Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

06 February 2025 - 9:07AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-277003

February 5, 2025

PepsiCo, Inc.

4.400% Senior Notes due 2027

4.450% Senior Notes due 2028

4.600% Senior Notes due 2030

5.000% Senior Notes due 2035

| Issuer: |

PepsiCo, Inc. |

| Ratings (S&P / Moody’s): |

A+ / A1 (Stable Outlook / Stable Outlook) |

| Trade Date: |

February 5, 2025 |

| Settlement Date (T+2): |

February 7, 2025 |

| Title of Securities: |

4.400% Senior Notes due 2027 |

4.450% Senior Notes due 2028 |

4.600% Senior Notes due 2030 |

5.000% Senior Notes due 2035 |

| Aggregate Principal Amount Offered: |

$500,000,000 |

$750,000,000 |

$1,000,000,000 |

$1,250,000,000 |

| Maturity Date: |

February 7, 2027 |

February 7, 2028 |

February 7, 2030 |

February 7, 2035 |

| Interest Payment Dates: |

Semi-annually in arrears on each February 7 and August 7, commencing August 7, 2025 |

Semi-annually in arrears on each February 7 and August 7, commencing August 7, 2025 |

Semi-annually in arrears on each February 7 and August 7, commencing August 7, 2025 |

Semi-annually in arrears on each February 7 and August 7, commencing August 7, 2025 |

| Benchmark Treasury: |

4.125% due January 31, 2027 |

4.250% due January 15, 2028 |

4.250% due January 31, 2030 |

4.250% due November 15, 2034 |

| Benchmark Treasury Yield: |

4.181% |

4.195% |

4.238% |

4.416% |

| Spread to Treasury: |

+22 basis points |

+27 basis points |

+40 basis points |

+60 basis points |

| Re-offer Yield: |

4.401% |

4.465% |

4.638% |

5.016% |

| Coupon: |

4.400% |

4.450% |

4.600% |

5.000% |

| Price to Public: |

99.998% |

99.958% |

99.832% |

99.875% |

| Optional Redemption: |

Prior to February 7, 2027, make-whole call at Treasury Rate plus 5 basis points |

Prior to January 7, 2028, make-whole call at Treasury Rate plus 5 basis points; par call at any time on or after January 7, 2028 |

Prior to January 7, 2030, make-whole call at Treasury Rate plus 10 basis points; par call at any time on or after January 7, 2030 |

Prior to November 7, 2034, make-whole call at Treasury Rate plus 10 basis points; par call at any time on or after November 7, 2034 |

| Net Proceeds to PepsiCo (Before Expenses): |

$499,240,000 |

$747,997,500 |

$994,820,000 |

$1,242,812,500 |

| Use of Proceeds: |

PepsiCo intends to use the net proceeds from this offering for general corporate purposes, including the repayment of commercial paper. |

| Day Count Fraction: |

30/360 |

30/360 |

30/360 |

30/360 |

| CUSIP / ISIN: |

713448 GD4 / US713448GD49 |

713448 GA0 / US713448GA00 |

713448 GB8 / US713448GB82 |

713448 GC6 / US713448GC65 |

| Minimum Denomination: |

$2,000 and integral multiples of $1,000 |

| Joint

Book-Running Managers: |

BNP Paribas Securities Corp.

Deutsche Bank Securities Inc.

Goldman Sachs & Co. LLC

Morgan Stanley & Co. LLC |

| Senior Co-Managers: |

HSBC Securities (USA) Inc.

Mizuho Securities USA LLC

Barclays Capital Inc.

SG Americas Securities, LLC |

| Co-Managers: |

Blaylock Van, LLC

Drexel Hamilton, LLC

Mischler Financial Group, Inc.

R. Seelaus & Co., LLC

Samuel A. Ramirez & Company, Inc.

Standard Chartered Bank

U.S. Bancorp Investments, Inc. |

The issuer expects that delivery of the notes will be made, against

payment for the notes, on or about February 7, 2025, which will be the second business day following the pricing of the notes. Under Rule

15c6-1 of the Securities Exchange Act of 1934, as amended, purchases or sales of securities in the secondary market generally are required

to settle within one business day (T+1), unless the parties to any such transactions expressly agree otherwise. Accordingly, purchasers

of notes who wish to trade the notes on the date hereof will be required, because the notes initially will settle within two business

days (T+2), to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of notes

who wish to trade on the date hereof should consult their own legal and financial advisors.

An explanation of the significance of ratings may be obtained from

the ratings agencies. Generally, ratings agencies base their ratings on such material and information, and such of their own investigations,

studies and assumptions, as they deem appropriate. The security ratings above are not a recommendation to buy, sell or hold the securities

offered hereby. The ratings may be subject to review, revision, suspension, reduction or withdrawal at any time by S&P and Moody’s.

Each of the security ratings above should be evaluated independently of any other security rating.

The issuer has filed a registration statement (including a prospectus)

with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration

statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You

may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any

dealer participating in the offering will arrange to send you the prospectus if you request it by calling BNP Paribas Securities Corp.

toll-free at 1-800-854-5674, Deutsche Bank Securities Inc. toll-free at 1-800-503-4611, Goldman Sachs & Co. LLC toll-free at 1-866-471-2526

or Morgan Stanley & Co. LLC toll-free at 1-866-718-1649.

Any disclaimers or other notices that may appear below are not applicable

to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication

being sent via Bloomberg or another email system.

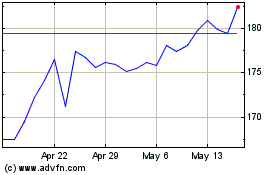

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

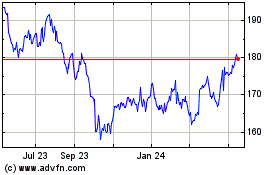

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Feb 2024 to Feb 2025