark used for determining an Interest Period hereunder, discontinue the availability of the

affected interest periods. With respect to Term SOFR, such replacement rate will be Daily Simple SOFR unless Lender reasonably determines

that Daily Simple SOFR is not readily available or shall otherwise reasonably determine that a different rate has been recommended as

a replacement benchmark rate for determining such a rate by the by the Federal Reserve Board or the Federal Reserve Bank of New York,

or a committee officially endorsed or convened by the Federal Reserve Board or the Federal Reserve Bank of New York, or any successor

thereto (the “Relevant Governmental Body”). In the case of a replacement rate other than Term SOFR, Lender may add a spread

adjustment selected by Lender, taking into consideration any selection or recommendation of a replacement rate by any relevant agency

or authority, and evolving or prevailing market practice. Such replacement rates for the Benchmark as applicable, each a “Benchmark

Replacement”. The term “Daily Simple SOFR” means a daily rate based on SOFR and determined by Lender in accordance with

the conventions for such rate selected by Lender.

(b)

Notices; Standards for Decisions and Determinations. Lender will notify Borrower of (i) the implementation

of any Benchmark Replacement and (ii) the effectiveness of any

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

5

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

Conforming

Changes in connection with the use, administration, adoption or implementation of a Benchmark Replacement. Lender will notify Borrower

of the removal or reinstatement of any tenor of a Benchmark pursuant to clause (a) above. Any determination, decision or election that

may be made by Lender pursuant to this provision, including any determination with respect to a tenor, rate or adjustment or of the occurrence

or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection, will

be conclusive and binding absent manifest error and may be made in its sole discretion and without consent from any other party to this

Note or any other Loan Documents, except, in each case, as expressly required pursuant to this provision.

Payments.

Both principal and interest are payable in lawful money of the United States of America to the Lender at 9800 Bren Road East, Suite 200,

Minnetonka, MN 55343 (or other location specified by the Lender) in immediately available funds. By its execution of this Note, the Borrower

authorizes the Lender to charge from time to time against any of Borrower’s depository accounts maintained with the Lender any

such payments when due and the Lender will use its reasonable efforts to notify the Borrower of such charges.

Prepayment; Minimum

Interest Charge. In any event, even upon full prepayment of this Note, Borrower understands that Lender is entitled to a minimum interest

charge of $15.00. Other than Borrower’s obligations to pay any minimum interest charge, Borrower may pay without penalty all or

a portion of the amount earlier than it is due. Early payments will not, unless agreed to by Lender in writing, relieve Borrower of Borrower’s

obligation to continue to make payments of accrued unpaid interest. Rather, early payment will reduce the principal balance due. Borrower

agrees not to send Lender payments marked “paid in full”, “without recourse”, or similar language. If Borrower

sends such a payment, Lender may accept it without losing any of Lender’s rights under this Note, and Borrower will remain obligated

to pay any further amount owed to Lender. All written communications concerning disputed amounts, including any check or other payment

instrument that indicates that the payment constitutes “payment in full” of the amount owed or that is tendered with other

conditions or limitations, or as full satisfaction of a disputed amount must be mailed or delivered to: Minnesota Bank & Trust, 9800

Bren Road East, Suite 200, Minnetonka, MN 55343.

Late Charge.

If a payment due hereunder is not made within seven days after the date when due, Borrower shall pay to Lender a late payment charge

of 5% of the amount of the overdue payment to compensate Lender for a portion of the cost related to handling the overdue payment.

Interest

After Default. Upon the occurrence and during the continuance of an Event of Default, including failure to pay upon final maturity,

the interest rate on this Note shall be increased by

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

6

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

adding an additional 3.000 percentage

point margin over the interest rate that would otherwise be in effect hereunder (such increased rate of interest being, the “Default

Rate”). However, in no event will the interest rate exceed the maximum interest rate limitations under applicable law.

Credit Agreement.

This Note is the Revolving Credit Note referred to in, and is entitled to the benefits of, the Amended and Restated Credit Agreement

dated as of November 6, 2020 (as amended to date and as it may be further amended, modified, supplemented or restated from time to time

being the “Credit Agreement”; capitalized terms not otherwise defined herein being used herein as therein defined)

between the Borrower and the Lender. The Credit Agreement, among other things, (i) provides for the making of Revolving Credit Loans

(the “Revolving Credit Loans”) by the Lender to the Borrower from time to time in an aggregate amount not to exceed

at any time outstanding the dollar amount first above mentioned, the indebtedness of the Borrower resulting from each such Revolving

Credit Loan being evidenced by this Note; (ii) contains provisions for acceleration of the maturity hereof upon the happening of certain

stated events prior to the maturity hereofupon the terms and conditions therein specified; and (iii) contains provisions for the mandatory

prepayment hereof upon certain conditions.

Security

Agreement. This Note is secured by, among other things, that certain Security Agreement dated September 6, 2018, executed by the

Borrower and certain of its Subsidiaries in favor of the Lender, as amended by that certain Amendment No. 4 to Amended and Restated Credit

Agreement and Security Agreement dated July 31, 2024.

Waiver of Presentment and Demand

for Payment, Etc. Borrower and any endorsers or guarantors hereof severally waive presentment and demand for payment, notice of intent

to accelerate maturity, protest or notice of protest and non-payment, bringing of suit and diligence in taking any action to collect

any sums owing hereunder or in proceeding against any of the rights and properties securing payment hereunder, and expressly agree that

this Note, or any payment hereunder, may be extended from time to time, and consent to the acceptance of further security or the release

of any security for this Note, all without in any way affecting the liability of Borrower and any endorsers or guarantors hereof. No

extension of time for the payment of this Note, or any installment thereof, made by agreement by Lender with any Person now or hereafter

liable for the payment of this Note, shall affect the original liability under this Note of the undersigned, even if the undersigned

is not a party to such agreement.

Event

of Default. Any “Event of Default” (as defined in the Credit Agreement) shall constitute an Event of Default under this

Note. Upon the occurrence of an Event of Default, in addition to any other rights or remedies Lender may have at law or in equity or

under the Credit Agreement or under any other Loan Document, Lender may, at its option, without notice to Borrower, declare

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

7

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

immediately

due and payable the entire unpaid principal sum hereof, together with all accrued and unpaid interest thereon plus any other sums owing

at the time of such Event of Default pursuant to this Note, the Security Agreement or any other Loan Document. The failure to exercise

the foregoing or any other options shall not constitute a waiver of the right to exercise the same or any other option at any subsequent

time in respect of the same event or any other event. The acceptance by the holder of any payment hereunder which is less than payment

in full of all amounts due and payable at the time of such payment shall not constitute a waiver of the right to exercise any of the foregoing

options at that time or at any subsequent time.

Expense Reimbursement.

Borrower agrees to pay all expenses for the preparation of this Note, as set forth in the Credit Agreement, including exhibits, and

any amendments to this Note as may from time to time hereafter be required, and the reasonable attorneys’ fees and legal expenses

of counsel for Lender from time to time incurred in connection with the preparation and execution of this Note and any document relevant

to this Note, any amendments hereto or thereto, and the consideration of legal questions relevant hereto and thereto. Borrower agrees

to reimburse Lender upon demand for all reasonable out-of-pocket expenses (including attorneys’ fees and legal expenses) in connection

with Lender’s enforcement of the obligations of the Borrower hereunder or under the Security Agreement or any other collateral document,

whether or not suit is commenced including, without limitation, attorneys’ fees and legal expenses in connection with any appeal

of a lower court’s order or judgment. The obligations of the Borrower under this paragraph shall survive any termination of the

Credit Agreement, this Note, the Security Agreement, and any other Loan Document.

Successors

and Assigns. This Note shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors

and assigns except that Borrower may not assign or transfer its rights hereunder without the prior written consent of Lender, which consent

may be withheld in Lender’s sole discretion. In connection with the actual or prospective sale by the Lender of any interest or

participation in the loan obligation evidenced by this Note, Borrower hereby authorizes the Lender to furnish any information concerning

the Borrower or any of its affiliates, however acquired, to any Person or entity.

Usury.

Borrower and Lender agree that no payment of interest or other consideration made or agreed to be made by Borrower to Lender pursuant

to this Note shall, at any time, be in excess of the maximum rate of interest permissible by law. In the event such payments of interest

or other consideration provided for in this Note shall result in an effective rate of interest which, for any period of time, is in excess

of the limit of the usury or any other law applicable to the loan evidenced hereby, all sums in excess of those lawfully collectible

as interest for the period in question shall, without further agreement or notice between or by any party hereto, be applied to

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

8

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

the unpaid

principal balance and not to the payment of interest; if a surplus remains after full payment of principal and lawful interest, the surplus

shall be remitted by Lender to Borrower, and Borrower hereby agrees to accept such remittance. This provision shall control every other

obligation of the Borrower and Lender relating to this Note.

Business Purpose

Loan. The Loan is a business loan. Borrower hereby represents that this loan is for commercial use and not for personal, family or

household purposes. The Borrower agrees that the Loan evidenced by this Note is an exempted transaction under the Truth In Lending Act,

15 U.S.C., §1601, et seq.

Governing Law.

THE VALIDITY, CONSTRUCTION AND ENFORCEABILITY OF THIS NOTE SHALL BE GOVERNED BY THE INTERNAL LAWS OF THE STATE OF MINNESOTA, WITHOUT

GIVING EFFECT TO CONFLICT OF LAWS PRINCIPLES THEREOF.

WAIVER

OF DEFENSES. OTHER THAN CLAIMS BASED UPON THE FAILURE OF THE LENDER TO ACT IN A COMMERCIALLY REASONABLE MANNER, THE BORROWER

WAIVES EVERY PRESENT AND FUTURE DEFENSE (OTHER THAN THE DEFENSE OF PAYMENT IN FULL OR THAT NO EVENT OF DEFAULT EXISTED), CAUSE OF ACTION,

COUNTERCLAIM OR SETOFF WHICH THE BORROWER MAY NOW HAVE OR HEREAFTER MAY HAVE TO ANY ACTION BY THE LENDER IN ENFORCING THIS NOTE OR ANY

OF THE LOAN DOCUMENTS. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE LENDER GRANTING ANY FINANCIAL ACCOMMODATION TO THE BORROWER.

Waiver of

Right to Jury Trial; Venue. BORROWER WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY ACTION RELATING TO OR ARISING FROM THIS

NOTE. AT THE OPTION OF LENDER, THIS NOTE MAY BE ENFORCED IN ANY UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MINNESOTA OR THE STATE

COURT SITTING IN HENNEPIN OR RAMSEY COUNTY, MINNESOTA. BORROWER CONSENTS TO THE JURISDICTION AND VENUE OF ANY SUCH COURT AND WAIVES ANY

ARGUMENT THAT VENUE IN SUCH FORUMS IS NOT PROPER OR CONVENIENT. IN THE EVENT AN ACTION IS COMMENCED IN ANOTHER JURISDICTION OR VENUE UNDER

ANY TORT OR CONTRACT THEORY ARISING DIRECTLY OR INDIRECTLY FROM THE RELATIONSHIP CREATED BY THIS NOTE, LENDER, AT ITS OPTION, SHALL BE

ENTITLED TO HAVE THE CASE TRANSFERRED TO ONE OF THE JURISDICTIONS AND VENUES ABOVE DESCRIBED, OR IF SUCH TRANSFER CANNOT BE ACCOMPLISHED

UNDER APPLICABLE LAW, TO HAVE SUCH CASE DISMISSED

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

9

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

WITHOUT PREJUDICE.

Amendment

and Restatement. This Note is being executed and delivered in amendment and restatement of, but not in payment of, that certain Amended

and Restated Revolving Credit Note dated July 31, 2024, made by the Borrower payable to the order of the Lender in the original principal

amount of $7,000,000.00 (the “Existing Note”) and is given in substitution for, but not in payment of, the Existing Note.

Delivery and acceptance of this Note shall not evidence repayment of or a novation with respect to the Existing Note or any remaining

indebtedness under the Existing Note, which indebtedness remains outstanding and shall be evidenced by this Note.

Counterparts.

This Note may be executed in any number of counterparts, each of which shall be deemed an original and all of which together constitute

a fully executed Note even though all signatures do not appear on the same document.

AMENDED

AND RESTATED REVOLVING CREDIT NOTE

Page

10

| U.S. $7,000,000.00 |

Dated as of December

23, 2024

|

IN WITNESS WHEREOF,

this Amended and Restated Revolving Credit Note has been executed to be effective as of the date set forth above.

|

BORROWER:

|

PRO-DEX,

INC. |

| |

|

| |

By: |

/s/ Richard L. Van Kirk |

| |

Name:

Its: |

Richard L. Van Kirk

Chief Executive Officer |

|

LENDER:

|

MINNESOTA BANK & TRUST, a division of HTLF Bank, successor by merger to Minnesota Bank and Trust |

| |

|

| |

By: |

/s/ Dianne Wegscheid |

| |

Name:

Its: |

Dianne Wegscheid

Senior Vice President |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

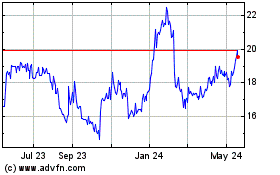

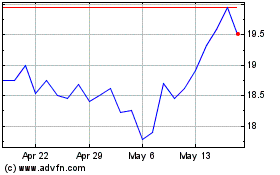

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

ProDex (NASDAQ:PDEX)

Historical Stock Chart

From Feb 2024 to Feb 2025